Deck 4: Financial Statement Analysis

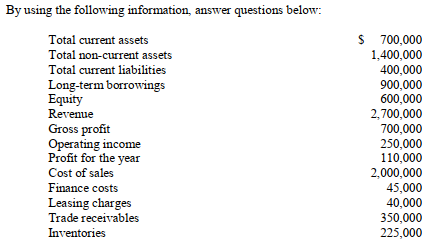

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

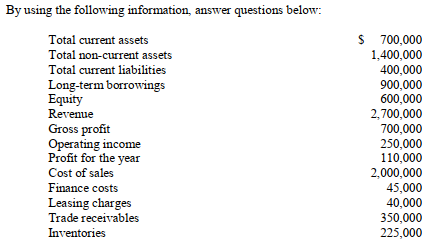

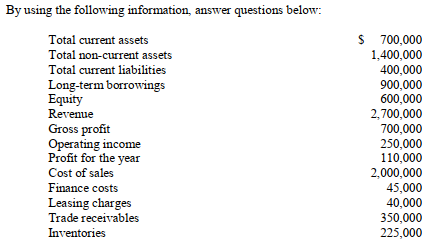

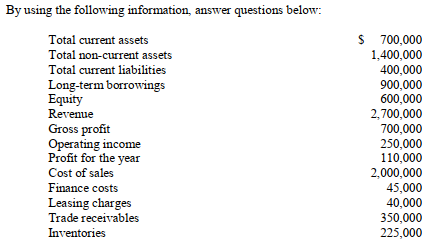

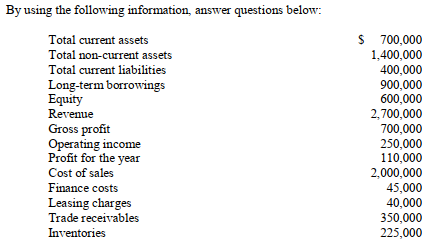

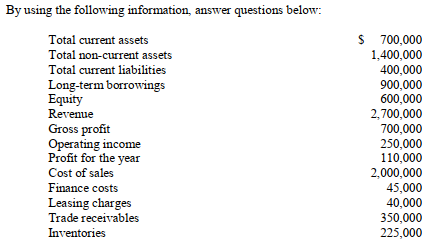

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

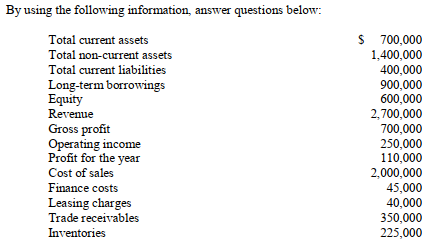

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

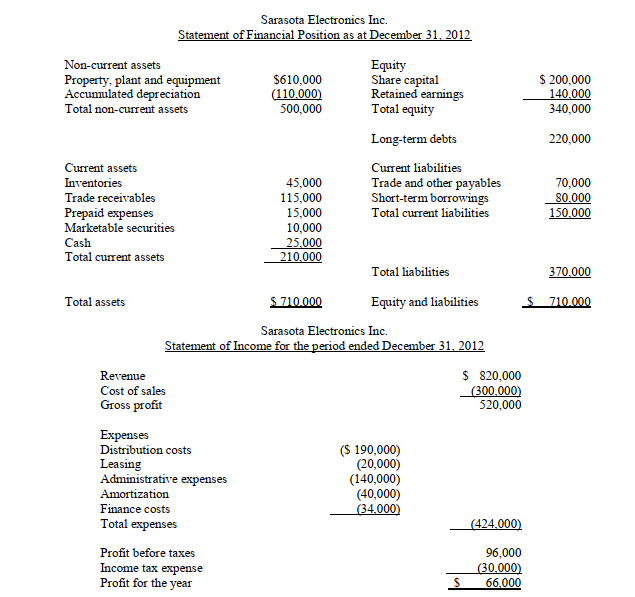

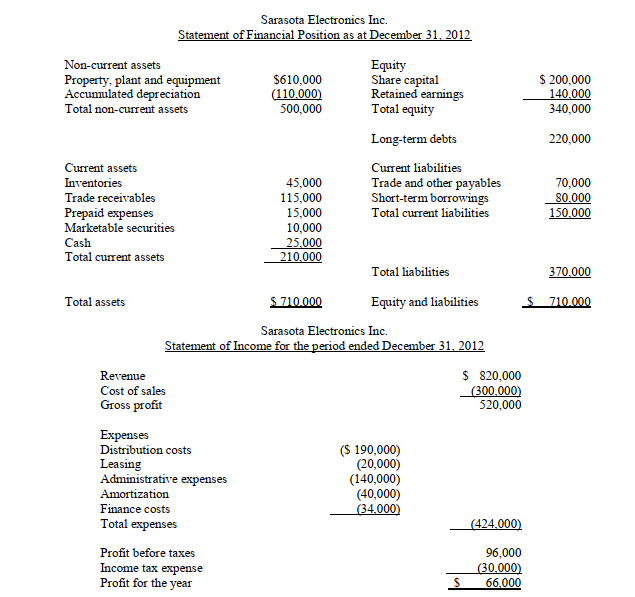

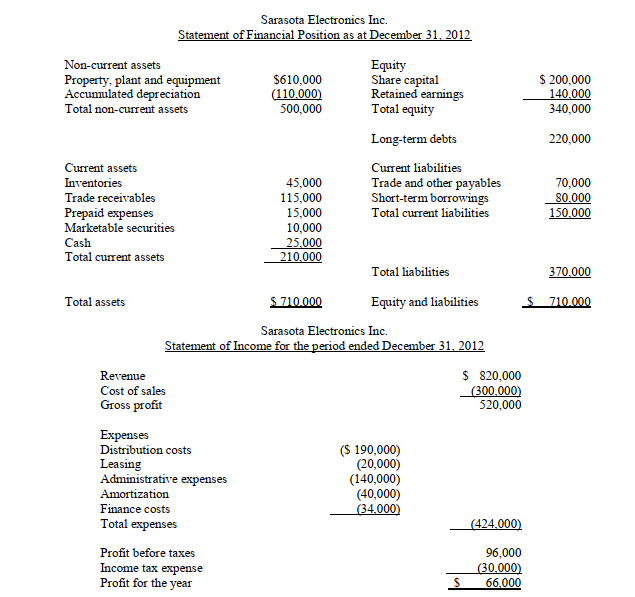

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

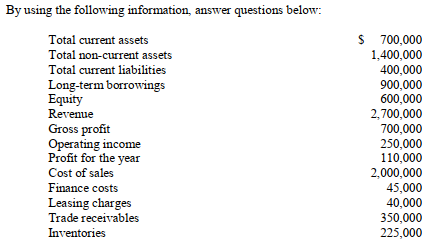

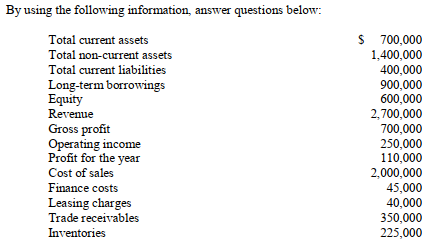

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/256

Play

Full screen (f)

Deck 4: Financial Statement Analysis

1

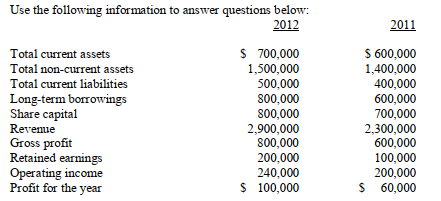

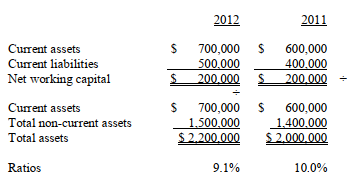

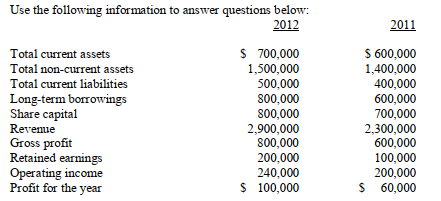

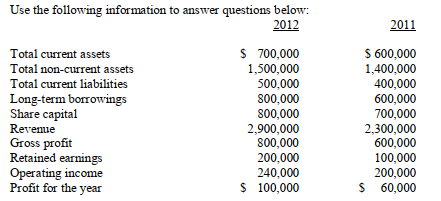

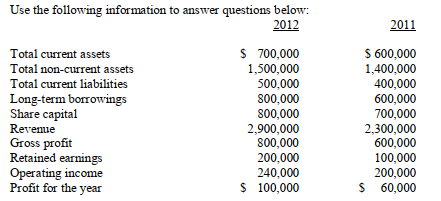

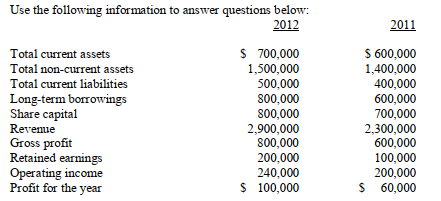

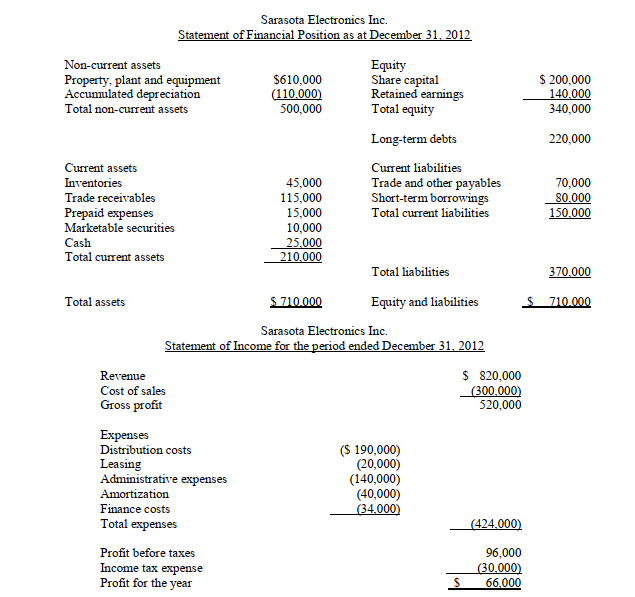

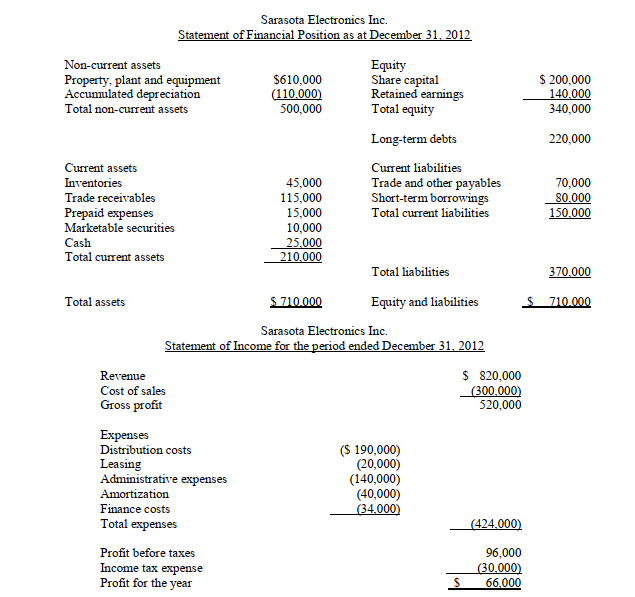

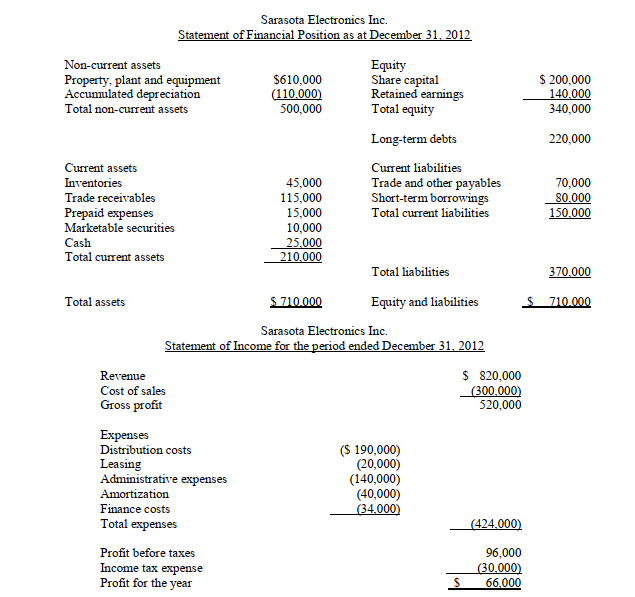

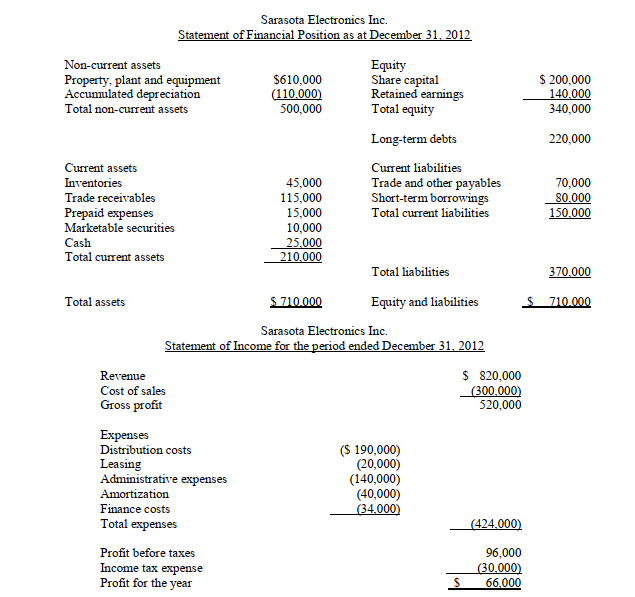

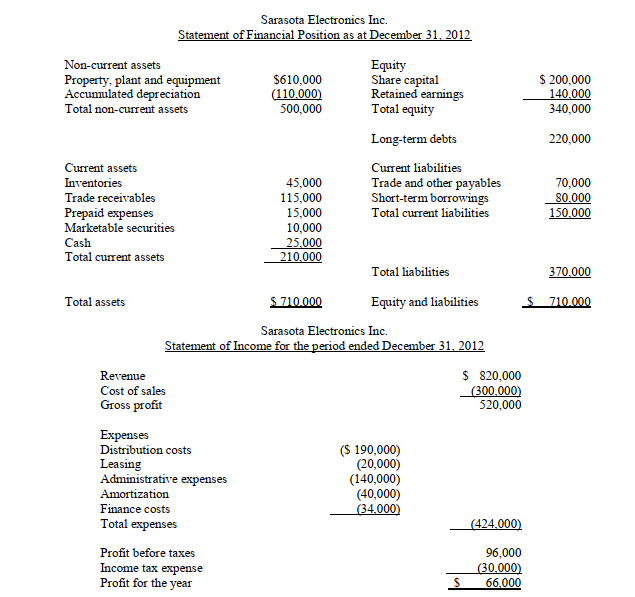

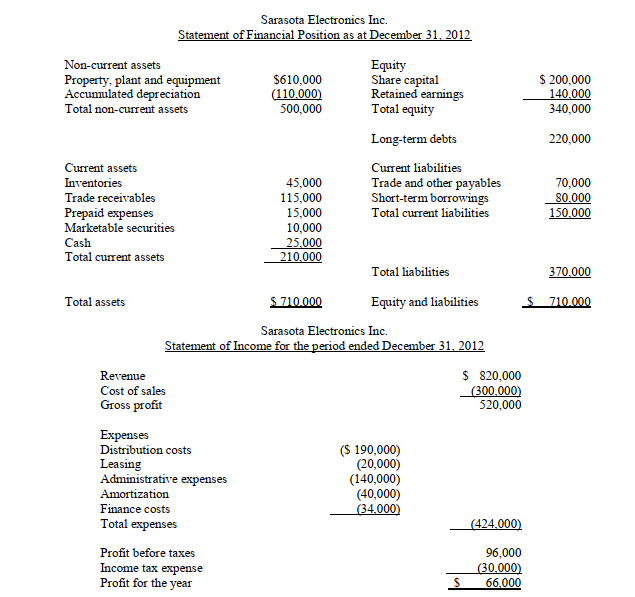

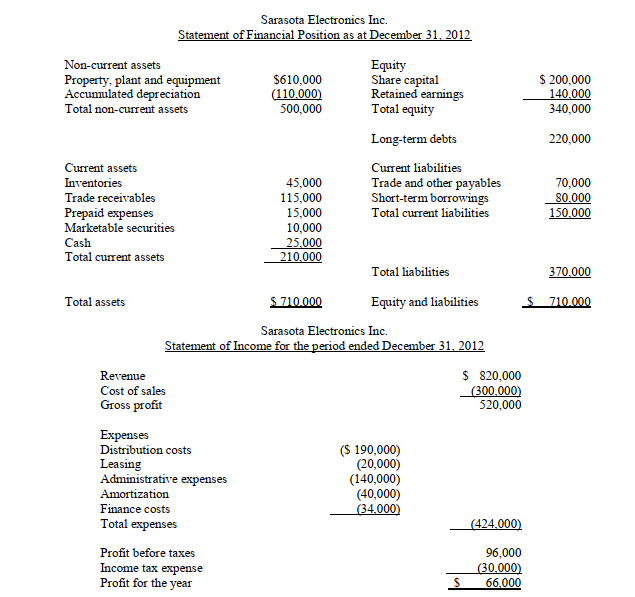

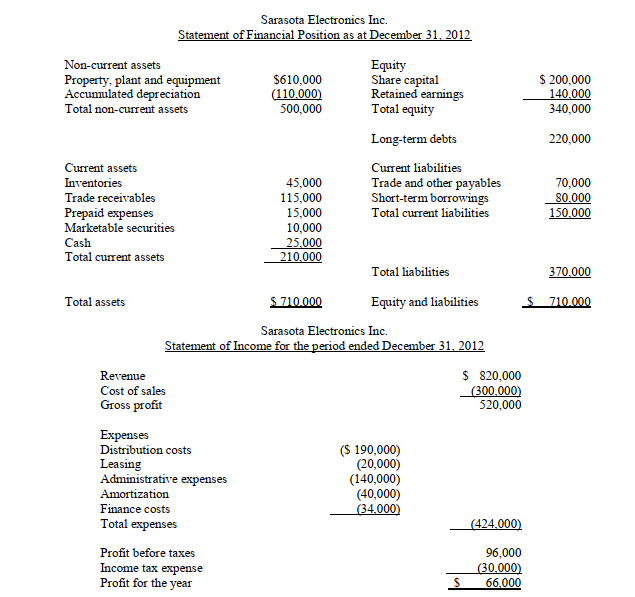

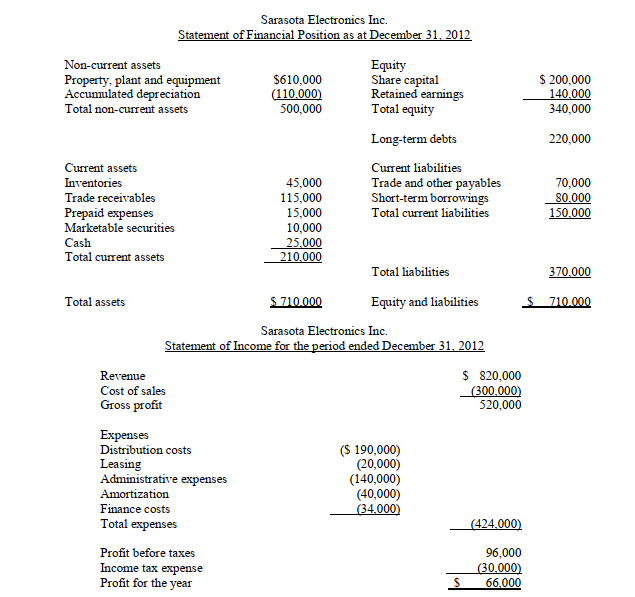

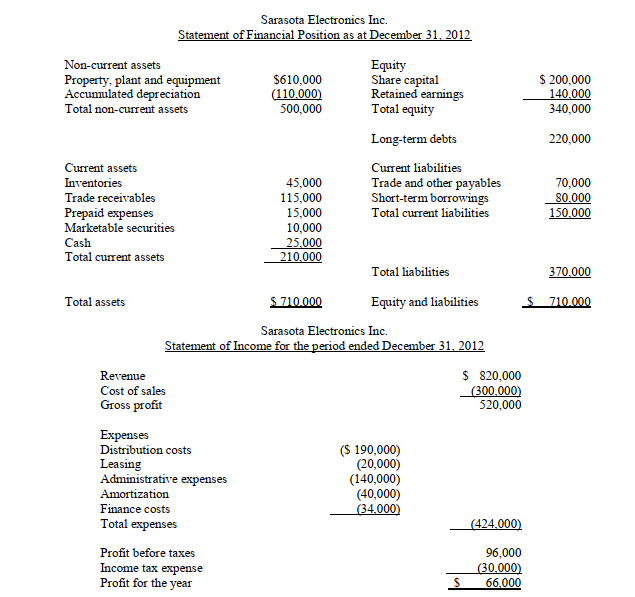

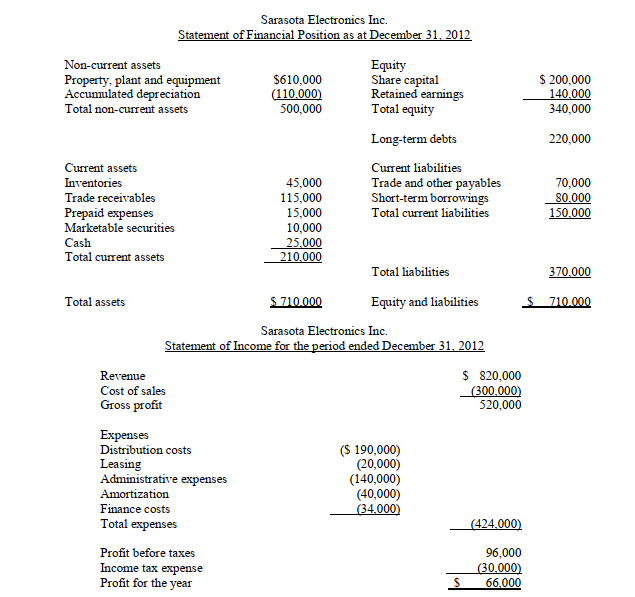

-Calculate the net working capital in terms of dollars and as a percentage of total assets for both years:

Net working capital ____________ _____________

Ratios ____________ _____________

2

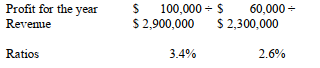

-Calculate the return on revenue ratio for both years:

Ratios ____________ _____________

3

-Calculate the profit margin on revenue ratio for both years:

Ratios ____________ _____________

4

-Calculate the return on equity ratio for both years:

Ratios ____________ _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

5

-Calculate the return on total assets ratio for both years:

Ratios ____________ _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

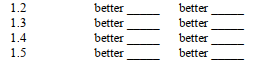

6

-Identify with a check mark, which ratios show an improvement between the two years:

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

7

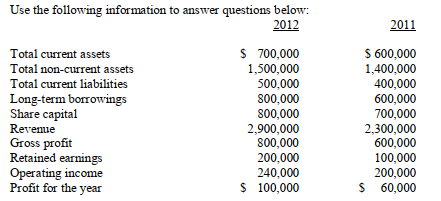

-Calculate the net working capital's change in dollars and in percentage between the years 2012 and 2011:

In dollars _____________

In percentage _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

8

-Calculate the shareholders' equity change in dollars and in percentage between the years 2012 and 2011:

In dollars _____________

In percentage _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

9

-Calculate the total liabilities change in dollars and in percentage between the years 2011 and 2012

In dollars _____________

In percentage _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

10

-Calculate the total assets' change in dollars and in percentage between the years 2011 and 2012

In dollars _____________

In percentage _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

11

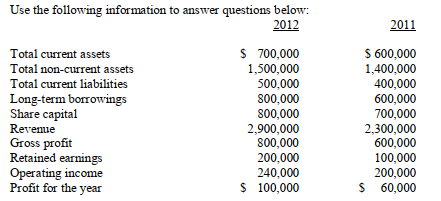

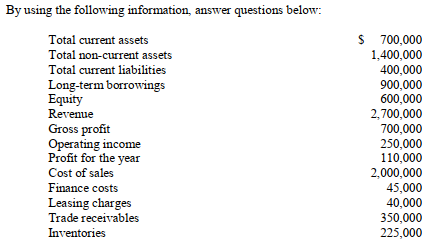

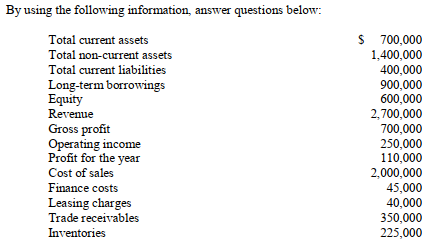

-Total assets turnover is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

12

-Return on total assets is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

13

-Profit margin on revenue is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

14

-Return on equity is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

15

-Debt-to-total assets is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

16

-Debt-to-equity is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

17

-Return on revenue is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

18

-Times-interest-earned is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

19

-Fixed-charges-coverage ratio is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

20

-Average collection period is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

21

-Inventory turnover is: _____________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

22

-The current ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

23

-The quick ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

24

-The debt-to-total assets ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

25

-The debt-to-equity ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

26

-The times-interest-earned ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

27

-The fixed-charges coverage ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

28

-The average collection period is:_________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

29

-The inventory turnover is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

30

-The capital assets turnover is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

31

-The total assets turnover is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

32

-The profit margin on revenue ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

33

-The return on revenue ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

34

-The return on total assets ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

35

-The return on equity ratio is:_________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

36

-Total non-current assets:_________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

37

-Inventories:_________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

38

-Total current assets: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

39

-Total equity:_________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

40

-Total current liabilities: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

41

-Total liabilities: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

42

-Cost of sales: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

43

-Total distribution costs: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

44

-Total administrative expenses: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

45

-Profit before taxes: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

46

-The current ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

47

-The quick ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

48

-The debt-to-total assets ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

49

-The debt-to-equity ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

50

-The times-interest-earned ratio is:_________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

51

-The fixed-charges coverage ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

52

-The average collection period is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

53

-The inventory turnover is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

54

-The capital assets turnover is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

55

-The total assets turnover is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

56

-The profit margin on revenue ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

57

-The return on revenue ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

58

-The return on total assets ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

59

-The return on equity ratio is: _________________

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

60

What is the best measure of a company's liquidity?

A) the quick ratio

B) the debt-to-total assets ratio

C) the current ratio

D) the times-interest-earned

A) the quick ratio

B) the debt-to-total assets ratio

C) the current ratio

D) the times-interest-earned

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

61

Why do managers analyze financial statements?

A) to review the company's profitability

B) to see whether or not the financial statements have been prepared in accordance with generally accepted accounting principles

C) to see how the company is performing and to use that information to determine whether budgets have been met and goals achieved

D) to examine the past to gauge past performance and use that information to enhance future performance

A) to review the company's profitability

B) to see whether or not the financial statements have been prepared in accordance with generally accepted accounting principles

C) to see how the company is performing and to use that information to determine whether budgets have been met and goals achieved

D) to examine the past to gauge past performance and use that information to enhance future performance

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

62

What is the "rule of thumb" for the-debt-to-total-assets ratio, and what does it mean?

A) The debt-to-equity ratio is 45%, which is a satisfactory debt-to-equity ratio.

B) The debt-to-total-assets ratio is 65%, and creditors may not provide more debt financing to the company.

C) The debt-to-total assets ratio is 50%, and creditors will provide more debt financing.

D) The debt-to-total-debt ratio is 50%, and creditors may be reluctant to provide more financing.

A) The debt-to-equity ratio is 45%, which is a satisfactory debt-to-equity ratio.

B) The debt-to-total-assets ratio is 65%, and creditors may not provide more debt financing to the company.

C) The debt-to-total assets ratio is 50%, and creditors will provide more debt financing.

D) The debt-to-total-debt ratio is 50%, and creditors may be reluctant to provide more financing.

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

63

What are the components of working capital?

A) current revenues and current expenses

B) operating assets and operating expenses

C) current assets and current liabilities

D) current assets and long-term borrowings

A) current revenues and current expenses

B) operating assets and operating expenses

C) current assets and current liabilities

D) current assets and long-term borrowings

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

64

What is removed from current assets to calculate the quick ratio?

A) marketable securities

B) cash

C) trade receivables

D) inventories

A) marketable securities

B) cash

C) trade receivables

D) inventories

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is a debt-coverage ratio?

A) inventory turnover

B) earnings per share

C) times-interest-earned

D) return on equity

A) inventory turnover

B) earnings per share

C) times-interest-earned

D) return on equity

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

66

What is the denominator of the times-interest-earned ratio?

A) finance costs

B) profit for the year

C) finance costs less income taxes

D) profit before taxes

A) finance costs

B) profit for the year

C) finance costs less income taxes

D) profit before taxes

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is an asset-management measure?

A) return on assets

B) times-interest-charges

C) average collection period

D) current ratio

A) return on assets

B) times-interest-charges

C) average collection period

D) current ratio

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following is divided by inventory to calculate the inventory turnover ratio?

A) total assets

B) gross profit

C) cost of sales

D) operating expenses

A) total assets

B) gross profit

C) cost of sales

D) operating expenses

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is divided by total assets to calculate the total assets turnover ratio?

A) cost of sales

B) profit for the year

C) revenue

D) profit before taxes

A) cost of sales

B) profit for the year

C) revenue

D) profit before taxes

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

70

What is the profit margin on revenue performance measure related to?

A) operating income

B) gross profit

C) capital assets

D) working capital

A) operating income

B) gross profit

C) capital assets

D) working capital

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is a measure of profitability?

A) return on revenue

B) times-interest-earned

C) inventory turnover

D) quick ratio

A) return on revenue

B) times-interest-earned

C) inventory turnover

D) quick ratio

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

72

What is related to a company's performance under the DuPont financial system?

A) gross profit

B) revenue

C) total assets

D) equity

A) gross profit

B) revenue

C) total assets

D) equity

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is a measure of liquidity?

A) total assets turnover ratio

B) average collection period

C) return on revenue ratio

D) current ratio

A) total assets turnover ratio

B) average collection period

C) return on revenue ratio

D) current ratio

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is a measure of returns?

A) total assets turnover

B) quick ratio

C) average collection period

D) return on revenue ratio

A) total assets turnover

B) quick ratio

C) average collection period

D) return on revenue ratio

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

75

Which ratio measures solvency?

A) debt-to-equity ratio

B) return on total assets ratio

C) total assets turnover ratio

D) return on revenue ratio

A) debt-to-equity ratio

B) return on total assets ratio

C) total assets turnover ratio

D) return on revenue ratio

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following helps measure growth in components of a financial statement?

A) common-size statement analysis

B) the cash budget

C) the DuPont financial system

D) horizontal analysis

A) common-size statement analysis

B) the cash budget

C) the DuPont financial system

D) horizontal analysis

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following ratios tells us how management is managing the largest current asset in a company such as Future Shop or Best Buy?

A) The quick ratio.

B) The current ratio.

C) The debt-to-total assets ratio.

D) The inventory turnover.

A) The quick ratio.

B) The current ratio.

C) The debt-to-total assets ratio.

D) The inventory turnover.

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is NOT an asset-management ratio?

A) earnings per share

B) total assets turnover

C) inventory turnover

D) average collection period

A) earnings per share

B) total assets turnover

C) inventory turnover

D) average collection period

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

79

Which ratio is most likely to interest marketing managers?

A) debt-to-total assets

B) profit margin on revenue

C) current ratio

D) total assets turnover

A) debt-to-total assets

B) profit margin on revenue

C) current ratio

D) total assets turnover

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck

80

What measures the productivity level of a business?

A) profit margin on revenue

B) current ratio

C) total assets turnover

D) average collection period

A) profit margin on revenue

B) current ratio

C) total assets turnover

D) average collection period

Unlock Deck

Unlock for access to all 256 flashcards in this deck.

Unlock Deck

k this deck