Deck 11: International Arbitarage

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 11: International Arbitarage

1

Which of the following statements is or are correct?

A) Arbitrage is generally defined as capitalizing on a discrepancy in quoted prices as a result of a violation of and equilibrium condition.

B) The arbitrage process theoretically restores equilibrium.

C) The importance of arbitrage is that no-arbitrage conditions are used for asset pricing.

D) All of the answers given are correct.

A) Arbitrage is generally defined as capitalizing on a discrepancy in quoted prices as a result of a violation of and equilibrium condition.

B) The arbitrage process theoretically restores equilibrium.

C) The importance of arbitrage is that no-arbitrage conditions are used for asset pricing.

D) All of the answers given are correct.

All of the answers given are correct.

2

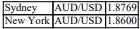

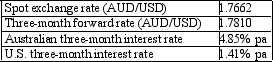

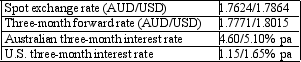

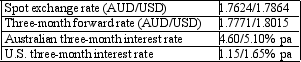

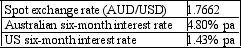

Calculate the Australian dollar profit, if any, on a two-point arbitrage. You are given the following exchange rate quotes in the markets identified:

A) 16.9 points

B) AUD0.0169

C) Nil

D) USD0.0048

A) 16.9 points

B) AUD0.0169

C) Nil

D) USD0.0048

AUD0.0169

3

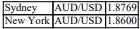

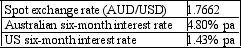

Calculate the Australian dollar profit, if any, on a two-point arbitrage. You are given the following exchange rate quotes in the markets identified:

A) AUD0.0131

B) AUD1.0131

C) Nil

D) 13.1 points

A) AUD0.0131

B) AUD1.0131

C) Nil

D) 13.1 points

AUD0.0131

4

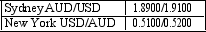

Calculate the US dollar profit, if any, on a three-point arbitrage. You are given the following exchange rate quotes in Sydney:

A) USD0.2320 for every 1 USD invested

B) USD0.0043 for every 1 USD invested

C) USD1.0043 for every 1 USD invested

D) Nil

A) USD0.2320 for every 1 USD invested

B) USD0.0043 for every 1 USD invested

C) USD1.0043 for every 1 USD invested

D) Nil

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

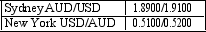

Calculate the US dollar profit, if any, on a three-point arbitrage. You are given the following exchange rate quotes in Sydney:

A) USD0.0086 for every 1 USD invested

B) USD0.0043 for every 1 USD invested

C) USD1.0086 for every 1 USD invested

D) Nil

A) USD0.0086 for every 1 USD invested

B) USD0.0043 for every 1 USD invested

C) USD1.0086 for every 1 USD invested

D) Nil

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

If the domestic currency price of a commodity is greater than the domestic currency equivalent of the foreign price of the same commodity, then according to the LOP:

A) the foreign price must rise

B) the exchange rate must rise

C) the foreign price must rise and/or the exchange rate must rise

D) the foreign currency must depreciate

A) the foreign price must rise

B) the exchange rate must rise

C) the foreign price must rise and/or the exchange rate must rise

D) the foreign currency must depreciate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

If the foreign currency equivalent of the domestic price of a commodity is less than the foreign price of the same commodity, then the LOP implies that:

A) the foreign currency is overvalued

B) the foreign currency is undervalued

C) the domestic currency is overvalued

D) none of the given answers

A) the foreign currency is overvalued

B) the foreign currency is undervalued

C) the domestic currency is overvalued

D) none of the given answers

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

If the interest rate differential and the forward spread are positive and equal then:

A) the foreign currency should offer a higher interest rate and sell at a forward discount

B) the foreign currency should offer a higher interest rate and sell at a forward premium

C) the domestic currency should offer a higher interest rate and sell at a forward premium

D) the domestic currency should offer a higher interest rate and sell at a forward discount

A) the foreign currency should offer a higher interest rate and sell at a forward discount

B) the foreign currency should offer a higher interest rate and sell at a forward premium

C) the domestic currency should offer a higher interest rate and sell at a forward premium

D) the domestic currency should offer a higher interest rate and sell at a forward discount

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

If the interest rate differential and the forward spread are negative and equal then:

A) the foreign currency should offer a higher interest rate and sell at a forward discount

B) the foreign currency should offer a higher interest rate and sell at a forward premium

C) the domestic currency should offer a higher interest rate and sell at a forward premium

D) the domestic currency should offer a higher interest rate and sell at a forward discount

A) the foreign currency should offer a higher interest rate and sell at a forward discount

B) the foreign currency should offer a higher interest rate and sell at a forward premium

C) the domestic currency should offer a higher interest rate and sell at a forward premium

D) the domestic currency should offer a higher interest rate and sell at a forward discount

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

If the interest rate differential and the forward spread are positive and the interest differential is lower than the spread then:

A) the foreign currency should offer a higher interest rate and sell at a forward discount

B) the foreign currency should offer a higher interest rate and sell at a forward premium

C) the domestic currency should offer a higher interest rate and sell at a forward premium

D) the domestic currency should offer a higher interest rate and sell at a forward discount

A) the foreign currency should offer a higher interest rate and sell at a forward discount

B) the foreign currency should offer a higher interest rate and sell at a forward premium

C) the domestic currency should offer a higher interest rate and sell at a forward premium

D) the domestic currency should offer a higher interest rate and sell at a forward discount

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Under which of the following conditions will outward arbitrage be triggered?

A) The interest rate differential and forward spread are positive and the differential is greater than the spread

B) The interest rate differential and forward spread are negative and the absolute value of the interest . differential is lower than the absolute value of the spread

C) The interest rate differential and forward spread are positive and the interest differential is lower than the spread

D) The interest rate differential is positive while the spread is negative

A) The interest rate differential and forward spread are positive and the differential is greater than the spread

B) The interest rate differential and forward spread are negative and the absolute value of the interest . differential is lower than the absolute value of the spread

C) The interest rate differential and forward spread are positive and the interest differential is lower than the spread

D) The interest rate differential is positive while the spread is negative

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Under which of the following conditions will inward arbitrage be triggered?

A) The interest rate differential and forward spread are positive and the differential is lower than the spread

B) The interest rate differential and forward spread are negative and the absolute value of the interest . differential is lower than the absolute value of the spread

C) The interest rate differential and forward spread are negative and the absolute value of the interest differential is greater than the absolute value of the spread

D) The interest rate differential is negative while the spread is positive

A) The interest rate differential and forward spread are positive and the differential is lower than the spread

B) The interest rate differential and forward spread are negative and the absolute value of the interest . differential is lower than the absolute value of the spread

C) The interest rate differential and forward spread are negative and the absolute value of the interest differential is greater than the absolute value of the spread

D) The interest rate differential is negative while the spread is positive

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

Outward covered arbitrage does not cause:

A) a rise in the domestic interest rate

B) a fall in the foreign interest rate

C) a fall in the forward exchange rate

D) a fall in the spot exchange rate

A) a rise in the domestic interest rate

B) a fall in the foreign interest rate

C) a fall in the forward exchange rate

D) a fall in the spot exchange rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

Inward covered arbitrage does not cause:

A) a fall in the domestic interest rate

B) a rise in the foreign interest rate

C) a rise in the spot exchange rate

D) a rise in the forward exchange rate

A) a fall in the domestic interest rate

B) a rise in the foreign interest rate

C) a rise in the spot exchange rate

D) a rise in the forward exchange rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

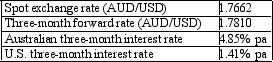

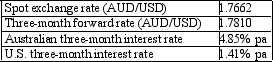

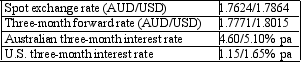

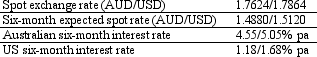

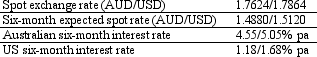

Calculate the precise outward covered margin from an Australian perspective.You are given the following information:

A) 2 basis points

B) -2 basis points

C) 257 basis points

D) -259 basis points

A) 2 basis points

B) -2 basis points

C) 257 basis points

D) -259 basis points

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

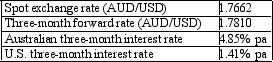

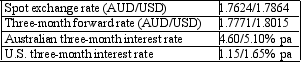

16

Calculate the precise inward covered margin from an Australian perspective. You are given the following information:

A) 2 basis points

B) -2 basis points

C) 257 basis points

D) -259 basis points

A) 2 basis points

B) -2 basis points

C) 257 basis points

D) -259 basis points

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

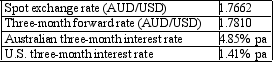

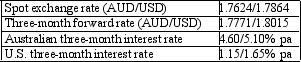

17

Calculate the precise outward covered margin from a U.S. perspective. You are given the following information:

A) 2 basis points

B) -2 basis points

C) 257 basis points

D) -259 basis points

A) 2 basis points

B) -2 basis points

C) 257 basis points

D) -259 basis points

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

If the net foreign return is lower than the domestic interest rate then:

A) the interest parity forward rate is lower than the actual forward rate

B) the interest parity forward rate is higher than the actual forward rate

C) the interest rate differential is lower than the forward spread

D) none of the given answers

A) the interest parity forward rate is lower than the actual forward rate

B) the interest parity forward rate is higher than the actual forward rate

C) the interest rate differential is lower than the forward spread

D) none of the given answers

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

If the gross domestic return is higher than the gross covered foreign return then:

A) the interest parity forward rate is lower than the actual forward rate

B) the interest rate differential is lower than the forward spread

C) the interest parity forward rate is higher than the actual forward rate

D) none of the given answers

A) the interest parity forward rate is lower than the actual forward rate

B) the interest rate differential is lower than the forward spread

C) the interest parity forward rate is higher than the actual forward rate

D) none of the given answers

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

The demand for forward contracts by arbitragers depends on the difference between:

A) the expected spot rate and the actual forward rate

B) the expected spot rate and the expected forward rate

C) the interest parity forward rate and the actual forward rate

D) the expected forward rate and the actual forward rate

A) the expected spot rate and the actual forward rate

B) the expected spot rate and the expected forward rate

C) the interest parity forward rate and the actual forward rate

D) the expected forward rate and the actual forward rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

The demand for forward contracts by spot speculators on the difference between:

A) the expected spot rate and the actual forward rate

B) the expected spot rate and the expected forward rate

C) the interest parity forward rate and the actual forward rate

D) the expected forward rate and the actual forward rate

A) the expected spot rate and the actual forward rate

B) the expected spot rate and the expected forward rate

C) the interest parity forward rate and the actual forward rate

D) the expected forward rate and the actual forward rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

The demand for forward contracts by forward speculators depends on the difference between:

A) the expected spot rate and the actual forward rate

B) the expected spot rate and the expected forward rate

C) the interest parity forward rate and the actual forward rate

D) the expected forward rate and the actual forward rate

A) the expected spot rate and the actual forward rate

B) the expected spot rate and the expected forward rate

C) the interest parity forward rate and the actual forward rate

D) the expected forward rate and the actual forward rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

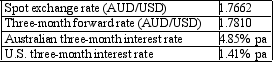

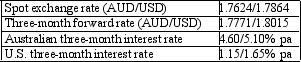

23

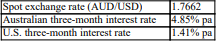

If CIP holds, what should be the AUD/USD three-month forward exchange rate, according to the precise CIP formula? You are given the following information:

A) AUD/USD 1.8261

B) AUD/USD 1.7083

C) AUD/USD 1.7512

D) AUD/USD 1.7813

A) AUD/USD 1.8261

B) AUD/USD 1.7083

C) AUD/USD 1.7512

D) AUD/USD 1.7813

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

If CIP holds, what should be the AUD/USD three-month forward exchange rate, according to the approximate CIP formula? You are given the following information:

A) AUD/USD 1.8261

B) AUD/USD 1.7083

C) AUD/USD 1.7814

D) AUD/USD 1.7813

A) AUD/USD 1.8261

B) AUD/USD 1.7083

C) AUD/USD 1.7814

D) AUD/USD 1.7813

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

In the presence of bid-offer spreads, outward arbitrage comes to an end when:

A) the difference between the domestic bid interest rate and the foreign offer interest rate is equal to the difference between the forward spread and the bid-offer spread

B) the difference between the domestic offer interest rate and the foreign bid interest rate is equal to the . difference between the forward spread and the bid-offer spread

C) the difference between the domestic offer interest rate and the foreign offer interest rate is equal to the forward spread

D) the difference between the domestic bid interest rate and the foreign bid interest rate is equal to the bid-offer spread

A) the difference between the domestic bid interest rate and the foreign offer interest rate is equal to the difference between the forward spread and the bid-offer spread

B) the difference between the domestic offer interest rate and the foreign bid interest rate is equal to the . difference between the forward spread and the bid-offer spread

C) the difference between the domestic offer interest rate and the foreign offer interest rate is equal to the forward spread

D) the difference between the domestic bid interest rate and the foreign bid interest rate is equal to the bid-offer spread

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

In the presence of bid-offer spreads, inward arbitrage comes to an end when:

A) the difference between the domestic offer interest rate and the foreign bid interest rate is equal to the sum of the forward spread and the bid-offer spread

B) the difference between the domestic bid interest rate and the foreign bid interest rate is equal to the sum of the forward spread and the bid-offer spread

C) the difference between the domestic bid interest rate and the foreign offer interest rate is equal to the . sum of the forward spread and the bid-offer spread

D) the difference between the domestic offer interest rate and the foreign offer interest rate is equal to . the difference between the forward spread and the bid-offer spread

A) the difference between the domestic offer interest rate and the foreign bid interest rate is equal to the sum of the forward spread and the bid-offer spread

B) the difference between the domestic bid interest rate and the foreign bid interest rate is equal to the sum of the forward spread and the bid-offer spread

C) the difference between the domestic bid interest rate and the foreign offer interest rate is equal to the . sum of the forward spread and the bid-offer spread

D) the difference between the domestic offer interest rate and the foreign offer interest rate is equal to . the difference between the forward spread and the bid-offer spread

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Calculate the precise inward covered margin from an Australian perspective. You are given the following information:

A) 152 basis points

B) -146 basis points

C) 68 basis points

D) 298 basis points

A) 152 basis points

B) -146 basis points

C) 68 basis points

D) 298 basis points

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Calculate the precise outward covered margin from an Australian perspective. You are given the following information:

A) -46 basis points

B) -151 basis points

C) 149 basis points

D) -448 basis points

A) -46 basis points

B) -151 basis points

C) 149 basis points

D) -448 basis points

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

Calculate the approximate inward covered margin from an Australian perspective. You are given the following information:

A) 152 basis points

B) -147 basis points

C) 68 basis points

D) 298 basis points

A) 152 basis points

B) -147 basis points

C) 68 basis points

D) 298 basis points

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

UIP can be obtained by combining:

A) CIP and unbiased efficiency

B) ex ante PPP and unbiased efficiency

C) ex ante PPP and general efficiency

D) CIP and cross-sectional efficiency

A) CIP and unbiased efficiency

B) ex ante PPP and unbiased efficiency

C) ex ante PPP and general efficiency

D) CIP and cross-sectional efficiency

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following does NOT represent the UIP equilibrium condition?

A) Gross domestic return is equal to the expected uncovered gross foreign return

B) The interest parity forward rate is equal to the expected spot rate

C) The interest parity forward rate is equal to the actual forward rate

D) The interest differential is equal to the expected percentage change in the spot exchange rate

A) Gross domestic return is equal to the expected uncovered gross foreign return

B) The interest parity forward rate is equal to the expected spot rate

C) The interest parity forward rate is equal to the actual forward rate

D) The interest differential is equal to the expected percentage change in the spot exchange rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

UIP implies that:

A) the currency offering the lower interest tends to depreciate

B) the currency offering the higher interest tends to appreciate

C) the currency offering the higher interest rate tends to depreciate

D) neither of the currencies is expected to change since it is implicitly assumed that the expected change in the exchange rate is zero

A) the currency offering the lower interest tends to depreciate

B) the currency offering the higher interest tends to appreciate

C) the currency offering the higher interest rate tends to depreciate

D) neither of the currencies is expected to change since it is implicitly assumed that the expected change in the exchange rate is zero

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following conditions will NOT trigger outward uncovered arbitrage?

A) The interest parity forward rate is higher than the expected spot rate

B) The expected spot rate is higher than the interest parity forward rate

C) The interest differential is less than the expected percentage change in the spot exchange rate

D) The expected uncovered foreign return is greater than the domestic interest rate

A) The interest parity forward rate is higher than the expected spot rate

B) The expected spot rate is higher than the interest parity forward rate

C) The interest differential is less than the expected percentage change in the spot exchange rate

D) The expected uncovered foreign return is greater than the domestic interest rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following will NOT trigger inward uncovered arbitrage?

A) The interest parity forward rate is higher than the expected change in the exchange rate

B) The domestic interest rate is higher than the net expected uncovered foreign return

C) The expected percentage change in the spot exchange rate is less than the interest differential

D) The expected percentage change in the spot exchange rate is greater than the interest differential

A) The interest parity forward rate is higher than the expected change in the exchange rate

B) The domestic interest rate is higher than the net expected uncovered foreign return

C) The expected percentage change in the spot exchange rate is less than the interest differential

D) The expected percentage change in the spot exchange rate is greater than the interest differential

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Under which of these conditions will outward uncovered arbitrage be profitable?

A) The foreign interest rate is lower than the domestic interest rate, and the foreign currency appreciates by more than the interest differential

B) The foreign interest rate is higher than the domestic interest rate, and the foreign currency depreciates by more than the interest differential

C) The foreign interest rate is less than the domestic rate, and the domestic currency stays unchanged

D) The foreign interest rate is higher than the domestic interest rate, and the foreign currency depreciates by a percentage which is equal to the interest differential

A) The foreign interest rate is lower than the domestic interest rate, and the foreign currency appreciates by more than the interest differential

B) The foreign interest rate is higher than the domestic interest rate, and the foreign currency depreciates by more than the interest differential

C) The foreign interest rate is less than the domestic rate, and the domestic currency stays unchanged

D) The foreign interest rate is higher than the domestic interest rate, and the foreign currency depreciates by a percentage which is equal to the interest differential

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

Under which of these conditions will inward uncovered arbitrage be profitable?

A) The foreign interest rate is lower than the domestic interest rate, and the foreign currency appreciates by more than the interest differential

B) The foreign interest rate is higher than the domestic interest rate, and the foreign currency appreciates by more than the interest differential

C) The foreign interest rate is less than the domestic rate, and the domestic currency stays unchanged

D The foreign interest rate is higher than the domestic interest rate, and the foreign currenc depreciates by a percentage which is equal to the interest differential

A) The foreign interest rate is lower than the domestic interest rate, and the foreign currency appreciates by more than the interest differential

B) The foreign interest rate is higher than the domestic interest rate, and the foreign currency appreciates by more than the interest differential

C) The foreign interest rate is less than the domestic rate, and the domestic currency stays unchanged

D The foreign interest rate is higher than the domestic interest rate, and the foreign currenc depreciates by a percentage which is equal to the interest differential

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

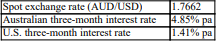

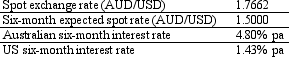

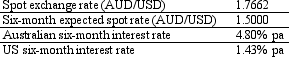

Calculate the precise inward uncovered margin from an Australian perspective. You are given the following information:

A) 2,197 basis points

B) -1,375 basis points

C) 1,986 basis points

D) Nil

A) 2,197 basis points

B) -1,375 basis points

C) 1,986 basis points

D) Nil

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

If UIP holds, what should the AUD/USD exchange rate be in six months time, according to the approximate UIP formula? You are given the following information:

A) 1.8257

B) 1.7957

C) 1.7364

D) 1.7662

A) 1.8257

B) 1.7957

C) 1.7364

D) 1.7662

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

Calculate the precise outward uncovered margin from an Australian perspective. You are given the following information:

A) -46 basis points

B) -1,874 basis points

C) 149 basis points

D) -448 basis points

A) -46 basis points

B) -1,874 basis points

C) 149 basis points

D) -448 basis points

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Calculate the approximate inward uncovered margin from an Australian perspective. You are given the following information:

A) 152 basis points.

B) 1,518 basis points.

C) 68 basis points.

D) 298 basis points.

A) 152 basis points.

B) 1,518 basis points.

C) 68 basis points.

D) 298 basis points.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck