Deck 24: Surpluses,deficits,public Debt,and the Federal Budget

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/68

Play

Full screen (f)

Deck 24: Surpluses,deficits,public Debt,and the Federal Budget

1

In the 1980s and early 1990s the annual federal budget deficit was ________ percent of GDP.

A) less than 1

B) 1 to 3

C) 3 to 6

D) slightly under 10

E) over 50

A) less than 1

B) 1 to 3

C) 3 to 6

D) slightly under 10

E) over 50

C

2

A government budget deficit has the greatest inflationary impact if it is financed by

A) increasing personal and corporate taxes.

B) creating new money.

C) borrowing from consumers and businesses.

D) impounding surplus funds.

E) reducing government expenditures.

A) increasing personal and corporate taxes.

B) creating new money.

C) borrowing from consumers and businesses.

D) impounding surplus funds.

E) reducing government expenditures.

B

3

If people believe that in the future the government will have to resort to creating money to pay the interest on debt currently financed by the sale of bonds,they may

A) try to hold less money now, pushing up the current demand for goods and services as well as the current price level.

B) increase the demand for current government bonds, raising bond prices and reducing interest rates.

C) reduce current consumption because they expect price levels to fall in the future as the government is forced to lower taxes.

D) increase their current holdings of government bonds because they expect interest rates on government bonds to rise.

E) do any of the above since government deficits have an unpredictable impact on the economy.

A) try to hold less money now, pushing up the current demand for goods and services as well as the current price level.

B) increase the demand for current government bonds, raising bond prices and reducing interest rates.

C) reduce current consumption because they expect price levels to fall in the future as the government is forced to lower taxes.

D) increase their current holdings of government bonds because they expect interest rates on government bonds to rise.

E) do any of the above since government deficits have an unpredictable impact on the economy.

A

4

Approximately what share of the U.S.public debt is held by federal government agencies and NOT held by the public?

A) 20 percent

B) 30 percent

C) 40 percent

D) 50 percent

E) 60 percent

A) 20 percent

B) 30 percent

C) 40 percent

D) 50 percent

E) 60 percent

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

5

The crowding-out effect

A) is a basic tenet of Keynesian analysis.

B) occurs when people expect prices to rise as a result of stabilization policy and take measures to raise their wages.

C) asserts that expansionary fiscal policy will bid up interest rates and reduce private spending.

D) asserts that an increase in aggregate supply will force down price levels and reduce competition for output by households and businesses.

E) states that increasing the money supply will lower interest rates, making it impossible for some borrowers to obtain adequate funds.

A) is a basic tenet of Keynesian analysis.

B) occurs when people expect prices to rise as a result of stabilization policy and take measures to raise their wages.

C) asserts that expansionary fiscal policy will bid up interest rates and reduce private spending.

D) asserts that an increase in aggregate supply will force down price levels and reduce competition for output by households and businesses.

E) states that increasing the money supply will lower interest rates, making it impossible for some borrowers to obtain adequate funds.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

6

An excess of government revenues over expenditures

A) is most appropriate during a severe recession.

B) is called a surplus.

C) causes the national debt to grow larger.

D) has been the norm in the U.S. economy since 1980.

E) leads to a decline in national saving.

A) is most appropriate during a severe recession.

B) is called a surplus.

C) causes the national debt to grow larger.

D) has been the norm in the U.S. economy since 1980.

E) leads to a decline in national saving.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

7

During the last 30 years,the federal government budget has

A) failed to record a surplus in any year.

B) recorded a surplus only in the year 1984.

C) had surpluses scattered over 10 of these years.

D) been in surplus annually since 1995.

E) recorded a surplus for the years 1999-2001.

A) failed to record a surplus in any year.

B) recorded a surplus only in the year 1984.

C) had surpluses scattered over 10 of these years.

D) been in surplus annually since 1995.

E) recorded a surplus for the years 1999-2001.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

8

Large federal government budget deficits financed by foreign lenders tend to

A) depress net exports.

B) lower the value of the dollar and reduce imports.

C) crowd out domestic lenders and reduce investment.

D) immediately transfer purchasing power to the foreign investors.

E) reduce the size of the national debt, since the bonds are held by foreign investors.

A) depress net exports.

B) lower the value of the dollar and reduce imports.

C) crowd out domestic lenders and reduce investment.

D) immediately transfer purchasing power to the foreign investors.

E) reduce the size of the national debt, since the bonds are held by foreign investors.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

9

When the government finances a deficit by selling its securities to the Fed

A) it will have a smaller inflationary impact than if it sells securities to households and firms.

B) interest rates will rise by greater amounts than if these securities are sold to households and firms.

C) it is spared having to pay interest on the borrowed money, reducing borrowing costs.

D) there will be increases in the money supply, aggregate demand, and price level.

E) the value of these securities are not counted as part of the national debt because they are held by a government agency.

A) it will have a smaller inflationary impact than if it sells securities to households and firms.

B) interest rates will rise by greater amounts than if these securities are sold to households and firms.

C) it is spared having to pay interest on the borrowed money, reducing borrowing costs.

D) there will be increases in the money supply, aggregate demand, and price level.

E) the value of these securities are not counted as part of the national debt because they are held by a government agency.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

10

The idea that an economy experiencing considerable unemployment and government deficit spending may increase output,which in turn may increase investment,is called the crowding-________ effect.

A) out

B) through

C) over

D) in

E) under

A) out

B) through

C) over

D) in

E) under

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

11

When evaluating the size of the annual federal budget deficit,it is useful to express it as a percentage of the

A) average deficit in other countries.

B) level of net exports.

C) economy's GDP.

D) amount of government spending minus income.

E) assets of the commercial banking system.

A) average deficit in other countries.

B) level of net exports.

C) economy's GDP.

D) amount of government spending minus income.

E) assets of the commercial banking system.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

12

When the government finances its expenditures by borrowing from consumers and business firms

A) it creates a surplus.

B) it is more inflationary than if it borrows from the central bank.

C) it creates new money, making the deficit greater than it would otherwise have been.

D) the national debt goes down.

E) interest rates rise, reducing private investment spending.

A) it creates a surplus.

B) it is more inflationary than if it borrows from the central bank.

C) it creates new money, making the deficit greater than it would otherwise have been.

D) the national debt goes down.

E) interest rates rise, reducing private investment spending.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

13

If the government goes into the credit market to finance a current budget deficit,the

A) quantity supplied of loanable funds will fall.

B) interest rate will fall.

C) Treasury must print more currency.

D) private sector borrowing will also increase to pay for the bonds.

E)demand curve for loanable funds will shift to the right.

A) quantity supplied of loanable funds will fall.

B) interest rate will fall.

C) Treasury must print more currency.

D) private sector borrowing will also increase to pay for the bonds.

E)demand curve for loanable funds will shift to the right.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

14

The difference between the budget deficit and the national debt is that the deficit is

A) financed by borrowing; the debt is financed by selling bonds.

B) a long-term concept; the debt is a short-term concept.

C) the difference between the size of the debt and the amount of government revenues in a given year.

D) the estimated revenue shortfall; the debt is the actual revenue shortfall.

E) the difference between expenditures and revenues; the debt is the total amount owed by the government.

A) financed by borrowing; the debt is financed by selling bonds.

B) a long-term concept; the debt is a short-term concept.

C) the difference between the size of the debt and the amount of government revenues in a given year.

D) the estimated revenue shortfall; the debt is the actual revenue shortfall.

E) the difference between expenditures and revenues; the debt is the total amount owed by the government.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

15

If government revenues fall short of expenditures,the difference can be financed by

A) reducing taxes.

B) reducing the national debt.

C) declaring bankruptcy.

D) borrowing or creating new money.

E) buying gold.

A) reducing taxes.

B) reducing the national debt.

C) declaring bankruptcy.

D) borrowing or creating new money.

E) buying gold.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

16

The phenomenon of a government deficit accompanied by a tight money policy,leading to a rise in interest rates and causing a reduction in private spending,is an example of

A) rational expectations theory.

B) the law of diminishing returns.

C) the equation of exchange.

D) the acceleration principle.

E) the crowding-out effect.

A) rational expectations theory.

B) the law of diminishing returns.

C) the equation of exchange.

D) the acceleration principle.

E) the crowding-out effect.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

17

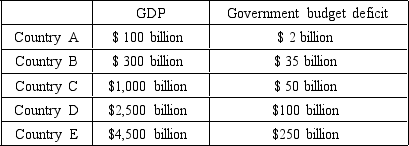

Which of the following countries in the table above has the most burdensome budget deficit?

A) Country A

B) Country B

C) Country C

D) Country D

E) Country E

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

18

The ways the federal government can finance its expenditures

A) require selling the Treasury's gold holdings.

B) number only two: raising and lowering taxes.

C) are raising taxes, borrowing, and creating new money.

D) require exporting more than it imports.

E) all lead to an increase in the national debt.

A) require selling the Treasury's gold holdings.

B) number only two: raising and lowering taxes.

C) are raising taxes, borrowing, and creating new money.

D) require exporting more than it imports.

E) all lead to an increase in the national debt.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

19

A budget deficit has its inflationary impact reduced by

A) borrowing from the public.

B) creating new money.

C) borrowing from the central bank.

D) simultaneously reducing taxes.

E) raising the national debt.

A) borrowing from the public.

B) creating new money.

C) borrowing from the central bank.

D) simultaneously reducing taxes.

E) raising the national debt.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

20

One generally recognized problem of large government budgetary deficits is

A) that they crowd out private investment and lower U.S. exports.

B) that the debt is primarily "owed to ourselves."

C) the burden any current government borrowing inevitably imposes on future generations.

D) the recessions that such government deficits simultaneously cause.

E) the addition to our country's productive capacity as a result of the deficits.

A) that they crowd out private investment and lower U.S. exports.

B) that the debt is primarily "owed to ourselves."

C) the burden any current government borrowing inevitably imposes on future generations.

D) the recessions that such government deficits simultaneously cause.

E) the addition to our country's productive capacity as a result of the deficits.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

21

According to the textbook discussion,the principal way in which one generation can impose a debt burden on succeeding generations is by

A) using up some of the nation's productive capacity.

B) engaging in war.

C) failing to balance the budget.

D) maintaining stable price levels.

E) failing to pay off the national debt.

A) using up some of the nation's productive capacity.

B) engaging in war.

C) failing to balance the budget.

D) maintaining stable price levels.

E) failing to pay off the national debt.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

22

An excess of government expenditures over tax receipts

A) is called a surplus.

B) is a means of reducing the national debt.

C) is always desirable.

D) can lead to prolonged depression.

E) can stimulate the economy and raise GDP.

A) is called a surplus.

B) is a means of reducing the national debt.

C) is always desirable.

D) can lead to prolonged depression.

E) can stimulate the economy and raise GDP.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

23

A government budget deficit

A) is more inflationary when financed by higher tax rates.

B) is generally considered undesirable in the Keynesian view of economic policy.

C) can never occur when the structural deficit is zero.

D) that is financed by creating new money draws funds that might otherwise have been spent on consumption and investment.

E) could result from recession-induced decreases in tax revenues rather than from increases in government spending.

A) is more inflationary when financed by higher tax rates.

B) is generally considered undesirable in the Keynesian view of economic policy.

C) can never occur when the structural deficit is zero.

D) that is financed by creating new money draws funds that might otherwise have been spent on consumption and investment.

E) could result from recession-induced decreases in tax revenues rather than from increases in government spending.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

24

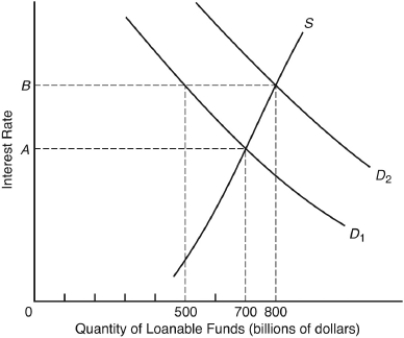

If S is the supply curve of loanable funds,D₁ is the demand curve for loanable funds before government borrowing,and D₂ is the demand curve for loanable funds after government borrowing,the size of the government deficit must be ________ billion.

A) $800

B) $700

C) $500

D) $300

E) $100

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

25

The United States' national debt

A) has been steadily declining since World War II.

B) represents a smaller share of national output than in 1945.

C) is currently larger than its GDP.

D) is primarily an externally held debt.

E) totals less than $1 trillion, two-thirds of which is held by government agencies.

A) has been steadily declining since World War II.

B) represents a smaller share of national output than in 1945.

C) is currently larger than its GDP.

D) is primarily an externally held debt.

E) totals less than $1 trillion, two-thirds of which is held by government agencies.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

26

An increase in the structural deficit most likely reflects the fact that fiscal policy is

A) having little or no impact on the economy.

B) effectively reducing the size of the national debt.

C) becoming more expansionary.

D) creating a substantial gap between potential and full-employment GDP.

E) causing the price level to fall.

A) having little or no impact on the economy.

B) effectively reducing the size of the national debt.

C) becoming more expansionary.

D) creating a substantial gap between potential and full-employment GDP.

E) causing the price level to fall.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

27

About what percentage of national output does the United States' current national debt represent?

A) between 10 and 25 percent

B) between 25 and 40 percent

C) between 40 and 55 percent

D) between 55 and 70 percent

E) over 70 percent

A) between 10 and 25 percent

B) between 25 and 40 percent

C) between 40 and 55 percent

D) between 55 and 70 percent

E) over 70 percent

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

28

The structural deficit is

A) the deficit necessary to reduce interest rates.

B) the difference between tax revenues and government expenditures in a given year.

C) the difference between tax revenues and government expenditures that would result if GDP were at its potential level.

D) the budget resulting from a policy of functional finance.

E) a concept first suggested by John Maynard Keynes in 1938.

A) the deficit necessary to reduce interest rates.

B) the difference between tax revenues and government expenditures in a given year.

C) the difference between tax revenues and government expenditures that would result if GDP were at its potential level.

D) the budget resulting from a policy of functional finance.

E) a concept first suggested by John Maynard Keynes in 1938.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

29

The difference between tax revenues and government expenditures that would result if GDP were at its potential level is called the

A) permanent income budget balance.

B) net relative expenditure differential.

C) Ricardian equivalence.

D) balanced budget shortfall.

E) structural deficit.

A) permanent income budget balance.

B) net relative expenditure differential.

C) Ricardian equivalence.

D) balanced budget shortfall.

E) structural deficit.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

30

If the structural deficit shows a surplus

A) government officials should begin to slow down the economy to prevent the impending danger of inflation.

B) actual revenues exceed actual expenditures.

C) the actual unemployment rate must be less than 4 percent.

D) fiscal policy is not overly expansionary, since at full employment, the federal government would be running a surplus.

E) the economy is on a proper course, since the national debt is being retired without undue deflationary pressure.

A) government officials should begin to slow down the economy to prevent the impending danger of inflation.

B) actual revenues exceed actual expenditures.

C) the actual unemployment rate must be less than 4 percent.

D) fiscal policy is not overly expansionary, since at full employment, the federal government would be running a surplus.

E) the economy is on a proper course, since the national debt is being retired without undue deflationary pressure.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

31

The United States' national debt

A) is approximately $100 billion.

B) is the amount the government owes foreign nations.

C) has been declining in absolute terms since World War II.

D) is composed of bonds, notes, and other government I.O.U.s of various kinds.

E) has been steadily increasing in relation to national output since World War II.

A) is approximately $100 billion.

B) is the amount the government owes foreign nations.

C) has been declining in absolute terms since World War II.

D) is composed of bonds, notes, and other government I.O.U.s of various kinds.

E) has been steadily increasing in relation to national output since World War II.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

32

The national debt differs from consumer debt in that

A) no interest is paid on the national debt.

B) the national debt is of no economic consequence.

C) most of the national debt is held by foreigners.

D) the national debt influences the amount of aggregate spending.

E) the national debt need never be paid off if it is held internally.

A) no interest is paid on the national debt.

B) the national debt is of no economic consequence.

C) most of the national debt is held by foreigners.

D) the national debt influences the amount of aggregate spending.

E) the national debt need never be paid off if it is held internally.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

33

An outcome associated with a large national debt is that the interest payments on the debt

A) increase the size of the country's capital stock.

B) require that the government sell off some of the country's assets such as public lands.

C) lead to a redistribution of income from the poor to the rich.

D) reduce the amount of tax revenues collected by the government.

E) reduce the Fed's ability to carry out monetary policy.

A) increase the size of the country's capital stock.

B) require that the government sell off some of the country's assets such as public lands.

C) lead to a redistribution of income from the poor to the rich.

D) reduce the amount of tax revenues collected by the government.

E) reduce the Fed's ability to carry out monetary policy.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

34

The size of the structural deficit tells us

A) what increase to expect in the actual deficit over the next fiscal period.

B) what relative impact current fiscal policy is having on the economy.

C) what size tax increase is needed to balance the budget.

D) the best way to finance the current deficit.

E) how much of the budget should be financed by borrowing and how much by raising taxes.

A) what increase to expect in the actual deficit over the next fiscal period.

B) what relative impact current fiscal policy is having on the economy.

C) what size tax increase is needed to balance the budget.

D) the best way to finance the current deficit.

E) how much of the budget should be financed by borrowing and how much by raising taxes.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

35

As a result of government borrowing,private sector borrowing is

A) unaffected.

B) reduced by $100 billion.

C) reduced by $200 billion.

D) reduced by $300 billion.

E) reduced by $500 billion.

A) unaffected.

B) reduced by $100 billion.

C) reduced by $200 billion.

D) reduced by $300 billion.

E) reduced by $500 billion.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

36

Balancing the government's budget every year

A) is necessary because all debts eventually come due.

B) is a fundamental tenet of Keynesian economics.

C) is sensible for the same reasons as is balancing the family budget.

D) makes it difficult to use fiscal policy to stabilize the economy.

E) results in simultaneous inflation and unemployment.

A) is necessary because all debts eventually come due.

B) is a fundamental tenet of Keynesian economics.

C) is sensible for the same reasons as is balancing the family budget.

D) makes it difficult to use fiscal policy to stabilize the economy.

E) results in simultaneous inflation and unemployment.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

37

If the actual federal budget shows a deficit but the structural budget deficit is falling,economists would conclude that

A) the structural deficit is based on an incorrect estimate of potential output.

B) the actual budget deficit should be revised to equal the structural deficit.

C) government spending should be curtailed severely.

D) current fiscal policy is probably doing a fair job of stabilizing the economy.

E) the tax rate is too low.

A) the structural deficit is based on an incorrect estimate of potential output.

B) the actual budget deficit should be revised to equal the structural deficit.

C) government spending should be curtailed severely.

D) current fiscal policy is probably doing a fair job of stabilizing the economy.

E) the tax rate is too low.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

38

If the actual federal budget shows a deficit but the structural budget deficit is falling,most economists would attribute the deficit in the actual budget to

A) unemployment.

B) unchecked government spending.

C) rising consumer demand.

D) incomplete data.

E) inflation.

A) unemployment.

B) unchecked government spending.

C) rising consumer demand.

D) incomplete data.

E) inflation.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

39

The idea that,under certain circumstances,deficits can increase investment is known as

A) the structural deficit.

B) the crowd-out effect.

C) structural unemployment.

D) the crowd-in effect.

E) the Laffer effect.

A) the structural deficit.

B) the crowd-out effect.

C) structural unemployment.

D) the crowd-in effect.

E) the Laffer effect.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

40

The size of the structural deficit

A) can be used to evaluate the extent to which government fiscal policy is promoting economic stability.

B) generally exceeds the actual budget surplus or deficit in a given fiscal year.

C) generally equals actual budgetary deficits and surpluses.

D) is greater during those years when a full-employment equilibrium GDP prevails.

E) automatically nets out to zero over the course of the business cycle.

A) can be used to evaluate the extent to which government fiscal policy is promoting economic stability.

B) generally exceeds the actual budget surplus or deficit in a given fiscal year.

C) generally equals actual budgetary deficits and surpluses.

D) is greater during those years when a full-employment equilibrium GDP prevails.

E) automatically nets out to zero over the course of the business cycle.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

41

In general,appropriate fiscal policy would involve a budget

A) deficit during a recession and a surplus during periods of inflationary full employment.

B) balanced annually regardless of the economic climate.

C) surplus at all times.

D) that completely eliminates the national debt in a single year.

E) that makes the actual budget deficit equal to the full-employment budget surplus.

A) deficit during a recession and a surplus during periods of inflationary full employment.

B) balanced annually regardless of the economic climate.

C) surplus at all times.

D) that completely eliminates the national debt in a single year.

E) that makes the actual budget deficit equal to the full-employment budget surplus.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

42

A budget policy in which the government is expected to run a big enough surplus during periods of high employment to offset deficits during an ensuing period of excessive unemployment is called a(n)

A) annually balanced budget.

B) structural budget.

C) full-employment budget.

D) conflict-resolution budget.

E) budget balanced over the course of the business cycle.

A) annually balanced budget.

B) structural budget.

C) full-employment budget.

D) conflict-resolution budget.

E) budget balanced over the course of the business cycle.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

43

The budget policy that sets the government's budget to attain a socially optimal combination of unemployment and inflation is likely to

A) be balanced each and every year.

B) cause continual growth in the public debt.

C) have a cyclically adjusted surplus.

D) run surpluses even when unemployment is high.

E) be balanced over the course of the business cycle.

A) be balanced each and every year.

B) cause continual growth in the public debt.

C) have a cyclically adjusted surplus.

D) run surpluses even when unemployment is high.

E) be balanced over the course of the business cycle.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

44

Which agency of the executive branch of the government is primarily responsible for preparing the budget proposal?

A) General Accounting Office

B) Treasury Department

C) Office of Management and Budget

D) Congressional Budget Office

E) Internal Revenue Service

A) General Accounting Office

B) Treasury Department

C) Office of Management and Budget

D) Congressional Budget Office

E) Internal Revenue Service

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

45

The Senate committee that considers major tax legislation before it goes to the entire Senate is the ________ Committee.

A) Ways and Means

B) Finance

C) Tax Analysis

D) Tax Legislation

E) Senate Budget

A) Ways and Means

B) Finance

C) Tax Analysis

D) Tax Legislation

E) Senate Budget

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

46

Balancing the government's budget over the course of each business cycle

A) results in a stable economy at all times.

B) does not take into account the fact that the size of the deficits needed to reduce unemployment may not equal the size of the surpluses needed to moderate subsequent inflation.

C) guarantees a steady decrease in the national debt.

D) is a policy biased in favor of reducing unemployment at the cost of allowing persistent inflation.

E) is called functional finance.

A) results in a stable economy at all times.

B) does not take into account the fact that the size of the deficits needed to reduce unemployment may not equal the size of the surpluses needed to moderate subsequent inflation.

C) guarantees a steady decrease in the national debt.

D) is a policy biased in favor of reducing unemployment at the cost of allowing persistent inflation.

E) is called functional finance.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

47

The president submits his budget for the next fiscal year to Congress in

A) January.

B) March.

C) June.

D) September.

E) December.

A) January.

B) March.

C) June.

D) September.

E) December.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

48

A bill incorporating a major tax change

A) is first considered by the House Ways and Means Committee.

B) is considered by the House after it is approved by the Senate.

C) may be vetoed by the central bank.

D) is sent to a conference committee when differences exist between Congress and the president.

E) need be passed only by the House if the two legislative branches cannot agree.

A) is first considered by the House Ways and Means Committee.

B) is considered by the House after it is approved by the Senate.

C) may be vetoed by the central bank.

D) is sent to a conference committee when differences exist between Congress and the president.

E) need be passed only by the House if the two legislative branches cannot agree.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

49

Some opposed to using federal budget surpluses to cut taxes argue that

A) surpluses could disappear and deficits return in the future, so we should not take any chances and instead pay down the national debt.

B) since the tax has already been collected, there is no need to return it.

C) cutting taxes would set off a recession, reducing government revenue.

D) the larger the budget surplus, the greater the money supply, which automatically reduces taxes.

E) taxes are currently at historically low levels.

A) surpluses could disappear and deficits return in the future, so we should not take any chances and instead pay down the national debt.

B) since the tax has already been collected, there is no need to return it.

C) cutting taxes would set off a recession, reducing government revenue.

D) the larger the budget surplus, the greater the money supply, which automatically reduces taxes.

E) taxes are currently at historically low levels.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

50

If the House and Senate pass different versions of a tax bill

A) the president gets to choose which version becomes law.

B) the Treasury Department is called in to arrange a compromise.

C) the legislation automatically dies and the process must begin all over again.

D) a conference committee is formed to iron out the differences between the two houses.

E) the Senate version prevails unless vetoed by the president.

A) the president gets to choose which version becomes law.

B) the Treasury Department is called in to arrange a compromise.

C) the legislation automatically dies and the process must begin all over again.

D) a conference committee is formed to iron out the differences between the two houses.

E) the Senate version prevails unless vetoed by the president.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

51

Over the past 50 years,the prevailing national attitude toward the government budget has been one

A) that consistently advocated surpluses.

B) that supported increasingly larger surpluses.

C) that paid increasing lip service to the desirability of growth deficits.

D) that changed from favoring annually balanced budgets to favoring a budget balanced over the business cycle back to favoring annually balanced budgets.

E) of indifference, since it is clear that the government budget has no effect on economic activity.

A) that consistently advocated surpluses.

B) that supported increasingly larger surpluses.

C) that paid increasing lip service to the desirability of growth deficits.

D) that changed from favoring annually balanced budgets to favoring a budget balanced over the business cycle back to favoring annually balanced budgets.

E) of indifference, since it is clear that the government budget has no effect on economic activity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

52

Supply-siders argue that federal budget surpluses should be used to

A) pay down the national debt.

B) increase government spending on education and health care.

C) finance tax reductions.

D) eliminate the deficit in the balance of payments.

E) increase the money supply.

A) pay down the national debt.

B) increase government spending on education and health care.

C) finance tax reductions.

D) eliminate the deficit in the balance of payments.

E) increase the money supply.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

53

Various kinds of economic analysis to help senators and representatives evaluate different budgetary programs and proposals are undertaken by the

A) Treasury Department.

B) Office of Management and Budget.

C) Internal Revenue Service.

D) Congressional Budget Office.

E) Office of Economic Opportunity.

A) Treasury Department.

B) Office of Management and Budget.

C) Internal Revenue Service.

D) Congressional Budget Office.

E) Office of Economic Opportunity.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

54

The federal budget is

A) for a fiscal year, from January 1 to December 31.

B) a statement of the government's anticipated expenditures and revenues.

C) a statement of how much the various agencies of the federal government would like to spend.

D) managed by the Federal Reserve System.

E) submitted by the president to Congress and must be either rejected or accepted without modification.

A) for a fiscal year, from January 1 to December 31.

B) a statement of the government's anticipated expenditures and revenues.

C) a statement of how much the various agencies of the federal government would like to spend.

D) managed by the Federal Reserve System.

E) submitted by the president to Congress and must be either rejected or accepted without modification.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

55

The budget policy that requires revenues to equal expenditures each and every year is called

A) an annually balanced budget.

B) functional finance.

C) a full-employment budget.

D) a conflict resolution budget.

E) a budget balanced over the course of the business cycle.

A) an annually balanced budget.

B) functional finance.

C) a full-employment budget.

D) a conflict resolution budget.

E) a budget balanced over the course of the business cycle.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

56

In addition to annually and cyclically balanced budget policies,a third approach argues that the government's budget should be

A) set to promote the preferred combination of unemployment and inflation.

B) balanced over the course of the business cycle.

C) measured in current rather than constant dollars to accurately reflect the magnitude of fiscal stimulus.

D) designed to ensure persistent surpluses to reduce unemployment.

E) using the tax laws to stimulate investment.

A) set to promote the preferred combination of unemployment and inflation.

B) balanced over the course of the business cycle.

C) measured in current rather than constant dollars to accurately reflect the magnitude of fiscal stimulus.

D) designed to ensure persistent surpluses to reduce unemployment.

E) using the tax laws to stimulate investment.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

57

The U.S.government's fiscal year runs from

A) January 1 to December 31.

B) April 15 to April 14.

C) June 1 to May 31.

D) October 1 to September 30.

E) December 1 to November 30.

A) January 1 to December 31.

B) April 15 to April 14.

C) June 1 to May 31.

D) October 1 to September 30.

E) December 1 to November 30.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

58

The federal budget surpluses experienced at the turn of the twenty-first century disappeared largely because of

A) multiyear tax cuts in 2001 and 2003.

B) federal spending on homeland security.

C) the war and reconstruction of Iraq.

D) the recession of 2001.

E) all of the above, which contributed to the return of federal budget deficits.

A) multiyear tax cuts in 2001 and 2003.

B) federal spending on homeland security.

C) the war and reconstruction of Iraq.

D) the recession of 2001.

E) all of the above, which contributed to the return of federal budget deficits.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

59

Alternative policies regarding the federal budget include the

A) annually and cyclically balanced budget policies and budgets that promote a socially optimal and attainable combination of inflation and unemployment.

B) seldom, rarely, and never balanced budget policies.

C) actual, proposed, and cyclically adjusted budget policies.

D) executive, congressional, and treasury budget policies.

E) monthly, quarterly, and annually balanced budget policies.

A) annually and cyclically balanced budget policies and budgets that promote a socially optimal and attainable combination of inflation and unemployment.

B) seldom, rarely, and never balanced budget policies.

C) actual, proposed, and cyclically adjusted budget policies.

D) executive, congressional, and treasury budget policies.

E) monthly, quarterly, and annually balanced budget policies.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

60

Proponents of a budget that promotes an optimal combination of unemployment and inflation generally hold that the problems of an increased national debt that may result are

A) nonexistent.

B) completely avoidable by the use of monetary policy.

C) severe but worth the cost in the long run.

D) completely unpredictable in scope and direction.

E) small in comparison to social problems caused by unemployment and inflation.

A) nonexistent.

B) completely avoidable by the use of monetary policy.

C) severe but worth the cost in the long run.

D) completely unpredictable in scope and direction.

E) small in comparison to social problems caused by unemployment and inflation.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

61

The 1990 budget agreement between President Bush and Congress incorporated

A) an increase in both the income tax and some excise tax rates.

B) substantial reductions in defense spending with no change in taxes.

C) a significant increase in the money supply to cover the revenue shortfall.

D) a line-item veto option the president can use to ensure a balanced budget.

E) a supply-side tax cut designed to improve worker incentives.

A) an increase in both the income tax and some excise tax rates.

B) substantial reductions in defense spending with no change in taxes.

C) a significant increase in the money supply to cover the revenue shortfall.

D) a line-item veto option the president can use to ensure a balanced budget.

E) a supply-side tax cut designed to improve worker incentives.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

62

How did the proposed fiscal policies of President Eisenhower and President Nixon differ?

A) Eisenhower felt unemployment was the most pressing economic problem of the time; Nixon saw inflation as more serious.

B) Nixon favored a balanced budget; Eisenhower did not.

C) Nixon favored strong growth in the economy; Eisenhower wanted to create a budget surplus.

D) Eisenhower was a strong believer in the use of fiscal policy to influence the economy; Nixon had a laissez-faire attitude.

E) They both favored the same fiscal policies but differed on monetary policy.

A) Eisenhower felt unemployment was the most pressing economic problem of the time; Nixon saw inflation as more serious.

B) Nixon favored a balanced budget; Eisenhower did not.

C) Nixon favored strong growth in the economy; Eisenhower wanted to create a budget surplus.

D) Eisenhower was a strong believer in the use of fiscal policy to influence the economy; Nixon had a laissez-faire attitude.

E) They both favored the same fiscal policies but differed on monetary policy.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

63

The fiscal policy recommendations of the Reagan administration generally advocated

A) small changes in existing government tax and spending programs.

B) significant increases in defense spending, coupled with increased taxes.

C) holding taxes constant while significantly increasing both defense and nondefense spending.

D) increases in nondefense spending matched dollar for dollar by decreases in defense spending.

E) reductions in both taxes and non-defense-related government programs.

A) small changes in existing government tax and spending programs.

B) significant increases in defense spending, coupled with increased taxes.

C) holding taxes constant while significantly increasing both defense and nondefense spending.

D) increases in nondefense spending matched dollar for dollar by decreases in defense spending.

E) reductions in both taxes and non-defense-related government programs.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

64

In his first year in office,President Clinton's fiscal policy proposals led to

A) a middle-class tax cut.

B) an upper-income tax increase.

C) significant increases in social welfare spending programs.

D) higher taxes on imported goods to promote increased employment in the United States.

E) a balanced federal budget for the first time in 25 years.

A) a middle-class tax cut.

B) an upper-income tax increase.

C) significant increases in social welfare spending programs.

D) higher taxes on imported goods to promote increased employment in the United States.

E) a balanced federal budget for the first time in 25 years.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

65

During the Clinton administration,fiscal policy was

A) successful in keeping the unemployment rate at about 4 percent.

B) the primary policy tool used to combat inflation.

C) exercised through the monetary authorities.

D) focused on reducing both tax rates and government spending.

E) dominated by a desire to reduce budget deficits.

A) successful in keeping the unemployment rate at about 4 percent.

B) the primary policy tool used to combat inflation.

C) exercised through the monetary authorities.

D) focused on reducing both tax rates and government spending.

E) dominated by a desire to reduce budget deficits.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

66

The popularity of the annually balanced budget policy has increased in recent decades because of a

A) realization that the deficit has been growing at a faster rate than GDP.

B) sharp decline in U.S. overseas borrowing.

C) growing business support of higher taxes to firms.

D) gradual decline in inflation rates.

E) growing surplus in the structural deficit.

A) realization that the deficit has been growing at a faster rate than GDP.

B) sharp decline in U.S. overseas borrowing.

C) growing business support of higher taxes to firms.

D) gradual decline in inflation rates.

E) growing surplus in the structural deficit.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

67

The debt incurred in World War II

A) was fully paid by taxes.

B) was paid by war bonds in the 1940s.

C) has never been fully paid and continues to be part of our current national debt.

D) was negligible because the war effort was covered by our excess military capacity.

E) was paid off by reparations payments from the defeated nations.

A) was fully paid by taxes.

B) was paid by war bonds in the 1940s.

C) has never been fully paid and continues to be part of our current national debt.

D) was negligible because the war effort was covered by our excess military capacity.

E) was paid off by reparations payments from the defeated nations.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck

68

A tax bill passed by Congress

A) automatically becomes law.

B) may still be vetoed by the president.

C) must still go to the Internal Revenue for approval.

D) cannot be amended in any way, whether it becomes law or not.

E) is administered by the Federal Reserve System.

A) automatically becomes law.

B) may still be vetoed by the president.

C) must still go to the Internal Revenue for approval.

D) cannot be amended in any way, whether it becomes law or not.

E) is administered by the Federal Reserve System.

Unlock Deck

Unlock for access to all 68 flashcards in this deck.

Unlock Deck

k this deck