Deck 30: Portfolio Optimization with Negative Correlation: Finding Minimum Variance and Weight Allocation

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/2

Play

Full screen (f)

Deck 30: Portfolio Optimization with Negative Correlation: Finding Minimum Variance and Weight Allocation

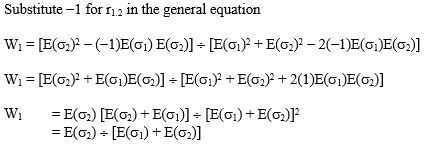

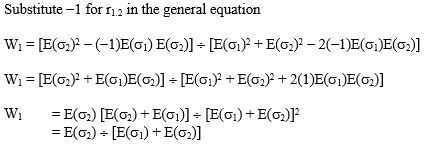

Refer to Exhibit 7B.1.What is the value of W₁ when r₁.₂ = -1 and E(s₁)= .10 and E(s₂)= .12?

A) 45.46%

B) 50.00%

C) 59.45%

D) 54.55%

E) 74.55%

D

W₁ = 12/(.12 + .10)= .5455 = 54.55%

W₁ = 12/(.12 + .10)= .5455 = 54.55%

![<strong> Refer to Exhibit 7B.1.Show the minimum portfolio variance for a portfolio of two risky assets when r₁.₂ = -1.</strong> A) E(s1) ¸ [E(s1) + E(s2)] B) E(s1) ¸ [E(s1) - E(s2)] C) E(s2) ¸ [E(s1) + E(s2)] D) E(s2) ¸ [E(s1) - E(s2)] E) None of the above](https://d2lvgg3v3hfg70.cloudfront.net/TB2018/11ea42bb_436f_f684_87d3_ddca967bc11d_TB2018_00_TB2018_00.jpg)

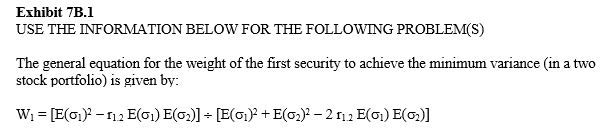

Refer to Exhibit 7B.1.Show the minimum portfolio variance for a portfolio of two risky assets when r₁.₂ = -1.

A) E(s1) ¸ [E(s1) + E(s2)]

B) E(s1) ¸ [E(s1) - E(s2)]

C) E(s2) ¸ [E(s1) + E(s2)]

D) E(s2) ¸ [E(s1) - E(s2)]

E) None of the above

C