Deck 5: Hedge Funds, Futures, Risk Management, Investors and the Investment Process

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/7

Play

Full screen (f)

Deck 5: Hedge Funds, Futures, Risk Management, Investors and the Investment Process

1

You manage $15 million hedge fund portfolio with beta = 1.2 and alpha = 2% per quarter. Assume that the risk-free rate is 2% per quarter and the current value of the S&P 500 index = 1200. You want to exploit positive alpha but you are afraid are afraid that the share market may fall and hedge your portfolio by selling the 3-month S&P 500 future contracts. The S&P contract multiplier is $250. When you hedge your share portfolio with futures contracts the value of your portfolio beta is ________.

A) 0

B) 1

C) 1.2

D) Beta cannot be determined from information given

A) 0

B) 1

C) 1.2

D) Beta cannot be determined from information given

0

2

How much is the portfolio expected to be worth 3 months from now?

A) $15 000 000

B) $15 450 000

C) $15 600 000

D) $16 000 000

A) $15 000 000

B) $15 450 000

C) $15 600 000

D) $16 000 000

$15 600 000

3

Suppose that the pre-tax holding period returns on two shares are the same. Share A has a high dividend payout policy and share B has a low dividend payout policy. If you are a high tax rate individual and do not intend to sell the shares during the holding period, ________.

A) Share A will have a higher after-tax holding period return than Share B

B) the after-tax holding period returns on Shares A and B will be the same

C) Share B will have a higher after-tax holding period return than Share A

D) it is impossible to determine which share will have a higher after-tax holding period return given the information available

A) Share A will have a higher after-tax holding period return than Share B

B) the after-tax holding period returns on Shares A and B will be the same

C) Share B will have a higher after-tax holding period return than Share A

D) it is impossible to determine which share will have a higher after-tax holding period return given the information available

Share B will have a higher after-tax holding period return than Share A

4

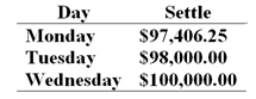

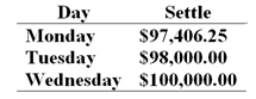

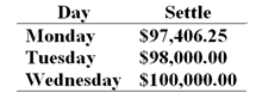

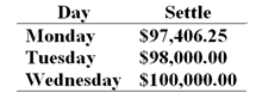

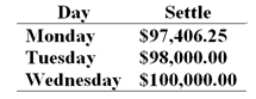

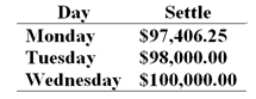

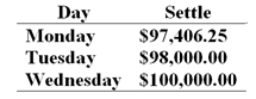

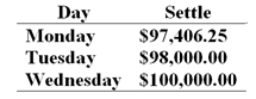

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97 843.75. The contract's face value is $100 000. The initial margin requirement is $2 700 and the maintenance margin requirement is $2 000 per contract. Use the following price data to answer the question.  After Monday's close the balance on your margin account will be ________.

After Monday's close the balance on your margin account will be ________.

A) $2 700.00

B) $2 000.00

C) $3 137.50

D) $2 262.50

After Monday's close the balance on your margin account will be ________.

After Monday's close the balance on your margin account will be ________.A) $2 700.00

B) $2 000.00

C) $3 137.50

D) $2 262.50

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

5

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97 843.75. The contract's face value is $100 000. The initial margin requirement is $2 700 and the maintenance margin requirement is $2 000 per contract. Use the following price data to answer the question.  At the close of day Tuesday your cumulative rate of return on your investment is

At the close of day Tuesday your cumulative rate of return on your investment is

A) 16.2%

B) -5.8%

C) -0.16%

D) -2.2%

At the close of day Tuesday your cumulative rate of return on your investment is

At the close of day Tuesday your cumulative rate of return on your investment isA) 16.2%

B) -5.8%

C) -0.16%

D) -2.2%

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

6

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97 843.75. The contract's face value is $100 000. The initial margin requirement is $2 700 and the maintenance margin requirement is $2 000 per contract. Use the following price data to answer the question.  On which of the given days do you get a margin call?

On which of the given days do you get a margin call?

A) Monday

B) Tuesday

C) Wednesday

D) None

On which of the given days do you get a margin call?

On which of the given days do you get a margin call?A) Monday

B) Tuesday

C) Wednesday

D) None

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck

7

On Monday morning you sell one June T-bond futures contract at 97:27 or for $97 843.75. The contract's face value is $100 000. The initial margin requirement is $2 700 and the maintenance margin requirement is $2 000 per contract. Use the following price data to answer the question.  Your cumulative rate of return on your investment after Wednesday is a/an ________.

Your cumulative rate of return on your investment after Wednesday is a/an ________.

A) 79.9% loss

B) 2.6% loss

C) 33.0% gain

D) 53.9% loss

Your cumulative rate of return on your investment after Wednesday is a/an ________.

Your cumulative rate of return on your investment after Wednesday is a/an ________.A) 79.9% loss

B) 2.6% loss

C) 33.0% gain

D) 53.9% loss

Unlock Deck

Unlock for access to all 7 flashcards in this deck.

Unlock Deck

k this deck