Deck 11: Capital Budgeting: The Basics

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 11: Capital Budgeting: The Basics

1

The Overseas Private Investment Corporation (OPIC) is a development agency of the U.S. government that offers insurance coverage for most types of projects in almost all countries. This insurance protects companies against all except which of the following risks?

A) Irregular changes of government (that is, coups de état).

B) Currency inconvertibility.

C) Expropriation.

D) Political violence.

E) OPIC insurance protects companies against all of the risks stated above.

A) Irregular changes of government (that is, coups de état).

B) Currency inconvertibility.

C) Expropriation.

D) Political violence.

E) OPIC insurance protects companies against all of the risks stated above.

Irregular changes of government (that is, coups de état).

2

It is often suggested that foreign projects be analyzed from multiple perspectives in order to compartmentalize risks and gain further insight into the potential profitability of an investment. Which of the following analytical points of view is not suggested?

A) Parent or owner perspective.

B) Creditor perspective.

C) Country perspective.

D) Project perspective.

E) All of the analytical perspectives above are suggested in the text as appropriate.

A) Parent or owner perspective.

B) Creditor perspective.

C) Country perspective.

D) Project perspective.

E) All of the analytical perspectives above are suggested in the text as appropriate.

Creditor perspective.

3

Operating cash flows from the project (subsidiary) to the parent include all except which of the following?

A) License fees.

B) Management fees.

C) Royalties.

D) Payment for parts and inventory items.

E) All of the above are operating cash flows to the parent.

A) License fees.

B) Management fees.

C) Royalties.

D) Payment for parts and inventory items.

E) All of the above are operating cash flows to the parent.

All of the above are operating cash flows to the parent.

4

The text suggests that the project should be evaluated from the perspective of host country stakeholders (usually this is restricted to the government). Which of the following statements are not reasons for this recommendation?

A) The country analysis allows management to assess whether the project adds value to the country, thereby giving insight into potential future problems.

B) The country analysis demonstrates to local monetary authorities the impact of the project on the balance of trade and, hence, on its ability to manage the economy.

C) The country analysis highlights the impact of the project on politically sensitive areas such as job creation, training, social services, and technology access.

D) The country analysis provides relevant information about the project that can be used during negotiations with the host government about the terms under which the project will be allowed.

E) All of the statements above are reasons a country analysis is recommended.

A) The country analysis allows management to assess whether the project adds value to the country, thereby giving insight into potential future problems.

B) The country analysis demonstrates to local monetary authorities the impact of the project on the balance of trade and, hence, on its ability to manage the economy.

C) The country analysis highlights the impact of the project on politically sensitive areas such as job creation, training, social services, and technology access.

D) The country analysis provides relevant information about the project that can be used during negotiations with the host government about the terms under which the project will be allowed.

E) All of the statements above are reasons a country analysis is recommended.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

Multinational enterprises with projects in foreign countries face challenges in evaluating projects that are not usually encountered in a purely home country analysis. These challenges include all except which of the following?

A) Cash flows are often generated in foreign currencies and, because exchange rates often fluctuate over time, the dollar-equivalent amounts are even less certain than the original foreign currency cash flows.

B) Some countries either place restrictions on the amount of money that can be repatriated from the local subsidiary to the parent (or prohibit repatriation of capital and earnings until the operation is liquidated or sold to local investors), or impose high taxes on funds sent abroad.

C) Estimating the salvage value of equipment in place at the end of the foreign project's life and the residual value of net operating working capital is complicated by the need to calculate a going concern value in addition to a liquidating value.

D) Foreign projects are subject to the whims and political undercurrents of a sovereign host government that may change the rules for repatriating funds at any time, may adopt confiscatory tax policies (or even expropriate local operations of MNEs), and may change the accounting rules.

E) All of the statements above are challenges encountered in analyzing foreign projects.

A) Cash flows are often generated in foreign currencies and, because exchange rates often fluctuate over time, the dollar-equivalent amounts are even less certain than the original foreign currency cash flows.

B) Some countries either place restrictions on the amount of money that can be repatriated from the local subsidiary to the parent (or prohibit repatriation of capital and earnings until the operation is liquidated or sold to local investors), or impose high taxes on funds sent abroad.

C) Estimating the salvage value of equipment in place at the end of the foreign project's life and the residual value of net operating working capital is complicated by the need to calculate a going concern value in addition to a liquidating value.

D) Foreign projects are subject to the whims and political undercurrents of a sovereign host government that may change the rules for repatriating funds at any time, may adopt confiscatory tax policies (or even expropriate local operations of MNEs), and may change the accounting rules.

E) All of the statements above are challenges encountered in analyzing foreign projects.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

If a foreign subsidiary pays a cash dividend to its parent in the U.S., the U.S. tax authorities require several computations to ascertain the extent of any tax liability in the U.S. Which of the following statements about this process are correct?

A) The company must "gross-up" the dividend to its before-tax equivalent and add this to taxable income.

B) The IRS allows the company to deduct a foreign tax credit from total parent taxable foreign-source dividends before taxes are calculated.

C) If the deemed-paid tax to the foreign country is less than the tax that would be due on the same income in the U.S., the company must pay the difference to the IRS.

D) All of the statements above are correct.

E) Only statements b and c are correct.

A) The company must "gross-up" the dividend to its before-tax equivalent and add this to taxable income.

B) The IRS allows the company to deduct a foreign tax credit from total parent taxable foreign-source dividends before taxes are calculated.

C) If the deemed-paid tax to the foreign country is less than the tax that would be due on the same income in the U.S., the company must pay the difference to the IRS.

D) All of the statements above are correct.

E) Only statements b and c are correct.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

Foreign projects are subjected to unique risks that are not present in domestic projects. Two different methods have been suggested in the literature to allow explicitly for these additional risks. Which of the following statements is most correct when describing how to adjust for foreign risks?

A) When foreign risks are present in a project, an additional risk premium can be included in the denominator of the valuation equation. That is, the WACC can be increased to compensate for the additional project risk.

B) When foreign risks are present in a project, the cash flows in the numerator of the valuation equation can be reduced by including as expenses the cost of neutralizing the foreign risks, and then discounting the remaining net cash flows at a rate appropriate for an equivalent domestic project.

C) When foreign risks are present in a project, the cash flows in the numerator can be reduced by including as expenses the cost of forward cover to neutralize foreign exchange risks and the premium for OPIC insurance that protects against all other risks. The remaining risk-free cash flows are then discounted at the risk-free rate.

D) When foreign risks are present in a project, the beta for the project can be adjusted upward by the ratio of the standard deviation of the project cash flows to the standard deviation of the market, multiplied by 0.6, or

E) Only statements a and b above are feasible, and b is preferred on theoretical grounds if it can be done.

A) When foreign risks are present in a project, an additional risk premium can be included in the denominator of the valuation equation. That is, the WACC can be increased to compensate for the additional project risk.

B) When foreign risks are present in a project, the cash flows in the numerator of the valuation equation can be reduced by including as expenses the cost of neutralizing the foreign risks, and then discounting the remaining net cash flows at a rate appropriate for an equivalent domestic project.

C) When foreign risks are present in a project, the cash flows in the numerator can be reduced by including as expenses the cost of forward cover to neutralize foreign exchange risks and the premium for OPIC insurance that protects against all other risks. The remaining risk-free cash flows are then discounted at the risk-free rate.

D) When foreign risks are present in a project, the beta for the project can be adjusted upward by the ratio of the standard deviation of the project cash flows to the standard deviation of the market, multiplied by 0.6, or

E) Only statements a and b above are feasible, and b is preferred on theoretical grounds if it can be done.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

If an MNE conducts a project analysis of a foreign project whose cash flows are in a foreign currency, then the issue of the additional risk caused by fluctuating exchange rates arises. Companies in practice handle this issue in several different ways. Which of the following procedures is/are recommended in the text?

A) Estimate the project's cash flows in the foreign currency and discount them at the appropriate host country discount rate. Convert the resulting foreign currency NPV into equivalent dollars using the current spot rate.

B) Estimate what the project's cash flows would be if they were generated in the home currency and discount them at the appropriate home country discount rate. The NPV will already be in the home currency.

C) Estimate the project's cash flows in the foreign currency and then use forward rates, interest rate parity, purchasing power parity, or other such theory to convert them into expected home currency cash flows. Discount them at the appropriate home country discount rate, and the NPV will already be in the home currency.

D) Both statements a and c are recommended.

E) Both statements a and b are recommended.

A) Estimate the project's cash flows in the foreign currency and discount them at the appropriate host country discount rate. Convert the resulting foreign currency NPV into equivalent dollars using the current spot rate.

B) Estimate what the project's cash flows would be if they were generated in the home currency and discount them at the appropriate home country discount rate. The NPV will already be in the home currency.

C) Estimate the project's cash flows in the foreign currency and then use forward rates, interest rate parity, purchasing power parity, or other such theory to convert them into expected home currency cash flows. Discount them at the appropriate home country discount rate, and the NPV will already be in the home currency.

D) Both statements a and c are recommended.

E) Both statements a and b are recommended.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is incorrect?

A) Compared to a domestic project, estimating the salvage value of equipment in place at the end of the foreign project's life and the residual value of net operating working capital is complicated by the need to calculate a going concern value in addition to a liquidating value.

B) When foreign risks are present in a project, the cash flows in the numerator of the valuation equation can be reduced by including as expenses the cost of neutralizing the foreign risks, and then discounting the remaining net cash flows at a rate appropriate for an equivalent domestic project.

C) The issue of how to treat additional risks in a foreign project caused by fluctuating exchange rates can be resolved by estimating the project's cash flows in the foreign currency and then use forward rates, interest rate parity, purchasing power parity or other such theory to convert them into expected home currency cash flows. Discount them at the appropriate home country discount rate, and the NPV will be in the home currency as desired.

D) The Overseas Private Investment Corporation (OPIC) is a development agency of the U.S. government that offers three types of insurance for foreign risks: currency inconvertibility, expropriation, and political violence.

E) None of the statements above; all are correct.

A) Compared to a domestic project, estimating the salvage value of equipment in place at the end of the foreign project's life and the residual value of net operating working capital is complicated by the need to calculate a going concern value in addition to a liquidating value.

B) When foreign risks are present in a project, the cash flows in the numerator of the valuation equation can be reduced by including as expenses the cost of neutralizing the foreign risks, and then discounting the remaining net cash flows at a rate appropriate for an equivalent domestic project.

C) The issue of how to treat additional risks in a foreign project caused by fluctuating exchange rates can be resolved by estimating the project's cash flows in the foreign currency and then use forward rates, interest rate parity, purchasing power parity or other such theory to convert them into expected home currency cash flows. Discount them at the appropriate home country discount rate, and the NPV will be in the home currency as desired.

D) The Overseas Private Investment Corporation (OPIC) is a development agency of the U.S. government that offers three types of insurance for foreign risks: currency inconvertibility, expropriation, and political violence.

E) None of the statements above; all are correct.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

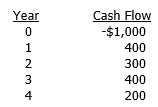

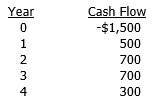

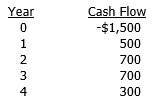

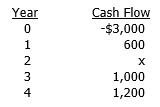

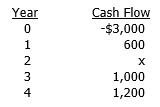

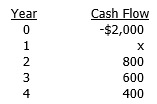

A project has the following after-tax cash flows:

What is this project's payback period?

What is this project's payback period?

A) 2.00 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.00 years

What is this project's payback period?

What is this project's payback period?A) 2.00 years

B) 2.25 years

C) 2.50 years

D) 2.75 years

E) 3.00 years

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

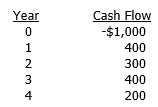

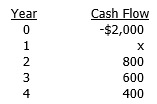

A project has the following after-tax cash flows:

If the firm's WACC is 10 percent, what is the net present value of the project?

If the firm's WACC is 10 percent, what is the net present value of the project?

A) -$28.34

B) $83.74

C) $99.39

D) $125.52

E) $133.60

If the firm's WACC is 10 percent, what is the net present value of the project?

If the firm's WACC is 10 percent, what is the net present value of the project?A) -$28.34

B) $83.74

C) $99.39

D) $125.52

E) $133.60

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

A project has the following after-tax cash flows:

If the firm's WACC is 13 percent, what is the internal rate of return of the project?

If the firm's WACC is 13 percent, what is the internal rate of return of the project?

A) 12.87%

B) 13.38%

C) 14.80%

D) 16.73%

E) 18.26%

If the firm's WACC is 13 percent, what is the internal rate of return of the project?

If the firm's WACC is 13 percent, what is the internal rate of return of the project?A) 12.87%

B) 13.38%

C) 14.80%

D) 16.73%

E) 18.26%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

The Spanish subsidiary of a U.S. MNE had taxable income of €10,000,000 and paid taxes (at 35 percent) of €3,500,000, so its net operating income was €6,500,000. It paid a cash dividend of €4,000,000 to its U.S. parent. How much tax, if any, is owed to the U.S. government if the U.S. tax rate is 40 percent and the exchange rate is $1.2100/€?

A) $307,692

B) $372,307

C) $846,154

D) $1,023,846

E) None of the above.

A) $307,692

B) $372,307

C) $846,154

D) $1,023,846

E) None of the above.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

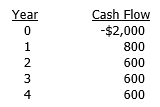

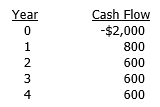

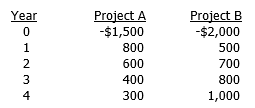

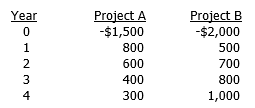

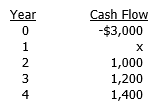

Two projects, A and B, have the following after-tax cash flows:

If the firm's WACC is 11 percent, at what cost of capital do these projects have the same NPV?

If the firm's WACC is 11 percent, at what cost of capital do these projects have the same NPV?

A) 12.01%

B) 12.38%

C) 13.91%

D) 14.49%

E) 16.26%

If the firm's WACC is 11 percent, at what cost of capital do these projects have the same NPV?

If the firm's WACC is 11 percent, at what cost of capital do these projects have the same NPV?A) 12.01%

B) 12.38%

C) 13.91%

D) 14.49%

E) 16.26%

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

Casey Manufacturing just purchased equipment for a new project that costs $3 million. The project is expected to last 4 years, and at the end of the project the equipment will be sold at its expected market value of $1.2 million. The equipment will be depreciated on a straight-line basis over 6 years toward a zero book value. If the firm's tax rate is 40 percent, what is the after-tax salvage value of the equipment?

A) $0.98 million

B) $1.02 million

C) $1.12 million

D) $1.20 million

E) $1.28 million

A) $0.98 million

B) $1.02 million

C) $1.12 million

D) $1.20 million

E) $1.28 million

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

What types of projects might a firm have to choose from

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

Describe the three major capital budgeting decision criteria discussed in the text.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

What is meant by "relevant" cash flows? Should sunk costs, opportunity costs, or externalities be considered? Explain.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

Which method, the NPV or IRR, should a firm use to choose between mutually exclusive projects? Explain.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

Should a capital budgeting analysis include adjustments for inflation, and if so, how?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

If a project is being considered in another country, how should the analysis account for the added risk of operating in a foreign country

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

An analyst has calculated a positive NPV for a foreign project. The positive NPV is all that he/she cares about and has said the project should be accepted. Is the analyst correct? Explain.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

If a firm is taking out a loan to help pay for a project, should the resulting interest expense be included in the cash flow analysis? Explain.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

An executive at a firm for which you are a consultant says that the NPV method is all that matters. He calculates the NPVs of available projects and accepts those that have the highest positive NPV. He does not care about any other decision criteria. Do you agree with him? Explain.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

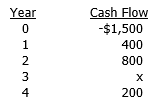

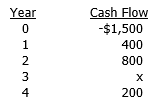

A project has the following after-tax cash flows:

The project's payback period is 3.5 years. What is the value of the missing cash flow, x, that occurs in the second year?

The project's payback period is 3.5 years. What is the value of the missing cash flow, x, that occurs in the second year?

The project's payback period is 3.5 years. What is the value of the missing cash flow, x, that occurs in the second year?

The project's payback period is 3.5 years. What is the value of the missing cash flow, x, that occurs in the second year?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

A project has the following after-tax cash flows:

If the firm's WACC is 11 percent and the project's NPV is $7.00, what is the value of the missing cash flow?

If the firm's WACC is 11 percent and the project's NPV is $7.00, what is the value of the missing cash flow?

If the firm's WACC is 11 percent and the project's NPV is $7.00, what is the value of the missing cash flow?

If the firm's WACC is 11 percent and the project's NPV is $7.00, what is the value of the missing cash flow?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

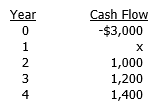

A project has the following after-tax cash flows:

If the project's IRR is 17.80 percent, what is the value of the missing cash flow? (Round to the nearest whole dollar.)

If the project's IRR is 17.80 percent, what is the value of the missing cash flow? (Round to the nearest whole dollar.)

If the project's IRR is 17.80 percent, what is the value of the missing cash flow? (Round to the nearest whole dollar.)

If the project's IRR is 17.80 percent, what is the value of the missing cash flow? (Round to the nearest whole dollar.)

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

A project has the following after-tax cash flows:

If the firm's WACC is 10 percent and the project's IRR is 13.06 percent, what is the project's NPV? (Round the missing cash flow to the nearest whole dollar before calculating the project's NPV.)

If the firm's WACC is 10 percent and the project's IRR is 13.06 percent, what is the project's NPV? (Round the missing cash flow to the nearest whole dollar before calculating the project's NPV.)

If the firm's WACC is 10 percent and the project's IRR is 13.06 percent, what is the project's NPV? (Round the missing cash flow to the nearest whole dollar before calculating the project's NPV.)

If the firm's WACC is 10 percent and the project's IRR is 13.06 percent, what is the project's NPV? (Round the missing cash flow to the nearest whole dollar before calculating the project's NPV.)

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck