Deck 22: Evaluation of Investment Performance

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/38

Play

Full screen (f)

Deck 22: Evaluation of Investment Performance

1

Which of the following is not one of the major factors to consider when comparing different portfolios?

A) differential time periods

B) differential investor preferences

C) differential risk levels

D) appropriate benchmarks

A) differential time periods

B) differential investor preferences

C) differential risk levels

D) appropriate benchmarks

differential investor preferences

2

Which of the following statements is not true concerning portfolios?

A) Diversification can reduce portfolio risk.

B) There do not exist any precise universally agreed upon method of portfolio evaluation.

C) If a portfolio contained unsystematic risk, it is important to know if adequate compensation was earned.

D) The track record of a mutual fund portfolio is a guarantee of future returns.

A) Diversification can reduce portfolio risk.

B) There do not exist any precise universally agreed upon method of portfolio evaluation.

C) If a portfolio contained unsystematic risk, it is important to know if adequate compensation was earned.

D) The track record of a mutual fund portfolio is a guarantee of future returns.

The track record of a mutual fund portfolio is a guarantee of future returns.

3

Which one of the following statements is true?

Notation: Sharpe - Sharpe's reward-to-variability measure (RVAR)

Treynor - Treynor's reward-to-volatility measure (RVOL)

A) Treynor is based on total risk while Sharpe is based on systematic risk.

B) Sharpe is based on total risk while Treynor is based on systematic risk.

C) Sharpe is based on unsystematic risk while Treynor is based on systematic risk.

D) Treynor is based on total risk while Sharpe is based on unsystematic risk.

Notation: Sharpe - Sharpe's reward-to-variability measure (RVAR)

Treynor - Treynor's reward-to-volatility measure (RVOL)

A) Treynor is based on total risk while Sharpe is based on systematic risk.

B) Sharpe is based on total risk while Treynor is based on systematic risk.

C) Sharpe is based on unsystematic risk while Treynor is based on systematic risk.

D) Treynor is based on total risk while Sharpe is based on unsystematic risk.

Sharpe is based on total risk while Treynor is based on systematic risk.

4

According to Jensen's differential return measure, which interpretation of alpha is incorrect?

A) If alpha is significantly positive, this is evidence of superior performance.

B) If alpha is significantly negative, this is evidence of interior performance.

C) If alpha is insignificantly different from zero, this is evidence that the portfolio manager did not match the market on a risk-adjusted basis.

D) All the above are correct interpretations of alpha.

A) If alpha is significantly positive, this is evidence of superior performance.

B) If alpha is significantly negative, this is evidence of interior performance.

C) If alpha is insignificantly different from zero, this is evidence that the portfolio manager did not match the market on a risk-adjusted basis.

D) All the above are correct interpretations of alpha.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

5

The alpha for a particular fund for a particular period can be:

A) zero or positive, but not negative.

B) zero or negative, but not positive.

C) positive or negative, but not zero.

D) positive, zero, or negative.

A) zero or positive, but not negative.

B) zero or negative, but not positive.

C) positive or negative, but not zero.

D) positive, zero, or negative.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

6

Superior portfolio performance can result:

A) from only the selection of undervalued securities.

B) from only the superior ability to time market turns.

C) from either the superior selectivity or timing performance.

D) neither from superior selection nor timing as the market is too efficient.

A) from only the selection of undervalued securities.

B) from only the superior ability to time market turns.

C) from either the superior selectivity or timing performance.

D) neither from superior selection nor timing as the market is too efficient.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

7

Select the correct statement about Sharpe's reward-to-variability ratio (RVAR).

A) RVAR is an absolute measure of performance.

B) RVAR measures the slope of the line from RF to the portfolio being evaluated.

C) The closer the RVAR to 0.0, the better is the performance.

D) RVAR does not take into account how well diversified a portfolio was.

A) RVAR is an absolute measure of performance.

B) RVAR measures the slope of the line from RF to the portfolio being evaluated.

C) The closer the RVAR to 0.0, the better is the performance.

D) RVAR does not take into account how well diversified a portfolio was.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

8

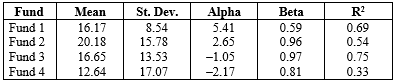

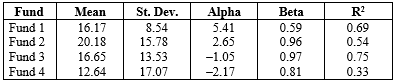

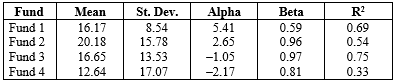

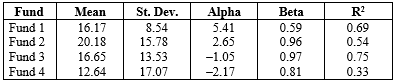

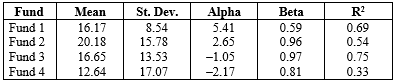

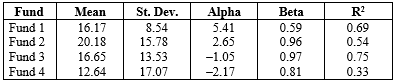

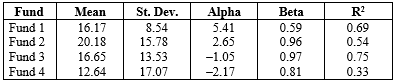

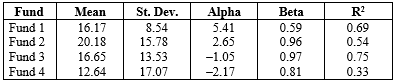

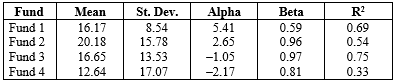

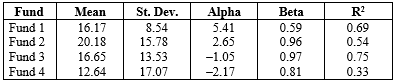

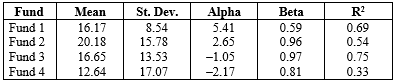

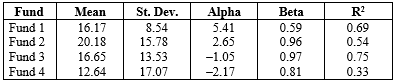

The following information is to be used to answer the following questions

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-Sharpe's RVAR for the Market Index was:

A) negative.

B) between zero and 1.0.

C) between 1.0 and 5.0.

D) greater than 5.0.

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-Sharpe's RVAR for the Market Index was:

A) negative.

B) between zero and 1.0.

C) between 1.0 and 5.0.

D) greater than 5.0.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

9

The following information is to be used to answer the following questions

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The mutual fund with the best performance, using Treynor's RVOL was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The mutual fund with the best performance, using Treynor's RVOL was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

10

The following information is to be used to answer the following questions

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The fund with the best performance, using Sharpe's RVAR was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The fund with the best performance, using Sharpe's RVAR was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

11

The following information is to be used to answer the following questions

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The fund with the smallest proportion of systematic risk was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The fund with the smallest proportion of systematic risk was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

12

The following information is to be used to answer the following questions

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The mutual fund with the lowest proportion of non-systematic risk was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The mutual fund with the lowest proportion of non-systematic risk was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

13

The following information is to be used to answer the following questions

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The mutual fund with the greatest diversification was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Over the 11-year period,1997-2007, the Market Index (MI) had an average annual return of 13.5 percent and a standard deviation of 9 percent. The average annual return on Treasury bills was 6.75 percent. For four open-end mutual funds, some summary data are shown:

-The mutual fund with the greatest diversification was:

A) Fund 1.

B) Fund 2.

C) Fund 3.

D) Fund 4.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

14

The last step in the investment process involves:

A) realizing actual gains through the liquidation of the portfolio.

B) changing the characteristics of the portfolio by rebalancing.

C) measuring the ex post return on the portfolio to make ex ante return forecasts.

D) evaluating the performance of the portfolio relative to its risk.

A) realizing actual gains through the liquidation of the portfolio.

B) changing the characteristics of the portfolio by rebalancing.

C) measuring the ex post return on the portfolio to make ex ante return forecasts.

D) evaluating the performance of the portfolio relative to its risk.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

15

Sharpe's reward-to-volatility ratio measures the excess return per unit of:

A) total risk.

B) systematic risk.

C) market risk.

D) nonmarket risk.

A) total risk.

B) systematic risk.

C) market risk.

D) nonmarket risk.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

16

Under Jensen's differential return approach to portfolio evaluation, superior market timing is exhibited by a:

A) positive alpha that is statistically significant.

B) negative alpha that is statistically significant.

C) zero alpha.

D) statistically significant beta since alphas can be positive, negative or zero.

A) positive alpha that is statistically significant.

B) negative alpha that is statistically significant.

C) zero alpha.

D) statistically significant beta since alphas can be positive, negative or zero.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

17

The dollar-weighted rate of return (DWR) measure:

A) compounds all cash flows except the initial portfolio value to determine the terminal value.

B) is equivalent to the IRR measure used in capital budgeting.

C) is an appropriate measure to make comparisons to other portfolios or market indexes.

D) like the Time-Weighted Returns (TWR) are heavily influenced by cash flows subsequent to the initial amount.

A) compounds all cash flows except the initial portfolio value to determine the terminal value.

B) is equivalent to the IRR measure used in capital budgeting.

C) is an appropriate measure to make comparisons to other portfolios or market indexes.

D) like the Time-Weighted Returns (TWR) are heavily influenced by cash flows subsequent to the initial amount.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

18

The first step in performance attribution of a portfolio:

A) seeks to determine before the fact why success or failure occurred.

B) is typically a bottom-up approach.

C) does not require the identification of a benchmark of performance.

D) is often to begin with the policy statement that guides the management of a portfolio.

A) seeks to determine before the fact why success or failure occurred.

B) is typically a bottom-up approach.

C) does not require the identification of a benchmark of performance.

D) is often to begin with the policy statement that guides the management of a portfolio.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

19

CFA Institute's Global Investment Performance Standards® (GIPS®) require:

A) cash accounting.

B) inclusion of terminated portfolios.

C) a 10-year performance record as the minimum period to be presented.

D) exclusion of cash and cash equivalents.

A) cash accounting.

B) inclusion of terminated portfolios.

C) a 10-year performance record as the minimum period to be presented.

D) exclusion of cash and cash equivalents.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

20

CFA Institute's Global Investment Performance Standards® (GIPS®):

A) are adopted on a nation by nation basis.

B) allow performance measures to be tailored but disclosed for each portfolio.

C) seek to promote fair global competition for investment firms without creating barriers to entry.

D) are inconsistent with industry regulation on a global basis.

A) are adopted on a nation by nation basis.

B) allow performance measures to be tailored but disclosed for each portfolio.

C) seek to promote fair global competition for investment firms without creating barriers to entry.

D) are inconsistent with industry regulation on a global basis.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

21

Evaluating portfolio performance is only important if the investment is made directly.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

22

To assess portfolio carefully, an investor must evaluate the portfolio's returns on a risk-adjusted basis.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

23

Differential time periods is only a problem when comparing different mutual funds.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

24

The benchmark portfolio is normally considered to be the S&P/TSX Composite Index.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

25

Sharpe's measure is a ratio of excess return to the standard deviation of the portfolio.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

26

Treynor's measure is a ratio of excess return on a portfolio to its beta.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

27

Jensen's measure of performance, just like Sharpe's measure, is based on the CAPM.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

28

Under CFA Institute's Global Investment Performance Standards® (GIPS®), 10 years is the minimum period to be presented for a performance record.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

29

Jensen's measure was not designed for ranking portfolio performance, but it can be modified to do so

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

30

When evaluating the performance of a mutual fund manager, one should use the dollar-weighted return method.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

31

Any differences between RVAR and RVOL measures are attributable to the poor diversification of the portfolio.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

32

The CFA Institute's Global Investment Performance Standards® (GIPS®) specifically states that time-weighted rates of return must be presented.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

33

Treynor's alpha is very suitable for ranking portfolio performance.

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

34

What should one consider when evaluating a portfolio's performance?

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

35

What are two objectives of CFA Institute's Global Investment Performance Standards® (GIPS®)? What are several of their presentation requirements?

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

36

How well do relative performance measures predict future performance?

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

37

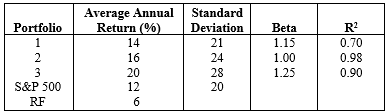

The following data are available for three portfolios and the market for a recent 10-year period:

(a) Rank these portfolios using the Sharpe measure (3 = highest).

(b) Rank these portfolios using the Treynor measure.

(c) Which of these portfolios outperformed the market?

(a) Rank these portfolios using the Sharpe measure (3 = highest).

(b) Rank these portfolios using the Treynor measure.

(c) Which of these portfolios outperformed the market?

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck

38

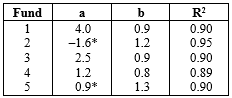

Consider the following five funds.

*Significant at the 5 per cent level

(a) Which fund's returns are best explained by the market's returns?

(b) Which fund had the largest total risk?

(c) Which fund had the lowest market risk? The highest?

(d) Which fund(s), according to Jensen's alpha, outperformed the market?

*Significant at the 5 per cent level

(a) Which fund's returns are best explained by the market's returns?

(b) Which fund had the largest total risk?

(c) Which fund had the lowest market risk? The highest?

(d) Which fund(s), according to Jensen's alpha, outperformed the market?

Unlock Deck

Unlock for access to all 38 flashcards in this deck.

Unlock Deck

k this deck