Deck 4: Financial Statement Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

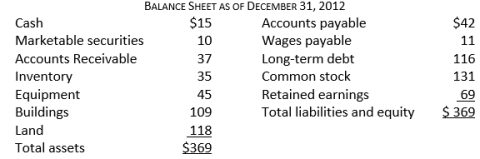

Question

Question

Question

Question

Question

Question

Question

Question

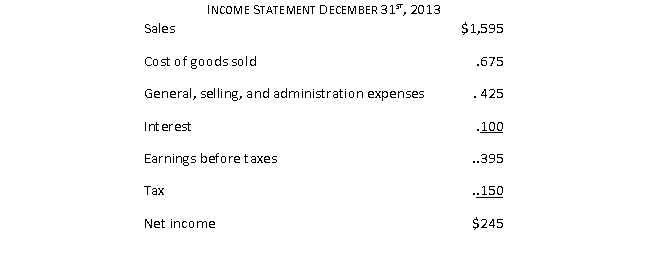

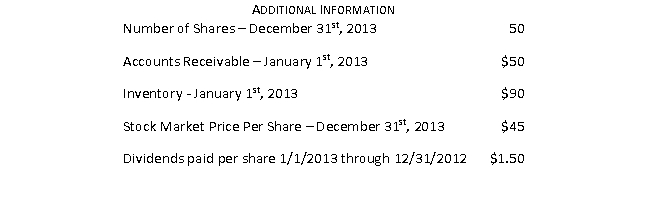

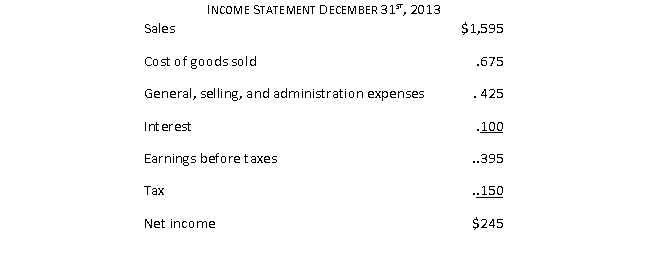

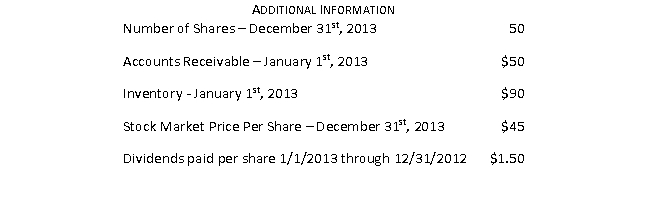

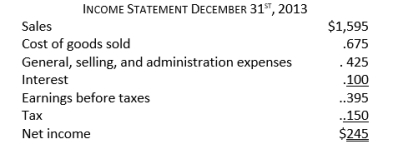

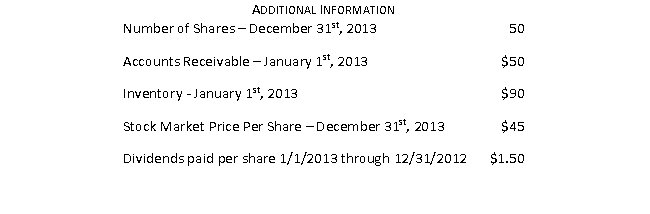

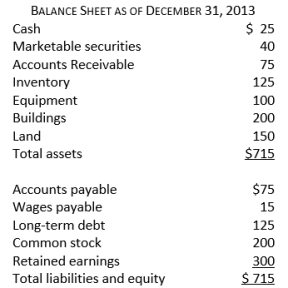

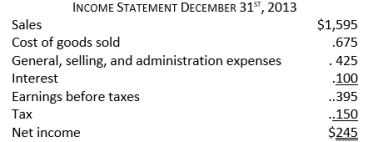

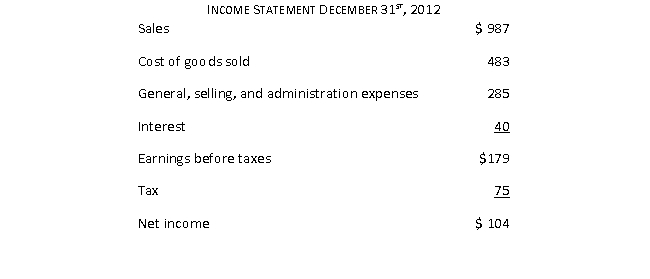

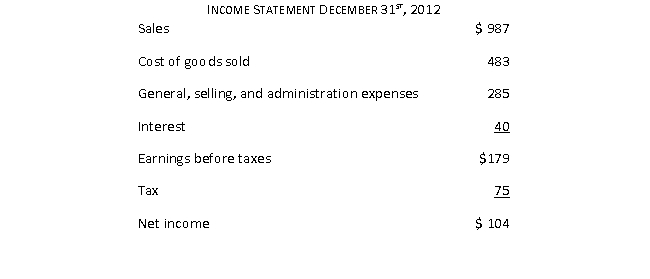

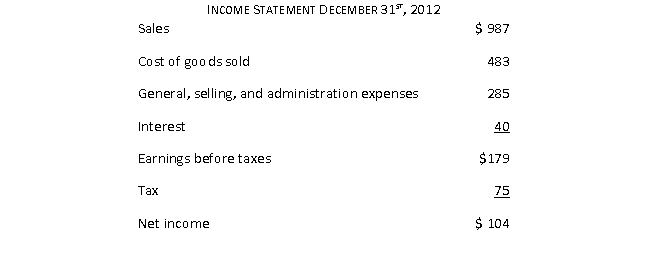

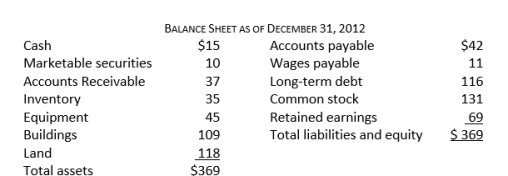

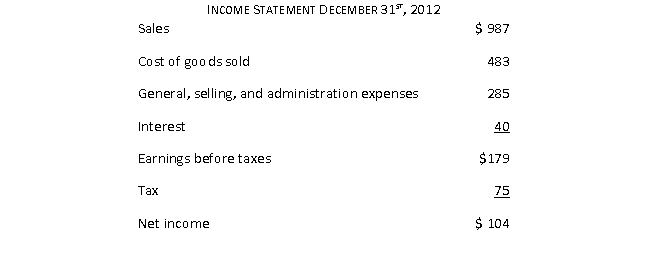

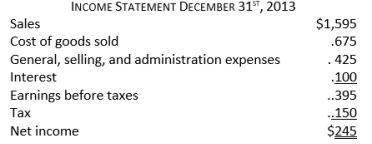

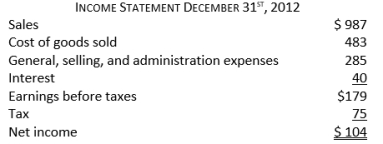

Question

Question

Question

Question

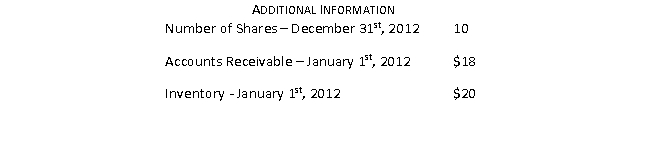

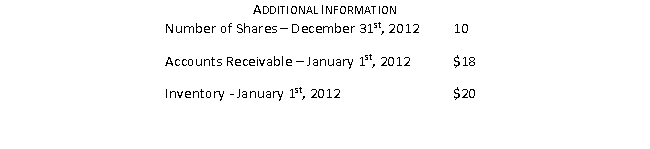

Question

Question

Question

Question

Question

Question

Question

Question

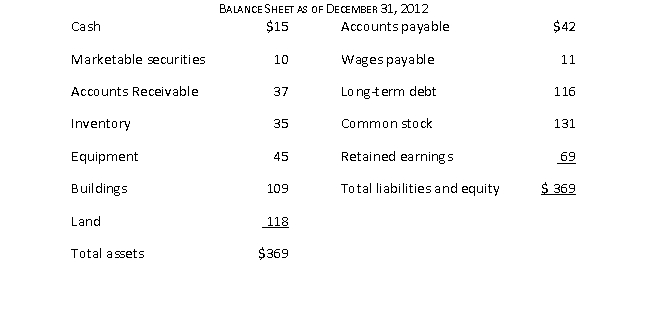

Question

Question

Question

Question

Question

Question

Question

Question

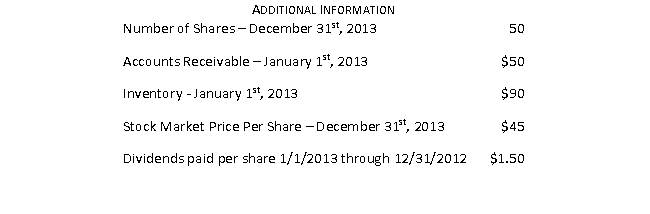

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/96

Play

Full screen (f)

Deck 4: Financial Statement Analysis

1

The debt ratio is classified as which type of ratio?

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

Financial Leverage

2

The price-earnings ratio is classified as which type of ratio?

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

Owner

3

The gross profit margin is classified as which type of ratio?

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

Efficiency

4

Inventory turnover, accounts receivable turnover, fixed asset turnover, and total asset turnover are all classified as which type of ratio?

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

A) Owner

B) Liquidity

C) Efficiency

D) Productivity

E) Financial Leverage

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following statements would most likely be considered false?

A) Analysts can utilize individual ratios on their own.

B) Other dimensions of the company must be looked at when analyzing ratios.

C) A company's historical ratios, or the trend in its ratios, adds context when analyzing ratios.

D) Ratios of comparable companies or industry average ratios give context to a company's ratios.

A) Analysts can utilize individual ratios on their own.

B) Other dimensions of the company must be looked at when analyzing ratios.

C) A company's historical ratios, or the trend in its ratios, adds context when analyzing ratios.

D) Ratios of comparable companies or industry average ratios give context to a company's ratios.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

6

ABC Company attempts to manage its earnings by extending the useful life of all of its equipment. Which of the following will not be an outcome of this choice by management?

A) Income will be higher than it would have been under prior accounting methods.

B) Equipment values will be higher than they would have been without the change.

C) Depreciation expense will be lower than it would have been under prior accounting methods.

D) Depreciation expense will be higher than it would have been under prior accounting methods.

A) Income will be higher than it would have been under prior accounting methods.

B) Equipment values will be higher than they would have been without the change.

C) Depreciation expense will be lower than it would have been under prior accounting methods.

D) Depreciation expense will be higher than it would have been under prior accounting methods.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

7

How easily something can be converted into cash is referred to as:

A) liquidity

B) quick assets

C) current assets

D) working capital

E) operating cycle

A) liquidity

B) quick assets

C) current assets

D) working capital

E) operating cycle

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

8

Days of sales in inventory + Days sales outstanding is best described as the:

A) operating cycle.

B) cash conversion cycle.

C) average collection period.

D) number of days of inventory.

A) operating cycle.

B) cash conversion cycle.

C) average collection period.

D) number of days of inventory.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

9

The average number of days the company has inventory in its possession in the form of raw materials, work-in-process, and finished goods is best described as the:

A) operating cycle.

B) cash conversion cycle.

C) day's sales in inventory.

D) day's sales outstanding.

A) operating cycle.

B) cash conversion cycle.

C) day's sales in inventory.

D) day's sales outstanding.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

10

It is important for a company to know the level of sales at which it covers all its variable and fixed operating costs. This level of sales is best described as the:

A) gross profit margin.

B) contribution margin.

C) operating break even.

D) operating profit margin.

A) gross profit margin.

B) contribution margin.

C) operating break even.

D) operating profit margin.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

11

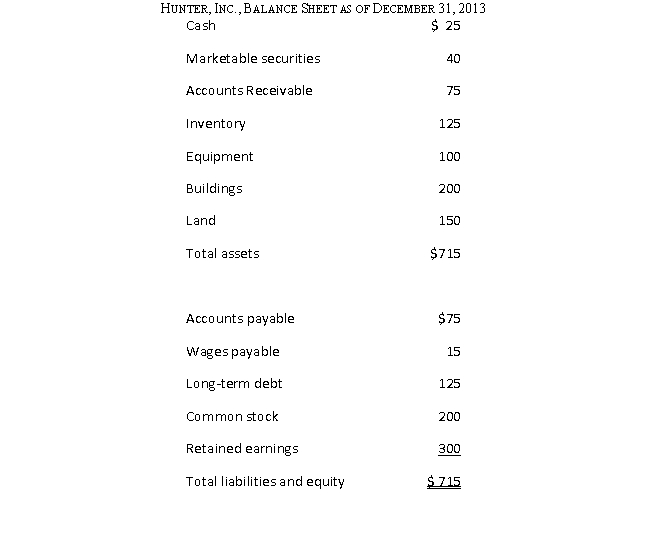

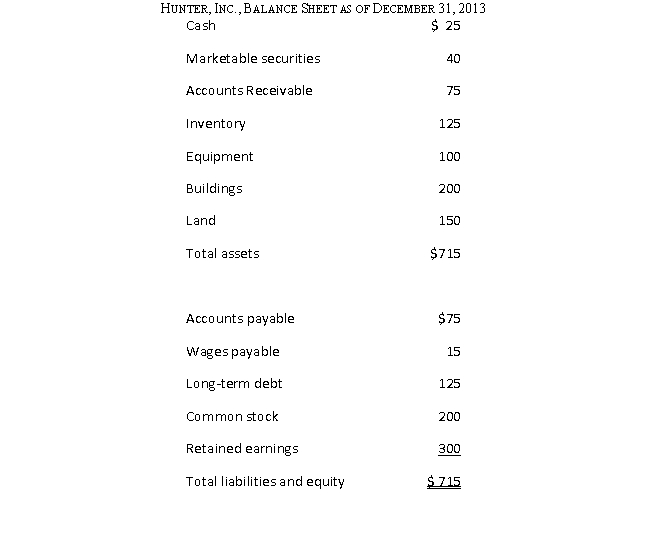

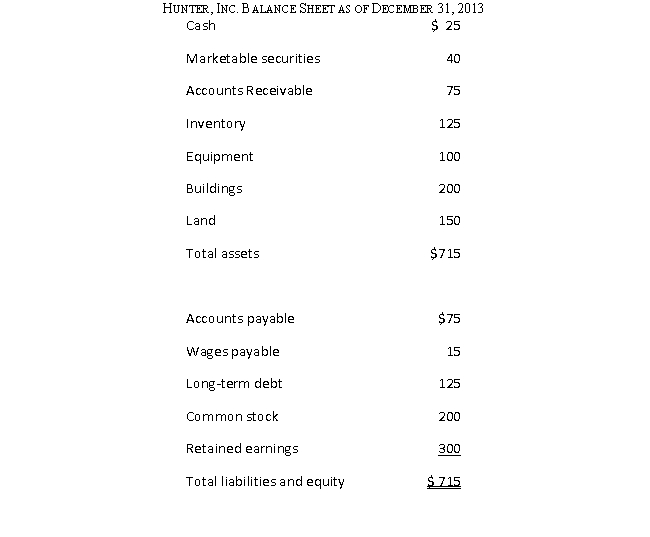

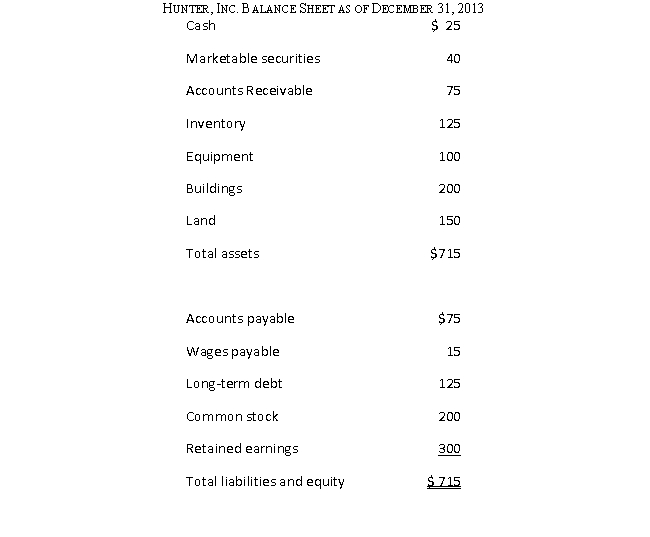

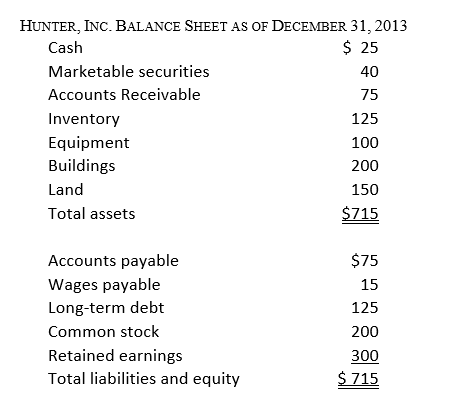

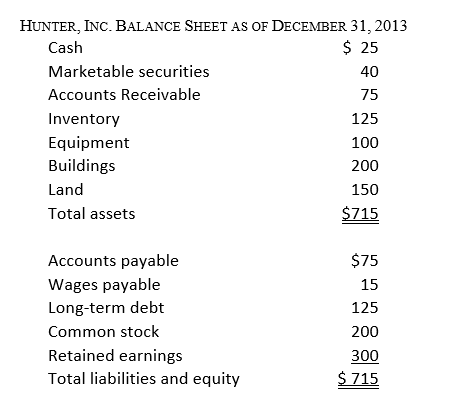

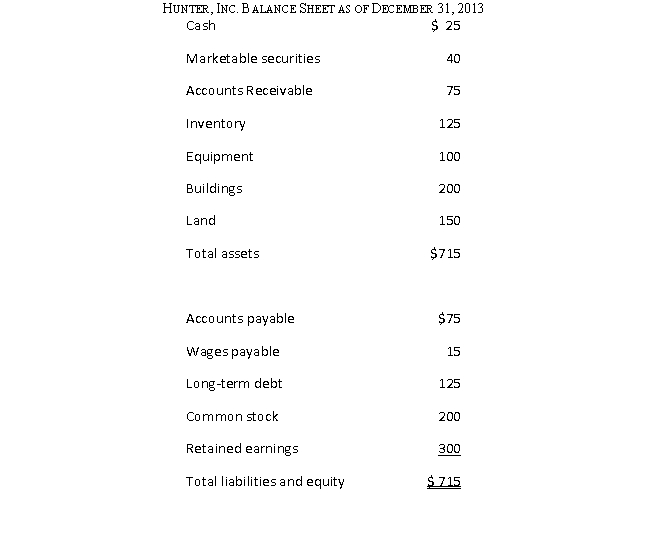

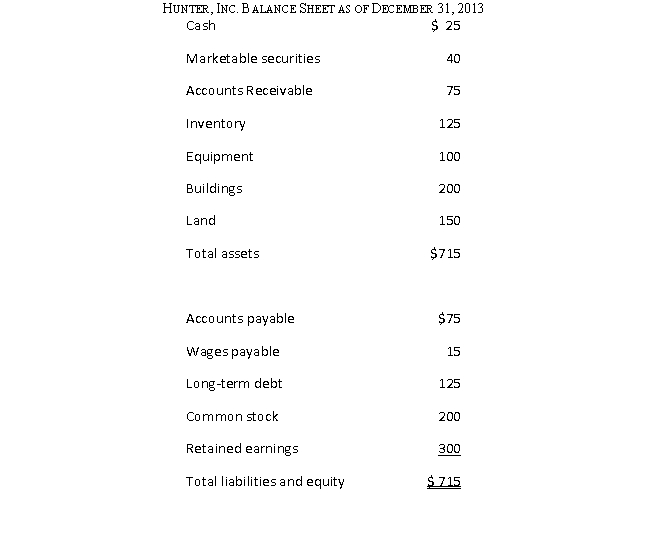

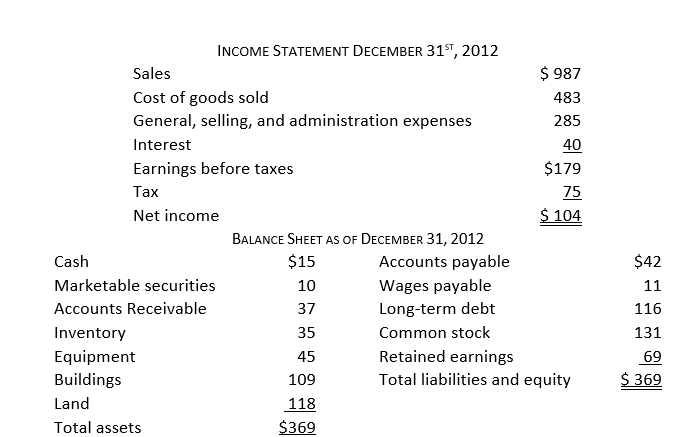

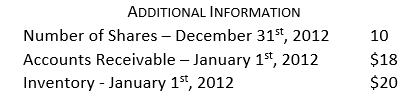

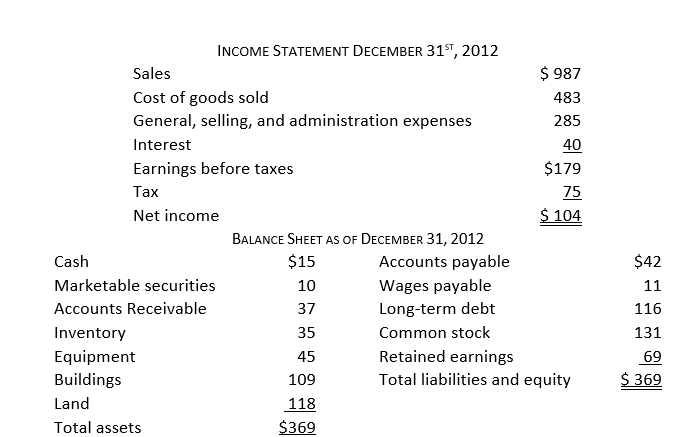

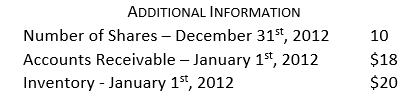

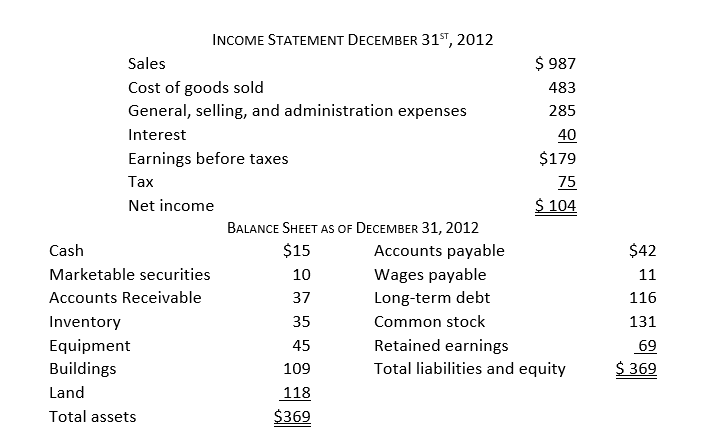

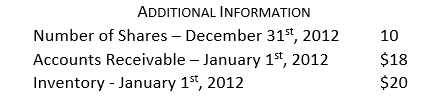

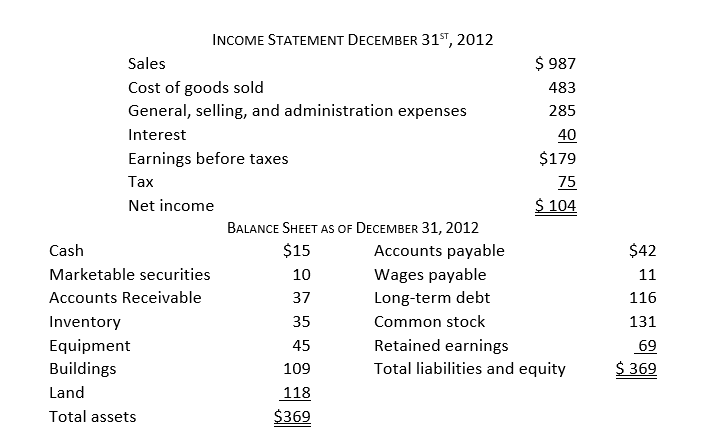

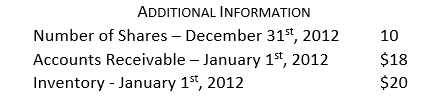

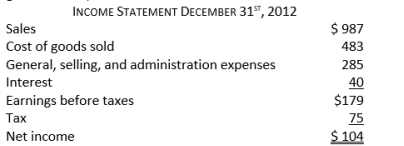

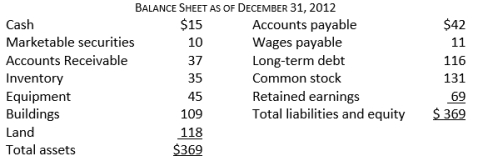

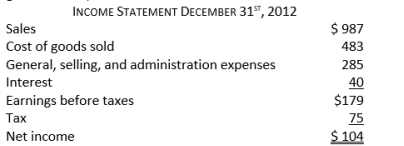

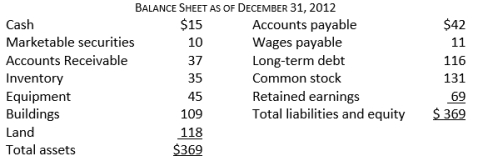

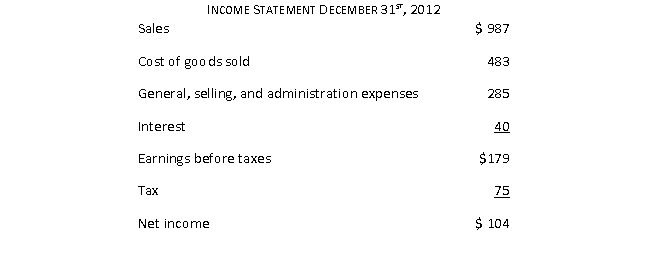

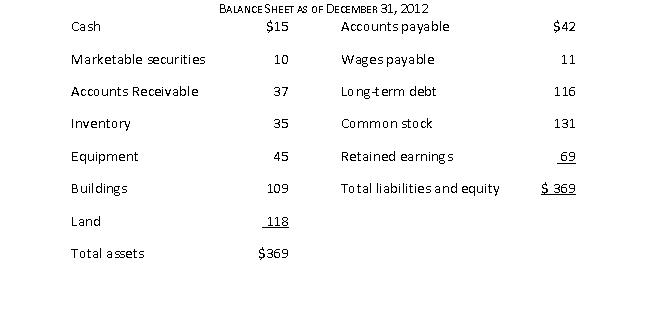

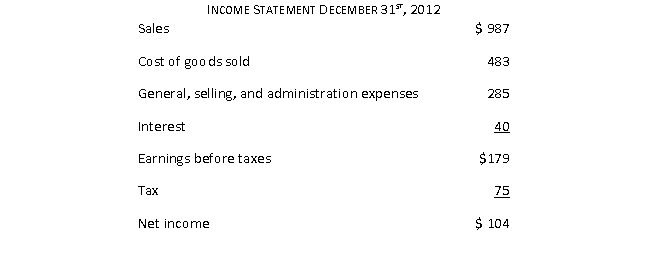

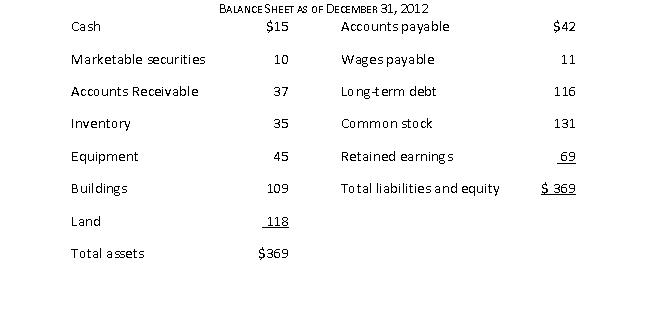

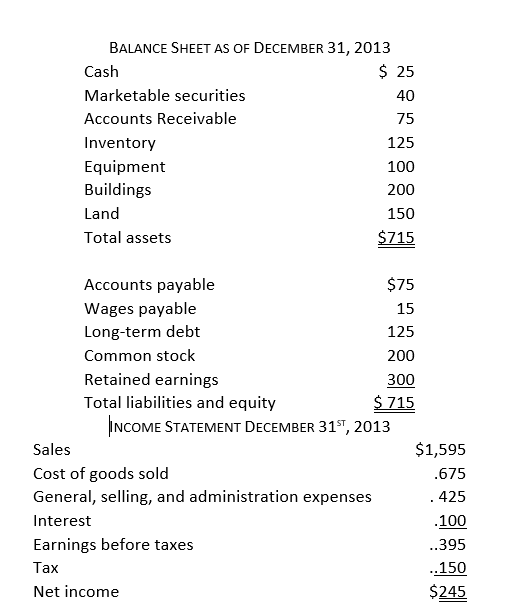

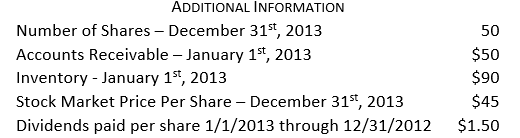

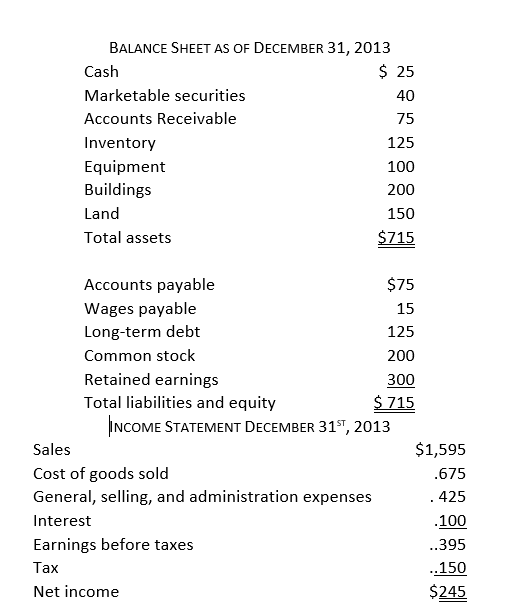

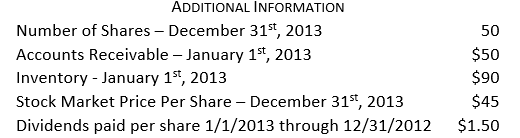

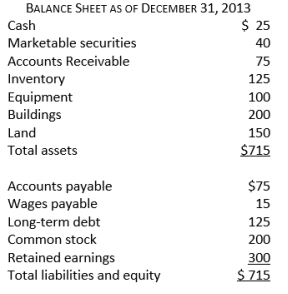

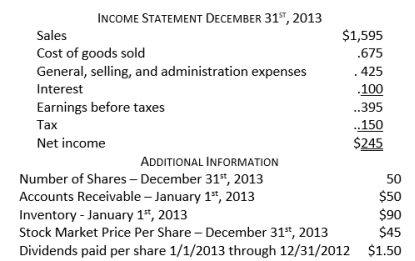

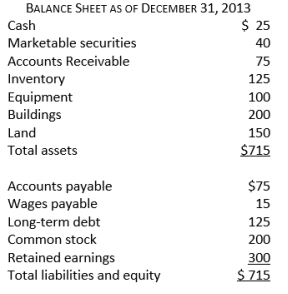

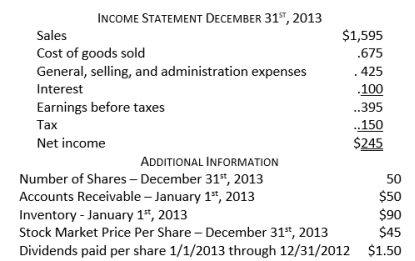

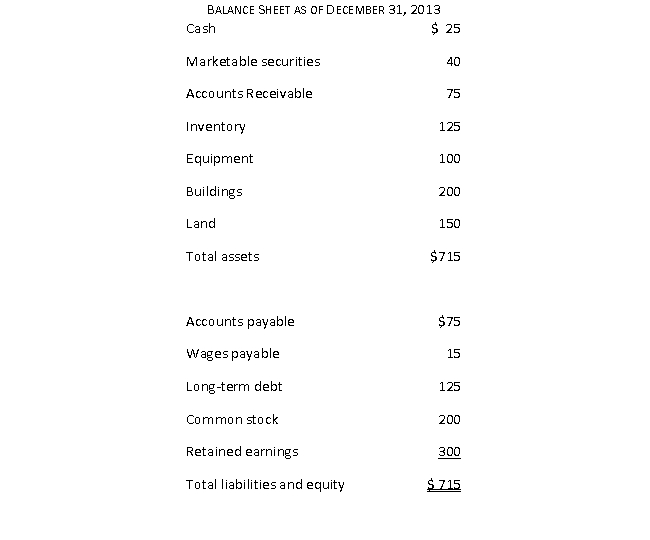

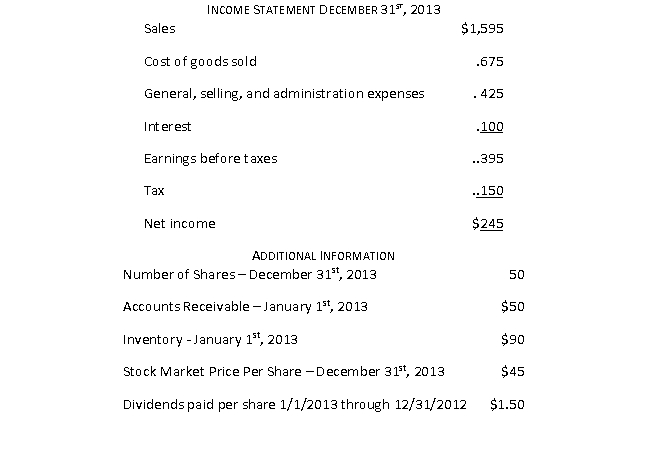

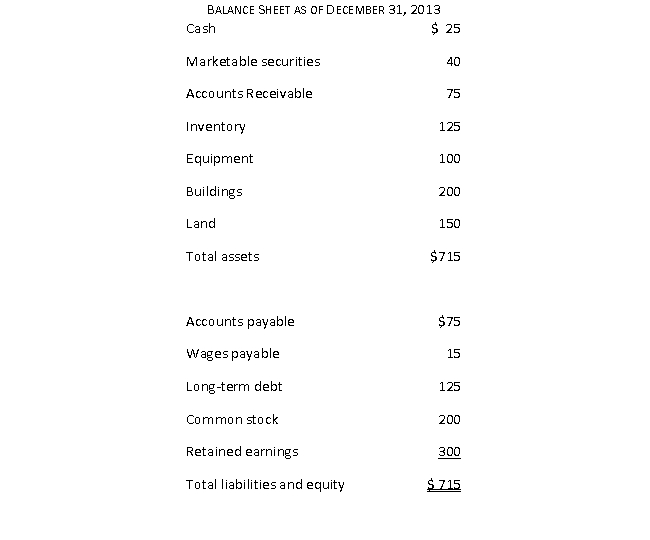

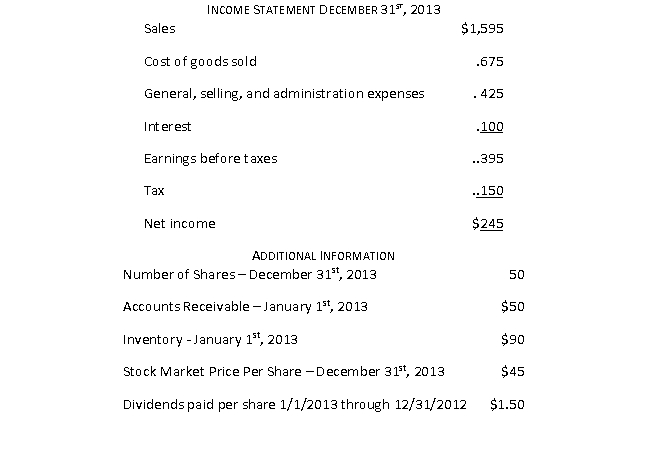

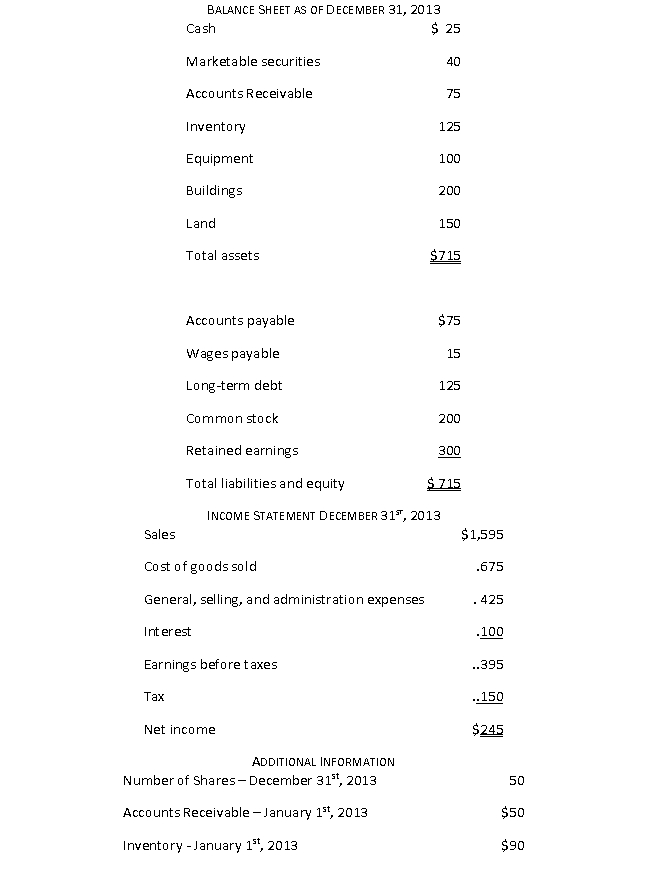

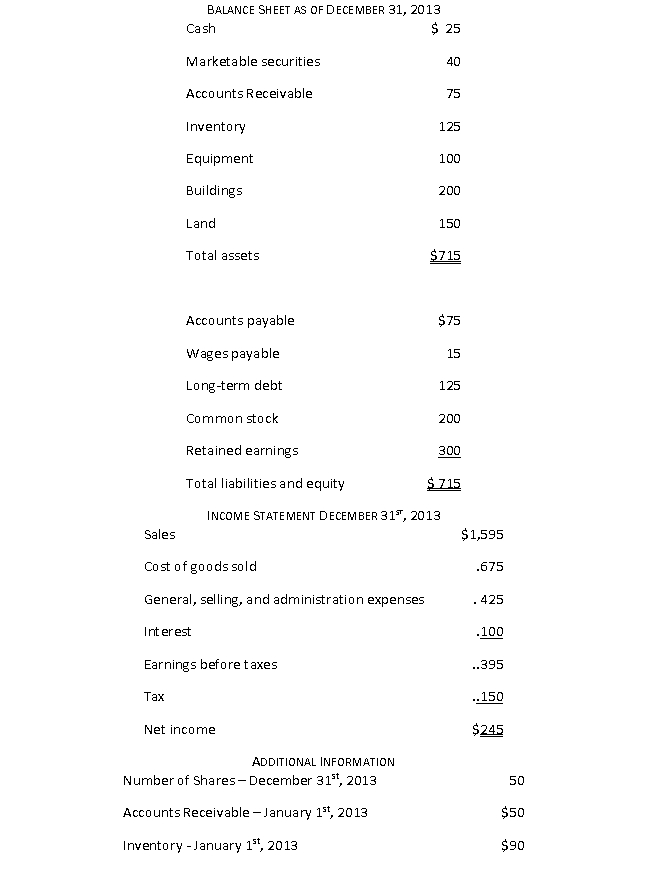

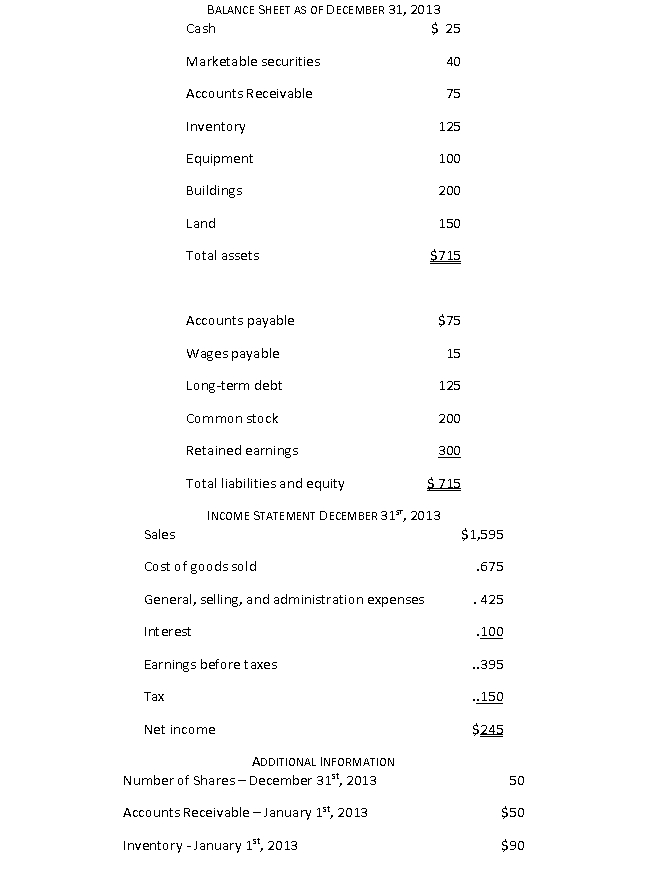

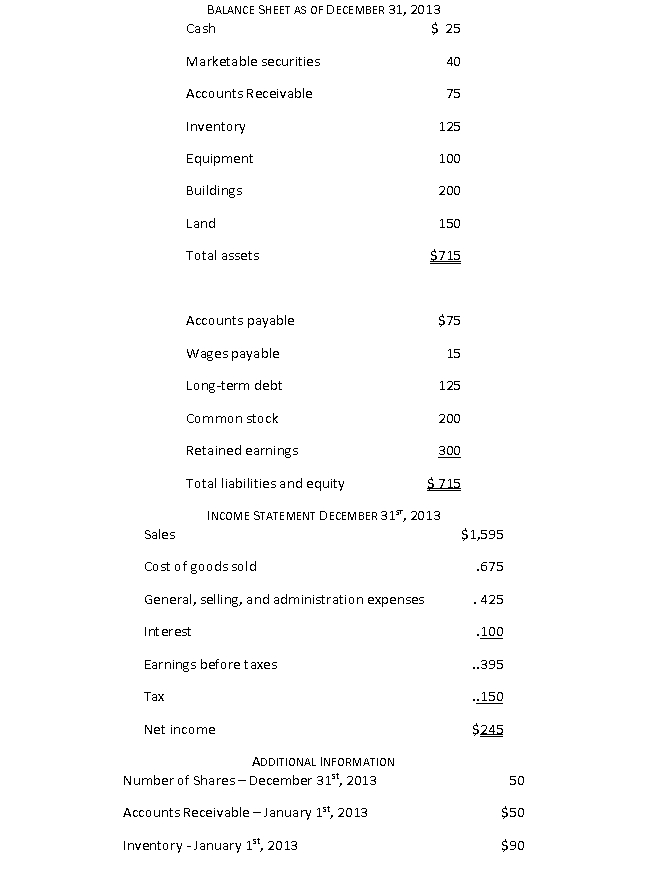

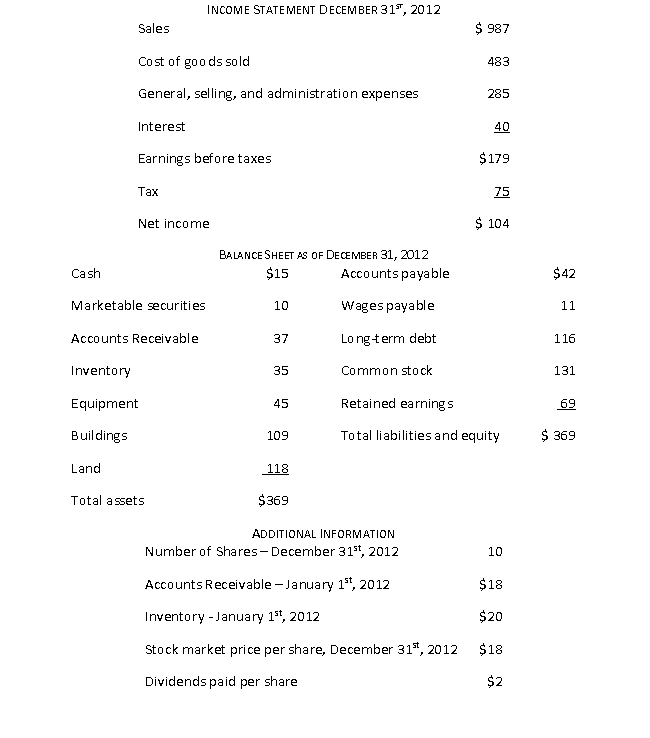

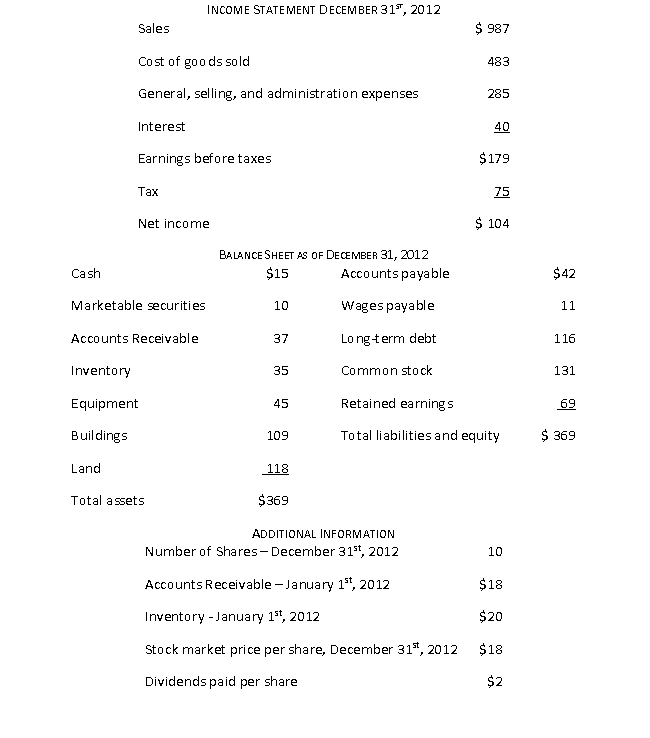

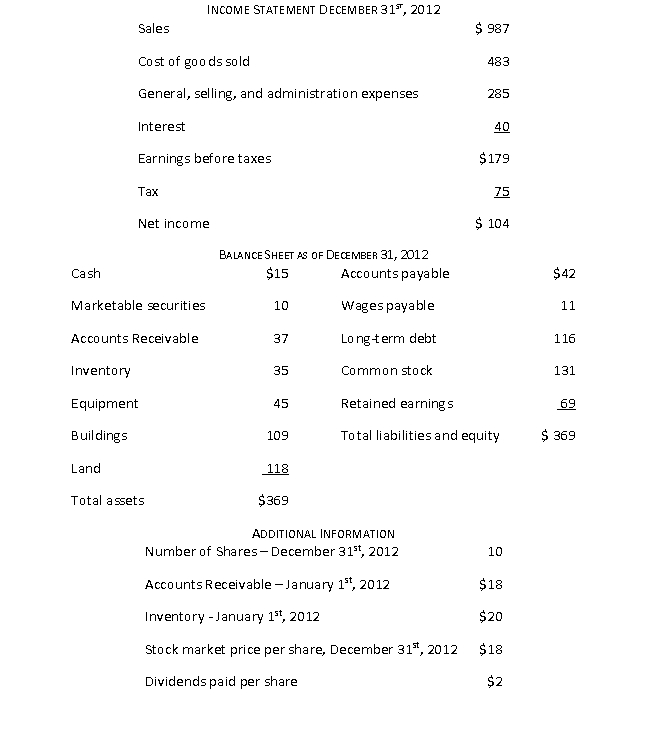

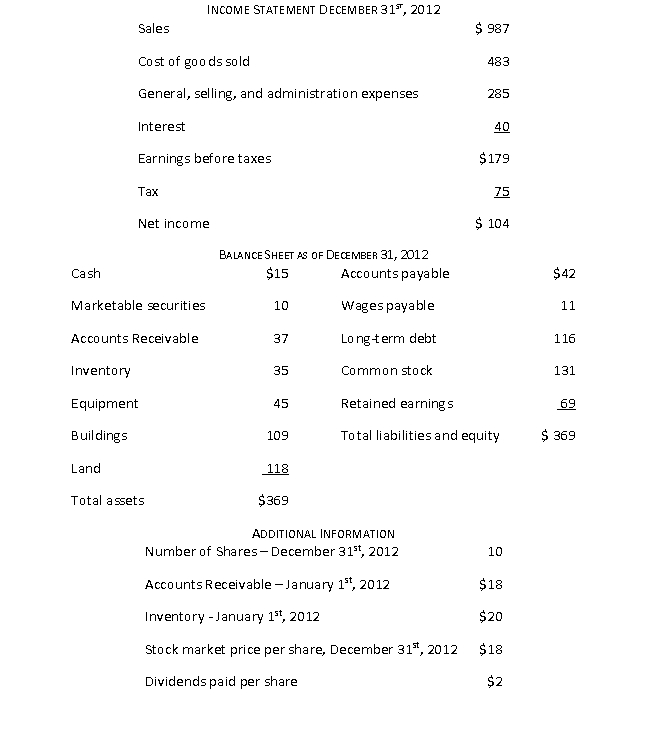

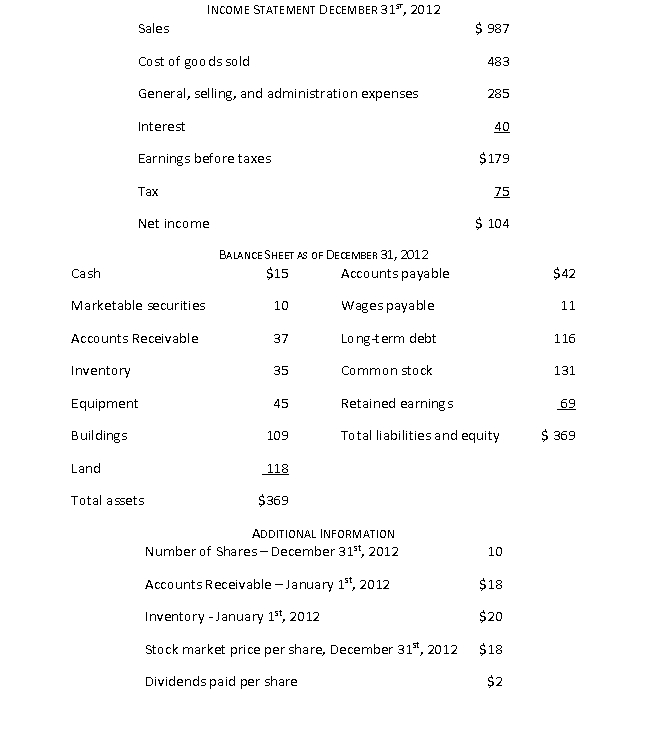

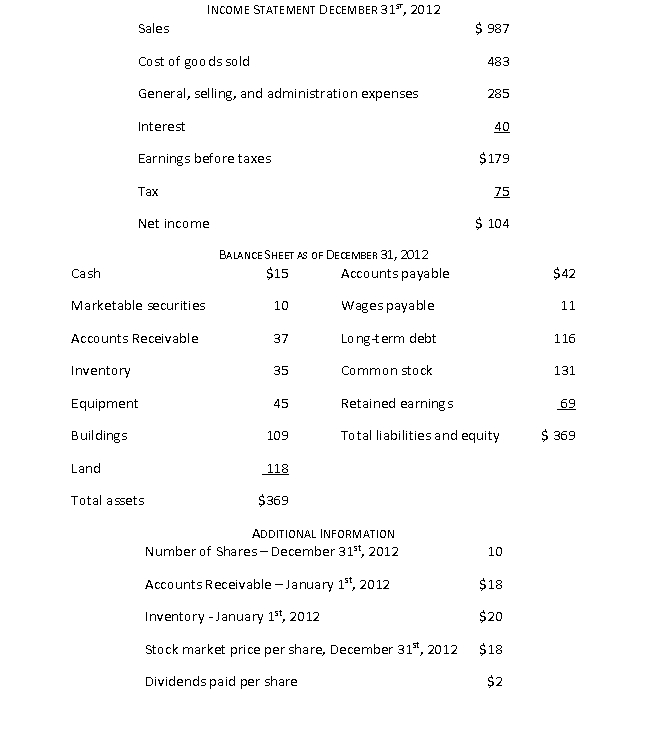

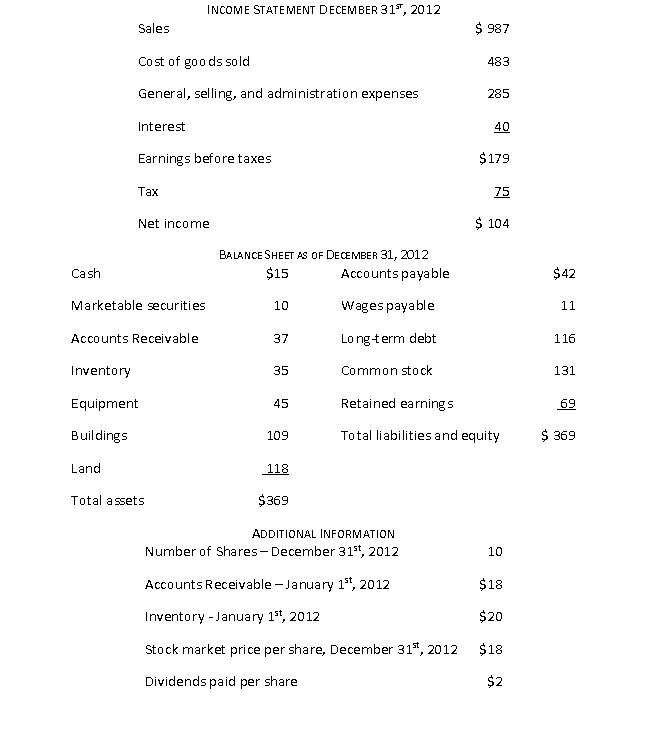

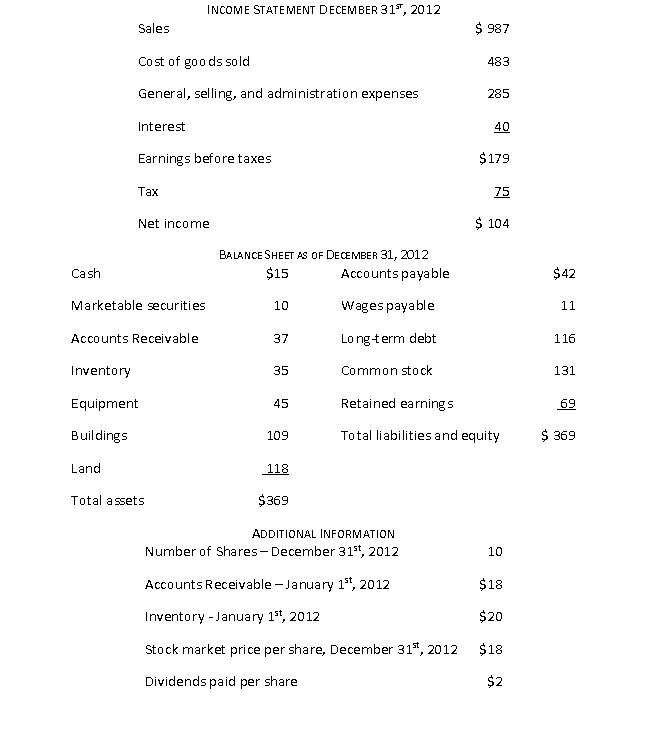

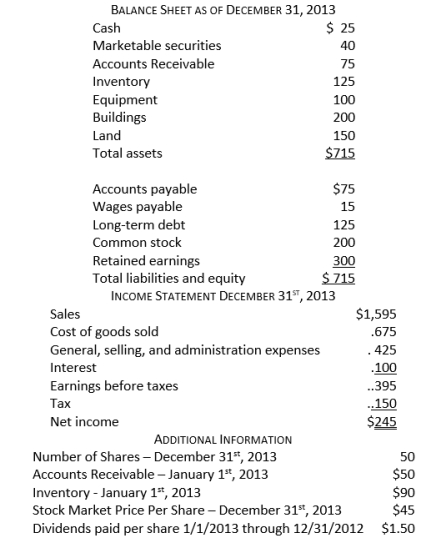

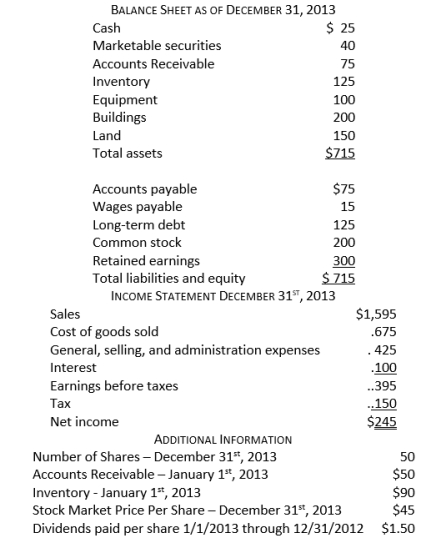

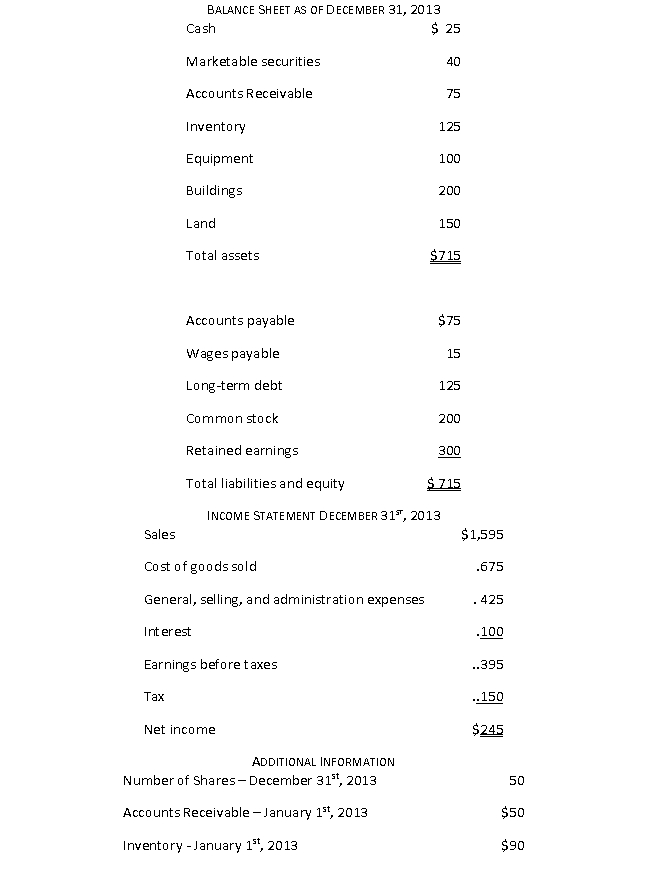

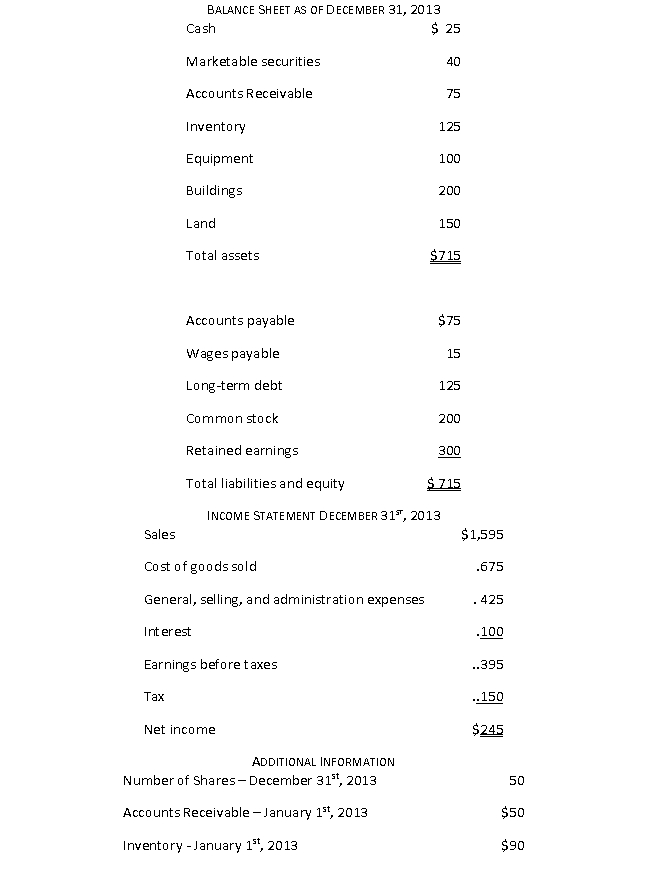

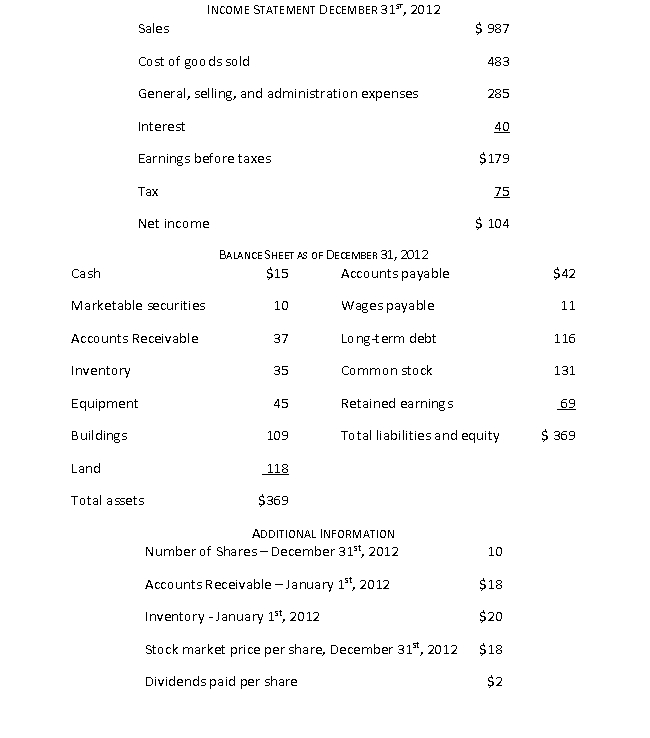

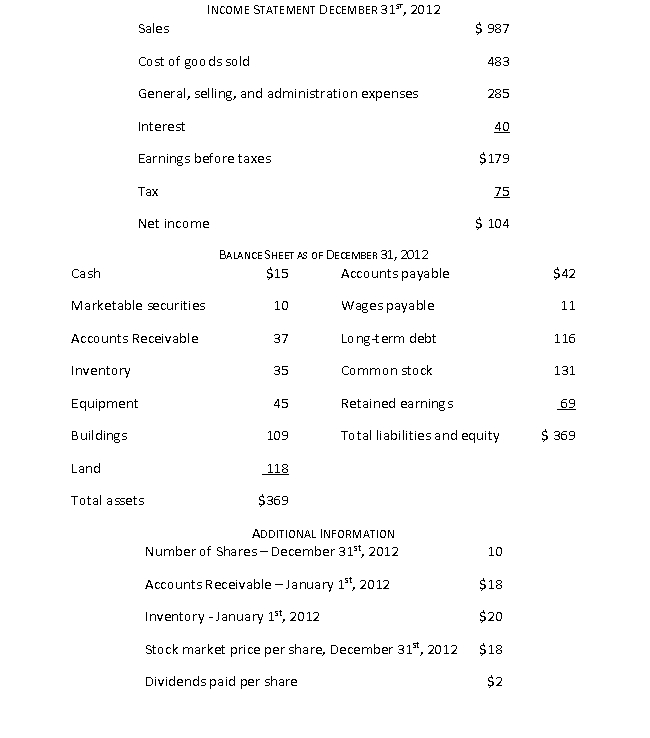

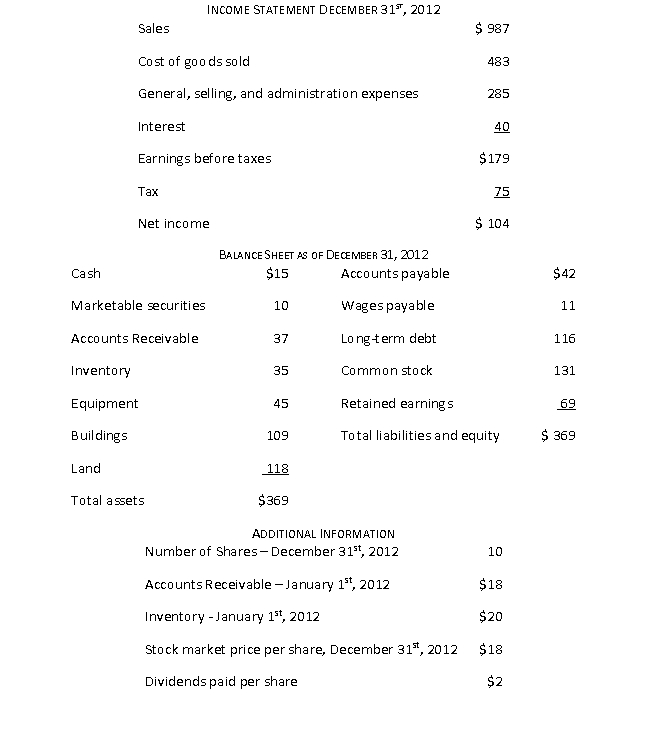

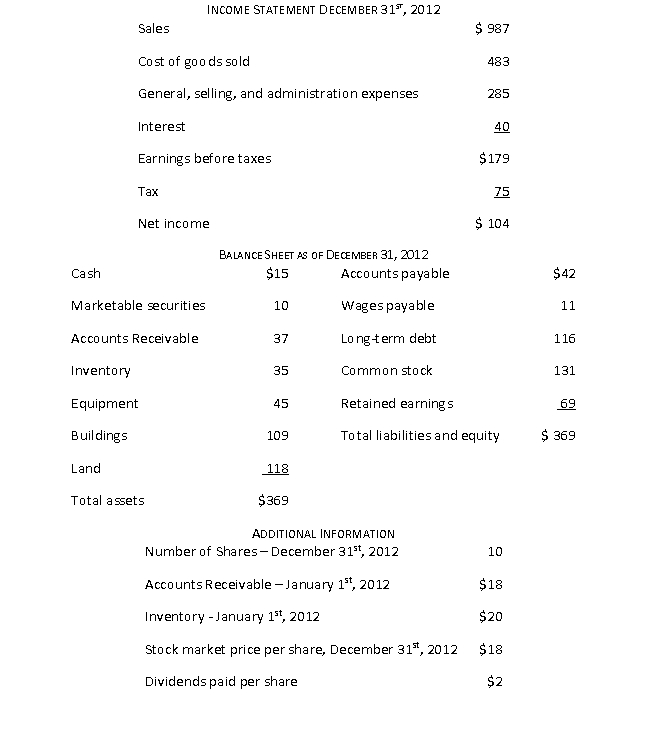

If Hunter Inc. has the following account balances,

Hunter, Inc.'s working capital ratio closest to

Hunter, Inc.'s working capital ratio closest to

A) 0.29

B) 0.37

C) 0.53

D) 0.63

Hunter, Inc.'s working capital ratio closest to

Hunter, Inc.'s working capital ratio closest toA) 0.29

B) 0.37

C) 0.53

D) 0.63

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

12

Given the following account balances:

Hunter, Inc.'s quick ratio is closest to:

Hunter, Inc.'s quick ratio is closest to:

A) 0.28

B) 0.72

C) 1.56

D) 2.94

Hunter, Inc.'s quick ratio is closest to:

Hunter, Inc.'s quick ratio is closest to:A) 0.28

B) 0.72

C) 1.56

D) 2.94

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

13

Given the following account balances,

Hunter's the current ratio, is closest to:

Hunter's the current ratio, is closest to:

A) 0.29

B) 2.94

C) 3.53

Hunter's the current ratio, is closest to:

Hunter's the current ratio, is closest to:A) 0.29

B) 2.94

C) 3.53

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

14

Given the following information for Hunter, Inc.,

Hunter's net working capital is closest to:

Hunter's net working capital is closest to:

A) 50

B) 65

C) 175

D) 500

Hunter's net working capital is closest to:

Hunter's net working capital is closest to:A) 50

B) 65

C) 175

D) 500

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

15

Given the following financial information,

the working capital ratio is closest to:

the working capital ratio is closest to:

A) 0.15

B) 0.26

C) 0.52

D) 0.72

the working capital ratio is closest to:

the working capital ratio is closest to:A) 0.15

B) 0.26

C) 0.52

D) 0.72

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

16

Given the following financial information,

the quick ratio is closest to:

the quick ratio is closest to:

A) .15

B) .47

C) .62

D) 1.17

the quick ratio is closest to:

the quick ratio is closest to:A) .15

B) .47

C) .62

D) 1.17

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

17

Given the following financial information,

the current ratio is closest to:

the current ratio is closest to:

A) 0.26

B) 1.17

C) 1.83

D) 2.31

the current ratio is closest to:

the current ratio is closest to:A) 0.26

B) 1.17

C) 1.83

D) 2.31

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

18

Given the following financial information,

the net working capital is closest to:

the net working capital is closest to:

A) 9

B) 44

C) 175

D) 200

the net working capital is closest to:

the net working capital is closest to:A) 9

B) 44

C) 175

D) 200

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

19

Given the following information,

the gross profit margin is closest to:

the gross profit margin is closest to:

A) 11%

B) 15%

C) 42%

D) 58%

E) 173%

the gross profit margin is closest to:

the gross profit margin is closest to:A) 11%

B) 15%

C) 42%

D) 58%

E) 173%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

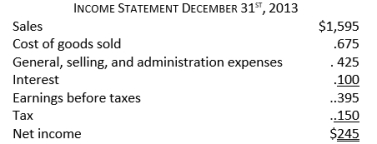

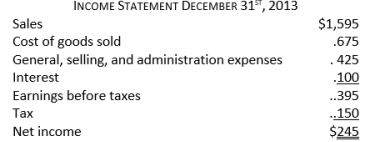

20

Given the following information,

the net profit margin is closest to:

the net profit margin is closest to:

A) 15%

B) 19%

C) 27%

D) 33%

the net profit margin is closest to:

the net profit margin is closest to:A) 15%

B) 19%

C) 27%

D) 33%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

21

Given the following information,

the gross profit margin is closest to:

the gross profit margin is closest to:

A) 48%

B) 49%

C) 50%

D) 51%

the gross profit margin is closest to:

the gross profit margin is closest to:A) 48%

B) 49%

C) 50%

D) 51%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

22

Given the following information,

the net profit margin is closest to:

the net profit margin is closest to:

A) 11%

B) 48%

C) 49%

D) 51%

the net profit margin is closest to:

the net profit margin is closest to:A) 11%

B) 48%

C) 49%

D) 51%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

23

Given the following information,

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:

A) 0.14

B) 0.19

C) 5.40

D) 7.36

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:A) 0.14

B) 0.19

C) 5.40

D) 7.36

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

24

Given the following information,

The accounts receivable turnover ratio is closest to:

The accounts receivable turnover ratio is closest to:

A) 12.8

B) 21.3

C) 25.5

D) 34.1

The accounts receivable turnover ratio is closest to:

The accounts receivable turnover ratio is closest to:A) 12.8

B) 21.3

C) 25.5

D) 34.1

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

25

Given the following information,

the fixed asset turnover ratio is closest to:

the fixed asset turnover ratio is closest to:

A) 0.28

B) 0.58

C) 2.04

D) 3.54

the fixed asset turnover ratio is closest to:

the fixed asset turnover ratio is closest to:A) 0.28

B) 0.58

C) 2.04

D) 3.54

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

26

Given the following information,

the total assets turnover ratio is closest to:

the total assets turnover ratio is closest to:

A) 1.29

B) 2.23

C) 4.28

D) 7.42

the total assets turnover ratio is closest to:

the total assets turnover ratio is closest to:A) 1.29

B) 2.23

C) 4.28

D) 7.42

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

27

Given the following information,

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:

A) 13.8

B) 14.4

C) 17.6

D) 26.7

the inventory turnover ratio is closest to:

the inventory turnover ratio is closest to:A) 13.8

B) 14.4

C) 17.6

D) 26.7

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

28

The accounts receivable turnover ratio is closest to:

A) 13.8

B) 14.4

C) 17.6

D) 26.7

A) 13.8

B) 14.4

C) 17.6

D) 26.7

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

29

Given the following financial information:

the fixed asset turnover ratio is closest to:

the fixed asset turnover ratio is closest to:

A) 1.8

B) 2.7

C) 3.6

the fixed asset turnover ratio is closest to:

the fixed asset turnover ratio is closest to:A) 1.8

B) 2.7

C) 3.6

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

30

Given the following financial information,

the total assets turnover ratio is closest to:

the total assets turnover ratio is closest to:

A) 1.37

B) 1.85

C) 2.67

D) 3.63

the total assets turnover ratio is closest to:

the total assets turnover ratio is closest to:

A) 1.37

B) 1.85

C) 2.67

D) 3.63

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

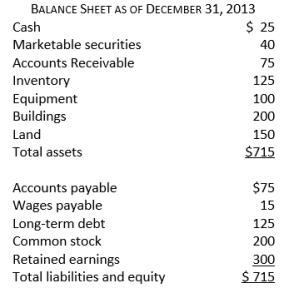

31

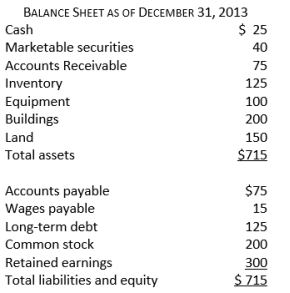

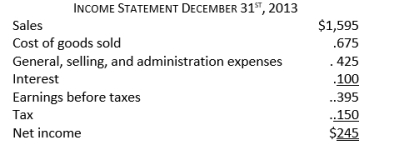

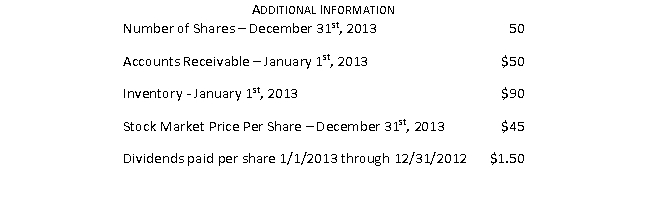

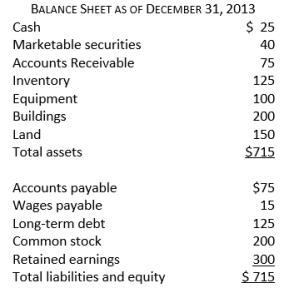

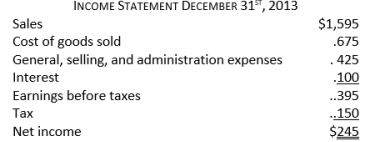

Consider the following financial information:

The debt ratio is closest to:

The debt ratio is closest to:

A) 18%

B) 25%

C) 30%

D) 70%

The debt ratio is closest to:

The debt ratio is closest to:

A) 18%

B) 25%

C) 30%

D) 70%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

32

Consider the following financial information:

The debt-equity ratio of this company is closest to:

The debt-equity ratio of this company is closest to:

A) 25%

B) 43%

C) 57%

D) 75%

The debt-equity ratio of this company is closest to:

The debt-equity ratio of this company is closest to:A) 25%

B) 43%

C) 57%

D) 75%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

33

Consider the following financial information:

The equity multiplier is closest to:

The equity multiplier is closest to:

A) 0.70

B) 1.00

C) 1.43

D) 1.80

The equity multiplier is closest to:

The equity multiplier is closest to:A) 0.70

B) 1.00

C) 1.43

D) 1.80

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

34

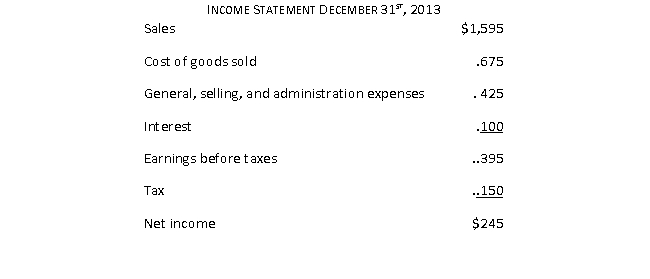

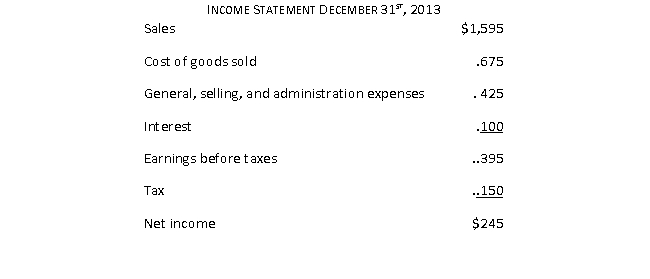

Consider the following financial information:

The times interest earned is closest to:

The times interest earned is closest to:

A) 2.45

B) 3.95

C) 4.95

The times interest earned is closest to:

The times interest earned is closest to:A) 2.45

B) 3.95

C) 4.95

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

35

Consider the following financial information:

The debt ratio is closest to:

The debt ratio is closest to:

A) 31%

B) 46%

C) 48%

D) 58%

The debt ratio is closest to:

The debt ratio is closest to:A) 31%

B) 46%

C) 48%

D) 58%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

36

Consider the following financial information:

The debt-equity ratio is closest to:

The debt-equity ratio is closest to:

A) 31%

B) 46%

C) 58%

D) 85%

The debt-equity ratio is closest to:

The debt-equity ratio is closest to:A) 31%

B) 46%

C) 58%

D) 85%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

37

Consider the following financial information:

The equity multiplier is closest to:

The equity multiplier is closest to:

A) 0.5

B) 1.0

C) 1.6

D) 1.8

The equity multiplier is closest to:

The equity multiplier is closest to:A) 0.5

B) 1.0

C) 1.6

D) 1.8

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

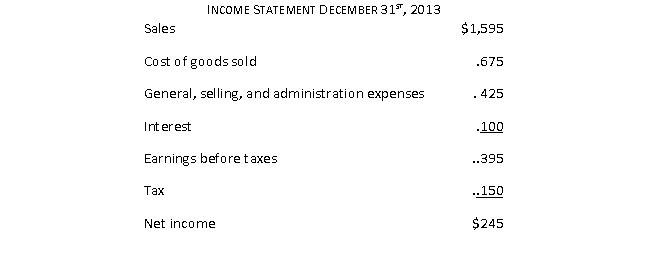

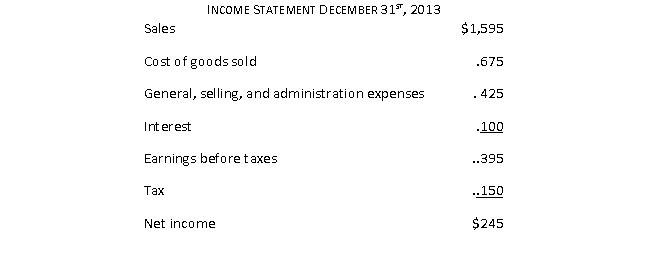

38

Consider the following financial information:

The times interest earned is closest to:

The times interest earned is closest to:

A) 2.6

B) 4.5

C) 5.5

The times interest earned is closest to:

The times interest earned is closest to:A) 2.6

B) 4.5

C) 5.5

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

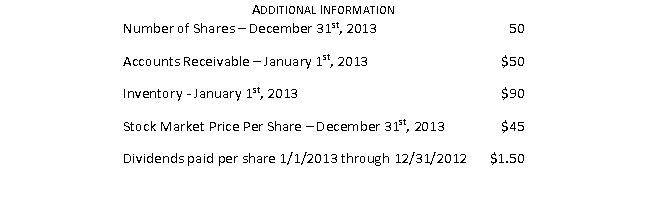

39

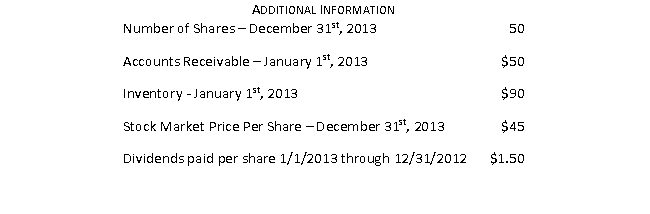

Consider the following financial information:

The book value per share is closest to:

The book value per share is closest to:

A) $1.50

B) $4.50

C) $10.00

D) $14.30

E) $31.90

The book value per share is closest to:

The book value per share is closest to:A) $1.50

B) $4.50

C) $10.00

D) $14.30

E) $31.90

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

40

Consider the following financial information:

The market to book value is closest to:

The market to book value is closest to:

A) 0.49

B) 3.00

C) 4.50

D) 9.18

The market to book value is closest to:

The market to book value is closest to:A) 0.49

B) 3.00

C) 4.50

D) 9.18

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

41

Consider the following financial information:

The price earnings ratio is closest to:

The price earnings ratio is closest to:

A) 0.18

B) 1.41

C) 2.04

D) 9.18

The price earnings ratio is closest to:

The price earnings ratio is closest to:A) 0.18

B) 1.41

C) 2.04

D) 9.18

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

42

Consider the following financial information:

The dividend payout is closest to:

The dividend payout is closest to:

A) 1%

B) 10%

C) 15%

D) 31%

E) 69%

The dividend payout is closest to:

The dividend payout is closest to:A) 1%

B) 10%

C) 15%

D) 31%

E) 69%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

43

Consider the following financial information:

The dividend yield is closest to:

The dividend yield is closest to:

A) 1%

B) 3%

C) 15%

D) 31%

The dividend yield is closest to:

The dividend yield is closest to:A) 1%

B) 3%

C) 15%

D) 31%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

44

Consider the following financial information:

The book value per share is closest to:

The book value per share is closest to:

A) $1.80

B) $20.00

C) $36.90

D) $98.70

The book value per share is closest to:

The book value per share is closest to:A) $1.80

B) $20.00

C) $36.90

D) $98.70

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

45

Consider the following financial information:

The market to book value is closest to:

The market to book value is closest to:

A) 0.52

B) 0.90

C) 1.73

The market to book value is closest to:

The market to book value is closest to:A) 0.52

B) 0.90

C) 1.73

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

46

Consider the following financial information:

The price earnings ratio is closest to:

The price earnings ratio is closest to:

A) .17

B) .18

C) 1.73

D) 1.92

The price earnings ratio is closest to:

The price earnings ratio is closest to:A) .17

B) .18

C) 1.73

D) 1.92

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

47

Consider the following financial information:

The dividend payout is closest to:

The dividend payout is closest to:

A) 2%

B) 10%

C) 19%

D) 24%

The dividend payout is closest to:

The dividend payout is closest to:A) 2%

B) 10%

C) 19%

D) 24%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

48

Consider the following financial information:

The dividend yield is closest to:

The dividend yield is closest to:

A) 2%

B) 10%

C) 11%

D) 19%

The dividend yield is closest to:

The dividend yield is closest to:A) 2%

B) 10%

C) 11%

D) 19%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

49

Which "bottom line" ratio best measures how well a company's management has put the company's assets to work to produce a profit?

A) Return on equity

B) Return on assets

C) Net profit margin

D) Gross profit margin

A) Return on equity

B) Return on assets

C) Net profit margin

D) Gross profit margin

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

50

Useful approaches to using financial ratios include all of the following except:

A) the DuPont System.

B) examining individual ratios.

C) comparisons of ratios across time.

D) comparisons of ratios across companies.

E) looking at changes going on in the company.

A) the DuPont System.

B) examining individual ratios.

C) comparisons of ratios across time.

D) comparisons of ratios across companies.

E) looking at changes going on in the company.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

51

The method of analyzing return ratios by breaking down these ratios into their components is:

A) classification.

B) return analysis.

C) the DuPont System.

D) break down method.

A) classification.

B) return analysis.

C) the DuPont System.

D) break down method.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is not a ratio in the DuPont System?

A) Equity multiplier

B) Return on equity

C) Net profit margin

D) Debt to equity ratio

E) Asset turnover ratio

A) Equity multiplier

B) Return on equity

C) Net profit margin

D) Debt to equity ratio

E) Asset turnover ratio

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is not true?

A) The DuPont System focuses on owner ratios.

B) The DuPont System was pioneered by the DuPont Corporation.

C) The DuPont System is a way of summarizing a company's key financial ratios.

D) The DuPont System is a method of analyzing return ratios by breaking down these ratios into their components.

E) Return on equity, net profit margin, asset turnover ratio, and the equity multiplier are the major components of the DuPont System.

A) The DuPont System focuses on owner ratios.

B) The DuPont System was pioneered by the DuPont Corporation.

C) The DuPont System is a way of summarizing a company's key financial ratios.

D) The DuPont System is a method of analyzing return ratios by breaking down these ratios into their components.

E) Return on equity, net profit margin, asset turnover ratio, and the equity multiplier are the major components of the DuPont System.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

54

Generic Company has a return on assets of 8% and a return on equity of 15%. Generic Company's equity multiplier is nearest to:

A) 0.1875

B) 0.533

C) 1.875

D) 5.333

A) 0.1875

B) 0.533

C) 1.875

D) 5.333

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

55

Consider the following financial information:

The return on assets is closest to:

The return on assets is closest to:

A) 34%

B) 54%

C) 55%

D) 66%

E) 69%

The return on assets is closest to:

The return on assets is closest to:A) 34%

B) 54%

C) 55%

D) 66%

E) 69%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

56

Consider the following financial information:

The return on equity is closest to:

The return on equity is closest to:

A) 34%

B) 49%

C) 51%

D) 79%

E) 99%

The return on equity is closest to:

The return on equity is closest to:A) 34%

B) 49%

C) 51%

D) 79%

E) 99%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

57

Consider the following financial information:

The return on assets is closest to:

The return on assets is closest to:

A) 28%

B) 38%

C) 49%

D) 59%

The return on assets is closest to:

The return on assets is closest to:A) 28%

B) 38%

C) 49%

D) 59%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

58

Consider the following financial information:

The return on equity is closest to:

The return on equity is closest to:

A) 28%

B) 52%

C) 90%

D) 110%

The return on equity is closest to:

The return on equity is closest to:A) 28%

B) 52%

C) 90%

D) 110%

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

59

If Company As equity multiplier is 3.65, which of the following would not be true?

A) 3.65 is the financial leverage ratio using the DuPont System.

B) Company As total assets are 3.65 times its shareholders equity.

C) Company A has leveraged every dollar of shareholders' equity into $3.65 of total financing.

D) 3.65 can be multiplied by return on equity for Company A to find Company As return on assets.

A) 3.65 is the financial leverage ratio using the DuPont System.

B) Company As total assets are 3.65 times its shareholders equity.

C) Company A has leveraged every dollar of shareholders' equity into $3.65 of total financing.

D) 3.65 can be multiplied by return on equity for Company A to find Company As return on assets.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

60

The current ratio is an example of a ratio that provides information on a company's efficiency.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

61

Turnover ratios are often used in the analysis of the productivity of a business enterprise.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

62

Because financial ratios are the ratio of two values, the accounting principles are not important because these cancel out in the ratio.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

63

A choice of accounting method will only affect a single financial statement.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

64

When calculating ratios that involve fixed assets, the use of historical costs does not affect the ratios.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

65

Long term assets are also referred to as working capital.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

66

You calculate the day's purchases outstanding ratio for XYZ Company and it comes out to 45.13. This means that XYZ Company takes an average of 45.13 days to pay its creditors.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

67

Financial leverage magnifies earnings or losses to owners.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

68

XYZ Company's dividend payout ratio is .325. This would mean that the company also has a plowback ratio of 0.825.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

69

New Venture has a forward P/E ratio of 38.12. Value Company has a forward P/E ratio of 12.25. This means that if EPS stays the same for both companies, the investor will recoup their investment in nearly a third of the time with Value Company that it will take to recoup the investment in New Venture.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

70

Trailing P/E is current share price divided by last year's EPS.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

71

Total debt is the same as total liabilities.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

72

Generally speaking, the larger a company's inventory, the larger the difference between its current ratio and quick ratio.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

73

Companies with inventory will always have a quick ratio that is more than their current ratio.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

74

If an analyst wanted to look at the age of a company's receivables, they should examine the Days sales outstanding ratio.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

75

A customer of your company has a times interest earned ratio of 23.25. This means that for every dollar of interest expense, the customer had $23.25 of income available to pay interest and taxes.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

76

The return earned by owners on their investment in a company is return on assets.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

77

If a company's return on equity has been declining over time, this could likely be due to a decline in net income or a decline in shareholders' equity.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

78

The use of trend analysis may not be appropriate if the company has experienced significant acquisitions or significant divestures.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

79

Discuss what an analyst should consider regarding accounting principles when they analyze a company.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

80

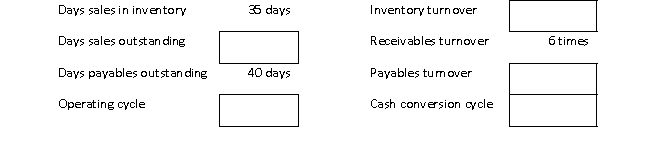

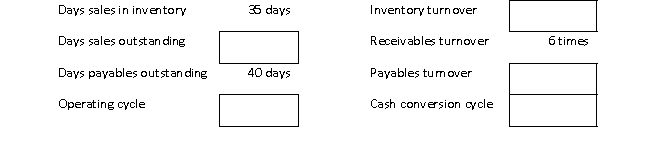

Complete the following table

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck