Deck 18: Income Inequality and Poverty

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 18: Income Inequality and Poverty

1

The average household income in the United States in 2014 was:

A) $25,000.

B) $37,231.

C) $56,025.

D) $68,426.

A) $25,000.

B) $37,231.

C) $56,025.

D) $68,426.

$68,426.

2

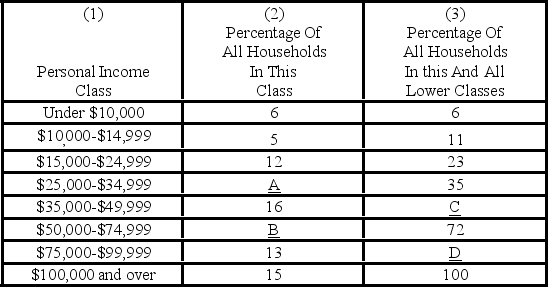

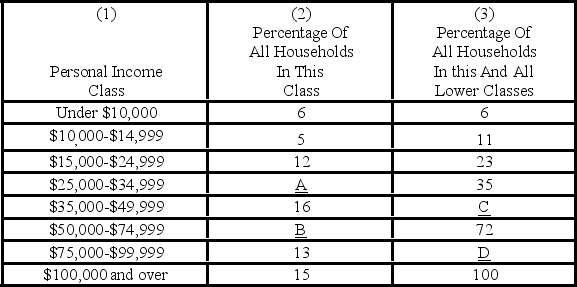

- Using the data in the above table, what percentage should be reported in blank B of column 2?

A) 6

B) 16

C) 21

D) 25

21

3

- Using the data in the above table, what percentage should be reported in blank D of column 3?

A) 21

B) 35

C) 85

D) 94

85

4

Suppose that Jennifer earns $10,000 in year 1 and $40,000 in year 2, while Shawna earns $40,000 in year 1 and only $10,000 in year 2. Is there income inequality for the two individuals?

A) The yearly data and the data over the two years indicate equality.

B) The yearly data and the data over the two years indicate inequality.

C) The yearly data indicate equality, but the data over the two years indicate inequality.

D) The yearly data indicate inequality, but the data over the two years indicate equality.

A) The yearly data and the data over the two years indicate equality.

B) The yearly data and the data over the two years indicate inequality.

C) The yearly data indicate equality, but the data over the two years indicate inequality.

D) The yearly data indicate inequality, but the data over the two years indicate equality.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

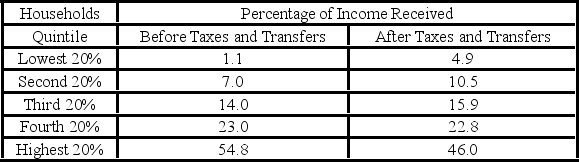

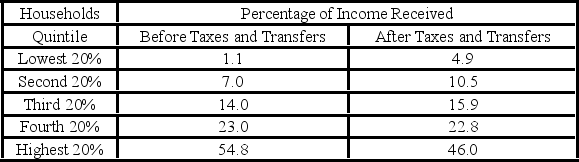

- Refer to the above table. Before taxes and transfers:

A) the highest 20 percent of households received 46.0 percent of income.

B) the highest 20 percent of households received 54.8 percent of income.

C) the lowest 20 percent of households received 70 percent of income.

D) the lowest 20 percent of households received 4.9 percent of income.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

- Refer to the above table. The change in the distribution of income received before and after taxes and transfers suggests that overall this system:

A) is progressive.

B) is regressive.

C) is proportional.

D) uses only an income tax to redistribute income.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Suppose that Teresa Thomas obtains 12 units of utility from the last dollar of income she receives, while Richard Voote obtains 7 units of utility from the last dollar of his income. Both have identical marginal-utility-of-income-curves. Those who:

A) favor an equal distribution of income would advocate redistributing income from Richard to Teresa.

B) favor an equal distribution of income would advocate redistributing income from Teresa to Richard.

C) favor an equal distribution of income would be content with the distribution of income between Teresa and Richard.

D) do not favor an equal distribution of income would argue that any redistribution between Teresa and Richard would increase total utility.

A) favor an equal distribution of income would advocate redistributing income from Richard to Teresa.

B) favor an equal distribution of income would advocate redistributing income from Teresa to Richard.

C) favor an equal distribution of income would be content with the distribution of income between Teresa and Richard.

D) do not favor an equal distribution of income would argue that any redistribution between Teresa and Richard would increase total utility.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Suppose Rita obtains 10 units of utility from the last dollar of income she receives and Nigel obtains 6 units of utility from his last dollar of income. Assume both Nigel and Rita have the same capacity to derive utility from income with identical marginal-utility-of-income-curves. Those who favor an equal distribution of income would:

A) advocate redistributing income from Nigel to Rita.

B) advocate redistributing income from Rita to Nigel.

C) be content with this distribution of income between Rita and Nigel.

D) argue that any redistribution of income between them would increase total utility.

A) advocate redistributing income from Nigel to Rita.

B) advocate redistributing income from Rita to Nigel.

C) be content with this distribution of income between Rita and Nigel.

D) argue that any redistribution of income between them would increase total utility.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose Stacey obtains 7 units of utility from the last dollar of income she receives and Raj obtains 7 units of utility from his last dollar of income. Assume both Raj and Stacey have the same capacity to derive utility from income with identical marginal-utility-of-income-curves. Those who favor an equal distribution of income would:

A) advocate redistributing income from Raj to Stacey.

B) advocate redistributing income from Stacey to Raj.

C) be content with this distribution of income between Stacey and Raj.

D) argue that any redistribution of income between them would increase total utility.

A) advocate redistributing income from Raj to Stacey.

B) advocate redistributing income from Stacey to Raj.

C) be content with this distribution of income between Stacey and Raj.

D) argue that any redistribution of income between them would increase total utility.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

In 2016, an unattached individual would be defined as living in poverty if his or her income was less than:

A) $12,228.

B) $10,956.

C) $24,563.

D) $32,928.

A) $12,228.

B) $10,956.

C) $24,563.

D) $32,928.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

In 2016, the poverty line for a family of four was:

A) $8300.

B) $12,228.

C) $24,563.

D) $32,928.

A) $8300.

B) $12,228.

C) $24,563.

D) $32,928.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

The poverty rate in 2016 was:

A) substantially higher than at the start of the Great Recession.

B) about the same level as before the Great Recession.

C) lowest it has been since 1959.

D) higher than it was in 1959.

A) substantially higher than at the start of the Great Recession.

B) about the same level as before the Great Recession.

C) lowest it has been since 1959.

D) higher than it was in 1959.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is true about poverty since 2007?

A) Poverty rose for all groups during the Great Recession, but by 2016 had fallen to prerecession levels.

B) Poverty rose for all groups during the Great Recession and have remained at higher but stable levels for most groups.

C) Poverty rates were largely unchanged during the Great Recession.

D) Poverty rose during the Great Recession and rates have continued to climb.

A) Poverty rose for all groups during the Great Recession, but by 2016 had fallen to prerecession levels.

B) Poverty rose for all groups during the Great Recession and have remained at higher but stable levels for most groups.

C) Poverty rates were largely unchanged during the Great Recession.

D) Poverty rose during the Great Recession and rates have continued to climb.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

What form of aid is used for the Supplemental Nutrition Assistance Program(SNAP)?

A) Cash

B) Coupons and vouchers

C) Electronic Benefit Transfer cards

D) Insurance

A) Cash

B) Coupons and vouchers

C) Electronic Benefit Transfer cards

D) Insurance

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

Social insurance is distinguished from public assistance, or welfare, by the fact that:

A) all social insurance benefits are paid in cash while all public assistance benefits are paid in kind (food, housing, medical care).

B) an individual acquires a right to social insurance benefits by meeting objective eligibility criteria while public assistance benefits are determined according to individual need.

C) the total amount paid in benefits is much larger in the public assistance programs than in the social insurance programs.

D) payroll taxes are used to finance public assistance programs while general revenues are used to finance social insurance programs.

A) all social insurance benefits are paid in cash while all public assistance benefits are paid in kind (food, housing, medical care).

B) an individual acquires a right to social insurance benefits by meeting objective eligibility criteria while public assistance benefits are determined according to individual need.

C) the total amount paid in benefits is much larger in the public assistance programs than in the social insurance programs.

D) payroll taxes are used to finance public assistance programs while general revenues are used to finance social insurance programs.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

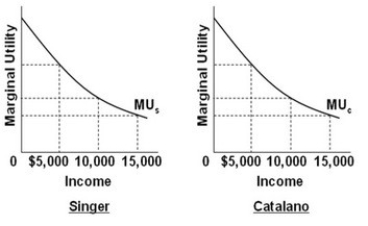

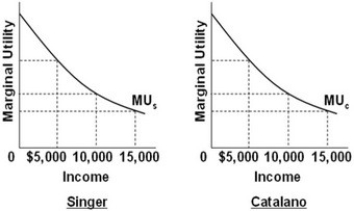

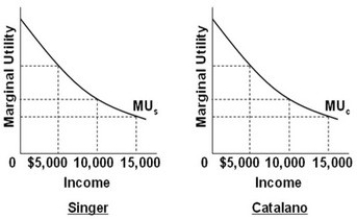

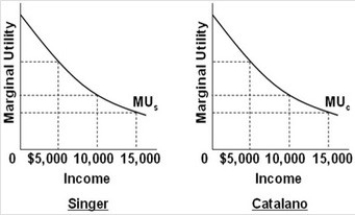

- Refer to the above diagrams that show identical marginal utility from income curves for Singer and Catalano. The marginal utility from income curves are drawn on the assumption that:

A) Singer buys more inferior goods than does Catalano.

B) Singer and Catalano have identical capacities to enjoy income.

C) Catalano has a greater capacity to enjoy income than does Singer.

D) Singer has a greater capacity to enjoy income than does Catalano.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

- Refer to the above diagrams that show identical marginal utility from income curves for Singer and Catalano. If a given income of $20,000 is initially distributed so that Singer receives $15,000 and Catalano $5,000, the marginal utility:

A) of the last dollar of income will be greater for Catalano than for Singer.

B) derived from the last dollar will not be comparable between the two income receivers.

C) of the last dollar of income will be the same for both Singer and Catalano.

D) of the last dollar of income will be greater for Singer than for Catalano.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

- Refer to the above diagrams that show identical marginal utility from income curves for Singer and Catalano. If a given income of $20,000 is initially distributed so that Singer receives $15,000 and Catalano $5,000:

A) no judgment can be made as to the effect of a redistribution of income on total utility.

B) this initial distribution of income is maximizing the combined total utility of the two consumers.

C) the combined total utility of the two consumers can be increased by redistributing income from Catalano to Singer.

D) the combined total utility of the two consumers can be increased by redistributing income from Singer to Catalano.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

- Refer to the above diagrams that show identical marginal utility from income curves for Singer and Catalano. If this initial distribution of $15,000 to Singer and $5,000 to Catalano is altered in favor of greater equality, it may be argued that:

A) the combined total utility of the two consumers will decline because Catalano has a greater capacity to derive utility from income than does Singer.

B) incentives to produce will be weakened and total income will decrease.

C) incentives to produce will be enhanced and total income will increase.

D) the combined total utility of the two consumers will decline because Singer has a greater capacity to derive utility from income than does Catalano.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

The incidence of poverty rose significantly during the Great Recession and has remained above prerecession levels.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck