Deck 12: Financial Statement Analysis and Decision Making

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/32

Play

Full screen (f)

Deck 12: Financial Statement Analysis and Decision Making

1

Analyses that provide information about an entity's relative position within an industry are known as:

A) company standards.

B) industry boundaries.

C) industry averages.

D) comparative advantages.

A) company standards.

B) industry boundaries.

C) industry averages.

D) comparative advantages.

industry averages.

2

Comparisons with other entities that provide insight into an entity's competitive position are:

A) intra-industry analyses.

B) competitor data.

C) industry averages.

D) inter-entity comparisons.

A) intra-industry analyses.

B) competitor data.

C) industry averages.

D) inter-entity comparisons.

inter-entity comparisons.

3

Liquidity ratios are used to assess:

A) short-term ability of an entity to pay maturing obligations.

B) long-term solvency.

C) short-term sales levels.

D) ability of an entity to survive over a long term.

A) short-term ability of an entity to pay maturing obligations.

B) long-term solvency.

C) short-term sales levels.

D) ability of an entity to survive over a long term.

short-term ability of an entity to pay maturing obligations.

4

The current ratio is calculated by dividing:

A) current liabilities by current assets.

B) current creditors by current accounts receivable.

C) current assets by current liabilities.

D) cash by inventory.

A) current liabilities by current assets.

B) current creditors by current accounts receivable.

C) current assets by current liabilities.

D) cash by inventory.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

5

Radiance Limited has cash of $35,000, marketable securities totaling $15,000, net receivables amounting to $20,000, and current liabilities of $55,000. The quick ratio for this company is:

A) 1.000.

B) 0.780.

C) 1.273.

D) 1.875.

A) 1.000.

B) 0.780.

C) 1.273.

D) 1.875.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

6

Return on ordinary shareholders' equity is driven by:

A) gross profit rate.

B) profit margin and free cash flow.

C) times interest earned.

D) return on assets and leverage.

A) gross profit rate.

B) profit margin and free cash flow.

C) times interest earned.

D) return on assets and leverage.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

7

Examples of estimates normally found in financial statements include all of the following except:

A) cash.

B) provision for warranties.

C) depreciation expense.

D) allowance for doubtful debts.

A) cash.

B) provision for warranties.

C) depreciation expense.

D) allowance for doubtful debts.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

8

Traditional financial statements are normally based on:

A) market values.

B) net present values.

C) cost.

D) exit prices.

A) market values.

B) net present values.

C) cost.

D) exit prices.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

9

In a traditional set of financial statements, the values of items found in a statement of financial position will be:

A) lower than their current market value.

B) higher than their current market value.

C) the same as their current market value.

D) stated at a premium to their market value.

A) lower than their current market value.

B) higher than their current market value.

C) the same as their current market value.

D) stated at a premium to their market value.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

10

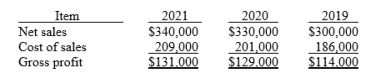

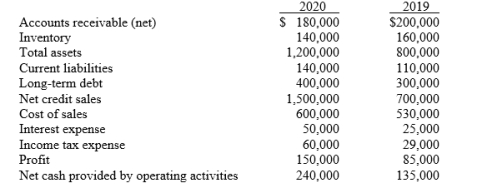

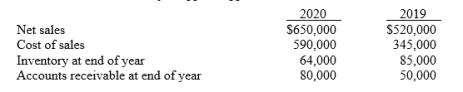

Comparative information taken from the Rugby Ltd's financial statements is shown below:

Required: Using horizontal analysis, show the percentage change from 2019 to 2020 with 2019 as the base year.

Required: Using horizontal analysis, show the percentage change from 2019 to 2020 with 2019 as the base year.

Required: Using horizontal analysis, show the percentage change from 2019 to 2020 with 2019 as the base year.

Required: Using horizontal analysis, show the percentage change from 2019 to 2020 with 2019 as the base year.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

11

Button Ltd reported profit of $4,000,000 in 2019. Using 2019 as the base year, profit decreased by 70% in 2020 and increased by 180% in 2021.

Compute the profit reported by Button Ltd for 2020 and 2021.

Compute the profit reported by Button Ltd for 2020 and 2021.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

12

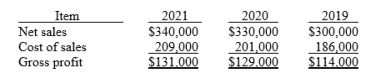

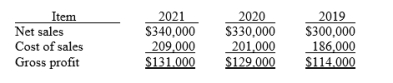

The following items were taken from the financial statements of James Limited, over a three-year period:

Required: Using horizontal analysis and 2019 as the base year, compute the trend percentages for net sales, cost of sales and gross profit. Explain whether the trends are favourable or unfavourable for each item.

Required: Using horizontal analysis and 2019 as the base year, compute the trend percentages for net sales, cost of sales and gross profit. Explain whether the trends are favourable or unfavourable for each item.

Required: Using horizontal analysis and 2019 as the base year, compute the trend percentages for net sales, cost of sales and gross profit. Explain whether the trends are favourable or unfavourable for each item.

Required: Using horizontal analysis and 2019 as the base year, compute the trend percentages for net sales, cost of sales and gross profit. Explain whether the trends are favourable or unfavourable for each item.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

13

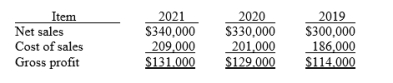

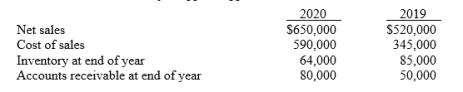

The following items were taken from the financial statements of Greenley Ltd over a three-year period:

Required: Compute the following for each of the above time periods.

Required: Compute the following for each of the above time periods.

a. The amount and percentage change from 2019 to 2020.

b. The amount and percentage change from 2020 to 2021.

Required: Compute the following for each of the above time periods.

Required: Compute the following for each of the above time periods.a. The amount and percentage change from 2019 to 2020.

b. The amount and percentage change from 2020 to 2021.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

14

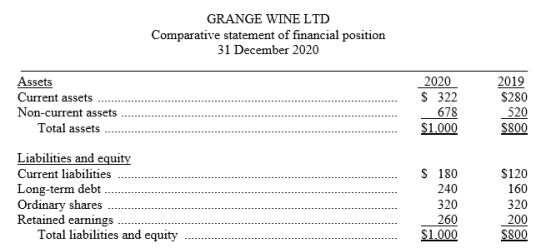

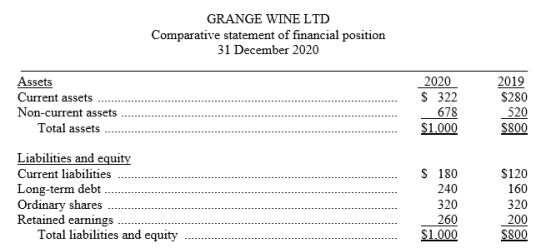

The comparative statement of financial position of Grange Wine Ltd appears below:

Instructions:

Instructions:

(a) Using horizontal analysis, show the percentage change for each statement of financial position item using 2019 as a base year.

(b) Using vertical analysis, prepare a common-size comparative statement of financial position.

Instructions:

Instructions:(a) Using horizontal analysis, show the percentage change for each statement of financial position item using 2019 as a base year.

(b) Using vertical analysis, prepare a common-size comparative statement of financial position.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

15

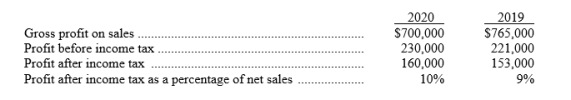

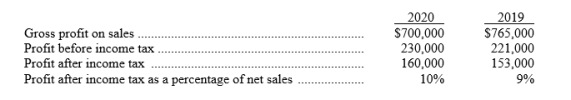

The following information was taken from the financial statements of Genesis Ltd:

Required:

Required:

(a) Compute the net sales for each year.

(b) Compute the cost of sales in dollars and as a percentage of net sales for each year.

(c) Compute operating expenses in dollars and as a percentage of net sales for each year. (Income taxes are not operating expenses).

Required:

Required:(a) Compute the net sales for each year.

(b) Compute the cost of sales in dollars and as a percentage of net sales for each year.

(c) Compute operating expenses in dollars and as a percentage of net sales for each year. (Income taxes are not operating expenses).

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

16

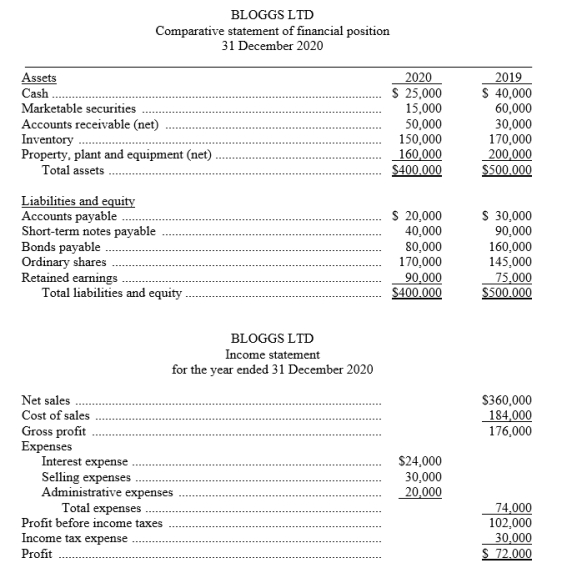

Selected information from the comparative financial statements of Dryman Ltd for the year ended 31 December appears below:

Required: Answer the following questions relating to the year ended 31 December 2020. Show computations.

Required: Answer the following questions relating to the year ended 31 December 2020. Show computations.

1. Inventory turnover for 2020 is __________.

2. The number of times interest earned ratio in 2020 is __________.

3. The debt to total assets ratio for 2020 is __________.

4. Receivables turnover for 2020 is __________.

5. Return on assets for 2020 is __________.

6. The cash return on sales ratio for 2020 is __________.

7. Current cash debt coverage for 2020 is __________.

Required: Answer the following questions relating to the year ended 31 December 2020. Show computations.

Required: Answer the following questions relating to the year ended 31 December 2020. Show computations.1. Inventory turnover for 2020 is __________.

2. The number of times interest earned ratio in 2020 is __________.

3. The debt to total assets ratio for 2020 is __________.

4. Receivables turnover for 2020 is __________.

5. Return on assets for 2020 is __________.

6. The cash return on sales ratio for 2020 is __________.

7. Current cash debt coverage for 2020 is __________.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

17

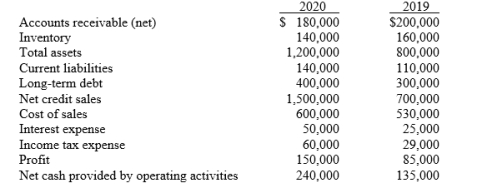

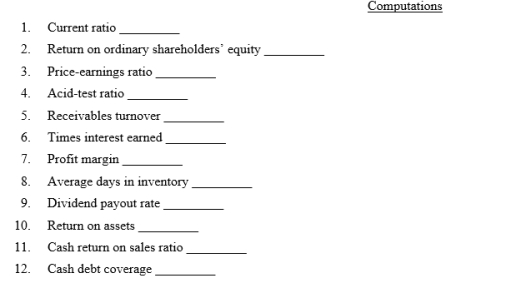

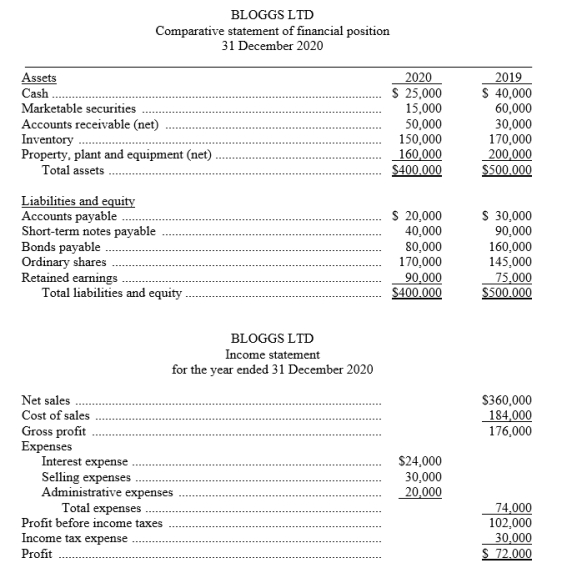

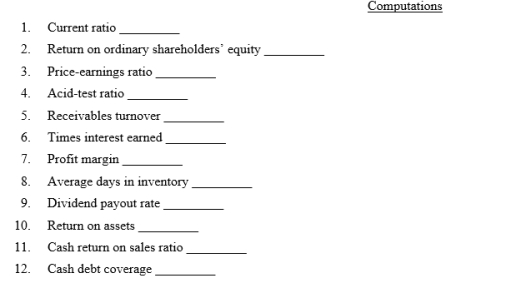

The financial statements of Bloggs Ltd appear below:

Additional information:

Additional information:

a. Cash dividends of $57,000 were declared and paid in 2020.

b. Weighted-average number of shares of ordinary shares outstanding during 2020 was 60,000 shares.

c. Market value of ordinary shares on 31 December 2020 was $18 per share.

d. Net cash provided by operating activities for 2020 was $63,000.

Required:Using the financial statements and additional information, compute the following ratios for the Boggs Ltd for 2020. Show all computations.

Additional information:

Additional information:a. Cash dividends of $57,000 were declared and paid in 2020.

b. Weighted-average number of shares of ordinary shares outstanding during 2020 was 60,000 shares.

c. Market value of ordinary shares on 31 December 2020 was $18 per share.

d. Net cash provided by operating activities for 2020 was $63,000.

Required:Using the financial statements and additional information, compute the following ratios for the Boggs Ltd for 2020. Show all computations.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

18

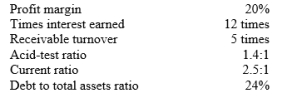

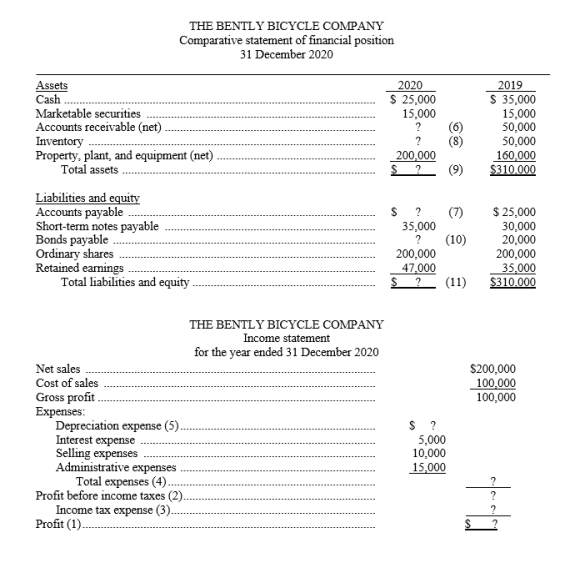

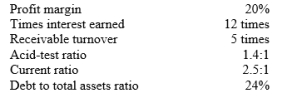

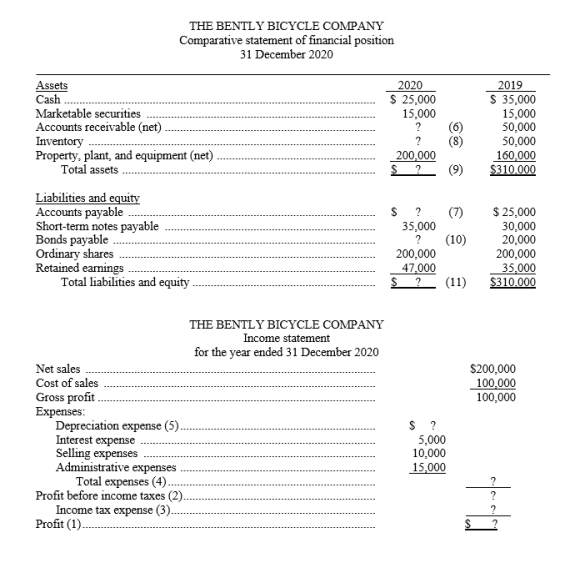

The following ratios have been computed for the Bently Bicycle Company for 2020

The 2020 financial statements for James Ltd with missing information follows:

The 2020 financial statements for James Ltd with missing information follows:

Required: Use the above ratios and information from The Bently Bicycle Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

Required: Use the above ratios and information from The Bently Bicycle Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

The 2020 financial statements for James Ltd with missing information follows:

The 2020 financial statements for James Ltd with missing information follows: Required: Use the above ratios and information from The Bently Bicycle Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

Required: Use the above ratios and information from The Bently Bicycle Company financial statements to fill in the missing information on the financial statements. Follow the sequence indicated. Show computations that support your answers.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

19

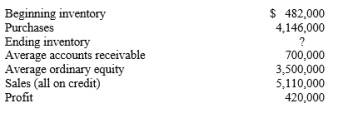

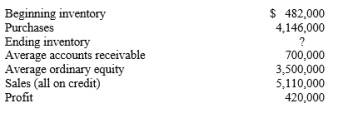

Selected data for Marcy's Apparel appear below.

Compute the following for 2020:

Compute the following for 2020:

(a) Gross profit percentage

(b) Inventory turnover

(c) Receivables turnover

Compute the following for 2020:

Compute the following for 2020:(a) Gross profit percentage

(b) Inventory turnover

(c) Receivables turnover

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

20

Willow Ltd has issued ordinary shares only. The company has been successful and has a gross profit rate of 20%. The information shown below was taken from the company's financial statements.

Compute the following:

Compute the following:

(a) Receivables turnover and the average number of days required to collect the accounts receivable.

(b) The inventory turnover and the average days in inventory.

(c) Return on ordinary shareholders' equity.

Compute the following:

Compute the following:(a) Receivables turnover and the average number of days required to collect the accounts receivable.

(b) The inventory turnover and the average days in inventory.

(c) Return on ordinary shareholders' equity.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

21

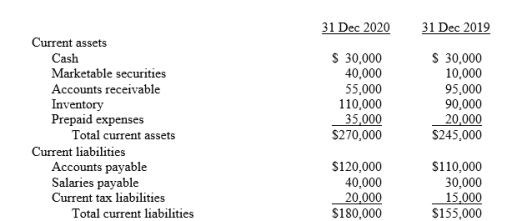

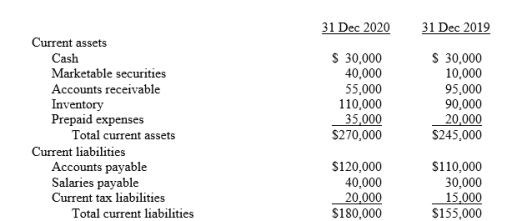

Birch Ltd had the following comparative current assets and current liabilities:

During 2020, credit sales and cost of sales were $450,000 and $250,000, respectively. Net cash provided by operating activities for 2020 was $134,000.

During 2020, credit sales and cost of sales were $450,000 and $250,000, respectively. Net cash provided by operating activities for 2020 was $134,000.

Compute the following liquidity measures for 2020:

1. Current ratio

2. Quick ratio

3. Current cash debt coverage

4. Receivables turnover

5. Inventory turnover

During 2020, credit sales and cost of sales were $450,000 and $250,000, respectively. Net cash provided by operating activities for 2020 was $134,000.

During 2020, credit sales and cost of sales were $450,000 and $250,000, respectively. Net cash provided by operating activities for 2020 was $134,000.Compute the following liquidity measures for 2020:

1. Current ratio

2. Quick ratio

3. Current cash debt coverage

4. Receivables turnover

5. Inventory turnover

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

22

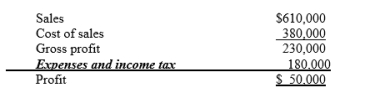

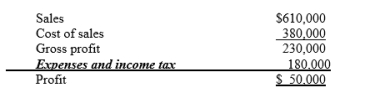

The income statement for the Yarrah Ltd for the year ended 31 December 2020 appears below.

*Includes $30,000 of interest expense and $16,000 of income tax expense.

*Includes $30,000 of interest expense and $16,000 of income tax expense.

Additional information:

1. Ordinary shares outstanding on 1 January 2020 was 50,000 shares. On 1 July 2020

10,000 more shares were issued.

2. The market price of Yarrah shares was $12 at the end of 2020.

3. Cash dividends of $30,000 were paid, $6,000 of which were paid to preferred shareholders.

Compute the following ratios for 2020:

(a) earnings per share

(b) price-earnings ratio

(c) times interest earned.

*Includes $30,000 of interest expense and $16,000 of income tax expense.

*Includes $30,000 of interest expense and $16,000 of income tax expense.Additional information:

1. Ordinary shares outstanding on 1 January 2020 was 50,000 shares. On 1 July 2020

10,000 more shares were issued.

2. The market price of Yarrah shares was $12 at the end of 2020.

3. Cash dividends of $30,000 were paid, $6,000 of which were paid to preferred shareholders.

Compute the following ratios for 2020:

(a) earnings per share

(b) price-earnings ratio

(c) times interest earned.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

23

Complete the following statements:

-If the inventory turnover ratio is 5 times, and the average inventory was $600,000, the cost of goods sold during the year was $______________ and the average days to sell the inventory was ______________ days.

-If the inventory turnover ratio is 5 times, and the average inventory was $600,000, the cost of goods sold during the year was $______________ and the average days to sell the inventory was ______________ days.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

24

Complete the following statements:

-Hansen Company reported profit for the year of $300,000 and profit margin of 25%. If total average assets were $200,000, the asset turnover ratio was ____________ times.

-Hansen Company reported profit for the year of $300,000 and profit margin of 25%. If total average assets were $200,000, the asset turnover ratio was ____________ times.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

25

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Cash return on sales ratio

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

-Cash return on sales ratio

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

26

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Return on assets

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

-Return on assets

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

27

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Receivables turnover

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

-Receivables turnover

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

28

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Current cash debt coverage

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

-Current cash debt coverage

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

29

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Acid-test ratio (Quick ratio)

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

-Acid-test ratio (Quick ratio)

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

30

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Debt to total assets ratio

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

-Debt to total assets ratio

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

31

For each of the ratios listed , select the appropriate code letter, whether it is a liquidity ratio, a profitability ratio or a solvency ratio:

-Inventory turnover

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

-Inventory turnover

A) Liquidity ratio (L)

B) Profitability ratio(P)

C) Solvency ratio(S)

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

32

Communication: Fast Express specialises in the transportation of medical equipment and laboratory specimens overnight. The company has selected the following information from its most recent annual report to be the subject of an immediate press release.

• The financial statements are being released.

• Profit this year was $2.1 million. Last year's profit had been $1.8 million.

• The current ratio has changed to 2:1 from last year's 1.5:1.

• The debt/total assets ratio has changed to 4:5 from last year's 3:5.

• The company expanded its truck fleet substantially by purchasing ten new delivery vans.

• The company already had twelve delivery vans. The company is now the largest medical courier on the Eastern seaboard.

Required: Prepare a brief press release incorporating the information above. Include all information. Think carefully which information (if any) is good news for the company, and which (if any) is bad news.

• The financial statements are being released.

• Profit this year was $2.1 million. Last year's profit had been $1.8 million.

• The current ratio has changed to 2:1 from last year's 1.5:1.

• The debt/total assets ratio has changed to 4:5 from last year's 3:5.

• The company expanded its truck fleet substantially by purchasing ten new delivery vans.

• The company already had twelve delivery vans. The company is now the largest medical courier on the Eastern seaboard.

Required: Prepare a brief press release incorporating the information above. Include all information. Think carefully which information (if any) is good news for the company, and which (if any) is bad news.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck