Deck 13: Foreign Exchange Risk Management

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/37

Play

Full screen (f)

Deck 13: Foreign Exchange Risk Management

1

The decision to hedge or not to hedge foreign currency exposure is a speculative decision because:

A) both hedging and speculation involve a deliberate assumption of risk

B) it depends on the expected movement in the exchange rate

C) hedging is a profit making operation

D) the outcome of hedging depends on movements in the forward rate

A) both hedging and speculation involve a deliberate assumption of risk

B) it depends on the expected movement in the exchange rate

C) hedging is a profit making operation

D) the outcome of hedging depends on movements in the forward rate

it depends on the expected movement in the exchange rate

2

Which of the following is NOT an argument why there is NO need to worry about foreign exchange risk?

A) If international parity conditions hold then foreign exchange risk will not arise

B) Foreign exchange risk can be controlled if it is possible to forecast exchange rates

C) Risk implies both good and bad outcomes

D) Shareholders are naturally hedged through diversification

A) If international parity conditions hold then foreign exchange risk will not arise

B) Foreign exchange risk can be controlled if it is possible to forecast exchange rates

C) Risk implies both good and bad outcomes

D) Shareholders are naturally hedged through diversification

Risk implies both good and bad outcomes

3

If unbiased efficiency holds then:

A) forward hedging will be unnecessary in the long run

B) forward hedging will be useful in the long run

C) forward hedging will be unnecessary in the short run and the long run

D) hedging will be successful only if it is based on a spot exchange rate forecast other than the forward rate

A) forward hedging will be unnecessary in the long run

B) forward hedging will be useful in the long run

C) forward hedging will be unnecessary in the short run and the long run

D) hedging will be successful only if it is based on a spot exchange rate forecast other than the forward rate

forward hedging will be unnecessary in the long run

4

If UIP holds then:

A) foreign interest rates will equal domestic interest rates so hedging is unnecessary

B) the spot exchange rate will not change so hedging is unnecessary

C) the forward rate will equal the spot rate at maturity of the forward contract so hedging is unnecessary

D) the foreign currency return will equal the domestic currency return and any change in the spot rate . will be offset by change in the interest rate differential so hedging is unnecessary

A) foreign interest rates will equal domestic interest rates so hedging is unnecessary

B) the spot exchange rate will not change so hedging is unnecessary

C) the forward rate will equal the spot rate at maturity of the forward contract so hedging is unnecessary

D) the foreign currency return will equal the domestic currency return and any change in the spot rate . will be offset by change in the interest rate differential so hedging is unnecessary

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

5

If PPP holds then:

A) real currency depreciation or appreciation will not occur as changes in commodity prices will be offset by changes in the nominal exchange rate so hedging will not be necessary

B) the spot exchange rate will not change so hedging will not be necessary

C) the forward rate will equal the spot rate at maturity of the forward contract so hedging will not be necessary

D) the foreign currency return will equal the domestic currency return and any change in the spot rate . will be offset by change in the interest rate differential so hedging will not be necessary

A) real currency depreciation or appreciation will not occur as changes in commodity prices will be offset by changes in the nominal exchange rate so hedging will not be necessary

B) the spot exchange rate will not change so hedging will not be necessary

C) the forward rate will equal the spot rate at maturity of the forward contract so hedging will not be necessary

D) the foreign currency return will equal the domestic currency return and any change in the spot rate . will be offset by change in the interest rate differential so hedging will not be necessary

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is NOT a benefit of hedging?

A) In a progressive tax environment hedging increases after tax income

B) A more stable income may be more conducive to sales in the case of consumer durables and capital goods

C) Firms which hedge are valued significantly more highly than firms which do not hedge

D) Volatile earnings may lead to higher employee turnover and higher wage demands

A) In a progressive tax environment hedging increases after tax income

B) A more stable income may be more conducive to sales in the case of consumer durables and capital goods

C) Firms which hedge are valued significantly more highly than firms which do not hedge

D) Volatile earnings may lead to higher employee turnover and higher wage demands

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

7

A decision to hedge payables in the money market will be taken if:

A) the domestic interest rate is higher than the foreign interest rate

B) the domestic interest rate is lower than the foreign interest rate

C) the interest parity forward rate is higher than the expected spot rate

D) the interest parity forward rate is lower than the expected spot rate

A) the domestic interest rate is higher than the foreign interest rate

B) the domestic interest rate is lower than the foreign interest rate

C) the interest parity forward rate is higher than the expected spot rate

D) the interest parity forward rate is lower than the expected spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

8

A decision to hedge receivables in the money market will be taken if:

A) the domestic interest rate is higher than the foreign interest rate

B) the domestic interest rate is lower than the foreign interest rate

C) the interest parity forward rate is higher than the expected spot rate

D) the interest parity forward rate is lower than the expected spot rate

A) the domestic interest rate is higher than the foreign interest rate

B) the domestic interest rate is lower than the foreign interest rate

C) the interest parity forward rate is higher than the expected spot rate

D) the interest parity forward rate is lower than the expected spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

9

In the presence of bid-offer spreads the decision to hedge payables in the money market will be taken if:

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the offer interest parity forward rate is higher than the expected offer spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is equal to the expected offer spot rate

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the offer interest parity forward rate is higher than the expected offer spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is equal to the expected offer spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

10

In the presence of bid-offer spreads the decision NOT to hedge payables in the money market will be taken if:

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the offer interest parity forward rate is higher than the expected offer spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is equal to the expected offer spot rate

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the offer interest parity forward rate is higher than the expected offer spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is equal to the expected offer spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

11

In the presence of bid-offer spreads the decision to hedge receivables in the money market will be taken if:

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the bid interest parity forward rate is higher than the expected bid spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is higher than the expected offer spot rate

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the bid interest parity forward rate is higher than the expected bid spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is higher than the expected offer spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

12

In the presence of bid-offer spreads the decision NOT to hedge receivables in the money market will be taken if:

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the bid interest parity forward rate is higher than the expected bid spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is higher than the expected offer spot rate

A) the offer interest parity forward rate is lower than the expected offer spot rate

B) the bid interest parity forward rate is higher than the expected bid spot rate

C) the bid interest parity forward rate is lower than the expected bid spot rate

D) the bid interest parity forward rate is higher than the expected offer spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

13

In the presence of bid-offer spreads, there will be indifference between the hedge and no-hedge decisions with respect to payables when:

A) the offer interest parity forward rate is equal to the expected offer spot rate

B) the offer interest parity forward rate is equal to the expected bid spot rate

C) the bid interest parity forward rate is equal to the expected offer spot rate

D) the bid interest parity forward rate is equal to the expected bid spot rate

A) the offer interest parity forward rate is equal to the expected offer spot rate

B) the offer interest parity forward rate is equal to the expected bid spot rate

C) the bid interest parity forward rate is equal to the expected offer spot rate

D) the bid interest parity forward rate is equal to the expected bid spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

14

In the presence of bid-offer spreads, there will be indifference between the hedge and no-hedge decisions with respect to receivables when:

A) the offer interest parity forward rate is equal to the expected offer spot rate

B) the offer interest parity forward rate is equal to the expected bid spot rate

C) the bid interest parity forward rate is equal to the expected offer spot rate

D) the bid interest parity forward rate is equal to the expected bid spot rate

A) the offer interest parity forward rate is equal to the expected offer spot rate

B) the offer interest parity forward rate is equal to the expected bid spot rate

C) the bid interest parity forward rate is equal to the expected offer spot rate

D) the bid interest parity forward rate is equal to the expected bid spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

15

A decision to hedge payables in the forward market will be taken if:

A) the actual forward rate is higher than the expected spot rate

B) the actual forward rate is lower than the expected spot rate

C) the interest parity forward rate is equal to the expected spot rate

D) the interest parity forward rate is higher than the expected spot rate

A) the actual forward rate is higher than the expected spot rate

B) the actual forward rate is lower than the expected spot rate

C) the interest parity forward rate is equal to the expected spot rate

D) the interest parity forward rate is higher than the expected spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

16

A decision to hedge receivables in the forward market will be taken if:

A) the actual forward rate is higher than the expected spot rate

B) the actual forward rate is lower than the expected spot rate

C) the interest parity forward rate is lower than the expected spot rate

D) the interest parity forward rate is equal to the expected spot rate

A) the actual forward rate is higher than the expected spot rate

B) the actual forward rate is lower than the expected spot rate

C) the interest parity forward rate is lower than the expected spot rate

D) the interest parity forward rate is equal to the expected spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

17

Forward hedging of payables will be preferred to money market hedging if the actual forward rate is:

A) higher than the expected spot rate

B) lower than the expected spot rate

C) lower than the interest parity forward rate

D) higher than the expected spot rate.

A) higher than the expected spot rate

B) lower than the expected spot rate

C) lower than the interest parity forward rate

D) higher than the expected spot rate.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

18

Money market hedging of payables will be preferred to forward hedging if the actual forward rate is:

A) higher than the expected spot rate

B) lower than the expected spot rate

C) higher than the interest parity forward rate

D) higher than the expected spot rate.

A) higher than the expected spot rate

B) lower than the expected spot rate

C) higher than the interest parity forward rate

D) higher than the expected spot rate.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

19

Money market hedging of receivables will be preferred to forward hedging if the actual forward rate is:

A) higher than the expected spot rate

B) lower than the expected spot rate

C) lower than the interest parity forward rate

D) higher than the expected spot rate.

A) higher than the expected spot rate

B) lower than the expected spot rate

C) lower than the interest parity forward rate

D) higher than the expected spot rate.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

20

Forward hedging of receivables will be preferred to money market hedging if the actual forward rate is:

A) higher than the expected spot rate

B) lower than the expected spot rate

C) higher than the interest parity forward rate

D) equal to the expected spot rate

A) higher than the expected spot rate

B) lower than the expected spot rate

C) higher than the interest parity forward rate

D) equal to the expected spot rate

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

21

Futures hedging produces different results from those produced by forward hedging for the following reasons except:

A) Futures contracts are standardised with respect to size.

B) Futures contracts are traded on organised exchanges.

C) Futures contracts are standardised with respect to the settlement date.

D) Futures contracts involve marking to market.

A) Futures contracts are standardised with respect to size.

B) Futures contracts are traded on organised exchanges.

C) Futures contracts are standardised with respect to the settlement date.

D) Futures contracts involve marking to market.

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

22

Under an option hedge, the domestic currency value of payables and receivables is not known in advance because:

A) the price of an option depends on the volatility of the underlying exchange rate

B) the outcome depends on the vega of the option

C) the outcome depends on the delta of the option

D) the outcome depends on whether or not the option is exercised

A) the price of an option depends on the volatility of the underlying exchange rate

B) the outcome depends on the vega of the option

C) the outcome depends on the delta of the option

D) the outcome depends on whether or not the option is exercised

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

23

If the foreign currency is expected to appreciate and there are no hedging instruments available, youmight still hedge the payables position by:

A) buying forward a currency which has a strong positive correlation with the foreign currency in question

B) buying forward a currency which has a strong negative correlation with the foreign currency in question

C) selling forward a currency which has a strong positive correlation with the foreign currency in question

D) selling forward a currency which has a strong negative correlation with the foreign currency in question

A) buying forward a currency which has a strong positive correlation with the foreign currency in question

B) buying forward a currency which has a strong negative correlation with the foreign currency in question

C) selling forward a currency which has a strong positive correlation with the foreign currency in question

D) selling forward a currency which has a strong negative correlation with the foreign currency in question

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

24

If the foreign currency is expected to appreciate it is better:

A) to get receivables earlier

B) to pay payables earlier

C) both to get receivables earlier and to pay payables later

D) to pay payables later

A) to get receivables earlier

B) to pay payables earlier

C) both to get receivables earlier and to pay payables later

D) to pay payables later

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

25

If the foreign currency is expected to depreciate it is better:

A) to get receivables earlier

B) to pay payables earlier

C) both to get receivables earlier and to pay payables later

D) to pay payables later

A) to get receivables earlier

B) to pay payables earlier

C) both to get receivables earlier and to pay payables later

D) to pay payables later

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following instruments is NOT used for managing transaction exposure?

A) leading and lagging

B) cross hedging

C) transfer pricing

D) currency diversification

A) leading and lagging

B) cross hedging

C) transfer pricing

D) currency diversification

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

27

A real appreciation of the foreign currency may lead to:

A) an increase in domestic sales

B) a decrease in domestic sales

C) a decrease in foreign sales

D) a decrease in the cost of imported raw materials

A) an increase in domestic sales

B) a decrease in domestic sales

C) a decrease in foreign sales

D) a decrease in the cost of imported raw materials

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

28

Translation exposure is a source of concern because it affects:

A) future cash flows

B) market share

C) financial indicators

D) the competitiveness of the firm

A) future cash flows

B) market share

C) financial indicators

D) the competitiveness of the firm

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

29

The problem with hedging translation exposure by using a forward contract is that:

A) the outcome depends on the future spot rate

B) it does not work when the foreign exchange market is volatile

C) it creates economic exposure

D) it creates transaction exposure

A) the outcome depends on the future spot rate

B) it does not work when the foreign exchange market is volatile

C) it creates economic exposure

D) it creates transaction exposure

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

30

A currency 'collar' is:

A) used to set a minimum value for the domestic receivables at the expense of accepting a maximum value

B) created by adding a long put and a short call to an existing long underlying exposure

C) created by adding a short put and a long call to an existing long underlying exposure

D) it is created by adding a long put and a short call to an existing long underlying exposure and is used . to set a minimum value for the domestic receivables at the expense of accepting a maximum value

A) used to set a minimum value for the domestic receivables at the expense of accepting a maximum value

B) created by adding a long put and a short call to an existing long underlying exposure

C) created by adding a short put and a long call to an existing long underlying exposure

D) it is created by adding a long put and a short call to an existing long underlying exposure and is used . to set a minimum value for the domestic receivables at the expense of accepting a maximum value

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

31

An Australian company has payables of USD100,000, due in three months. The current spot AUD/ USD exchange rate is 1.7900/1.8000. The current three-month forward AUD/USD exchange rate is 1.7400/1.7500. The expected AUD/USD exchange rate is 1.7500/1.7600 in three months time. Calculate the profit or loss you would expect to make on a forward hedge.

A) AUD1,000 loss

B) AUD1,000 profit

C) AUD2,000 profit

D) AUD2,000 loss

A) AUD1,000 loss

B) AUD1,000 profit

C) AUD2,000 profit

D) AUD2,000 loss

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

32

An Australian company has receivables of USD100,000, due in three months. The current spot AUD/ USD exchange rate is 1.7900/1.8000. The current three-month forward AUD/USD exchange rate is 1.7400/1.7500. The expected exchange rate is 1.7500/1.7600 in three months' time. Calculate the profit or loss you would expect to make on a forward hedge.

A) AUD1,000 loss

B) AUD1,000 profit

C) AUD2,000 profit

D) AUD2,000 loss

A) AUD1,000 loss

B) AUD1,000 profit

C) AUD2,000 profit

D) AUD2,000 loss

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

33

An Australian company has receivables of USD100,000, due in six months. The current AUD/USD exchange rate is 1.7900/1.8000. The expected exchange rate is 1.8200/1.8300 in six months' time. The six-month put with a strike of 1.8700 has a premium of AUD0.03. Calculate the estimated Australian dollar value of the receivables if an options hedge is taken out and the forecast turns out to be correct.

A) AUD186,000

B) AUD182,000

C) AUD184,000

D) AUD183,000

A) AUD186,000

B) AUD182,000

C) AUD184,000

D) AUD183,000

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

34

An Australian company has payables of USD100,000, due in three months. The current AUD/USD exchange rate is 1.7900/1.8000. The expected exchange rate is 1.7500/1.7600 in three months' time. The three-month call with a strike of 1.7200 has a premium of AUD0.03. Calculate the estimated Australian dollar value of the payables if an options hedge is taken out.

A) 175,000

B) 172,000

C) 169,000

D) 176,000

A) 175,000

B) 172,000

C) 169,000

D) 176,000

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

35

An Australian company has payables of USD100,000, due in three months. The current AUD/USD exchange rate is 1.7900/1.8000, the three-month Australian interest rate is 3.4/3.5%pa and the three-month U.S. interest rate is 2.5/2.6%pa. Calculate the implicit forward rate achieved via a money market hedge.

A) 1.8176

B) 1.7826

C) 1.8450

D) 1.8045

A) 1.8176

B) 1.7826

C) 1.8450

D) 1.8045

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

36

An Australian company has receivables of USD100,000, due in six months. The current AUD/USD exchange rate is 1.7900/1.8000, the six-month Australian interest rate is 3.4/3.5%pa and the six-month U.S. interest rate is 2.5/2.6%pa. Calculate the implied forward rate achieved via a money market hedge.

A) 1.7971

B) 1.8089

C) 1.7988

D) 1.8000

A) 1.7971

B) 1.8089

C) 1.7988

D) 1.8000

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck

37

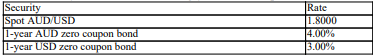

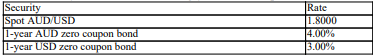

Calculate the implied forward price for the U.S. dollar as at 31 December 2002. On 1 January 2002, the following yields were quoted in the market. ?

A) 1.7827

B) 1.8720

C) 1.8175

D) 1.8540

A) 1.7827

B) 1.8720

C) 1.8175

D) 1.8540

Unlock Deck

Unlock for access to all 37 flashcards in this deck.

Unlock Deck

k this deck