Deck 16: Nonprofit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 16: Nonprofit Organizations

1

Contributed services to professional associations generally are recognized as revenues by the associations.

False

2

The accounting period in which pledged revenues are recognized is dependent on donor specifications.

True

3

Fund-raising costs expected to benefit future accounting periods are deferred by nonprofit organizations.

False

4

Collections are a type of nonexhaustible plant assets of nonprofit organizations.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

The modified accrual basis of accounting used by some funds of a governmental entity is appropriate for some funds of a nonprofit organization.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

The Designated Fund Balance ledger account of a nonprofit organization's unrestricted fund is similar to a retained earnings appropriation account of a business corporation.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

A life income fund of a nonprofit organization resembles a sinking fund for the retirement of debt of a business enterprise.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

A quasi-endowment fund may be expended by a nonprofit organization after either the passage of a period of time or the occurrence of an event specified by the donor of the endowment principal.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

The provision for doubtful loans of a university's student loan fund is debited to the Doubtful Loans Expense ledger account.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

Assets of the unrestricted fund of a nonprofit organization may be transferred to a restricted fund by the organization's board of directors.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

Fund accounting is inappropriate for a nonprofit hospital.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

Contributed material is recognized as revenues by a nonprofit organization's unrestricted fund.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

If a university waives tuition charges for children of its faculty and staff, no revenues are recognized.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

Depreciation expense is recognized by nonprofit organizations.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

Assets of a nonprofit organization's restricted funds are derived from the operations of the organization.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

The principal of term endowment funds may be expended by a nonprofit organization after the passage of a period of time or the occurrence of an event.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

Payments to the beneficiary of a nonprofit organization's life income fund are fixed in amount.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

The issuance of a statement of activities is appropriate for nonprofit organizations.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

A gift to a nonprofit hospital that is not restricted by the donor is credited in the hospital's general fund to:

A) Fund Balance

B) Deferred Revenues

C) Contributions Revenues

D) Nonoperating Revenues

A) Fund Balance

B) Deferred Revenues

C) Contributions Revenues

D) Nonoperating Revenues

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following funds of a nonprofit organization makes periodic payments of a fixed amount at equal intervals.

A) Annuity fund

B) Agency fund

C) Endowment fund

D) Restricted fund

A) Annuity fund

B) Agency fund

C) Endowment fund

D) Restricted fund

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

An annuity fund of a nonprofit organization is most similar to the organization's:

A) Endowment fund

B) Restricted fund

C) Agency fund

D) Life income fund

A) Endowment fund

B) Restricted fund

C) Agency fund

D) Life income fund

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

The current fair value of contributed material is recognized in a nonprofit organization's unrestricted fund with a debit to Inventories and a credit to:

A) Undesignated Fund Balance

B) Payable to Restricted Fund

C) Designated Fund Balance-Merchandise

D) Contributions Revenues

E) Some other ledger account

A) Undesignated Fund Balance

B) Payable to Restricted Fund

C) Designated Fund Balance-Merchandise

D) Contributions Revenues

E) Some other ledger account

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

Are tuition remissions for which there is no intention of collection from the student recognized by a nonprofit university as:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not a source of resources of a nonprofit organization's restricted fund?

A) Operations of the nonprofit organization

B) Contributions of individuals or governmental entities

C) Gains on disposals of investments

D) Revenues from endowments

A) Operations of the nonprofit organization

B) Contributions of individuals or governmental entities

C) Gains on disposals of investments

D) Revenues from endowments

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

One-half of the tuition of classes taken by spouses of Colby College faculty members is remitted (waived) by Colby. In the journal entry for tuition for a four-unit course for a professor's spouse, with tuition at $210 a unit, Tuition Revenues is credited for:

A) $0 (credit Remission Revenue)

B) $420

C) $840

D) Some other amount

A) $0 (credit Remission Revenue)

B) $420

C) $840

D) Some other amount

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

The type of endowment fund for which the principal may be expended after the occurrence of an event specified by the donor of the principal is:

A) A pure endowment fund

B) A quasi-endowment fund

C) An expendable endowment fund

D) None of the foregoing

A) A pure endowment fund

B) A quasi-endowment fund

C) An expendable endowment fund

D) None of the foregoing

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

Any restrictions on gifts, grants, or bequests received by nonprofit organizations are imposed by:

A) State laws

B) Governing boards

C) Donors

D) "Nonprofit Organizations"

A) State laws

B) Governing boards

C) Donors

D) "Nonprofit Organizations"

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

Are unpaid amounts of conditional pledges that may be revoked by a nonprofit organization recognized as expense when:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

The difference between a nonprofit organization's annuity funds and life income funds is:

A) The nature of the Fund Balance ledger account

B) The fixed versus variable amount of payments to recipients

C) The status of each fund in the organization's investment pool

D) Some other difference

A) The nature of the Fund Balance ledger account

B) The fixed versus variable amount of payments to recipients

C) The status of each fund in the organization's investment pool

D) Some other difference

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

One characteristic of nonprofit organizations that is comparable with characteristics of governmental entities is:

A) Stewardship of resources

B) Governance by board of directors

C) Measurement of cost expirations

D) None of the foregoing

A) Stewardship of resources

B) Governance by board of directors

C) Measurement of cost expirations

D) None of the foregoing

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

A nonprofit organization's restricted fund typically is established in Rationale to:

A) A resolution of the organization's board of trustees

B) A mandate of a governmental agency

C) Provisions of a contribution to the organization

D) Some other transaction or event

A) A resolution of the organization's board of trustees

B) A mandate of a governmental agency

C) Provisions of a contribution to the organization

D) Some other transaction or event

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

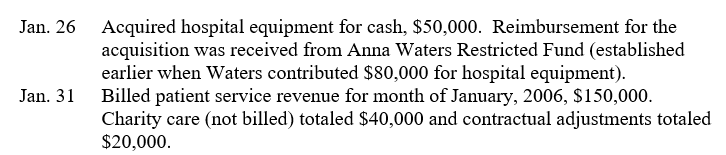

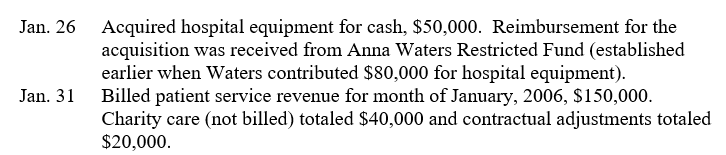

Prepare journal entries (omit explanations) for the following transactions or events of the General Fund and Anna Waters Restricted Fund of Modem Hospital (a nonprofit organization) during January, 2006.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

On July 1, 2006, the Unrestricted Fund, Restricted Fund, and Endowment Fund of Urban Health Organization, a nonprofit organization, pooled their investments, as follows:

During the month of July, 2006, the Urban Health Organization investment pool, managed by the Unrestricted Fund, received interest and dividends revenue totaling $64,000.

During the month of July, 2006, the Urban Health Organization investment pool, managed by the Unrestricted Fund, received interest and dividends revenue totaling $64,000.

Prepare journal entries dated July 31, 2006, in the three funds of Urban Health Organization to record receipt of the interest and dividends revenue. Omit explanations, but identify the fund in which each journal entry is recorded.

During the month of July, 2006, the Urban Health Organization investment pool, managed by the Unrestricted Fund, received interest and dividends revenue totaling $64,000.

During the month of July, 2006, the Urban Health Organization investment pool, managed by the Unrestricted Fund, received interest and dividends revenue totaling $64,000.Prepare journal entries dated July 31, 2006, in the three funds of Urban Health Organization to record receipt of the interest and dividends revenue. Omit explanations, but identify the fund in which each journal entry is recorded.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

The Student Loan Fund of Dorris College had the following transactions and events during the month of September, 2006.

(1) Disbursed new loans totaling $400,000.

(2) Received payments of $120,000 on loans receivable, including $4,000 interest.

(3) Wrote off uncollectible loans totaling $30,000.

(4) Estimated a required increase of $40,000 in the Allowance for Doubtful Loans ledger account balance on September 30, 2006.

(5) Computed accrued interest of $8,000 on loans receivable on September 30, 2006.

Prepare journal entries for the Dorris College Student Loan Fund to record the foregoing transactions and events. Omit explanations.

(1) Disbursed new loans totaling $400,000.

(2) Received payments of $120,000 on loans receivable, including $4,000 interest.

(3) Wrote off uncollectible loans totaling $30,000.

(4) Estimated a required increase of $40,000 in the Allowance for Doubtful Loans ledger account balance on September 30, 2006.

(5) Computed accrued interest of $8,000 on loans receivable on September 30, 2006.

Prepare journal entries for the Dorris College Student Loan Fund to record the foregoing transactions and events. Omit explanations.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

Martha Randall, audit manager of the CPA firm Alan West & Company, is conducting a staff training program on accounting and auditing of nonprofit organizations. During the program, staff assistant Milton Rogers questions the feasibility of the Financial Accounting Standards Board's establishing accounting standards for all nonprofit organizations. "Given the wide variety of nonprofit organizations, from cemetery organizations to zoological societies,"

says Rogers, "it seems unfeasible to believe that one set of standards would fit all such organizations."

What should be Martha Randall's (or another training program participant's) Rationale to Milton Rogers? Explain.

says Rogers, "it seems unfeasible to believe that one set of standards would fit all such organizations."

What should be Martha Randall's (or another training program participant's) Rationale to Milton Rogers? Explain.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck