Deck 5: Risk and Return

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/17

Play

Full screen (f)

Deck 5: Risk and Return

1

Which of the following statements is most correct?

A) Holding foreign stocks in one's portfolio affords greater diversification potential because the stock market returns in different countries are not perfectly correlated.

B) Exchange rate risk could be a significant issue if a portfolio is internationally diversified, particularly when shares from only a few countries are held.

C) A world market index and a global risk-free rate should be used to evaluate internationally diversified portfolios. These can be proxied by using the Morgan Stanley Capital International global index and the required return on long-term United Nations bonds.

D) All of the statements above are correct.

E) Only statements a and b are correct.

A) Holding foreign stocks in one's portfolio affords greater diversification potential because the stock market returns in different countries are not perfectly correlated.

B) Exchange rate risk could be a significant issue if a portfolio is internationally diversified, particularly when shares from only a few countries are held.

C) A world market index and a global risk-free rate should be used to evaluate internationally diversified portfolios. These can be proxied by using the Morgan Stanley Capital International global index and the required return on long-term United Nations bonds.

D) All of the statements above are correct.

E) Only statements a and b are correct.

Only statements a and b are correct.

2

Parson Plastic's stock has an estimated beta of 1.4, and its required rate of return is 13 percent. Podactor Motors' stock has a beta of 0.8. The risk-free rate is 6 percent. What is the required rate of return on Podactor Motors' stock?

A) 7.0%

B) 10.4%

C) 12.0%

D) 11.0%

E) 10.0%

A) 7.0%

B) 10.4%

C) 12.0%

D) 11.0%

E) 10.0%

10.0%

3

A U.S. investor bought a one-year French security for €10,000 and received €10,550 at the end of the year. The exchange rate on the date the investment was made was $0.87265/€ and the rate on the date it matured was $1.27244/€. The dollar-equivalent rate of return was

A) +53.83%

B) +27.65%

C) +5.50%

D) -27.65%

E) -53.83%

A) +53.83%

B) +27.65%

C) +5.50%

D) -27.65%

E) -53.83%

+53.83%

4

Assume that the risk-free rate is 5.5 percent and the market risk premium is 6 percent. A money manager has $10 million invested in a portfolio that has a required return of 12 percent. The manager plans to sell $3 million of stock with a beta of 1.6 that is part of the portfolio. She plans to reinvest this $3 million into another stock that has a beta of 0.7. If she goes ahead with this planned transaction, what will be the required return of her new portfolio?

A) 8.28%

B) 10.38%

C) 10.52%

D) 10.90%

E) 11.31%

A) 8.28%

B) 10.38%

C) 10.52%

D) 10.90%

E) 11.31%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

5

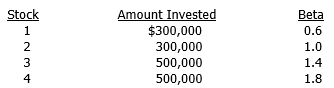

A money manager is holding the following portfolio:

The risk-free rate is 6 percent and the portfolio's required rate of return is 12.5 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

The risk-free rate is 6 percent and the portfolio's required rate of return is 12.5 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

A) 11.91%

B) 12.24%

C) 12.87%

D) 13.63%

E) 14.12%

The risk-free rate is 6 percent and the portfolio's required rate of return is 12.5 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

The risk-free rate is 6 percent and the portfolio's required rate of return is 12.5 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?A) 11.91%

B) 12.24%

C) 12.87%

D) 13.63%

E) 14.12%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

6

When does an analyst use population or sample standard deviation for returns?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

7

What is risk aversion and how is it measured?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

8

If stocks' returns do not appropriately compensate investors for risk, what would happen to stock prices?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

9

What is the difference between stand-alone and portfolio risk?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

10

What is the difference between diversifiable and market risk?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

11

What is the capital asset pricing model (CAPM)?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

12

When actually using the CAPM, what values should be used for the risk-free rate, market risk premium, and beta?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

13

Brennan Beverages' stock has an estimated beta of 1.3, and its required rate of return is 14 percent. Super Soda's stock has a beta of 0.9, and the risk-free rate is 5 percent. What is the required rate of return on Super Soda's stock?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

14

A U.S. investor bought a one-year German security for €20,000 and received €20,950 at the end of the year. The exchange rate on the date the investment was made was $0.975/€ and the rate on the date it matured was $1.113/€. What was the dollar-equivalent rate of return?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

15

You are holding a stock that has a beta of 2.0 and is currently in equilibrium. The required return on the stock is 15.25 percent, and the return on an average stock is 9 percent. What would be the new return on the stock, if the return on an average stock increased by 25 percent while the risk-free rate remained unchanged?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

16

Assume that the risk-free rate is 5 percent and the market risk premium is 5 percent. A money manager has $10 million invested in a portfolio that has a required return of 12 percent. The manager plans to sell $4 million of stock with a beta of 1.6 that is part of the portfolio. She plans to reinvest this $4 million into another stock that has a beta of 0.8. If she goes ahead with this planned transaction, what will be the required return of her new portfolio?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

17

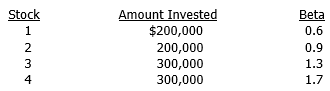

A money manager is holding the following portfolio:

The risk-free rate is 6 percent and the portfolio's required rate of return is 12 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

The risk-free rate is 6 percent and the portfolio's required rate of return is 12 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

The risk-free rate is 6 percent and the portfolio's required rate of return is 12 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

The risk-free rate is 6 percent and the portfolio's required rate of return is 12 percent. The manager would like to sell all of her holdings of Stock 1 and use the proceeds to purchase more shares of Stock 4. What would be the portfolio's required rate of return following this change?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck