Deck 4: Exchange Rate Determination

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 4: Exchange Rate Determination

1

An exchange rate is said to follow a random walk when:

A) it wanders randomly across time

B) appreciation is followed by depreciation and vice versa

C) the period-to-period changes in the exchange rate are random and unpredictable

D) it responds in a random and unpredictable manner to changes in economic fundamentals

A) it wanders randomly across time

B) appreciation is followed by depreciation and vice versa

C) the period-to-period changes in the exchange rate are random and unpredictable

D) it responds in a random and unpredictable manner to changes in economic fundamentals

the period-to-period changes in the exchange rate are random and unpredictable

2

A rise in the domestic inflation rate and a simultaneous fall in the foreign inflation rate lead to:

A) depreciation of the foreign currency

B) depreciation of the domestic currency

C) no change in the exchange rate

D) the effect cannot be determined without knowing the exact changes in inflation rates

A) depreciation of the foreign currency

B) depreciation of the domestic currency

C) no change in the exchange rate

D) the effect cannot be determined without knowing the exact changes in inflation rates

depreciation of the domestic currency

3

Some countries have high interest rates and depreciating currencies because:

A) they are politically unstable

B) their central banks do not intervene in the foreign exchange market to support the currency

C) their inflation rates are high, making the real interest rates low

D) they do not have developed financial systems

A) they are politically unstable

B) their central banks do not intervene in the foreign exchange market to support the currency

C) their inflation rates are high, making the real interest rates low

D) they do not have developed financial systems

their inflation rates are high, making the real interest rates low

4

A rise in the domestic and foreign growth rates leads to:

A) depreciation of the foreign currency

B) depreciation of the domestic currency

C) no change in the domestic currency

D) the effect cannot be determined without knowing the exact growth rates

A) depreciation of the foreign currency

B) depreciation of the domestic currency

C) no change in the domestic currency

D) the effect cannot be determined without knowing the exact growth rates

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

The government can affect the exchange rate by:

A) selecting the exchange rate regime

B) intervening in the foreign exchange market by buying and selling currencies

C) affecting, via monetary policy, the variables that determine the exchange rate

D) all of the given answers

A) selecting the exchange rate regime

B) intervening in the foreign exchange market by buying and selling currencies

C) affecting, via monetary policy, the variables that determine the exchange rate

D) all of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

Central banks intervene in the foreign exchange market to:

A) curb speculation against the domestic currency

B) smooth out excessive fluctuations in exchange rates

C) prevent arbitrageurs from earning risk-free profit

D) provide an environment which is conducive to hedging foreign exchange risk

A) curb speculation against the domestic currency

B) smooth out excessive fluctuations in exchange rates

C) prevent arbitrageurs from earning risk-free profit

D) provide an environment which is conducive to hedging foreign exchange risk

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is NOT an argument for central bank intervention?

A) Exchange rates are highly volatile.

B) Exchange rate fluctuations have an adverse effect on the macroeconomy.

C) The market knows better than economic policy makers the appropriate level of the exchange rate.

D) Central bank intervention can smooth out fluctuations in exchange rates.

A) Exchange rates are highly volatile.

B) Exchange rate fluctuations have an adverse effect on the macroeconomy.

C) The market knows better than economic policy makers the appropriate level of the exchange rate.

D) Central bank intervention can smooth out fluctuations in exchange rates.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is NOT conducive to the success of central bank intervention?

A) The objective is to reverse an established market trend.

B) Intervention is concerted and coordinated.

C) Intervention is publicised after it has taken place.

D) Intervention is not announced before it has taken place.

A) The objective is to reverse an established market trend.

B) Intervention is concerted and coordinated.

C) Intervention is publicised after it has taken place.

D) Intervention is not announced before it has taken place.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

Expectations affect the exchange rate because:

A) arbitrageurs buy and sell currencies on the basis of expectations

B) speculators buy and sell currencies on the basis of expectations

C) all financial decisions are based on expectations

D) the central bank intervenes in the foreign exchange market when the domestic currency is expected to depreciate

A) arbitrageurs buy and sell currencies on the basis of expectations

B) speculators buy and sell currencies on the basis of expectations

C) all financial decisions are based on expectations

D) the central bank intervenes in the foreign exchange market when the domestic currency is expected to depreciate

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

A speculative attack on a currency is triggered when:

A) the domestic inflation rate is higher than that of other trading partners

B) the central bank loses control over the domestic money supply

C) the currency is overvalued relative to what is warranted by the economic fundamentals

D) one big speculator starts the attack and small speculators follow

A) the domestic inflation rate is higher than that of other trading partners

B) the central bank loses control over the domestic money supply

C) the currency is overvalued relative to what is warranted by the economic fundamentals

D) one big speculator starts the attack and small speculators follow

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

'News' as used in the exchange rate literature refers to:

A) political news which speculators follow

B) unanticipated changes in the variables that affect the exchange rate

C) economic news which market participants follow

D) rumours and gossip

A) political news which speculators follow

B) unanticipated changes in the variables that affect the exchange rate

C) economic news which market participants follow

D) rumours and gossip

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

Stabilising speculation occurs when speculators:

A) buy high and sell low

B) buy low and keep the currency for a long period of time

C) base their decisions on fundamental, rather than technical, analysis

D) buy low and sell high

A) buy high and sell low

B) buy low and keep the currency for a long period of time

C) base their decisions on fundamental, rather than technical, analysis

D) buy low and sell high

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

Destabilising speculation occurs when speculators:

A) buy high and sell low

B) buy low and sell high

C) do not keep their positions for long enough

D) base their decisions on technical, rather than fundamental, analysis

A) buy high and sell low

B) buy low and sell high

C) do not keep their positions for long enough

D) base their decisions on technical, rather than fundamental, analysis

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

If the foreign currency equivalent of the domestic price of a commodity is less than the foreign price of the same commodity, then the derivation of PPP implies that:

A) the foreign currency is overvalued

B) the foreign currency is undervalued

C) the domestic currency is overvalued

D) none of the given answers

A) the foreign currency is overvalued

B) the foreign currency is undervalued

C) the domestic currency is overvalued

D) none of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

If the domestic currency price of a commodity is greater than the domestic currency equivalent of the foreign price of the same commodity, then the derivation of PPP implies that:

A) the foreign price must rise

B) the exchange rate must rise

C) the foreign price must rise and/or the exchange rate must rise

D) the foreign currency must depreciate

A) the foreign price must rise

B) the exchange rate must rise

C) the foreign price must rise and/or the exchange rate must rise

D) the foreign currency must depreciate

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

The price of a commodity in the US is USD2.54, while the price of the same commodity in Australia is AUD3.00 and the AUD/USD exchange rate is 1.8769. What is the Australian dollar price of the commodity compatible with the derivation of PPP?

A) AUD2.54

B) AUD3.00

C) AUD4.77

D) AUD1.60

A) AUD2.54

B) AUD3.00

C) AUD4.77

D) AUD1.60

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

The price of a commodity in the US is USD2.54, while the price of the same commodity in Australia is AUD3.00 and the AUD/USD exchange rate is 1.8769.

What is the AUD/USD exchange rate compatible with the derivation of PPP?

A) USD/AUD 0.8467

B) AUD/USD 1.8769

C) AUD/USD 0.8467

D) AUD/USD 1.1811

What is the AUD/USD exchange rate compatible with the derivation of PPP?

A) USD/AUD 0.8467

B) AUD/USD 1.8769

C) AUD/USD 0.8467

D) AUD/USD 1.1811

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following assumptions is NOT compatible with PPP in its strict form?

A) The absence of restrictions on the movement of commodities

B) Zero transportation costs

C) Zero tariffs

D) Traders are risk averse

A) The absence of restrictions on the movement of commodities

B) Zero transportation costs

C) Zero tariffs

D) Traders are risk averse

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

At the beginning of 2002 the AUD/USD exchange rate was 1.9585 and the forecast inflation rates for 2002 were 4.00% for Australia and 2.50% for the US.

What is the AUD/USD exchange rate forecast to be at the end of 2002, according to PPP theory?

A) USD/AUD 1.9872

B) AUD/USD 1.9872

C) AUD/USD 1.9303

D) none of the given answers

What is the AUD/USD exchange rate forecast to be at the end of 2002, according to PPP theory?

A) USD/AUD 1.9872

B) AUD/USD 1.9872

C) AUD/USD 1.9303

D) none of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

At the beginning of 2002 the AUD/USD exchange rate was 1.9585 and the forecast inflation rates for 2002 were 3.00% for Australia and 4.00% for the US.

What is the AUD/USD exchange rate forecast to be at the end of 2002, according to PPP theory?

A) USD/AUD 1.9397

B) AUD/USD 1.9775

C) AUD/USD 1.9397

D) none of the given answers

What is the AUD/USD exchange rate forecast to be at the end of 2002, according to PPP theory?

A) USD/AUD 1.9397

B) AUD/USD 1.9775

C) AUD/USD 1.9397

D) none of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

At the beginning of 2002 the AUD/USD exchange rate was 1.9585 and the forecast inflation rates for 2002 were 4.00% for Australia and 2.50% for the US.

What is the USD/AUD exchange rate forecast to be at the end of 2002, according to PPP theory?

A) USD/AUD 0.5032

B) USD/AUD 1.9872

C) USD/AUD 0.5029

D) none of the given answers

What is the USD/AUD exchange rate forecast to be at the end of 2002, according to PPP theory?

A) USD/AUD 0.5032

B) USD/AUD 1.9872

C) USD/AUD 0.5029

D) none of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

At the beginning of 2002 the AUD/USD exchange rate was 1.9585 and the 2002 inflation rates were 3.10% for Australia and 2.33% for the US.

What should the AUD/USD exchange rate have been at the end of 2002, according to PPP theory?

A) USD/AUD 0.5068

B) AUD/USD 1.9439

C) AUD/USD 1.9732

D) none of the given answers

What should the AUD/USD exchange rate have been at the end of 2002, according to PPP theory?

A) USD/AUD 0.5068

B) AUD/USD 1.9439

C) AUD/USD 1.9732

D) none of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

At the beginning of 2002 the AUD/USD exchange rate was 1.9585 and the 2002 inflation rates were 3.10% for Australia and 2.33% for the US.

What should the USD/AUD exchange rate have been at the end of 2002, according to PPP theory?

A) AUD/USD 0.5068

B) AUD/USD 1.9439

C) USD/AUD 0.5068

D) None of the given answers

What should the USD/AUD exchange rate have been at the end of 2002, according to PPP theory?

A) AUD/USD 0.5068

B) AUD/USD 1.9439

C) USD/AUD 0.5068

D) None of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

If PPP holds precisely, then the real exchange rate will be:

A) stationary

B) volatile

C) mean reverting

D) constant

A) stationary

B) volatile

C) mean reverting

D) constant

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following may be taken in support of the PPP hypothesis?

A) The real and nominal exchange rates are highly correlated

B) The real exchange rate is stationary

C) The real exchange rate follows a random walk

D) The real exchange rate does not have the tendency for mean reversion

A) The real and nominal exchange rates are highly correlated

B) The real exchange rate is stationary

C) The real exchange rate follows a random walk

D) The real exchange rate does not have the tendency for mean reversion

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following conditions is the LEAST likely to produce support for PPP?

A) the flexible exchange rates of the 1920s

B) a long period of 100 years

C) high and hyperinflation

D) the post-Bretton Woods exchange rate arrangements

A) the flexible exchange rates of the 1920s

B) a long period of 100 years

C) high and hyperinflation

D) the post-Bretton Woods exchange rate arrangements

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

Assuming the exchange rate is measured in direct quotation and that a PPP trading rule is adopted, if the actual exchange rate is higher than the PPP rate, then:

A) the foreign currency should be bought

B) the foreign currency should be sold

C) the foreign currency should be sold short

D) the foreign currency should be sold and/or the foreign currency should be sold short

A) the foreign currency should be bought

B) the foreign currency should be sold

C) the foreign currency should be sold short

D) the foreign currency should be sold and/or the foreign currency should be sold short

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Assuming the exchange rate is measured in direct quotation and that a PPP trading rule is adopted, if the actual exchange rate is lower than the PPP rate, then:

A) the foreign currency should be bought

B) the foreign currency should be sold

C) the foreign currency should be sold short

D) the foreign currency should be sold and/or the foreign currency should be sold short

A) the foreign currency should be bought

B) the foreign currency should be sold

C) the foreign currency should be sold short

D) the foreign currency should be sold and/or the foreign currency should be sold short

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

At the beginning of 2003 the AUD/USD exchange rate was 1.7662. At the same time, the forecast change in the AUD/USD in 2003 was 2.00% and the forecast inflation rate for the US in 2003 was 1.50%. What should be the forecast inflation rate for Australia in 2003, according to PPP theory?

A) 3.53%

B) 0.50%

C) -0.50%

D) -3.50%

A) 3.53%

B) 0.50%

C) -0.50%

D) -3.50%

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

According to the monetary model of exchange rates, a fall in national real income will lead to:

A) a depreciation of the domestic currency

B) an appreciation of the domestic currency

C) a depreciation of the foreign currency

D) no change in the value of the domestic currency

A) a depreciation of the domestic currency

B) an appreciation of the domestic currency

C) a depreciation of the foreign currency

D) no change in the value of the domestic currency

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is consistent with the monetary model of exchange rate determination?

A) A monetary expansion leads to a proportional depreciation of the domestic currency

B) A rise in income levels leads to an appreciation of the domestic currency

C) A rise in foreign price levels leads to an appreciation of the domestic currency

D) All of the given answers

A) A monetary expansion leads to a proportional depreciation of the domestic currency

B) A rise in income levels leads to an appreciation of the domestic currency

C) A rise in foreign price levels leads to an appreciation of the domestic currency

D) All of the given answers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

The bid exchange rate is determined by:

A) the demand by customers and the supply by market makers

B) the supply by customers and the demand by market makers

C) the demand by customers and the demand by market makers

D) the supply by customers and the supply by market makers

A) the demand by customers and the supply by market makers

B) the supply by customers and the demand by market makers

C) the demand by customers and the demand by market makers

D) the supply by customers and the supply by market makers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

The offer exchange rate is determined by:

A) the demand by customers and the supply by market makers

B) the supply by customers and the demand by market makers

C) the demand by customers and the demand by market makers

D) the supply by customers and the supply by market makers

A) the demand by customers and the supply by market makers

B) the supply by customers and the demand by market makers

C) the demand by customers and the demand by market makers

D) the supply by customers and the supply by market makers

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

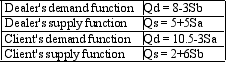

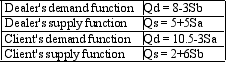

Calculate the bid offer spread. You are given the following demand and supply functions:

A) 2.08%

B) 208 pips

C) 3.1%

D) 20.8 points

A) 2.08%

B) 208 pips

C) 3.1%

D) 20.8 points

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

The presence of the bid-offer spread in foreign exchange transactions:

A) reduces the profitability of speculation, because speculators buy at the offer rate and sell at the bid rate

B) raises the profitability of speculation, because speculators buy at the bid rate and sell at the offer rate

C) does not affect the profitability of speculation, since speculators face a zero bid-offer spread

D) raises the profitability of speculation, because speculators buy at the offer rate and sell at the bid rate

A) reduces the profitability of speculation, because speculators buy at the offer rate and sell at the bid rate

B) raises the profitability of speculation, because speculators buy at the bid rate and sell at the offer rate

C) does not affect the profitability of speculation, since speculators face a zero bid-offer spread

D) raises the profitability of speculation, because speculators buy at the offer rate and sell at the bid rate

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following was NOT a reason for the depreciation of the Australian dollar between 1997 and 2002?

A) the Asian currency crisis of 1997/98

B) the Russian crisis of 1998

C) the introduction of the euro

D) the appreciation of the US dollar

A) the Asian currency crisis of 1997/98

B) the Russian crisis of 1998

C) the introduction of the euro

D) the appreciation of the US dollar

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following was NOT a reason for the depreciation of the Australian dollar between March

A) the Treasurer's remark about the 'banana republic' in May 1986

B) the feeling that the Australian dollar was undervalued in early 1984

C) weak commodity prices

D) uncertainty about inflation

A) the Treasurer's remark about the 'banana republic' in May 1986

B) the feeling that the Australian dollar was undervalued in early 1984

C) weak commodity prices

D) uncertainty about inflation

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following was NOT a reason for the appreciation of the Australian dollar between July

A) a higher interest differential in favour of the Australian dollar

B) rising commodity prices

C) improving terms of trade

D) declining inflation rate

A) a higher interest differential in favour of the Australian dollar

B) rising commodity prices

C) improving terms of trade

D) declining inflation rate

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is NOT a reason why the RBA intervenes in the foreign exchange market?

A) to prevent exchange rate overshooting

B) to calm the market when it becomes disorderly

C) to keep the exchange rate within a policy-determined range

D) to give monetary policy greater room to manoeuvre

A) to prevent exchange rate overshooting

B) to calm the market when it becomes disorderly

C) to keep the exchange rate within a policy-determined range

D) to give monetary policy greater room to manoeuvre

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck