Deck 2: Capital Pricing, Arbitrage Pricing Theory, Bond Prices, Yields, Efficient Market Hypothesis and Behavioral Finance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/11

Play

Full screen (f)

Deck 2: Capital Pricing, Arbitrage Pricing Theory, Bond Prices, Yields, Efficient Market Hypothesis and Behavioral Finance

1

You would typically find all but which one of the following in a bond contract?

A) A dividend restriction clause

B) A sinking fund clause

C) A requirement to subordinate any new debt issued

D) A price earnings ratio

A) A dividend restriction clause

B) A sinking fund clause

C) A requirement to subordinate any new debt issued

D) A price earnings ratio

A price earnings ratio

2

The ________ of a bond is computed as the ratio of coupon payments to market price.

A) nominal yield

B) current yield

C) yield to maturity

D) yield to call

A) nominal yield

B) current yield

C) yield to maturity

D) yield to call

current yield

3

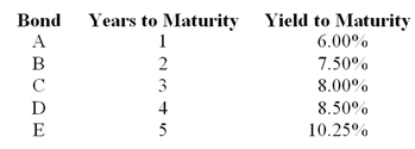

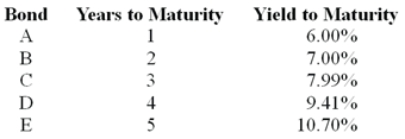

Consider the following $1 000 par value zero-coupon bonds:

The expected one-year interest rate two years from now should be ________.

The expected one-year interest rate two years from now should be ________.

A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

The expected one-year interest rate two years from now should be ________.

The expected one-year interest rate two years from now should be ________.A) 7.00%

B) 8.00%

C) 9.00%

D) 10.00%

9.00%

4

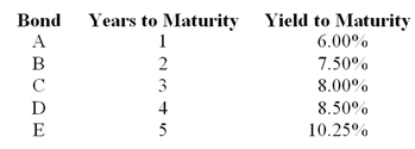

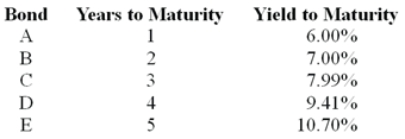

Consider the following $1 000 par value zero-coupon bonds:

The expected one-year interest rate four years from now should be ________.

The expected one-year interest rate four years from now should be ________.

A) 16.00%

B) 18.00%

C) 20.00%

D) 22.00%

The expected one-year interest rate four years from now should be ________.

The expected one-year interest rate four years from now should be ________.A) 16.00%

B) 18.00%

C) 20.00%

D) 22.00%

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

5

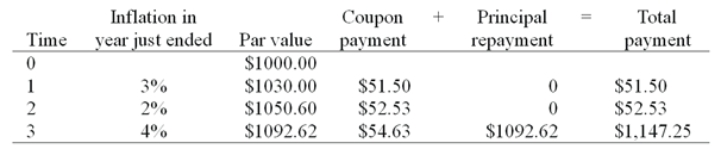

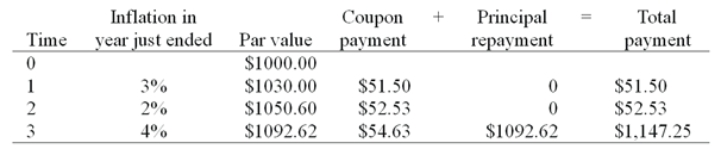

Consider a newly issued TIPS bond with a three year maturity, par value of $1000, and a coupon rate of 5%. Assume annual coupon payments.  What is the nominal rate of return on the TIPS bond in the first year?

What is the nominal rate of return on the TIPS bond in the first year?

A) 5.00%

B) 5.15%

C) 8.15%

D) 9.00%

What is the nominal rate of return on the TIPS bond in the first year?

What is the nominal rate of return on the TIPS bond in the first year?A) 5.00%

B) 5.15%

C) 8.15%

D) 9.00%

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

6

An investor pays $989.40 for a bond. The bond has an annual coupon rate of 4.8%. What is the current yield on this bond?

A) 4.80%

B) 4.85%

C) 9.60%

D) 9.70%

A) 4.80%

B) 4.85%

C) 9.60%

D) 9.70%

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

7

Growth shares usually exhibit ________ price-to-book ratios and ________ price-to-earnings ratios.

A) low, low

B) low, high

C) high, low

D) high, high

A) low, low

B) low, high

C) high, low

D) high, high

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

8

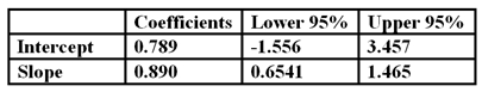

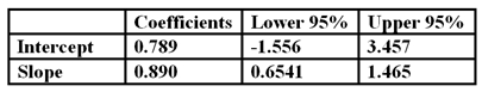

You run a regression of a share's returns versus a market index and find the following: Based on the data you know that the share

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to 0.890

C) has a beta that could be anything between 0.6541 and 1.465 inclusive

D) has no systematic risk

A) earned a positive alpha that is statistically significantly different from zero

B) has a beta precisely equal to 0.890

C) has a beta that could be anything between 0.6541 and 1.465 inclusive

D) has no systematic risk

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

9

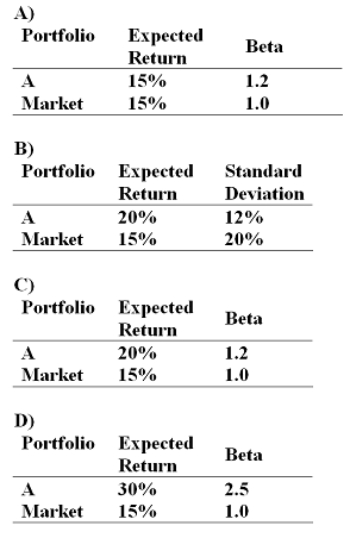

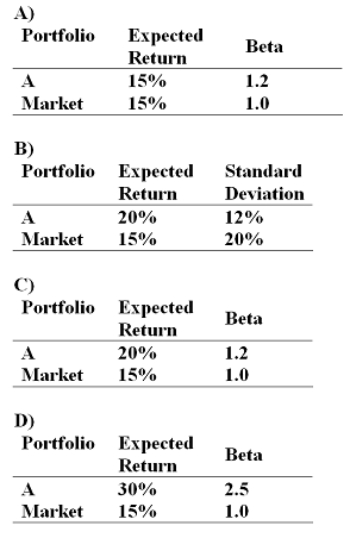

If the simple CAPM is valid and all portfolios are priced correctly, which of the situations below are possible? Consider each situation independently and assume the risk-free rate is 5%.

A) Option A

B) Option B

C) Option C

D) Option D

A) Option A

B) Option B

C) Option C

D) Option D

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

10

What is the expected return on a share with a beta of 0.8, given a risk-free rate of 3.5% and an expected market return of 15.5%?

A) 3.8%

B) 13.1%

C) 15.6%

D) 19.1%

A) 3.8%

B) 13.1%

C) 15.6%

D) 19.1%

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck

11

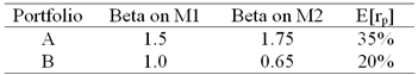

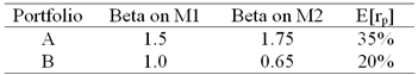

There are two independent economic factors M1 and M2. The risk-free rate is 5% and all shares have independent firm-specific components with a standard deviation of 25%. Portfolios A and B are well diversified. Given the data below which equation provides the correct pricing model?

A) E(rP) = 5 + 1.12?P1 + 11.86?P2

B) E(rP) = 5 + 4.96?P1 + 13.26?P2

C) E(rP) = 5 + 3.23?P1 + 8.46?P2

D) E(rP) = 5 + 8.71?P1 + 9.68?P2

A) E(rP) = 5 + 1.12?P1 + 11.86?P2

B) E(rP) = 5 + 4.96?P1 + 13.26?P2

C) E(rP) = 5 + 3.23?P1 + 8.46?P2

D) E(rP) = 5 + 8.71?P1 + 9.68?P2

Unlock Deck

Unlock for access to all 11 flashcards in this deck.

Unlock Deck

k this deck