Deck 7: Applications of Simple Interest

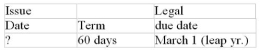

Question

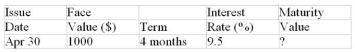

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

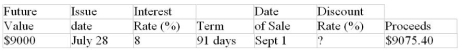

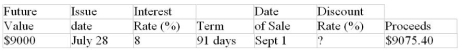

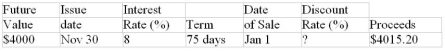

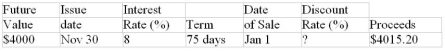

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 7: Applications of Simple Interest

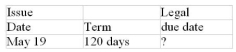

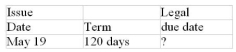

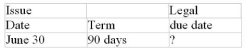

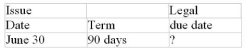

1

a) What will be the maturity value of $15,000 placed in a 120-day term deposit paying an interest rate of 2.25%?

b) If on the maturity date the combined principal and interest are "rolled over" into a 90-day term deposit paying 2.15%, what amount will the depositor receive when the second term deposit matures?

b) If on the maturity date the combined principal and interest are "rolled over" into a 90-day term deposit paying 2.15%, what amount will the depositor receive when the second term deposit matures?

a) $15,110.96

b) $15,191.07

b) $15,191.07

2

For amounts between $10,000 and $24,999, a credit union pays a rate of 2.5% on term deposits with maturities in the 91 to 120-day range. However, early redemption will result in a rate of 1.75% being applied. How much more interest will a 91-day $20,000 term deposit earn if it is held until maturity than if it is redeemed after 80 days?

$47.95

3

For 90- to 365-day GICs, TD Canada Trust offered a rate of 3.00% on investments of $25,000 to $59,999 and a rate of 3.20% on investments of $60,000 to $99,999. How much more will an investor earn from a single $60,000, 270-day GIC than from two $30,000, 270-day GICs?

$88.77

4

On a $10,000 principal investment, a bank offered interest rates of 3.45% on 270- to 364-day GIC's and 3.15% on 180- to 269-day GICs. How much more will an investor earn from a 364-day GIC than from two consecutive 182-day GICs? (Assume that the interest rate on 180- to 269-day GICs will be the same on the renewal date as it is today. Remember that both the principal and the interest from the first 182-day GIC can be invested in the second 182-day GIC.)

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

Joan has savings of $12,000 on June 1. Since she may need some of the savings during the next 3 months, she is considering two options at her bank. (1) An Investment Builder savings account earns a 2.25% rate of interest. The interest is calculated on the daily closing balance and paid on the first day of the following month. (2) A 90- to 179-day cashable term deposit earns a rate of 2.8%, paid at maturity. If interest rates do not change and Joan does not withdraw any of the funds, how much more will she earn from the term deposit up to September 1? (Keep in mind that savings account interest paid on the first day of the month will itself subsequently earn interest during the subsequent month.)

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

An Investment Savings account offered by a trust company pays a rate of 1.25% on the first $1000 of daily closing balance, 1.5% on the portion of the balance between $1000 and $3000, and 1.75% on any balance in excess of $3000. What interest will be paid for the month of April if the opening balance was $2439, $950 was deposited on April 10, and $500 was withdrawn on April 23?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

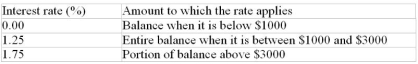

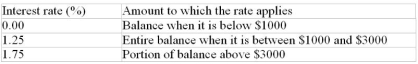

The Moneybuilder account offered by a chartered bank calculates interest daily based on the daily closing balance as follows:

The balance at the beginning of March was $1678. On March 5, $700 was withdrawn. Then $2500 was deposited on March 15, and $900 was withdrawn on March 23. What interest will be credited to the account for the month of March?

The balance at the beginning of March was $1678. On March 5, $700 was withdrawn. Then $2500 was deposited on March 15, and $900 was withdrawn on March 23. What interest will be credited to the account for the month of March?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

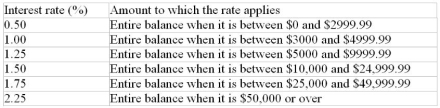

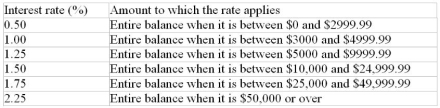

The Super Savings account offered by a trust company calculates interest daily based on the lesser of each day's opening or closing balance as follows:

September's opening balance was $8572. The transactions in the account for the month were a $9500 deposit on September 6, a deposit of $8600 on September 14, and a withdrawal of $25,000 on September 23. What interest will be credited to the account at the end of September?

September's opening balance was $8572. The transactions in the account for the month were a $9500 deposit on September 6, a deposit of $8600 on September 14, and a withdrawal of $25,000 on September 23. What interest will be credited to the account at the end of September?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

For principal amounts of $5000 to $49,999, a bank pays an interest rate of 2.95% on 180- to 269-day non-redeemable GICs, and 3.00% on 270- to 364-day non-redeemable GICs. Ranjit has $10,000 to invest for 364 days. Because he thinks interest rates will be higher six months from now, he is debating whether to choose a 182-day GIC now (and reinvest its maturity value in another 182-day GIC) or to choose a 364-day GIC today. What would the interest rate on 182-day GICs have to be on the reinvestment date for both alternatives to yield the same maturity value 364 days from now?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

Follow the instructions in the NET @ssets box in Section 7.1 to find the "Royal Bank Rates" link to the Royal Bank's Web page for current interest rates. In this page's navigation bar, select "Redeemable GIC" or "Non-Redeemable GIC" to obtain current rates for these simple-interest investments.

a) For each type of GIC, how much interest will you earn on $10,000 invested for 100 days?

b) How much interest will you earn on the Redeemable GIC if you redeem it after: (i) 29 days? (ii) 31 days?

a) For each type of GIC, how much interest will you earn on $10,000 invested for 100 days?

b) How much interest will you earn on the Redeemable GIC if you redeem it after: (i) 29 days? (ii) 31 days?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

If the market-determined rate of return on an investment declines, what happens to the investment's fair market value? Explain. (Assume the expected cash flows from the investment do not change.)

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

An investment promises two payments of $1000, on dates 60 and 90 days from today. What price will an investor pay today:

a) If her required return is 10%?

b) If her required return is 11%?

c) Give an explanation for the lower price at the higher required return.

a) If her required return is 10%?

b) If her required return is 11%?

c) Give an explanation for the lower price at the higher required return.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

A contract requires payments of $1500, $2000, and $1000 in 100, 150, and 200 days, respectively, from today. What is the value of the contract today if the payments are discounted to yield a 10.5% rate of return?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

An agreement stipulates payments of $4000, $2500, and $5000 in 3, 6, and 9 months, respectively, from today. What is the highest price an investor will offer today to purchase the agreement if he requires a minimum rate of return of 9.25%?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

An assignable loan contract executed three months ago requires two payments to be paid five and ten months after the contract date. Each payment consists of a principal portion of $1800 plus interest at 10% on $1800 from the date of the contract. The payee is offering to sell the contract to a finance company in order to raise cash. If the finance company requires a return of 15%, what price will it be prepared to pay today for the contract?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

Claude Scales, a commercial fisherman, bought a new navigation system for $10,000 from Coast Marine Electronics on March 20. He paid $2000 in cash and signed a conditional sales contract requiring a payment on July 1 of $3000 plus interest on the $3000 at a rate of 11%, and another payment on September 1 of $5000 plus interest at 11% from the date of the sale. The vendor immediately sold the contract to a finance company, which discounted the payments at its required return of 16%. What proceeds did Coast Marine receive from the sale of the contract?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

If short-term interest rates have increased during the past week, will investors pay more this week (than last week) for T-bills of the same maturity and face value? Explain.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

Calculate the price on its issue date of $100,000 face value, 90-day commercial paper issued by G E Capital Canada if the prevailing market rate of return is 3.932%.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

A money market mutual fund purchased $1 million face value of Honda Canada Finance Inc. 90-day commercial paper 28 days after its issue. What price was paid if the paper was discounted at 4.10%?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

A 168-day, $100,000 T-bill was initially issued at a price that would yield the buyer 5.19%. If the yield required by the market remains at 5.19%, how many days before its maturity date will the T-bill's market price first exceed $99,000?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

A $100,000, 168-day Government of Canada Treasury bill was purchased on its date of issue to yield 3.1%.

a) What price did the investor pay?

b) Calculate the market value of the T-bill 85 days later if the rate of return then required by the market has: (i) risen to 3.4%. (ii) remained at 3.1%. (iii) fallen to 2.8%.

c) Calculate the rate of return actually realized by the investor if the T-bill is sold at each of the three prices calculated in part (b).

a) What price did the investor pay?

b) Calculate the market value of the T-bill 85 days later if the rate of return then required by the market has: (i) risen to 3.4%. (ii) remained at 3.1%. (iii) fallen to 2.8%.

c) Calculate the rate of return actually realized by the investor if the T-bill is sold at each of the three prices calculated in part (b).

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

Over the past 35 years, the prevailing market yield or discount rate on 90-day T-bills has ranged from a low of 0.20% in May, 2009 to a high of 20.82% in August of 1981. (The period from 1979 to 1990 was a time of historically high inflation rates and interest rates.) How much more would you have paid for a $100,000 face value 90-day T-bill at the May 2009 discount rate than at the August 1981 discount rate?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

Dr. Robillard obtained a $75,000 operating line of credit at prime plus 1%. Accrued interest up to but not including the last day of the month is deducted from his bank account on the last day of each month. On February 5 (of a leap year) he received the first draw of $15,000. He made a payment of $10,000 toward principal on March 15, but took another draw of $7000 on May 1. Prepare a loan repayment schedule showing the amount of interest charged to his bank account on the last days of February, March, April, and May. Assume that the prime rate remained at 7.5% through to the end of May.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

McKenzie Wood Products negotiated a $200,000 revolving line of credit with the Bank of Montreal at prime plus 2%. On the 20th of each month, interest is calculated (up to but not including the 20th) and deducted from the company's chequing account. If the initial loan advance of $25,000 on July 3 was followed by a further advance of $30,000 on July 29, how much interest was charged on July 20 and August 20? The prime rate was at 8% on July 3 and fell to 7.75% on August 5.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

On the June 12 interest payment date, the outstanding balance on Delta Nurseries' revolving loan was $65,000. The floating interest rate on the loan stood at 6.25% on June 12, but rose to 6.5% on July 3, and to 7% on July 29. If Delta made principal payments of $10,000 on June 30 and July 31, what were the interest charges to its bank account on July 12 and August 12? Present a repayment schedule supporting the calculations

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

Scotiabank approved a $75,000 line of credit for Curved Comfort Furniture on the security of its accounts receivable. Curved Comfort drew down $30,000 on October 7, another $15,000 on November 24, and $20,000 on December 23. The bank debited interest at the rate of prime plus 1.5% from the business's bank account on the fifteenth of each month. The prime rate was 6.25% on October 7, and dropped by 0.25% on December 17. Present a loan repayment schedule showing details of transactions up to and including January 15.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

Hercules Sports obtained a $60,000 operating line of credit on March 26. Interest charges at the rate of prime plus 2.5% were deducted from its chequing account on the eighteenth of each month. Hercules took an initial draw of $30,000 on March 31, when the prime rate was 5.25%. Further advances of $10,000 and $15,000 were taken on April 28 and June 1. Payments of $5000 and $10,000 were applied against the principal on June 18 and July 3. The prime rate rose to 5.25% effective May 14. Present a repayment schedule showing details of transactions up to and including July 18.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

Giovando, Lindstrom & Co. obtained a $6000 demand loan at prime plus 1.5% on April 1 to purchase new office furniture. The company agreed to fixed monthly payments of $1000 on the first of each month, beginning May 1. Calculate the total interest charges over the life of the loan if the prime rate started at 6.75% on April 1, decreased to 6.5% effective June 7, and returned to 6.75% on August 27. Present a repayment schedule in support of your answer.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

Doina borrowed $7000 from her credit union on a demand loan on July 20 to purchase a motorcycle. The terms of the loan require fixed monthly payments of $1400 on the first day of each month, beginning September 1. The floating rate on the loan is prime plus 3%. The prime rate started at 5.75%, but rose 0.5% on August 19, and another 0.25% effective November 2. Prepare a loan repayment schedule presenting the amount of each payment and the allocation of each payment to interest and principal.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

Sarah's Canada Student Loans totalled $9400 by the time she graduated from Georgian College in May. She arranged to capitalize the interest on November 30 and to begin monthly payments of $135 on December 31. Sarah elected the floating rate interest option (prime plus 2.5%). The prime rate stood at 6.75% on June 1, dropped to 6.5% effective September 3, and then increased by 0.25% on January 17. Prepare a repayment schedule presenting details of the first three payments. February has 28 days.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

Harjap completed his program at Nova Scotia Community College in December. On June 30, he paid all the interest that had accrued (at prime plus 2.5%) on his $5800 Canada Student Loan during the 6-month grace period. He selected the fixed rate option (prime plus 5%) and agreed to make end-of-month payments of $95 beginning July 31. The prime rate began the grace period at 8% and rose by 0.5% effective March 29. On August 13, the prime rate rose another 0.5%. The relevant February had 28 days.

a) What amount of interest accrued during the grace period?

b) Calculate the total interest paid in the first three regular payments, and the balance owed after the third payment.

a) What amount of interest accrued during the grace period?

b) Calculate the total interest paid in the first three regular payments, and the balance owed after the third payment.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

Monica finished her program at New Brunswick Community College on June 3 with Canada Student Loans totalling $6800. She decided to capitalize the interest that accrued (at prime plus 2.5%) during the grace period. In addition to regular end-of-month payments of $200, she made an extra $500 lump payment on March 25 that was applied entirely to principal. The prime rate dropped from 6% to 5.75% effective September 22, and declined another 0.5% effective March 2. Calculate the balance owed on the floating rate option after the regular March 31 payment. The relevant February had 28 days.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

Seth had accumulated Canada Student Loans totalling $5200 by the time he graduated from Mount Royal College in May. He arranged with the Bank of Nova Scotia to select the floating-rate option (at prime plus 2½ %) and to begin monthly payments of $110 on December 31. Prepare a loan repayment schedule up to and including the February 28 payment. The prime rate was initially at 7.25%. It dropped by 0.25% effective January 31. Seth made an additional principal payment of $300 on February 14.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

A $100,000, 182-day Province of New Brunswick Treasury bill was issued 66 days ago. What will it sell at today to yield the purchaser 4.48%?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

A chartered bank offers a rate of 5.50% on investments of $25,000 to $59,999 and a rate of 5.75% on investments of $60,000 to $99,999 in 90 to 365-day GICs. How much more will an investor earn from a single $80,000, 180-day GIC than from two $40,000, 180-day GICs?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

An Investment Savings account offered by a trust company pays a rate of 1.00% on the first $1000 of daily closing balance, 1.75% on the portion of the balance between $1000 and $3000, and 2.25% on any balance in excess of $3000. What interest will be paid for the month of January if the opening balance was $3678, $2800 was withdrawn on the 14th of the month, and $950 was deposited on the 25th of the month?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

An agreement stipulates payments of $4500, $3000, and $5500 in 4, 8, and 12 months, respectively, from today. What is the highest price an investor will offer today to purchase the agreement if he requires a minimum rate of return of 10.5%?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

Paul has $20,000 to invest for 6 months. For this amount, his bank pays 3.3% on a 90-day GIC and 3.5% on a 180-day GIC. If the interest rate on a 90-day GIC is the same 3 months from now, how much more interest will Paul earn by purchasing the 180-day GIC than by buying a 90-day GIC and then reinvesting its maturity value in a second 90-day GIC?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

Suppose that the current rates on 60 and 120-day GICs are 5.50% and 5.75%, respectively. An investor is weighing the alternatives of purchasing a 120-day GIC versus purchasing a 60-day GIC and then reinvesting its maturity value in a second 60-day GIC. What would the interest rate on 60-day GICs have to be 60 days from now for the investor to end up in the same financial position with either alternative?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

A conditional sale contract requires two payments 3 and 6 months after the date of the contract. Each payment consists of $1900 principal plus interest at 12.5% on $1900 from the date of the contract. One month into the contract, what price would a finance company pay for the contract if it requires an 18% rate of return on its purchases?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

Ruxandra's Canada Student Loans totalled $7200 by the time she finished Conestoga College in April. The accrued interest at prime plus 2.5% for the grace period was converted to principal on October

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

George borrowed $4000 on demand from CIBC on January 28 for an RRSP contribution. Because he used the loan proceeds to purchase CIBC's mutual funds for his RRSP, the interest rate on the loan was set at the bank's prime rate. George agreed to make monthly payments of $600 (except for a smaller final payment) on the twenty-first of each month, beginning February 21. The prime rate was initially 6.75%, dropped to 6.5% effective May 15, and decreased another 0.25% on July 5. It was not a leap year. Construct a repayment schedule showing the amount of each payment and the allocation of each payment to interest and principal.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

Ms. Wadeson obtained a $15,000 demand loan from the Canadian Imperial Bank of Commerce on May 23 to purchase a car. The interest rate on the loan was prime plus 2%. The loan required payments of $700 on the 15th of each month, beginning June 15. The prime rate was 7.5% at the outset, dropped to 7.25% on July 26, and then jumped by 0.5% on September 14. Prepare a loan repayment schedule showing the details of the first five payments.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

Mayfair Fashions has a $90,000 line of credit from the Bank of Montreal. Interest at prime plus 2% is deducted from Mayfair's chequing account on the 24th of each month. Mayfair initially drew down $40,000 on March 8 and another $15,000 on April 2. On June 5, $25,000 of principal was repaid. If the prime rate was 5.25% on March 8 and rose by 0.25% effective May 13, what were the first four interest deductions charged to the store's account?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

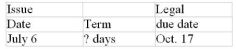

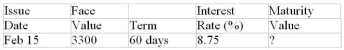

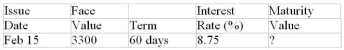

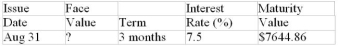

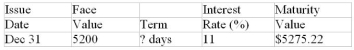

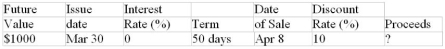

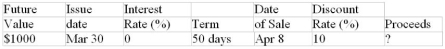

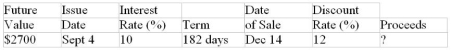

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

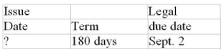

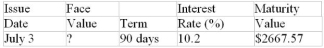

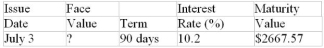

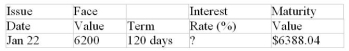

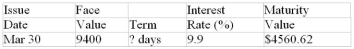

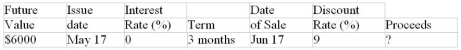

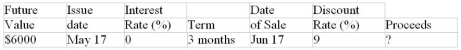

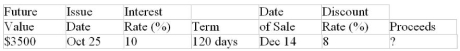

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

62

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

66

Calculate missing value for the promissory note:

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

Determine the legal due date for:

a) A 5-month note dated September 29, 2010.

b) A 150-day note issued September 29, 2010.

a) A 5-month note dated September 29, 2010.

b) A 150-day note issued September 29, 2010.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

Determine the legal due date for:

a) A 4-month note dated April 30, 2010.

b) A 120-day note issued April 30, 2010.

a) A 4-month note dated April 30, 2010.

b) A 120-day note issued April 30, 2010.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

Calculate the maturity value of a 120-day, $1000 face value note dated November 30, 2011, and earning interest at 10.75%.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

Calculate the maturity value of a $1000 face value, 5-month note dated December 31, 2011, and bearing interest at 9.5%.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

A 6-month non-interest-bearing note issued on September 30, 2010 for $3300 was discounted at 11.25% on December 1. What were the proceeds of the note?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

The payee on a 3-month $2700 note earning interest at 8% wishes to sell the note to raise some cash. What price should she be prepared to accept for the note (dated May 19) on June 5 in order to yield the purchaser an 11% rate of return?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

A 6-month note dated June 30 for $2900 bears interest at 13.5%. Determine the proceeds of the note if it is discounted at 9.75% on September 1.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

Calculate the maturity value of a 120-day, $1000 face value note dated September 5, 2003, earning interest at 4.75%.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Determine the legal due date for a three-month note dated October 6, 2003.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

A 90-day non-interest-bearing note issued on September 30, 2003 for $5000 was discounted at 5.75% on November 5, 2003. What were the proceeds of the note?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

A six-month non-interest-bearing note issued on April 11, 2003, for $4000 was discounted at 6.25% on September 2, 2003. What were the proceeds of the note?

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

What will be the maturity value of $25,000 placed in a 90-day term deposit paying an interest rate of 4.75%?

A) $24,710.58

B) $25,396.77

C) $25,292.81

D) $25,306.77

E) $25,302.57

A) $24,710.58

B) $25,396.77

C) $25,292.81

D) $25,306.77

E) $25,302.57

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

An investment earning 16% simple interest has a maturity value of $9440.00 after eight months. What was the initial amount invested?

A) $8530.12

B) $10,446.93

C) $7228.92

D) $8853.33

E) $7780.22

A) $8530.12

B) $10,446.93

C) $7228.92

D) $8853.33

E) $7780.22

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

An investment will pay $3000 six months from now. What purchase price will provide a rate of return of 12%?

A) $2830.19

B) $3180.00

C) $2000.00

D) $2500.00

E) $2724.17

A) $2830.19

B) $3180.00

C) $2000.00

D) $2500.00

E) $2724.17

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck