Deck 6: The Theory of Tariffs and Quotas

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 6: The Theory of Tariffs and Quotas

1

Which of the following is FALSE about issues/negotiations in the Doha Development agenda?

A)It is intended to deal with economic development issues and trade barriers facing developing countries that were not adequately addressed in the Uruguay Round.

B)Many developing countries are upset with the levels of tariffs and other barriers that industrialized countries use to protect agriculture,clothing and textiles.

C)Industrialized countries want developing countries to reduce their tariffs,which on average are higher than the rates of richer countries.

D)Developing countries don't use tariffs,and they want higher income countries to follow their model.

A)It is intended to deal with economic development issues and trade barriers facing developing countries that were not adequately addressed in the Uruguay Round.

B)Many developing countries are upset with the levels of tariffs and other barriers that industrialized countries use to protect agriculture,clothing and textiles.

C)Industrialized countries want developing countries to reduce their tariffs,which on average are higher than the rates of richer countries.

D)Developing countries don't use tariffs,and they want higher income countries to follow their model.

D

2

In order for large countries to successfully use tariffs to increase well being,

A)they must have significant market power so that foreign firms will cut prices to preserve their sales.

B)the deadweight loss created by the tariff must be greater than the government revenue the tariff generates.

C)domestic production must increase more significantly than for the small country case.

D)domestic consumption and imports must decrease more significantly than in the small country case.

A)they must have significant market power so that foreign firms will cut prices to preserve their sales.

B)the deadweight loss created by the tariff must be greater than the government revenue the tariff generates.

C)domestic production must increase more significantly than for the small country case.

D)domestic consumption and imports must decrease more significantly than in the small country case.

A

3

Suppose a manufacturer of software develops a new computer program that sells for $50.The $50 cost includes $0.25 for the CD it is stored on,$5 for the labor of the company software programmers,and $1.75 for packaging materials and transportation costs.Value added by the software company is

A)$49.75.

B)$48.25.

C)$48.

D)$44.75.

E)$43.

A)$49.75.

B)$48.25.

C)$48.

D)$44.75.

E)$43.

C

4

Nominal rates of protection

A)are always greater than effective rates of protection.

B)are always smaller than effective rates of protection.

C)refer to the tariffs placed on intermediate goods used to make the final good or service.

D)cannot be negative.

A)are always greater than effective rates of protection.

B)are always smaller than effective rates of protection.

C)refer to the tariffs placed on intermediate goods used to make the final good or service.

D)cannot be negative.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is NOT correct about the effects of a tariff on an imported product?

A)Tariffs benefit domestic producers by raising price and domestic output.

B)Tariffs increase government revenue.

C)Tariffs mean higher prices and less consumption for consumers of the product.

D)Tariffs increase the efficiency of how resources are allocated.

A)Tariffs benefit domestic producers by raising price and domestic output.

B)Tariffs increase government revenue.

C)Tariffs mean higher prices and less consumption for consumers of the product.

D)Tariffs increase the efficiency of how resources are allocated.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

High tariffs on intermediate inputs

A)increase the effective rate of protection on final goods.

B)have no impact on the effective rate of protection on final goods.

C)decrease the effective rate of protection on final goods.

D)lower the nominal rate of protection on final goods.

E)raise the nominal rate of protection on final goods.

A)increase the effective rate of protection on final goods.

B)have no impact on the effective rate of protection on final goods.

C)decrease the effective rate of protection on final goods.

D)lower the nominal rate of protection on final goods.

E)raise the nominal rate of protection on final goods.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

The production side efficiency loss of a tariff is caused by

A)confusion about prices when a tariff is imposed.

B)higher profits gained by foreign producers.

C)the expansion of relative inefficient domestic production.

D)the contraction of domestic consumption.

E)the increase in government revenue.

A)confusion about prices when a tariff is imposed.

B)higher profits gained by foreign producers.

C)the expansion of relative inefficient domestic production.

D)the contraction of domestic consumption.

E)the increase in government revenue.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

Producer surplus is equal to the area

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the demand curve.

D)under the supply curve.

E)under the demand curve and above the price line.

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the demand curve.

D)under the supply curve.

E)under the demand curve and above the price line.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

In a small country,the net national cost of tariff protection is equal to the reduction in consumer surplus minus

A)the gain to foreigners.

B)the increase in government revenue and the increase in producer surplus.

C)the increase in government revenue.

D)the increase in producer surplus.

E)the efficiency loss and the consumption side loss.

A)the gain to foreigners.

B)the increase in government revenue and the increase in producer surplus.

C)the increase in government revenue.

D)the increase in producer surplus.

E)the efficiency loss and the consumption side loss.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

Scenario 6.1

Suppose that United States furniture makers import $100 of wood and parts in order to make a dining room table selling for $500.The imports have no tariff of quota restrictions.

Based on Scenario 6.1 above,value added in the United States is

A)$500.

B)$600.

C)$400.

D)$300.

E)None of the above.

Suppose that United States furniture makers import $100 of wood and parts in order to make a dining room table selling for $500.The imports have no tariff of quota restrictions.

Based on Scenario 6.1 above,value added in the United States is

A)$500.

B)$600.

C)$400.

D)$300.

E)None of the above.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following would be a deadweight loss from a tariff?

A)The shift of consumer surplus to government

B)The increase in producer surplus

C)The decrease in consumer surplus

D)The decrease in consumer surplus due to a drop in consumption

E)All of the above.

A)The shift of consumer surplus to government

B)The increase in producer surplus

C)The decrease in consumer surplus

D)The decrease in consumer surplus due to a drop in consumption

E)All of the above.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

Average tariff rates are highest for

A)high-income countries.

B)middle-income countries.

C)low-income countries.

D)industrialized countries.

A)high-income countries.

B)middle-income countries.

C)low-income countries.

D)industrialized countries.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

Scenario 6.1

Suppose that United States furniture makers import $100 of wood and parts in order to make a dining room table selling for $500.The imports have no tariff of quota restrictions.

Based on Scenario 6.1 above,if a tariff of 20 percent is placed on imports of dining room tables,the effective rate of protection is

A)20 percent.

B)25 percent.

C)30 percent.

D)40 percent.

E)There is not enough information to tell.

Suppose that United States furniture makers import $100 of wood and parts in order to make a dining room table selling for $500.The imports have no tariff of quota restrictions.

Based on Scenario 6.1 above,if a tariff of 20 percent is placed on imports of dining room tables,the effective rate of protection is

A)20 percent.

B)25 percent.

C)30 percent.

D)40 percent.

E)There is not enough information to tell.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

Efficiency losses are

A)deadweight losses caused by consumers being prevented by tariffs from buying products at the world price,products that they value more highly than that price.

B)the total loss in consumer surplus from a tariff.

C)the increase in producer surplus that is created by a tariff.

D)the deadweight loss that is created because domestic firms have to charge higher prices to produce units of output than foreign firms would have to charge.

A)deadweight losses caused by consumers being prevented by tariffs from buying products at the world price,products that they value more highly than that price.

B)the total loss in consumer surplus from a tariff.

C)the increase in producer surplus that is created by a tariff.

D)the deadweight loss that is created because domestic firms have to charge higher prices to produce units of output than foreign firms would have to charge.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

Consumer surplus is equal to the area

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the demand curve.

D)under the supply curve.

E)under the demand curve and above the price line.

A)under the demand curve and above the supply curve.

B)above the supply curve and below the price line.

C)under the demand curve.

D)under the supply curve.

E)under the demand curve and above the price line.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

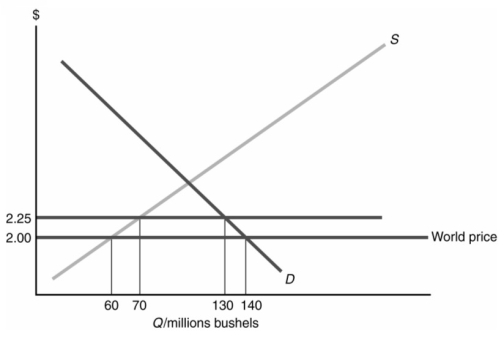

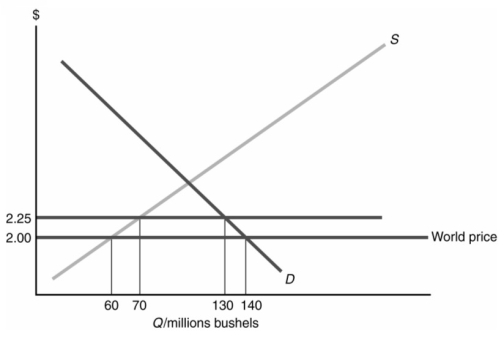

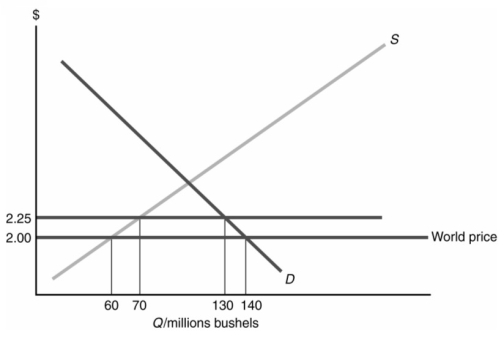

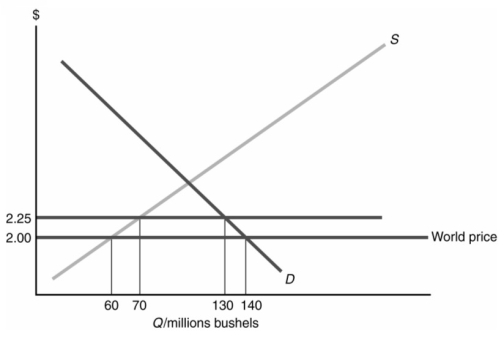

Figure 6.1

Use the graph below and the following information to answer the next question(s).The world price of soybeans is $2.00 per bushel,and the importing country is small enough not to affect the world price.

Based on Figure 6.1,suppose the government puts a tariff of $0.25 per bushel on soybean imports.How much will the tariff reduce imports?

A)Imports will decrease by 10 million bushels.

B)Imports will decrease by 20 million bushels.

C)Imports will decrease by 60 million bushels.

D)Imports will not change after the tariff.

Use the graph below and the following information to answer the next question(s).The world price of soybeans is $2.00 per bushel,and the importing country is small enough not to affect the world price.

Based on Figure 6.1,suppose the government puts a tariff of $0.25 per bushel on soybean imports.How much will the tariff reduce imports?

A)Imports will decrease by 10 million bushels.

B)Imports will decrease by 20 million bushels.

C)Imports will decrease by 60 million bushels.

D)Imports will not change after the tariff.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

Large countries can improve their welfare by levying a tariff only if it does not

A)encourage rent seeking elsewhere in the economy.

B)discourage innovation.

C)lead to retaliation by the nation's trading partners.

D)All of the above.

E)None of the above.

A)encourage rent seeking elsewhere in the economy.

B)discourage innovation.

C)lead to retaliation by the nation's trading partners.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

Tariffs reallocate income from

A)consumers to producers.

B)producers to consumers.

C)government to producers.

D)consumers to foreigners.

E)Both A and D.

A)consumers to producers.

B)producers to consumers.

C)government to producers.

D)consumers to foreigners.

E)Both A and D.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is FALSE?

A)Consumer surplus increases after a tariff is placed on imports.

B)Producer surplus increases after a tariff is imposed.

C)Government revenue increases after a tariff is imposed.

D)Deadweight losses result from tariffs.

A)Consumer surplus increases after a tariff is placed on imports.

B)Producer surplus increases after a tariff is imposed.

C)Government revenue increases after a tariff is imposed.

D)Deadweight losses result from tariffs.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

Scenario 6.1

Suppose that United States furniture makers import $100 of wood and parts in order to make a dining room table selling for $500.The imports have no tariff of quota restrictions.

Based on Scenario 6.1 above,if a tariff of 20 percent is placed on imports of dining room tables,and another tariff of 50 percent is placed on imports of wood and parts,then the effective rate of protection on tables made in the United States is

A)70 percent.

B)50 percent.

C)20 percent.

D)12.5 percent.

E)0 percent.

Suppose that United States furniture makers import $100 of wood and parts in order to make a dining room table selling for $500.The imports have no tariff of quota restrictions.

Based on Scenario 6.1 above,if a tariff of 20 percent is placed on imports of dining room tables,and another tariff of 50 percent is placed on imports of wood and parts,then the effective rate of protection on tables made in the United States is

A)70 percent.

B)50 percent.

C)20 percent.

D)12.5 percent.

E)0 percent.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

If the effective rate of protection is greater than the nominal rate of protection,there must be tariffs on intermediate products.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

What are some of the long-run costs of tariffs?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

What has been the most significant obstacle to progress in the Doha Round?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

How is the Agreement on Textiles and Clothing impacting trade today?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

In the case of a small country,consumer surplus

A)decreases less with a tariff than with an equivalent quota.

B)decreases less with a quota than with an equivalent tariff.

C)is not changed by tariffs or quotas.

D)decreases the same with tariffs and equivalent quotas.

E)increases more with quotas.

A)decreases less with a tariff than with an equivalent quota.

B)decreases less with a quota than with an equivalent tariff.

C)is not changed by tariffs or quotas.

D)decreases the same with tariffs and equivalent quotas.

E)increases more with quotas.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

The rules for respecting property rights as they relate to trade were negotiated during the Uruguay Round (1986-1994)and culminated in the Trade Related Aspects Intellectual Property Rights (TRIPS)agreement.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

Nontariff barriers to trade are less transparent than tariffs.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

Since the mid-1980s tariff rates in most nations have risen.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

Tariff revenue is an important source of operating revenue for many governments of high income countries.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

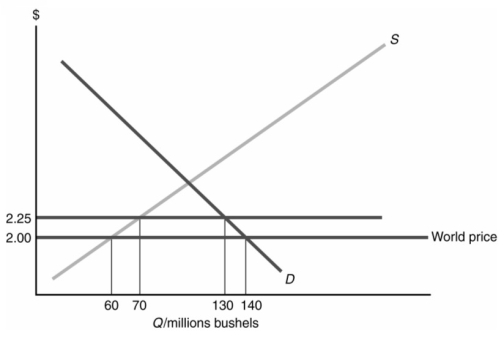

Figure 6.1

Use the graph below and the following information to answer the next question(s).The world price of soybeans is $2.00 per bushel,and the importing country is small enough not to affect the world price.

Based on Figure 6.1,how much revenue will the government raise from a $0.25 per bushel tariff on soybean imports?

A)The government will raise $2.5 million.

B)The government will raise $5 million.

C)The government will raise $15 million.

D)The government will raise $32.5 million.

E)The government will see no increase in income;because the country is small,foreign firms will simply not serve it after the tariff is imposed.

Use the graph below and the following information to answer the next question(s).The world price of soybeans is $2.00 per bushel,and the importing country is small enough not to affect the world price.

Based on Figure 6.1,how much revenue will the government raise from a $0.25 per bushel tariff on soybean imports?

A)The government will raise $2.5 million.

B)The government will raise $5 million.

C)The government will raise $15 million.

D)The government will raise $32.5 million.

E)The government will see no increase in income;because the country is small,foreign firms will simply not serve it after the tariff is imposed.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is NOT an expected benefit of reducing nontariff barriers to trade?

A)Fewer firms to compete with

B)Lower prices for many goods

C)Increase in the volume of exports and imports

D)Increase in production levels

E)Improved overall economic welfare

A)Fewer firms to compete with

B)Lower prices for many goods

C)Increase in the volume of exports and imports

D)Increase in production levels

E)Improved overall economic welfare

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

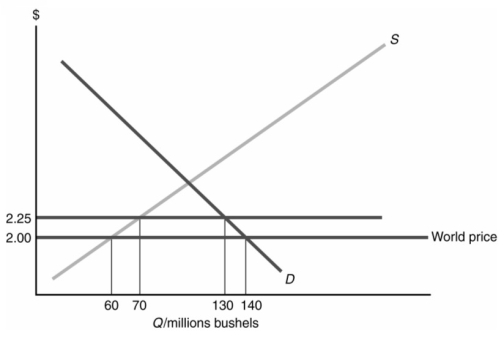

Figure 6.1

Use the graph below and the following information to answer the next question(s).The world price of soybeans is $2.00 per bushel,and the importing country is small enough not to affect the world price.

Based on Figure 6.1,given a tariff of $0.25 per bushel on soybean imports,how much will domestic production increase?

A)Domestic firms will increase output by 10 million bushels.

B)Domestic firms will increase output by 20 million bushels.

C)Domestic firms will increase output by 70 million bushels.

D)Domestic firms' production will not be changed by the tariff.

Use the graph below and the following information to answer the next question(s).The world price of soybeans is $2.00 per bushel,and the importing country is small enough not to affect the world price.

Based on Figure 6.1,given a tariff of $0.25 per bushel on soybean imports,how much will domestic production increase?

A)Domestic firms will increase output by 10 million bushels.

B)Domestic firms will increase output by 20 million bushels.

C)Domestic firms will increase output by 70 million bushels.

D)Domestic firms' production will not be changed by the tariff.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

Draw a graph showing the effects of imposing a tariff in the small country case.Describe the results,using the concepts of producer surplus,consumer surplus and deadweight loss.Specifically address the effects on consumers,producers,government revenue and overall national well being,connecting those effects to areas of your graph.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

Deadweight losses are the only potential cost associated with tariffs,which is why they are preferred to quotas.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

Developing countries have identified which key issues as important to them in current trade talks?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is FALSE?

A)Tariffs are a relatively easy tax to administer and often form an important part of revenue for low-income countries.

B)Taxes on income,sales,and property require more complex accounting systems than do tariffs.

C)Low-income countries often have large informal markets with the sales of many goods and services not being recorded,which makes it difficult to apply many kinds of taxes.

D)Taxes on income and property run into powerful interest groups in low-income countries,which work to prevent the creation or payment of these taxes.

E)Tariffs are not an attractive tax option for most low-income countries,so they mostly rely on quota licenses for revenue.

A)Tariffs are a relatively easy tax to administer and often form an important part of revenue for low-income countries.

B)Taxes on income,sales,and property require more complex accounting systems than do tariffs.

C)Low-income countries often have large informal markets with the sales of many goods and services not being recorded,which makes it difficult to apply many kinds of taxes.

D)Taxes on income and property run into powerful interest groups in low-income countries,which work to prevent the creation or payment of these taxes.

E)Tariffs are not an attractive tax option for most low-income countries,so they mostly rely on quota licenses for revenue.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

Why is the Doha Round called the Doha Development Round?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

38

What do developing countries want regarding agriculture in the Doha Round?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

The new GATS and TRIPS are separate agreements negotiated within the WTO framework as part of the Uruguay Round that apply to

A)services and aircraft.

B)services and transportation.

C)agriculture and textiles.

D)services and intellectual property.

E)textiles and transportation.

A)services and aircraft.

B)services and transportation.

C)agriculture and textiles.

D)services and intellectual property.

E)textiles and transportation.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

In which way are tariffs different from quotas?

A)They reduce the volume of imported products.

B)They raise the price of the imported products to consumers.

C)They increase the domestic quantity supplied of the product.

D)They raise government revenue.

A)They reduce the volume of imported products.

B)They raise the price of the imported products to consumers.

C)They increase the domestic quantity supplied of the product.

D)They raise government revenue.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

What are the three major types of quotas?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

Describe intellectual property rights.What agreements have been reached regarding their protection? What are the benefits and the costs of protecting intellectual property rights?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

Quotas usually lead to larger deadweight losses than tariffs.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

What is the name of the agreement related to intellectual property rights?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

Nontariff measures are generally much more difficult to eliminate than tariffs and quotas because they are embedded more deeply in national economic policies.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

Both tariffs and quotas lead to a decrease in imports,a decrease in domestic consumption,and an increase in domestic production.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

Which type of restriction on quantity of imports is the most transparent?

A)Quota

B)Licensing requirements

C)Voluntary export restraints

D)Government procurement policies

A)Quota

B)Licensing requirements

C)Voluntary export restraints

D)Government procurement policies

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

Internationally,the TRIPS agreement is uniformly regarded as a positive step for world prosperity.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

Give an example of an industry that would seek intellectual property rights protection because its product incorporates innovation and research.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

An increase in domestic demand for a product protected by a quota results in an increase in producer surplus for domestic firms,while for a tariff it would result in more imports.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

What is Joseph Stiglitz' main criticism regarding intellectual property rights protection?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

Intellectual property rights protection is a critical issue for the pharmaceutical industry among others.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

A real cost of tariffs and quotas that is difficult to measure is that they

A)encourage rent seeking.

B)shift income from consumers to producers.

C)limit the quantity of imports.

D)reduce wages.

E)cause deflation.

A)encourage rent seeking.

B)shift income from consumers to producers.

C)limit the quantity of imports.

D)reduce wages.

E)cause deflation.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

If politicians decide to proceed with protection,why might economists prefer tariffs to quotas? Explain at least three reasons.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

When did intellectual property rights become part of trade agreements?

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is FALSE?

A)At the end of the twentieth century,more and more traded goods and services incorporated specialized knowledge and unique ideas.

B)Pharmaceuticals,computer hardware,telecommunications equipment,and other high technology products are valuable because of the innovation and research they incorporate.

C)Software,movies,music,and other artistic expressions are valued for their creativity.

D)Developing countries usually strongly advocate the protection of intellectual property rights.

E)The protection given to creators and innovators varied greatly internationally until standardization began with the signing of the TRIPs agreement.

A)At the end of the twentieth century,more and more traded goods and services incorporated specialized knowledge and unique ideas.

B)Pharmaceuticals,computer hardware,telecommunications equipment,and other high technology products are valuable because of the innovation and research they incorporate.

C)Software,movies,music,and other artistic expressions are valued for their creativity.

D)Developing countries usually strongly advocate the protection of intellectual property rights.

E)The protection given to creators and innovators varied greatly internationally until standardization began with the signing of the TRIPs agreement.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

In the case of a small country,producer surplus

A)increases more with a tariff than with an equivalent quota.

B)increases more with a quota than with an equivalent tariff.

C)is not changed by tariffs or quotas.

D)increases the same with tariffs and equivalent quotas.

E)increases more with quotas.

A)increases more with a tariff than with an equivalent quota.

B)increases more with a quota than with an equivalent tariff.

C)is not changed by tariffs or quotas.

D)increases the same with tariffs and equivalent quotas.

E)increases more with quotas.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

In economic terms,tariffs are preferred to quotas because

A)domestic manufacturers gain more producer surplus.

B)there is less loss of consumer surplus.

C)tariffs are easier to administer.

D)quotas create a greater production inefficiency.

E)given the way quotas are usually administered,tariffs cause a smaller net national welfare loss.

A)domestic manufacturers gain more producer surplus.

B)there is less loss of consumer surplus.

C)tariffs are easier to administer.

D)quotas create a greater production inefficiency.

E)given the way quotas are usually administered,tariffs cause a smaller net national welfare loss.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

59

Give an example from your text of a nontariff measure that could reduce the quantity of imports or exports.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck