Deck 11: Statement of Cash Flows

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/47

Play

Full screen (f)

Deck 11: Statement of Cash Flows

1

Zentak Ltd engaged in the following transactions. For each transaction, indicate where, if at all, it would normally be classified on the statement of cash flows. For questions 16-22, assume the indirect method is used.

-Declared and issued a share dividend:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

-Declared and issued a share dividend:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

Does not represent a cash flow

2

Zentak Ltd engaged in the following transactions. For each transaction, indicate where, if at all, it would normally be classified on the statement of cash flows. For questions 16-22, assume the indirect method is used.

-Collected accounts receivable:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

-Collected accounts receivable:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

Operating activities section

3

Zentak Ltd engaged in the following transactions. For each transaction, indicate where, if at all, it would normally be classified on the statement of cash flows. For questions 16-22, assume the indirect method is used.

-Retired long-term debt with cash:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

-Retired long-term debt with cash:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

Financing activities section

4

Zentak Ltd engaged in the following transactions. For each transaction, indicate where, if at all, it would normally be classified on the statement of cash flows. For questions 16-22, assume the indirect method is used.

-Paid interest on note payable:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

-Paid interest on note payable:

A) Operating activities section

B) Investing activities section

C) Financing activities section

D) Does not represent a cash flow

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

5

Accounts receivable arising from sales to customers amounted to $35,000 and $30,000 at the beginning and end of the year respectively. Revenue reported on the income statement for the year was $130,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is:

A) $100,000.

B) $115,000.

C) $165,000.

D) $135,000.

A) $100,000.

B) $115,000.

C) $165,000.

D) $135,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

6

Stella Ltd reported profit of $40,000 for the year. During the year, accounts receivable increased by $6,000, accounts payable decreased by $4,000 and depreciation expense of $7,000 was recorded. Net cash provided by operating activities for the year is:

A) $31,000.

B) $43,000.

C) $37,000.

D) $23,000.

A) $31,000.

B) $43,000.

C) $37,000.

D) $23,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

7

Tuncurry Ltd reported a loss of $15,000 for the year ended December 31. During the year, accounts receivable decreased $6,000, merchandise inventory increased $4,000, accounts payable increased by $5,000, and depreciation expense of $3,000 was recorded. During the year, operating activities:

A) used net cash of $3,000.

B) used net cash of $5,000.

C) provided net cash of $5,000.

D) provided net cash of $3,000.

A) used net cash of $3,000.

B) used net cash of $5,000.

C) provided net cash of $5,000.

D) provided net cash of $3,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

8

A company reported profit of $175,000. Depreciation expense is $17,000. During the year Accounts receivable increased and Inventory decreased $12,000 and $30,000, respectively. Prepaid expenses and Accounts payable decreased $1,500 and $5,000, respectively. There was also a loss on the sale of equipment of $6,000. The amount of cash provided by operating activities was:

A) $188,500.

B) $212,500.

C) $206,500.

D) $200,500.

A) $188,500.

B) $212,500.

C) $206,500.

D) $200,500.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

9

The profit reported on the income statement for the current year was $200,000. Depreciation recorded on plant assets was $38,000. Accounts receivable increased and inventories decreased by $2,000 and $8,000, respectively. Prepaid expenses decreased and Accounts payable increased by $1,000 and $11,000, respectively. The amount of cash provided by operating activities was:

A) $180,000.

B) $218,000.

C) $256,000.

D) $238,000.

A) $180,000.

B) $218,000.

C) $256,000.

D) $238,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

10

Profit reported on the income statement for the current year was $100,000. Depreciation was $25,000. Accounts receivable and inventories decreased by $5,000 and $15,000, respectively. Prepaid expenses and accounts payable increased, respectively, by $500 and $4,000. The cash was provided by operating activities was:

A) $130,500

B) $148,500

C) $141,500

D) $98,500

A) $130,500

B) $148,500

C) $141,500

D) $98,500

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

11

If a gain of $25,000 is incurred in selling (for cash) office equipment with a book value of $100,000, the total amount reported as a cash flow from investing activities is:

A) $75,000.

B) $100,000.

C) $125,000.

D) $25,000.

A) $75,000.

B) $100,000.

C) $125,000.

D) $25,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

12

If a loss of $9,500 is incurred in selling (for cash) computer equipment with a book value of $15,500, the total amount reported as a cash flow from investing activities is:

A) $9,500.

B) $15,500.

C) $25,000.

D) $6,000

A) $9,500.

B) $15,500.

C) $25,000.

D) $6,000

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

13

Gant Limited reported a $15,000 increase in inventory and a $5,000 increase in accounts payable during the year. Cost of Sales for the year was $150,000. The cash payments made to suppliers were:

A) $150,000.

B) $160,000.

C) $130,000.

D) $145,000.

A) $150,000.

B) $160,000.

C) $130,000.

D) $145,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

14

The cost of sales sold during the year was $50,000. Inventory decreased by $2,000 during the year and accounts payable decreased by $1,000. Using the direct method of reporting, cash payments to suppliers total:

A) $47,000.

B) $49,000.

C) $51,000.

D) $53,000.

A) $47,000.

B) $49,000.

C) $51,000.

D) $53,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

15

During 2020, Stacy Ltd had $300,000 in cash sales and $3,500,000 in credit sales. The accounts receivable balances were $450,000 and $530,000 at December 31, 2019 and 2020, respectively. The total cash collected from all customers during 2020 was:

A) $3,420,000.

B) $3,880,000.

C) $3,800,000.

D) $3,720,000.

A) $3,420,000.

B) $3,880,000.

C) $3,800,000.

D) $3,720,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

16

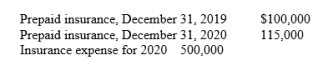

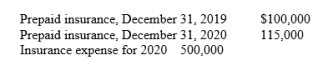

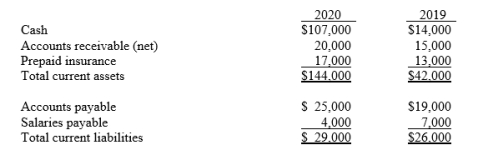

Johnson Limited had the following information available:

The amount of cash paid for insurance premiums by Johnson during 2020 was:

The amount of cash paid for insurance premiums by Johnson during 2020 was:

A) $485,000.

B) $515,000.

C) $600,000.

D) $615,000.

The amount of cash paid for insurance premiums by Johnson during 2020 was:

The amount of cash paid for insurance premiums by Johnson during 2020 was:A) $485,000.

B) $515,000.

C) $600,000.

D) $615,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

17

Stapp Limited had an increase in inventory of $40,000. The cost of sales was $90,000. There was a $5,000 decrease in accounts payable from the prior period. What were Stapp's cash payments to suppliers?

A) $135,000.

B) $85,000.

C) $125,000.

D) $95,000.

A) $135,000.

B) $85,000.

C) $125,000.

D) $95,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

18

Beech Limited shows income tax expense of $80,000. There has been a $2,000 increase in income taxes payable. What was Beech's cash payment for income taxes?

A) $80,000

B) $78,000

C) $75,000

D) $82,000

A) $80,000

B) $78,000

C) $75,000

D) $82,000

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

19

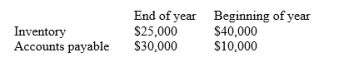

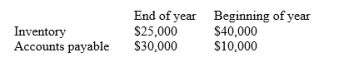

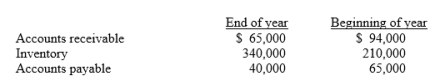

Boone Ltd reports the following:

If cost of sales for the year is $150,000, the amount of cash paid to suppliers is:

If cost of sales for the year is $150,000, the amount of cash paid to suppliers is:

A) $155,000.

B) $145,000.

C) $115,000.

D) $185,000.

If cost of sales for the year is $150,000, the amount of cash paid to suppliers is:

If cost of sales for the year is $150,000, the amount of cash paid to suppliers is:A) $155,000.

B) $145,000.

C) $115,000.

D) $185,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

20

During the year Salaries payable decreased by $6,000. If Salary expense amounted to $160,000 for the year, the cash paid to employees is:

A) $166,000.

B) $160,000.

C) $154,000.

D) $172,000.

A) $166,000.

B) $160,000.

C) $154,000.

D) $172,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

21

The cash-based ratio that is the counterpart of profit margin percentage is the:

A) current cash debt coverage.

B) cash return on sales ratio.

C) cash debt coverage.

D) cash flow ratio.

A) current cash debt coverage.

B) cash return on sales ratio.

C) cash debt coverage.

D) cash flow ratio.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

22

Selected transactions of Daffodil Ltd are listed below:

1. Ordinary shares are sold for cash.

2. Debentures are issued for cash at a discount.

3. Interest on a short-term note receivable is collected.

4. Merchandise is sold to customers for cash.

5. Cash is paid to purchase inventory.

6. Equipment is purchased by signing a 3-year, 10% note payable.

7. Cash dividends on ordinary shares are declared and paid.

8. One hundred shares of XYZ ordinary shares are purchased for cash.

9. Land is sold for cash at its carrying value.

10. Unsecured notes payable are converted into ordinary shares.

Required: Classify each transaction as either (a) an operating activity, (b) an investing activity, (c) a financing activity or (d) a non-cash investing and financing activity

1. Ordinary shares are sold for cash.

2. Debentures are issued for cash at a discount.

3. Interest on a short-term note receivable is collected.

4. Merchandise is sold to customers for cash.

5. Cash is paid to purchase inventory.

6. Equipment is purchased by signing a 3-year, 10% note payable.

7. Cash dividends on ordinary shares are declared and paid.

8. One hundred shares of XYZ ordinary shares are purchased for cash.

9. Land is sold for cash at its carrying value.

10. Unsecured notes payable are converted into ordinary shares.

Required: Classify each transaction as either (a) an operating activity, (b) an investing activity, (c) a financing activity or (d) a non-cash investing and financing activity

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

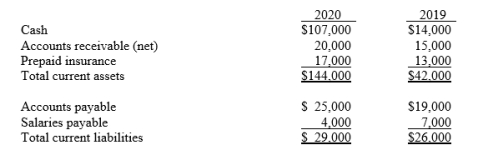

23

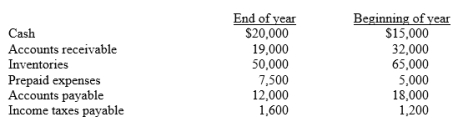

Purple Ltd reported a profit of $260,000 for the current year. Depreciation recorded on buildings and equipment amounted to $80,000 for the year. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows:

Required: Determine the cash flows from the operating activities of the company using the indirect method.

Required: Determine the cash flows from the operating activities of the company using the indirect method.

Required: Determine the cash flows from the operating activities of the company using the indirect method.

Required: Determine the cash flows from the operating activities of the company using the indirect method.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

24

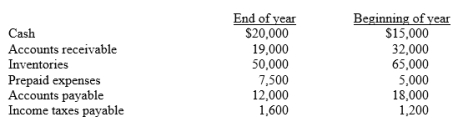

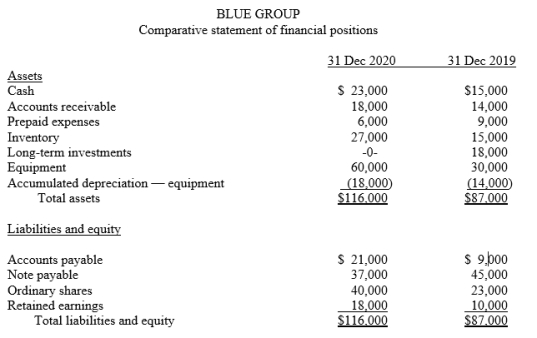

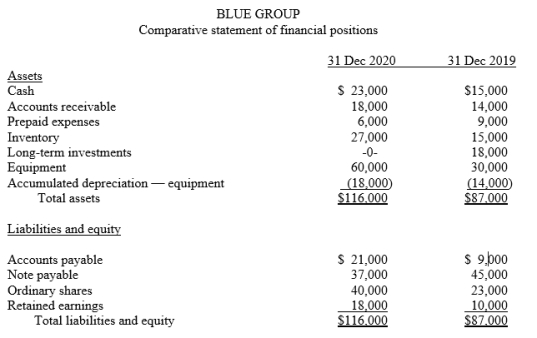

The comparative statement of financial positions for The Blue Group appear below:

Additional information:

Additional information:

1. Profit for the year ending 31 December 2020, was $20,000.

2. Cash dividends of $12,000 were declared and paid during the year.

3. Long-term investments that had a carrying amount of $18,000 were sold for $16,000.

4. Sales for 2020 were $120,000.

Required:

1. Prepare a statement of cash flows for the year ended 31 December 2020.

2. Compute the following cash-based ratios:

a. Current cash debt coverage ratio

b. Cash return on sales ratio

c. Cash debt coverage ratio

Additional information:

Additional information:1. Profit for the year ending 31 December 2020, was $20,000.

2. Cash dividends of $12,000 were declared and paid during the year.

3. Long-term investments that had a carrying amount of $18,000 were sold for $16,000.

4. Sales for 2020 were $120,000.

Required:

1. Prepare a statement of cash flows for the year ended 31 December 2020.

2. Compute the following cash-based ratios:

a. Current cash debt coverage ratio

b. Cash return on sales ratio

c. Cash debt coverage ratio

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

25

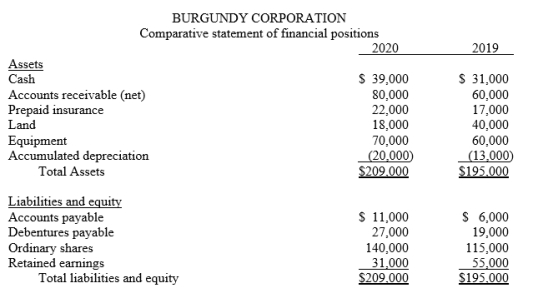

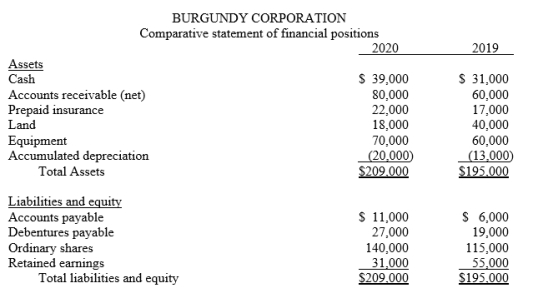

Comparative statement of financial positions for the Burgundy Corporation are presented below:

Additional information:

Additional information:

Additional information:

1. Net loss for 2020 is $20,000. Net sales for 2020 are $250,000.

2. Cash dividends of $4,000 were declared and paid during the year.

3. Land was sold for cash at a loss of $10,000. This was the only land transaction during the year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash.

5. $12,000 of debentures were retired during the year at their carrying amount.

6. Equipment was acquired for ordinary shares. The fair market value of the shares at the time of the exchange was $25,000.

Required:

1. Prepare a statement of cash flows for the year ended 2020.

2. Compute the following cash based ratios:

a. current cash debt coverage

b. cash return on sales ratio

c. cash debt coverage ratio.

Additional information:

Additional information:

Additional information:1. Net loss for 2020 is $20,000. Net sales for 2020 are $250,000.

2. Cash dividends of $4,000 were declared and paid during the year.

3. Land was sold for cash at a loss of $10,000. This was the only land transaction during the year.

4. Equipment with a cost of $15,000 and accumulated depreciation of $10,000 was sold for $5,000 cash.

5. $12,000 of debentures were retired during the year at their carrying amount.

6. Equipment was acquired for ordinary shares. The fair market value of the shares at the time of the exchange was $25,000.

Required:

1. Prepare a statement of cash flows for the year ended 2020.

2. Compute the following cash based ratios:

a. current cash debt coverage

b. cash return on sales ratio

c. cash debt coverage ratio.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

26

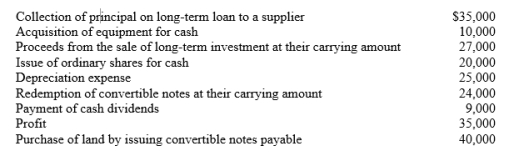

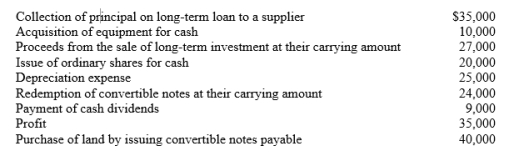

The following information is available for the Bright Ltd for the year ended 31 December 2020:

In addition, the following information is available from the comparative statement of financial positions at the end of 2020 and 2019:

In addition, the following information is available from the comparative statement of financial positions at the end of 2020 and 2019:

Required: Prepare Bright's statement of cash flows for the year ended 31 December 2020, using the indirect method.

Required: Prepare Bright's statement of cash flows for the year ended 31 December 2020, using the indirect method.

In addition, the following information is available from the comparative statement of financial positions at the end of 2020 and 2019:

In addition, the following information is available from the comparative statement of financial positions at the end of 2020 and 2019: Required: Prepare Bright's statement of cash flows for the year ended 31 December 2020, using the indirect method.

Required: Prepare Bright's statement of cash flows for the year ended 31 December 2020, using the indirect method.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

27

Delphine Limited had total operating expenses of $140,000 in the year which included Depreciation expense of $20,000. Also during the year, prepaid expenses increased by $5,000 and accrued expenses decreased by $6,700.

Calculate the amount of cash payments for operating expenses in the year.

Calculate the amount of cash payments for operating expenses in the year.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

28

a. Sales = $804,420; Accounts receivable increased by $49,700. Calculate cash receipts from sales.

b. Cost of sales = $1,520,000; inventory decreased by $78,000; accounts payable decreased by $28,500. Calculate cash payments for purchases.

c. The income statement shows $12,500 in income taxes. The statement of financial position shows an increase in taxes payable of $2,525. Calculate the cash paid for income taxes.

d. Operating expenses total $104,750; Depreciation expense = $37,200; Prepaid expenses increased by $17,400; Accrued wages decreased by $5,600. Calculate cash payments for operating expenses.

b. Cost of sales = $1,520,000; inventory decreased by $78,000; accounts payable decreased by $28,500. Calculate cash payments for purchases.

c. The income statement shows $12,500 in income taxes. The statement of financial position shows an increase in taxes payable of $2,525. Calculate the cash paid for income taxes.

d. Operating expenses total $104,750; Depreciation expense = $37,200; Prepaid expenses increased by $17,400; Accrued wages decreased by $5,600. Calculate cash payments for operating expenses.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

29

a. Sales = $930,000; Accounts receivable decreased by $40,000. Calculate cash receipts from sales.

b. Cost of goods sold = $650,000; inventory increased by $15,000; accounts payable increased by $28,000. Calculate cash payments for purchases.

c. The income statement shows $25,500 in income taxes. The statement of financial position shows a decrease in taxes payable of $2,500. Calculate the cash paid for income taxes.

d. Operating expenses total $100,000; Depreciation expense = $4,000; Prepaid expenses decreased by $13,000; Accrued liabilities increased by $6,000. Calculate cash payments for operating expenses.

b. Cost of goods sold = $650,000; inventory increased by $15,000; accounts payable increased by $28,000. Calculate cash payments for purchases.

c. The income statement shows $25,500 in income taxes. The statement of financial position shows a decrease in taxes payable of $2,500. Calculate the cash paid for income taxes.

d. Operating expenses total $100,000; Depreciation expense = $4,000; Prepaid expenses decreased by $13,000; Accrued liabilities increased by $6,000. Calculate cash payments for operating expenses.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

30

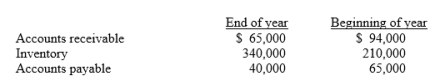

The general ledger of the Grey Limited provides the following information:

The company's net sales for the year was $2,000,000 and cost of sales sold amounted to $1,700,000.

The company's net sales for the year was $2,000,000 and cost of sales sold amounted to $1,700,000.

Required: Compute the following:

(a) Cash receipts from customers.

(b) Cash payments to suppliers.

The company's net sales for the year was $2,000,000 and cost of sales sold amounted to $1,700,000.

The company's net sales for the year was $2,000,000 and cost of sales sold amounted to $1,700,000.Required: Compute the following:

(a) Cash receipts from customers.

(b) Cash payments to suppliers.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

31

The income statement of Feather Ltd for the year ended 31 December 2020, reported the following condensed information:

The statement of financial position contained the following comparative data at December 31:

The statement of financial position contained the following comparative data at December 31:

There are no depreciable assets. Accounts payable pertains to operating expenses.

There are no depreciable assets. Accounts payable pertains to operating expenses.

Required: Prepare the operating activities section of the statement of cash flows using the direct method.

The statement of financial position contained the following comparative data at December 31:

The statement of financial position contained the following comparative data at December 31: There are no depreciable assets. Accounts payable pertains to operating expenses.

There are no depreciable assets. Accounts payable pertains to operating expenses.Required: Prepare the operating activities section of the statement of cash flows using the direct method.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

32

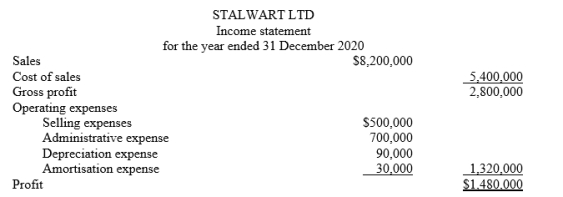

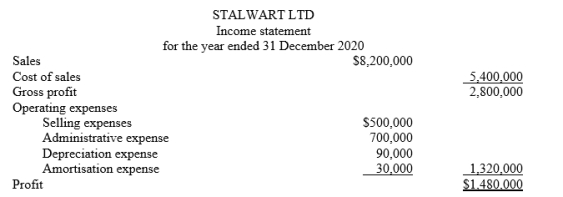

The income statement of Stalwart Ltd is shown below:

Additional information:

Additional information:

1. Accounts receivable increased $400,000 during the year.

2. Inventory increased $250,000 during the year.

3. Prepaid expenses increased $200,000 during the year.

4. Accounts payable to merchandise suppliers increased $100,000 during the year.

5. Accrued expenses payable increased $180,000 during the year.

Required: Prepare the operating activities section of the statement of cash flows for the year ended 31 December 2020, for Stalwart Ltd.

Additional information:

Additional information:1. Accounts receivable increased $400,000 during the year.

2. Inventory increased $250,000 during the year.

3. Prepaid expenses increased $200,000 during the year.

4. Accounts payable to merchandise suppliers increased $100,000 during the year.

5. Accrued expenses payable increased $180,000 during the year.

Required: Prepare the operating activities section of the statement of cash flows for the year ended 31 December 2020, for Stalwart Ltd.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

33

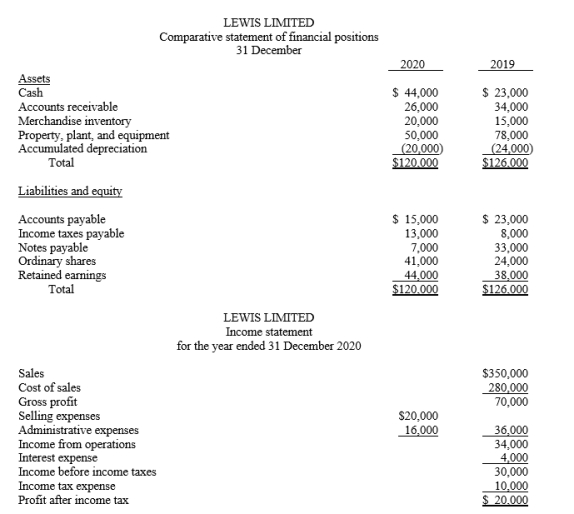

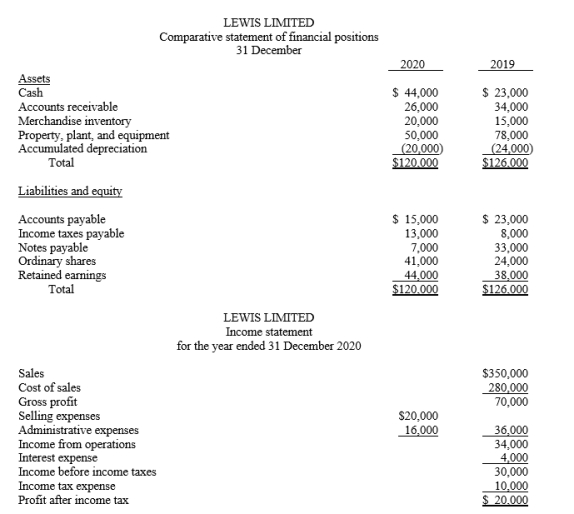

The financial statements of Lewis Limited appear below:

The following additional data were provided:

The following additional data were provided:

1. Dividends declared and paid were $14,000.

2. During the year equipment was sold for $12,000 cash. This equipment cost $28,000 originally and had a carrying amount of $12,000 at the time of sale.

3. All depreciation expense is in the selling expense category.

4. All sales and purchases are on account.

5. Accounts payable pertain to merchandise suppliers.

6. All operating expenses except for depreciation were paid in cash.

Required: Prepare a statement of cash flows for Lewis Limited using the direct method.

The following additional data were provided:

The following additional data were provided:1. Dividends declared and paid were $14,000.

2. During the year equipment was sold for $12,000 cash. This equipment cost $28,000 originally and had a carrying amount of $12,000 at the time of sale.

3. All depreciation expense is in the selling expense category.

4. All sales and purchases are on account.

5. Accounts payable pertain to merchandise suppliers.

6. All operating expenses except for depreciation were paid in cash.

Required: Prepare a statement of cash flows for Lewis Limited using the direct method.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

34

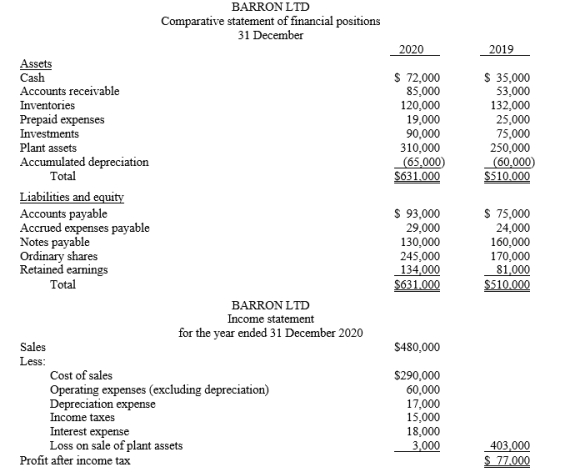

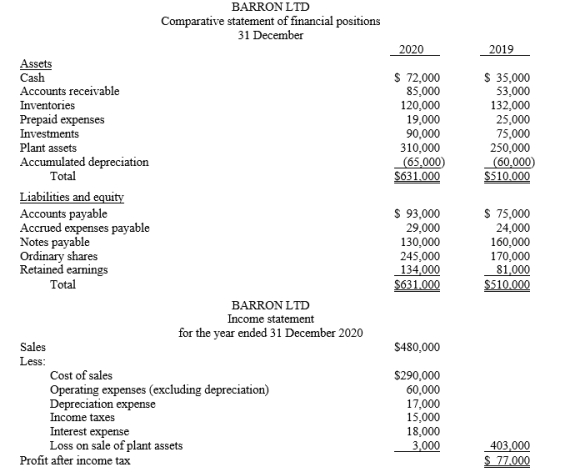

Condensed financial data of Barron Ltd appear below:

Additional information:

Additional information:

1. New plant assets costing $85,000 were purchased for cash in 2020.

2. Old plant assets costing $25,000 were sold for $10,000 cash when their carrying amount was $13,000.

3. Notes with a face value of $30,000 were converted into $30,000 of ordinary shares.

4. A cash dividend of $24,000 was declared and paid during the year.

5. Accounts payable pertain to merchandise purchases.

Required:

1. Prepare a statement of cash flows for the year.

2. Compute the following cash basis ratios:

a. Current cash debt coverage

b. Cash return on sales ratio

c. Cash debt coverage ratio

Additional information:

Additional information:1. New plant assets costing $85,000 were purchased for cash in 2020.

2. Old plant assets costing $25,000 were sold for $10,000 cash when their carrying amount was $13,000.

3. Notes with a face value of $30,000 were converted into $30,000 of ordinary shares.

4. A cash dividend of $24,000 was declared and paid during the year.

5. Accounts payable pertain to merchandise purchases.

Required:

1. Prepare a statement of cash flows for the year.

2. Compute the following cash basis ratios:

a. Current cash debt coverage

b. Cash return on sales ratio

c. Cash debt coverage ratio

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

35

Please complete the following statements:

-Non-cash expense in the income statement are ___________ to profit and non-cash income is ______________ to compute cash provided by operations.

-Non-cash expense in the income statement are ___________ to profit and non-cash income is ______________ to compute cash provided by operations.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

36

Please complete the following statements:

-Cost of sales for the year amounted to $100,000, and during the year, accounts payable ______________ by $3,000 and inventory decreased by $7,000 resulting in cash paid to suppliers of $90,000.

-Cost of sales for the year amounted to $100,000, and during the year, accounts payable ______________ by $3,000 and inventory decreased by $7,000 resulting in cash paid to suppliers of $90,000.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

37

Please complete the following statements:

-The cash ______________ ratio indicates the company's ability to turn sales into dollars.

-The cash ______________ ratio indicates the company's ability to turn sales into dollars.

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

38

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Decrease in accounts payable during a period.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Decrease in accounts payable during a period.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

39

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Declaration and payment of a cash dividend.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Declaration and payment of a cash dividend.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

40

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Decrease in accounts receivable during a period.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Decrease in accounts receivable during a period.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

41

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Depreciation expense.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Depreciation expense.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

42

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Conversion of notes payable into ordinary shares.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Conversion of notes payable into ordinary shares.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

43

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Decrease in merchandise inventory during a period.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Decrease in merchandise inventory during a period.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

44

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Sale of equipment for cash at book value.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Sale of equipment for cash at book value.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

45

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Issue of preferred shares for cash.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Issue of preferred shares for cash.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

46

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Purchase of land for cash.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Purchase of land for cash.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck

47

For each of the following items, indicate by choosing the appropriate code letter, how the item should be reported in the statement of cash flows using the direct method:

-Loss on sale of a plant asset.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

-Loss on sale of a plant asset.

A) Added in determining cash receipts from customers

B) Deducted in determining cash receipts from customers

C) Added in determining cash payments to suppliers

D) Deducted in determining cash payments to suppliers

E) Cash outflow - investing activity

F) Cash inflow - investing activity

G) Cash outflow - financing activity

H) Cash inflow - financing activity

I) Significant non-cash investing and financing activity

J) Is not shown

Unlock Deck

Unlock for access to all 47 flashcards in this deck.

Unlock Deck

k this deck