Deck 7: The Economics of Health Care

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/35

Play

Full screen (f)

Deck 7: The Economics of Health Care

1

Over the past 170 years in the United States, life expectancy

A) has remained fairly constant.

B) has slightly declined.

C) has more than doubled.

D) increased up to the 1950s and then declined for the next 60 years.

A) has remained fairly constant.

B) has slightly declined.

C) has more than doubled.

D) increased up to the 1950s and then declined for the next 60 years.

has more than doubled.

2

Between 1981 and 2017, the overall mortality rate in the United States

A) decreased by more than 25 percent.

B) slowly but steadily increased.

C) remained fairly constant.

D) was similar to the average rate in most low-income countries.

A) decreased by more than 25 percent.

B) slowly but steadily increased.

C) remained fairly constant.

D) was similar to the average rate in most low-income countries.

decreased by more than 25 percent.

3

In the United States from 1981 to 2017, deaths from all of the following declined substantially except

A) cancer.

B) kidney disease.

C) heart attacks.

D) strokes.

A) cancer.

B) kidney disease.

C) heart attacks.

D) strokes.

kidney disease.

4

In the United States from 1981 to 2017, deaths from diabetes increased largely due to the effects of

A) foreign-produced insulin.

B) stress in the workplace.

C) a larger immigrant population.

D) increasing obesity.

A) foreign-produced insulin.

B) stress in the workplace.

C) a larger immigrant population.

D) increasing obesity.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

5

The overall mortality rate in the United States has remained fairly constant for the past 36 years.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

6

Between 1981 and 2017, deaths from cancer have increased in the United States.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

7

In the United States in 2018, the percentage of people who received health insurance through their employer was about

A) 9%.

B) 11%.

C) 39%.

D) 55%.

A) 9%.

B) 11%.

C) 39%.

D) 55%.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

8

In the United States in 2018, the percentage of people without any form of health insurance was about

A) 9%.

B) 29%.

C) 64%.

D) 83%.

A) 9%.

B) 29%.

C) 64%.

D) 83%.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

9

In the United States in 2018, the percentage of people who received health insurance through a government program was about

A) 11%.

B) 16%.

C) 39%.

D) 55%.

A) 11%.

B) 16%.

C) 39%.

D) 55%.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

10

In the United States in 2018, the percentage of firms that employed more than 100 workers and offered health insurance as a fringe benefit to the workers was

A) 11%.

B) 39%.

C) 57%.

D) 96%.

A) 11%.

B) 39%.

C) 57%.

D) 96%.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

11

In the United States in 2018, the percentage of all firms that offered health insurance as a fringe benefit to the workers was about

A) 11%.

B) 39%.

C) 57%.

D) 96%.

A) 11%.

B) 39%.

C) 57%.

D) 96%.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

12

In the United States in 2018, the percentage of people that directly purchased an individual or family health insurance policy from an insurance company was about

A) 8%.

B) 11%.

C) 39%.

D) 55%.

A) 8%.

B) 11%.

C) 39%.

D) 55%.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

13

In the United States in 2018, more than seventy percent of those who were not covered by health insurance

A) are single and unemployed.

B) live in families in which at least one member has a job.

C) live in families in which all members are unemployed.

D) are retired from the workforce.

A) are single and unemployed.

B) live in families in which at least one member has a job.

C) live in families in which all members are unemployed.

D) are retired from the workforce.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

14

In the United States in 2018, of those companies that offered health care to those workers, ________ of employees accepted the coverage.

A) about 10 percent

B) roughly 36 percent

C) fewer than two-thirds

D) almost 98 percent

A) about 10 percent

B) roughly 36 percent

C) fewer than two-thirds

D) almost 98 percent

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

15

Government-provided health care is funded by tax revenues in which of the following countries?

A) Canada

B) Japan

C) the United Kingdom

D) all of the above

A) Canada

B) Japan

C) the United Kingdom

D) all of the above

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

16

In which of the following countries are copayments for as much as 30 percent of charges typically required as a part of the health care system?

A) Canada

B) Japan

C) the United Kingdom

D) all of the above

A) Canada

B) Japan

C) the United Kingdom

D) all of the above

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

17

The largest government-run health care system in the world is in

A) Canada.

B) Japan.

C) the United Kingdom.

D) the United States.

A) Canada.

B) Japan.

C) the United Kingdom.

D) the United States.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

18

In the United States in 2018, over 90 percent of people without health insurance were below the age of 35.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

19

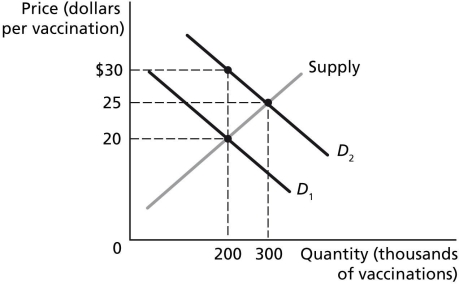

Figure 7-1 represents the market for vaccinations. Vaccinations are considered a benefit to society, and the figure shows both the marginal private benefit and the marginal social benefit from vaccinations.

-Refer to Figure 7-1. At the market equilibrium, the deadweight loss is equal to

A) $0.

B) $250,000.

C) $500,000.

D) $1,000,000.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

20

Suppose you see a 2010 MINI Cooper Clubman advertised in the local newspaper for $4,500. If you knew the car was reliable, you would be willing to pay $6,000 for it. If you knew the car was unreliable, you would only be willing to pay $2,500 for it. Under what circumstances should you buy the car at the asking price?

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

21

In 2019, health care's share of gross domestic product in the United States

A) had returned to its 1995 level.

B) had declined to only 6.5 percent.

C) was about three times as high as it was in 1965.

D) reached a level of 75 percent.

A) had returned to its 1995 level.

B) had declined to only 6.5 percent.

C) was about three times as high as it was in 1965.

D) reached a level of 75 percent.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

22

Which provision of the Affordable Care Act (ACA) was repealed by Congress in 2017?

A) the individual mandate

B) the state health insurance marketplace

C) the employer mandate

D) the regulation of health insurance

A) the individual mandate

B) the state health insurance marketplace

C) the employer mandate

D) the regulation of health insurance

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

23

All of the following are part of the "state health insurance marketplaces" provision of the Affordable Care Act (ACA) except

A) each state is required to establish an Affordable Insurance Exchange.

B) small businesses with fewer than 50 employees are exempt from being required to participate in the program.

C) low-income individuals are eligible for tax credits to offset the costs of buying health insurance.

D) the marketplaces offer health insurance policies that meet certain specified requirements.

A) each state is required to establish an Affordable Insurance Exchange.

B) small businesses with fewer than 50 employees are exempt from being required to participate in the program.

C) low-income individuals are eligible for tax credits to offset the costs of buying health insurance.

D) the marketplaces offer health insurance policies that meet certain specified requirements.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is a part of the "employer mandate" provision of the Affordable Care Act (ACA)?

A) Every firm with more than 3 full-time employees must offer health insurance to its employees and must automatically enroll them in the plan.

B) Small businesses with fewer than 50 employees are exempt from being required to participate in the program.

C) Firms with 50 or more full-time employees must offer health insurance or pay a fee to the federal government for every employee who receives a tax credit from the federal government for obtaining health insurance through a health insurance marketplace.

D) Every resident of the United States must have health insurance that meets certain basic requirements.

A) Every firm with more than 3 full-time employees must offer health insurance to its employees and must automatically enroll them in the plan.

B) Small businesses with fewer than 50 employees are exempt from being required to participate in the program.

C) Firms with 50 or more full-time employees must offer health insurance or pay a fee to the federal government for every employee who receives a tax credit from the federal government for obtaining health insurance through a health insurance marketplace.

D) Every resident of the United States must have health insurance that meets certain basic requirements.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

25

Under the "Medicare for All" program that was proposed by several 2020 Democratic presidential candidates, a system would be established in which

A) all private health insurance plans would be supplemented by a government health insurance plan.

B) the federal government would pay for all medical care.

C) everyone would be required to purchase health insurance from a newly formed government health insurance brokerage.

D) only people working for companies that employ fewer than 100 people would receive free health insurance from the government.

A) all private health insurance plans would be supplemented by a government health insurance plan.

B) the federal government would pay for all medical care.

C) everyone would be required to purchase health insurance from a newly formed government health insurance brokerage.

D) only people working for companies that employ fewer than 100 people would receive free health insurance from the government.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

26

All of the following are part of the "regulation of health insurance" provision of the Affordable Care Act (ACA) except

A) individuals with pre-existing medical conditions are able to acquire health insurance.

B) all policies must provide coverage for dependant children up to age 26.

C) lifetime dollar maximums on coverage are prohibited.

D) limits on the size of deductibles and on waiting periods before coverage takes effect have been eliminated.

A) individuals with pre-existing medical conditions are able to acquire health insurance.

B) all policies must provide coverage for dependant children up to age 26.

C) lifetime dollar maximums on coverage are prohibited.

D) limits on the size of deductibles and on waiting periods before coverage takes effect have been eliminated.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

27

All of the following are part of the "taxes" provision of the Affordable Care Act (ACA) except

A) workers earning more than $200,000 pay higher Medicare payroll taxes.

B) workers earning more than $200,000 pay a 3.8% tax on their investment income.

C) beginning in 2022 all taxes on employer-provided health insurance plans will be reduced or eliminated.

D) All of the above are a part of the "taxes" provision of the Affordable Care Act.

A) workers earning more than $200,000 pay higher Medicare payroll taxes.

B) workers earning more than $200,000 pay a 3.8% tax on their investment income.

C) beginning in 2022 all taxes on employer-provided health insurance plans will be reduced or eliminated.

D) All of the above are a part of the "taxes" provision of the Affordable Care Act.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not an argument used by economists and policymakers who are in favor of moving toward a Medicare for All system of health care?

A) The Medicare for All structure would ultimately increase competition in the health insurance industry, and this would reduce health care costs and increase economic efficiency.

B) A single-payer plan would reduce the paperwork caused by the current system.

C) Medicare for All would potentially reduce the administrative cost of coordinating a decentralized system.

D) The Medicare for All structure would save costs due to the bargaining power of the federal government.

A) The Medicare for All structure would ultimately increase competition in the health insurance industry, and this would reduce health care costs and increase economic efficiency.

B) A single-payer plan would reduce the paperwork caused by the current system.

C) Medicare for All would potentially reduce the administrative cost of coordinating a decentralized system.

D) The Medicare for All structure would save costs due to the bargaining power of the federal government.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

29

Under the Medicare for All plan,

A) people would not be charged an insurance premium but would have to pay deductibles.

B) people would be charged an insurance premium and would have to pay deductibles.

C) people would be charged an insurance premium but would not have to pay deductibles.

D) people would not be charged an insurance premium and would not have to pay deductibles.

A) people would not be charged an insurance premium but would have to pay deductibles.

B) people would be charged an insurance premium and would have to pay deductibles.

C) people would be charged an insurance premium but would not have to pay deductibles.

D) people would not be charged an insurance premium and would not have to pay deductibles.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

30

Some economists and policymakers who are opposed to the Medicare for All plan believe that this plan will ________ moral hazard problems by ________ deductibles and coinsurance payments.

A) reduce; eliminating

B) increase; eliminating

C) reduce; increasing

D) increase; increasing

A) reduce; eliminating

B) increase; eliminating

C) reduce; increasing

D) increase; increasing

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

31

Under the Affordable Care Act (ACA), residents who do not have health insurance will not be allowed to seek employment.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

32

Under the Affordable Care Act (ACA), insurance companies are required to participate in a high-risk pool that will cover individuals with pre-existing medical conditions.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

33

In 2022, a tax is scheduled to be imposed on employer-provided health insurance plans known as 'Cadillac plans'.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

34

By 2019, spending on federal health care programs such as Medicare and Medicaid had grown to 5.4 percent of GDP.

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck

35

Identify the 6 main provisions of the Affordable Care Act (ACA).

Unlock Deck

Unlock for access to all 35 flashcards in this deck.

Unlock Deck

k this deck