Deck 12: Foreign Exchange Risk and Exposure

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 12: Foreign Exchange Risk and Exposure

1

Uncertainty differs from risk in that the former:

A) pertains to the long run only

B) implies that the probability distribution of the outcome is unknown

C) implies a higher probability for bad outcomes than in the case of risk

D) is not a term that is used in financial analysis

A) pertains to the long run only

B) implies that the probability distribution of the outcome is unknown

C) implies a higher probability for bad outcomes than in the case of risk

D) is not a term that is used in financial analysis

implies that the probability distribution of the outcome is unknown

2

The definition of risk includes:

A) the extent of dispersion around the mean

B) the possibility of a gain

C) the volatility of unexpected outcomes

D) all of the given answers

A) the extent of dispersion around the mean

B) the possibility of a gain

C) the volatility of unexpected outcomes

D) all of the given answers

all of the given answers

3

Foreign exchange risk arises because of:

A) unanticipated changes in the nominal exchange rate

B) unanticipated changes in the real exchange rate

C) deviations from UIP

D) all of the given answers

A) unanticipated changes in the nominal exchange rate

B) unanticipated changes in the real exchange rate

C) deviations from UIP

D) all of the given answers

unanticipated changes in the nominal exchange rate

4

The USD/AUD exchange rate on 31 December 2002 was 0.5662 as compared with 0.5636 on the previous day. Calculate the daily return.

A) 1.0046%

B) 0.46%

C) 4.6%

D) -0.46

A) 1.0046%

B) 0.46%

C) 4.6%

D) -0.46

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Calculate the mean return of the USD/AUD over this period. You have calculated the following daily returns for the USD/AUD.

A) -0.16%

B) 0.36%

C) -0.05%

D) 0.46%

A) -0.16%

B) 0.36%

C) -0.05%

D) 0.46%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

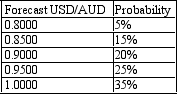

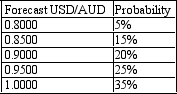

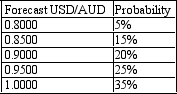

Calculate the mean of the expected percentage change of the USD/AUD. An Australian investor buys a U.S. financial asset for USD at the time the asset is purchased is 0.8800. On maturity the exchange rate may assume one of several values according to the following probability distribution:

A) 2.27%

B) 0.9350

C) 6.25%

D) 0.9000%

A) 2.27%

B) 0.9350

C) 6.25%

D) 0.9000%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

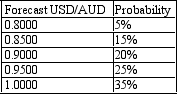

Calculate the standard deviation of the expected percentage change of the USD/AUD. An Australian investor buys a U.S. financial asset for USD at the time the asset is purchased is 0.8800. On maturity the exchange rate may assume one of several values according to the following probability distribution:

A) 4.60%

B) 2.06%

C) 0.21%%

D) 25.00%

A) 4.60%

B) 2.06%

C) 0.21%%

D) 25.00%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

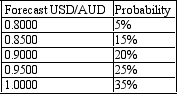

8

Calculate the variance of the expected percentage change of the USD/AUD. An Australian investor buys a U.S. financial asset for USD at the time the asset is purchased is 0.8800. On maturity the exchange rate may assume one of several values according to the following probability distribution:

A) 4.60%

B) 2.06%

C) 0.21%%

D) 25.00%

A) 4.60%

B) 2.06%

C) 0.21%%

D) 25.00%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Calculate the volatility of the USD/AUD over this period. You have calculated the following daily returns and the mean daily return for the USD/AUD.

A) 1.04%

B) 0.85%

C) 1.83%

D) 2.00%

A) 1.04%

B) 0.85%

C) 1.83%

D) 2.00%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

Calculate the mean absolute deviation of the USD/AUD over this period. You have calculated the following daily returns and the mean daily return for the USD/AUD.

A) 1.04%

B) 0.78%

C) 1.83%

D) 2.00%

A) 1.04%

B) 0.78%

C) 1.83%

D) 2.00%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

'Value-at-risk' refers to:

A) foreign exchange exposure

B) the maximum amount expected to be lost with a given probability over a certain period of time

C) the value of foreign currency assets under management

D) the value of risky assets

A) foreign exchange exposure

B) the maximum amount expected to be lost with a given probability over a certain period of time

C) the value of foreign currency assets under management

D) the value of risky assets

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

The main problem with the parametric approach to the calculation of value-at-risk is the assumption that the rate of return:

A) is not serially correlated

B) has a constant variance

C) has a zero mean

D) is normally distributed

A) is not serially correlated

B) has a constant variance

C) has a zero mean

D) is normally distributed

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Distributions of financial returns are not normal because they:

A) have fat tails and tend to be skewed to the left

B) have a constant variance

C) have a zero mean

D) are abnormally large

A) have fat tails and tend to be skewed to the left

B) have a constant variance

C) have a zero mean

D) are abnormally large

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

The benefits offered by the value-at-risk methodology include:

A) its simplicity in summing the risk of an entire portfolio in one number

B) its suitability for risk limit setting

C) its accuracy

D) both its simplicity in summing the risk of an entire portfolio in one number and its suitability for risk limit setting

A) its simplicity in summing the risk of an entire portfolio in one number

B) its suitability for risk limit setting

C) its accuracy

D) both its simplicity in summing the risk of an entire portfolio in one number and its suitability for risk limit setting

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

Value-at-risk:

A)summarises the expected worst-case loss of a firm, over a specific time-period, with a given level of confidence

B) equals the present value of future cash flows

C) is used primarily by manufacturing companies

D) is a precise measurement of how much a firm will lose

A)summarises the expected worst-case loss of a firm, over a specific time-period, with a given level of confidence

B) equals the present value of future cash flows

C) is used primarily by manufacturing companies

D) is a precise measurement of how much a firm will lose

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

The mean return on the AUD/USD is 0.314%, with a standard deviation of 1.867%. Calculate the one-day value-at-risk of an AUD1m position on the USD, using the parametric approach subject to a probability of 1%.

A) AUD15.530m

B) AUD40.361m

C) AUD3.140m

D) AUD10.000m

A) AUD15.530m

B) AUD40.361m

C) AUD3.140m

D) AUD10.000m

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

The mean return on the AUD/USD is 0.314%, with a standard deviation of 1.867%. Calculate the one-day value-at-risk of an AUD1m position on the USD, using the parametric approach subject to a probability of 2.5%.

A) AUD3.656m

B) AUD40.361m

C) AUD68,312

D) AUD10,000m

A) AUD3.656m

B) AUD40.361m

C) AUD68,312

D) AUD10,000m

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

Parametric value-at-risk:

A) estimates value-at-risk by revaluing portfolios for each of a range of random scenarios

B) estimates value-at-risk by revaluing portfolios for each historical change in the market

C) is accurate for calculating the value-at-risk of assets with non-linear exposures to risk

D) estimates value-at-risk based on the mean and standard deviation measures for each asset

A) estimates value-at-risk by revaluing portfolios for each of a range of random scenarios

B) estimates value-at-risk by revaluing portfolios for each historical change in the market

C) is accurate for calculating the value-at-risk of assets with non-linear exposures to risk

D) estimates value-at-risk based on the mean and standard deviation measures for each asset

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Parametric value-at-risk:

A) is fast and simple to calculate

B) is accurate for linear and non-linear exposures

C) requires more computing power than either the Monte Carlo or historical methods

D) requires more data than the historical method

A) is fast and simple to calculate

B) is accurate for linear and non-linear exposures

C) requires more computing power than either the Monte Carlo or historical methods

D) requires more data than the historical method

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Based on the survey conduct in 1999 by Moosa and Knight, which of the statements below is incorrect?

A) companies that do not use value-at-risk mostly employ scenario analysis

B) companies that use value-at-risk predominantly use the parametric approach

C) a minority of users employ back testing and stress testing

D) companies that do not use value-at-risk claim that it is not relevant to their operations

A) companies that do not use value-at-risk mostly employ scenario analysis

B) companies that use value-at-risk predominantly use the parametric approach

C) a minority of users employ back testing and stress testing

D) companies that do not use value-at-risk claim that it is not relevant to their operations

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

The main advantages of value-at-risk include:

A) it facilitates the aggregation of a firm's exposures to market risk

B) it is very accurate

C) it may be expressed in a dollar value, which allows direct comparison with the firm's profitability and capital

D) it both facilitates the aggregation of a firm's exposures to market risk and it may be expressed in a . dollar value, which allows direct comparison with the firm's profitability and capital

A) it facilitates the aggregation of a firm's exposures to market risk

B) it is very accurate

C) it may be expressed in a dollar value, which allows direct comparison with the firm's profitability and capital

D) it both facilitates the aggregation of a firm's exposures to market risk and it may be expressed in a . dollar value, which allows direct comparison with the firm's profitability and capital

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Value-at-risk is subject to a number of limitations including:

A) it does not deal well with event and stability risks

B) it is complex

C) it does not deal well with illiquid and unpriced securities

D) it does not deal well with event and stability risks and it does not deal well with illiquid and unpriced securities

A) it does not deal well with event and stability risks

B) it is complex

C) it does not deal well with illiquid and unpriced securities

D) it does not deal well with event and stability risks and it does not deal well with illiquid and unpriced securities

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

A 'long' exposure to foreign exchange risk is:

A) a large exposure to a foreign currency

B) an exposure to foreign liabilities

C) an exposure to foreign assets

D) to have significant exposure to foreign exchange risk

A) a large exposure to a foreign currency

B) an exposure to foreign liabilities

C) an exposure to foreign assets

D) to have significant exposure to foreign exchange risk

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

A 'short' exposure to foreign exchange risk is:

A) a small exposure to a foreign currency

B) an exposure to foreign liabilities

C) an exposure to foreign assets

D) to have no exposure to foreign exchange risk

A) a small exposure to a foreign currency

B) an exposure to foreign liabilities

C) an exposure to foreign assets

D) to have no exposure to foreign exchange risk

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

The volatility of the real exchange rate is close to the volatility of the nominal exchange rate because:

A) the real exchange rate takes into account domestic prices only

B) the real exchange rate takes into account foreign prices only

C) the volatility of domestic prices is counterbalanced by the volatility of foreign prices

D) prices are not highly volatile

A) the real exchange rate takes into account domestic prices only

B) the real exchange rate takes into account foreign prices only

C) the volatility of domestic prices is counterbalanced by the volatility of foreign prices

D) prices are not highly volatile

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

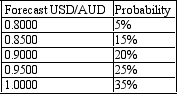

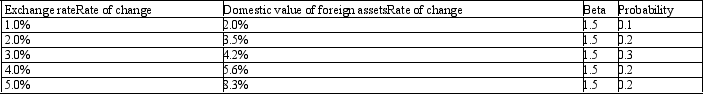

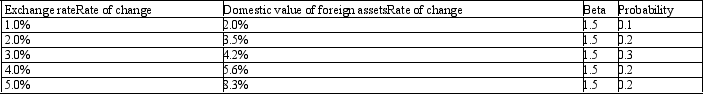

Calculate the value of the exposure of the firm holding these foreign assets. The following table shows the probability distribution associated with changes in the exchange rate and in the domestic currency value of foreign assets.

A) 0.64

B) 0.78

C) 1.56

D) 1.50

A) 0.64

B) 0.78

C) 1.56

D) 1.50

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Foreign exchange transaction exposure arises:

A) if receivables are denominated in the local currency

B) if payables are denominated in a foreign currency

C) irrespective of the currency payables and receivables are denominated in

D) only for multinational companies

A) if receivables are denominated in the local currency

B) if payables are denominated in a foreign currency

C) irrespective of the currency payables and receivables are denominated in

D) only for multinational companies

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Between 2004 and 2008, the Australian dollar exchange rate tended to be most volatile in:

A) 2008

B) 2007

C) 2006

D) 2004

A) 2008

B) 2007

C) 2006

D) 2004

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is NOT a source of transaction exposure?

A) The purchase of a foreign asset or liability

B) A contract involving future foreign currency cash flows

C) The expected loss of foreign market share resulting from domestic currency appreciation

D) Current interest payments on a foreign currency loan

A) The purchase of a foreign asset or liability

B) A contract involving future foreign currency cash flows

C) The expected loss of foreign market share resulting from domestic currency appreciation

D) Current interest payments on a foreign currency loan

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

A long position on the U.S. dollar by an Australian firm can be most effectively hedged by taking a short position on the

A) EUR

B) AUD

C) GBP

D) JPY

A) EUR

B) AUD

C) GBP

D) JPY

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Purely domestic firms are exposed to foreign exchange risk because:

A) they borrow from overseas

B) they import raw materials from overseas

C) changes in the exchange rate may affect domestic interest rates, prices and sales

D) changes in the exchange rate affect the value of the country's foreign assets

A) they borrow from overseas

B) they import raw materials from overseas

C) changes in the exchange rate may affect domestic interest rates, prices and sales

D) changes in the exchange rate affect the value of the country's foreign assets

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

A firm's economic exposure to changes in exchange rates:

A) can be accurately calculated in advance

B) concerns contractual planned cashflows

C) can be estimated from a regression equation relating changes in real cashflows to changes in the . exchange rates to which they may be exposed

D) none of the given answers

A) can be accurately calculated in advance

B) concerns contractual planned cashflows

C) can be estimated from a regression equation relating changes in real cashflows to changes in the . exchange rates to which they may be exposed

D) none of the given answers

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

In practice, the most widely used method of translating balance sheet items to the domestic currency values is based on:

A) the exchange rate at the end of the accounting period for all balance sheet items

B) the closing rate for the current balance sheet items and the historical rate for non-current items

C) the closing rate for monetary items and the historic rate for non-monetary items

D) the closing rate for balance sheet items stated at market value and the historic rate for items stated at cost

A) the exchange rate at the end of the accounting period for all balance sheet items

B) the closing rate for the current balance sheet items and the historical rate for non-current items

C) the closing rate for monetary items and the historic rate for non-monetary items

D) the closing rate for balance sheet items stated at market value and the historic rate for items stated at cost

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

According to the current/non-current method of translation:

A) current assets are translated at the current exchange rate, while long-term assets are translated at the average exchange rate

B) current items are translated at the current rate, while long-term items are translated at the historical rate

C) current items are translated at the closing rate, while long-term assets are translated at the average rate

D) current items are translated at the average rate, while long-term items are translated at the historical rate

A) current assets are translated at the current exchange rate, while long-term assets are translated at the average exchange rate

B) current items are translated at the current rate, while long-term items are translated at the historical rate

C) current items are translated at the closing rate, while long-term assets are translated at the average rate

D) current items are translated at the average rate, while long-term items are translated at the historical rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

According to the monetary/non-monetary method, which of the following items is translated at the closing rate?

A) bonds

B) real estate

C) plant and equipment

D) fixed assets

A) bonds

B) real estate

C) plant and equipment

D) fixed assets

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

According to the monetary/non-monetary method, which of the following items is translated at the historical rate?

A) bonds

B) deposits

C) buildings

D) bank loans

A) bonds

B) deposits

C) buildings

D) bank loans

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following methods is the most widely used method for translating foreign exposures?

A) closing rate method

B) current/non-current method

C) monetary/non-monetary method

D) temporal method

A) closing rate method

B) current/non-current method

C) monetary/non-monetary method

D) temporal method

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

According to the temporal method, which of the following items is translated at the closing rate?

A) a balance sheet item stated at replacement cost

B) a balance sheet item stated at realisable value

C) a balance sheet item stated at market value

D) all of the answers given

A) a balance sheet item stated at replacement cost

B) a balance sheet item stated at realisable value

C) a balance sheet item stated at market value

D) all of the answers given

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Non-transaction gains or losses:

A) are accounted for in the income statement

B) are accounted for in the cash flow statement

C) are recorded on the balance sheet as reflected by changes in reserves

D) are not reported until realised

A) are accounted for in the income statement

B) are accounted for in the cash flow statement

C) are recorded on the balance sheet as reflected by changes in reserves

D) are not reported until realised

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following principles are observed in practice?

A) translation of the balance sheet items is based on the closing rate

B) transaction gains and losses are accounted for in the income statement

C) non transaction gains and losses are recorded on the balance sheet as reflected by changes in reserves

D) all of the given answers

A) translation of the balance sheet items is based on the closing rate

B) transaction gains and losses are accounted for in the income statement

C) non transaction gains and losses are recorded on the balance sheet as reflected by changes in reserves

D) all of the given answers

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck