Deck 11: International Accounting Standards; Accounting for Foreign Currency Transactions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/24

Play

Full screen (f)

Deck 11: International Accounting Standards; Accounting for Foreign Currency Transactions

1

Foreign currency transaction gains and losses are displayed in an income statement as extraordinary items because they are unusual in nature and are not expected to recur as a consequence of customary and continuing business activities.

False

2

If the spot rates for the local currency unit (LCU) are: buying rate, LCU1 = $0.0090; and selling rate, LCU1 = $0.0096, a U.S. multinational enterprise pays $900 to a foreign currency dealer for a LCU 100,000 draft.

False

3

The liability under a forward contract is measured by the difference between the forward rate and the spot rate on the date of the contract.

False

4

The buying spot rate is used by a U.S. multinational enterprise to restate a trade account receivable from a foreign customer denominated in the foreign currency.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

5

A foreign currency transaction gain or loss is recognized on a forward contract that was not designated as a hedge whenever the forward rate for the foreign currency changes.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

6

Foreign currency transaction gains attributable to a forward contract designated as a hedge of a foreign-currency denominated firm commitment are recognized in the carrying amount of the hedged item.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

7

The pronouncements of the International Accounting Standards Board establish accounting rules that must be used by U.S. multinational enterprises.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

8

Spot rates are exchange rates applicable to current foreign currency transactions.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

9

Under the one-transaction perspective for foreign currency transactions, the original amount entered in the accounting records for a foreign merchandise purchase subsequently is adjusted when the exact amount of U.S. dollars required to obtain the foreign currency for payment to the supplier is known.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

10

A decrease in the selling spot rate for a foreign currency in which a trade account receivable of a U.S. multinational enterprise is denominated produces a foreign currency transaction gain to the enterprise.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

11

International Accounting Standards often are similar to the FASB's Statements of Financial Accounting Standards.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

12

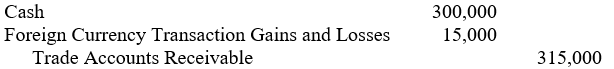

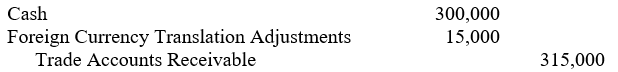

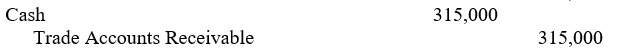

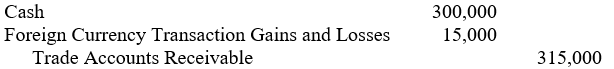

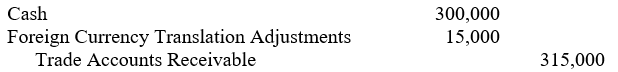

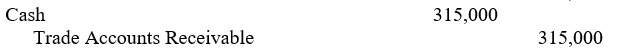

Export Company had a trade account receivable from a foreign customer stated in the local currency of the foreign customer. The trade account receivable for 900,000 local currency units (LCU) had been translated to $315,000 in Export's December 31, 2005, balance sheet. On January 15, 2006, the account receivable was collected in full when the exchange rate was LCU1 = $0.33 1/3. The journal entry (explanation omitted) that Export prepares to record the collection of this trade account receivable is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

13

A foreign currency transaction loss occurs on an open-account purchase from a foreign supplier denominated in local currency units (LCU) of the foreign supplier's country if the:

A) Buying spot rate for the LCU decreases between the purchase date and the payment date

B) Selling spot rate for the LCU decreases between the purchase date and the payment date

C) Buying spot rate for the LCU increases between the purchase date and the payment date

D) Selling spot rate for the LCU increases between the purchase date and the payment date

A) Buying spot rate for the LCU decreases between the purchase date and the payment date

B) Selling spot rate for the LCU decreases between the purchase date and the payment date

C) Buying spot rate for the LCU increases between the purchase date and the payment date

D) Selling spot rate for the LCU increases between the purchase date and the payment date

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

14

A foreign currency transaction gain or loss is:

A) A change in the exchange rate quoted by a foreign currency dealer

B) A term synonymous with translation of a foreign currency to U.S. dollars

C) The difference between the recorded U.S. dollar amount of a trade account receivable or a trade account payable denominated in a foreign currency and the amount of U.S. dollars ultimately received or paid

D) A change from the current/noncurrent method to the monetary/nonmonetary method of remeasuring a foreign investee's financial statements to the U.S. dollar functional currency

A) A change in the exchange rate quoted by a foreign currency dealer

B) A term synonymous with translation of a foreign currency to U.S. dollars

C) The difference between the recorded U.S. dollar amount of a trade account receivable or a trade account payable denominated in a foreign currency and the amount of U.S. dollars ultimately received or paid

D) A change from the current/noncurrent method to the monetary/nonmonetary method of remeasuring a foreign investee's financial statements to the U.S. dollar functional currency

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

15

If one Canadian dollar may be exchanged for 90 U.S. cents, the fraction to compute the exchange rate expressed in Canadian dollars is:

A) 1.10/1

B) 1/1.10

C) 1/0.90

D) 0.90/1

E) Some other fraction

A) 1.10/1

B) 1/1.10

C) 1/0.90

D) 0.90/1

E) Some other fraction

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

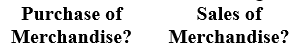

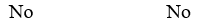

16

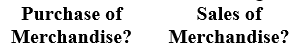

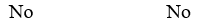

May foreign currency transaction gains or losses be recognized on the following transactions denominated in a foreign currency:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

17

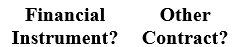

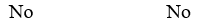

May a derivative instrument be a:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

18

Inter-Coastal Company acquired a sixty-day forward contract for 500,000 euros (i). With respect to that derivative instrument, the underlying is:

A) The euro currency

B) The forward rate

C) 500,000 euros

D) The U.S. dollar amount of the contract

A) The euro currency

B) The forward rate

C) 500,000 euros

D) The U.S. dollar amount of the contract

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

19

The number of types of forward contracts for which the FASB established standards in FASB Statement No. 133, "Accounting for Derivative Instruments and Hedging Activities," is:

A) Three

B) Four

C) Five

D) Six

A) Three

B) Four

C) Five

D) Six

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

20

On November 9, 2006, Usa Corporation, a U.S. multinational enterprise that prepares monthly financial statements, sold merchandise costing $20,000 to a foreign customer on 30-day open account for 50,000 local currency units (LCU). Usa employs the perpetual inventory system. On December 9, 2006, Usa received a draft for LCU50,000 from the foreign customer. Spot rates for the LCU during the remainder of 2006 were as follows:

Prepare journal entries for Usa Corporation's transactions with the foreign customer. Omit explanations.

Prepare journal entries for Usa Corporation's transactions with the foreign customer. Omit explanations.

Prepare journal entries for Usa Corporation's transactions with the foreign customer. Omit explanations.

Prepare journal entries for Usa Corporation's transactions with the foreign customer. Omit explanations.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

21

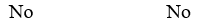

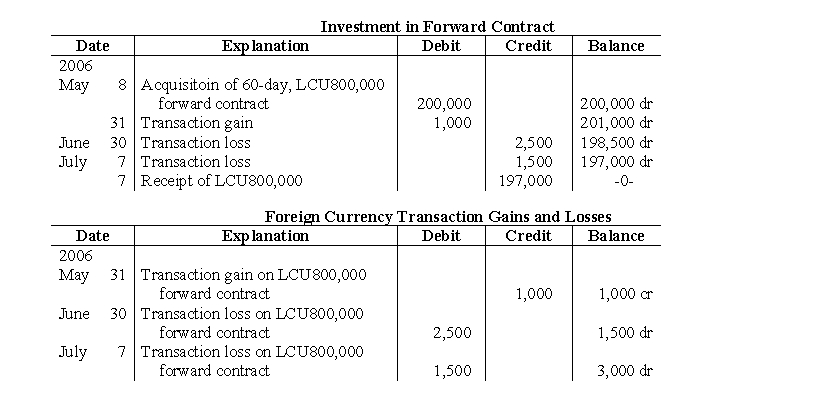

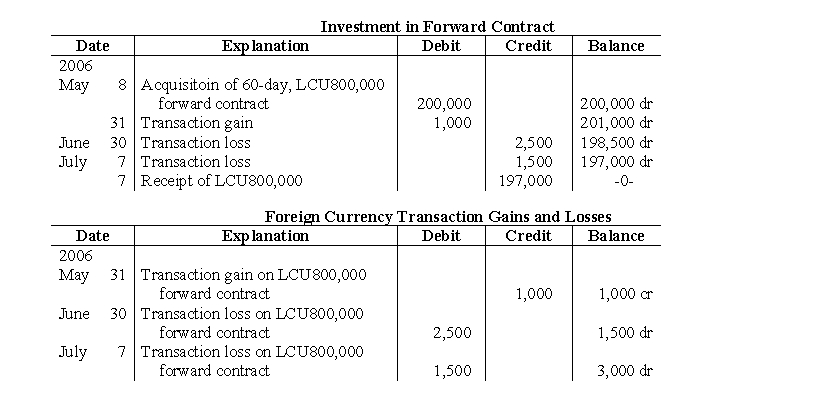

Selected ledger accounts of Texas Company, a U.S. multinational enterprise, related to a forward contract for 800,000 local currency units (LCU) that Texas had not designated as a hedge, are as follows:

Reconstruct Texas Company's journal entries for the forward contract on May 8, May 31, June 30, and July 7, 2006 (for the receipt of the local currency units only). Omit explanations.

Reconstruct Texas Company's journal entries for the forward contract on May 8, May 31, June 30, and July 7, 2006 (for the receipt of the local currency units only). Omit explanations.

Reconstruct Texas Company's journal entries for the forward contract on May 8, May 31, June 30, and July 7, 2006 (for the receipt of the local currency units only). Omit explanations.

Reconstruct Texas Company's journal entries for the forward contract on May 8, May 31, June 30, and July 7, 2006 (for the receipt of the local currency units only). Omit explanations.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

22

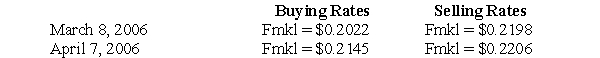

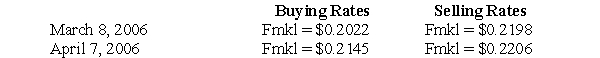

Spatial Industries, a U.S. multinational enterprise that prepares annual financial statements, received merchandise on March 8, 2006, from a Finnish supplier at a cost of 200,000 markkas (Fmk). Spatial acquired a draft on April 7, 2006, in the amount of Fmk200,000 for mailing to the Finnish supplier. Spot rates for the markka on the two dates were as follows:

Prepare a working paper to compute the amount of the foreign currency transaction gain or loss that Spatial Industries recognizes on April 7, 2006. Show computations.

Prepare a working paper to compute the amount of the foreign currency transaction gain or loss that Spatial Industries recognizes on April 7, 2006. Show computations.

Prepare a working paper to compute the amount of the foreign currency transaction gain or loss that Spatial Industries recognizes on April 7, 2006. Show computations.

Prepare a working paper to compute the amount of the foreign currency transaction gain or loss that Spatial Industries recognizes on April 7, 2006. Show computations.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

23

On November 18, 2006, when the selling spot rate for a foreign country's local currency unit (LCU) was LCU1 = $0.18, Usc Company acquired a 30-day forward contract for LCU100,000 at the forward rate of LCU1 = $0.21. The contract was not designated as a hedge. On November 30, 2006, the end of the accounting period, the 12-day forward rate for the LCU was LCU1 = $0.22. On December 18, 2006, when Usc paid the forward contract and received the LCUs, the selling spot rate was LCU1 = $0.23. The appropriate discount rate is 6%.

Prepare journal entries (omit explanations) for Usc Company on November 17 and 30 and December 17, 2006.

Prepare journal entries (omit explanations) for Usc Company on November 17 and 30 and December 17, 2006.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck

24

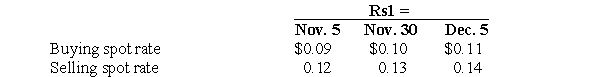

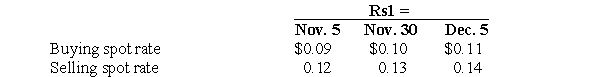

On November 5, 2006, Transnational Company sold merchandise costing $500 to an Indian customer for 10,000 rupees (Rs). On December 5, 2006, Transnational received from the Indian customer a draft for Rs10,000, which it exchanged for U.S. dollars. Transnational closed its accounting records monthly and uses the perpetual inventory system. Selected spot exchange rates for the rupee were as follows:

Prepare journal entries related to the transaction with the Indian customer in the accounting records of Transnational Company.

Prepare journal entries related to the transaction with the Indian customer in the accounting records of Transnational Company.

Prepare journal entries related to the transaction with the Indian customer in the accounting records of Transnational Company.

Prepare journal entries related to the transaction with the Indian customer in the accounting records of Transnational Company.

Unlock Deck

Unlock for access to all 24 flashcards in this deck.

Unlock Deck

k this deck