Deck 26: Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/16

Play

Full screen (f)

Deck 26: Capital Budgeting

1

Which of the following is not a capital budgeting decision?

A) Whether to acquire a subsidiary company.

B) Whether to expand a product line.

C) Whether to fill a special order.

D) Whether to purchase a fleet of trucks.

A) Whether to acquire a subsidiary company.

B) Whether to expand a product line.

C) Whether to fill a special order.

D) Whether to purchase a fleet of trucks.

Whether to fill a special order.

2

Which of the following is an example of a nonfinancial consideration in capital budgeting?

A) Will an investment generate adequate cash flows to promptly recover its cost?

B) Will an investment generate an acceptable rate of return?

C) Will an investment have a positive net present value?

D) Will an investment have an adverse effect on the environment?

A) Will an investment generate adequate cash flows to promptly recover its cost?

B) Will an investment generate an acceptable rate of return?

C) Will an investment have a positive net present value?

D) Will an investment have an adverse effect on the environment?

Will an investment have an adverse effect on the environment?

3

Which of the following is not considered when using the payback period to evaluate an investment?

A) The profitability of the investment over its entire life.

B) The annual net cash flow of the investment.

C) The cost of the investment.

D) The expected life of the investment.

A) The profitability of the investment over its entire life.

B) The annual net cash flow of the investment.

C) The cost of the investment.

D) The expected life of the investment.

The profitability of the investment over its entire life.

4

Stone Mfg. is considering expanding operations by investing $300,000 in equipment. The equipment has a useful life of eight years, with no salvage value. Straight-line depreciation is used. Stone predicts that net income will increase $37,500 per year as a result of this strategy.

-Refer to the above data. The payback period for this investment is:

A) 8 years.

B) 4 years.

C) Over 13 years.

D) 2.5 years.

-Refer to the above data. The payback period for this investment is:

A) 8 years.

B) 4 years.

C) Over 13 years.

D) 2.5 years.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

5

Stone Mfg. is considering expanding operations by investing $300,000 in equipment. The equipment has a useful life of eight years, with no salvage value. Straight-line depreciation is used. Stone predicts that net income will increase $37,500 per year as a result of this strategy.

-Refer to the above data. Return on average investment for this investment is:

A) 25%.

B) 20%.

C) 12 1/2%.

D) 15%.

-Refer to the above data. Return on average investment for this investment is:

A) 25%.

B) 20%.

C) 12 1/2%.

D) 15%.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

6

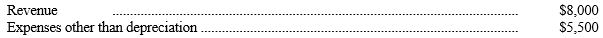

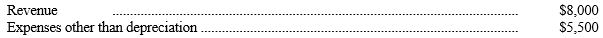

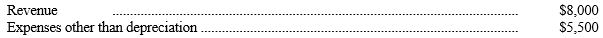

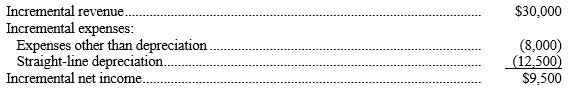

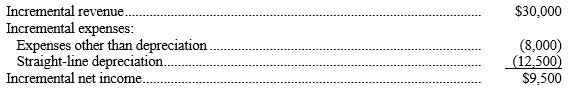

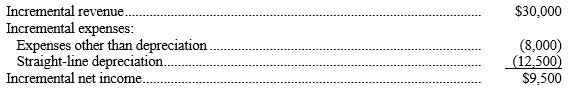

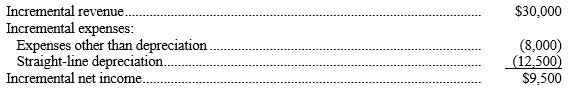

Physician's Pharmacy is considering the purchase of a copying machine, which it will make available to customers at a per-copy charge. The copying machine has an initial cost of $7,500, an estimated useful life of five years, and an estimated salvage value of $500. The estimated annual revenue and expenses relating to operation of the machine are as follows:

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

-Refer to the above data. Acquisition of the copying machine is expected to increase Physician's annual net income by:

A) $1,100.

B) $500.

C) $600.

D) Some other amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.-Refer to the above data. Acquisition of the copying machine is expected to increase Physician's annual net income by:

A) $1,100.

B) $500.

C) $600.

D) Some other amount.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

7

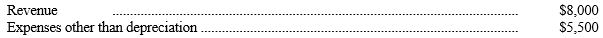

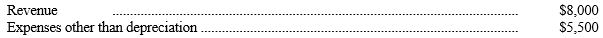

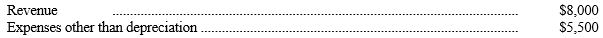

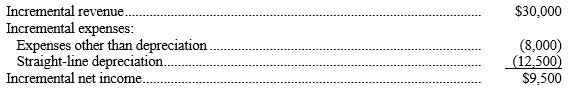

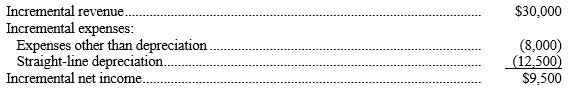

Physician's Pharmacy is considering the purchase of a copying machine, which it will make available to customers at a per-copy charge. The copying machine has an initial cost of $7,500, an estimated useful life of five years, and an estimated salvage value of $500. The estimated annual revenue and expenses relating to operation of the machine are as follows:

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

-Refer to the above data. The annual net cash flow expected from the investment in the machine is:

A) $1,000.

B) $600.

C) $500.

D) $2,500.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.-Refer to the above data. The annual net cash flow expected from the investment in the machine is:

A) $1,000.

B) $600.

C) $500.

D) $2,500.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

8

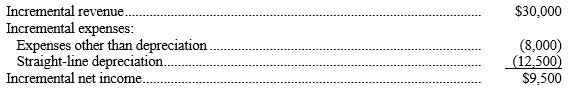

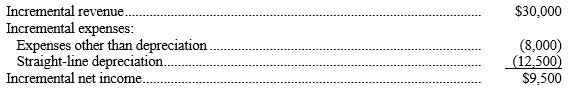

Physician's Pharmacy is considering the purchase of a copying machine, which it will make available to customers at a per-copy charge. The copying machine has an initial cost of $7,500, an estimated useful life of five years, and an estimated salvage value of $500. The estimated annual revenue and expenses relating to operation of the machine are as follows:

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

-Refer to the above data. The payback period on this investment is estimated at:

A) 1.125 years.

B) 7.5 years.

C) 3 years.

D) None of these answers.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.-Refer to the above data. The payback period on this investment is estimated at:

A) 1.125 years.

B) 7.5 years.

C) 3 years.

D) None of these answers.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

9

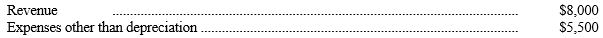

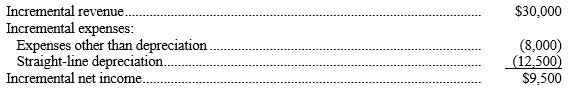

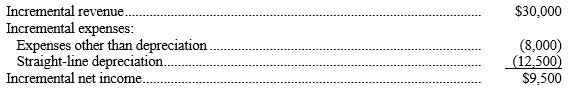

Physician's Pharmacy is considering the purchase of a copying machine, which it will make available to customers at a per-copy charge. The copying machine has an initial cost of $7,500, an estimated useful life of five years, and an estimated salvage value of $500. The estimated annual revenue and expenses relating to operation of the machine are as follows:

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

-Refer to the above data. The expected rate of return on average investment is:

A) 27.5%.

B) 33 1/3%.

C) 60%.

D) Some other rate.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.-Refer to the above data. The expected rate of return on average investment is:

A) 27.5%.

B) 33 1/3%.

C) 60%.

D) Some other rate.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

10

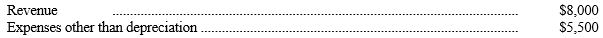

Physician's Pharmacy is considering the purchase of a copying machine, which it will make available to customers at a per-copy charge. The copying machine has an initial cost of $7,500, an estimated useful life of five years, and an estimated salvage value of $500. The estimated annual revenue and expenses relating to operation of the machine are as follows:

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

-Refer to the above data. The net present value of the proposed investment, discounted at an annual rate of 15% and rounded to the nearest dollar, is (tables show that using a discount rate of 15%, the present value of $1 due in five years is 0.497, and the present value of a five year $1 annuity is 3.352):

A) $528.

B)$(1,405)

C) $1,128.50

D) Some other amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight-line method.If you select answer d, indicate the correct amount.-Refer to the above data. The net present value of the proposed investment, discounted at an annual rate of 15% and rounded to the nearest dollar, is (tables show that using a discount rate of 15%, the present value of $1 due in five years is 0.497, and the present value of a five year $1 annuity is 3.352):

A) $528.

B)$(1,405)

C) $1,128.50

D) Some other amount.

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

11

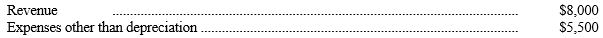

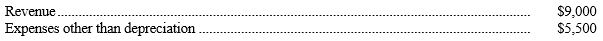

Port Pharmacy is considering the purchase of a copying machine, which it will make available to customers at a per copy charge. The copying machine has an initial cost of $8,500, an estimated useful life of five years, and an estimated salvage value of $2,500. The estimated annual revenue and expenses relating to operation of the machine are as follows:

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight line method.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight line method.

Compute for this proposal the expected:

a) Annual increase in Port's net income: $____________

b) Annual net cash flow: $____________

c) Payback period: ____________ years

d) Return on average investment: ___________ %

e) Net present value (round to the nearest dollar) of the proposed investment, discounted at an annual rate of 15% (Tables show that the present value of $1 to be received in five periods, discounted at 15%, is 0.497 and that the present value of a five year annuity of $1, discounted at 15%, is 3.352): $____________

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight line method.

All revenue will be received in cash; expenses other than depreciation will be paid in cash. Depreciation will be computed by the straight line method.Compute for this proposal the expected:

a) Annual increase in Port's net income: $____________

b) Annual net cash flow: $____________

c) Payback period: ____________ years

d) Return on average investment: ___________ %

e) Net present value (round to the nearest dollar) of the proposed investment, discounted at an annual rate of 15% (Tables show that the present value of $1 to be received in five periods, discounted at 15%, is 0.497 and that the present value of a five year annuity of $1, discounted at 15%, is 3.352): $____________

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

12

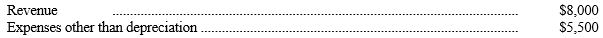

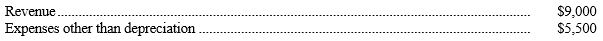

Beacon Manufacturing, Inc. is planning to buy a new cutting machine. The machine costs $125,000, has an estimated life of ten years and no salvage value. The machine is expected to have the following impact:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

-What is the annual net cash flow expected from the cutting machine investment? $____________

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:-What is the annual net cash flow expected from the cutting machine investment? $____________

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

13

Beacon Manufacturing, Inc. is planning to buy a new cutting machine. The machine costs $125,000, has an estimated life of ten years and no salvage value. The machine is expected to have the following impact:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

-What is the expected payback period of the cutting machine investment? ______ years

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:-What is the expected payback period of the cutting machine investment? ______ years

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

14

Beacon Manufacturing, Inc. is planning to buy a new cutting machine. The machine costs $125,000, has an estimated life of ten years and no salvage value. The machine is expected to have the following impact:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

-What is the expected return on average investment associated with the cutting machine? ____________%

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:-What is the expected return on average investment associated with the cutting machine? ____________%

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

15

Beacon Manufacturing, Inc. is planning to buy a new cutting machine. The machine costs $125,000, has an estimated life of ten years and no salvage value. The machine is expected to have the following impact:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

-What is the net present value of the cutting machine discounted at an annual rate of 10%, if the present value of a ten-year $1 annuity discounted at 10% is 6.145? $____________

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:-What is the net present value of the cutting machine discounted at an annual rate of 10%, if the present value of a ten-year $1 annuity discounted at 10% is 6.145? $____________

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck

16

Beacon Manufacturing, Inc. is planning to buy a new cutting machine. The machine costs $125,000, has an estimated life of ten years and no salvage value. The machine is expected to have the following impact:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

-What is the net present value of the cutting machine discounted at an annual rate of 20%, if the present value of a ten-year $1 annuity discounted at 20% is 4.192? $____________

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:

All revenue and expenses other than depreciation will be received or paid in cash. Compute the following for this proposal:-What is the net present value of the cutting machine discounted at an annual rate of 20%, if the present value of a ten-year $1 annuity discounted at 20% is 4.192? $____________

Unlock Deck

Unlock for access to all 16 flashcards in this deck.

Unlock Deck

k this deck