Deck 7: Risk, Capital Budgeting and Raising Long-Term Financing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/17

Play

Full screen (f)

Deck 7: Risk, Capital Budgeting and Raising Long-Term Financing

1

Smith Enterprises

Smith Enterprises recently conducted an IPO. In this, Smith received $14 per share from the underwriter, the offering price per share was $16 and the stock price rose to $19 on the first day of trading.

-Refer to Smith Enterprises. What is the first day return on an investment in the IPO?

A) 21.42%

B) 15.79%

C) 18.75%

D) 12.56%

Smith Enterprises recently conducted an IPO. In this, Smith received $14 per share from the underwriter, the offering price per share was $16 and the stock price rose to $19 on the first day of trading.

-Refer to Smith Enterprises. What is the first day return on an investment in the IPO?

A) 21.42%

B) 15.79%

C) 18.75%

D) 12.56%

18.75%

2

The following data have been computed for a firm: when sales are $20,000, EBIT is $5,000 and operating leverage is 2.5. Suppose sales increase to $23,000; what is the new level of EBIT?

A) $1,875

B) $6,875

C) $3,000

D) $8,435

A) $1,875

B) $6,875

C) $3,000

D) $8,435

$6,875

3

What is Never-crash Airline's WACC, if their marginal tax rate equals 34%?

A) 19.22%

B) 24.45%

C) 18.50%

D) 4.62%

A) 19.22%

B) 24.45%

C) 18.50%

D) 4.62%

18.50%

4

What is the Never-crash Airline's after tax cost of debt?

A) 7.00%

B) 4.62%

C) 2.38%

D) 4.50%

A) 7.00%

B) 4.62%

C) 2.38%

D) 4.50%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

5

What is the Never-crash Airline's cost of equity?

A) 33.00%

B) 7.05%

C) 24.45%

D) 28.50%

A) 33.00%

B) 7.05%

C) 24.45%

D) 28.50%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

6

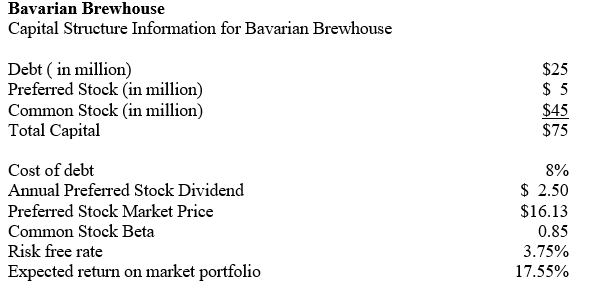

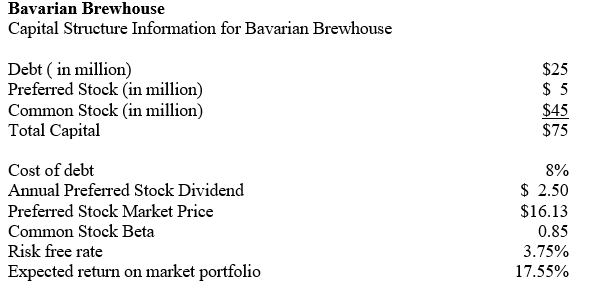

?

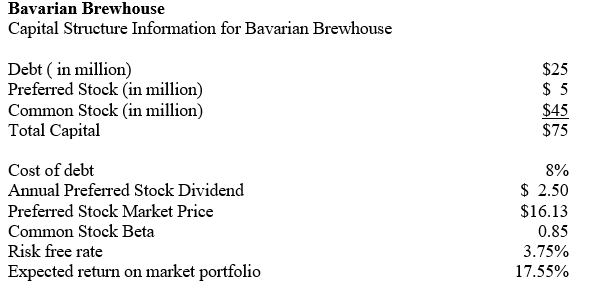

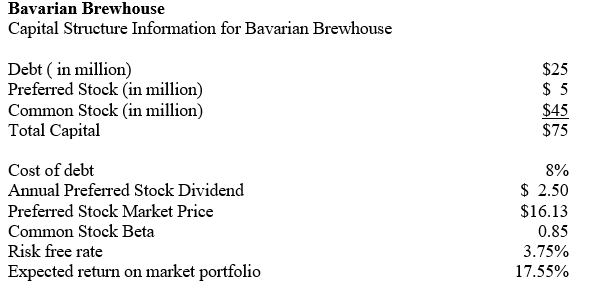

-What is Bavarian Brewhouse's cost of preferred stock?

A) 8.00%

B) 15.5%

C) 10.7%

D) 12.6%

-What is Bavarian Brewhouse's cost of preferred stock?

A) 8.00%

B) 15.5%

C) 10.7%

D) 12.6%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

7

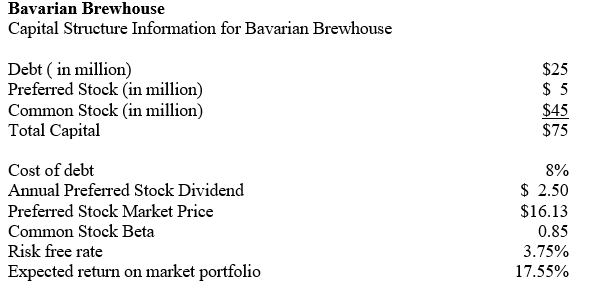

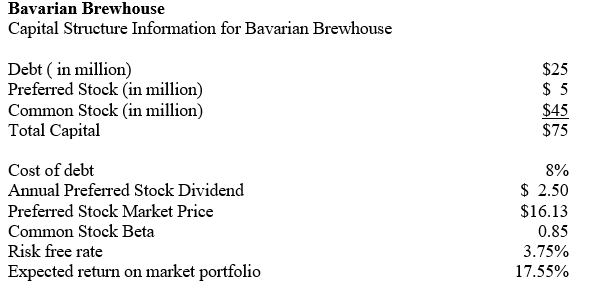

?

-What is Bavarian Brewhouse's cost of common equity?

A) 10.67%

B) 12.55%

C) 16.23%

D) 15.48%

-What is Bavarian Brewhouse's cost of common equity?

A) 10.67%

B) 12.55%

C) 16.23%

D) 15.48%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

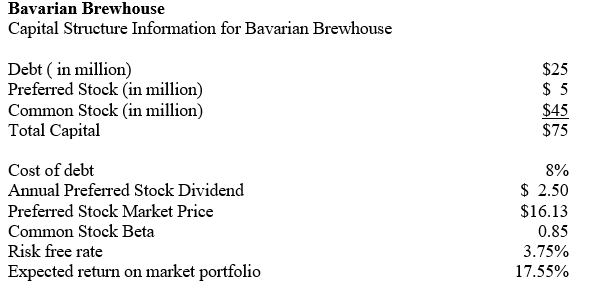

8

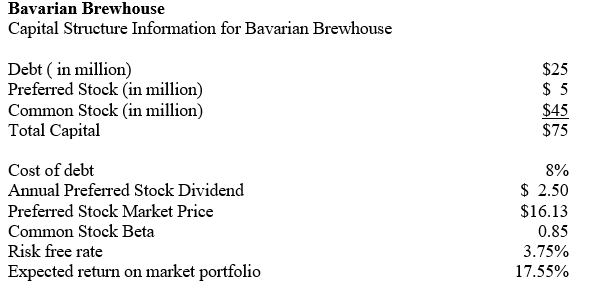

?

-What percentage of Bavarian Brewhouse's capital structure consists of total equity?

A) 6.67%

B) 60.00%

C) 33.33%

D) 66.67%

-What percentage of Bavarian Brewhouse's capital structure consists of total equity?

A) 6.67%

B) 60.00%

C) 33.33%

D) 66.67%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

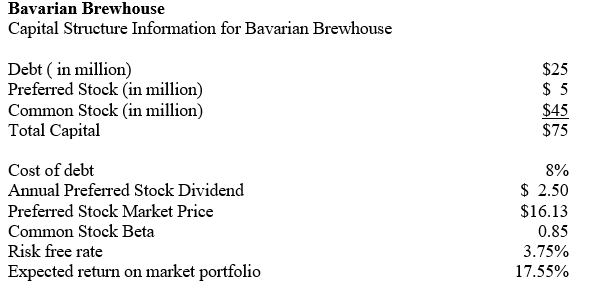

9

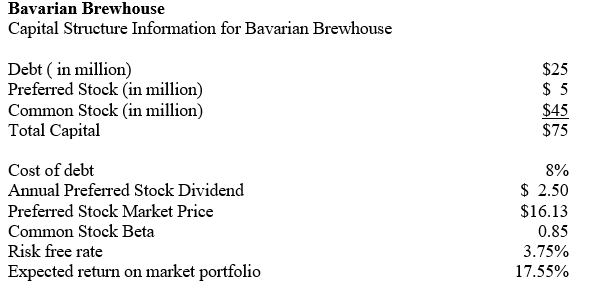

?

-Assuming no corporate taxes, what is Bavarian Brewhouse's WACC?

A) 16.23%

B) 12.99%

C) 13.44%

D) 5.28%

-Assuming no corporate taxes, what is Bavarian Brewhouse's WACC?

A) 16.23%

B) 12.99%

C) 13.44%

D) 5.28%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

10

?

-What is Bavarian Brewhouse's WACC if their marginal tax rate equals 34%

A) 12.08%

B) 12.99%

C) 13.44%

D) 5.28%

-What is Bavarian Brewhouse's WACC if their marginal tax rate equals 34%

A) 12.08%

B) 12.99%

C) 13.44%

D) 5.28%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

11

Miller's Dairy Products reported sales of $1.5 million in 2002 and $2.25 million in 2003. Their EBIT in 2002 was $550,000 and in 2003 the EBIT rose to $925,000. What is the company's operating leverage?

A) 2.36

B) 1.36

C) 1.96

D) 2.86

A) 2.36

B) 1.36

C) 1.96

D) 2.86

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

12

Running Shoes, Inc.

Running Shoes, Inc. has 2 million shares of stock outstanding. The stock currently sells for $12.50 per share. The firm's debt is publicly traded and was recently quoted at 90% of face value. It has a total face value of $10 million, and it is currently priced to yield 8%. The risk free rate is 2% and the market risk premium is 8%. You've estimated that the firm has a beta of 1.20. The corporate tax rate is 40%.

-Refer to Running Shoes, Inc. What is the cost of equity?

A) 9.20%

B) 9.60%

C) 10.40%

D) 11.60%

Running Shoes, Inc. has 2 million shares of stock outstanding. The stock currently sells for $12.50 per share. The firm's debt is publicly traded and was recently quoted at 90% of face value. It has a total face value of $10 million, and it is currently priced to yield 8%. The risk free rate is 2% and the market risk premium is 8%. You've estimated that the firm has a beta of 1.20. The corporate tax rate is 40%.

-Refer to Running Shoes, Inc. What is the cost of equity?

A) 9.20%

B) 9.60%

C) 10.40%

D) 11.60%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

13

Running Shoes, Inc.

Running Shoes, Inc. has 2 million shares of stock outstanding. The stock currently sells for $12.50 per share. The firm's debt is publicly traded and was recently quoted at 90% of face value. It has a total face value of $10 million, and it is currently priced to yield 8%. The risk free rate is 2% and the market risk premium is 8%. You've estimated that the firm has a beta of 1.20. The corporate tax rate is 40%.

-What is the percentage of equity used by Running Shoes, Inc.?

A) 74.63%

B) 73.53%

C) 72.46%

D) 68.97%

Running Shoes, Inc. has 2 million shares of stock outstanding. The stock currently sells for $12.50 per share. The firm's debt is publicly traded and was recently quoted at 90% of face value. It has a total face value of $10 million, and it is currently priced to yield 8%. The risk free rate is 2% and the market risk premium is 8%. You've estimated that the firm has a beta of 1.20. The corporate tax rate is 40%.

-What is the percentage of equity used by Running Shoes, Inc.?

A) 74.63%

B) 73.53%

C) 72.46%

D) 68.97%

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

14

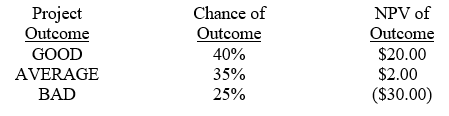

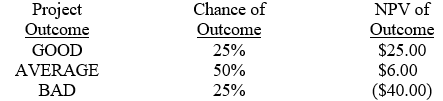

A project under consideration for a firm has several possible outcomes shown in the table below. Given the assumptions below, what is the expected NPV for the project?

A) -$8.00

B) -$2.50

C) $1.20

D) $1.40

A) -$8.00

B) -$2.50

C) $1.20

D) $1.40

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

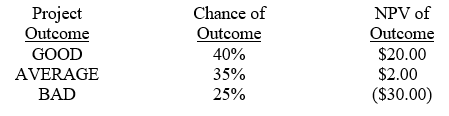

15

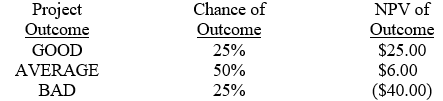

A project under consideration for a firm has several possible outcomes shown in the table below. Given the assumptions below, what is the expected NPV for the project?

A) -$9.00

B) -$3.00

C) -$0.75

D) $1.20

A) -$9.00

B) -$3.00

C) -$0.75

D) $1.20

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

16

You are given the opportunity to play a game of high stakes gambling. The game begins by you paying an entry fee of $35,000,000 followed by a fair coin toss. If the coin toss is "heads" then you have an 80% probability of receiving a perpetuity of $10,000,000 per year and a 20% probability of receiving a perpetuity of $1,000,000 per year. Assume that the proper discount rate for the perpetual cash flow is 10%. If the coin toss is "tails"you can continue to play but you will lose $50,000,000 with certainty. Alternatively, you can make a make an opt-out payment of $10,000,000 after a "tail" to prevent you from going down such a costly path. What is the present value of playing such a game?

A) $1,000,000

B) -$1,000,000

C) -$39,000,000

D) none of the above

A) $1,000,000

B) -$1,000,000

C) -$39,000,000

D) none of the above

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

17

You are a professional football running back who is eligible to be a free agent. You are offered a two-year contract to play for your current team for $3,000,000. If you accept that contract, the firm retains your rights and you will not be able to play for another team at the conclusion of the contract. Otherwise, you can play for you current team for two years at a price of $2,000,000 but you have the ability to play for any team at the expiration of this agreement. What is the value of the option to pay for any team you like after two years? Assume a discount rate of 5%.

A) $5,578,231

B) $3,718,821

C) $1,859,410

D) none of the above

A) $5,578,231

B) $3,718,821

C) $1,859,410

D) none of the above

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck