Deck 9: Compound Interest: Further Topics and Applications

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/168

Play

Full screen (f)

Deck 9: Compound Interest: Further Topics and Applications

1

If FV is less than PV, what can you predict about the value for i?

If FV < PV, the quality is decreasing in size as time passes. Therefore, the rate of growth is negative. That is, the value for i is negative

2

Is FV negative if you lose money on an investment?

No You will lose money on an investment in FV (including income paid during the holding period) is less than PV

3

Which scenario had the higher periodic rate of return: "$1 grew to $2" or "$3 grew to $5"? Both investments were for the same length of time at the same compounding frequency. Justify your choice

Since the time interval is the same for both cases, the relative size of the periodic rates of return is indicated by the overall percent increase rather than the overall dollar increase. In the case "$1 grew to $2," the final value is twice the initial value (100% increase). In the case "$3 grew to $5," the final value is 1.667 time the initial value (66.7% increase). Therefore, the periodic rate of return was higher in the "$1 grew to $2" scenario.

4

What was the annually compounded nominal rate of growth if the future value of $1000 after 20 years was $4016.94?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

5

An initial $1800 investment was worth $2299.16 after two years and nine months. What quarterly compounded nominal rate of return did the investment earn?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

6

The amount owed on a promissory note for $950 after two years and five months is $1165.79. What monthly compounded nominal rate of interest was charged on the debt?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

7

Philippe contributed $4300 to an RRSP eight years and six months ago. The money was invested in a Canadian Equity mutual fund. The investment is now worth $10,440.32. Over the entire period, what monthly compounded nominal rate of return has the investment delivered?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

8

When he died in 1790, Benjamin Franklin left $4600 to the city of Boston, with the stipulation that the money and its earnings could not be used for 100 years. The bequest grew to $332,000 by 1890. What equivalent compound annual rate of return did the bequest earn?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

9

In early 2009, the Templeton Growth Fund ran advertisements containing the message: $10,000 INVESTED IN TEMPLETON GROWTH FUND IN 1954 WOULD BE WORTH OVER $5.09 MILLION TODAY.

What compound annual rate of return did the fund realize over this period (December 31, 1954 to December 31, 2009)?

What compound annual rate of return did the fund realize over this period (December 31, 1954 to December 31, 2009)?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

10

The maturity value of a $5000 four-year compound- interest GIC was $6147.82. What quarterly compounded rate of interest did it earn?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

11

a) The population of Canada grew from 24,343,000 in 1981 to 33,505,000 in 2008. What was the overall compound annual rate of growth in our population during the period?

b) According to the Canadian Real Estate Association, the average selling price of Canadian homes rose from $67,000 in 1980 to $315,000 in 2008. What has been the overall compound annual appreciation of home prices?

b) According to the Canadian Real Estate Association, the average selling price of Canadian homes rose from $67,000 in 1980 to $315,000 in 2008. What has been the overall compound annual appreciation of home prices?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

12

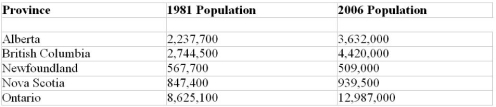

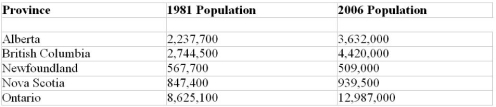

The following table contains 1981 and 2006 population figures for five provinces. Calculate each province's equivalent compound annual rate of population increase during the period.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

13

For an investment to double in value during a 10-year period.

a) What annually compounded rate of return must it earn?

b) What semiannually compounded rate of return must it earn?

c) What monthly compounded rate of return must it earn?

a) What annually compounded rate of return must it earn?

b) What semiannually compounded rate of return must it earn?

c) What monthly compounded rate of return must it earn?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

14

What compound annual rate of return is required for an investment to double in:

a) 12 years?

b) 10 years?

c) 8 years?

d) 6 years?

For each case, multiply the annual rate of return (in %) by the time period (in years). Compare the four products. Does the comparison suggest a general rule-of-thumb?

a) 12 years?

b) 10 years?

c) 8 years?

d) 6 years?

For each case, multiply the annual rate of return (in %) by the time period (in years). Compare the four products. Does the comparison suggest a general rule-of-thumb?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

15

The Canadian Consumer Price Index (based on a value of 100 in 1971) rose from 97.2 in 1970 to 210.6 in 1980. What was the (equivalent) annual rate of inflation in the decade of the 1970s?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

16

According to Statistics Canada, undergraduate students paid an average of $4724 in tuition fees for the 2008/2009 academic year compared to fees of $1464 for the 1990/1991 year. During the same period, the Consumer Price Index rose from 78.5 to 115.80.

a) What would have been the average tuition fees for the 2008/2009 year if tuition fees had grown just at the rate of inflation since the 1990/1991 year?

b) What was the (equivalent) compound annual rate of increase of tuition fees during the period?

c) What was the (equivalent) compound annual rate of inflation during the period?

a) What would have been the average tuition fees for the 2008/2009 year if tuition fees had grown just at the rate of inflation since the 1990/1991 year?

b) What was the (equivalent) compound annual rate of increase of tuition fees during the period?

c) What was the (equivalent) compound annual rate of inflation during the period?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

17

A four-year promissory note for $3800 plus interest at 9.5% compounded semiannually was sold 18 months before maturity for $4481. What quarterly compounded (annual) rate of return will the buyer realize on her investment?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

18

An investor's portfolio increased in value by 93% over a seven-year period in which the Consumer Price Index rose from 95.6 to 115.3. What was the compound annual real rate of return on the portfolio during the period?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

19

At the end of 2009, the RBC Canadian Dividend Fund was the largest equity mutual fund in Canada. The aggregate market value of its holdings at the end of 2009 was $9.995 billion. The fund's annual returns in successive years from 2000 to 2009 inclusive were 28.3%, 4.4%, -0.5%, 23.5%, 12.9%, 21.1%, 15.1%, 3.0% - 27.0%, and 27.3% respectively. For the 3-year, 5-year, and 10-year periods ending December 31, 2009, what were the fund's equivalent annually compounded returns?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

20

At the end of 2009, the Trans IMS Canadian Growth Fund had one of the worst 10-year compound annual returns of any Canadian diversified equity mutual fund. The fund's annual returns in successive years from 2000 to 2009 inclusive were -12.8%, -38.3%, -24.1%, 25.4%, 9.2%, 18.6%, 12.0%, -0.2%, - 38.5%, and 15.6%, respectively. For 3-year, 5-year, and 10-year periods ended December 31, 2009, what were the fund's equivalent annually compounded returns?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

21

In June of 2006, AIC Limited published full-page advertisements focused on the fact that its AIC Advantage Mutual Fund was Canada's "Best Performing Canadian Equity Fund over the 20 years"

ending May 31, 2006. The equivalent annual rate of return during the 20 years was 11.9% compared to 9.9% for the benchmark S&P/TSX Composite Total Return Index. But the advertisement failed to point out that during the second half of that 20-year period, the fund's 9.4% compounded annual return was actually less than the 10.2% growth rate for the S&P/TSX Composite Total Return Index. Furthermore, in the final 5 years of the 20-year period, the fund's 2.4% annual rate of return was far below the index's 9.5% annual growth. The Advantage Fund's five-year performance was even less than the median performance of all Canadian equity mutual funds. In short, AIC was still trying to capitalize on the initial 10 years of truly outstanding performance, even though the Advantage Fund's subsequent 10 years' performance was at best mediocre.

a) What would $10,000 invested in the AIC Advantage Fund on May 31, 1986 have grown to after 20 years?

b) What was this investment worth after the first 10 years?

c) What compound annual rate of return did the AIC Advantage Fund earn during the first 10 years of the

20-year period?

d) What was the overall percent increase in the value of an investment in the AIC Advantage Fund during: (i) The first 10 years?

(ii) The second 10 years?

ending May 31, 2006. The equivalent annual rate of return during the 20 years was 11.9% compared to 9.9% for the benchmark S&P/TSX Composite Total Return Index. But the advertisement failed to point out that during the second half of that 20-year period, the fund's 9.4% compounded annual return was actually less than the 10.2% growth rate for the S&P/TSX Composite Total Return Index. Furthermore, in the final 5 years of the 20-year period, the fund's 2.4% annual rate of return was far below the index's 9.5% annual growth. The Advantage Fund's five-year performance was even less than the median performance of all Canadian equity mutual funds. In short, AIC was still trying to capitalize on the initial 10 years of truly outstanding performance, even though the Advantage Fund's subsequent 10 years' performance was at best mediocre.

a) What would $10,000 invested in the AIC Advantage Fund on May 31, 1986 have grown to after 20 years?

b) What was this investment worth after the first 10 years?

c) What compound annual rate of return did the AIC Advantage Fund earn during the first 10 years of the

20-year period?

d) What was the overall percent increase in the value of an investment in the AIC Advantage Fund during: (i) The first 10 years?

(ii) The second 10 years?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

22

Searching a Mutual Fund Data Base Follow the instructions in the NET @ssets box earlier in this section to locate the "Mutual Funds" link in the student textbook's OLC. When the globefund. Com page loads, move your cursor over "GLOBE FUND" in the menu bar and select "Fund Selector" from the drop-down list. In the "Option C" area, you can enter the name of a particular fund. Enter "RBC Canadian Dividend" and click on "Go."

The table that loads has several tabs along its top. Select "Long-term." This brings up another table with columns giving the fund's compound annual return for 3-year, 5-year, and 10-year periods ending on the last business day of the previous month. How much would $10,000 invested in this fund 10 years earlier be worth at the end of the previous month? Repeat for the "IA Group Dividends" and the "Trans IMS Canadian Growth" funds.

The table that loads has several tabs along its top. Select "Long-term." This brings up another table with columns giving the fund's compound annual return for 3-year, 5-year, and 10-year periods ending on the last business day of the previous month. How much would $10,000 invested in this fund 10 years earlier be worth at the end of the previous month? Repeat for the "IA Group Dividends" and the "Trans IMS Canadian Growth" funds.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

23

Under what circumstance does the value calculated for n equal the number of years in the term of the loan or investment?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

24

Which investment scenario requires more time: "$1 growing to $2" or "$3 growing to $5"? Both investments earn the same rate of return. Justify your choice.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

25

How long did it take $4625 earning 7.875% compounded annually to grow to $8481.61?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

26

$5000 invested in a GIC earning 3.7% compounded semiannually matured at$5789.73. What was the term of the GIC?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

27

The current balance on a loan is $3837.30. If the interest rate on the loan is 10% compounded monthly, how long ago was the $2870 loan made?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

28

Rounded to the nearest month, how long will it take a town's population to:

a) Grow from 32,500 to 40,000 if the annual growth rate is 3%?

b) Shrink from 40,000 to 32,500 if the annual rate of decline is 3%?

a) Grow from 32,500 to 40,000 if the annual growth rate is 3%?

b) Shrink from 40,000 to 32,500 if the annual rate of decline is 3%?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

29

When discounted to yield 10.5% compounded monthly, a $2600 three-year promissory note bearing interest at 12.25% compounded annually was priced at $3283.57. How long after the issue date did the discounting take place?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

30

The proceeds from the sale of a $4500 five-year promissory note bearing interest at 9% compounded quarterly were $6055.62. How long before its maturity date was the note sold if it was discounted to yield 10.5% compounded monthly?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

31

A $4000 loan at 7.5% compounded monthly was settled by a single payment of $5000 including accrued interest. Rounded to the nearest day, how long after the initial loan was the $5000 payment made? For the purpose of determining the number of days in a partial month, assume that a full month has 30 days.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

32

Consider the Province of British Columbia strip bond in Table 9.1.

a) Calculate the bond's market price on June 1, 2009 based on the quoted yield of 4.311% compounded semiannually.

b) What would the price be one year later if the bond's yield remains the same?

a) Calculate the bond's market price on June 1, 2009 based on the quoted yield of 4.311% compounded semiannually.

b) What would the price be one year later if the bond's yield remains the same?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

33

Consider the Province of Ontario strip bond in Table 9.1.

a) Calculate the bond's market price on June 1, 2009 based on the quoted yield of 5.081% compounded semiannually.

b) What would the price be on June 1, 2015 if the bond's yield remains the same?

a) Calculate the bond's market price on June 1, 2009 based on the quoted yield of 5.081% compounded semiannually.

b) What would the price be on June 1, 2015 if the bond's yield remains the same?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

34

Consider the Province of Newfoundland strip bond in Table 9.1.

a) Calculate the bond's yield to four-figure accuracy on June 1, 2009, based on the quoted price of $48.550.

b) What would the yield be one year later if the bond's price remains the same?

a) Calculate the bond's yield to four-figure accuracy on June 1, 2009, based on the quoted price of $48.550.

b) What would the yield be one year later if the bond's price remains the same?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

35

Consider the Bell Canada strip bond maturing May 15, 2032, in Table 9.1.

a) Calculate the bond's yield to four-figure accuracy on June 1, 2009 based on the quoted price of $26.40.

b) What would the yield be one year later if the bond's price remains the same?

a) Calculate the bond's yield to four-figure accuracy on June 1, 2009 based on the quoted price of $26.40.

b) What would the yield be one year later if the bond's price remains the same?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

36

What is the effective interest rate corresponding to a nominal annual rate of:

a. 6% compounded semiannually?

b. 6% compounded quarterly?

c. 6% compounded monthly?

a. 6% compounded semiannually?

b. 6% compounded quarterly?

c. 6% compounded monthly?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

37

What is the effective interest rate corresponding to a nominal annual rate of:

a) 9% compounded semiannually?

b) 9% compounded quarterly?

c) 9% compounded monthly?

a) 9% compounded semiannually?

b) 9% compounded quarterly?

c) 9% compounded monthly?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

38

Lisa is offered a loan from a bank at 7.2% compounded monthly. A credit union offers similar terms but a rate of 7.4% compounded semiannually. Which loan should she accept? Present calculations that support your answer.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

39

Camille can obtain a residential mortgage loan from a bank at 6.5% compounded semiannually, or from an independent mortgage broker at 6.4% compounded monthly. Which source should she pick if other terms and conditions of the loan are the same? Present calculations that support your answer.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

40

Columbia Trust wants its annually, semiannually, and monthly compounded five-year GICs all to have an effective interest rate of 5.75%. What nominal annual rates should it quote for the three compounding options?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

41

Belleville Credit Union has established interest rates on its three-year GICs so that the effective rate of interest is 7% on all three compounding options. What are the monthly, semiannually, and annually compounded rates?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

42

Suppose the periodic rate for 6 months is 4%. Is the equivalent periodic rate for three months (pick one):

(i) equal to ?

?

(ii) less than 2%?

(iii) greater than 2%?

Answer the question without doing any calculations. Explain your choice.

(i) equal to

?

?(ii) less than 2%?

(iii) greater than 2%?

Answer the question without doing any calculations. Explain your choice.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

43

To be equivalent to 10% compounded annually, what must be the nominal rate with:

a. semiannual compounding?

b. quarterly compounding?

c. monthly compounding?

a. semiannual compounding?

b. quarterly compounding?

c. monthly compounding?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

44

To be equivalent to 10% compounded quarterly, what must be the nominal rate with:

a. annual compounding?

b. semiannual compounding?

c. monthly compounding?

a. annual compounding?

b. semiannual compounding?

c. monthly compounding?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

45

What quarterly compounded rate is equivalent to 7.5% compounded semiannually?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

46

A trust company pays 5.5% compounded semiannually on its three-year GICs. For you to prefer an annually compounded GIC of the same maturity, what value must its nominal interest rate exceed?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

47

A credit union pays 5.25% compounded annually on five-year Compound Interest: Further Topics GICs. It wants to set the rates on its semiannually and monthly compounded GICs of the same maturity so that investors will earn the same total interest. What should be the rates on the GICs with the higher compounding frequencies?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

48

Calculate the income yield, capital gain yield, and rate of total return in each of 2005 and 2006 for Loblaw Companies' share and Mawer New Canada Fund units. Use the data in Tables 9.3, and 9.4.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

49

Calculate the income yield, capital gain yield, and rate of total return in each of 2005 and 2006 for Cameco Corporation shares and Sprott Canadian Equity Fund units. Use the data in Tables 9.3 and 9.4.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

50

Calculate the income yield, capital gain yield, and rate of total return in each of 2005 and 2006 for Research in Motion shares and PH&N Bond Fund units. Use the data in Tables 9.3, and 9.4.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

51

Assume that the TD Bank shares in Table 9.3 will pay a $2.04 per share dividend in 2007. What must the share price be at the end of 2007 for a total rate of return in 2007 of 10%?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

52

Loblaw shares in Table 9.3 will pay a $0.84 dividend in 2007. What must the share price be at the end of 2007 for a total rate of return in 2007 of 7%?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

53

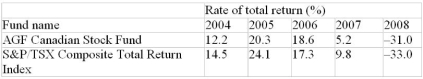

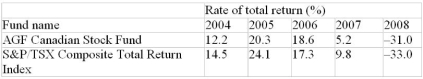

The following table presents the rates of total return in successive years from 2004 to 2008 for the AGF Canadian Stock Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

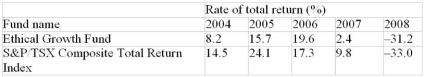

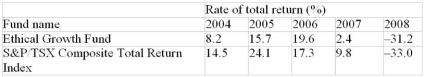

54

The following table presents the rates of total return in successive years from 2004 to 2008 for the Ethical Growth Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

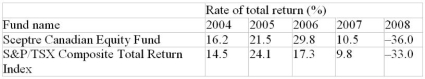

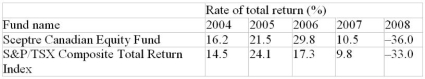

55

The following table presents the rates of total return in successive years from 2004 to 2008 for the Sceptre Canadian Equity Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's

growth?

growth?

growth?

growth?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

56

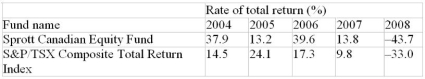

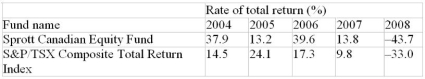

The following table presents the rates of total return in successive years from 2004 to 2008 for the Sprott Canadian Equity Fund and for the benchmark Toronto Stock Exchange S&P/TSX Composite Index. By how much did the mutual fund's overall percentage return exceed or fall short of the Index's growth?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

57

The home the Bensons purchased 13 years ago for $85,000 is now appraised at $215,000.

What has been the annual rate of appreciation of the value of their home during the 13- year period?

What has been the annual rate of appreciation of the value of their home during the 13- year period?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

58

One thousand shares of Frontier Mining were purchased at $6.50 per share. The share price rose 110% in the first year after purchase, declined 55% in the second year, and then dropped another 55% in the third year.

a) What was the percent change in share price over the entire three years?

b) How much (in dollars and cents) did the share price drop in the second year?

a) What was the percent change in share price over the entire three years?

b) How much (in dollars and cents) did the share price drop in the second year?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

59

You are offered a loan at a rate of 10.5% compounded monthly. What would a semiannually compounded nominal rate have to be below to make it more attractive?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

60

A company's annual report states that the prices of its common shares had changes of 23%, 10%, -15%, and 5% during the past 4 fiscal years. If the shares were trading at $30.50 just after the 5% increase in the most recently completed year.

a) What was the price of the shares at the beginning of the 4-year period?

b) How much (in dollars and cents) did the price decline in the third year?

a) What was the price of the shares at the beginning of the 4-year period?

b) How much (in dollars and cents) did the price decline in the third year?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

61

One of the more volatile mutual funds in recent years has been the AGF China Focus Fund. The fund's annual returns in successive years from 2003 to 2008 inclusive were 20.8%,-11.0%, 63.4%,_ 9.3%, 8.6%, 67.6%, 30.5 and -41.7, respectively. What was the fund's equivalent compound annual return for the six years ended December 31, 2008?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

62

To the nearest month, how long will it take an investment to increase in value by 200% if it earns 7.5% compounded semiannually?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

63

An investor's portfolio increased in value by 53% over a five-year period while the Consumer Price Index rose from 121.6 to 135.3. What was the annually compounded real rate of return on the portfolio for the 5 years?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

64

A portfolio earned -13%, 18%, 5%, 24%, and -5% in five successive years. What was the portfolio's five-year compound annual return?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

65

A bank pays a simple interest rate of 4.1% on 30 to 179-day GICs of at least $100,000. What is the effective annualized rate of return:

a) On a 40-day GIC?

b) On a 160-day GIC?

a) On a 40-day GIC?

b) On a 160-day GIC?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

66

If the holding-period return on a money market mutual fund for the most recent seven days is 0.081%, what current (simple) yield and effective annualized yield will be quoted for the fund in the financial press?

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

67

What amount invested at 10% compounded semiannually will be worth $6380.00 after 38 months?

A) $8690.00

B) $6331.04

C) $4684.05

D) $999.14

E) $3488.73

A) $8690.00

B) $6331.04

C) $4684.05

D) $999.14

E) $3488.73

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

68

At what monthly compounded nominal rate of interest will money triple in eight years?

A) 13.81%

B) 9.59%

C) 14.72%

D) 1.23%

E) 115.10%

A) 13.81%

B) 9.59%

C) 14.72%

D) 1.23%

E) 115.10%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

69

An invoice indicates that interest at the rate of 1.75% per month will be charged on overdue amounts. What effective rate of interest is being charged?

A) 19.21%

B) 23.14%

C) 24.75%

D) 26.67%

E) 21.00%

A) 19.21%

B) 23.14%

C) 24.75%

D) 26.67%

E) 21.00%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

70

Find the monthly compounded nominal interest rate that is equivalent to an effective rate of 21%.

A) 1.75%

B) 23.144%

C) 1.929%

D) 19.214%

E) 1.601%

A) 1.75%

B) 23.144%

C) 1.929%

D) 19.214%

E) 1.601%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

71

What effective rate of interest is equivalent to a nominal rate of 19.214% compounded monthly?

A) 1.210%

B) 21.000%

C) 14.530%

D) 22.000%

E) 17.704%

A) 1.210%

B) 21.000%

C) 14.530%

D) 22.000%

E) 17.704%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

72

ln[(1.03)4 (1.10)6] =

A) 0.1331

B) 1.0131

C) 0.5863

D) 0.6901

E) 1.9939

A) 0.1331

B) 1.0131

C) 0.5863

D) 0.6901

E) 1.9939

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

73

A six-year, $20,000 GIC has a maturity value of $29,625. Calculate the semi-annually compounded nominal interest rate.

A) 6.77%

B) 6.66%

C) 4.23%

D) 6.94%

E) 5.44%

A) 6.77%

B) 6.66%

C) 4.23%

D) 6.94%

E) 5.44%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

74

A $50,000 GIC will earn $70,000 of interest over its 10-year term. What is the monthly compounded nominal rate of interest?

A) 7.32%

B) 9.15%

C) 3.37%

D) 8.79%

E) 3.42%

A) 7.32%

B) 9.15%

C) 3.37%

D) 8.79%

E) 3.42%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

75

At what quarterly compounded nominal interest rate will money double in 75 months?

A) 11.25%

B) 15.06%

C) 3.77%

D) 28.11%

E) 11.73%

A) 11.25%

B) 15.06%

C) 3.77%

D) 28.11%

E) 11.73%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

76

Seven years before it matures the value of a $1,000 strip bond is $672. What is the semi-annually compounded nominal interest rate?

A) 5.76%

B) 5.84%

C) 3.10%

D) 24.40%

E) 2.88%

A) 5.76%

B) 5.84%

C) 3.10%

D) 24.40%

E) 2.88%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

77

At what annually compounded interest rate will an investment of $71,294.69 double in 90 months?

A) 6.97%

B) 7.23%

C) 9.68%

D) 9.28%

E) 10.55%

A) 6.97%

B) 7.23%

C) 9.68%

D) 9.28%

E) 10.55%

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

78

What is the term of a compound-interest Guaranteed Investment Certificate if $8,500 invested at 6.1% compounded annually will earn interest totalling $4,365.50?

A) 11.25 years

B) 10.59 years

C) 8.50 years

D) 7.75 years

E) 7.00 years

A) 11.25 years

B) 10.59 years

C) 8.50 years

D) 7.75 years

E) 7.00 years

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

79

At 14% compounded annually, an investment of $50,000 will grow to $1,000,000 in 22.86 years. How much longer will it take at 11% compounded annually?

A) 8.33 years

B) 3.45 years

C) 5.84 years

D) 13.78 years

E) 28.71 years

A) 8.33 years

B) 3.45 years

C) 5.84 years

D) 13.78 years

E) 28.71 years

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

80

If the population of Dodge City is decreasing at a rate of 19% per year, how long will it take to decrease from 7,700 to 2,000?

A) 7.75 years

B) 6.4 years

C) 9.6 years

D) 5.8 years

E) 4.9 years

A) 7.75 years

B) 6.4 years

C) 9.6 years

D) 5.8 years

E) 4.9 years

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck