Deck 15: International Long-Term Financing and Investment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 15: International Long-Term Financing and Investment

1

A U.S. dollar loan granted to an Australian borrower by a syndicate of U.S. banks based in London

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

a Euroloan.

2

A U.S. dollar loan granted to an Australian borrower by a syndicate of U.S. banks based in New York

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

a foreign loan.

3

A U.S. dollar loan granted to an Australian borrower by an Australian bank based in Sydney is:

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

a Euroloan.

4

An Australian dollar loan granted to a U.S. borrower by a syndicate of U.S. banks based in Sydney

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

An Australian dollar loan granted to an Australian borrower by a syndicate of Australian banks based in Sydney is:

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

A) a Euroloan.

B) a foreign loan.

C) an international loan.

D) a domestic loan.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

The spread over LIBOR paid on syndicated loans tends to be higher:

A) when liquidity is available.

B) for high-quality borrowers.

C) for short-maturity loans.

D) when administrative fees are high.

A) when liquidity is available.

B) for high-quality borrowers.

C) for short-maturity loans.

D) when administrative fees are high.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The spread over LIBOR is a factor of:

A) market liquidity.

B) the creditworthiness of the borrower.

C) the maturity of the loan.

D) all of the given answers.

A) market liquidity.

B) the creditworthiness of the borrower.

C) the maturity of the loan.

D) all of the given answers.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

LIBOR is the:

A) interest rate charged by Eurobanks.

B) maximum deposit rate paid on Eurodeposits.

C) maximum interest rate offered on bonds that are issued in London.

D) average inflation rate on European countries.

A) interest rate charged by Eurobanks.

B) maximum deposit rate paid on Eurodeposits.

C) maximum interest rate offered on bonds that are issued in London.

D) average inflation rate on European countries.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

LIBOR is the:

A) London International Borrowing Rate.

B) London Interbank Offered Rate.

C) Liquid International Borrowing Rate.

D) Liquid Interbank Offer Rate.

A) London International Borrowing Rate.

B) London Interbank Offered Rate.

C) Liquid International Borrowing Rate.

D) Liquid Interbank Offer Rate.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Yankee bonds are:

A) U.S. dollar bonds issued by non-U.S. borrowers.

B) U.S. dollar bonds issued by U.S. borrowers.

C) non-U.S. dollar bonds issued by U.S. borrowers.

D) non-U.S. dollar bonds issued by non-U.S. borrowers and placed in the U.S.

A) U.S. dollar bonds issued by non-U.S. borrowers.

B) U.S. dollar bonds issued by U.S. borrowers.

C) non-U.S. dollar bonds issued by U.S. borrowers.

D) non-U.S. dollar bonds issued by non-U.S. borrowers and placed in the U.S.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Samurai bonds are:

A) non-yen bonds issued by Japanese borrowers.

B) non-yen bonds issued by international borrowers.

C) yen-denominated foreign bonds.

D) yen-denominated Eurobonds.

A) non-yen bonds issued by Japanese borrowers.

B) non-yen bonds issued by international borrowers.

C) yen-denominated foreign bonds.

D) yen-denominated Eurobonds.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

The difference between straight bonds and zero coupon bonds is that:

A) straight bonds have longer maturities.

B) zero coupon bonds are issued on the basis of private placement only.

C) zero coupon bonds are normally domestic bonds.

D) zero coupon bonds do not involve re-investment risk.

A) straight bonds have longer maturities.

B) zero coupon bonds are issued on the basis of private placement only.

C) zero coupon bonds are normally domestic bonds.

D) zero coupon bonds do not involve re-investment risk.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

The main advantage to the issuer of convertible bonds over straight bonds is that:

A) convertible bonds are convertible into equity prior to maturity.

B) convertible bonds are issued at a higher coupon rate.

C) convertible bonds are issued at a lower coupon rate.

D) convertible bonds are issued at a discount.

A) convertible bonds are convertible into equity prior to maturity.

B) convertible bonds are issued at a higher coupon rate.

C) convertible bonds are issued at a lower coupon rate.

D) convertible bonds are issued at a discount.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

The main advantage to the holder of global bonds over straight bonds is that:

A) global bonds may be held and cleared through several different systems.

B) global bonds are highly liquid.

C) global bonds trade at a premium in the secondary market.

D) both global bonds may be held and cleared through several different systems and global bonds are highly liquid.

A) global bonds may be held and cleared through several different systems.

B) global bonds are highly liquid.

C) global bonds trade at a premium in the secondary market.

D) both global bonds may be held and cleared through several different systems and global bonds are highly liquid.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

A borrower will prefer to issue a foreign denominated bond if:

A) the domestic interest rate is greater than the sum of the foreign interest rate and the annual expected change in the exchange rate.

B) the domestic interest rate is less than the sum of the foreign interest rate and the annual expected change in the exchange rate.

C) the domestic interest rate is equal to the sum of the foreign interest rate and the annual expected change in the exchange rate.

D) the foreign interest rate is greater than the sum of the domestic interest rate and the annual expected change in the exchange rate.

A) the domestic interest rate is greater than the sum of the foreign interest rate and the annual expected change in the exchange rate.

B) the domestic interest rate is less than the sum of the foreign interest rate and the annual expected change in the exchange rate.

C) the domestic interest rate is equal to the sum of the foreign interest rate and the annual expected change in the exchange rate.

D) the foreign interest rate is greater than the sum of the domestic interest rate and the annual expected change in the exchange rate.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

A borrower will prefer to issue a domestic denominated bond if:

A) the domestic interest rate is greater than the sum of the foreign interest rate and the annual expected change in the exchange rate.

B) the domestic interest rate is less than the sum of the foreign interest rate and the annual expected change in the exchange rate.

C) the domestic interest rate is equal to the sum of the foreign interest rate and the annual expected change in the exchange rate.

D) the foreign interest rate is greater than the sum of the domestic interest rate and the annual expected change in the exchange rate.

A) the domestic interest rate is greater than the sum of the foreign interest rate and the annual expected change in the exchange rate.

B) the domestic interest rate is less than the sum of the foreign interest rate and the annual expected change in the exchange rate.

C) the domestic interest rate is equal to the sum of the foreign interest rate and the annual expected change in the exchange rate.

D) the foreign interest rate is greater than the sum of the domestic interest rate and the annual expected change in the exchange rate.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

In the 1980s, the Kuwaiti dinar bond market was a popular source of U.S. dollar loans due to the fact that:

A) the interest rate on the Kuwaiti dinar was 6% above U.S. dollar rates and the Kuwaiti dinar was relatively stable.

B) the Kuwaiti dinar was expected to depreciate against the U.S. dollar.

C) the interest rate on the Kuwaiti dinar was 6% below U.S. dollar rates and the Kuwaiti dinar was relatively stable.

D) the Kuwaiti dinar was overvalued.

A) the interest rate on the Kuwaiti dinar was 6% above U.S. dollar rates and the Kuwaiti dinar was relatively stable.

B) the Kuwaiti dinar was expected to depreciate against the U.S. dollar.

C) the interest rate on the Kuwaiti dinar was 6% below U.S. dollar rates and the Kuwaiti dinar was relatively stable.

D) the Kuwaiti dinar was overvalued.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not an objective of listing shares on foreign stock exchanges?

A) improving the liquidity of existing shares.

B) preparing for mergers and acquisitions.

C) boosting commercial and political visibility in foreign countries.

D) broadening ownership outside the national frontiers.

A) improving the liquidity of existing shares.

B) preparing for mergers and acquisitions.

C) boosting commercial and political visibility in foreign countries.

D) broadening ownership outside the national frontiers.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

'American Depository Receipts' are:

A) U.S. dollar certificates of deposit.

B) Eurodollar deposits.

C) U.S. dollar time deposits with offshore banking units.

D) negotiable certificates issued by U.S. banks to represent ownership of underlying U.S. shares.

A) U.S. dollar certificates of deposit.

B) Eurodollar deposits.

C) U.S. dollar time deposits with offshore banking units.

D) negotiable certificates issued by U.S. banks to represent ownership of underlying U.S. shares.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

U.S. firms find it easier to list on foreign stock exchanges than non-U.S. firms wishing to list on U.S.stock exchanges because:

A) disclosure requirements are more stringent in the U.S.

B) there is a limit on the number of foreign shares that can be listed on U.S. stock exchanges.

C) the cost of listing on U.S. exchanges is extremely high.

D) all of the given answers.

A) disclosure requirements are more stringent in the U.S.

B) there is a limit on the number of foreign shares that can be listed on U.S. stock exchanges.

C) the cost of listing on U.S. exchanges is extremely high.

D) all of the given answers.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

A 'Euro-equity' is:

A) an equity security denominated in euros.

B) an equity security denominated in a European currency.

C) an equity security denominated in a currency, which is not that of the country in which the market on which it is listed is located.

D) an equity security listed on a European based equity market.

A) an equity security denominated in euros.

B) an equity security denominated in a European currency.

C) an equity security denominated in a currency, which is not that of the country in which the market on which it is listed is located.

D) an equity security listed on a European based equity market.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

A 'private placement' is:

A) an issue of shares to a single buyer or small number of buyers.

B) an issue of shares to the public at large.

C) an issue of shares not disclosed to the market.

D) an issue of shares to existing shareholders.

A) an issue of shares to a single buyer or small number of buyers.

B) an issue of shares to the public at large.

C) an issue of shares not disclosed to the market.

D) an issue of shares to existing shareholders.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

The advantages of parallel loans include:

A) the fact that they circumvent foreign exchange controls

B) the fact that they avoid the cost of the bid-offer spreads in both interest and exchange rates.

C) the fact that they are easy to arrange.

D) both the fact that they circumvent foreign exchange controls and the fact that they avoid the cost of . the bid-offer spreads in both interest and exchange rates.

A) the fact that they circumvent foreign exchange controls

B) the fact that they avoid the cost of the bid-offer spreads in both interest and exchange rates.

C) the fact that they are easy to arrange.

D) both the fact that they circumvent foreign exchange controls and the fact that they avoid the cost of . the bid-offer spreads in both interest and exchange rates.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

A 'soft' loan is:

A) a loan which is unlikely to be repaid.

B) a loan with a low or zero rate of interest.

C) a bad loan.

D) none of the given answers.

A) a loan which is unlikely to be repaid.

B) a loan with a low or zero rate of interest.

C) a bad loan.

D) none of the given answers.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

An Australian company wishes to borrow AUD1 000 000 for ten years. The ten-year bond rate in the U.K. is 3.50%, the AUD/GBP spot rate is 2.5000 and the estimated spot rate at maturity is 2.8000. What is the estimated effective annual financing rate?

A) 12.39%

B) 15.92%

C) 57.99%

D) 4.68%

A) 12.39%

B) 15.92%

C) 57.99%

D) 4.68%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

An Australian company wishes to borrow AUD1 000 000 for ten years. The ten-year bond rate in the U.K. is 3.50%, the AUD/GBP spot rate is 2.5000 and the estimated spot rate at maturity is 2.2000. What is the estimated effective annual financing rate?

A) 2.19%

B) 4.83%

C) 24.13%

D) 3.50%

A) 2.19%

B) 4.83%

C) 24.13%

D) 3.50%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

An Australian company wishes to borrow AUD1 000 000 for ten years. The ten-year bond rate in the U.K. is 3.50% and in Australia is 5.3%. The AUD/GBP spot rate is 2.5000 and the estimated spot rate at maturity is 2.8000. In what currency will a risk neutral firm denominate its bonds?

A) U.K. pounds.

B) Australian dollar.

C) Either U.K. pounds or Australian dollar.

D) There is insufficient information to determine.

A) U.K. pounds.

B) Australian dollar.

C) Either U.K. pounds or Australian dollar.

D) There is insufficient information to determine.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

A foreign bond investment is preferred to a domestic bond investment if:

A) the expected percentage change in the exchange rate is greater than the rate of return on the foreign bond.

B) the expected percentage change in the exchange rate is greater than the rate of return on the domestic bond.

C) the expected annual percentage change in the exchange rate is greater than the rate of return differential.

D) the yield to maturity on the foreign bond is greater than the yield to maturity on the domestic bond.

A) the expected percentage change in the exchange rate is greater than the rate of return on the foreign bond.

B) the expected percentage change in the exchange rate is greater than the rate of return on the domestic bond.

C) the expected annual percentage change in the exchange rate is greater than the rate of return differential.

D) the yield to maturity on the foreign bond is greater than the yield to maturity on the domestic bond.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

A domestic bond investment is preferred to a foreign bond investment if:

A) the expected percentage change in the exchange rate is greater than the rate of return on the foreign bond.

B) the expected annual percentage change in the exchange rate is less than the rate of return differential.

C) the expected annual percentage change in the exchange rate is greater than the rate of return differential.

D) the yield to maturity on the foreign bond is greater than the yield to maturity on the domestic bond.

A) the expected percentage change in the exchange rate is greater than the rate of return on the foreign bond.

B) the expected annual percentage change in the exchange rate is less than the rate of return differential.

C) the expected annual percentage change in the exchange rate is greater than the rate of return differential.

D) the yield to maturity on the foreign bond is greater than the yield to maturity on the domestic bond.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

In the presence of income and capital gains taxes, foreign currency denominated bonds are preferred to domestic bonds as an investment if:

A) the income tax rate is high and the capital gains tax is low.

B) the income tax rate is low and the capital gains tax is high.

C) the income tax rate is low and the capital gains tax is low.

D) the income tax rate is high and the capital gains tax is high.

A) the income tax rate is high and the capital gains tax is low.

B) the income tax rate is low and the capital gains tax is high.

C) the income tax rate is low and the capital gains tax is low.

D) the income tax rate is high and the capital gains tax is high.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

In the presence of income and capital gains taxes, domestic currency denominated bonds are preferred to foreign bonds as an investment if:

A) the income tax rate is high and the capital gains tax is low.

B) the income tax rate is low and the capital gains tax is high.

C) the income tax rate is low and the capital gains tax is low.

D) the income tax rate is high and the capital gains tax is high.

A) the income tax rate is high and the capital gains tax is low.

B) the income tax rate is low and the capital gains tax is high.

C) the income tax rate is low and the capital gains tax is low.

D) the income tax rate is high and the capital gains tax is high.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

A foreign equity investment is preferred to a domestic equity investment if:

A) the expected percentage change in the exchange rate is greater than the domestic dividend yield.

B) the expected percentage change in the exchange rate is greater than the domestic rate of capital appreciation.

C) the foreign dividend yield is greater than the domestic dividend yield.

D) the expected percentage change in the exchange rate is greater than the sum of the dividend yield . and the rates of capital appreciation differentials.

A) the expected percentage change in the exchange rate is greater than the domestic dividend yield.

B) the expected percentage change in the exchange rate is greater than the domestic rate of capital appreciation.

C) the foreign dividend yield is greater than the domestic dividend yield.

D) the expected percentage change in the exchange rate is greater than the sum of the dividend yield . and the rates of capital appreciation differentials.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

A domestic equity investment is preferred to a foreign equity investment if:

A) the expected percentage change in the exchange rate is less than the sum of the dividend yield and the rates of capital appreciation differentials.

B) the expected percentage change in the exchange rate is greater than the domestic rate of capital appreciation.

C) the foreign dividend yield is greater than the domestic dividend yield.

D) the expected percentage change in the exchange rate is greater than the sum of the dividend yield . and the rates of capital appreciation differentials.

A) the expected percentage change in the exchange rate is less than the sum of the dividend yield and the rates of capital appreciation differentials.

B) the expected percentage change in the exchange rate is greater than the domestic rate of capital appreciation.

C) the foreign dividend yield is greater than the domestic dividend yield.

D) the expected percentage change in the exchange rate is greater than the sum of the dividend yield . and the rates of capital appreciation differentials.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

An Australian company wishes to invest AUD1 000 000 in ten-year bonds. The ten-year bond rate in Australia is 5.11% and in the U.K. is 4.00%. The AUD/GBP spot rate is 2.5372 and the estimated spot rate at maturity is 2.6000. The income tax rate in Australia is 49% and in the U.K. is 39%. Where would you invest?

A) Invest in the U.K.

B) Invest in Australia.

C) Either, as there is no difference.

D) There is insufficient information to decide.

A) Invest in the U.K.

B) Invest in Australia.

C) Either, as there is no difference.

D) There is insufficient information to decide.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

An Australian company wishes to invest AUD1 000 000 in ten-year bonds. The ten-year bond rate in Australia is 5.11% and in the U.K. is 4.00%. The AUD/GBP spot rate is 2.5372 and the estimated spot rate at maturity is 2.6000. The income tax rates for Australia and the U.K. are respectively 49% and 39%. The capital gains tax rate in Australia is 39%.Where would you invest?

A) Invest in the U.K.

B) Invest in Australia.

C) Either, as there is no difference.

D) There is insufficient information to decide.

A) Invest in the U.K.

B) Invest in Australia.

C) Either, as there is no difference.

D) There is insufficient information to decide.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

An Australian company wishes to invest AUD1 000 000 in five-year bonds. The five-year bond rate in the U.K. is 3.50%, the AUD/GBP spot rate is 2.5372 and the estimated spot rate at maturity is 2.6000.Calculate the effective rate of return.

A) +2.67%

B) +21.71%

C) +4.01%

D) +6.06%

A) +2.67%

B) +21.71%

C) +4.01%

D) +6.06%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

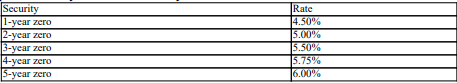

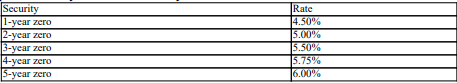

Calculate the market value of the bond based on the above zero coupon yields.You have a 2-year 8% coupon bond with a face value of $100 000 and you are at time zero. Interest is paid annually at the end of the year. ?

A) $111 005

B) $105 615

C) $110 513

D) $97 959

A) $111 005

B) $105 615

C) $110 513

D) $97 959

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

The efficient frontier representing domestic securities may:

A)only fall to the left of the efficient frontier representing international diversification due to the fact that international diversification has a quantitatively less significant effect.

B) only fall to the left of the efficient frontier representing international diversification due to the fact that international diversification has a quantitatively more significant effect.

C) only fall to the right of the efficient frontier representing international diversification due to the fact that international diversification has a quantitatively less significant effect.

D) only fall to the right of the efficient frontier representing international diversification due to the fact . that international diversification has a quantitatively more significant effect.

A)only fall to the left of the efficient frontier representing international diversification due to the fact that international diversification has a quantitatively less significant effect.

B) only fall to the left of the efficient frontier representing international diversification due to the fact that international diversification has a quantitatively more significant effect.

C) only fall to the right of the efficient frontier representing international diversification due to the fact that international diversification has a quantitatively less significant effect.

D) only fall to the right of the efficient frontier representing international diversification due to the fact . that international diversification has a quantitatively more significant effect.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

The conventional or domestic CAPM postulates that the expected return on an asset or a portfolio is:

A) negatively related to its systematic risk, the element of risk that cannot be eliminated by diversification.

B) positively related to its systematic risk, the element of risk that cannot be eliminated by diversification.

C) positively related to its unsystematic risk, the element of risk that cannot be eliminated by diversification.

D) a function of both its systematic and unsystematic risk.

A) negatively related to its systematic risk, the element of risk that cannot be eliminated by diversification.

B) positively related to its systematic risk, the element of risk that cannot be eliminated by diversification.

C) positively related to its unsystematic risk, the element of risk that cannot be eliminated by diversification.

D) a function of both its systematic and unsystematic risk.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is a factor in international market segmentation?

A) Legal barriers to foreign investment.

B) The difficulty of interpreting information about foreign securities.

C) Foreign exchange risk.

D) All of the given answers.

A) Legal barriers to foreign investment.

B) The difficulty of interpreting information about foreign securities.

C) Foreign exchange risk.

D) All of the given answers.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck