Deck 16: Business Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/129

Play

Full screen (f)

Deck 16: Business Investment Decisions

1

Vencap Enterprises is evaluating an investment opportunity that can be purchased for $37,000. Further product development will require contributions of $30,000 in Year 1 and $10,000 in Year 2. Then returns of $20,000, $60,000, and $40,000 are expected in the three following years.

a) Use the Valuation Principle to determine whether Vencap should make the investment if its cost of capital is 12%.

b) By what amount will the current economic value of Vencap be increased or decreased if it proceeds with purchasing the investment for $37,000?

a) Use the Valuation Principle to determine whether Vencap should make the investment if its cost of capital is 12%.

b) By what amount will the current economic value of Vencap be increased or decreased if it proceeds with purchasing the investment for $37,000?

a) the investment should be made (NPV = $40,30)

b) the increase in economic value is $3,306

b) the increase in economic value is $3,306

2

Vencap Enterprises is evaluating an investment opportunity that can be purchased for $37,000. Further product development will require contributions of $30,000 in Year 1 and $10,000 in Year 2. Then returns of $20,000, $60,000, and $40,000 are expected in the three following years.

a) Use the Valuation Principle to determine whether Vencap should make the investment if its cost of capital is 15%.

b) By what amount will the current economic value of Vencap be increased or decreased if it proceeds with purchasing the investment for $37,000?

a) Use the Valuation Principle to determine whether Vencap should make the investment if its cost of capital is 15%.

b) By what amount will the current economic value of Vencap be increased or decreased if it proceeds with purchasing the investment for $37,000?

a) the investment shoul not be made

b) the economic value would be decreased by $3306

b) the economic value would be decreased by $3306

3

Vencap Enterprises is evaluating an investment opportunity that can be purchased for $37,000. Further product development will require contributions of $30,000 in Year 1 and $10,000 in Year 2. Then returns of $20,000, $60,000, and $40,000 are expected in the three following years. Cost of capital is 15%. What price should Vencap offer for the investment opportunity if it requires a 17% return on investment?

$29,805

4

The timber rights to a tract of forest can be purchased for $220,000. The harvesting agreement would allow 25% of the timber to be cut in each of the first, second, fourth, and fifth years. The purchaser of the timber rights would be required to replant, at its expense, the logged areas in Years 3 and 6. Arrowsmith Lumber calculates that its profit in each of the four cutting years would be $90,000 and that the cost of replanting the harvested areas in each of Years 3 and 6 would be $30,000.

a) Should Arrowsmith Lumber buy the timber rights if its cost of capital is 10%?

b) By what amount would the economic value of Arrowsmith Lumber be increased or decreased if it proceeded with purchasing the timber rights for $220,000?

a) Should Arrowsmith Lumber buy the timber rights if its cost of capital is 10%?

b) By what amount would the economic value of Arrowsmith Lumber be increased or decreased if it proceeded with purchasing the timber rights for $220,000?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

5

The timber rights to a tract of forest can be purchased for $220,000. The harvesting agreement would allow 25% of the timber to be cut in each of the first, second, fourth, and fifth years. The purchaser of the timber rights would be required to replant, at its expense, the logged areas in Years 3 and 6. Arrowsmith Lumber calculates that its profit in each of the four cutting years would be $90,000 and that the cost of replanting the harvested areas in each of Years 3 and 6 would be $30,000.

a) Should Arrowsmith Lumber buy the timber rights if its cost of capital is 12.5%?

b) By what amount would the economic value of Arrowsmith Lumber be increased or decreased if it proceeded with purchasing the timber rights for $220,000?

a) Should Arrowsmith Lumber buy the timber rights if its cost of capital is 12.5%?

b) By what amount would the economic value of Arrowsmith Lumber be increased or decreased if it proceeded with purchasing the timber rights for $220,000?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

6

The timber rights to a tract of forest can be purchased for $220,000. The harvesting agreement would allow 25% of the timber to be cut in each of the first, second, fourth, and fifth years. The purchaser of the timber rights would be required to replant, at its expense, the logged areas in Years 3 and 6. Arrowsmith Lumber calculates that its profit in each of the four cutting years would be $90,000 and that the cost of replanting the harvested areas in each of Years 3 and 6 would be $30,000. Its cost of capital is 14%. At what price would Arrowsmith Lumber be willing to purchase the timber rights if it requires a return on investment of 15%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

7

A machine can be leased for four years at $1000 per month payable at the beginning of each month. Alternatively, it can be purchased for $45,000 and sold for $5000 after four years. Should the machine be purchased or leased if the firm's cost of borrowing is:

a) 6.6% compounded monthly?

b) 9% compounded monthly?

a) 6.6% compounded monthly?

b) 9% compounded monthly?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

8

A real estate salesperson can lease an automobile for five years at $500 per month payable at the beginning of each month, or purchase it for $28,000. She can obtain a loan at 9.75% compounded monthly to purchase the car. Should she lease or buy the car if:

a) The trade-in value after five years is $5000?

b) The trade-in value after five years is $8000?

a) The trade-in value after five years is $5000?

b) The trade-in value after five years is $8000?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

9

A college can purchase a telephone system for $30,000 or lease a system for five years for a front-end charge of $3000 and regular payments of $1500 at the beginning of every quarter (including the first quarter). The system can be purchased at the end of the lease period for $3000.

a) Should the college lease or buy the system if it can borrow funds at 10% compounded quarterly?

b) What is the current economic value of the savings with the lower-cost option?

a) Should the college lease or buy the system if it can borrow funds at 10% compounded quarterly?

b) What is the current economic value of the savings with the lower-cost option?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

10

Rocky Mountain Bus Tours needs an additional bus for three years. It can lease a bus for $2100 payable at the beginning of each month, or it can buy a similar bus for $120,000 using financing at the rate of 7.5% compounded monthly. The bus's resale value after three years is expected to be $60,000.

a) On strictly financial considerations, should the company lease or buy the bus?

b) What is the financial advantage in current dollars of the preferred choice?

a) On strictly financial considerations, should the company lease or buy the bus?

b) What is the financial advantage in current dollars of the preferred choice?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

11

Ralph Harder has been transferred to Regina for five years. He has found an attractive house that he can buy for $180,000 or rent for $1000 per month, payable at the beginning of each month. He estimates that the resale value of the house in five years will be $200,000 net of the selling commission. If he buys the house, the average (month-end) costs for repairs, maintenance, and property taxes will be $300. Should Mr. Harder rent or buy the house if mortgage rates are:

a) 7% compounded monthly?

b) 6% compounded monthly?

a) 7% compounded monthly?

b) 6% compounded monthly?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

12

St. Lawrence Bus Lines is offered a contract for busing schoolchildren that will produce an annual profit of $70,000 for seven years. To fulfill the contract, St. Lawrence would have to buy three buses at a total cost of $333,000. At the end of the contract the resale value of the buses is estimated to be $80,000.

Should St. Lawrence Bus Lines sign the contract if its cost of capital is:

a) 12%?

b) 14%?

c) 16%?

Should St. Lawrence Bus Lines sign the contract if its cost of capital is:

a) 12%?

b) 14%?

c) 16%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

13

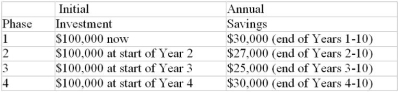

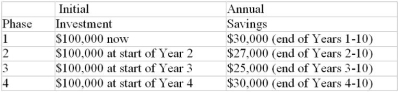

An automotive parts plant is scheduled to be closed in 10 years. Nevertheless, its engineering department thinks that some investments in computer controlled equipment can be justified by savings in labour and energy costs within that time frame. The engineering department is proposing a four phase capital investment program:

The four phases are independent of one another. In other words, a decision not to proceed with an earlier phase does not affect the forecast savings from a later phase. The savings from any later phase are in addition to savings from earlier phases. There will be no significant residual value from any of the proposed investments. The firm's cost of capital is 14%. As the plant's financial analyst, what phases, if any, of the proposal would you accept?

The four phases are independent of one another. In other words, a decision not to proceed with an earlier phase does not affect the forecast savings from a later phase. The savings from any later phase are in addition to savings from earlier phases. There will be no significant residual value from any of the proposed investments. The firm's cost of capital is 14%. As the plant's financial analyst, what phases, if any, of the proposal would you accept?

The four phases are independent of one another. In other words, a decision not to proceed with an earlier phase does not affect the forecast savings from a later phase. The savings from any later phase are in addition to savings from earlier phases. There will be no significant residual value from any of the proposed investments. The firm's cost of capital is 14%. As the plant's financial analyst, what phases, if any, of the proposal would you accept?

The four phases are independent of one another. In other words, a decision not to proceed with an earlier phase does not affect the forecast savings from a later phase. The savings from any later phase are in addition to savings from earlier phases. There will be no significant residual value from any of the proposed investments. The firm's cost of capital is 14%. As the plant's financial analyst, what phases, if any, of the proposal would you accept?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

14

The pro forma projections for growing a 20-hectare ginseng crop require the expenditure of $150,000 in the summer that the crop is planted and an additional $50,000 in each of the next two summers to cultivate and fertilize the growing crop. After payment of the costs of harvesting the crop, the profit should be $200,000 in the third summer after planting, and $300,000 in the fourth summer. Allowing for a cost of capital of 15% compounded annually, what is the economic value of the project at the time of planting? (Hint: The project's economic value is its NPV.)

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

15

A proposed strip mine would require the investment of $2 million at the beginning of the first year and a further investment of $3 million at the end of the first year. Mining operations are expected to yield annual year-end profits of $1 million starting in Year 2. The ore body will sustain 10 years of mining operations. At the end of the last year of operations, the mining company would also have to spend $1 million on environmental restoration. Would the project provide the mining company with a rate of return exceeding its 15% cost of capital? (Hint: The project will provide a rate of return exceeding the cost of capital if it has a positive NPV.)

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

16

The development of a new product will require the expenditure of $150,000 at the beginning of each of the next three years. When the product reaches the market at the beginning of Year 4, it is expected to increase the firm's annual year-end profit by $90,000 for seven years. Then the product line will be terminated, and $100,000 of the original expenditures should be recoverable promptly. If the firm's cost of capital is 14%, should it proceed with the project?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

17

The introduction of a new product will require an initial investment of $400,000. The annual profit expected from the new product is forecast to be $100,000 for Years 1 to 3, $70,000 for Years 4 to 6, and $50,000 for Years 7 to 12. Should the firm proceed with the investment if its required compound annual return is 15%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

18

Jasper Ski Corp. is studying the feasibility of installing a new chair lift to expand the capacity of its downhill-skiing operation. Site preparation would require the expenditure of $900,000 at the beginning of the first year. Construction would take place early in the second year at a cost of $3.8 million. The lift would have a useful life of 12 years and a residual value of $800,000. The increased capacity should generate increased annual profits of $600,000 at the end of Years 2 to 5 inclusive and $1 million in Years 6 to 13 inclusive. Should Jasper proceed with the project if it requires a return on investment of 14%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

19

A capital project would require an immediate investment of $150,000 and a further investment of $40,000 on a date four years from now. On the operating side, the project is expected to lose $30,000 in the first year and $10,000 in the second, to break even in the third year, and to turn annual profits of $70,000 in Years 4 to 7 and $40,000 in Years 8 to 10. The estimated residual value at the end of the 10th year is $50,000. Is the project acceptable if a return on investment of 15% is required?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

20

To manufacture a new product, a company must immediately invest $275,000 in new equipment. At the end of Years 3 and 5, there will have to be a major overhaul of the equipment at a cost of $40,000 on each occasion. The new product is expected to increase annual operating profits by $75,000 in each of the first four years and by $55,000 in each of the subsequent three years. The equipment will then be salvaged to recover about $30,000. Should the product be manufactured if the company's cost of capital is 14% compounded annually?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

21

A new machine that will lead to savings in labour costs of $16,000 per year can be purchased for $52,000. However, it will cost $1500 per year for the first four years and $2500 per year for the next four years to service and maintain it. In addition, its annual electrical power consumption will cost $1000. After a service life of eight years, the salvage value of the machine is expected to be $5000. Should the machine be acquired if the company requires a minimum return on investment of 15%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

22

Wildcat Drilling Contractors Inc. is considering the acquisition of a new deep-drilling rig at a cost of $12 million. With this added drilling capability, the company's net operating profits would increase by $2 million in the first year and grow by 10% per year over the seven-year service life of the rig. The salvage value of the rig after seven years would be about $2 million. Should Wildcat Drilling acquire the new drilling rig if its cost of capital is 13% compounded annually?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

23

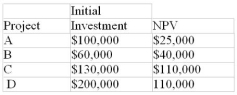

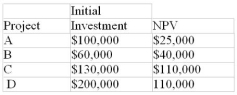

A firm has identified the following four investment opportunities and calculated their net present values. If the firm's capital budget for this period is limited to $300,000, which projects should be selected?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

24

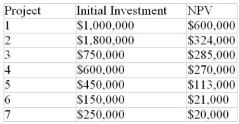

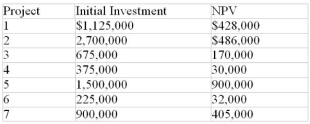

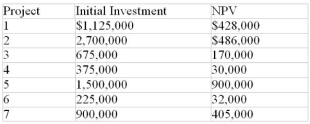

The investment committee of a company has identified the following seven projects with positive NPVs. If the board of directors has approved a $3-million capital budget for the current period, which projects should be selected?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

25

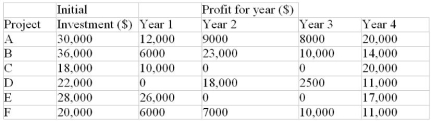

Mohawk Enterprises is considering the following investment opportunities.

If Mohawk's cost of capital is 15% per annum and its capital budget is limited to $90,000, what projects should it choose?

If Mohawk's cost of capital is 15% per annum and its capital budget is limited to $90,000, what projects should it choose?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

26

A small regional airline has narrowed down the possible choices for its next passenger plane purchase to two alternatives. The Eagle model costs $600,000 and would have an estimated resale value of $100,000 after seven years. The Albatross model has a $725,000 price and would have an estimated resale value of $300,000 after seven years. The annual operating profit from the Eagle would be $150,000. Because of its greater fuel efficiency and slightly larger seating capacity, the Albatross's annual profit would be $190,000. Which plane should the airline purchase if its cost of capital is 13%? In current dollars, what is the economic advantage of selecting the preferred alternative over the other?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

27

Carl Williams does custom wheat combining in southern Alberta. He will purchase either a new Massey or a new Deere combine to replace his old machine. The Massey combine costs $190,000, and the Deere combine costs $156,000. Their trade-in values after six years would be about $50,000 and $40,000, respectively. Because the Massey cuts an 18-foot swath versus the Deere's 15-foot swath, Carl estimates that his annual profit with the Massey will be 10% higher than the $70,000 he could make with the Deere. The Massey equipment dealer will provide 100% financing at 11% per annum, and the Deere dealer will approve 100% financing at 10% per annum. Which combine should Carl purchase? How much more, in current dollars, is the better alternative worth?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

28

A business is evaluating two mutually exclusive projects. Project A requires an immediate investment of $6000 plus another $8000 in three years. It would produce a profit of $6000 in the second year, $18,000 in the fourth year, and $12,000 in the seventh year. Project B requires an immediate investment of $5000, another $8000 in two years, and a further $5000 in four years. It would produce an annual profit of $5400 for seven years. Neither project would have any residual value after seven years. Which project should be selected if the required rate of return is 14%? What is the economic advantage, in current dollars, of the preferred project over the other?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

29

A company must choose between two investments. Investment C requires an immediate outlay of $50,000 and then, in two years, another investment of $30,000. Investment D requires annual investments of $25,000 at the beginning of each of the first four years. C would return annual profits of $16,000 for 10 years beginning with the first year. D's profits would not start until Year 4 but would be $35,000 in Years 4 to 10 inclusive. The residual values after 10 years are estimated to be $30,000 for C and $20,000 for D. Which investment should the company choose if its cost of capital is 15%? How much more is the preferred project worth today?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

30

Machine A costs $40,000 and is forecast to generate an annual profit of $15,000 for four years. Machine B, priced at $60,000, will produce the same annual profits for eight years. The trade-in value of A after four years is expected to be $10,000, and the resale value of B after eight years is also estimated to be $10,000. If either machine satisfies the firm's requirements, which one should be selected? Use a required return of 14%.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

31

A sawmill requires a new saw for cutting small-dimension logs. Model H, with a three-year service life, costs $119,000 and will generate an annual profit of $55,000. Model J, with a four-year service life, costs $160,000 and will return an annual profit of $58,000. Neither saw will have significant salvage value. If the mill's cost of capital is 13%, which model should be purchased?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

32

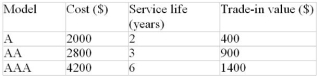

A landscaping business will buy one of three rototillers. The initial cost, expected service life, and tradein value (at the end of the service life) of each model are presented in the following table. The annual profit from rototilling services is $1400.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

33

An independent trucker is trying to decide whether to buy a 15-tonne or 25-tonne truck. A 15-tonne truck would cost $150,000; it would have a service life of seven years and a trade-in value of about $30,000 at seven years of age. A 25-tonne truck would cost $200,000, and would have a service life of six years and be worth about $40,000 at six years of age. The estimated annual profit (after provision for a normal salary for the driver-owner) would be $35,000 for the smaller truck and $48,000 for the larger truck. Which truck should be purchased if the cost of financing a truck is 9% compounded annually? What is the average annual economic benefit of making the right decision?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

34

Consumer Digest recently reported that car batteries X, Y, and Z have average service lives of three, four, and six years, respectively. Grace found that the best retail prices for these batteries in her town are $95, $120, and $165. If money is worth 7% compounded annually, which battery has the lowest equivalent annual cost?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

35

The provincial government's Ministry of Forest Resources requires a spotter plane for its fire service. The price of a Hawk is $240,000, and its annual operating costs will be $60,000. Given the heavy use it will receive, it will be sold for about $60,000 after five years and replaced. A more durable but less efficient Falcon, priced at $190,000, will cost $80,000 per year to operate, will last seven years, and will have a resale value of $80,000. If the provincial government pays an interest rate of 6.5% compounded annually on its midterm debt, which plane has the lower equivalent annual cost?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

36

Neil always trades in his car when it reaches five years of age because of the large amount of driving he does in his job. He is investigating whether there would be a financial advantage in buying a two-year-old car every three years instead of buying a new car every five years. His research indicates that, for the make of car he prefers, he could buy a two-year-old car for $18,000, whereas a new car of the same model sells for $30,000. In either case, the resale value of the five-year-old car would be $6000. Repairs and maintenance average $450 per year for the first two years of the car's life and $1500 per year for the next three. Which alternative has the lower equivalent annual cost if money is worth 7% compounded annually?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

37

A construction company has identified two machines that will accomplish the same job. The Caterpillar model costs $160,000 and has a service life of eight years if it receives a $30,000 overhaul every two years. The International model costs $210,000 and should last 12 years with a $20,000 overhaul every three years. In either case, the overhaul scheduled for the year of disposition would not be performed, and the machine would be sold for about $20,000. If the company's cost of capital is 12%, which machine should be purchased?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

38

A 10-year licence to distribute a product should increase the distributor's profit by $10,000 per year. If the licence can be acquired for $50,000, what is the investment's IRR?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

39

Burger Master bought the food concession for a baseball stadium for five years at a price of $1.2 million. If the operating profit is $400,000 per year, what IRR will Burger Master realize on its investment?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

40

An automotive parts plant is scheduled to be closed in 10 years. Nevertheless, its engineering department thinks that some investments in computer-controlled equipment can be justified by savings in labour and energy costs within that time frame. The engineering department is proposing a four-phase program that would require the expenditure of $100,000 at the beginning of each of the next four years. Each successive phase would produce additional annual savings of $30,000, $27,000, $22,000, and $22,000. The savings from any phase are in addition to annual savings already realized from previous phases. There will be no significant residual value. The firm's cost of capital is 14%. Calculate the IRR of each of the four stages of the cost reduction proposal.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

41

A project requires an initial investment of $60,000. It will generate an annual profit of $12,000 for eight years and have a terminal value of $10,000. Calculate the project's IRR. Should it be accepted if the cost of capital is 15%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

42

An investment of $100,000 will yield annual profits of $16,000 for 10 years. The proceeds on disposition at the end of the 10 years are estimated at $25,000. On the basis of its IRR and a 12% cost of capital, should the investment be made?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

43

St. Lawrence Bus Lines is offered a contract for busing schoolchildren that will produce an annual profit of $36,000 for seven years. To fulfill the contract, St. Lawrence would have to buy three buses at a total cost of $165,000. At the end of the contract the resale value of the buses is estimated to be $40,000. Determine the IRR on the school bus contract.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

44

A $100,000 capital investment will produce annual profits of $20,000 for the first five years and $15,000 for the next five years. It will have no residual value. What is its IRR? Should it be undertaken if the cost of capital is 12%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

45

A natural resource development and extraction project would require an investment of $1 million now and $1 million at the end of each of the next four years. Then it would generate annual profits of $2 million in each of the following four years. There would be no residual value. What would be the IRR of the project? Would it be acceptable to a company requiring a 12% return on investment?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

46

The introduction of a new product would require an initial investment of $120,000. The forecast profits in successive years of the anticipated four-year product life are $25,000, $60,000, $50,000, and $35,000. Determine the IRR of the investment. Should the product be introduced if the firm's cost of capital is 15%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

47

A venture requiring an immediate investment of $500,000 and an additional investment of $200,000 in three years' time will generate annual profits of $150,000 for seven years starting next year. There will be no significant terminal value. Calculate the IRR of the investment. Should the investment be undertaken at a 13% cost of capital?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

48

A proposed strip-mine would require the investment of $1 million at the beginning of the first year and a further investment of $1.5 million at the end of the first year. Mining operations are expected to yield annual profits of $500,000 beginning in Year 2. The ore body will sustain 10 years of mining operations. At the end of the last year of operations, the mining company would also have to spend $500,000 on environmental restoration. Cost of capital is 15%. Determine the IRR on the strip-mine proposal.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

49

The pro forma projections for growing a 20-hectare ginseng crop require the expenditure of $150,000 in the summer that the crop is planted and an additional $50,000 in each of the next two summers to cultivate and fertilize the growing crop. After payment of the costs of harvesting the crop, the profit should be $200,000 in the third summer after planting, and $300,000 in the fourth summer. Determine the IRR of the ginseng crop.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

50

Jasper Ski Corp. is studying the feasibility of installing a new chair lift to expand the capacity of its downhill-skiing operation. Site preparation would require the expenditure of $900,000 at the beginning of the first year. Construction would take place early in the second year at a cost of $3.8 million. The lift would have a useful life of 12 years and a residual value of $800,000. The increased capacity should generate increased annual profits of $600,000 at the end of Years 2 to 5 inclusive and $1 million in Years 6 to 13 inclusive. Determine the IRR of the project. Should the expansion be undertaken, given Jasper Ski Corp's required return of 14%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

51

Two mutually exclusive investments are available to a firm. Project C, requiring a capital investment of $150,000, will generate an annual profit of $43,000 for six years. Project D is expected to yield an annual profit of $30,000 for six years on an initial investment of $100,000.

a) Calculate the internal rate of return on each project. Based upon their IRRs, which project should be selected?

b) Which project should be selected if the firm's cost of capital is 15%?

c) Which project should be selected if the firm's cost of capital is 12%?

a) Calculate the internal rate of return on each project. Based upon their IRRs, which project should be selected?

b) Which project should be selected if the firm's cost of capital is 15%?

c) Which project should be selected if the firm's cost of capital is 12%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

52

Academic Publishing is trying to decide which of two books to publish. The larger book will cost $100,000 to publish and print. Sales are expected to produce an annual profit of $32,000 for five years. The smaller book will cost $60,000 to publish and print, and should generate an annual profit of $20,000 for five years.

a) Calculate the internal rate of return on each book. On the basis of their IRRs, which book should be published?

b) Which book should be published if the firm's cost of capital is 17%?

c) Which book should be published if the firm's cost of capital is 14%?

a) Calculate the internal rate of return on each book. On the basis of their IRRs, which book should be published?

b) Which book should be published if the firm's cost of capital is 17%?

c) Which book should be published if the firm's cost of capital is 14%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

53

Due to a restricted capital budget, a company can undertake only one of the following three-year projects. Both require an initial investment of $650,000 and will have no significant terminal value. Project X is anticipated to have annual profits of $400,000, $300,000, and $200,000 in successive years, whereas Project Y's only profit, $1.05 million, comes at the end of Year 3.

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?

b) Which project should be selected if the firm's cost of capital is 14%?

c) Which project should be selected if the firm's cost of capital is 11%?

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?

b) Which project should be selected if the firm's cost of capital is 14%?

c) Which project should be selected if the firm's cost of capital is 11%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

54

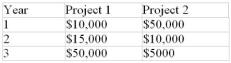

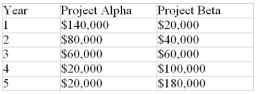

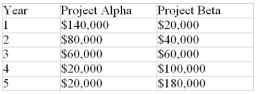

Two mutually exclusive projects each require an initial investment of $50,000 and should have a residual value of $10,000 after three years. The following table presents their forecast annual profits.

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?

b) Which project should be selected if the firm's cost of capital is 14%?

c) Which project should be selected if the firm's cost of capital is 12%?

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?

a) Calculate the IRR of each project. On the basis of their IRRs, which project should be selected?b) Which project should be selected if the firm's cost of capital is 14%?

c) Which project should be selected if the firm's cost of capital is 12%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

55

A company is examining two mutually exclusive projects. Project X requires an immediate investment of $100,000 and produces no profit until Year 3. Then the annual profit is $60,000 for Years 3 to 5 inclusive. Project Y requires an investment of $50,000 now and another $50,000 in 1 year. It is expected to generate an annual profit of $40,000 in Years 2 to 5.

a) Calculate the IRR of each project. On the basis of their IRRs, which project is preferred?

b) Which project should be selected if the firm's cost of capital is 15%?

c) Which project should be selected if the firm's cost of capital is 12%?

a) Calculate the IRR of each project. On the basis of their IRRs, which project is preferred?

b) Which project should be selected if the firm's cost of capital is 15%?

c) Which project should be selected if the firm's cost of capital is 12%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

56

A company is evaluating two mutually exclusive projects. Both require an initial investment of $240,000 and have no appreciable disposal value. Their expected profits over their five-year lifetimes are as follows:

The company's cost of capital is 12%. Calculate the NPV and IRR for each project. Which project should be chosen? Why?

The company's cost of capital is 12%. Calculate the NPV and IRR for each project. Which project should be chosen? Why?

The company's cost of capital is 12%. Calculate the NPV and IRR for each project. Which project should be chosen? Why?

The company's cost of capital is 12%. Calculate the NPV and IRR for each project. Which project should be chosen? Why?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

57

The expected profits from a $52,000 investment are $8000 in Year 1, $12,000 in each of Years 2 to 5, and $6000 in each of Years 6 and 7.

a) What is the investment's payback period?

b) If the firm's required payback period is four years, will it make the investment?

a) What is the investment's payback period?

b) If the firm's required payback period is four years, will it make the investment?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

58

A firm is considering the purchase of a $30,000 machine that would save labour costs of $5000 per year in the first three years and $6000 per year for the next four years. Will the firm purchase the machine if the payback requirement is:

a) Five years?

b) Six years?

a) Five years?

b) Six years?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

59

Projects X and Y both require an initial investment of $100,000. Project X will generate an annual operating profit of $25,000 per year for six years. Project Y produces no profit in the first year but will yield an annual profit of $25,000 for the seven subsequent years. Rank the projects based on their payback periods and on their NPVs (at a 10% cost of capital).

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

60

A capital investment requiring a single initial cash outflow is forecast to have an operating profit of $50,000 per year for five years. There is no salvage value at the end of the five years. If the investment has an IRR of 17%, calculate its payback period.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

61

Investment proposals A and B require initial investments of $45,000 and $35,000, respectively. Both have an economic life of four years with no residual value. Their expected profits are as follows:

If the firm's cost of capital is 14%, rank the proposals based on their:

a) NPVs.

b) IRRs.

c) Payback periods.

If the firm's cost of capital is 14%, rank the proposals based on their:

a) NPVs.

b) IRRs.

c) Payback periods.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

62

A manufacturer's sales rep can lease an automobile for five years at $385 per month payable at the beginning of each month, or purchase it for $22,500. He can obtain a loan at 9% compounded monthly to purchase the car. Should he lease or buy the car if:

a) The trade-in value after five years is $5000?

b) The trade-in value after five years is $7000?

a) The trade-in value after five years is $5000?

b) The trade-in value after five years is $7000?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

63

Jurgen Wiebe has been transferred to Winnipeg for five years. He has found an attractive house that he can buy for $160,000 or rent for $1150 per month, payable at the beginning of each month. He estimates that the resale value of the house in five years will be $175,000 net of the selling commission. If he buys the house, the average (end-of-month) costs for repairs, maintenance, and property taxes will be $400. Should Mr. Wiebe rent or buy the house if the interest rate on five-year mortgage loans is 6.6% compounded monthly?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

64

A proposed open-pit mine would require the investment of $2 million at the beginning of the first year and a further investment of $1 million at the end of the first year. Mining operations are expected to yield annual profits of $750,000, beginning in Year 2. The ore body will sustain eight years of ore extraction. At the beginning of the tenth year, the mining company must spend $1 million on cleanup and environmental restoration. Will the project provide the mining company with a rate of return exceeding its 14% cost of capital?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

65

The development of a new product will require the expenditure of $125,000 at the beginning of each of the next two years. When the product reaches the market in Year 3, it is expected to increase the firm's annual profit by $50,000 for eight years. (Assume that the profit is received at the end of each year.) Then $75,000 of the original expenditures should be recoverable. If the firm's cost of capital is 12%, should it proceed with the project?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

66

Rainbow Aviation needs an additional plane for five years. It could buy the plane for $360,000, using funds borrowed at 7.5% compounded monthly, and then sell the plane for an estimated $140,000 after five years. Alternatively, it could lease the plane for $5600, payable at the beginning of each month. Which alternative should Rainbow Aviation choose? What is the economic value of the financial advantage on the initial date of the preferred alternative?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

67

Huron Charters can purchase a sailboat for $100,000 down and a $60,000 payment due in one year. The boat would generate additional annual operating profits of $24,000 for the first five years and $15,000 for the next five years. New sails costing $16,000 would be required after five years. After ten years the boat would be replaced; its resale value would be about $60,000. Should Huron purchase the sailboat if its cost of capital is 13% compounded annually?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

68

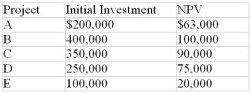

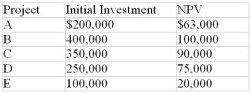

A company's board of directors has imposed an $800,000 limit on capital spending for the current year. Management has identified the following five projects as all providing a return on investment greater than the cost of capital. Which projects should be chosen?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

69

A company is considering two mutually exclusive investment projects. Each requires an initial investment of $25,000. Project A will generate an annual profit of $6000 for eight years and have a residual value of $5000. Project B's profits are more irregular: $15,000 in the first year, $19,000 in the fifth year, and $24,000 (including the residual value) in the eighth year. Which project should be chosen if the required return on investment is 15% compounded annually?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

70

A new machine that will lead to savings in labour costs of $20,000 per year can be purchased for $60,000. However, it will cost $2000 per year for the first four years and $3000 per year for the next four years to service and maintain the machine. In addition, its annual fuel consumption will cost $1500. After a service life of eight years, the salvage value of the machine is expected to be $10,000. Should the machine be acquired if the company requires a minimum annual rate of return on investment of 15%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

71

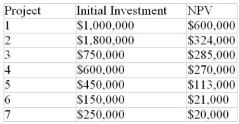

The investment committee of a company has identified the following seven projects with positive NPVs. If the board of directors has approved a $4.5-million capital budget for the current period, which projects should be selected?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

72

Machine X costs $50,000 and is forecast to generate an annual profit of $16,000 for five years. Machine Y, priced at $72,000, will produce the same annual profits for 10 years. The trade-in value of X after five years is expected to be $10,000, and the resale value of Y after 10 years is also thought to be $10,000. If either machine satisfies the firm's requirements, which one should be selected? Use a required return of 14%.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

73

A U-Print store requires a new photocopier. A Sonapanic copier with a four-year service life costs $35,000 and will generate an annual profit of $14,000. A higher-speed Xorex copier with a five-year service life costs $52,000 and will return an annual profit of $17,000. Neither copier will have significant salvage value. If U-Print's cost of capital is 13%, which model should be purchased?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

74

The provincial government's Ministry of Fisheries requires a new patrol boat. The price of a Songster is $90,000, and its annual operating costs will be $10,000. It will be sold for about $20,000 after five years, and replaced. A more durable and more efficient Boston Wailer, priced at $110,000, would cost $8000 per year to operate, last seven years, and have a resale value of $40,000. If the provincial government pays an interest rate of 6.5% compounded annually on its midterm debt, which boat has the lower equivalent annual cost?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

75

A seven-year licence to distribute a product should increase the distributor's profit by $16,000 per year. If the licence can be acquired for $70,000, what is the investment's IRR?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

76

A firm can manufacture the same product with either of two machines. Machine C requires an initial investment of $55,000 and would earn a profit of $30,000 per year for three years. It would then be replaced, because repairs would be required too frequently after three years. Its trade-in value would be $10,000. Machine D costs $100,000 and would have a service life of five years. The annual profit would be $5000 higher than Machine C's profit because of its lower repair and maintenance costs. Its recoverable value after five years would be about $20,000. Which machine should be purchased if the firm's cost of capital is 16%? What is the equivalent annual economic advantage of the preferred choice?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

77

A potato farmer needs to buy a new harvester. Two types have performed satisfactorily in field trials. The SpudFinder costs $140,000 and should last for five years. The simpler TaterTaker costs only $80,000 but requires an extra operator at $20,000 per season. This machine has a service life of seven years. The disposal value of either machine is insignificant. If the farmer requires a 13% return on investment, which harvester should she buy?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

78

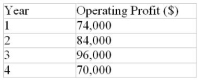

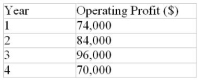

A capital investment requiring one initial cash outflow is forecast to have the operating profits listed below. The investment has an NPV of $20,850, based on a required rate of return of 12%. Calculate the payback period of the investment.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

79

The introduction of a new product will require a $400,000 investment in demonstration models, promotion, and staff training. The new product will increase annual profits by $100,000 for the first four years and $50,000 for the next four years. There will be no significant recoverable amounts at the end of the eight years. The firm's cost of capital is 13%. Calculate the expected IRR on the proposed investment in the new product. Should the new product be introduced? Why?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

80

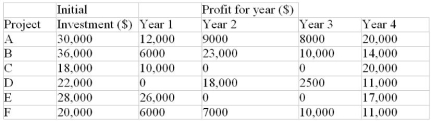

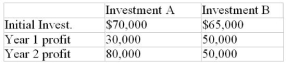

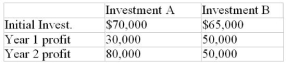

The initial investment and expected profits from two mutually exclusive capital investments being considered by a firm are as follows:

a) Calculate the internal rate of return for each investment. Which one would be selected based on an IRR ranking?

b) Which investment should be chosen if the firm's cost of capital is 14%?

c) Which investment should be chosen if the firm's cost of capital is 17%?

a) Calculate the internal rate of return for each investment. Which one would be selected based on an IRR ranking?

b) Which investment should be chosen if the firm's cost of capital is 14%?

c) Which investment should be chosen if the firm's cost of capital is 17%?

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck