Deck 2: Conceptual Framework Underlying Financial Accounting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 2: Conceptual Framework Underlying Financial Accounting

1

A conceptual framework underlying financial accounting is necessary because future accounting practice problems can be solved by reference to the conceptual framework and a formal standard-setting body will not be necessary.

False

2

Use of a sound conceptual framework in the development of accounting principles will make financial statements of all entities comparable because alternative accounting methods for similar transactions will be eliminated.

False

3

Accounting theory is developed without consideration of the environment within which it exists.

False

4

Information that has been measured and reported in a similar manner for different enterprises is considered comparable.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

The fact that equity represents an ownership interest and a residual claim against the net assets of an enterprise means that in the event of liquidation, creditors have a priority over owners in the distribution of assets.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

The three elements assets, liabilities, and equity describe transactions, events, and circumstances that affect an enterprise during a period of time.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

The going concern assumption is generally applicable in most business situations unless liquidation appears imminent.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

The periodicity assumption is a result of the demands of various financial statement user groups for timely reporting of financial information.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

Recognition of revenue when cash is collected is appropriate only when it is impossible to establish the revenue figure at the time of sale because of the uncertainty of collection.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

Under the matching principle, it is possible to have an expense reported on the income statement in one period and the cash payment for that expense reported in another period.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

The full disclosure principle states that information should be provided when it is of sufficient importance to influence the judgment and decisions of an informed user.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

The notes to financial statements generally summarize the items presented in the main body of the statements.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

When an amount is determined by the accountant to be immaterial in relation to other amounts reported in the financial statements, that amount may be deleted from the financial statements.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

The peculiar nature of some industries and concerns sometimes requires departure from basic theory.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not a benefit associated with the FASB Conceptual Framework Project?

A) A conceptual framework should increase financial statement users' understanding of and confidence in financial reporting.

B) Practical problems should be more quickly solvable by reference to an existing conceptual framework.

C) A coherent set of accounting standards and rules should result.

D) Business entities will need far less assistance from accountants because the financial reporting process will be quite easy to apply.

A) A conceptual framework should increase financial statement users' understanding of and confidence in financial reporting.

B) Practical problems should be more quickly solvable by reference to an existing conceptual framework.

C) A coherent set of accounting standards and rules should result.

D) Business entities will need far less assistance from accountants because the financial reporting process will be quite easy to apply.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not an objective of financial reporting?

A) To provide information about economic resources, the claims to those resources, and the changes in them.

B) To provide information that is helpful to investors and creditors and other users in assessing the amounts, timing, and uncertainty of future cash flows.

C) To provide information that is useful to those making investment and credit decisions.

D) All of these are objectives of financial reporting.

A) To provide information about economic resources, the claims to those resources, and the changes in them.

B) To provide information that is helpful to investors and creditors and other users in assessing the amounts, timing, and uncertainty of future cash flows.

C) To provide information that is useful to those making investment and credit decisions.

D) All of these are objectives of financial reporting.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

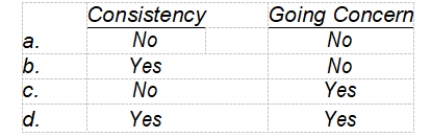

17

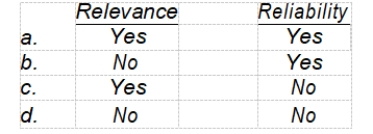

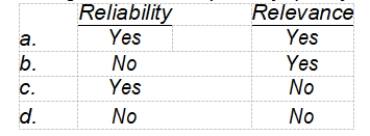

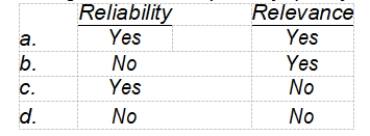

According to Statement of Financial Accounting Concepts No. 2, timeliness is an ingredient of the primary quality of

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

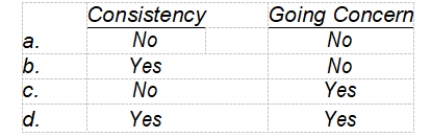

18

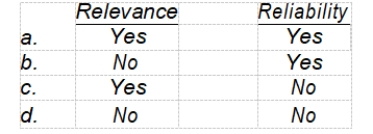

According to Statement of Financial Accounting Concepts No. 2, verifiability is an ingredient of the primary quality of

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

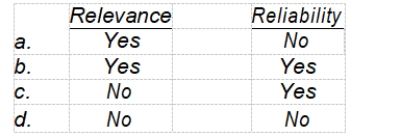

19

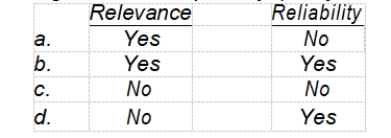

Under Statement of Financial Accounting Concepts No. 2, representational faithfulness is an ingredient of the primary quality of

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following violates the concept of reliability?

A) The management report refers to new discoveries and inventions made, but the financial statements never report the results.

B) Financial statements included goodwill with a carrying amount estimated by management.

C) Financial statements were issued one year late.

D) An interim report is not issued even though it would provide feedback on past performance.

A) The management report refers to new discoveries and inventions made, but the financial statements never report the results.

B) Financial statements included goodwill with a carrying amount estimated by management.

C) Financial statements were issued one year late.

D) An interim report is not issued even though it would provide feedback on past performance.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

If accounting information is verifiable, representationally faithful, and neutral, it can be considered

A) relevant.

B) timely.

C) comparable.

D) reliable.

A) relevant.

B) timely.

C) comparable.

D) reliable.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

The major objective of the consistency principle is to

A) provide timely financial information for statement users.

B) promote comparability between financial statements of different accounting periods.

C) match the appropriate revenues and expenses in a given accounting period.

D) be sure the same information is disclosed in each accounting period.

A) provide timely financial information for statement users.

B) promote comparability between financial statements of different accounting periods.

C) match the appropriate revenues and expenses in a given accounting period.

D) be sure the same information is disclosed in each accounting period.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Comprehensive income as characterized in SFAC No. 6 includes all changes in equity during a period except

A) sale of assets other than inventory.

B) those resulting from investments by or distribution to owners.

C) sales to a particular entity where ultimate payment by the entity is doubtful.

D) those resulting from revenue generated by a totally owned subsidiary.

A) sale of assets other than inventory.

B) those resulting from investments by or distribution to owners.

C) sales to a particular entity where ultimate payment by the entity is doubtful.

D) those resulting from revenue generated by a totally owned subsidiary.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

One of the elements of financial statements is comprehensive income. As described in Statement of Financial Accounting Concepts No. 6, "Elements of Financial Statements," comprehensive income is equal to

A) revenues minus expenses plus gains minus losses.

B) revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners.

C) revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners plus assets minus liabilities.

D) none of these.

A) revenues minus expenses plus gains minus losses.

B) revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners.

C) revenues minus expenses plus gains minus losses plus investments by owners minus distributions to owners plus assets minus liabilities.

D) none of these.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

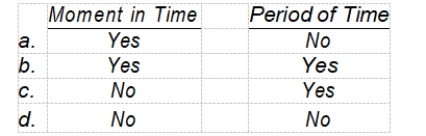

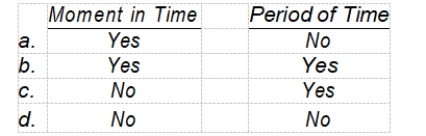

According to the FASB Conceptual Framework, the elements assets, liabilities, and equity describe amounts of resources and claims to resources at/during a

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

The economic entity assumption in accounting is best reflected by which of the following statements?

A) When a parent and subsidiary company are merged for accounting and reporting purposes, the economic entity assumption is violated.

B) The best way to truly measure the results of enterprise activity is to measure them at the time the enterprise is liquidated.

C) The activity of a business enterprise can be kept separate and distinct from its owners and any other business unit.

D) A business enterprise is in business to enhance the economic well being of its owners.

A) When a parent and subsidiary company are merged for accounting and reporting purposes, the economic entity assumption is violated.

B) The best way to truly measure the results of enterprise activity is to measure them at the time the enterprise is liquidated.

C) The activity of a business enterprise can be kept separate and distinct from its owners and any other business unit.

D) A business enterprise is in business to enhance the economic well being of its owners.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

Continuation of an accounting entity in the absence of evidence to the contrary is an example of the basic concept of

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

In accounting, an economic entity may be defined as

A) a business enterprise.

B) an individual.

C) a division within a business enterprise.

D) all of the above.

A) a business enterprise.

B) an individual.

C) a division within a business enterprise.

D) all of the above.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Although many objections have been raised about the historical cost principle, it is still widely supported for financial reporting because it

A) is an objectively determinable amount.

B) is a good measure of current value.

C) facilitates comparisons between years.

D) takes into account price-level adjusted information.

A) is an objectively determinable amount.

B) is a good measure of current value.

C) facilitates comparisons between years.

D) takes into account price-level adjusted information.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

Under the revenue recognition principle, revenue is generally recognized when the earning process is virtually complete and

A) an exchange transaction has occurred.

B) the merchandise has been ordered.

C) all expenses have been identified.

D) the accounting process is virtually complete.

A) an exchange transaction has occurred.

B) the merchandise has been ordered.

C) all expenses have been identified.

D) the accounting process is virtually complete.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is an incorrect statement regarding the matching principle?

A) Expenses are recognized when they make a contribution to revenue.

B) Costs are never charged to the current period as an expense simply because no connection with revenue can be determined.

C) In recognizing expenses, accountants attempt to follow the approach of let the expense follow the revenue.

D) If no direct connection appears between costs and revenues, but the costs benefit future years, an allocation of cost on some systematic and rational basis might be appropriate.

A) Expenses are recognized when they make a contribution to revenue.

B) Costs are never charged to the current period as an expense simply because no connection with revenue can be determined.

C) In recognizing expenses, accountants attempt to follow the approach of let the expense follow the revenue.

D) If no direct connection appears between costs and revenues, but the costs benefit future years, an allocation of cost on some systematic and rational basis might be appropriate.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

The concept referred to by the matching principle is that

A) current liabilities have the same period of existence as the current assets.

B) all cash disbursements for a period be matched to cash receipts for the period.

C) net income should be reported on a quarterly basis.

D) where possible the expenses to be included in the income statement were incurred to produce the revenues.

A) current liabilities have the same period of existence as the current assets.

B) all cash disbursements for a period be matched to cash receipts for the period.

C) net income should be reported on a quarterly basis.

D) where possible the expenses to be included in the income statement were incurred to produce the revenues.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

In complying with the full disclosure principle, an accountant must determine the amount of disclosure necessary. How much disclosure is enough?

A) Information sufficient for a person without any knowledge of accounting to understand the statements.

B) All information that might be of interest to an owner of a business enterprise.

C) Information that is of sufficient importance to influence the judgment and decisions of an informed user.

D) Information sufficient to permit most persons coming in contact with the statements to reach an accurate decision about the financial condition of the enterprise.

A) Information sufficient for a person without any knowledge of accounting to understand the statements.

B) All information that might be of interest to an owner of a business enterprise.

C) Information that is of sufficient importance to influence the judgment and decisions of an informed user.

D) Information sufficient to permit most persons coming in contact with the statements to reach an accurate decision about the financial condition of the enterprise.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements concerning the cost-benefit relationship is not true?

A) Business reporting should exclude information outside of management's expertise.

B) Management should not be required to report information that would significantly harm the company's competitive position.

C) Management should not be required to provide forecasted financial information.

D) If needed by financial statement users, management should gather information not included in the financial statements that would not otherwise be gathered for internal use.

A) Business reporting should exclude information outside of management's expertise.

B) Management should not be required to report information that would significantly harm the company's competitive position.

C) Management should not be required to provide forecasted financial information.

D) If needed by financial statement users, management should gather information not included in the financial statements that would not otherwise be gathered for internal use.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

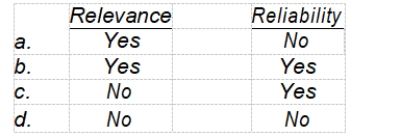

35

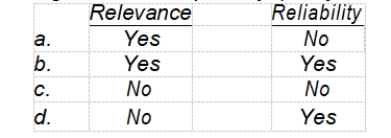

According to the FASB's conceptual framework, predictive value is an ingredient of

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck