Deck 8: Reporting and Analysing Non-Current Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/131

Play

Full screen (f)

Deck 8: Reporting and Analysing Non-Current Assets

1

Which of the following is not a characteristic of a plant asset?

A) Plant assets are intangible.

B) Plant assets are used in the operations of a business.

C) Plant assets are expected to provide future economic benefits for a number of years.

D) Not currently used in the business but held for future use.

A) Plant assets are intangible.

B) Plant assets are used in the operations of a business.

C) Plant assets are expected to provide future economic benefits for a number of years.

D) Not currently used in the business but held for future use.

Plant assets are intangible.

2

Wisemans Winery purchases land for $200,000 cash. Wisemans Winery assumes $2,500 in rates and taxes due on the land. The title and legal fees totaled $2,750. Wisemans Winery has the land graded for $5,000 and fenced for $20,000. What amount does Wisemans Winery record as the cost for the land?

A) $200,000

B) $230,250

C) $210,250

D) $202,750

A) $200,000

B) $230,250

C) $210,250

D) $202,750

$210,250

3

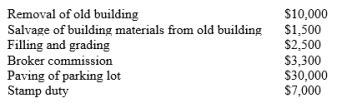

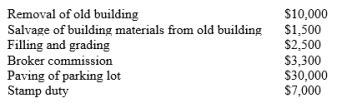

Endevour Enterprises acquires land for $250,000 cash. Additional costs are as follows:

Endevour Enterprises will record the acquisition cost of the land as:

Endevour Enterprises will record the acquisition cost of the land as:

A) $268,000

B) $250,000

C) $298,000

D) $269,500

Endevour Enterprises will record the acquisition cost of the land as:

Endevour Enterprises will record the acquisition cost of the land as:A) $268,000

B) $250,000

C) $298,000

D) $269,500

$268,000

4

Warners Warehouse installs a new parking lot. The paving cost $45,000 and the lights to illuminate the new parking area cost $15,000. Which of the following statements is true with respect to these additions?

A) $45,000 should be debited to the Land account.

B) $60,000 should be debited to Land improvements.

C) $60,000 should be debited to the Land account.

D) $15,000 should be debited to Land improvements.

A) $45,000 should be debited to the Land account.

B) $60,000 should be debited to Land improvements.

C) $60,000 should be debited to the Land account.

D) $15,000 should be debited to Land improvements.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

5

Trentham Transport purchases a new delivery truck for $80,000. The stamp and transfer duty is $3,000. The logo of the company is painted on the side of the truck for $500. The truck registration is $700 and a 12 month accident insurance policy is $1100. The truck undergoes safety testing for $330. What does Trentham Transport record as the cost of the new truck?

A) $85,630.

B) $83,830.

C) $80,000.

D) $83,000.

A) $85,630.

B) $83,830.

C) $80,000.

D) $83,000.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

6

All leases are classified as either:

A) capital leases or long-term leases.

B) capital leases or operating leases.

C) operating leases or finance leases.

D) long-term leases or current leases.

A) capital leases or long-term leases.

B) capital leases or operating leases.

C) operating leases or finance leases.

D) long-term leases or current leases.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements regarding accounting for the acquisition of property, plant and equipment is incorrect?

A) Asset acquisition costs that are not expensed immediately are referred to as capital expenditures.

B) Capital expenditures are expenditures that increase the company's investment in productive facilities.

C) When the construction of a building is complete, the cost of interest is recorded as interest expense.

D) When purchasing land, the cost for clearing, draining, filling and grading should be charged to a Land Improvements account.

A) Asset acquisition costs that are not expensed immediately are referred to as capital expenditures.

B) Capital expenditures are expenditures that increase the company's investment in productive facilities.

C) When the construction of a building is complete, the cost of interest is recorded as interest expense.

D) When purchasing land, the cost for clearing, draining, filling and grading should be charged to a Land Improvements account.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements regarding depreciation is true?

A) All property, plant and equipment assets must be depreciated.

B) Recording deprecation on plant assets affects the income statement only.

C) In calculating depreciation expense both the cost of the asset and its residual value are estimates.

D) Depreciable amount is the cost of the asset less its residual value.

A) All property, plant and equipment assets must be depreciated.

B) Recording deprecation on plant assets affects the income statement only.

C) In calculating depreciation expense both the cost of the asset and its residual value are estimates.

D) Depreciable amount is the cost of the asset less its residual value.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

9

Equipment was purchased for $45,000. Freight charges amounted to $500 and there was a cost of $2,500 for building a foundation and installing the equipment. It is estimated that the equipment will have a $8,000 residual value at the end of its 5-year useful life. Depreciation expense each year using the straight-line method will be:

A) $9,600.

B) $8,000.

C) $9,000.

D) $7,400.

A) $9,600.

B) $8,000.

C) $9,000.

D) $7,400.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

10

Equipment with a cost of $160,000 has an estimated residual value of $10,000 and an estimated life of 4 years or 12,000 hours. It is to be depreciated by the straight-line method. What is the amount of depreciation expense for the first full year, during which the equipment was used 3,300 hours?

A) $40,000.

B) $37,500.

C) $41,250.

D) $42,500.

A) $40,000.

B) $37,500.

C) $41,250.

D) $42,500.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

11

Equipment with a cost of $160,000 has an estimated residual value of $10,000 and an estimated life of 4 years or 12,000 hours. It is to be depreciated by the units-of-production method. What is the amount of depreciation expense for the first full year, during which the equipment was used 3,300 hours?

A) $40,000.

B) $41,250.

C) $42,500.

D) $37,500.

A) $40,000.

B) $41,250.

C) $42,500.

D) $37,500.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

12

Equipment with a cost of $160,000 has an estimated residual value of $10,000 and an estimated life of 4 years or 12,000 hours. It is to be depreciated by the diminishing value method with a constant depreciation rate of 37.5%. What is the amount of depreciation expense for the first full year, during which the equipment was used 3,300 hours?

A) $60,000.

B) $80,000.

C) $56,250.

D) $55,500.

A) $60,000.

B) $80,000.

C) $56,250.

D) $55,500.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

13

A company purchased factory equipment on April 1, 2019, for $48,000. It is estimated that the equipment will have a $6,000 residual value at the end of its 10-year useful life. Using the straight-line method of depreciation, the amount to be recorded as depreciation expense at 31 December, 2019, is:

A) $4,800.

B) $3,150.

C) $4,200.

D) $3,600.

A) $4,800.

B) $3,150.

C) $4,200.

D) $3,600.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

14

A plant asset was purchased on 1 January for $30,000 with an estimated residual value of $6,000 at the end of its useful life. The current year's depreciation expense is $3,000 calculated on the straight-line basis and the balance of the Accumulated depreciation account at the end of the year is $15,000. The remaining useful life of the plant asset is:

A) 10 years.

B) 8 years.

C) 5 years.

D) 3 years.

A) 10 years.

B) 8 years.

C) 5 years.

D) 3 years.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

15

Jeff's Copy Shop purchased equipment for $18,000 on 1 January, 2019. Jeff estimated the useful life to be 3 years with no residual value, and the straight-line method of depreciation will be used. On 1 January, 2020, Jeff decides that the business will use the equipment for a total of 5 more years. What is the revised depreciation expense for 2019?

A) $6,000.

B) $3,000.

C) $2,400.

D) $4,500.

A) $6,000.

B) $3,000.

C) $2,400.

D) $4,500.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

16

Vickers Company use the units-of-production method in computing depreciation expense. A new plant asset is purchased for $18,000 that will produce an estimated 100,000 units over its useful life. Estimated residual value at the end of its useful life is $2,000. What is the depreciation cost per unit?

A) $0.16.

B) $1.80.

C) $1.60.

D) $0.18.

A) $0.16.

B) $1.80.

C) $1.60.

D) $0.18.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

17

Additions and improvements:

A) occur frequently during the ownership of a plant asset.

B) should be capitalised and depreciated over the remaining useful life of the related PPE asset.

C) normally involve immaterial expenditures.

D) typically only benefit the current accounting period.

A) occur frequently during the ownership of a plant asset.

B) should be capitalised and depreciated over the remaining useful life of the related PPE asset.

C) normally involve immaterial expenditures.

D) typically only benefit the current accounting period.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

18

The first step in the revaluation of an asset is to:

A) transfer the balance of accumulated depreciation to the income statement.

B) record depreciation up to the date of the asset revaluation.

C) record the revaluation.

D) write-off the accumulated depreciation balance.

A) transfer the balance of accumulated depreciation to the income statement.

B) record depreciation up to the date of the asset revaluation.

C) record the revaluation.

D) write-off the accumulated depreciation balance.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

19

Value in use is the:

A) book value of net cash flows.

B) nominal value of net cash flows.

C) present value of net cash flows.

D) face value of net cash flows.

A) book value of net cash flows.

B) nominal value of net cash flows.

C) present value of net cash flows.

D) face value of net cash flows.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

20

Cole Company buys land for $50,000 on 31/12/19. As of 31/3/20, the land has appreciated in value to $50,500. On 31/12/20, the land has an appraised value of $51,800. By what amount must the Land account be increased in 2022?

A) $0.

B) $500.

C) $1,300.

D) $1,800.

A) $0.

B) $500.

C) $1,300.

D) $1,800.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

21

A truck costing $12,000 and on which $9,000 of accumulated depreciation has been recorded was discarded as having no value. The entry to record this event would include a:

A) gain of $3,000.

B) loss of $3,000.

C) credit to accumulated depreciation for $9,000.

D) credit to accumulated depreciation for $12,000.

A) gain of $3,000.

B) loss of $3,000.

C) credit to accumulated depreciation for $9,000.

D) credit to accumulated depreciation for $12,000.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

22

In a period subsequent to a revaluation increment, if the revaluation reverses, the original revaluation should be:

A) added to the revaluation reserve account.

B) added to the income statement.

C) offset against equity.

D) offset against the previous revaluation.

A) added to the revaluation reserve account.

B) added to the income statement.

C) offset against equity.

D) offset against the previous revaluation.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

23

A truck that cost $12,000 and on which $9,000 of accumulated depreciation has been recorded was disposed of for $2,000 cash. The entry to record this event would include a:

A) gain of $1,000.

B) loss of $1,000.

C) credit to Truck account for $3,000.

D) credit to Accumulated depreciation for $9,000.

A) gain of $1,000.

B) loss of $1,000.

C) credit to Truck account for $3,000.

D) credit to Accumulated depreciation for $9,000.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

24

A truck costing $35,000 was destroyed when its engine caught fire. At the date of the fire, the accumulated depreciation on the truck was $16,000. An insurance cheque for $40,000 was received based on the replacement cost of the truck. The entry to record the insurance proceeds and the disposition of the truck will include a:

A) gain on disposal of $5,000.

B) debit to the Truck account of $19,000.

C) credit to the Accumulated depreciation account for $16,000.

D) gain on disposal of $21,000.

A) gain on disposal of $5,000.

B) debit to the Truck account of $19,000.

C) credit to the Accumulated depreciation account for $16,000.

D) gain on disposal of $21,000.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

25

A plant asset with a cost of $30,000 and accumulated depreciation of $27,500 is sold for $3,500. What is the amount of the gain or loss on disposal of the plant asset?

A) $2,500 loss.

B) $1,000 loss.

C) $1,000 gain.

D) $2,500 gain.

A) $2,500 loss.

B) $1,000 loss.

C) $1,000 gain.

D) $2,500 gain.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

26

On July 1, 2019, Waters Kennels sells equipment for $22,000. The equipment originally cost $60,000, had an estimated 5-year life and an expected residual value of $10,000. The Accumulated depreciation account had a balance of $35,000 on 1 January, 2019, using the straight-line method. The gain or loss on disposal is:

A) $3,000 gain.

B) $2,000 loss.

C) $3,000 loss.

D) $2,000 gain.

A) $3,000 gain.

B) $2,000 loss.

C) $3,000 loss.

D) $2,000 gain.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

27

An asset register is:

A) an internal control procedure designed to manage and protect non-current assets.

B) a list of the market prices of an entity's assets.

C) a list of the maintenance conducted on current assets during the year.

D) a schedule of all intangible assets sold during the year.

A) an internal control procedure designed to manage and protect non-current assets.

B) a list of the market prices of an entity's assets.

C) a list of the maintenance conducted on current assets during the year.

D) a schedule of all intangible assets sold during the year.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

28

Typically the details contained in an asset register include all of the following except:

A) date of purchase.

B) details of registration.

C) depreciation method and rate.

D) current selling price.

A) date of purchase.

B) details of registration.

C) depreciation method and rate.

D) current selling price.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

29

On July 1, 2019, Marlin Company purchased the copyright to Bodine Educational Tutorials for $81,000. It is estimated that the copyright will have a useful life of 5 years with an estimated residual value of $6,000. The amount of Amortisation Expense recognised to 31 December 2019 would be:

A) $16,200.

B) $7,500.

C) $15,000.

D) $8,100.

A) $16,200.

B) $7,500.

C) $15,000.

D) $8,100.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

30

An IT company has $3,000,000 in research costs. Before accounting for these costs the profit of the company is $2,200,000. What is the amount of profit or loss after these research costs are accounted for?

A) $2,200,000 profit.

B) $800,000 loss.

C) $0.

D) Cannot be determined from the information provided.

A) $2,200,000 profit.

B) $800,000 loss.

C) $0.

D) Cannot be determined from the information provided.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

31

An agricultural activity is the management by an entity of the biological transformation of:

A) agricultural produce into biological assets.

B) biological assets into agricultural produce.

C) harvested produce into biological assets.

D) processed goods into harvested goods.

A) agricultural produce into biological assets.

B) biological assets into agricultural produce.

C) harvested produce into biological assets.

D) processed goods into harvested goods.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

32

Biological assets cannot be recognised unless the assets can be reliably measured and:

A) the products are the result of harvesting.

B) it is probable that the future economic benefits will eventuate

C) the asset can be sold into an active market.

D) the cost of the asset is zero.

A) the products are the result of harvesting.

B) it is probable that the future economic benefits will eventuate

C) the asset can be sold into an active market.

D) the cost of the asset is zero.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

33

Natural resources are regarded as a special type of asset because they:

A) are wasting assets.

B) are not regenerating.

C) have no market value.

D) are not living animals or plant.

A) are wasting assets.

B) are not regenerating.

C) have no market value.

D) are not living animals or plant.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

34

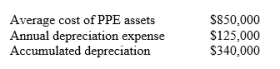

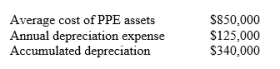

Waters Filtration Equipment has obtained the following data from its accounting records:

The average useful life of PPE assets is:

The average useful life of PPE assets is:

A) 2.5 years.

B) 2.72 years.

C) 6.8 years.

D) Cannot be determined from the data provided.

The average useful life of PPE assets is:

The average useful life of PPE assets is:A) 2.5 years.

B) 2.72 years.

C) 6.8 years.

D) Cannot be determined from the data provided.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

35

Plant assets are ordinarily presented in the statement of financial position:

A) at current market values.

B) at replacement costs.

C) at cost less accumulated depreciation.

D) in a separate section along with intangible assets.

A) at current market values.

B) at replacement costs.

C) at cost less accumulated depreciation.

D) in a separate section along with intangible assets.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

36

Delta Ltd purchased factory equipment with an invoice price of $50,000. Other costs incurred were freight costs, $1,300; installation wiring and foundation, $2,200; material and labour costs in testing equipment, $700; oil lubricants and supplies to be used with equipment, $500; fire insurance policy covering equipment, $1,400. The equipment is estimated to have a $5,000 residual value at the end of its 8-year useful life.

Required:

(a) Calculate the acquisition cost of the equipment. Clearly identify each element of cost.

(b) If the straight-line method of depreciation was used, the annual rate applied to the depreciable cost would be __________.

Required:

(a) Calculate the acquisition cost of the equipment. Clearly identify each element of cost.

(b) If the straight-line method of depreciation was used, the annual rate applied to the depreciable cost would be __________.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

37

Miller Ltd purchased land adjacent to its plant to improve access for trucks making deliveries. Expenditures incurred in purchasing the land were as follows: purchase price, $40,000; agent's fees, $7,000; title search and other fees, $6,000; demolition of an old building on the property, $3,700; grading, $1,200; digging foundation for the road, $3,000; laying and paving driveway, $25,000; lighting $7,500; signs, $1,500. List the items and amounts that should be included in the Land account.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

38

Indicate whether each of the following expenditures should be classified as:

-Parking lots

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Parking lots

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

39

Indicate whether each of the following expenditures should be classified as:

-Electricity used by a machine

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Electricity used by a machine

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

40

Indicate whether each of the following expenditures should be classified as:

-Sewage system cost

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Sewage system cost

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

41

Indicate whether each of the following expenditures should be classified as:

-Interest on building construction loan

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Interest on building construction loan

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

42

Indicate whether each of the following expenditures should be classified as:

-Cost of trial runs for machinery

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Cost of trial runs for machinery

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

43

Indicate whether each of the following expenditures should be classified as:

-Drainage costs

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Drainage costs

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

44

Indicate whether each of the following expenditures should be classified as:

-Cost to install a machine

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Cost to install a machine

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

45

Indicate whether each of the following expenditures should be classified as:

-Fences

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Fences

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

46

Indicate whether each of the following expenditures should be classified as:

-Unpaid (past) rates and taxes assumed

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Unpaid (past) rates and taxes assumed

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

47

Indicate whether each of the following expenditures should be classified as:

-Cost of tearing down a building when land and a building on it are purchased

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

-Cost of tearing down a building when land and a building on it are purchased

A) land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X).

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

48

For each entry below make a correcting entry if necessary.

(a) The $50 cost of repairing a printer was charged to Computer equipment.

(b) The $5,500 cost of a major engine overhaul was debited to Repair expense. The overhaul is expected to increase the operating efficiency of the truck.

(c) $6,000 of stamp duty costs associated with the acquisition of land were debited to Legal expense.

(d) A $400 charge for transportation expenses on new equipment purchased was debited to Freight-in.

(a) The $50 cost of repairing a printer was charged to Computer equipment.

(b) The $5,500 cost of a major engine overhaul was debited to Repair expense. The overhaul is expected to increase the operating efficiency of the truck.

(c) $6,000 of stamp duty costs associated with the acquisition of land were debited to Legal expense.

(d) A $400 charge for transportation expenses on new equipment purchased was debited to Freight-in.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

49

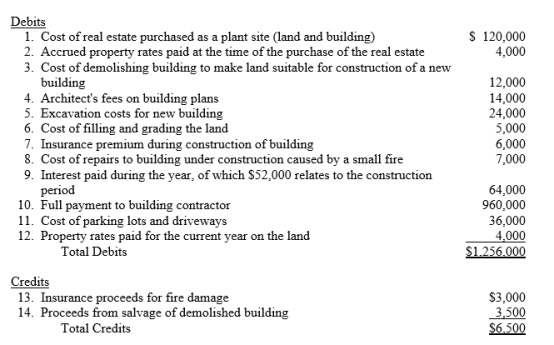

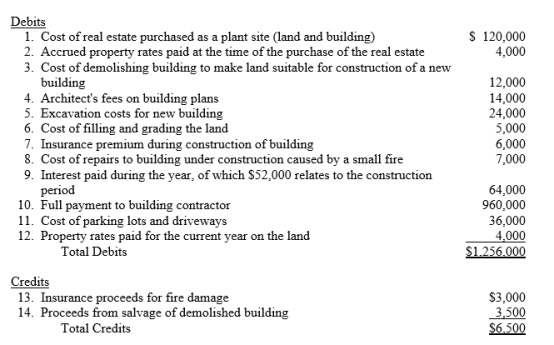

Americanos Ltd was incorporated on 1 January. During the first year of operations, the following expenditures and receipts were recorded in random order in the Land account.

Required: Analyse the foregoing transactions using the following tabular arrangement. Insert the number of each transaction in the Item space and insert the amounts in the appropriate columns.

Required: Analyse the foregoing transactions using the following tabular arrangement. Insert the number of each transaction in the Item space and insert the amounts in the appropriate columns.

Required: Analyse the foregoing transactions using the following tabular arrangement. Insert the number of each transaction in the Item space and insert the amounts in the appropriate columns.

Required: Analyse the foregoing transactions using the following tabular arrangement. Insert the number of each transaction in the Item space and insert the amounts in the appropriate columns.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

50

Radiata Ltd purchased equipment on 1 January, 2016, at a cost of $60,000. The equipment was originally estimated to have a salvage value of $5,000 and an estimated life of 10 years. Depreciation has been recorded through 31 December, 2019, using the straight-line method. On 1 January, 2020, the estimated residual value was revised to $6,000 and the useful life was revised to a total of 8 years.

Determine Radiata Ltd's Depreciation Expense for 2020.

Determine Radiata Ltd's Depreciation Expense for 2020.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

51

Kauri Ltd purchased equipment on 1 January, 2018, at a cost of $75,000. The equipment was originally estimated to have a residual value of $5,000 and an estimated life of 10 years. Depreciation has been recorded through 31 December, 2020, using the straight-line method. On 1 January, 2021, the estimated salvage value was revised to $6,000 and the useful life was revised to a further 8 years.

Instructions: Determine the depreciation expense for 2021

Instructions: Determine the depreciation expense for 2021

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

52

Indicate whether each of the following expenditures should be classified as:

-Computer installation cost

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Computer installation cost

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

53

Indicate whether each of the following expenditures should be classified as:

-Driveway cost

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Driveway cost

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

54

Indicate whether each of the following expenditures should be classified as:

-Architect's fee

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Architect's fee

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

55

Indicate whether each of the following expenditures should be classified as:

-Surveying costs

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Surveying costs

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

56

Indicate whether each of the following expenditures should be classified as:

-Grading costs

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Grading costs

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

57

Indicate whether each of the following expenditures should be classified as:

-Cost of lighting for parking lot

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Cost of lighting for parking lot

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

58

Indicate whether each of the following expenditures should be classified as:

-Insurance and freight on equipment purchased

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Insurance and freight on equipment purchased

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

59

Indicate whether each of the following expenditures should be classified as:

-Material and labour costs incurred to construct factory

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Material and labour costs incurred to construct factory

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

60

Indicate whether each of the following expenditures should be classified as:

-Cost of tearing down a warehouse on land just purchased

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Cost of tearing down a warehouse on land just purchased

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

61

Indicate whether each of the following expenditures should be classified as:

-Electricity cost during first year

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

-Electricity cost during first year

A)land (L)

B) land improvements (LI)

C) buildings (B)

D) equipment (E)

E) none of these (X)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

62

Matai Ltd purchased a machine on 1 January, 2018. In addition to the purchase price paid, the following additional costs were incurred:

(a) sales tax paid on the purchase price

(b) transportation and insurance costs while the machinery was in transit from the seller

(c) personnel training costs for initial operation of the machinery

(d) installation costs necessary to secure the machinery to the building flooring

(e) major overhaul to extend the life of the machinery

(f) lubrication of the machinery gearing before the machinery was placed into service

(g) lubrication of the machinery gearing after the machinery was placed into service

(h) annual operating license fee.

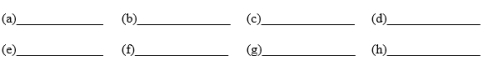

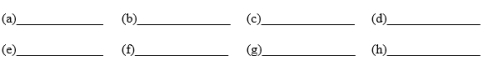

Indicate whether the items (a) through (h) are capital or revenue expenditures in the spaces provided: C = capital, R = revenue.

(a) sales tax paid on the purchase price

(b) transportation and insurance costs while the machinery was in transit from the seller

(c) personnel training costs for initial operation of the machinery

(d) installation costs necessary to secure the machinery to the building flooring

(e) major overhaul to extend the life of the machinery

(f) lubrication of the machinery gearing before the machinery was placed into service

(g) lubrication of the machinery gearing after the machinery was placed into service

(h) annual operating license fee.

Indicate whether the items (a) through (h) are capital or revenue expenditures in the spaces provided: C = capital, R = revenue.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

63

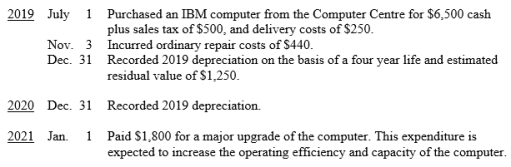

Nelson Word Processing Service Ltd uses the straight-line method of depreciation. The company's financial year end is 31 December. The following transactions and events occurred during the first three years.

Prepare the necessary entries. (Show computations.)

Prepare the necessary entries. (Show computations.)

Prepare the necessary entries. (Show computations.)

Prepare the necessary entries. (Show computations.)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

64

Identify the following expenditures :

-Replacement of worn out gears on factory machinery.

A) capital expenditures

B) revenue expenditures.

-Replacement of worn out gears on factory machinery.

A) capital expenditures

B) revenue expenditures.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

65

Identify the following expenditures :

-Painting the exterior of a building.

A) capital expenditures

B) revenue expenditures.

-Painting the exterior of a building.

A) capital expenditures

B) revenue expenditures.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

66

Identify the following expenditures :

-Oil change on a company truck.

A) capital expenditures

B) revenue expenditures.

-Oil change on a company truck.

A) capital expenditures

B) revenue expenditures.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

67

Identify the following expenditures :

-Replacing a Pentium chip with a core 2 Duo chip, which increases productive capacity. No extension of useful life expected.

A) capital expenditures

B) revenue expenditures.

-Replacing a Pentium chip with a core 2 Duo chip, which increases productive capacity. No extension of useful life expected.

A) capital expenditures

B) revenue expenditures.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

68

Identify the following expenditures :

-Overhaul of a truck motor. One-year extension in useful life is expected.

A) capital expenditures

B) revenue expenditures.

-Overhaul of a truck motor. One-year extension in useful life is expected.

A) capital expenditures

B) revenue expenditures.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

69

Identify the following expenditures :

-Purchased a wastebasket at a cost of $10.

A) capital expenditures

B) revenue expenditures.

-Purchased a wastebasket at a cost of $10.

A) capital expenditures

B) revenue expenditures.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

70

Identify the following expenditures :

-Painting and lettering of a used truck upon acquisition of the truck.

A) capital expenditures

B) revenue expenditures.

-Painting and lettering of a used truck upon acquisition of the truck.

A) capital expenditures

B) revenue expenditures.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

71

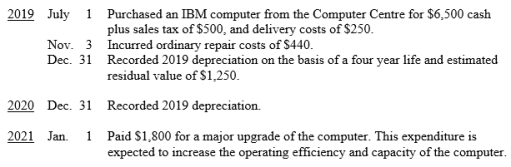

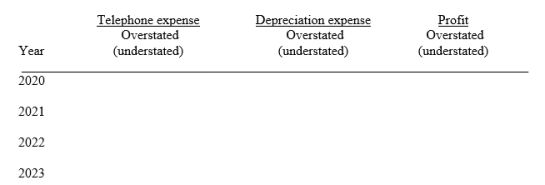

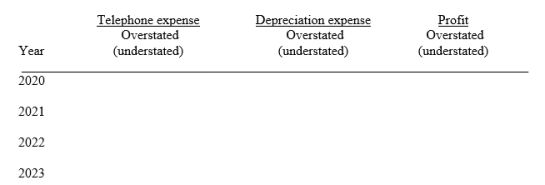

On 1 January, 2019, Rata Ltd purchased and installed a telephone system at a cost of $20,000. The equipment was expected to last five years with a salvage value of $3,000. On 1 January, 2020, more telephone equipment was purchased to tie-in with the current system for $8,000. The new equipment is expected to have a useful life of four years. Through an error, the new equipment was debited to Telephone expense. Rata Ltd uses the straight-line method of depreciation.

Prepare a schedule showing the effects of the error on Telephone expense, depreciation expense, and Net profit for each year and in total beginning in 2019 through the useful life of the new equipment.

Prepare a schedule showing the effects of the error on Telephone expense, depreciation expense, and Net profit for each year and in total beginning in 2019 through the useful life of the new equipment.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

72

(a) Barnes Ltd purchased equipment on 1 January, 2013 for $80,000 and estimated an $8,000 salvage value at the end of the equipment's 10-year useful life. At 31 December, 2019, there was $50,400 in the Accumulated depreciation account for this equipment using the straight-line method of depreciation. On March 31, 2020, the equipment was sold for $21,000.

Prepare the appropriate journal entries to remove the equipment from the books of Barnes Ltd on March 31, 2020.

(b) Lanne Manufacturing sold a delivery truck for $11,000. The delivery truck originally cost $25,000 in 2005 and $6,000 was spent on a major overhaul in 2010 (charged to Delivery Truck account). Accumulated depreciation on the delivery truck to the date of disposal was $20,000.

Prepare the appropriate journal entry to record the disposition of the delivery truck.

(c) Crown Travel Ltd sold office equipment that had a carrying amount of $4,500 for $6,000. The office equipment originally cost $15,000 and it is estimated that it would cost $19,000 to replace the office equipment.

Prepare the appropriate journal entry to record the disposition of the office equipment.

Prepare the appropriate journal entries to remove the equipment from the books of Barnes Ltd on March 31, 2020.

(b) Lanne Manufacturing sold a delivery truck for $11,000. The delivery truck originally cost $25,000 in 2005 and $6,000 was spent on a major overhaul in 2010 (charged to Delivery Truck account). Accumulated depreciation on the delivery truck to the date of disposal was $20,000.

Prepare the appropriate journal entry to record the disposition of the delivery truck.

(c) Crown Travel Ltd sold office equipment that had a carrying amount of $4,500 for $6,000. The office equipment originally cost $15,000 and it is estimated that it would cost $19,000 to replace the office equipment.

Prepare the appropriate journal entry to record the disposition of the office equipment.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

73

Prepare the journal entries to record the following transactions for the Nobles Company, which has a financial year end of 31 December and uses the straight-line method of depreciation.

(a) On 30 September, 2019, the company sold old delivery equipment for $9,000. The delivery equipment was purchased on 1 January, 2017, for $21,000 and was estimated to have a $3,000 residual value at the end of its 5-year life. Depreciation on the delivery equipment has been recorded through 31 December, 2018.

(b) On 30 June, 2019, the company sold old office equipment for $18,000. The office equipment originally cost $24,000 and had accumulated depreciation to the date of disposal of $10,000.

(a) On 30 September, 2019, the company sold old delivery equipment for $9,000. The delivery equipment was purchased on 1 January, 2017, for $21,000 and was estimated to have a $3,000 residual value at the end of its 5-year life. Depreciation on the delivery equipment has been recorded through 31 December, 2018.

(b) On 30 June, 2019, the company sold old office equipment for $18,000. The office equipment originally cost $24,000 and had accumulated depreciation to the date of disposal of $10,000.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

74

a. A machine that cost $18,000 and on which $13,000 of depreciation had been recorded was disposed of for $5,200. Indicate whether a gain or loss should be recorded, and for what amount.

b. Assume that the machine in part A above was instead discarded. Indicate whether a gain or loss should be recorded, and for what amount.

c. Assume that the machine in part A above was instead sold for $4,800. Indicate whether a gain or loss should be recorded, and for what amount.

b. Assume that the machine in part A above was instead discarded. Indicate whether a gain or loss should be recorded, and for what amount.

c. Assume that the machine in part A above was instead sold for $4,800. Indicate whether a gain or loss should be recorded, and for what amount.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

75

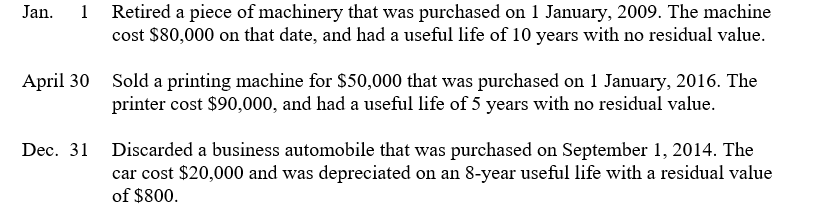

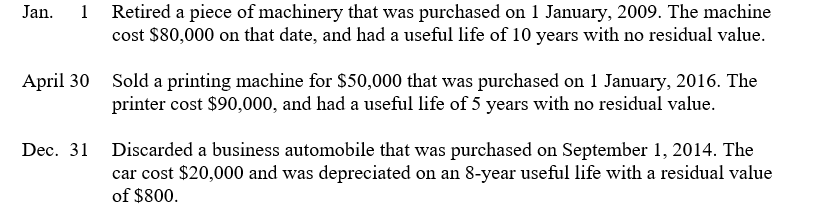

Presented below are selected transactions for Ronnen Products Ltd for 2019.

Journalise all entries required as a result of the above transactions. Ronnen Products Ltd uses the straight-line method of depreciation and has recorded depreciation through 31 December, 2019.

Journalise all entries required as a result of the above transactions. Ronnen Products Ltd uses the straight-line method of depreciation and has recorded depreciation through 31 December, 2019.

Journalise all entries required as a result of the above transactions. Ronnen Products Ltd uses the straight-line method of depreciation and has recorded depreciation through 31 December, 2019.

Journalise all entries required as a result of the above transactions. Ronnen Products Ltd uses the straight-line method of depreciation and has recorded depreciation through 31 December, 2019.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

76

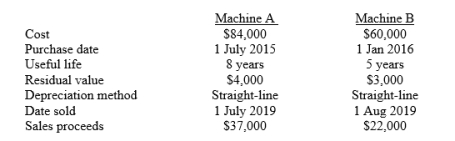

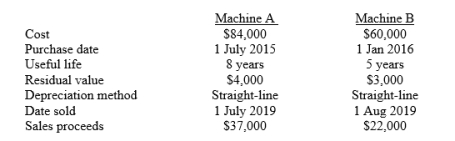

Winningham Ltd sold the following two machines in 2019:

Journalise all entries required to update depreciation and record the sales of the two assets in 2019. The company has recorded depreciation on the machine through 31 December, 2018.

Journalise all entries required to update depreciation and record the sales of the two assets in 2019. The company has recorded depreciation on the machine through 31 December, 2018.

Journalise all entries required to update depreciation and record the sales of the two assets in 2019. The company has recorded depreciation on the machine through 31 December, 2018.

Journalise all entries required to update depreciation and record the sales of the two assets in 2019. The company has recorded depreciation on the machine through 31 December, 2018.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

77

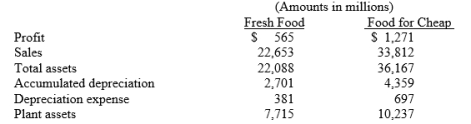

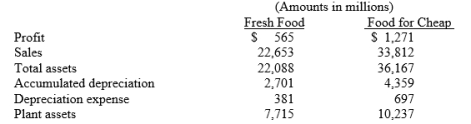

The following information is available from the 2019 annual reports of Fresh Food and Food for Cheap:

Required:

Required:

(a) Based on the preceding information, calculate the following values for each company:

1. average useful life of plant assets

2. average age of plant assets

3. asset turnover.

(b) What conclusion concerning the management of plant assets can be drawn from these data?

Required:

Required:(a) Based on the preceding information, calculate the following values for each company:

1. average useful life of plant assets

2. average age of plant assets

3. asset turnover.

(b) What conclusion concerning the management of plant assets can be drawn from these data?

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

78

(a) A company purchased a patent on 1 January, 2019, for $2,500,000. The patent's legal life is 20 years but the company estimates that the patent's useful life will only be 5 years from the date of acquisition. On 30 June, 2019, the company paid legal costs of $162,000 in successfully defending the patent in an infringement suit. Prepare the journal entry to amortise the patent at year end on 31 December, 2019.

(b) The Walker Company purchased a franchise from the Tasty Food Company for $400,000 on 1 January, 2019. The franchise is for an indefinite time period and gives the Walker Company the exclusive rights to sell Tasty Wings in a particular territory. Prepare the journal entry to record the acquisition of the franchise and any necessary adjusting entry at year end on 31 December, 2019. The franchise is expected to have value for a period of 20 years.

(c) Dawson Company incurred research and development costs of $500,000 in 2019 in developing a new product.

Prepare the necessary journal entries during 2019 to record these events and any adjustments at year end on 31 December, 2019.

(b) The Walker Company purchased a franchise from the Tasty Food Company for $400,000 on 1 January, 2019. The franchise is for an indefinite time period and gives the Walker Company the exclusive rights to sell Tasty Wings in a particular territory. Prepare the journal entry to record the acquisition of the franchise and any necessary adjusting entry at year end on 31 December, 2019. The franchise is expected to have value for a period of 20 years.

(c) Dawson Company incurred research and development costs of $500,000 in 2019 in developing a new product.

Prepare the necessary journal entries during 2019 to record these events and any adjustments at year end on 31 December, 2019.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

79

A patent that was acquired for $800,000 at the beginning of the current year expires in 20 years and is expected to have value for 4 years. Present the adjusting entry to amortise the patent for the current year.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

80

For each item listed, choose a code letter to indicate the allocation terminology for the item. Use the following codes for your answer:

-Goodwill

A) Amortisation (A)

B) Depreciation (D)

C) None of these (N)

-Goodwill

A) Amortisation (A)

B) Depreciation (D)

C) None of these (N)

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck