Deck 6: Capital Structure and Capital Budgeting Decision Methods

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/13

Play

Full screen (f)

Deck 6: Capital Structure and Capital Budgeting Decision Methods

1

An investment banking firm has estimated the following after-tax cost of debt and cost of equity for Toronto's Finest Resorts.

What is the cost of capital for Toronto's optimal capital structure given the above information?

A) 11.70%

B) 11.54%

C) 11.75%

D) 11.65%

What is the cost of capital for Toronto's optimal capital structure given the above information?

A) 11.70%

B) 11.54%

C) 11.75%

D) 11.65%

11.54%

2

Vancouver's Famous Barbeque has estimated the following cost of debt (before-tax) and cost of equity.

What is the cost of capital for Vancouver's optimal capital structure given the above information and a 40% effective tax rate?

A) 8.71%

B) 8.89%

C) 9.03%

D) 9.37%

What is the cost of capital for Vancouver's optimal capital structure given the above information and a 40% effective tax rate?

A) 8.71%

B) 8.89%

C) 9.03%

D) 9.37%

8.89%

3

An investment banking firm has estimated the following after-tax cost of debt and cost of equity for Red Deer Luxury Mountain Travel Tours.

What is the cost of capital for Red Deer's optimal capital structure given the above information?

A) 8.95%

B) 8.40%

C) 8.30%

D) 8.15%

What is the cost of capital for Red Deer's optimal capital structure given the above information?

A) 8.95%

B) 8.40%

C) 8.30%

D) 8.15%

8.30%

4

The Edmonton Eskimos Football Club has estimated the following cost of debt (before-tax) and cost of equity for its food and beverage operations.

What is the cost of capital for the Edmonton Eskimos' optimal capital structure given the above information and a 40% effective tax rate?

A) 10.78%

B) 11.02%

C) 11.13%

D) 11.45%

What is the cost of capital for the Edmonton Eskimos' optimal capital structure given the above information and a 40% effective tax rate?

A) 10.78%

B) 11.02%

C) 11.13%

D) 11.45%

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

5

A project's net present value is a measure of a project's contribution to firm value.

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

6

What is the profitability index for an acceptable capital budgeting project?

A) greater than 1.0

B) less than 1.0

C) greater than 0.0

D) less than 0.0

A) greater than 1.0

B) less than 1.0

C) greater than 0.0

D) less than 0.0

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

7

A capital budgeting project has a net investment of $1,000,000 and is expected to generate net cash flows of $350,000 annually for 4 years. What is the internal rate of return?

A) 22.11%

B) 14.96%

C) 2.48%

D) 26.43%

A) 22.11%

B) 14.96%

C) 2.48%

D) 26.43%

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

8

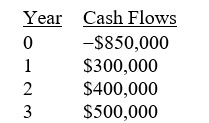

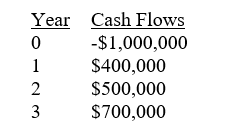

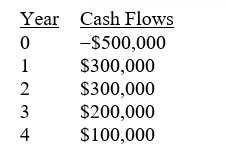

A capital budgeting project is expected to have the following cash flows:

What is the project's payback period?

A) 1.50 years

B) 3.30 years

C) 2.50 years

D) 2.30 years

What is the project's payback period?

A) 1.50 years

B) 3.30 years

C) 2.50 years

D) 2.30 years

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

9

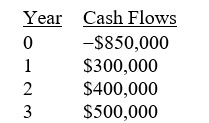

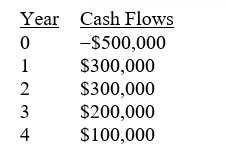

A capital budgeting project is expected to have the following cash flows:

What is the project's net present value at an 18% required rate of return?

A) -$4,173.50

B) $10,800.96

C) -$18,725.33

D) $350,000.00

What is the project's net present value at an 18% required rate of return?

A) -$4,173.50

B) $10,800.96

C) -$18,725.33

D) $350,000.00

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

10

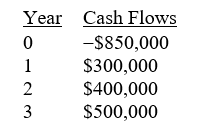

A capital budgeting project is expected to have the following cash flows:

What is the project's internal rate of return?

A) 21.65%

B) 30.88%

C) 24.90%

D) 27.95%

What is the project's internal rate of return?

A) 21.65%

B) 30.88%

C) 24.90%

D) 27.95%

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

11

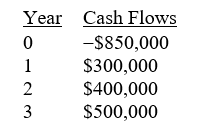

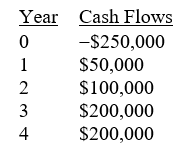

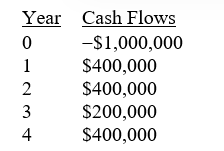

A capital budgeting project is expected to have the following cash flows:

What is the project's payback period?

A) 2.75 years

B) 2.25 years

C) 2.50 years

D) 1.25 years

What is the project's payback period?

A) 2.75 years

B) 2.25 years

C) 2.50 years

D) 1.25 years

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

12

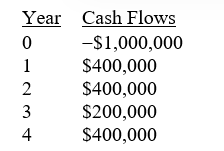

A capital budgeting project is expected to have the following cash flows:

What is the project's net present value at a 12% required rate of return?

A) $212,923

B) $200,373

C) $225,868

D) $276,475

What is the project's net present value at a 12% required rate of return?

A) $212,923

B) $200,373

C) $225,868

D) $276,475

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck

13

A capital budgeting project is expected to have the following cash flows:

What is the project's internal rate of return?

A) 16.00%

B) 8.99%

C) 21.86%

D) 15.54%

What is the project's internal rate of return?

A) 16.00%

B) 8.99%

C) 21.86%

D) 15.54%

Unlock Deck

Unlock for access to all 13 flashcards in this deck.

Unlock Deck

k this deck