Deck 7: Revenue Recognition

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

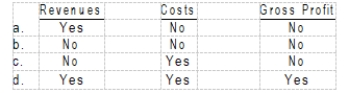

Question

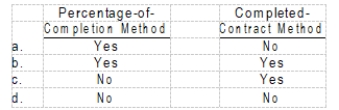

Question

Question

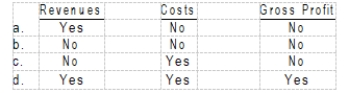

Question

Question

Question

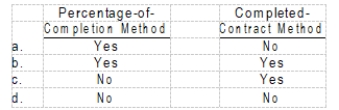

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/52

Play

Full screen (f)

Deck 7: Revenue Recognition

1

The revenue recognition principle adopted by the FASB provides that revenue is recognized when (a) it is collected and (b) the earnings process is complete.

False

2

Transactions for which sales recognition is postponed because of a high ratio of returned merchandise should not be recognized as sales until the return privilege has substantially expired.

True

3

Trade loading and channel stuffing are management and marketing policy decisions and actions that hype sales, distort operating results, and window dress financial statements.

True

4

Under the cost-to-cost basis, the percentage of completion is measured by comparing costs incurred to date with the most recent estimate of revenues collected to date.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

5

The principal advantage of the completed-contract method in accounting for long-term construction contracts is that reported income is based on final results rather than on estimates of unperformed work.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

6

The major disadvantage of the completed-contract method as compared with the percentage of-completion method is that total net income over the life of the construction contract is normally smaller under the completed-contract method.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

7

Because payment for a product sold on an installment basis is spread over a relatively long period, the risk of loss resulting from uncollectible accounts is greater in installment sales transactions than in ordinary sales.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

8

Under the installment-sales method, emphasis is placed on collection rather than on sale, and revenue is considered unrealized until the entire sales price has been collected.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

9

The difference between realized gross profit and deferred gross profit on installment sales is based on the cash collections related to the installment sales.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

10

The deposit method postpones recognizing a sale until a determination can be made as to whether a sale has occurred for accounting purposes.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

11

The annual entries to record costs of construction, progress billings, and collections from customers under the completed-contract method would be identical to those illustrated under the percentage-of- completion method with the significant exclusion of the recognition of revenue and gross profit.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

12

Repossessed merchandise as a result of a defaulted installment sales contract should be recorded at the best possible estimate of what the item can ultimately be resold for in the second-hand market.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

13

When interest is involved in installment sales, it should be accounted for as an addition to gross profit recognized on the installment sales collections during the period.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not an accurate representation concerning revenue recognition?

A) Companies recognize revenue from selling products at the date of sale, usually interpreted to mean the date of delivery to customers.

B) Companies recognize revenue from services rendered when cash is received or when services have been performed.

C) Companies recognize revenue from permitting others to use enterprise assets as time passes or as the assets are used.

D) Companies recognize revenue from disposing of assets other than products at the date of sale.

A) Companies recognize revenue from selling products at the date of sale, usually interpreted to mean the date of delivery to customers.

B) Companies recognize revenue from services rendered when cash is received or when services have been performed.

C) Companies recognize revenue from permitting others to use enterprise assets as time passes or as the assets are used.

D) Companies recognize revenue from disposing of assets other than products at the date of sale.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

15

The FASB concluded that if a company sells its product but gives the buyer the right to return the product, revenue from the sales transaction shall be recognized at the time of sale only if all of six conditions have been met. Which of the following is not one of these six conditions?

A) The amount of future returns can be reasonably estimated.

B) The seller's price is substantially fixed or determinable at time of sale.

C) The buyer's obligation to the seller would not be changed in the event of theft or damage of the product.

D) The buyer is obligated to pay the seller upon resale of the product.

A) The amount of future returns can be reasonably estimated.

B) The seller's price is substantially fixed or determinable at time of sale.

C) The buyer's obligation to the seller would not be changed in the event of theft or damage of the product.

D) The buyer is obligated to pay the seller upon resale of the product.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a condition that must be present for a company to recognize revenue at the time of sale when the company gives the buyer the right to return the product?

A) The buyer has paid the seller, or the buyer is obligated to pay the seller and the obligation is not contingent on resale of the product.

B) The present value of the future returns can be reasonably estimated.

C) The seller does not have significant obligations for future performance to directly bring about resale of the product by the buyer.

D) The seller's price to the buyer is substantially fixed or determinable at the date of sale.

A) The buyer has paid the seller, or the buyer is obligated to pay the seller and the obligation is not contingent on resale of the product.

B) The present value of the future returns can be reasonably estimated.

C) The seller does not have significant obligations for future performance to directly bring about resale of the product by the buyer.

D) The seller's price to the buyer is substantially fixed or determinable at the date of sale.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

17

The percentage-of-completion method must be used when certain conditions exist. Which of the following is not one of those necessary conditions?

A) Estimates of progress toward completion, revenues, and costs are reasonably dependable.

B) The contractor can be expected to perform the contractual obligation.

C) The buyer can be expected to satisfy some of the obligations under the contract.

D) The contract clearly specifies the enforceable rights of the parties, the consideration to be exchanged, and the manner and terms of settlement.

A) Estimates of progress toward completion, revenues, and costs are reasonably dependable.

B) The contractor can be expected to perform the contractual obligation.

C) The buyer can be expected to satisfy some of the obligations under the contract.

D) The contract clearly specifies the enforceable rights of the parties, the consideration to be exchanged, and the manner and terms of settlement.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

18

Cost estimates on a long-term contract may indicate that a loss will result on completion of the entire contract. In this case, the entire expected loss should be

A) recognized in the current period, regardless of whether the percentage-of-completion or completed-contract method is employed.

B) recognized in the current period under the percentage-of-completion method, but the completed-contract method should defer recognition of the loss to the time when the contract is completed.

C) recognized in the current period under the completed-contract method, but the percentage-of-completion method should defer the loss until the contract is completed.

D) deferred and recognized when the contract is completed, regardless of whether the percentage-of-completion or completed-contract method is employed.

A) recognized in the current period, regardless of whether the percentage-of-completion or completed-contract method is employed.

B) recognized in the current period under the percentage-of-completion method, but the completed-contract method should defer recognition of the loss to the time when the contract is completed.

C) recognized in the current period under the completed-contract method, but the percentage-of-completion method should defer the loss until the contract is completed.

D) deferred and recognized when the contract is completed, regardless of whether the percentage-of-completion or completed-contract method is employed.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

19

When there is a significant increase in the estimated total contract costs but the increase does not eliminate all profit on the contract, which of the following is correct?

A) Under both the percentage-of-completion and the completed-contract methods, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods.

B) Under the percentage-of-completion method only, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods.

C) Under the completed-contract method only, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods.

D) No current period adjustment is required.

A) Under both the percentage-of-completion and the completed-contract methods, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods.

B) Under the percentage-of-completion method only, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods.

C) Under the completed-contract method only, the estimated cost increase requires a current period adjustment of excess gross profit recognized on the project in prior periods.

D) No current period adjustment is required.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

20

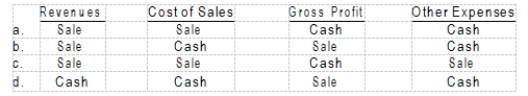

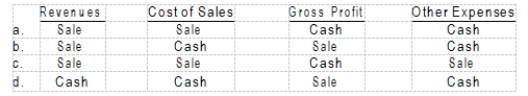

Under the completed-contract method of accounting for long-term construction contracts, interim charges and/or credits to the income statement are made for

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

21

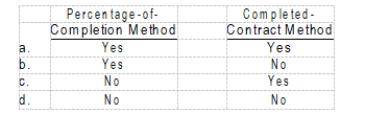

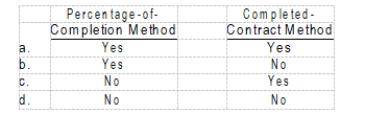

The Nathan Company is involved in the construction of an asset under a long-term construction contract. At the end of the third year of the five-year contract, the cost estimates indicate that a loss will result on the completion of the entire contract. In accounting for this contract, the entire expected loss must be recognized in the current period under the

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following methods or bases is used when the collectibility of the receivable is so uncertain that gross profit (or income) is not recognized until cash is received?

A) Percentage-of-completion method

B) Completed-contract method

C) Installment-sales method

D) Deposit method

A) Percentage-of-completion method

B) Completed-contract method

C) Installment-sales method

D) Deposit method

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

23

Under the installment-sales accounting method, certain items related to the sale are recognized in the period of the sale and certain items are recognized in the period in which cash is collected. Of the following items, which are recognized in the period of sale and which are recognized in the period in which the cash is collected?

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

24

How should the balances of progress billings and construction in process be shown at reporting dates prior to the completion of a long-term contract?

A) Progress billings as deferred income, construction in progress as a deferred expense.

B) Progress billings as income, construction in process as inventory.

C) Net, as a current asset if debit balance, and current liability if credit balance.

D) Net, as income from construction if credit balance, and loss from construction if debit balance.

A) Progress billings as deferred income, construction in progress as a deferred expense.

B) Progress billings as income, construction in process as inventory.

C) Net, as a current asset if debit balance, and current liability if credit balance.

D) Net, as income from construction if credit balance, and loss from construction if debit balance.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

25

How should earned but unbilled revenues at the balance sheet date on a long-term construction contract be disclosed if the percentage-of-completion method of revenue recognition is used?

A) As construction in process in the current asset section of the balance sheet.

B) As construction in process in the noncurrent asset section of the balance sheet.

C) As a receivable in the noncurrent asset section of the balance sheet.

D) In a note to the financial statements until the customer is formally billed for the portion of work completed.

A) As construction in process in the current asset section of the balance sheet.

B) As construction in process in the noncurrent asset section of the balance sheet.

C) As a receivable in the noncurrent asset section of the balance sheet.

D) In a note to the financial statements until the customer is formally billed for the portion of work completed.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

26

In accounting for long-term construction-type contracts, construction costs are accumu-lated in an inventory account called Construction in Process under the

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

27

Under the installment-sales method,

A) revenue, costs, and gross profit are recognized proportionate to the cash that is received from the sale of the product.

B) gross profit is deferred proportionate to cash uncollected from sale of the product, but total revenues and costs are recognized at the point of sale.

C) gross profit is not recognized until the amount of cash received exceeds the cost of the item sold.

D) revenues and costs are recognized proportionate to the cash received from the sale of the product, but gross profit is deferred until all cash is received.

A) revenue, costs, and gross profit are recognized proportionate to the cash that is received from the sale of the product.

B) gross profit is deferred proportionate to cash uncollected from sale of the product, but total revenues and costs are recognized at the point of sale.

C) gross profit is not recognized until the amount of cash received exceeds the cost of the item sold.

D) revenues and costs are recognized proportionate to the cash received from the sale of the product, but gross profit is deferred until all cash is received.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

28

The realization of income on installment sales transactions involves

A) recognition of the difference between the cash collected on installment sales and the cash expenses incurred.

B) deferring the net income related to installment sales and recognizing the income as cash is collected.

C) deferring gross profit while recognizing operating or financial expenses in the period incurred.

D) deferring gross profit and all additional expenses related to installment sales until cash is ultimately collected.

A) recognition of the difference between the cash collected on installment sales and the cash expenses incurred.

B) deferring the net income related to installment sales and recognizing the income as cash is collected.

C) deferring gross profit while recognizing operating or financial expenses in the period incurred.

D) deferring gross profit and all additional expenses related to installment sales until cash is ultimately collected.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

29

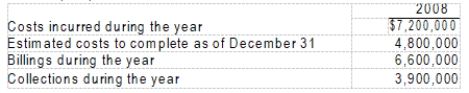

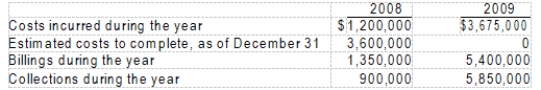

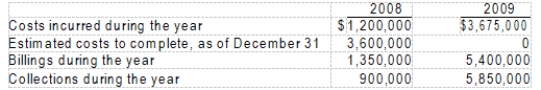

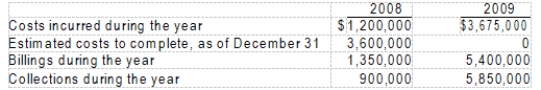

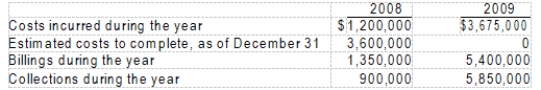

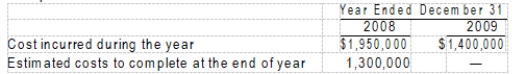

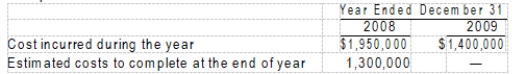

Reese Construction Corporation contracted to construct a building for $1,500,000. Construction began in 2008 and was completed in 2009. Data relating to the contract are summarized below:

Reese uses the percentage-of-completion method as the basis for income recognition. For the years ended December 31, 2008, and 2009, respectively, Reese should report gross profit of

A) $270,000 and $180,000.

B) $900,000 and $600,000.

C) $300,000 and $150,000.

D) $0 and $450,000.

Reese uses the percentage-of-completion method as the basis for income recognition. For the years ended December 31, 2008, and 2009, respectively, Reese should report gross profit of

A) $270,000 and $180,000.

B) $900,000 and $600,000.

C) $300,000 and $150,000.

D) $0 and $450,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

30

Winsor Construction Company uses the percentage-of-completion method of accounting. In 2008, Winsor began work on a contract it had received which provided for a contract price of $15,000,000. Other details follow:

What should be the gross profit recognized in 2008?

What should be the gross profit recognized in 2008?

A) $600,000

B) $7,800,000

C) $1,800,000

D) $3,000,000

What should be the gross profit recognized in 2008?

What should be the gross profit recognized in 2008?A) $600,000

B) $7,800,000

C) $1,800,000

D) $3,000,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

31

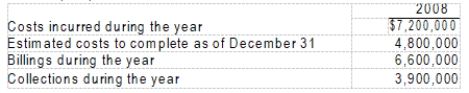

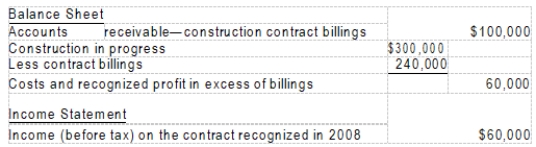

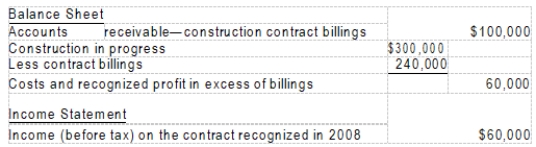

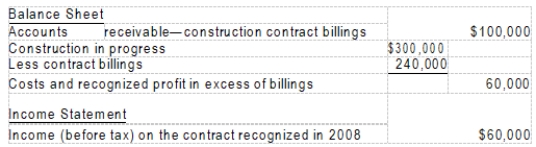

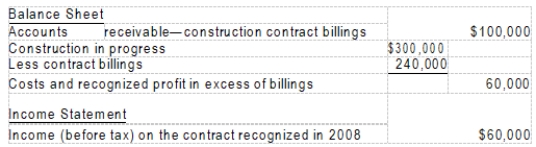

In 2008, Crane Corporation began construction work under a three-year contract. The contract price is $2,400,000. Crane uses the percentage-of- completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2008, follow:

-How much cash was collected in 2008 on this contract?

A) $100,000

B) $140,000

C) $20,000

D) $240,000

-How much cash was collected in 2008 on this contract?

A) $100,000

B) $140,000

C) $20,000

D) $240,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

32

In 2008, Crane Corporation began construction work under a three-year contract. The contract price is $2,400,000. Crane uses the percentage-of- completion method for financial accounting purposes. The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract. The financial statement presentations relating to this contract at December 31, 2008, follow:

-What was the initial estimated total income before tax on this contract?

A) $300,000

B) $320,000

C) $400,000

D) $480,000

-What was the initial estimated total income before tax on this contract?

A) $300,000

B) $320,000

C) $400,000

D) $480,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

33

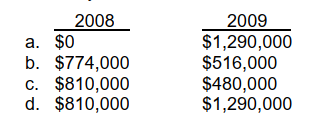

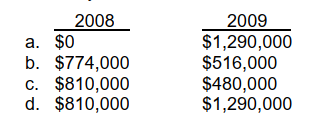

Eaton Construction Co. uses the percentage-of-completion method. In 2008, Eaton began work on a contract for $3,300,000 and it was completed in 2009. Data on the costs are:

For the years 2008 and 2009, Eaton should recognize gross profit of

For the years 2008 and 2009, Eaton should recognize gross profit of

For the years 2008 and 2009, Eaton should recognize gross profit of

For the years 2008 and 2009, Eaton should recognize gross profit of

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

34

Ramos, Inc. began work in 2008 on contract 3814, which provided for a contract price of $7,200,000. Other details follow:

-Assume that Ramos uses the percentage-of-completion method of accounting. The portion of the total gross profit to be recognized as income in 2008 is

A) $450,000.

B) $600,000.

C) $1,800,000.

D) $2,400,000.

-Assume that Ramos uses the percentage-of-completion method of accounting. The portion of the total gross profit to be recognized as income in 2008 is

A) $450,000.

B) $600,000.

C) $1,800,000.

D) $2,400,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

35

Ramos, Inc. began work in 2008 on contract 3814, which provided for a contract price of $7,200,000. Other details follow:

-Assume that Ramos uses the completed-contract method of accounting. The portion of the total gross profit to be recognized as income in 2009 is

A) $900,000.

B) $1,350,000.

C) $2,325,000.

D) $7,200,000.

-Assume that Ramos uses the completed-contract method of accounting. The portion of the total gross profit to be recognized as income in 2009 is

A) $900,000.

B) $1,350,000.

C) $2,325,000.

D) $7,200,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

36

Miley, Inc. began work in 2008 on a contract for $8,400,000. Other data are as follows:

-If Miley uses the percentage-of-completion method, the gross profit to be recognized in 2008 is

A) $1,440,000.

B) $1,600,000.

C) $2,160,000.

D) $2,400,000.

-If Miley uses the percentage-of-completion method, the gross profit to be recognized in 2008 is

A) $1,440,000.

B) $1,600,000.

C) $2,160,000.

D) $2,400,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

37

Miley, Inc. began work in 2008 on a contract for $8,400,000. Other data are as follows:

-If Miley uses the completed-contract method, the gross profit to be recognized in 2009 is

A) $1,360,000.

B) $2,800,000.

C) $1,400,000.

D) $5,600,000.

-If Miley uses the completed-contract method, the gross profit to be recognized in 2009 is

A) $1,360,000.

B) $2,800,000.

C) $1,400,000.

D) $5,600,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

38

Parker Construction Co. uses the percentage-of-completion method. In 2008, Parker began work on a contract for $5,500,000; it was completed in 2009. The following cost data pertain to this contract:

The amount of gross profit to be recognized on the income statement for the year ended December 31, 2009 is

The amount of gross profit to be recognized on the income statement for the year ended December 31, 2009 is

A) $800,000.

B) $860,000.

C) $900,000.

D) $2,150,000.

The amount of gross profit to be recognized on the income statement for the year ended December 31, 2009 is

The amount of gross profit to be recognized on the income statement for the year ended December 31, 2009 isA) $800,000.

B) $860,000.

C) $900,000.

D) $2,150,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

39

Kirby Builders, Inc. is using the completed-contract method for a $5,600,000 contract that will take two years to complete. Data at December 31, 2008, the end of the first year, are as follows:

The gross profit or loss that should be recognized for 2008 is

The gross profit or loss that should be recognized for 2008 is

A) $0.

B) a $240,000 loss.

C) a $120,000 loss.

D) a $105,600 loss.

The gross profit or loss that should be recognized for 2008 is

The gross profit or loss that should be recognized for 2008 isA) $0.

B) a $240,000 loss.

C) a $120,000 loss.

D) a $105,600 loss.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

40

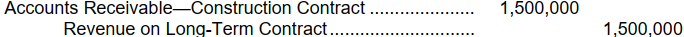

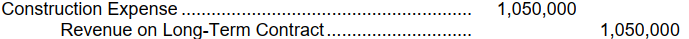

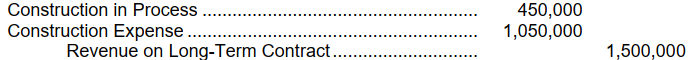

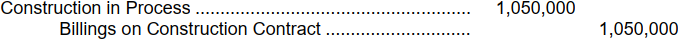

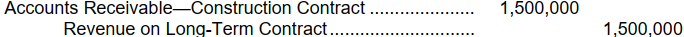

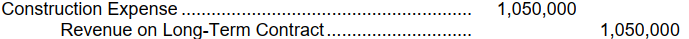

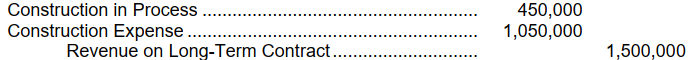

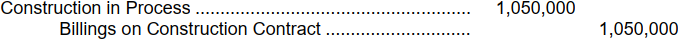

At the end of the first year which of the following entries would be made to recognize revenue on the contract?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

41

Bretts Construction Company had a contract starting April 2008, to construct a $6,000,000 building that is expected to be completed in September 2010, at an estimated cost of $5,500,000. At the end of 2008, the costs to date were $2,530,000 and the estimated total costs to complete had not changed. The progress billings during 2008 were $1,200,000 and the cash collected during 2008 was $800,000. Bretts uses the percentage-of-completion method.

-For the year ended December 31, 2008, Bretts would recognize gross profit on the building of

A) $210,833.33.

B) $230,000.00.

C) $270,000.00.

D) $0.

-For the year ended December 31, 2008, Bretts would recognize gross profit on the building of

A) $210,833.33.

B) $230,000.00.

C) $270,000.00.

D) $0.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

42

Bretts Construction Company had a contract starting April 2008, to construct a $6,000,000 building that is expected to be completed in September 2010, at an estimated cost of $5,500,000. At the end of 2008, the costs to date were $2,530,000 and the estimated total costs to complete had not changed. The progress billings during 2008 were $1,200,000 and the cash collected during 2008 was $800,000. Bretts uses the percentage-of-completion method.

-At December 31, 2008, Bretts would report Construction in Process in the amount of

A) $230,000.

B) $2,530,000.

C) $2,760,000.

D) $2,360,000.

-At December 31, 2008, Bretts would report Construction in Process in the amount of

A) $230,000.

B) $2,530,000.

C) $2,760,000.

D) $2,360,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

43

Harber Co. uses the installment -sales method. When an account had a balance of $8,400, no further collections could be made and the dining room set was repossessed. At that time, it was estimated that the dining room set could be sold for $2,400 as repossessed, or for $3,000 if the company spent $300 reconditioning it. The gross profit rate on this sale was 70%. The gain or loss on repossession was a

A) $5,880 loss.

B) $6,000 loss.

C) $600 gain.

D) $180 gain.

A) $5,880 loss.

B) $6,000 loss.

C) $600 gain.

D) $180 gain.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

44

Wagner Company sold some machinery to Granger Company on January 1, 2008. The cash selling price would have been $568,620. Granger entered into an installment sales contract which required annual payments of $150,000, including interest at 10%, over five years. The first payment was due on December 31, 2008. What amount of interest income should be included in Wagner's 2009 income statement (the second year of the contract)?

A) $15,000

B) $47,548

C) $30,000

D) $41,862

A) $15,000

B) $47,548

C) $30,000

D) $41,862

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

45

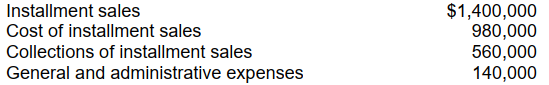

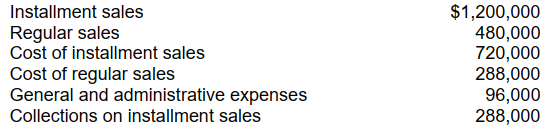

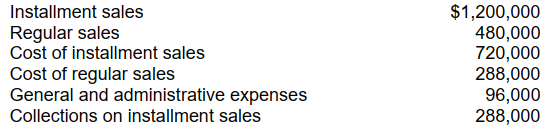

Lamberson Company has used the installment method of accounting since it began operations at the beginning of 2008. The following information pertains to its operations for 2008:

The amount to be reported on the December 31, 2008 balance sheet as Deferred Gross Profit should be

The amount to be reported on the December 31, 2008 balance sheet as Deferred Gross Profit should be

A) $168,000.

B) $252,000.

C) $336,000.

D) $840,000.

The amount to be reported on the December 31, 2008 balance sheet as Deferred Gross Profit should be

The amount to be reported on the December 31, 2008 balance sheet as Deferred Gross Profit should beA) $168,000.

B) $252,000.

C) $336,000.

D) $840,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

46

Singer Company sells plasma-screen televisions on an installment basis and appropri-ately uses the installment-sales method of accounting. A customer with an account balance of $5,600 refuses to make any more payments and the merchandise is repossessed. The gross profit rate on the original sale is 40%. Singer estimates that the television can be sold as is for $1,750, or for $2,100 if $140 is spent to refurbish it. The loss on repossession is

A) $3,850.

B) $2,240.

C) $1,610.

D) $1,400.

A) $3,850.

B) $2,240.

C) $1,610.

D) $1,400.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

47

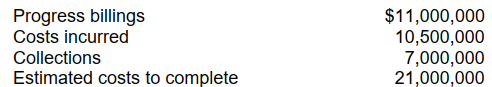

Noland Constructors, Inc. has consistently used the percentage-of-completion method of recognizing income. In 2008, Noland started work on a $35,000,000 construction contract that was completed in 2009. The following information was taken from Noland's 2008 accounting records:

What amount of gross profit should Noland have recognized in 2008 on this contract?

What amount of gross profit should Noland have recognized in 2008 on this contract?

A) $3,500,000

B) $2,333,334

C) $1,750,000

D) $1,166,667

What amount of gross profit should Noland have recognized in 2008 on this contract?

What amount of gross profit should Noland have recognized in 2008 on this contract?A) $3,500,000

B) $2,333,334

C) $1,750,000

D) $1,166,667

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

48

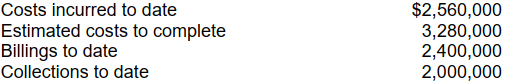

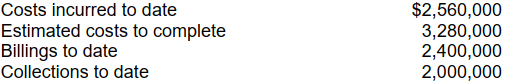

During 2008, Eaton Corp. started a construction job with a total contract price of $3,500,000. The job was completed on December 15, 2009. Additional data are as follows:

Under the completed-contract method, what amount should Eaton recognize as gross profit for 2009?

Under the completed-contract method, what amount should Eaton recognize as gross profit for 2009?

A) $225,000

B) $312,500

C) $475,000

D) $625,000

Under the completed-contract method, what amount should Eaton recognize as gross profit for 2009?

Under the completed-contract method, what amount should Eaton recognize as gross profit for 2009?A) $225,000

B) $312,500

C) $475,000

D) $625,000

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

49

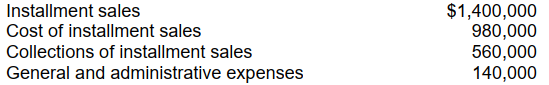

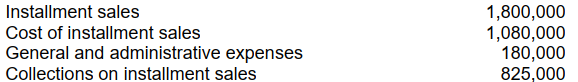

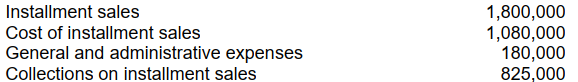

Neber Co., which began operations on January 1, 2008, appropriately uses the installment -sales method of accounting. The following information pertains to Neber's operations for the year 2008:

The deferred gross profit account in Neber's December 31, 2008 balance sheet should be

The deferred gross profit account in Neber's December 31, 2008 balance sheet should be

A) $115,200.

B) $192,000.

C) $364,800.

D) $480,000.

The deferred gross profit account in Neber's December 31, 2008 balance sheet should be

The deferred gross profit account in Neber's December 31, 2008 balance sheet should beA) $115,200.

B) $192,000.

C) $364,800.

D) $480,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, 2008, Stein Co. sold a used machine to Mays, Inc. for $350,000. On this date, the machine had a depreciated cost of $245,000. Mays paid $50,000 cash on January 1, 2008 and signed a $300,000 note bearing interest at 10%. The note was payable in three annual installments of $100,000 beginning January 1, 2009. Stein appropriately accounted for the sale under the installment method. Mays made a timely payment of the first installment on January 1, 2009 of $130,000, which included interest of $30,000 to date of payment. At December 31, 2009, Stein has deferred gross profit of

A) $70,000.

B) $66,000.

C) $60,000.

D) $51,000.

A) $70,000.

B) $66,000.

C) $60,000.

D) $51,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

51

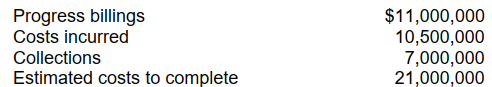

Grant Co. began operations on January 1, 2008 and appropriately uses the installment method of accounting. The following information pertains to Grant's operations for 2008:

The balance in the deferred gross profit account at December 31, 2008 should be

The balance in the deferred gross profit account at December 31, 2008 should be

A) $330,000.

B) $495,000.

C) $390,000.

D) $720,000.

The balance in the deferred gross profit account at December 31, 2008 should be

The balance in the deferred gross profit account at December 31, 2008 should beA) $330,000.

B) $495,000.

C) $390,000.

D) $720,000.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck

52

Lott Co. records all sales using the installment method of accounting. Installment sales contracts call for 36 equal monthly cash payments. According to the FASB's conceptual framework, the amount of deferred gross profit relating to collections 12 months beyond the balance sheet date should be reported in the

A) current liabilities section as a deferred revenue.

B) noncurrent liabilities section as a deferred revenue.

C) current assets section as a contra account.

D) noncurrent assets section as a contra account.

A) current liabilities section as a deferred revenue.

B) noncurrent liabilities section as a deferred revenue.

C) current assets section as a contra account.

D) noncurrent assets section as a contra account.

Unlock Deck

Unlock for access to all 52 flashcards in this deck.

Unlock Deck

k this deck