Deck 19: Options

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/55

Play

Full screen (f)

Deck 19: Options

1

Securities that give the holder the right, but not the obligation, to buy or sell a stated number of shares of stock within a specified period at a specified price is a(n):

A) futures contract.

B) option contract.

C) swap contract.

D) forward contract.

A) futures contract.

B) option contract.

C) swap contract.

D) forward contract.

option contract.

2

The standard option contract on an organized exchange is written on:

A) 10 shares of stock.

B) 50 shares of stock.

C) 100 shares of stock.

D) 1 share of stock.

A) 10 shares of stock.

B) 50 shares of stock.

C) 100 shares of stock.

D) 1 share of stock.

100 shares of stock.

3

Investors purchase call options when they expect the price of the underlying stock to:

A) increase.

B) decrease.

C) remain the same.

D) show great price volatility.

A) increase.

B) decrease.

C) remain the same.

D) show great price volatility.

increase.

4

Another name for the premium of the option is:

A) price paid by the option writer to the option buyer.

B) price paid by the option buyer to the writer of the option.

C) the per-share price that the option writer receives when the option is exercised.

D) the per-share prices that the option holder pays when the option is exercised.

A) price paid by the option writer to the option buyer.

B) price paid by the option buyer to the writer of the option.

C) the per-share price that the option writer receives when the option is exercised.

D) the per-share prices that the option holder pays when the option is exercised.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

5

The exercise price on an option :

A) changes as the price of the underlying stock increases or decreases.

B) has a series of standardized strike prices.

C) is not adjusted for stock splits.

D) is also known as the option premium.

A) changes as the price of the underlying stock increases or decreases.

B) has a series of standardized strike prices.

C) is not adjusted for stock splits.

D) is also known as the option premium.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements is true regarding a put writer?

A) The put writer expects the stock to remain the same or move upward.

B) The put writer expects the stock to remain the same or move down.

C) The put writer expects the stock to split.

D) The put writer expects to sell the stock prior to expiration of the option.

A) The put writer expects the stock to remain the same or move upward.

B) The put writer expects the stock to remain the same or move down.

C) The put writer expects the stock to split.

D) The put writer expects to sell the stock prior to expiration of the option.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

7

Which one is not a determinant of the value of a call option in the Black-Scholes model?

A) Volatility of the continuously compounded rate of return on the underlying stock

B) Exercise price of the option

C) Price of the underlying stock

D) The expected dividends on the underlying stock

A) Volatility of the continuously compounded rate of return on the underlying stock

B) Exercise price of the option

C) Price of the underlying stock

D) The expected dividends on the underlying stock

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

8

In order to hedge a short sale, which of the following basic option strategies would that investor follow?

A) buy a call.

B) write a call.

C) buy a put.

D) write a put.

A) buy a call.

B) write a call.

C) buy a put.

D) write a put.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

9

If the price of the common stock is below the exercise price of a put contract on the stock the put is said to be:

A) at the money.

B) out of the money.

C) in the money.

D) covered.

A) at the money.

B) out of the money.

C) in the money.

D) covered.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

10

Options that trade on organized exchanges are protected against:

A) default risk.

B) stock splits.

C) interest rate movements.

D) inflation.

A) default risk.

B) stock splits.

C) interest rate movements.

D) inflation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

11

Other things being equal, after an option first trades in the market:

A) its time value begins to decline and approaches zero as time gets closer to expiration.

B) its time value increases eventually reaching intrinsic value at expiration.

C) its time value increases if it is a call and decreases if it is a put.

D) if it is out of the money, it will have no time value.

A) its time value begins to decline and approaches zero as time gets closer to expiration.

B) its time value increases eventually reaching intrinsic value at expiration.

C) its time value increases if it is a call and decreases if it is a put.

D) if it is out of the money, it will have no time value.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

12

A writer of a call can terminate that particular contract anytime before its expiration by:

A) writing a second call.

B) buying a put.

C) buying a comparable call.

D) writing a put.

A) writing a second call.

B) buying a put.

C) buying a comparable call.

D) writing a put.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

13

The writer of a naked call faces:

A) limited potential profit and limited potential loss.

B) limited potential profit and unlimited potential loss.

C) unlimited potential profit and limited potential loss.

D) unlimited potential profit and unlimited potential loss.

A) limited potential profit and limited potential loss.

B) limited potential profit and unlimited potential loss.

C) unlimited potential profit and limited potential loss.

D) unlimited potential profit and unlimited potential loss.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is true for the time value of an option?

A) time value = option price - intrinsic value.

B) time value = intrinsic value + option price.

C) Time value is another name for intrinsic value.

D) Time value is zero for out of the money options.

A) time value = option price - intrinsic value.

B) time value = intrinsic value + option price.

C) Time value is another name for intrinsic value.

D) Time value is zero for out of the money options.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

15

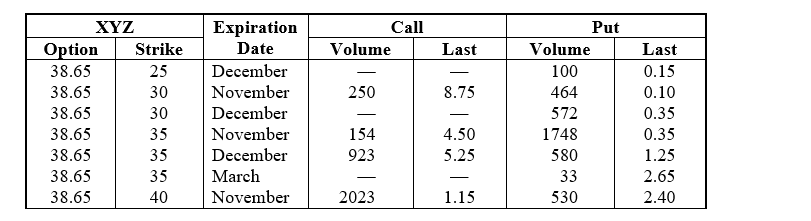

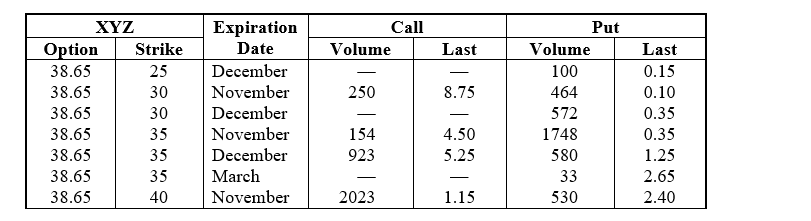

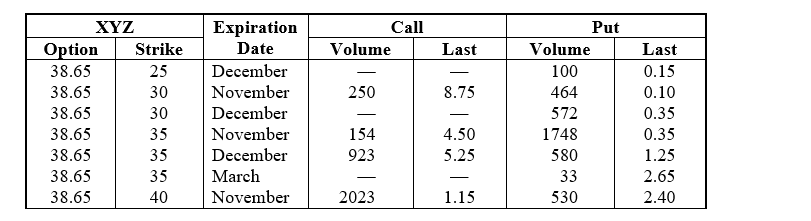

Questions are based on the following options data for XYZ Corporation:

-Of the series of options shown above, how many of the put contracts are currently trading out of the money?

A) 6

B) 5

C) 4

D) 1

-Of the series of options shown above, how many of the put contracts are currently trading out of the money?

A) 6

B) 5

C) 4

D) 1

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

16

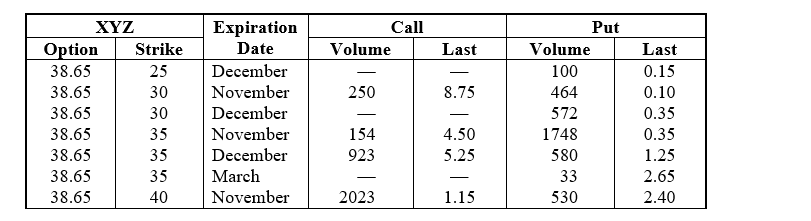

Questions are based on the following options data for XYZ Corporation:

-Which of the following options is furthest in the money?

A) November 30 Call

B) November 35 Call.

C) December 35Call

D) November 40 Call

-Which of the following options is furthest in the money?

A) November 30 Call

B) November 35 Call.

C) December 35Call

D) November 40 Call

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following statements is false?

A) An in the money call occurs if the stock price exceeds the exercise price.

B) An out of the money call occurs if the stock price is less than the exercise price.

C) If a call is out of the money, the intrinsic value is zero.

D) If a call is in the money, the intrinsic value is zero.

A) An in the money call occurs if the stock price exceeds the exercise price.

B) An out of the money call occurs if the stock price is less than the exercise price.

C) If a call is out of the money, the intrinsic value is zero.

D) If a call is in the money, the intrinsic value is zero.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements is false?

A) Options are a wasting asset.

B) Option prices almost always exceed intrinsic values.

C) As expiration approaches, the value of the option declines to zero.

D) The intrinsic value of a call is equal to its market value.

A) Options are a wasting asset.

B) Option prices almost always exceed intrinsic values.

C) As expiration approaches, the value of the option declines to zero.

D) The intrinsic value of a call is equal to its market value.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following statements is true?

A) The option premium is paid by the option writer.

B) The further that an option is in the money, the lower the option's intrinsic value.

C) An option's premium is usually below its intrinsic value.

D) When a call's exercise price is below the market price of the stock it is in the money.

A) The option premium is paid by the option writer.

B) The further that an option is in the money, the lower the option's intrinsic value.

C) An option's premium is usually below its intrinsic value.

D) When a call's exercise price is below the market price of the stock it is in the money.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

20

In addition to options trading on stocks, listed options are also offered on which of the following underlying assets:

A) stock-index options

B) interest rate options

C) currency options

D) All of the above have listed option contracts.

A) stock-index options

B) interest rate options

C) currency options

D) All of the above have listed option contracts.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is false regarding options prices?

A) At expiration, a call must have a value that is the maximum of 0 or its intrinsic value.

B) At expiration, a put must have a value that is the maximum of 0 or its intrinsic value.

C) The minimum price for a put is the price of the underlying stock.

D) The maximum price for a call is the price of the underlying stock.

A) At expiration, a call must have a value that is the maximum of 0 or its intrinsic value.

B) At expiration, a put must have a value that is the maximum of 0 or its intrinsic value.

C) The minimum price for a put is the price of the underlying stock.

D) The maximum price for a call is the price of the underlying stock.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

22

All of the following will lead to an increase of the market value of a call option except:

A) The price of the underlying increases.

B) The exercise price of the option contract increases.

C) The volatility of the continuously compounded rate of return on the underlying stock increases.

D) The time remaining to the expiration of the option increases

A) The price of the underlying increases.

B) The exercise price of the option contract increases.

C) The volatility of the continuously compounded rate of return on the underlying stock increases.

D) The time remaining to the expiration of the option increases

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

23

The three provisions which investors should carefully examine when selecting puts and calls are the:

A) option premium, expiration date, and striking price.

B) leverage ratio, time to maturity, and conversion premium.

C) hedge ratio, the speculative premium, and current stock price.

D) premium, maturity, and dividend yield.

A) option premium, expiration date, and striking price.

B) leverage ratio, time to maturity, and conversion premium.

C) hedge ratio, the speculative premium, and current stock price.

D) premium, maturity, and dividend yield.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not true concerning stock-index options?

A) Stock-index options enable investors to trade on general stock market movements.

B) Stock-index options are available on the S&P/TSX 60 and various ETFs.

C) Most index-options are European style, including the S&P/TSX 60 Index options.

D) In Canada stock-index options trade on the TSX.

A) Stock-index options enable investors to trade on general stock market movements.

B) Stock-index options are available on the S&P/TSX 60 and various ETFs.

C) Most index-options are European style, including the S&P/TSX 60 Index options.

D) In Canada stock-index options trade on the TSX.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

25

When an investor purchases one put contract and one call contract on the same stock with the same exercise price and expiry date he or she has formed a:

A) strip.

B) straddle.

C) strap.

D) spread.

A) strip.

B) straddle.

C) strap.

D) spread.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

26

A purchaser of a straddle:

A) believes that the underlying stock price will exhibit small volatility.

B) believes that the underlying stock price is highly volatile.

C) believes that the stock price will go up only a little.

D) believes that the stock price will go down only a little.

A) believes that the underlying stock price will exhibit small volatility.

B) believes that the underlying stock price is highly volatile.

C) believes that the stock price will go up only a little.

D) believes that the stock price will go down only a little.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

27

A combination of two puts and one call on the same stock with the same exercise price and expiry date is called a:

A) strip.

B) strap.

C) straddle.

D) spread.

A) strip.

B) strap.

C) straddle.

D) spread.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not a major difference between calls and warrants?

A) Warrants are generally longer term than calls.

B) Warrants are issued by corporation; calls are not.

C) Warrants provide more leverage than calls.

D) Warrants are not standardized; calls are.

A) Warrants are generally longer term than calls.

B) Warrants are issued by corporation; calls are not.

C) Warrants provide more leverage than calls.

D) Warrants are not standardized; calls are.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not a factor that affects the premium of a warrant?

A) price volatility of the common stock

B) current price of the warrant

C) dividend on the common stock

D) potential leverage of the warrant

A) price volatility of the common stock

B) current price of the warrant

C) dividend on the common stock

D) potential leverage of the warrant

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following is not a characteristic of a right?

A) Rights generally have short maturities consisting of a few weeks to three months.

B) Rights have certificates mailed to shareholders on the record date.

C) Rights are usually transferable.

D) The subscription price for a right is generally higher than the current market price.

A) Rights generally have short maturities consisting of a few weeks to three months.

B) Rights have certificates mailed to shareholders on the record date.

C) Rights are usually transferable.

D) The subscription price for a right is generally higher than the current market price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

31

A protective put is a strategy in which a short seller sells a call.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

32

The strategies with stock index options are considerably different from those for individual stocks.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

33

An option buyer has three courses of action available: exercise the option, sell it or let it expire.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

34

A straddle is considered a type of spread.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

35

Warrants are issued by corporations while puts and calls are written by investors.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

36

Warrants usually have expiration dates than are longer than rights.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

37

The options clearing corporation ensures fulfillment of option obligations.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

38

There is direct relationship between the price of a call option and the volatility of the underlying common stock.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

39

Writing a naked call can result in a greater loss than writing a naked put.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

40

Option trades settle on the next business day after the trade.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

41

The hedge ratio is the ratio of options written to shares of stock held long in a riskless portfolio.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

42

Put-call parity exists when the call and the put on the same stock for the same strike price and same expiration date have the same price.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

43

Stock index options are always used for hedging and not for speculation.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

44

Call options are normally bought by investors who expect the stock price to fall.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

45

Compare warrants with listed calls.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

46

What does the purchaser of a straddle think about the future of the underlying stock?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

47

What are the price boundaries for a warrant?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

48

A stock investor wants to hedge the BMO stock in his portfolio. How can he use a covered call to do this?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

49

A stock investor wants to hedge the TELUS Corp. stock in his portfolio. How can he use a protective put to do this?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

50

How would you replicate the payoff on a short position in a stock, using a call, a put, and a risk-free bond?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

51

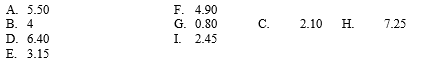

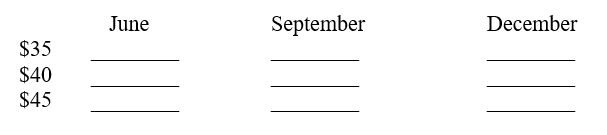

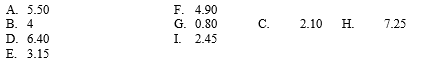

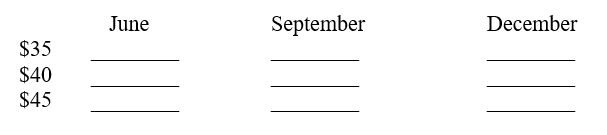

SCORP has puts and calls available for trading for the expiration months of June, September, and December. For the trading day May 2, 20XX, SCORP closed at $40 per share. Strike prices for SCORP are $35, $40, and $45. The following prices for the nine call options (three expiration dates and three strike prices) for this date were (in scrambled order):

Fill in the following matrix of prices for these calls, using letters only (i.e., A through I)

Fill in the following matrix of prices for these calls, using letters only (i.e., A through I)

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

52

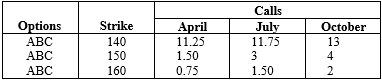

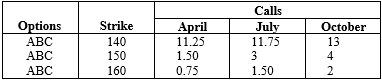

ABC, which closed at $151, has call options trading in April, July, and October with the following values:

(a) Calculate the intrinsic value of the April 150 call.

(b) Calculate the intrinsic value of the April 140 call.

(c) Should the price of ABC rise to $156, what is the minimum value that the April 150 call should trade at?

(a) Calculate the intrinsic value of the April 150 call.

(b) Calculate the intrinsic value of the April 140 call.

(c) Should the price of ABC rise to $156, what is the minimum value that the April 150 call should trade at?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

53

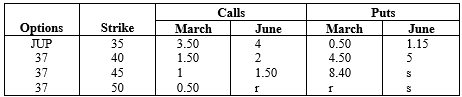

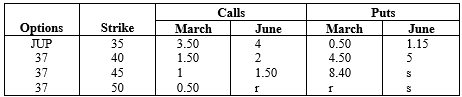

Listed below are the option quotes on JUP, Inc., in January of this year.

(a) Which calls are in the money?

(b) Which puts are in the money?

(c) Why are investors willing to pay 3.50 for the March 35 call but only 0.50 for the March 35 put?

(d) Calculate the intrinsic value of the June 35 call.

(e) Calculate the intrinsic value of the March 40 put.

(a) Which calls are in the money?

(b) Which puts are in the money?

(c) Why are investors willing to pay 3.50 for the March 35 call but only 0.50 for the March 35 put?

(d) Calculate the intrinsic value of the June 35 call.

(e) Calculate the intrinsic value of the March 40 put.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

54

Use the Black-Scholes model to calculate the theoretical value of a DBA December 45 call option. Assume that the risk free rate of return is 6 per cent, the stock has a variance of 36 per cent, there are 91 days until expiration of the contract, and DBA stock is currently selling at $50 in the market.

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck

55

You buy 1,000 shares of Sunbeam at 11.15 and write 10 calls at a premium of 4.40 with a strike price of 7.50 1/2. The stock goes to 20 in 6 months. You receive an 8 cent dividend per share. If the calls are exercised (which is the likely assumption), what is your percentage return?

Unlock Deck

Unlock for access to all 55 flashcards in this deck.

Unlock Deck

k this deck