Deck 13: Capital Structure and Distribution Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/30

Play

Full screen (f)

Deck 13: Capital Structure and Distribution Policy

1

The textbook suggests that the capital structure of the consolidated MNE is more important than and should take precedence over the local debt ratios of operating subsidiaries in determining the optimal capital structure. Reasons given in support of this proposition include all except which of the following statements?

A) Investors typically focus on the MNE's consolidated capital structure, translated into market values, so the consolidated capital structure should be of primary concern.

B) Creditors generally expect the parent to guarantee debt issued by subsidiaries in other countries, so subsidiary borrowings are often really obligations of the parent. This suggests that the consolidated capital structure is what is important.

C) If the MNE optimized each subsidiary capital structure according to local norms, it is unlikely that the consolidated capital structure would be optimal in the home-country market, leading to a higher cost of capital and lower firm value.

D) MNEs receive benefits from their global network that domestic companies cannot duplicate, and the MNE should not give up its global financing advantages in order to conform to local capital structure norms.

E) All of the statements above are reasons that support the view that the consolidated capital structure is what matters.

A) Investors typically focus on the MNE's consolidated capital structure, translated into market values, so the consolidated capital structure should be of primary concern.

B) Creditors generally expect the parent to guarantee debt issued by subsidiaries in other countries, so subsidiary borrowings are often really obligations of the parent. This suggests that the consolidated capital structure is what is important.

C) If the MNE optimized each subsidiary capital structure according to local norms, it is unlikely that the consolidated capital structure would be optimal in the home-country market, leading to a higher cost of capital and lower firm value.

D) MNEs receive benefits from their global network that domestic companies cannot duplicate, and the MNE should not give up its global financing advantages in order to conform to local capital structure norms.

E) All of the statements above are reasons that support the view that the consolidated capital structure is what matters.

All of the statements above are reasons that support the view that the consolidated capital structure is what matters.

2

Greater differences exist in capital structures from country to country than among industries within a given country. Reasons for this finding include all except which of the following statements?

A) Investors in different countries differ significantly in their willingness to assume risk, and this translates into more or less aggressive capital structures.

B) Governments in different countries impose different minimum equity capitalization requirements, and this translates into higher or lower debt ratios.

C) Information asymmetries and thus agency costs, are thought to be higher in shareholder-based systems of corporate governance (like in the U.S.) than in bank-based systems (like in Germany and Japan), so different capital structures are observed.

D) Capital structures in countries whose stock markets are not very efficient tend to have higher debt ratios because of the challenges of raising capital through new equity offerings.

E) Countries that are more concerned about employment, social security, etc. than about economic efficiency tend to adopt policies that discourage bankruptcy except in extreme circumstances, so the usual restraints on excessive debt do not operate as they would in open markets and companies use higher debt ratios.

A) Investors in different countries differ significantly in their willingness to assume risk, and this translates into more or less aggressive capital structures.

B) Governments in different countries impose different minimum equity capitalization requirements, and this translates into higher or lower debt ratios.

C) Information asymmetries and thus agency costs, are thought to be higher in shareholder-based systems of corporate governance (like in the U.S.) than in bank-based systems (like in Germany and Japan), so different capital structures are observed.

D) Capital structures in countries whose stock markets are not very efficient tend to have higher debt ratios because of the challenges of raising capital through new equity offerings.

E) Countries that are more concerned about employment, social security, etc. than about economic efficiency tend to adopt policies that discourage bankruptcy except in extreme circumstances, so the usual restraints on excessive debt do not operate as they would in open markets and companies use higher debt ratios.

Governments in different countries impose different minimum equity capitalization requirements, and this translates into higher or lower debt ratios.

3

Which of the reasons listed below support a policy of a high dividend payout from a foreign operating subsidiary to the parent (a so-called "internal" dividend)?

A) Devaluation of the local currency in the host country is expected and the MNE wants to remove as many monetary assets as possible from the country before the devaluation occurs.

B) Repatriated profits are subject to additional taxes in the U.S. if the local tax rate is lower than the U.S. rate or to excess foreign tax credits that the company may or may not be able to use in the current period.

C) Local minority shareholders want high and stable dividends.

D) All of the statements above support a high internal dividend payout policy.

E) Only statements a and c support a high internal dividend payout policy.

A) Devaluation of the local currency in the host country is expected and the MNE wants to remove as many monetary assets as possible from the country before the devaluation occurs.

B) Repatriated profits are subject to additional taxes in the U.S. if the local tax rate is lower than the U.S. rate or to excess foreign tax credits that the company may or may not be able to use in the current period.

C) Local minority shareholders want high and stable dividends.

D) All of the statements above support a high internal dividend payout policy.

E) Only statements a and c support a high internal dividend payout policy.

Only statements a and c support a high internal dividend payout policy.

4

Bellhorn Shoes' value with no debt is $150 million. However, the firm uses $60 million in debt financing, and its corporate tax rate is 40 percent. Bellhorn's CFO is trying to value the firm now. By how much does the firm's value change, if the CFO values Bellhorn using Modigliani and Miller's corporate taxes model instead of the no taxes model?

A) $20 million

B) $24 million

C) $36 million

D) $44 million

E) $60 million

A) $20 million

B) $24 million

C) $36 million

D) $44 million

E) $60 million

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

5

Mueller Inc.'s value with no debt is $130 million. However, the firm uses $30 million in debt financing, and its corporate tax rate is 40 percent. Mueller's CFO is trying to value the firm now. The appropriate personal tax rates on debt and stock income are 35 and 15 percent, respectively. By how much does the firm's value change, if the CFO values Mueller using Modigliani and Miller's corporate and personal taxes model instead of the no taxes model?

A) $6.46 million

B) $10.05 million

C) $12.92 million

D) $16.88 million

E) $18.51 million

A) $6.46 million

B) $10.05 million

C) $12.92 million

D) $16.88 million

E) $18.51 million

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

6

Damon Corporation's value with no debt is $270 million. However, the firm uses $70 million in debt financing, and its corporate tax rate is 40 percent. Damon's CFO is trying to value the firm now. The appropriate personal tax rates on debt and stock income are 35 and 15 percent, respectively. By how much does the firm's value change, if the CFO values Damon using Modigliani and Miller's corporate taxes model instead of the corporate and personal taxes model?

A) $8.54 million

B) $9.68 million

C) $12.92 million

D) $13.20 million

E) $14.52 million

A) $8.54 million

B) $9.68 million

C) $12.92 million

D) $13.20 million

E) $14.52 million

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

7

Lowe Co. has a capital budget of $1,200,000. The company wants to maintain a target capital structure that consists of 60 percent debt and 40 percent common equity. The company forecasts that its net income this year will be $600,000. If the company follows a residual dividend policy, what will be its payout ratio?

A) 10%

B) 20%

C) 30%

D) 40%

E) 50%

A) 10%

B) 20%

C) 30%

D) 40%

E) 50%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

8

Martinez Brothers Imports has a current debt ratio of 33.33 percent, and it needs to raise $100,000 to expand production. Management feels that its current debt ratio is too high and that an optimal debt ratio would be 16.67 percent. Sales are currently $750,000, and its total assets turnover is 7.5. How should its expansion be financed so Martinez reaches its desired debt ratio?

A) 100% equity

B) 20% debt, 80% equity

C) 40% debt, 60% equity

D) 60% debt, 40% equity

E) 100% debt

A) 100% equity

B) 20% debt, 80% equity

C) 40% debt, 60% equity

D) 60% debt, 40% equity

E) 100% debt

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

9

Kapler Inc. expects EBIT of $2,000,000 for the coming year. The firm's capital structure consists of 40 percent debt and 60 percent common equity, and its marginal tax rate is 40 percent. The cost of common equity is 14 percent, and the company pays a 10 percent interest rate on its $5,000,000 of long-term debt. One million shares of common stock are outstanding. In its next capital budgeting cycle, the firm expects to fund one large positive NPV project requiring an investment of $1,200,000, in accordance with its target capital structure. Assume that new debt will also have an interest rate of 10 percent. If the firm follows a residual dividend policy and has no other projects, what is its expected dividend payout ratio?

A) 12.9%

B) 15.1%

C) 16.5%

D) 17.4%

E) 19.3%

A) 12.9%

B) 15.1%

C) 16.5%

D) 17.4%

E) 19.3%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

10

Ramirez Supplies believes that at its current stock price of $16.00 the firm is undervalued in the market. Ramirez plans to repurchase 2.4 million of its 20 million shares outstanding. The firm's managers expect that they can repurchase the entire 2.4 million shares at the expected equilibrium price after repurchase. The firm's current earnings are $44 million. If management's assumptions hold, what is the expected per-share market price after repurchase? Assume that the firm's P/E ratio is not affected by the recapitalization.

A) $16.44

B) $17.37

C) $18.18

D) $19.58

E) $22.39

A) $16.44

B) $17.37

C) $18.18

D) $19.58

E) $22.39

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

11

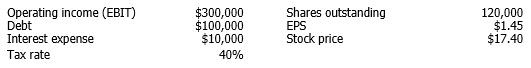

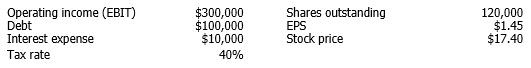

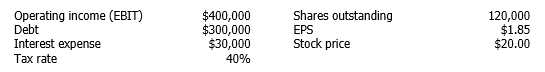

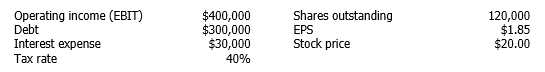

The following information applies to Shilling Medical Supplies:

The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.

The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.

Assume that the recapitalization has no effect on the company's price earnings (P/E) ratio. What is the expected price of the company's stock following the recapitalization?

A) $15.00

B) $16.25

C) $17.40

D) $18.00

E) $20.88

The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.

The company is considering a recapitalization where it would issue $348,000 worth of new debt and use the proceeds to buy back $348,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($17.40). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $50,000.Assume that the recapitalization has no effect on the company's price earnings (P/E) ratio. What is the expected price of the company's stock following the recapitalization?

A) $15.00

B) $16.25

C) $17.40

D) $18.00

E) $20.88

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

12

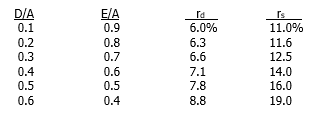

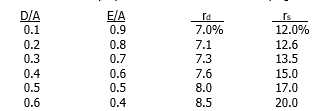

Foulke Enterprises has no debt, and is financed with 100 percent equity. The firm's marginal tax rate is 40 percent. However, Foulke's CFO is looking into restructuring the firm with some debt. He has estimated the costs of common equity and debt if Foulke raises varying amounts of capital as shown below:

If Foulke wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

If Foulke wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

A) 20%

B) 30%

C) 40%

D) 50%

E) 60%

If Foulke wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

If Foulke wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?A) 20%

B) 30%

C) 40%

D) 50%

E) 60%

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

13

The theories proposed by Professors Modigliani and Miller required several very restrictive assumptions. Since some of the assumptions are unrealistic, why should we care about what their theories said?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

14

Describe how the various Modigliani and Miller papers proceeded to evaluate the effect of capital structure on firm value and the cost of capital.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

15

Differentiate between internal and external corporate dividend policy.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

16

Are capital structures around the world generally the same or different, and what factors might impact capital structure?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

17

Should a multinational firm develop an optimal capital structure policy for the corporate entity or for each foreign subsidiary

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

18

Differentiate between target and optimal capital structures

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

19

Differentiate between business and financial risks

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

20

Do investors prefer dividends or capital gains? Explain.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

21

What is the residual dividend model, and how can it be used to set dividend policy?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

22

Millar Corporation's value with no debt is $130 million. However, the firm uses $50, million in debt financing, and its corporate tax rate is 40 percent. Millar's CFO is trying to value the firm now. By how much does the firm's value change, if the CFO values Millar using Modigliani and Miller's corporate taxes model instead of the no taxes model?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

23

Timlin Motors' value with no debt is $380 million. However, the firm uses $80 million in debt financing, and its corporate tax rate is 40 percent. Timlin's CFO is trying to value the firm now. The appropriate personal tax rates on debt and stock income are 35 and 15 percent, respectively. By how much does the firm's value change, if the CFO values Timlin using Modigliani and Miller's corporate and personal taxes model instead of the no taxes model?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

24

Embree Inc.'s value with no debt is $220 million. However, the firm uses $90 million in debt financing, and its corporate tax rate is 40 percent. Embree's CFO is trying to value the firm now. The appropriate personal tax rates on debt and stock income are 35 and 15 percent, respectively. By how much does the firm's value change, if the CFO values Embree using Modigliani and Miller's corporate taxes model instead of the corporate and personal taxes model?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

25

Cabrera Construction has a capital budget of $2,300,000. The company wants to maintain a target capital structure that consists of 70 percent debt and 30 percent common equity. The company forecasts that its net income this year will be $800,000. If the company follows a residual dividend policy, what will be its payout ratio?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

26

Hattendorf Consulting has a current debt ratio of 40 percent, and it needs to raise $200,000 to expand production. Management feels that its current debt ratio is too high and that an optimal debt ratio would be 30 percent. Sales are currently $2,000,000, and its total assets turnover is 8.0. How should the expansion be financed so Hattendorf reaches its desired debt ratio?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

27

Boothe Co. expects EBIT of $3,000,000 for the coming year. The firm's capital structure consists of 30 percent debt and 70 percent common equity, and its marginal tax rate is 40 percent. The cost of common equity is 15 percent, and the company pays an 11 percent interest rate on its $6,000,000 of long-term debt. One million shares of common stock are outstanding. In its next capital budgeting cycle, the firm expects to fund one large positive NPV project requiring an investment of $1,600,000, in accordance with its target capital structure. Assume that new debt will also have an interest rate of 11 percent. If the firm follows a residual dividend policy and has no other projects, what is its expected dividend payout ratio?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

28

Evanston Industries believes that at its current stock price of $40.00 the firm is undervalued in the market. Evanston plans to repurchase 1.8 million of its 10 million shares outstanding. The firm's managers expect that they can repurchase the entire 1.8 million shares at the expected equilibrium price after repurchase. The firm's current earnings are $50 million. If management's assumptions hold, what is the expected per-share market price after repurchase? Assume that the firm's P/E ratio is not affected by the recapitalization.

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

29

The following information applies to Bright Techtronics:

The company is considering a recapitalization where it would issue $250,000 worth of new debt and use the proceeds to buy back $250,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($20.00). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $55,000.

The company is considering a recapitalization where it would issue $250,000 worth of new debt and use the proceeds to buy back $250,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($20.00). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $55,000.

Assume that the recapitalization has no effect on the company's price earnings (P/E) ratio. What is the expected price of the company's stock following the recapitalization?

The company is considering a recapitalization where it would issue $250,000 worth of new debt and use the proceeds to buy back $250,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($20.00). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $55,000.

The company is considering a recapitalization where it would issue $250,000 worth of new debt and use the proceeds to buy back $250,000 worth of common stock. The buyback will be undertaken at the pre-recapitalization share price ($20.00). The recapitalization is not expected to have an effect on operating income or the tax rate. After the recapitalization, the company's interest expense will be $55,000.Assume that the recapitalization has no effect on the company's price earnings (P/E) ratio. What is the expected price of the company's stock following the recapitalization?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck

30

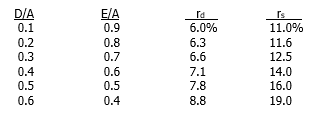

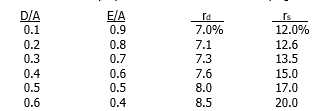

Ellison Enterprises has no debt, and is financed with 100 percent equity. The firm's marginal tax rate is 40 percent. However, Ellison's CFO is looking into restructuring the firm with some debt. He has estimated the costs of common equity and debt if Ellison raises varying amounts of capital.

If Ellison wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

If Ellison wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

If Ellison wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

If Ellison wants to maximize the firm's value by operating at its optimal capital structure, what debt ratio should it achieve?

Unlock Deck

Unlock for access to all 30 flashcards in this deck.

Unlock Deck

k this deck