Deck 5: Reporting and Analysing Inventory

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/45

Play

Full screen (f)

Deck 5: Reporting and Analysing Inventory

1

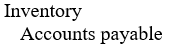

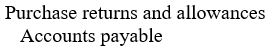

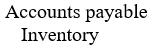

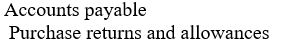

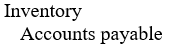

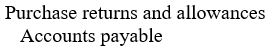

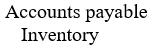

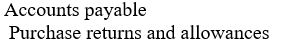

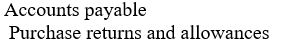

The journal entry to record a return of inventory purchased on account under a periodic inventory system would be:

A)

B)

C)

D)

A)

B)

C)

D)

2

Which of the following statements about a periodic inventory system is true?

A) Under the periodic inventory system purchases of inventory are typically credited to the Purchases account.

B) Available discounts taken by the customer for early payment of an invoice are termed discount received by the seller.

C) Freight-in is an account that is subtracted from the Purchases account to arrive at the net cost of goods purchased.

D) Under the periodic inventory system, allowances granted by the supplier to the merchandiser are credited to the Purchases returns and allowances account.

A) Under the periodic inventory system purchases of inventory are typically credited to the Purchases account.

B) Available discounts taken by the customer for early payment of an invoice are termed discount received by the seller.

C) Freight-in is an account that is subtracted from the Purchases account to arrive at the net cost of goods purchased.

D) Under the periodic inventory system, allowances granted by the supplier to the merchandiser are credited to the Purchases returns and allowances account.

Under the periodic inventory system, allowances granted by the supplier to the merchandiser are credited to the Purchases returns and allowances account.

3

Under a periodic inventory system inventory losses are included as a part of:

A) cost of sales.

B) purchase allowances.

C) purchase returns.

D) purchase costs.

A) cost of sales.

B) purchase allowances.

C) purchase returns.

D) purchase costs.

cost of sales.

4

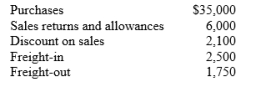

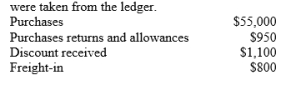

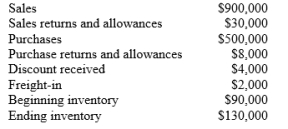

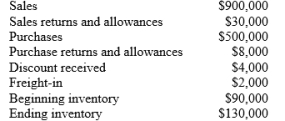

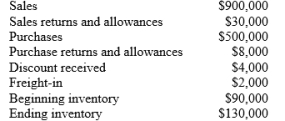

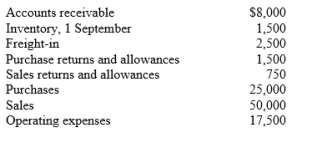

Greenfields Ltd has the following account balances. The net cost of goods purchased for the period is:

A) $37,500.

B) $41,000.

C) $36.750.

D) $39,250.

A) $37,500.

B) $41,000.

C) $36.750.

D) $39,250.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

5

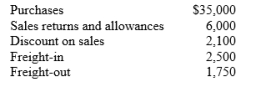

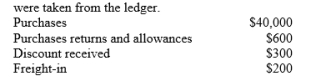

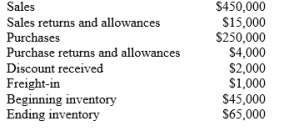

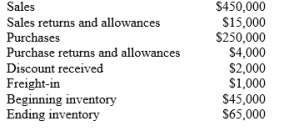

Assuming the periodic inventory method is used for the current period, the following data

Beginning inventory was $12,000 and ending inventory was $15,000. What was cost of goods purchased?

Beginning inventory was $12,000 and ending inventory was $15,000. What was cost of goods purchased?

A) $55,000.

B) $54,050.

C) $54,850.

D) $52,950.

Beginning inventory was $12,000 and ending inventory was $15,000. What was cost of goods purchased?

Beginning inventory was $12,000 and ending inventory was $15,000. What was cost of goods purchased?A) $55,000.

B) $54,050.

C) $54,850.

D) $52,950.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

6

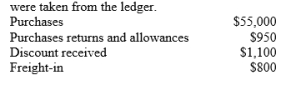

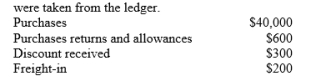

Assuming the periodic inventory method is used for the current period, the following data

Beginning inventory was $8,000 and ending inventory was $13,000. What was cost of sales?

Beginning inventory was $8,000 and ending inventory was $13,000. What was cost of sales?

A) $39,600.

B) $39,300.

C) $47,300.

D) $34,600.

Beginning inventory was $8,000 and ending inventory was $13,000. What was cost of sales?

Beginning inventory was $8,000 and ending inventory was $13,000. What was cost of sales?A) $39,600.

B) $39,300.

C) $47,300.

D) $34,600.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

7

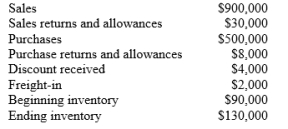

Assuming the periodic inventory method is used for the current year, the following data were taken from the accounting records:

What was the cost of goods available for sale?

What was the cost of goods available for sale?

A) $620,000.

B) $530,000.

C) $580,000.

D) $584,000.

What was the cost of goods available for sale?

What was the cost of goods available for sale?A) $620,000.

B) $530,000.

C) $580,000.

D) $584,000.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

8

Assuming the periodic inventory method is used for the current year, the following data were taken from the accounting records:

What was the amount for net purchases?

What was the amount for net purchases?

A) $245,000.

B) $246,000.

C) $435,000.

D) $292,000.

What was the amount for net purchases?

What was the amount for net purchases?A) $245,000.

B) $246,000.

C) $435,000.

D) $292,000.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

9

Assuming the periodic inventory method is used for the current year, the following data were taken from the accounting records:

Net sales are?

Net sales are?

A) $858,000.

B) $862,000.

C) $900,000.

D) $870,000.

Net sales are?

Net sales are?A) $858,000.

B) $862,000.

C) $900,000.

D) $870,000.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

10

A company just starting in business purchased three inventory items at the following prices: first purchase $110; second purchase $115; third purchase $120. If the company sold two units for a total of $300 and used FIFO costing, the gross profit for the period would be:

A) $65.

B) $60.

C) $75.

D) $70.

A) $65.

B) $60.

C) $75.

D) $70.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

11

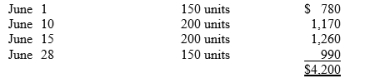

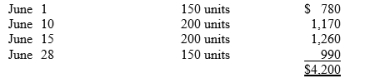

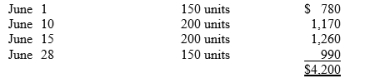

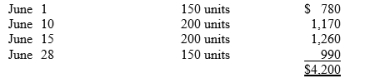

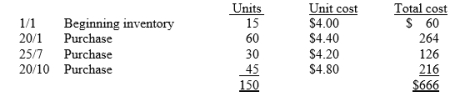

A company just starting business made the following four inventory purchases in June:

A physical count of inventory on June 30 reveals that there are 250 units on hand.

A physical count of inventory on June 30 reveals that there are 250 units on hand.

-Using the LIFO inventory method, the value of the ending inventory on June 30 is:

A) $2,835.

B) $1,620.

C) $2,580.

D) $1,365.

A physical count of inventory on June 30 reveals that there are 250 units on hand.

A physical count of inventory on June 30 reveals that there are 250 units on hand.-Using the LIFO inventory method, the value of the ending inventory on June 30 is:

A) $2,835.

B) $1,620.

C) $2,580.

D) $1,365.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

12

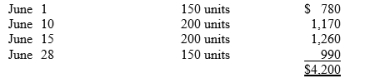

A company just starting business made the following four inventory purchases in June:

A physical count of inventory on June 30 reveals that there are 250 units on hand.

A physical count of inventory on June 30 reveals that there are 250 units on hand.

-Using the FIFO inventory method, the amount allocated to cost of sales for June is:

A) $1,620.

B) $2,290.

C) $2,580.

D) $2,835.

A physical count of inventory on June 30 reveals that there are 250 units on hand.

A physical count of inventory on June 30 reveals that there are 250 units on hand.-Using the FIFO inventory method, the amount allocated to cost of sales for June is:

A) $1,620.

B) $2,290.

C) $2,580.

D) $2,835.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

13

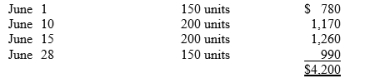

A company just starting business made the following four inventory purchases in June:

A physical count of inventory on June 30 reveals that there are 250 units on hand.

A physical count of inventory on June 30 reveals that there are 250 units on hand.

-Using the average cost method, the amount allocated to the ending inventory on June 30 is:

A) $4,200.

B) $2,700.

C) $1,150.

D) $1,500.

A physical count of inventory on June 30 reveals that there are 250 units on hand.

A physical count of inventory on June 30 reveals that there are 250 units on hand.-Using the average cost method, the amount allocated to the ending inventory on June 30 is:

A) $4,200.

B) $2,700.

C) $1,150.

D) $1,500.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

14

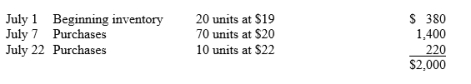

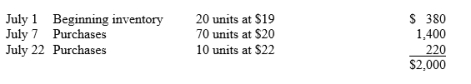

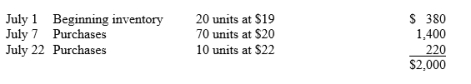

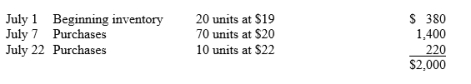

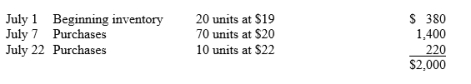

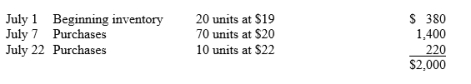

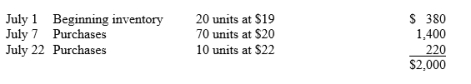

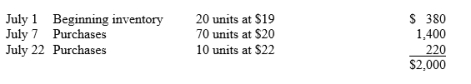

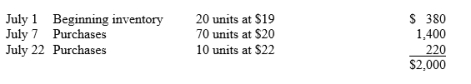

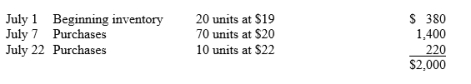

Use the following inventory information for the month of July to answer questions :

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

-Using the average cost method, the value of ending inventory is:

A) $700.

B) $711.67.

C) $1,300.

D) $1,321.67.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.-Using the average cost method, the value of ending inventory is:

A) $700.

B) $711.67.

C) $1,300.

D) $1,321.67.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following inventory information for the month of July to answer questions :

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

-Using the FIFO inventory method, the amount allocated to cost of sales for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.-Using the FIFO inventory method, the amount allocated to cost of sales for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following inventory information for the month of July to answer questions :

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

-Using the FIFO inventory method, the amount allocated to ending inventory for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.-Using the FIFO inventory method, the amount allocated to ending inventory for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following inventory information for the month of July to answer questions :

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

-Using the LIFO inventory method, the amount allocated to cost of sales for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.-Using the LIFO inventory method, the amount allocated to cost of sales for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

18

Use the following inventory information for the month of July to answer questions :

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

-Using the LIFO inventory method, the amount allocated to ending inventory for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

A physical count of inventory on July 30 reveals that there are 35 units on hand.

A physical count of inventory on July 30 reveals that there are 35 units on hand.-Using the LIFO inventory method, the amount allocated to ending inventory for July is:

A) $680.

B) $720.

C) $1,280.

D) $1,320.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

19

The main basis for recording and reporting inventory is:

A) cost.

B) gross selling price.

C) book value.

D) current replacement cost.

A) cost.

B) gross selling price.

C) book value.

D) current replacement cost.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

20

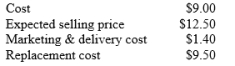

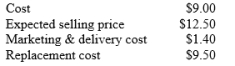

The following information relates to product J:

The net realisable value (NRV) of product J is

The net realisable value (NRV) of product J is

A) $11.10.

B) $12.50.

C) $9.50.

D) $13.90.

The net realisable value (NRV) of product J is

The net realisable value (NRV) of product J isA) $11.10.

B) $12.50.

C) $9.50.

D) $13.90.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is the same as 'net realisable value' of inventory?

A) Gross selling price.

B) Proceeds of sale less all further marketing, selling and distribution costs.

C) Average cost.

D) Replacement price.

A) Gross selling price.

B) Proceeds of sale less all further marketing, selling and distribution costs.

C) Average cost.

D) Replacement price.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

22

A high inventory turnover indicates:

A) a high level of funds tied up in inventory.

B) a low level of funds tied up in inventory.

C) inventory consists of mostly high value products.

D) inventory consists of mostly low value products.

A) a high level of funds tied up in inventory.

B) a low level of funds tied up in inventory.

C) inventory consists of mostly high value products.

D) inventory consists of mostly low value products.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

23

When using the LIFO method under a perpetual inventory system, the latest units purchased before a sale are allocated to:

A) cost of sales.

B) beginning inventory.

C) ending inventory.

D) average inventory.

A) cost of sales.

B) beginning inventory.

C) ending inventory.

D) average inventory.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

24

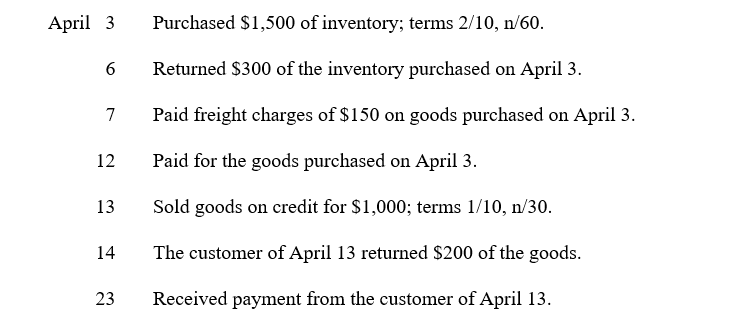

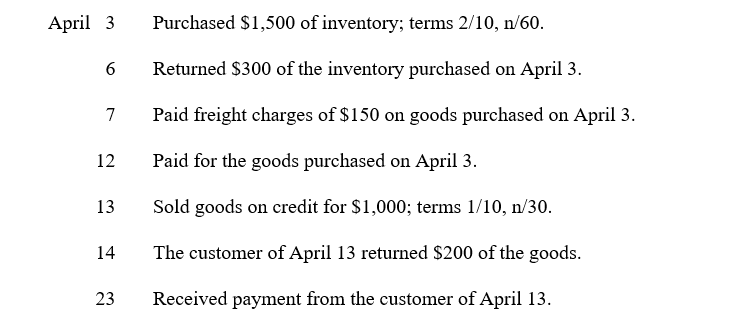

Lakeland Ltd uses a periodic inventory system. During April, the following transactions and events occurred:

Prepare the journal entries to record the transactions.

Prepare the journal entries to record the transactions.

Prepare the journal entries to record the transactions.

Prepare the journal entries to record the transactions.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

25

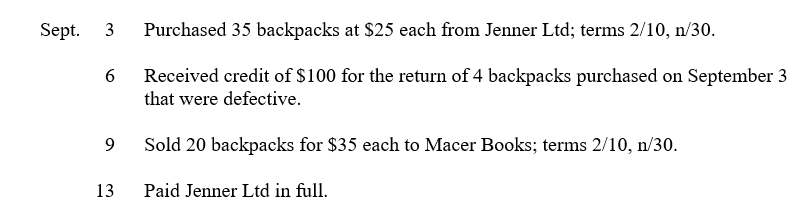

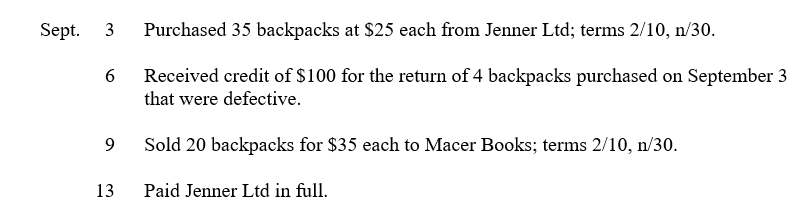

Continental Wholesale Ltd uses a periodic inventory system. During September, the following transactions and events occurred:

Journalise the September transactions for Continental Wholesale Ltd.

Journalise the September transactions for Continental Wholesale Ltd.

Journalise the September transactions for Continental Wholesale Ltd.

Journalise the September transactions for Continental Wholesale Ltd.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

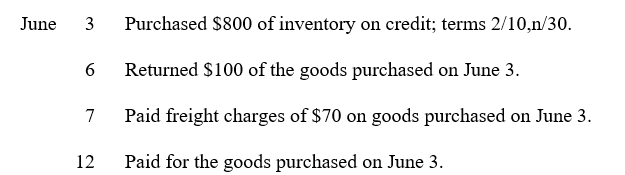

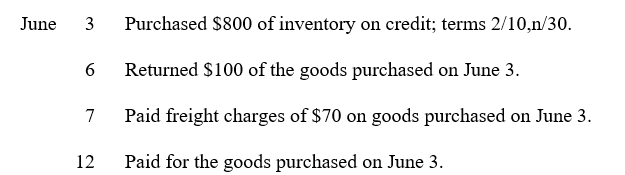

26

The Calendar Company Ltd entered into the following transactions during the month of June:

Prepare the journal entries to record the transactions assuming they use a periodic inventory system.

Prepare the journal entries to record the transactions assuming they use a periodic inventory system.

Prepare the journal entries to record the transactions assuming they use a periodic inventory system.

Prepare the journal entries to record the transactions assuming they use a periodic inventory system.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

27

Castle Packaging Ltd has just completed a physical inventory count at year-end (31 December). All items on the shelves, in storage and in the receiving area were counted and costed on the FIFO basis. The inventory amounted to $95,000. During the audit of the inventory count, the independent auditor discovered the following additional information:

(a) There were goods in transit on 31 December from a supplier with terms FOB destination, costing $10,000. Because the goods had not arrived, they were excluded from the physical inventory count.

(b) On 27 December, a regular customer purchased goods for cash amounting to $1,000 and left them for pickup on 4 January. Kemp Ltd had paid $500 for the goods and, because they were on hand, included them in the physical inventory count.

(c) Kemp Ltd, on the date of the inventory count, received notice from a supplier that goods ordered earlier at a cost of $4,000, had been delivered to the transportation company on 28 December. The terms were FOB shipping point. Because the shipment had not arrived on 31 December, it was excluded from the physical inventory.

(d) On 31 December there were goods in transit to customers, with terms FOB shipping point, amounting to $800 (expected delivery on January 8). Because the goods had been shipped, they were excluded from the physical inventory count.

(e) On 31 December, Kemp Ltd shipped $2,500 worth of goods to a customer, FOB destination. The goods arrived to the customer on 5 January. Because the goods were not on hand, they were not included in the physical inventory count.

(f) Kemp Ltd, as the consignee, had goods on consignment that cost $3,000. Because these goods were on hand as of 31 December they were included in the physical inventory count.

Analyse the above information and calculate a corrected amount for the ending inventory. Explain the basis for your treatment of each item.

(a) There were goods in transit on 31 December from a supplier with terms FOB destination, costing $10,000. Because the goods had not arrived, they were excluded from the physical inventory count.

(b) On 27 December, a regular customer purchased goods for cash amounting to $1,000 and left them for pickup on 4 January. Kemp Ltd had paid $500 for the goods and, because they were on hand, included them in the physical inventory count.

(c) Kemp Ltd, on the date of the inventory count, received notice from a supplier that goods ordered earlier at a cost of $4,000, had been delivered to the transportation company on 28 December. The terms were FOB shipping point. Because the shipment had not arrived on 31 December, it was excluded from the physical inventory.

(d) On 31 December there were goods in transit to customers, with terms FOB shipping point, amounting to $800 (expected delivery on January 8). Because the goods had been shipped, they were excluded from the physical inventory count.

(e) On 31 December, Kemp Ltd shipped $2,500 worth of goods to a customer, FOB destination. The goods arrived to the customer on 5 January. Because the goods were not on hand, they were not included in the physical inventory count.

(f) Kemp Ltd, as the consignee, had goods on consignment that cost $3,000. Because these goods were on hand as of 31 December they were included in the physical inventory count.

Analyse the above information and calculate a corrected amount for the ending inventory. Explain the basis for your treatment of each item.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

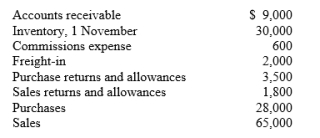

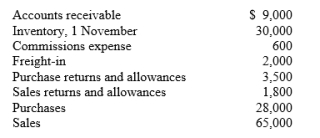

28

Harley Clothing Store employs the periodic inventory system and prepares monthly financial statements. All accounts have been adjusted except for inventory. A physical count of inventory on 30 November indicates that $22,000 was on hand. A partial listing of account balances follows:

Prepare a partial income for the Hanley Clothing Store for the month ended 30 November. The income statement should show all items through to gross profit.

Prepare a partial income for the Hanley Clothing Store for the month ended 30 November. The income statement should show all items through to gross profit.

Prepare a partial income for the Hanley Clothing Store for the month ended 30 November. The income statement should show all items through to gross profit.

Prepare a partial income for the Hanley Clothing Store for the month ended 30 November. The income statement should show all items through to gross profit.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

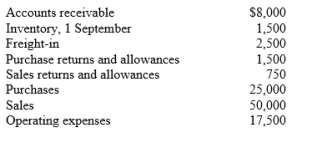

29

Barbara's Book Store employs the periodic inventory system and prepares monthly financial statements. All accounts have been adjusted except for inventory. A physical count of inventory on 30 September indicates that $2,000 was on hand. A partial listing of account balances follows:

Instructions: Prepare an income statement for Barbara's Book Store for the month ended 30 September.

Instructions: Prepare an income statement for Barbara's Book Store for the month ended 30 September.

Instructions: Prepare an income statement for Barbara's Book Store for the month ended 30 September.

Instructions: Prepare an income statement for Barbara's Book Store for the month ended 30 September.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

30

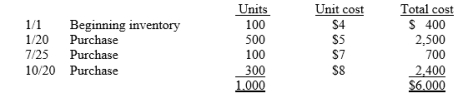

McGuire Metals Ltd uses the periodic inventory method and had the following inventory information available:

A physical count of inventory on 31 December revealed that there were 350 units on hand.

A physical count of inventory on 31 December revealed that there were 350 units on hand.

Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at 31 December is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on 31 December is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on 31 December is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

A physical count of inventory on 31 December revealed that there were 350 units on hand.

A physical count of inventory on 31 December revealed that there were 350 units on hand.Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at 31 December is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on 31 December is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on 31 December is $__________.

4. Determine the difference in the amount of income that the company would have reported if it had used the FIFO method instead of the LIFO method. Would income have been greater or less?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

31

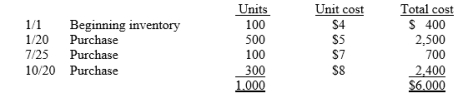

Harlow Ltd uses the periodic inventory method and had the following inventory information available:

A physical count of inventory on 31 December revealed that there were 50 units on hand.

A physical count of inventory on 31 December revealed that there were 50 units on hand.

Instructions : Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at 31 December is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on 31 December is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on 31 December is $__________.

4. Assume that the company uses the FIFO method. The value of the cost of sales at 31 December is $__________.

A physical count of inventory on 31 December revealed that there were 50 units on hand.

A physical count of inventory on 31 December revealed that there were 50 units on hand.Instructions : Answer the following independent questions and show computations supporting your answers.

1. Assume that the company uses the FIFO method. The value of the ending inventory at 31 December is $__________.

2. Assume that the company uses the average cost method. The value of the ending inventory on 31 December is $__________.

3. Assume that the company uses the LIFO method. The value of the ending inventory on 31 December is $__________.

4. Assume that the company uses the FIFO method. The value of the cost of sales at 31 December is $__________.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

32

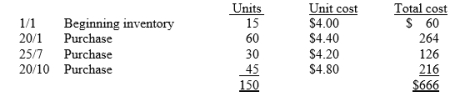

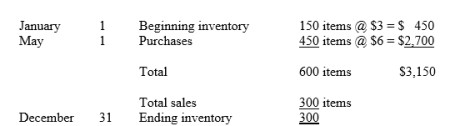

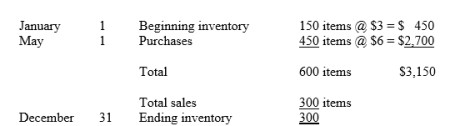

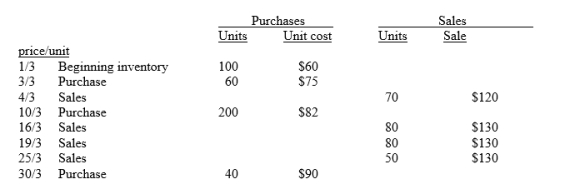

The following information is gathered in relation to sales and purchases of inventory during a year.

Calculate the cost to be assigned to ending inventory for each of the methods indicated below given the information about purchases and sales during the year.

Calculate the cost to be assigned to ending inventory for each of the methods indicated below given the information about purchases and sales during the year.

(a) Cost assigned on an average basis to ending inventory: $__________

(b) Cost assigned on a FIFO basis: $__________

(c) Costs assigned on a LIFO basis: $__________

Calculate the cost to be assigned to ending inventory for each of the methods indicated below given the information about purchases and sales during the year.

Calculate the cost to be assigned to ending inventory for each of the methods indicated below given the information about purchases and sales during the year.(a) Cost assigned on an average basis to ending inventory: $__________

(b) Cost assigned on a FIFO basis: $__________

(c) Costs assigned on a LIFO basis: $__________

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

33

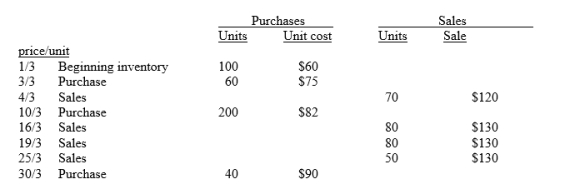

Delta Ltd sells many products. Alpha is one of its popular items. Below is an analysis of the inventory purchases and sales of alpha for the month of March. Delta Ltd uses the periodic inventory system.

(a) Using the FIFO assumption, calculate the amount charged to cost of sales for March. (Show computations.)

(a) Using the FIFO assumption, calculate the amount charged to cost of sales for March. (Show computations.)

(b) Using the average method, calculate the amount assigned to the inventory on hand on 31 March. (Show computations.)

(c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on 31 March. (Show computations.)

(a) Using the FIFO assumption, calculate the amount charged to cost of sales for March. (Show computations.)

(a) Using the FIFO assumption, calculate the amount charged to cost of sales for March. (Show computations.)(b) Using the average method, calculate the amount assigned to the inventory on hand on 31 March. (Show computations.)

(c) Using the LIFO assumption, calculate the amount assigned to the inventory on hand on 31 March. (Show computations.)

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

34

The following information is available for Barnes Ltd for the year. Barnes Ltd uses the LIFO inventory method.

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

35

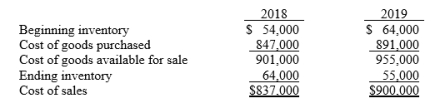

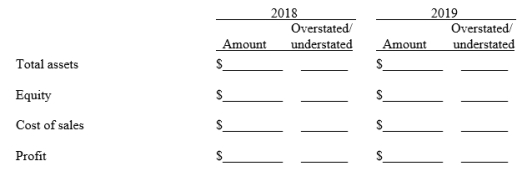

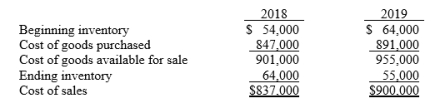

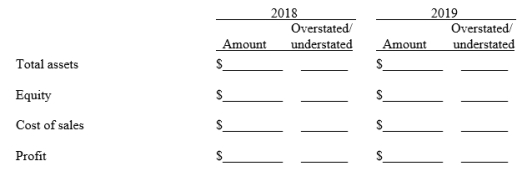

Bell's Pharmacy reported cost of sales as follows:

Bell's made two errors:

(1) 2018 ending inventory was overstated by $3,000.

(1) 2018 ending inventory was overstated by $3,000.

(2) 2019 ending inventory was understated by $9,000.

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

Bell's made two errors:

(1) 2018 ending inventory was overstated by $3,000.

(1) 2018 ending inventory was overstated by $3,000.(2) 2019 ending inventory was understated by $9,000.

Assuming the errors had not been corrected, indicate the dollar effect that the errors had on the items appearing on the financial statements listed below. Also indicate if the amounts are overstated (O) or understated (U).

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

36

Match the items below by choosing the appropriate code letter :

-Tracks the actual physical flow for each inventory item available for sale.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Tracks the actual physical flow for each inventory item available for sale.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

37

Match the items below by choosing the appropriate code letter :

-Goods that are only partially completed in a manufacturing company.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Goods that are only partially completed in a manufacturing company.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

38

Match the items below by choosing the appropriate code letter :

-Cost of sales consists of the most recent inventory purchases.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Cost of sales consists of the most recent inventory purchases.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

39

Match the items below by choosing the appropriate code letter :

-Goods ready for sale to customers by retailers and wholesalers.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Goods ready for sale to customers by retailers and wholesalers.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

40

Match the items below by choosing the appropriate code letter :

-Title to the goods transfers when the public carrier accepts the goods from the seller.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Title to the goods transfers when the public carrier accepts the goods from the seller.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

41

Match the items below by choosing the appropriate code letter :

-Ending inventory valuation consists of the most recent inventory purchases.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Ending inventory valuation consists of the most recent inventory purchases.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

42

Match the items below by choosing the appropriate code letter :

-The same unit cost is used to value ending inventory and cost of sales.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-The same unit cost is used to value ending inventory and cost of sales.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

43

Match the items below by choosing the appropriate code letter :

-Title to goods transfers when the goods are delivered to the buyer.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Title to goods transfers when the goods are delivered to the buyer.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

44

Match the items below by choosing the appropriate code letter :

-Measures the number of times inventory was sold during the period.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

-Measures the number of times inventory was sold during the period.

A) Inventory

B) Work in process

C) FOB shipping point

D) FOB destination

E) Specific identification method

F) First-in, first-out (FIFO) method

G) Last-in, first-out (LIFO) method

H) Average cost method

I) Inventory turnover

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck

45

Ethics: Lucia Kraus and Trent Lee are department managers in the housewares and shoe departments, respectively, for Hillards, a large department store. Trent has observed Lucia taking inventory from her own department home, apparently without paying for it. He hesitates confronting Lucia because he is due to be promoted, and needs Lucia's recommendation. He also does not want to notify the company management directly, because he doesn't want an ethics investigation on his record, believing that it will give him a 'goody-goody' image. This week, Lucia tried on several pairs of expensive running shoes in his department before finding a pair that suited her. She did not, however, buy them. That very pair was missing this morning.

Hillards recently replaced its old periodic inventory system with a perpetual inventory system using scanners and bar codes. In addition, the annual inventory is to be replaced by a monthly inventory conducted by an independent firm. On hearing the news of the changes, Trent relaxes. 'The system will catch Lucia now,' he says to himself.

Required:

1. Is Trent's attitude justified? Why or why not?

2. What, if any, action should Trent take now?

Hillards recently replaced its old periodic inventory system with a perpetual inventory system using scanners and bar codes. In addition, the annual inventory is to be replaced by a monthly inventory conducted by an independent firm. On hearing the news of the changes, Trent relaxes. 'The system will catch Lucia now,' he says to himself.

Required:

1. Is Trent's attitude justified? Why or why not?

2. What, if any, action should Trent take now?

Unlock Deck

Unlock for access to all 45 flashcards in this deck.

Unlock Deck

k this deck