Deck 36: The Federal Budget and the National Debt

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/97

Play

Full screen (f)

Deck 36: The Federal Budget and the National Debt

1

During the 1950s and 1960s,the national debt as a percent of GDP in the United States

A)soared to an all-time high.

B)declined.

C)increased.

D)was virtually unchanged.

A)soared to an all-time high.

B)declined.

C)increased.

D)was virtually unchanged.

B

2

If the federal government were to run a budget surplus,this would

A)increase the size of the national debt.

B)reduce the size of the national debt.

C)leave the size of the national debt unchanged.

D)decrease the national debt only if the government also reduces the supply of money.

A)increase the size of the national debt.

B)reduce the size of the national debt.

C)leave the size of the national debt unchanged.

D)decrease the national debt only if the government also reduces the supply of money.

B

3

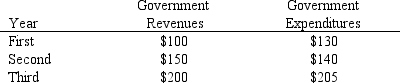

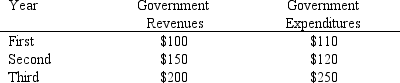

Suppose a new country is formed,and its government has the following revenues and expenditures for its first three years of existence.

Which of the following is correct regarding this government?

A)In the third year,it had a $5 national debt,and after the third year,it has a $25 deficit.

B)In the third year,it ran a $5 deficit,and its national debt after the third year is $45.

C)In the third year,it ran a $5 surplus,and its national debt after the third year is $25.

D)In the third year,it ran a $5 deficit,and its national debt after the third year is $25.

Which of the following is correct regarding this government?

A)In the third year,it had a $5 national debt,and after the third year,it has a $25 deficit.

B)In the third year,it ran a $5 deficit,and its national debt after the third year is $45.

C)In the third year,it ran a $5 surplus,and its national debt after the third year is $25.

D)In the third year,it ran a $5 deficit,and its national debt after the third year is $25.

D

4

From a public choice viewpoint,the persistent budget deficits of recent decades are

A)surprising,because politicians have a strong incentive to balance the government's budget.

B)an expected result,because the political incentive structure makes it attractive for politicians to levy taxes rather than spend on current programs.

C)surprising,because politicians have a strong incentive to run budget surpluses and thereby indicate that their actions have generated a profit.

D)an expected result,because the political incentive structure makes it attractive for politicians to spend on current programs rather than levy taxes.

A)surprising,because politicians have a strong incentive to balance the government's budget.

B)an expected result,because the political incentive structure makes it attractive for politicians to levy taxes rather than spend on current programs.

C)surprising,because politicians have a strong incentive to run budget surpluses and thereby indicate that their actions have generated a profit.

D)an expected result,because the political incentive structure makes it attractive for politicians to spend on current programs rather than levy taxes.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

5

The national debt is

A)the difference between a nation's exports and imports of goods and services.

B)the sum of the personal debt of all citizens in the United States.

C)the cumulative effect of all past budget deficits and surpluses of the federal government.

D)equal to the current size of the budget deficit.

A)the difference between a nation's exports and imports of goods and services.

B)the sum of the personal debt of all citizens in the United States.

C)the cumulative effect of all past budget deficits and surpluses of the federal government.

D)equal to the current size of the budget deficit.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

6

The national debt is the

A)difference between a nation's exports and imports of goods and services.

B)sum of the personal debt of all citizens in the United States.

C)indebtedness of the federal government in the form of outstanding interest-earning bonds.

D)sum of the net personal debts of Americans to foreigners.

A)difference between a nation's exports and imports of goods and services.

B)sum of the personal debt of all citizens in the United States.

C)indebtedness of the federal government in the form of outstanding interest-earning bonds.

D)sum of the net personal debts of Americans to foreigners.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

7

In 2011,approximately what percent of the national debt was held by federal government agencies?

A)1 percent

B)22 percent

C)32 percent

D)a little more than 80 percent

A)1 percent

B)22 percent

C)32 percent

D)a little more than 80 percent

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

8

How does inclusion of the current revenues and expenditures of the Social Security trust fund into the budget calculation currently affect the reported budget deficit of the federal government?

A)It increases the reported deficit.

B)It reduces the reported deficit.

C)It exerts no effect on the reported deficit.

D)It increases the deficit during an economic boom but reduces it during a recession.

A)It increases the reported deficit.

B)It reduces the reported deficit.

C)It exerts no effect on the reported deficit.

D)It increases the deficit during an economic boom but reduces it during a recession.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

9

The total indebtedness of the federal government in the form of outstanding interest-earning bonds is the

A)budget deficit.

B)budget surplus.

C)national debt.

D)trade deficit.

A)budget deficit.

B)budget surplus.

C)national debt.

D)trade deficit.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

10

If the federal government were to run a budget deficit,this would

A)increase the size of the national debt.

B)reduce the size of the national debt.

C)leave the size of the national debt unchanged.

D)increase the national debt only if the government also expands the supply of money.

A)increase the size of the national debt.

B)reduce the size of the national debt.

C)leave the size of the national debt unchanged.

D)increase the national debt only if the government also expands the supply of money.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

11

At year-end 2010,the national debt of the United States was approximately

A)5 percent of GDP.

B)25 percent of GDP.

C)75 percent of GDP.

D)95 percent of GDP.

A)5 percent of GDP.

B)25 percent of GDP.

C)75 percent of GDP.

D)95 percent of GDP.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

12

What is the difference between the federal budget deficit and the national debt?

A)The budget deficit is the amount by which expenditures exceed revenues in a particular year,while the national debt is the cumulative effect of all past budget deficits and surpluses.

B)The budget deficit is the cumulative effect of all prior national debts.

C)The national debt includes all outstanding bonds,while the budget deficit excludes bonds held by government agencies.

D)This is a trick question because there is no difference between the budget deficit and the national debt.

A)The budget deficit is the amount by which expenditures exceed revenues in a particular year,while the national debt is the cumulative effect of all past budget deficits and surpluses.

B)The budget deficit is the cumulative effect of all prior national debts.

C)The national debt includes all outstanding bonds,while the budget deficit excludes bonds held by government agencies.

D)This is a trick question because there is no difference between the budget deficit and the national debt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

13

In 2011,approximately what percent of the national debt was held by the Federal Reserve system?

A)5 percent

B)10 percent

C)40 percent

D)55 percent

A)5 percent

B)10 percent

C)40 percent

D)55 percent

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is true?

A)A budget deficit will reduce the national debt.

B)A budget deficit will increase the national debt.

C)A balanced budget will increase the national debt.

D)A budget surplus will increase the national debt.

A)A budget deficit will reduce the national debt.

B)A budget deficit will increase the national debt.

C)A balanced budget will increase the national debt.

D)A budget surplus will increase the national debt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

15

In 2009,a little more than half of the privately held national debt was held by

A)foreign investors.

B)Federal Reserve banks.

C)large corporations.

D)government trust funds.

A)foreign investors.

B)Federal Reserve banks.

C)large corporations.

D)government trust funds.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

16

If the federal government runs a budget deficit,but the budget deficit as a percent of GDP is less than the growth rate of real output,the

A)national debt will decrease as a share of GDP.

B)national debt will remain a constant share of GDP.

C)national debt will increase as a share of GDP.

D)size of the national debt (in dollar value)will decline.

A)national debt will decrease as a share of GDP.

B)national debt will remain a constant share of GDP.

C)national debt will increase as a share of GDP.

D)size of the national debt (in dollar value)will decline.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

17

What determines the creditworthiness of any organization,including the federal government?

A)the size of its debt relative to its income base

B)the interest rate at which it can borrow money

C)the length of time it has existed

D)the length of time it is expected to operate

A)the size of its debt relative to its income base

B)the interest rate at which it can borrow money

C)the length of time it has existed

D)the length of time it is expected to operate

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

18

The sum of all past budget deficits and surpluses of the federal government is the

A)budget deficit.

B)budget surplus.

C)national debt.

D)trade deficit.

A)budget deficit.

B)budget surplus.

C)national debt.

D)trade deficit.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

19

It is important to distinguish between the privately held portion of the national debt and the portion held by government agencies and the Federal Reserve system because

A)the government will not have to repay the privately held debt.

B)only the privately held debt creates a net interest liability for the federal government.

C)the privately held debt does not create a net interest liability for the federal government.

D)taxes will have to be raised in order to pay the interest on the debt held by the Federal Reserve system.

A)the government will not have to repay the privately held debt.

B)only the privately held debt creates a net interest liability for the federal government.

C)the privately held debt does not create a net interest liability for the federal government.

D)taxes will have to be raised in order to pay the interest on the debt held by the Federal Reserve system.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

20

If the federal government runs a budget deficit,and the budget deficit as a percent of GDP is equal to the growth rate of real output,the

A)national debt will decrease as a share of GDP.

B)national debt will remain a constant share of GDP.

C)national debt will increase as a share of GDP.

D)size of the national debt (in dollar value)will decline.

A)national debt will decrease as a share of GDP.

B)national debt will remain a constant share of GDP.

C)national debt will increase as a share of GDP.

D)size of the national debt (in dollar value)will decline.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

21

External debt is that portion of the national debt

A)held by private investors.

B)held by the Federal Reserve.

C)that the United States does not intend to repay.

D)held by foreigners.

A)held by private investors.

B)held by the Federal Reserve.

C)that the United States does not intend to repay.

D)held by foreigners.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

22

The idea that a large public debt is "mortgaging the future of our children and grandchildren" is misleading because

A)it is the Federal Reserve that will be responsible for making interest payments on the debt.

B)future generations will have to bear the opportunity costs of the resources that are used today.

C)future generations will not be liable for the interest obligations of the national debt.

D)future generations will inherit the interest income as well as the interest obligations.

A)it is the Federal Reserve that will be responsible for making interest payments on the debt.

B)future generations will have to bear the opportunity costs of the resources that are used today.

C)future generations will not be liable for the interest obligations of the national debt.

D)future generations will inherit the interest income as well as the interest obligations.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

23

The privately held government debt is that portion of the national debt that

A)must be paid off at some point in the future.

B)is owed to domestic and foreign investors.

C)cannot be refinanced by issuing new debt.

D)is owned by agencies of the federal government.

A)must be paid off at some point in the future.

B)is owed to domestic and foreign investors.

C)cannot be refinanced by issuing new debt.

D)is owned by agencies of the federal government.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following portions of the national debt impose a net interest burden on the federal government?

A)treasury bonds held by government agencies

B)treasury bonds held by private investors

C)treasury bonds held by the Federal Reserve system

D)treasury bonds held in the Social Security Trust Fund

A)treasury bonds held by government agencies

B)treasury bonds held by private investors

C)treasury bonds held by the Federal Reserve system

D)treasury bonds held in the Social Security Trust Fund

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

25

According to the new classical view,if people appropriately realize that an increase in government debt implies higher future taxes,they will

A)save less since the substitution of debt for taxes makes them wealthier.

B)increase their consumption since the substitution of debt for taxes makes them wealthier.

C)save more now to meet the future tax liability implied by the increase in debt.

D)alter neither their saving nor their consumption rate.

A)save less since the substitution of debt for taxes makes them wealthier.

B)increase their consumption since the substitution of debt for taxes makes them wealthier.

C)save more now to meet the future tax liability implied by the increase in debt.

D)alter neither their saving nor their consumption rate.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

26

According to the traditional (crowding-out)view,large budget deficits during normal times will lead to

A)bank failures in the future.

B)a smaller capital stock in the future.

C)lower interest rates in the future.

D)a bankrupt government in the future.

A)bank failures in the future.

B)a smaller capital stock in the future.

C)lower interest rates in the future.

D)a bankrupt government in the future.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

27

If households fail to recognize that debt-financing represents a future liability (in the form of higher taxes),they will tend to consume

A)less and pass less net wealth on to future generations.

B)more and pass more net wealth on to future generations.

C)less and pass more net wealth on to future generations.

D)more and pass less net wealth on to future generations.

A)less and pass less net wealth on to future generations.

B)more and pass more net wealth on to future generations.

C)less and pass more net wealth on to future generations.

D)more and pass less net wealth on to future generations.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is true of deficit spending and government debt?

A)The opportunity costs of government spending must be incurred today and cannot be passed on through deficit spending.

B)Because of the national debt,future generations will incur liabilities without any corresponding benefits.

C)Financing government spending with debt allows the government to pass the opportunity costs of government spending along to future generations.

D)All of the public debt is owed to foreigners because the people who pay taxes are U.S.citizens.

A)The opportunity costs of government spending must be incurred today and cannot be passed on through deficit spending.

B)Because of the national debt,future generations will incur liabilities without any corresponding benefits.

C)Financing government spending with debt allows the government to pass the opportunity costs of government spending along to future generations.

D)All of the public debt is owed to foreigners because the people who pay taxes are U.S.citizens.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

29

If one subtracts the amount of bonds held by agencies of the federal government and the Federal Reserve from the national debt,what remains is known as the

A)external debt.

B)privately held government debt.

C)trade deficit.

D)budget deficit.

A)external debt.

B)privately held government debt.

C)trade deficit.

D)budget deficit.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

30

The U.S.Treasury both pays and receives almost all of the interest on that portion of the national debt that is held by

A)domestic investors.

B)foreign investors.

C)government agencies and the Federal Reserve system.

D)commercial banks.

A)domestic investors.

B)foreign investors.

C)government agencies and the Federal Reserve system.

D)commercial banks.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

31

The new classical view of budget deficits assumes that

A)people view government bonds as an addition to their wealth.

B)individuals do not anticipate the tax liability implied by deficit spending.

C)increased government borrowing will raise the interest rate and retard private borrowing and capital formation.

D)if future taxes (debt)are substituted for current taxes,people will save the reduction in current taxes in order to pay the higher future taxes.

A)people view government bonds as an addition to their wealth.

B)individuals do not anticipate the tax liability implied by deficit spending.

C)increased government borrowing will raise the interest rate and retard private borrowing and capital formation.

D)if future taxes (debt)are substituted for current taxes,people will save the reduction in current taxes in order to pay the higher future taxes.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

32

Currently,the Federal Reserve earns approximately $30 billion of interest annually on its holdings of government bonds.Only a small portion of these earnings is required to cover the Fed's operating costs.The remainder of these earnings is

A)distributed to the member banks of the Federal Reserve system.

B)invested in corporate stocks held by the Fed.

C)returned to the U.S.Treasury.

D)loaned to commercial banks.

A)distributed to the member banks of the Federal Reserve system.

B)invested in corporate stocks held by the Fed.

C)returned to the U.S.Treasury.

D)loaned to commercial banks.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

33

The new classical view argues that an increase in government debt will cause people to

A)increase their current saving so they will be better able to pay the higher future taxes implied by the increase in the debt.

B)increase their current consumption since the substitution of debt for taxes makes them wealthier.

C)shift their savings to foreign banks where they will be more secure.

D)do all of the above.

A)increase their current saving so they will be better able to pay the higher future taxes implied by the increase in the debt.

B)increase their current consumption since the substitution of debt for taxes makes them wealthier.

C)shift their savings to foreign banks where they will be more secure.

D)do all of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

34

As of March,2011,the privately held portion of the national debt was approximately

A)5 percent of the total.

B)20 percent of the total.

C)58 percent of the total.

D)88 percent of the total.

A)5 percent of the total.

B)20 percent of the total.

C)58 percent of the total.

D)88 percent of the total.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

35

What percent of the privately held national debt was owed to foreign investors in 2011?

A)1.5 percent

B)approximately 20 percent

C)approximately 54 percent

D)more than 80 percent

A)1.5 percent

B)approximately 20 percent

C)approximately 54 percent

D)more than 80 percent

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

36

When government debt is financed internally,future generations will

A)inherit a higher tax liability without additional interest income.

B)inherit neither higher taxes nor additional interest income.

C)inherit both higher taxes and additional interest income.

D)receive lower interest income and a lower tax liability.

A)inherit a higher tax liability without additional interest income.

B)inherit neither higher taxes nor additional interest income.

C)inherit both higher taxes and additional interest income.

D)receive lower interest income and a lower tax liability.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

37

Deficit spending and a large national debt can have important effects on future generations because they

A)make it possible for those living in the present to pass the opportunity costs of current government spending on to future generations.

B)can significantly impact spending on capital formation.

C)will pass interest obligations on to future generations with no corresponding benefits.

D)will cause the government to go bankrupt.

A)make it possible for those living in the present to pass the opportunity costs of current government spending on to future generations.

B)can significantly impact spending on capital formation.

C)will pass interest obligations on to future generations with no corresponding benefits.

D)will cause the government to go bankrupt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

38

Why are the bonds held by the Fed and government agencies excluded from the privately held debt figures?

A)The U.S.Treasury does not have to pay off these bonds.

B)These bonds were not issued by the U.S.Treasury.

C)These bonds do not create a net-interest obligation for the federal government.

D)These bonds are not interest-bearing bonds.

A)The U.S.Treasury does not have to pay off these bonds.

B)These bonds were not issued by the U.S.Treasury.

C)These bonds do not create a net-interest obligation for the federal government.

D)These bonds are not interest-bearing bonds.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is a valid concern about the national debt for a country whose debt is held entirely by its citizens?

A)The welfare of future generations will be directly related to the per-capita size of the national debt that they inherit.

B)Growth of the national debt will eventually lead to the bankruptcy of the government.

C)When the debt comes due,future generations may be unable to pay it off.

D)If the increases in the national debt reduce private expenditures on capital formation,future generations may have lower incomes because they will inherit a smaller stock of capital.

A)The welfare of future generations will be directly related to the per-capita size of the national debt that they inherit.

B)Growth of the national debt will eventually lead to the bankruptcy of the government.

C)When the debt comes due,future generations may be unable to pay it off.

D)If the increases in the national debt reduce private expenditures on capital formation,future generations may have lower incomes because they will inherit a smaller stock of capital.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

40

The new classical view of fiscal policy holds that

A)budget deficits will stimulate consumption.

B)budget deficits will decrease the saving rate.

C)individuals fail to recognize that debt-financing implies higher future taxes.

D)individuals fully anticipate the added tax liability implied by the debt financing and will increase their saving so they can meet this obligation.

A)budget deficits will stimulate consumption.

B)budget deficits will decrease the saving rate.

C)individuals fail to recognize that debt-financing implies higher future taxes.

D)individuals fully anticipate the added tax liability implied by the debt financing and will increase their saving so they can meet this obligation.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

41

Currently,the strategy of the Social Security system is to run surpluses to prepare for the retirement of the baby boom generation.The effectiveness of this strategy is being undermined because

A)rising interest rates make it more expensive for Social Security to borrow.

B)inflation is reducing the value of the Social Security surplus.

C)the trust fund is being used to finance current government expenditures,and the bonds held by the trust fund are an obligation of the U.S.Treasury.

D)the federal budget surplus reduces the Social Security surplus.

A)rising interest rates make it more expensive for Social Security to borrow.

B)inflation is reducing the value of the Social Security surplus.

C)the trust fund is being used to finance current government expenditures,and the bonds held by the trust fund are an obligation of the U.S.Treasury.

D)the federal budget surplus reduces the Social Security surplus.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

42

Among the major industrial economies,which of the following had the lowest net public debt as a percent of GDP in 2011?

A)Belgium

B)Australia

C)United States

D)Italy

A)Belgium

B)Australia

C)United States

D)Italy

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

43

As the size of a nation's outstanding debt gets larger and larger relative to the size of the economy,

A)eventually it will become difficult for the country to borrow in global credit markets.

B)the country will have to pay higher real interest rates in order to induce investors to purchase its bonds.

C)at some point,the country will be more or less forced to bring spending into line with revenues in order to maintain the confidence of investors.

D)all of the above are correct.

A)eventually it will become difficult for the country to borrow in global credit markets.

B)the country will have to pay higher real interest rates in order to induce investors to purchase its bonds.

C)at some point,the country will be more or less forced to bring spending into line with revenues in order to maintain the confidence of investors.

D)all of the above are correct.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

44

As baby-boomers reach retirement age and draw on Social Security and Medicare,

A)the Social Security Trust Fund will switch from running a deficit to a surplus.

B)unfunded promises included in the federal budget will decrease.

C)expenditures on these programs will increase the size of the federal debt.

D)the federal debt as a share of GDP will decrease.

A)the Social Security Trust Fund will switch from running a deficit to a surplus.

B)unfunded promises included in the federal budget will decrease.

C)expenditures on these programs will increase the size of the federal debt.

D)the federal debt as a share of GDP will decrease.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

45

As conventionally measured,budget deficit and surplus calculations include the revenues and expenditures of

A)only current government operations;government trust funds are omitted.

B)all government trust funds except Social Security.

C)the Social Security Trust Fund,but other government trust funds are omitted.

D)all government trust funds,including Social Security.

A)only current government operations;government trust funds are omitted.

B)all government trust funds except Social Security.

C)the Social Security Trust Fund,but other government trust funds are omitted.

D)all government trust funds,including Social Security.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

46

What will happen if a country uses money creation to finance a large and expanding national debt?

A)Real output and employment will grow rapidly.

B)Nominal interest rates will fall.

C)The foreign exchange value of the currency will increase.

D)The rate of inflation will rise.

A)Real output and employment will grow rapidly.

B)Nominal interest rates will fall.

C)The foreign exchange value of the currency will increase.

D)The rate of inflation will rise.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

47

Widespread acceptance of the Keynesian theory of fiscal policy

A)caused most economists to reject the public choice view of budget deficits.

B)relaxed the political pressure to balance the budget and,hence,paved the way for the persistent budget deficits of the last five decades.

C)was based on the view that continual budget deficits would help stabilize the economy.

D)increased the pressure for a constitutional amendment mandating that the federal government balance its budget.

A)caused most economists to reject the public choice view of budget deficits.

B)relaxed the political pressure to balance the budget and,hence,paved the way for the persistent budget deficits of the last five decades.

C)was based on the view that continual budget deficits would help stabilize the economy.

D)increased the pressure for a constitutional amendment mandating that the federal government balance its budget.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

48

If a country with a large government debt uses money creation to service and repay the debt,this will lead to

A)lower interest rates.

B)an appreciation of the nation's currency in the foreign exchange market.

C)inflation,higher interest rates,and a financial crisis.

D)rapid economic growth,as the expansionary monetary policy stimulates the economy and generates the additional tax revenue to service the larger debt.

A)lower interest rates.

B)an appreciation of the nation's currency in the foreign exchange market.

C)inflation,higher interest rates,and a financial crisis.

D)rapid economic growth,as the expansionary monetary policy stimulates the economy and generates the additional tax revenue to service the larger debt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

49

Since 1960,there have been how many years of budget surplus?

A)5

B)10

C)20

D)30

A)5

B)10

C)20

D)30

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

50

When the United States ran large budget deficits during 2001-2011,

A)private investment was strong and consumer expenditures declined as a percentage of GDP.

B)private investment was weak and consumption increased as a share of GDP.

C)the trade deficit of the United States shrank,indicating that borrowing from foreigners was declining.

D)the deficits were financed exclusively through borrowing from domestic sources.

A)private investment was strong and consumer expenditures declined as a percentage of GDP.

B)private investment was weak and consumption increased as a share of GDP.

C)the trade deficit of the United States shrank,indicating that borrowing from foreigners was declining.

D)the deficits were financed exclusively through borrowing from domestic sources.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

51

The large budget deficits of 2001-2011 were

A)financed entirely through borrowing from domestic sources.

B)accompanied by a rapid increase in private investment,which will enhance the welfare of future generations of Americans.

C)accompanied by an increase in consumption as a share of GDP,which indicates the current generation of Americans is gaining at the expense of future generations.

D)accompanied by large trade surpluses,which will enhance the welfare of future generations of Americans.

A)financed entirely through borrowing from domestic sources.

B)accompanied by a rapid increase in private investment,which will enhance the welfare of future generations of Americans.

C)accompanied by an increase in consumption as a share of GDP,which indicates the current generation of Americans is gaining at the expense of future generations.

D)accompanied by large trade surpluses,which will enhance the welfare of future generations of Americans.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

52

Among the major industrial economies,which of the following had the largest net public debt as a percent of GDP in 2011?

A)Australia

B)Greece

C)United States

D)United Kingdom

A)Australia

B)Greece

C)United States

D)United Kingdom

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

53

A government with a national debt that is large and growing relative to the size of the economy will

A)eventually find it difficult to borrow in global credit markets.

B)be able to borrow at lower interest rates than countries with less outstanding debt.

C)have to allocate a large and growing amount of tax revenue to the payment of interest on the outstanding debt.

D)do both a and c.

A)eventually find it difficult to borrow in global credit markets.

B)be able to borrow at lower interest rates than countries with less outstanding debt.

C)have to allocate a large and growing amount of tax revenue to the payment of interest on the outstanding debt.

D)do both a and c.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

54

Sizeable budget deficits can be expected in the years ahead because

A)the retirement of the baby boom generation will soon begin to push expenditures on both Social Security and Medicare upward.

B)the political incentive structure encourages politicians to spend more revenue than they are willing to tax.

C)both a and b are true.

D)both a and b are false.Budget surpluses can be expected in the years ahead.

A)the retirement of the baby boom generation will soon begin to push expenditures on both Social Security and Medicare upward.

B)the political incentive structure encourages politicians to spend more revenue than they are willing to tax.

C)both a and b are true.

D)both a and b are false.Budget surpluses can be expected in the years ahead.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following best explains the political attractiveness of debt financing relative to taxation?

A)Debt financing pushes the visible cost of government into the future.

B)Debt financing exposes the current costs of government programs;taxes do not.

C)Debt financing reduces the attractiveness of special-interest spending.

D)Taxes allow politicians to supply voters with immediate benefits without having to impose a visible cost.

A)Debt financing pushes the visible cost of government into the future.

B)Debt financing exposes the current costs of government programs;taxes do not.

C)Debt financing reduces the attractiveness of special-interest spending.

D)Taxes allow politicians to supply voters with immediate benefits without having to impose a visible cost.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

56

When is debt financing most likely to harm future generations of Americans?

A)When the debt is held by domestic investors.

B)Any time the debt is held by foreign investors.

C)When the debt is held by foreign investors and the funds are channeled into productive investment projects.

D)When the debt is held by foreign investors and the funds are used to finance either current consumption or unproductive investments.

A)When the debt is held by domestic investors.

B)Any time the debt is held by foreign investors.

C)When the debt is held by foreign investors and the funds are channeled into productive investment projects.

D)When the debt is held by foreign investors and the funds are used to finance either current consumption or unproductive investments.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

57

When a nation has a high debt/GDP ratio,that nation generally will

A)require high taxes just to pay interest on the debt.

B)be able to borrow funds at relatively low real interest rates.

C)find that its bonds are attractive to international investors seeking low-risk investments.

D)want to increase spending in order to gain the confidence of international investors.

A)require high taxes just to pay interest on the debt.

B)be able to borrow funds at relatively low real interest rates.

C)find that its bonds are attractive to international investors seeking low-risk investments.

D)want to increase spending in order to gain the confidence of international investors.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is likely to push the federal debt increasingly higher in the coming decades?

A)a strong rebound from the recession of 2008-2009

B)increased expenditures on the Social Security and Medicare programs

C)an increase in tax revenues as the baby boom generation retires

D)increased political pressure to balance federal budgets

A)a strong rebound from the recession of 2008-2009

B)increased expenditures on the Social Security and Medicare programs

C)an increase in tax revenues as the baby boom generation retires

D)increased political pressure to balance federal budgets

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

59

If the federal government fails to reduce the nation's debt relative to income,

A)it will become easier to borrow in the global credit markets.

B)the interest expenses on the outstanding debt will increase.

C)the cost of holding outstanding debt will decrease.

D)it will be easier to cover the interest on outstanding debt with tax revenues.

A)it will become easier to borrow in the global credit markets.

B)the interest expenses on the outstanding debt will increase.

C)the cost of holding outstanding debt will decrease.

D)it will be easier to cover the interest on outstanding debt with tax revenues.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

60

Public choice analysis explains that

A)politicians have strong incentives to favor deficit finance over tax finance.

B)policy makers believe the budget should be balanced except in times of war.

C)the legislator who is a spending "watch dog" can save her constituents a substantial amount of tax money.

D)given the way Congress operates,the apparent popularity of deficit financing is surprising.

A)politicians have strong incentives to favor deficit finance over tax finance.

B)policy makers believe the budget should be balanced except in times of war.

C)the legislator who is a spending "watch dog" can save her constituents a substantial amount of tax money.

D)given the way Congress operates,the apparent popularity of deficit financing is surprising.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

61

Deficit spending and a large national debt can have important effects on future generations because they

A)allow generations to pass the opportunity costs of government spending onto future generations.

B)can significantly impact spending on capital formation.

C)pass costs onto future generations with no corresponding benefits.

D)will cause the government to go bankrupt.

A)allow generations to pass the opportunity costs of government spending onto future generations.

B)can significantly impact spending on capital formation.

C)pass costs onto future generations with no corresponding benefits.

D)will cause the government to go bankrupt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

62

During 2009 and 2010,the federal government financed approximately ______ percent of its spending through borrowing.(Fill in the blank)

A)20

B)30

C)40

D)60

A)20

B)30

C)40

D)60

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

63

Privately held government debt is

A)the portion of the national debt held by government agencies.

B)the portion of the national debt that imposes a net interest burden on the federal government.

C)the portion of the national debt held by foreign citizens.

D)equal to the federal government debt minus any state and local government surpluses.

A)the portion of the national debt held by government agencies.

B)the portion of the national debt that imposes a net interest burden on the federal government.

C)the portion of the national debt held by foreign citizens.

D)equal to the federal government debt minus any state and local government surpluses.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

64

If the federal government fails to control the growth of its debt and the debt grows larger and larger as a share of the economy,which of the following is most likely to happen?

A)The government will default by refusing to pay the bondholders.

B)Interest rates will decline and this will make it easier for the government to handle the outstanding debt.

C)The government will repay bondholders with newly created money and this will lead to inflation.

D)The government will repay the bondholders with newly created money and the expansionary monetary policy will generate a long-term economic boom.

A)The government will default by refusing to pay the bondholders.

B)Interest rates will decline and this will make it easier for the government to handle the outstanding debt.

C)The government will repay bondholders with newly created money and this will lead to inflation.

D)The government will repay the bondholders with newly created money and the expansionary monetary policy will generate a long-term economic boom.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

65

In 2009,the privately held federal debt was approximately what percent of GDP?

A)11 percent

B)31 percent

C)57 percent

D)100 percent

A)11 percent

B)31 percent

C)57 percent

D)100 percent

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

66

The external debt is the portion of the national debt

A)owned by foreigners.

B)owned by the public instead of the Fed.

C)owned by any party other than the Treasury Department.

D)attributable to off-budget federal programs.

A)owned by foreigners.

B)owned by the public instead of the Fed.

C)owned by any party other than the Treasury Department.

D)attributable to off-budget federal programs.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

67

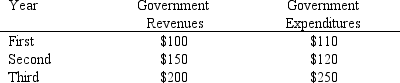

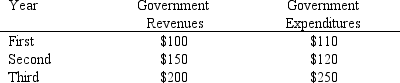

The table below shows the revenues and expenditures for a new country during its first three years of existence.Use this data to answer the following question(s).

Table ST8-1

Refer to Table ST8-1.In the first year,this country

A)ran a deficit of $210.

B)had a surplus of $10.

C)ran a deficit of $10.

D)had a surplus of $210.

Table ST8-1

Refer to Table ST8-1.In the first year,this country

A)ran a deficit of $210.

B)had a surplus of $10.

C)ran a deficit of $10.

D)had a surplus of $210.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

68

The difference between the federal budget deficit and the national debt is that the

A)national debt is the cumulative effect of all prior surpluses and deficits.

B)budget deficit is the cumulative effect of all prior debts and surpluses.

C)debt includes all outstanding bonds,while the deficit excludes bonds held by government agencies.

D)There is no difference.

A)national debt is the cumulative effect of all prior surpluses and deficits.

B)budget deficit is the cumulative effect of all prior debts and surpluses.

C)debt includes all outstanding bonds,while the deficit excludes bonds held by government agencies.

D)There is no difference.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

69

The idea that a large public debt is "mortgaging the future of our children and grandchildren" is misleading because

A)it is the Federal Reserve that will be responsible for making interest payments on the debt.

B)future generations will have to bear the opportunity costs of the resources that are used today.

C)future generations will not owe any interest obligations on the debt.

D)future generations will inherit interest payments along with interest obligations.

A)it is the Federal Reserve that will be responsible for making interest payments on the debt.

B)future generations will have to bear the opportunity costs of the resources that are used today.

C)future generations will not owe any interest obligations on the debt.

D)future generations will inherit interest payments along with interest obligations.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

70

As the outstanding debt of a nation becomes very large relative to the size of the economy,

A)the borrowing cost of the government will decline.

B)lenders will have no choice but to hold the outstanding bonds and to buy the new ones as they are offered.

C)a country like the United States will have no choice but to default on the payments to bond holders.

D)if the country has a central bank,it will almost certainly resort to money creation to service the debt rather than directly default.

A)the borrowing cost of the government will decline.

B)lenders will have no choice but to hold the outstanding bonds and to buy the new ones as they are offered.

C)a country like the United States will have no choice but to default on the payments to bond holders.

D)if the country has a central bank,it will almost certainly resort to money creation to service the debt rather than directly default.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

71

According to the traditional view of deficit financing,an increase in debt-financed government expenditure

A)causes interest rates to rise,private investment to fall,net exports to fall,and an inflow of foreign capital.

B)causes interest rates to rise,private investment to fall,net exports to fall,and an outflow of domestic capital.

C)causes interest rates to fall,private investment to rise,net exports to increase,and an inflow of foreign capital.

D)causes interest rates to rise,private investment to fall,net exports to fall,and an outflow of domestic capital.

A)causes interest rates to rise,private investment to fall,net exports to fall,and an inflow of foreign capital.

B)causes interest rates to rise,private investment to fall,net exports to fall,and an outflow of domestic capital.

C)causes interest rates to fall,private investment to rise,net exports to increase,and an inflow of foreign capital.

D)causes interest rates to rise,private investment to fall,net exports to fall,and an outflow of domestic capital.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

72

As the large baby-boom generation moves into the retirement phase of life,this will

A)make it easier for the federal government to finance its budget deficit because the baby-boomers will be the wealthiest generation of retirees in American history.

B)make it easier for the federal government to reduce spending because senior citizens do not spend much on consumption.

C)make it more difficult for the federal government to finance its budget deficit because the retirement of the baby-boomers will mean more expenditures for Social Security and Medicare.

D)not affect the federal deficit because there is no reason to expect that either federal spending or tax revenues will be influenced by the retirement of the baby-boomers.

A)make it easier for the federal government to finance its budget deficit because the baby-boomers will be the wealthiest generation of retirees in American history.

B)make it easier for the federal government to reduce spending because senior citizens do not spend much on consumption.

C)make it more difficult for the federal government to finance its budget deficit because the retirement of the baby-boomers will mean more expenditures for Social Security and Medicare.

D)not affect the federal deficit because there is no reason to expect that either federal spending or tax revenues will be influenced by the retirement of the baby-boomers.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

73

Domestically financed deficit spending shifts the cost of government spending to future generations by

A)causing a higher future tax liability with no offsetting gains.

B)shifting the opportunity cost of the resources used by government onto future generations.

C)reducing the capital stock,lowering productivity and wages.

D)all of the above.

A)causing a higher future tax liability with no offsetting gains.

B)shifting the opportunity cost of the resources used by government onto future generations.

C)reducing the capital stock,lowering productivity and wages.

D)all of the above.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

74

If a country with a large government debt uses money creation to service and repay the debt,this will lead to

A)lower interest rates.

B)an appreciation of the nation's currency in the foreign exchange market.

C)inflation,higher interest rates,and a financial crisis.

D)rapid economic growth,as the expansionary monetary policy stimulates the economy and generates the additional tax revenue to service the larger debt.

A)lower interest rates.

B)an appreciation of the nation's currency in the foreign exchange market.

C)inflation,higher interest rates,and a financial crisis.

D)rapid economic growth,as the expansionary monetary policy stimulates the economy and generates the additional tax revenue to service the larger debt.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

75

Why are the bonds held by the Fed and government agencies excluded from the privately held debt figures?

A)The U.S.Treasury does not have to pay off these bonds.

B)These bonds were not issued by the Treasury.

C)These bonds do not represent a net-interest obligation of the government.

D)These bonds are not interest-bearing bonds.

A)The U.S.Treasury does not have to pay off these bonds.

B)These bonds were not issued by the Treasury.

C)These bonds do not represent a net-interest obligation of the government.

D)These bonds are not interest-bearing bonds.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

76

Widespread acceptance of the Keynesian theory of fiscal policy

A)caused most economists to reject the public choice view of budget deficits.

B)relaxed the political pressure to balance the budget and hence paved the way for the continual budget deficits of recent decades.

C)was based on the view that continual budget deficits would help stabilize the economy.

D)increased the pressure for a constitutional amendment mandating that the federal government balance its budget.

A)caused most economists to reject the public choice view of budget deficits.

B)relaxed the political pressure to balance the budget and hence paved the way for the continual budget deficits of recent decades.

C)was based on the view that continual budget deficits would help stabilize the economy.

D)increased the pressure for a constitutional amendment mandating that the federal government balance its budget.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

77

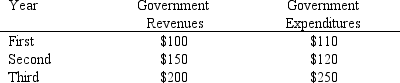

The table below shows the revenues and expenditures for a new country during its first three years of existence.Use this data to answer the following question(s).

Table ST8-1

Refer to Table ST8-1.In the second year,this country

A)ran a surplus of $20.

B)ran a surplus of $30.

C)had a deficit of $20.

D)had a deficit of $30.

Table ST8-1

Refer to Table ST8-1.In the second year,this country

A)ran a surplus of $20.

B)ran a surplus of $30.

C)had a deficit of $20.

D)had a deficit of $30.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is a true statement about the federal deficit and the national debt?

A)Both are "flow" concepts.

B)The deficit is a "flow" concept and the debt is a "stock" concept.

C)The deficit is a "stock" concept and the debt is a "flow" concept.

D)Both are "stock" concepts.

A)Both are "flow" concepts.

B)The deficit is a "flow" concept and the debt is a "stock" concept.

C)The deficit is a "stock" concept and the debt is a "flow" concept.

D)Both are "stock" concepts.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

79

Since 1970,the federal debt has expanded rapidly because

A)revenues have gone down,while expenditures have gone up.

B)expenditures have risen faster than revenues.

C)expenditures have increased slightly,while revenues have remained about the same.

D)revenues have fallen faster than expenditures.

A)revenues have gone down,while expenditures have gone up.

B)expenditures have risen faster than revenues.

C)expenditures have increased slightly,while revenues have remained about the same.

D)revenues have fallen faster than expenditures.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck

80

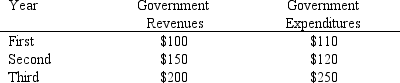

The table below shows the revenues and expenditures for a new country during its first three years of existence.Use this data to answer the following question(s).

Table ST8-1

Refer to Table ST8-1.Which of the following is correct regarding this government?

A)In the third year,it had a $50 national debt and ran a $30 deficit.

B)In the third year,it ran a $50 deficit and its national debt after the third year was $60.

C)In the third year,it ran a $50 surplus and its national debt after the third year was $30.

D)In the third year,it ran a $50 deficit and its national debt after the third year was $30.

Table ST8-1

Refer to Table ST8-1.Which of the following is correct regarding this government?

A)In the third year,it had a $50 national debt and ran a $30 deficit.

B)In the third year,it ran a $50 deficit and its national debt after the third year was $60.

C)In the third year,it ran a $50 surplus and its national debt after the third year was $30.

D)In the third year,it ran a $50 deficit and its national debt after the third year was $30.

Unlock Deck

Unlock for access to all 97 flashcards in this deck.

Unlock Deck

k this deck