Deck 6: Portfolio Performance Evaluation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/9

Play

Full screen (f)

Deck 6: Portfolio Performance Evaluation

1

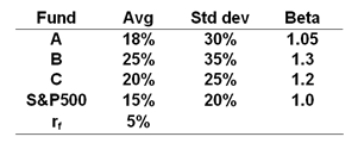

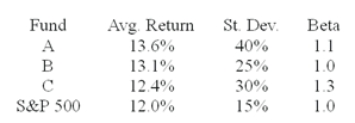

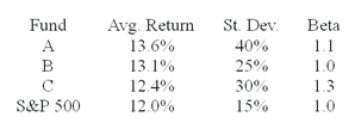

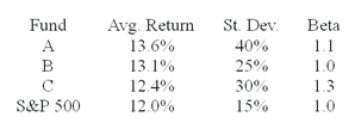

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

What is the T2 measure for Portfolio A?

What is the T2 measure for Portfolio A?

A) 12.4%

B) 2.38%

C) 0.91%

D) 3.64%

What is the T2 measure for Portfolio A?

What is the T2 measure for Portfolio A?A) 12.4%

B) 2.38%

C) 0.91%

D) 3.64%

2.38%

2

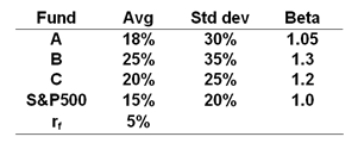

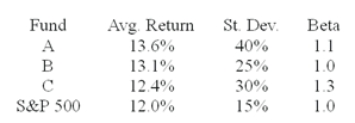

The risk-free rate, average returns, standard deviations and betas for three funds and the S&P500 are given below.

What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?

A) 0.43%

B) 1.25%

C) 1.77%

D) 1.43%

What is the M2 measure for Portfolio B?

What is the M2 measure for Portfolio B?A) 0.43%

B) 1.25%

C) 1.77%

D) 1.43%

1.43%

3

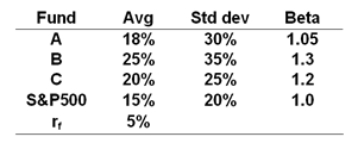

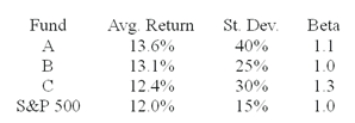

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

A) Fund A

B) Fund B

C) Fund C

D) indeterminable

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.

You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is ________.A) Fund A

B) Fund B

C) Fund C

D) indeterminable

Fund B

4

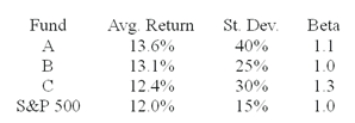

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

A) Fund A

B) Fund B

C) Fund C

D) indeterminable

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.

You wish to evaluate the three mutual funds using the Treynor measure for performance evaluation. The fund with the highest Treynor measure of performance is ________.A) Fund A

B) Fund B

C) Fund C

D) indeterminable

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

5

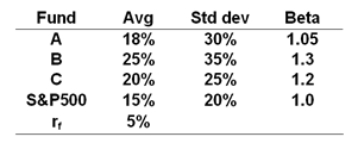

The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk-free return during the sample period is 6%.  You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

A) Fund A

B) Fund B

C) Fund C

D) S&P500

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.

You wish to evaluate the three mutual funds using the Jensen measure for performance evaluation. The fund with the highest Jensen measure of performance is ________.A) Fund A

B) Fund B

C) Fund C

D) S&P500

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

6

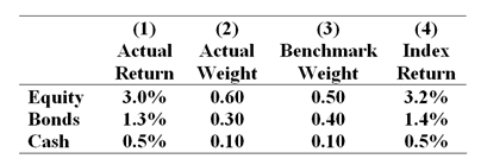

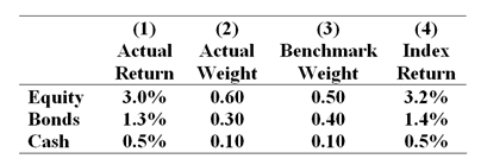

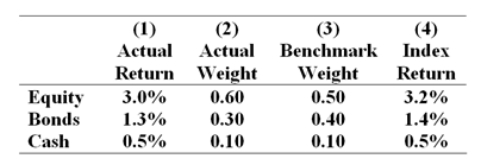

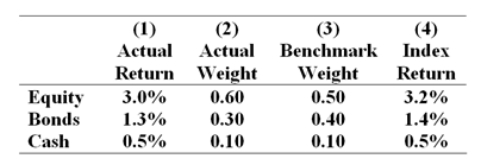

The table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3) and the returns of sector indexes in column (4).  What was the manager's return in the month?

What was the manager's return in the month?

A) 2.07%

B) 2.21%

C) 2.24%

D) 4.80%

What was the manager's return in the month?

What was the manager's return in the month?A) 2.07%

B) 2.21%

C) 2.24%

D) 4.80%

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

7

The table presents the actual return of each sector of the manager's portfolio in column (1), the fraction of the portfolio allocated to each sector in column (2), the benchmark or neutral sector allocations in column (3) and the returns of sector indexes in column (4).  What was the bogey's return in the month?

What was the bogey's return in the month?

A) 2.07%

B) 2.21%

C) 2.24%

D) 4.80%

What was the bogey's return in the month?

What was the bogey's return in the month?A) 2.07%

B) 2.21%

C) 2.24%

D) 4.80%

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

8

What is the contribution of security selection to relative performance?

A) -0.15%

B) 0.15%

C) -0.3%

D) 0.3%

A) -0.15%

B) 0.15%

C) -0.3%

D) 0.3%

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

9

What is the contribution of asset allocation to relative performance?

A) -0.18%

B) 0.18%

C) -0.15%

D) 0.15%

A) -0.18%

B) 0.18%

C) -0.15%

D) 0.15%

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck