Deck 17: Fiscal Policy and Budget Deficits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/166

Play

Full screen (f)

Deck 17: Fiscal Policy and Budget Deficits

1

The use of government spending and taxes to influence the economy is:

A) called fiscal policy.

B) called countercyclical policy.

C) called monetary policy.

D) initiated through actions of the Federal Reserve.

E) only done during times of recession.

A) called fiscal policy.

B) called countercyclical policy.

C) called monetary policy.

D) initiated through actions of the Federal Reserve.

E) only done during times of recession.

called fiscal policy.

2

If policymakers want to reduce the share of income that high income earners receive,then they should prefer a ________ tax system.

A) regressive income

B) progressive income

C) consumption

D) proportional income

E) per capita

A) regressive income

B) progressive income

C) consumption

D) proportional income

E) per capita

progressive income

3

When the economy falters,people often look to the government to help push the economy forward again.In fact,the government uses many different tools to try to affect the economy.Economists classify these tools on the basis of two different types of policy:

A) tax policy and spending policy.

B) monetary policy and fiscal policy.

C) expansionary policy and countercyclical policy.

D) tax policy and fiscal policy.

E) monetary policy and spending policy.

A) tax policy and spending policy.

B) monetary policy and fiscal policy.

C) expansionary policy and countercyclical policy.

D) tax policy and fiscal policy.

E) monetary policy and spending policy.

monetary policy and fiscal policy.

4

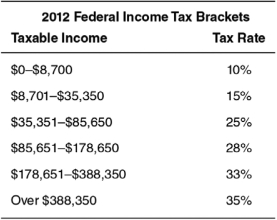

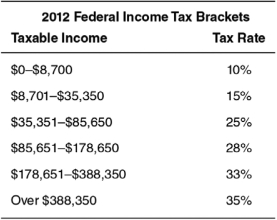

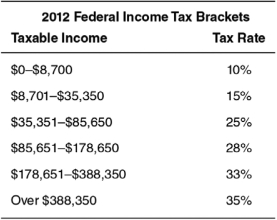

Refer to the following table to answer the questions that follow.

Using the table,what is the marginal income tax rate of a $5,000 raise for someone who currently makes $67,000 per year?

A) 10%

B) 15%

C) 25%

D) 28%

E) 0%

Using the table,what is the marginal income tax rate of a $5,000 raise for someone who currently makes $67,000 per year?

A) 10%

B) 15%

C) 25%

D) 28%

E) 0%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

5

A marginal tax rate is:

A) the tax rate paid on a worker's next dollar of income.

B) equal to a worker's income tax bracket.

C) the total tax paid divided by the amount of taxable income.

D) irrelevant for making decisions about earning extra income.

E) applied only to high earners under a progressive income tax system.

A) the tax rate paid on a worker's next dollar of income.

B) equal to a worker's income tax bracket.

C) the total tax paid divided by the amount of taxable income.

D) irrelevant for making decisions about earning extra income.

E) applied only to high earners under a progressive income tax system.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

6

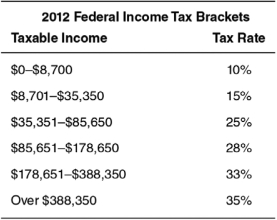

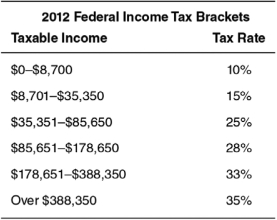

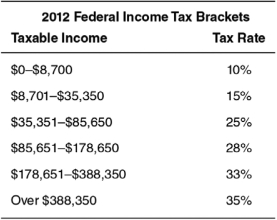

Refer to the following table to answer the questions that follow.

Using the table,what is the average tax rate for someone who makes $67,000 per year?

A) 10.0%

B) 14.2%

C) 16.7%

D) 25.0%

E) 19.1%

Using the table,what is the average tax rate for someone who makes $67,000 per year?

A) 10.0%

B) 14.2%

C) 16.7%

D) 25.0%

E) 19.1%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

7

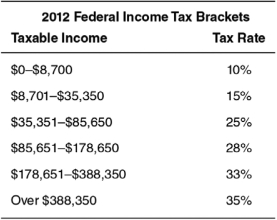

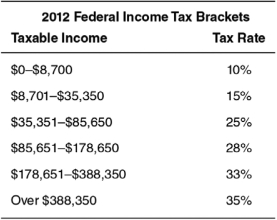

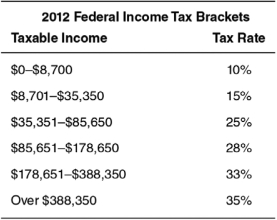

Refer to the following table to answer the questions that follow.

Using the table,what is the marginal income tax rate for someone who makes $67,000 per year?

A) 10.0%

B) 14.2%

C) 16.7%

D) 25.0%

E) 19.1%

Using the table,what is the marginal income tax rate for someone who makes $67,000 per year?

A) 10.0%

B) 14.2%

C) 16.7%

D) 25.0%

E) 19.1%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

8

The United States has a ________ income tax system.

A) progressive

B) regressive

C) marginal

D) good

E) bad

A) progressive

B) regressive

C) marginal

D) good

E) bad

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

9

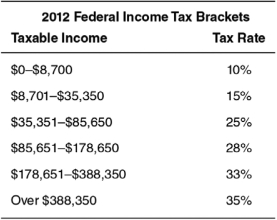

According to the U.S.Federal Tax Rates chart from the textbook (Table 17.1),a person earning $100,000 in a given year is in the 28% tax bracket.How much will this individual owe in taxes for that year?

A) $0

B) $28,000

C) more than $28,000

D) less than $28,000 but greater than $15,000

E) greater than $0 but less than $15,000

A) $0

B) $28,000

C) more than $28,000

D) less than $28,000 but greater than $15,000

E) greater than $0 but less than $15,000

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

10

A progressive income tax system is one in which:

A) income tax rates decrease as earned income increases.

B) everyone pays the same tax rate, so that wealthier people pay a larger sum of taxes.

C) everyone pays the same tax rate, so that people with low incomes pay a smaller sum of taxes.

D) income tax rates increase as earned income increases.

E) incomes taxes are based on occupation.

A) income tax rates decrease as earned income increases.

B) everyone pays the same tax rate, so that wealthier people pay a larger sum of taxes.

C) everyone pays the same tax rate, so that people with low incomes pay a smaller sum of taxes.

D) income tax rates increase as earned income increases.

E) incomes taxes are based on occupation.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

11

Refer to the following table to answer the questions that follow.

Using the table,what is the new average tax rate for a person who currently makes $80,000 per year and receives a $10,000 raise?

A) 20.7%

B) 20.0%

C) 28.0%

D) 27.5%

E) 22.3%

Using the table,what is the new average tax rate for a person who currently makes $80,000 per year and receives a $10,000 raise?

A) 20.7%

B) 20.0%

C) 28.0%

D) 27.5%

E) 22.3%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

12

Income tax revenue is calculated by:

A) tax rate × income.

B) tax rate + income.

C) income - tax rate.

D) tax rate/income.

E) income/tax rate.

A) tax rate × income.

B) tax rate + income.

C) income - tax rate.

D) tax rate/income.

E) income/tax rate.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

13

The U.S.federal income tax began in:

A) 1910.

B) 1911.

C) 1912.

D) 1913.

E) 1914.

A) 1910.

B) 1911.

C) 1912.

D) 1913.

E) 1914.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

14

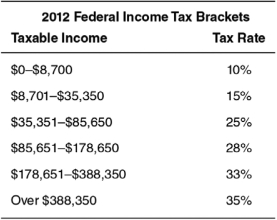

Refer to the following table to answer the questions that follow.

Using the table,what is the total federal income tax bill for someone who makes $67,000 per year?

A) $16,750

B) $12,780

C) $11,169

D) $10,050

E) $6,700

Using the table,what is the total federal income tax bill for someone who makes $67,000 per year?

A) $16,750

B) $12,780

C) $11,169

D) $10,050

E) $6,700

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

15

Monetary policy is conducted by the Federal Reserve.Fiscal policy is:

A) also conducted by the Federal Reserve.

B) conducted by Congress and the president.

C) conducted by the Supreme Court.

D) conducted by the Department of Defense.

E) conducted only at the state level.

A) also conducted by the Federal Reserve.

B) conducted by Congress and the president.

C) conducted by the Supreme Court.

D) conducted by the Department of Defense.

E) conducted only at the state level.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

16

The most relevant tax rate for making decisions about earning additional income is the ________ tax rate.

A) marginal

B) income

C) average

D) sales

E) property

A) marginal

B) income

C) average

D) sales

E) property

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

17

Suppose you are offered a job with Amazon upon graduation.Your starting salary will be $70,000,which will put you in the 25% federal income tax bracket.The total amount of income taxes you pay is $13,530.Your average tax rate is approximately:

A) 25.0%.

B) 37.5%.

C) 31.3%.

D) 19.3%.

E) 12.5%.

A) 25.0%.

B) 37.5%.

C) 31.3%.

D) 19.3%.

E) 12.5%.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

18

Fiscal policy is:

A) the use of the money supply to influence the economy.

B) actions taken by the Federal Reserve to influence the economy.

C) only used during times of recession.

D) only used during times of expansion.

E) the use of government spending and taxes to influence the economy.

A) the use of the money supply to influence the economy.

B) actions taken by the Federal Reserve to influence the economy.

C) only used during times of recession.

D) only used during times of expansion.

E) the use of government spending and taxes to influence the economy.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

19

Fiscal policy includes:

A) only increases and decreases to taxes.

B) only increases and decreases to government spending.

C) increases and decreases to both taxes and government spending.

D) only decreases in taxes and increases in government spending.

E) only increases in taxes and decreases in government spending.

A) only increases and decreases to taxes.

B) only increases and decreases to government spending.

C) increases and decreases to both taxes and government spending.

D) only decreases in taxes and increases in government spending.

E) only increases in taxes and decreases in government spending.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

20

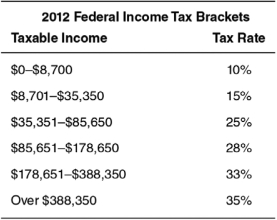

Refer to the following table to answer the questions that follow.

Using the table,what is the marginal income tax rate of a $5,000 raise for someone who currently makes $85,650 per year?

A) 10%

B) 15%

C) 25%

D) 28%

E) 0%

Using the table,what is the marginal income tax rate of a $5,000 raise for someone who currently makes $85,650 per year?

A) 10%

B) 15%

C) 25%

D) 28%

E) 0%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is an example of something that contains an excise tax?

A) property

B) income

C) clothing made and sold in Oregon (where the sales tax rate is 0%)

D) clothing imported from China and sold in Oregon

E) tobacco products

A) property

B) income

C) clothing made and sold in Oregon (where the sales tax rate is 0%)

D) clothing imported from China and sold in Oregon

E) tobacco products

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

22

Should average citizens be concerned with the government's budget?

A) No, because the government's spending and tax policies do not affect citizens.

B) No, because even if citizens do not like the budget, there is nothing they can do to influence it.

C) No, because the government is not spending the average citizen's money; therefore, the average citizen has no incentive to monitor the government's budget.

D) Yes, because an important part of civic duty is voting on the yearly budget.

E) Yes, because the government's yearly budget decisions have immediate and future implications for levels of taxation and the provision of public goods.

A) No, because the government's spending and tax policies do not affect citizens.

B) No, because even if citizens do not like the budget, there is nothing they can do to influence it.

C) No, because the government is not spending the average citizen's money; therefore, the average citizen has no incentive to monitor the government's budget.

D) Yes, because an important part of civic duty is voting on the yearly budget.

E) Yes, because the government's yearly budget decisions have immediate and future implications for levels of taxation and the provision of public goods.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

23

Typically,the average tax rate for a person is ________ his or her marginal tax rate,because the marginal tax rate applies to ________.

A) below; all income

B) below; the first dollars taxed, but not to all income

C) below; the last dollars taxed, but not to all income

D) above; the last dollars taxed, but not to all income

E) above; the first dollars taxed, but not to all income

A) below; all income

B) below; the first dollars taxed, but not to all income

C) below; the last dollars taxed, but not to all income

D) above; the last dollars taxed, but not to all income

E) above; the first dollars taxed, but not to all income

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is considered discretionary government spending?

A) payments to Social Security recipients

B) payments to unemployment insurance recipients

C) payments to government employees

D) payments to food stamp recipients

E) payments to foreign bondholders

A) payments to Social Security recipients

B) payments to unemployment insurance recipients

C) payments to government employees

D) payments to food stamp recipients

E) payments to foreign bondholders

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

25

The current tax rate for Social Security is:

A) 7.65% for the employee and 7.65% for the employer, if not self-employed.

B) 7.65%, if self-employed.

C) 6.2% for the employee and 6.2% for the employer, if not self-employed.

D) 1.45% for the employee and 1.45% for the employer, if not self-employed.

E) 6.2%, if self-employed.

A) 7.65% for the employee and 7.65% for the employer, if not self-employed.

B) 7.65%, if self-employed.

C) 6.2% for the employee and 6.2% for the employer, if not self-employed.

D) 1.45% for the employee and 1.45% for the employer, if not self-employed.

E) 6.2%, if self-employed.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

26

Excise taxes are levied on:

A) property that is gifted to others.

B) imports.

C) individual income.

D) corporate income.

E) specific goods or commodities.

A) property that is gifted to others.

B) imports.

C) individual income.

D) corporate income.

E) specific goods or commodities.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

27

Why do wealthy citizens contribute much more tax revenues to the government than poor citizens?

A) Wealthy citizens consume more government services, so they are taxed at a higher rate.

B) Wealthy citizens have a much lower average tax rate than poor citizens.

C) Wealthy citizens work more hours per week than poor citizens.

D) Wealthy citizens have much more taxable income than poor citizens.

E) Wealthy citizens do not contribute more tax revenues to the government than poor citizens.

A) Wealthy citizens consume more government services, so they are taxed at a higher rate.

B) Wealthy citizens have a much lower average tax rate than poor citizens.

C) Wealthy citizens work more hours per week than poor citizens.

D) Wealthy citizens have much more taxable income than poor citizens.

E) Wealthy citizens do not contribute more tax revenues to the government than poor citizens.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

28

A budget is:

A) a record of income and purchases from the previous year.

B) a plan for spending and earning money.

C) only necessary for individuals with low incomes.

D) only necessary for countries suffering from financial crises.

E) required to be balanced by Congress.

A) a record of income and purchases from the previous year.

B) a plan for spending and earning money.

C) only necessary for individuals with low incomes.

D) only necessary for countries suffering from financial crises.

E) required to be balanced by Congress.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is NOT a revenue source for the U.S.federal government?

A) sales taxes

B) federal gasoline taxes

C) federal income taxes

D) payroll taxes

E) admission fees for national parks

A) sales taxes

B) federal gasoline taxes

C) federal income taxes

D) payroll taxes

E) admission fees for national parks

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

30

The total current tax rate for Social Security is:

A) 3.9%.

B) 6.2%.

C) 12.4%.

D) 15.3%.

E) 16.5%.

A) 3.9%.

B) 6.2%.

C) 12.4%.

D) 15.3%.

E) 16.5%.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

31

Social Security and Medicare are funded by the collection of:

A) individual income taxes.

B) corporate income taxes.

C) payroll taxes.

D) excise taxes.

E) sales taxes.

A) individual income taxes.

B) corporate income taxes.

C) payroll taxes.

D) excise taxes.

E) sales taxes.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

32

The government withdraws social insurance taxes from the paychecks of workers to:

A) discourage people from working.

B) pay the salaries of the members of Congress.

C) assist the elderly retired who previously paid their payroll taxes.

D) penalize wealthy workers.

E) collect money for international aid.

A) discourage people from working.

B) pay the salaries of the members of Congress.

C) assist the elderly retired who previously paid their payroll taxes.

D) penalize wealthy workers.

E) collect money for international aid.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

33

Mandatory outlays:

A) usually change during the budget process.

B) cannot be altered once they are made into law.

C) require changes in existing laws if those outlays are to be altered.

D) are a minor component of total outlays, and so are usually ignored.

E) are another name for discretionary outlays.

A) usually change during the budget process.

B) cannot be altered once they are made into law.

C) require changes in existing laws if those outlays are to be altered.

D) are a minor component of total outlays, and so are usually ignored.

E) are another name for discretionary outlays.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

34

________ a government-administered retirement program.

A) Medicare is

B) Medicaid is

C) Unemployment compensation is

D) Social Security is

E) Food stamps are

A) Medicare is

B) Medicaid is

C) Unemployment compensation is

D) Social Security is

E) Food stamps are

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

35

The largest portion of the federal budget is dedicated to:

A) discretionary spending.

B) mandatory outlays.

C) interest payments.

D) tax collection.

E) defense spending.

A) discretionary spending.

B) mandatory outlays.

C) interest payments.

D) tax collection.

E) defense spending.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

36

Today,total annual government outlays in the United States are:

A) over $3 trillion.

B) over $6 trillion.

C) over $16 trillion.

D) less than $1 trillion.

E) equal to total annual revenue.

A) over $3 trillion.

B) over $6 trillion.

C) over $16 trillion.

D) less than $1 trillion.

E) equal to total annual revenue.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

37

Suppose you return to college and earn an MBA,after which you get an upper-management position with Yum! Brands.If your starting salary is $125,000,and the percentages are the same as they were in 2015,how much will you owe in Social Security taxes?

A) more than $8,800

B) more than $8,400 but less than $8,800

C) more than $7,900 but less than $8,400

D) more than $7,300 but less than $7,900

E) less than $7,300

A) more than $8,800

B) more than $8,400 but less than $8,800

C) more than $7,900 but less than $8,400

D) more than $7,300 but less than $7,900

E) less than $7,300

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

38

The funds used to pay for Social Security and Medicare come primarily from:

A) government borrowing.

B) donations from charitable organizations and citizens.

C) fees charged to doctors.

D) fees charged to medical organizations.

E) both the employer's and employee's portion of payroll taxes.

A) government borrowing.

B) donations from charitable organizations and citizens.

C) fees charged to doctors.

D) fees charged to medical organizations.

E) both the employer's and employee's portion of payroll taxes.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

39

In 2013,revenue from corporate income taxes totaled approximately ________ of total revenue.

A) 5%

B) 10%

C) 15%

D) 20%

E) 25%

A) 5%

B) 10%

C) 15%

D) 20%

E) 25%

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

40

The largest source of tax revenue for the government is:

A) individual income taxes.

B) corporate income taxes.

C) social insurance taxes.

D) estate taxes.

E) excise taxes.

A) individual income taxes.

B) corporate income taxes.

C) social insurance taxes.

D) estate taxes.

E) excise taxes.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

41

Federal government spending has grown quickly since 2007 primarily because of:

A) expansionary fiscal policy in response to the Great Recession.

B) increased spending on bridge and road infrastructure.

C) increased foreign aid to disaster-stricken areas.

D) increased spending on the U.S.education system.

E) the bailout payments made to big banks.

A) expansionary fiscal policy in response to the Great Recession.

B) increased spending on bridge and road infrastructure.

C) increased foreign aid to disaster-stricken areas.

D) increased spending on the U.S.education system.

E) the bailout payments made to big banks.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

42

Why do Social Security and Medicare pose problems for the federal government budget?

A) The number of people retiring is increasing.

B) The number of workers who can pay for these retirees is increasing.

C) Life expectancy is decreasing.

D) The number of sick people is rising too quickly.

E) Social insurance taxes cannot legally be raised any further.

A) The number of people retiring is increasing.

B) The number of workers who can pay for these retirees is increasing.

C) Life expectancy is decreasing.

D) The number of sick people is rising too quickly.

E) Social insurance taxes cannot legally be raised any further.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

43

The federal budget deficit has grown so quickly in the past 10-15 years because of:

A) increased tax revenue.

B) increased spending on entitlement programs, such as Social Security, Medicare, and food stamps.

C) lower income tax rates on the top 1% of households.

D) economic expansion.

E) higher interest payments on current government debt.

A) increased tax revenue.

B) increased spending on entitlement programs, such as Social Security, Medicare, and food stamps.

C) lower income tax rates on the top 1% of households.

D) economic expansion.

E) higher interest payments on current government debt.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

44

Discretionary government spending includes payments made for:

A) children's health insurance programs.

B) deposit insurance payments.

C) unemployment compensation.

D) the Department of Education.

E) pension payments for retired Coast Guard officers.

A) children's health insurance programs.

B) deposit insurance payments.

C) unemployment compensation.

D) the Department of Education.

E) pension payments for retired Coast Guard officers.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

45

When the government increases spending or decreases taxes to stimulate the economy toward expansion,the government is conducting:

A) expansionary monetary policy.

B) expansionary fiscal policy.

C) contractionary monetary policy

D) contractionary fiscal policy.

E) neither monetary policy nor fiscal policy.

A) expansionary monetary policy.

B) expansionary fiscal policy.

C) contractionary monetary policy

D) contractionary fiscal policy.

E) neither monetary policy nor fiscal policy.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

46

Why,even though interest payments are not specifically listed as mandatory spending in the federal budget,could they be considered mandatory?

A) They are considered mandatory spending because such payments are fixed at the time of borrowing and cannot be altered.

B) They are considered mandatory spending because the interest rates on federal debt are extremely high, and failing to pay accumulated interest would dramatically increase the total debt.

C) They are considered mandatory spending because not making such payments could cause the government to go into default, which could make it harder to borrow going forward.

D) They are considered mandatory spending because interest payments constitute the largest part of yearly government spending.

E) They are considered mandatory spending because most interest payments go to American households and those citizens depend on the interest payments for their livelihoods.

A) They are considered mandatory spending because such payments are fixed at the time of borrowing and cannot be altered.

B) They are considered mandatory spending because the interest rates on federal debt are extremely high, and failing to pay accumulated interest would dramatically increase the total debt.

C) They are considered mandatory spending because not making such payments could cause the government to go into default, which could make it harder to borrow going forward.

D) They are considered mandatory spending because interest payments constitute the largest part of yearly government spending.

E) They are considered mandatory spending because most interest payments go to American households and those citizens depend on the interest payments for their livelihoods.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

47

________ would be considered a mandatory outlay in your monthly budget.

A) A child support payment

B) A donation to your alma mater

C) A grocery bill

D) Cable TV service

E) Gasoline money (for travel to and from work)

A) A child support payment

B) A donation to your alma mater

C) A grocery bill

D) Cable TV service

E) Gasoline money (for travel to and from work)

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

48

Which federal budget category's portion of total government outlays decreased from 1991 to 2001?

A) Social Security

B) Medicare

C) Medicaid

D) defense

E) food stamps

A) Social Security

B) Medicare

C) Medicaid

D) defense

E) food stamps

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

49

If the economy begins to fall into a recession,one would expect Congress and the president to conduct:

A) expansionary fiscal policy.

B) expansionary monetary policy.

C) contractionary fiscal policy.

D) contractionary monetary policy.

E) countercyclical monetary policy.

A) expansionary fiscal policy.

B) expansionary monetary policy.

C) contractionary fiscal policy.

D) contractionary monetary policy.

E) countercyclical monetary policy.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

50

The goal of expansionary fiscal policy is to shift the ________ curve to the ________.

A) aggregate demand; left

B) aggregate demand; right

C) short-run aggregate supply; right

D) short-run aggregate supply; left

E) long-run aggregate supply; left

A) aggregate demand; left

B) aggregate demand; right

C) short-run aggregate supply; right

D) short-run aggregate supply; left

E) long-run aggregate supply; left

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

51

Congress and the president would conduct expansionary fiscal policy in order to:

A) try to control inflation.

B) prevent the economy from expanding past its long-run capabilities.

C) control the money supply.

D) raise tax revenues.

E) try to stimulate the economy toward expansion.

A) try to control inflation.

B) prevent the economy from expanding past its long-run capabilities.

C) control the money supply.

D) raise tax revenues.

E) try to stimulate the economy toward expansion.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

52

Between 2004 and 2014,real government outlays in the United States grew by:

A) less than 10%.

B) more than 20%.

C) more than 25%.

D) more than 50%.

E) less than 15%.

A) less than 10%.

B) more than 20%.

C) more than 25%.

D) more than 50%.

E) less than 15%.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

53

Transfer payments refer to funds that are transferred from one group in society to another group:

A) so these payments have no impact on the government budget deficit.

B) so these payments have no impact on the government debt.

C) so these payments are unfair to those who lose money in the transfer.

D) and these payments represent the largest share of U.S.federal outlays.

E) and these payments remain approximately constant over time.

A) so these payments have no impact on the government budget deficit.

B) so these payments have no impact on the government debt.

C) so these payments are unfair to those who lose money in the transfer.

D) and these payments represent the largest share of U.S.federal outlays.

E) and these payments remain approximately constant over time.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

54

Mandatory outlays are different than discretionary outlays because:

A) mandatory outlays usually change during the budget process, whereas discretionary outlays do not.

B) mandatory outlays have been decreasing as a percentage of the federal budget, whereas discretionary outlays have been increasing as a percentage of the federal budget.

C) discretionary outlays can be changed during the annual budget process, whereas mandatory outlays cannot.

D) discretionary outlays include entitlement programs (such as Social Security and Medicare), whereas mandatory outlays include important government programs (such as defense).

E) discretionary outlays comprise the vast majority of the total budget, whereas mandatory outlays make up only a minor fraction.

A) mandatory outlays usually change during the budget process, whereas discretionary outlays do not.

B) mandatory outlays have been decreasing as a percentage of the federal budget, whereas discretionary outlays have been increasing as a percentage of the federal budget.

C) discretionary outlays can be changed during the annual budget process, whereas mandatory outlays cannot.

D) discretionary outlays include entitlement programs (such as Social Security and Medicare), whereas mandatory outlays include important government programs (such as defense).

E) discretionary outlays comprise the vast majority of the total budget, whereas mandatory outlays make up only a minor fraction.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is considered mandatory government spending?

A) funding for the Environmental Protection Agency

B) payments to active military personnel

C) infrastructure maintenance spending

D) international aid to poor countries

E) payments to Social Security recipients

A) funding for the Environmental Protection Agency

B) payments to active military personnel

C) infrastructure maintenance spending

D) international aid to poor countries

E) payments to Social Security recipients

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

56

Assuming all of the following are in your personal monthly budget,your ________ payment is considered a discretionary outlay.

A) mortgage (or rent, if you do not own a home)

B) car insurance

C) water bill

D) cable TV service

E) income tax

A) mortgage (or rent, if you do not own a home)

B) car insurance

C) water bill

D) cable TV service

E) income tax

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

57

The federal government started running a budget surplus in 1998.By 2002,the budget surplus had turned into a budget deficit.Why do you think the budget deficit returned in 2002?

A) There were spending increases to reduce the impacts of the Great Recession.

B) Entitlement programs were expanded in 2002, causing outlays to exceed revenues.

C) There was increased military spending in response to the 9/11 terrorist attacks.

D) There were large decreases in tax rates, which reduced total tax revenues.

E) Politicians were spending the surplus too quickly on projects that would benefit their home districts.

A) There were spending increases to reduce the impacts of the Great Recession.

B) Entitlement programs were expanded in 2002, causing outlays to exceed revenues.

C) There was increased military spending in response to the 9/11 terrorist attacks.

D) There were large decreases in tax rates, which reduced total tax revenues.

E) Politicians were spending the surplus too quickly on projects that would benefit their home districts.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

58

Why do Social Security and Medicare pose problems for the federal government budget?

A) The number of workers who can pay for the retirees is increasing.

B) Payroll taxes are capped and cannot be raised.

C) The number of retirees is decreasing.

D) The number of sick people is rising too quickly.

E) Life expectancy of retirees is increasing.

A) The number of workers who can pay for the retirees is increasing.

B) Payroll taxes are capped and cannot be raised.

C) The number of retirees is decreasing.

D) The number of sick people is rising too quickly.

E) Life expectancy of retirees is increasing.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

59

Due to ________,government outlays have risen quickly since 2000.

A) less tax revenue

B) an aging population

C) increased government borrowing

D) economic expansion

E) lower interest payments on current government debt

A) less tax revenue

B) an aging population

C) increased government borrowing

D) economic expansion

E) lower interest payments on current government debt

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

60

An example of expansionary fiscal policy is:

A) lowering taxes.

B) increasing taxes on everyone in the economy.

C) decreasing the number of weeks an individual can receive unemployment.

D) increasing taxes only on the top earners in the economy.

E) increasing minimum wage.

A) lowering taxes.

B) increasing taxes on everyone in the economy.

C) decreasing the number of weeks an individual can receive unemployment.

D) increasing taxes only on the top earners in the economy.

E) increasing minimum wage.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

61

When the government decreases spending or increases taxes to slow economic expansion,the government is conducting:

A) expansionary monetary policy.

B) expansionary fiscal policy.

C) contractionary monetary policy.

D) contractionary fiscal policy.

E) neither monetary policy nor fiscal policy.

A) expansionary monetary policy.

B) expansionary fiscal policy.

C) contractionary monetary policy.

D) contractionary fiscal policy.

E) neither monetary policy nor fiscal policy.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

62

Expansionary fiscal policy occurs when the ________ to stimulate the economy toward expansion.

A) government decreases spending or increases taxes

B) government decreases spending or decreases taxes

C) government increases spending or increases taxes

D) government increases spending or decreases taxes

E) Federal Reserve increases money supply

A) government decreases spending or increases taxes

B) government decreases spending or decreases taxes

C) government increases spending or increases taxes

D) government increases spending or decreases taxes

E) Federal Reserve increases money supply

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

63

Typical fiscal policy focuses squarely on shifting ________ to change the economy.

A) aggregate demand

B) short-run aggregate supply

C) long-run aggregate supply

D) government spending

E) taxes

A) aggregate demand

B) short-run aggregate supply

C) long-run aggregate supply

D) government spending

E) taxes

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

64

If the unemployment rate falls below the natural rate of unemployment (u*):

A) the government will want to conduct expansionary fiscal policy.

B) the Federal Reserve will want to conduct expansionary monetary policy.

C) the economy is in a recession.

D) there will be no worries about inflation.

E) the government will want to conduct contractionary fiscal policy.

A) the government will want to conduct expansionary fiscal policy.

B) the Federal Reserve will want to conduct expansionary monetary policy.

C) the economy is in a recession.

D) there will be no worries about inflation.

E) the government will want to conduct contractionary fiscal policy.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

65

The Economic Stimulus Act of 2008 and the American Recovery and Reinvestment Act of 2009 are both examples of:

A) contractionary fiscal policy.

B) expansionary monetary policy.

C) contractionary monetary policy.

D) expansionary fiscal policy.

E) countercyclical monetary policy.

A) contractionary fiscal policy.

B) expansionary monetary policy.

C) contractionary monetary policy.

D) expansionary fiscal policy.

E) countercyclical monetary policy.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

66

During which of the following situations would you advise for expansionary fiscal policy?

A) when current output is above full employment output

B) when the economy is expanding at a rapid pace

C) when inflation is at 10% per year

D) when the current unemployment rate is below the natural rate of unemployment

E) when the current unemployment rate is above the natural rate of unemployment

A) when current output is above full employment output

B) when the economy is expanding at a rapid pace

C) when inflation is at 10% per year

D) when the current unemployment rate is below the natural rate of unemployment

E) when the current unemployment rate is above the natural rate of unemployment

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

67

The second of two significant fiscal policy initiatives enacted by the government during the Great Recession,signed in February 2009 by President Barack Obama,was the ________ Act of 2009.

A) Economic Stimulus

B) American Recovery and Reinvestment

C) American Stimulus

D) Economic Recovery and Reinvestment

E) Economic Tax Rebate

A) Economic Stimulus

B) American Recovery and Reinvestment

C) American Stimulus

D) Economic Recovery and Reinvestment

E) Economic Tax Rebate

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

68

Why would a government want to use expansionary fiscal policy to help stimulate aggregate demand if,in the long run,we would expect prices to adjust and the economy to return to its long-run equilibrium on its own?

A) Expansionary fiscal policy always works in stimulating aggregate demand.

B) It could take a long time for prices to adjust by market forces alone.

C) Expansionary fiscal policy has no adverse effects on the economy.

D) When prices adjust during a recession, we see increases in inflation.

E) Expansionary fiscal policy is easy to get approved by Congress and the president.

A) Expansionary fiscal policy always works in stimulating aggregate demand.

B) It could take a long time for prices to adjust by market forces alone.

C) Expansionary fiscal policy has no adverse effects on the economy.

D) When prices adjust during a recession, we see increases in inflation.

E) Expansionary fiscal policy is easy to get approved by Congress and the president.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

69

The Economic Stimulus Act of 2008 focused on ________,whereas the American Recovery and Reinvestment Act of 2009 focused on ________.

A) monetary policy; fiscal policy

B) fiscal policy; monetary policy

C) taxes; government spending

D) government spending; taxes

E) contractionary fiscal policy; expansionary fiscal policy

A) monetary policy; fiscal policy

B) fiscal policy; monetary policy

C) taxes; government spending

D) government spending; taxes

E) contractionary fiscal policy; expansionary fiscal policy

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

70

During recessionary periods,outlays:

A) increase and tax revenue falls.

B) increase and tax revenue increases.

C) decrease and tax revenue increases.

D) decrease and tax revenue falls.

E) and tax revenue stay the same.

A) increase and tax revenue falls.

B) increase and tax revenue increases.

C) decrease and tax revenue increases.

D) decrease and tax revenue falls.

E) and tax revenue stay the same.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

71

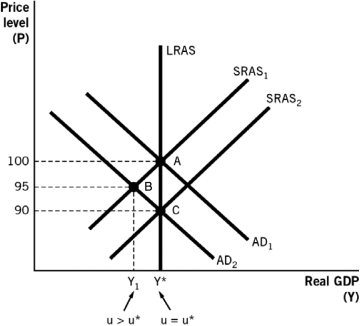

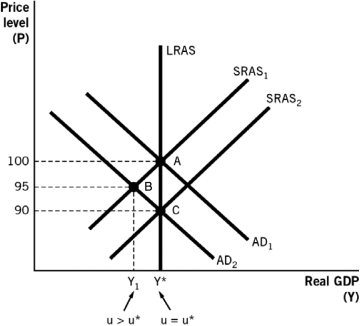

Refer to the following figure to answer the questions that follow.

Which of the following would be the theoretical outcome of expansionary fiscal policy in the following aggregate demand-aggregate supply model?

A) The aggregate demand (AD) curve would shift from AD₁ to AD₂.

B) The short-run aggregate supply (SRAS) curve would shift from SRAS2 to SRAS1.

C) The SRAS curve would shift from SRAS1 to SRAS2.

D) The AD curve would shift from AD₁ to AD₂ at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The AD curve would shift from AD₂ to AD₁.

Which of the following would be the theoretical outcome of expansionary fiscal policy in the following aggregate demand-aggregate supply model?

A) The aggregate demand (AD) curve would shift from AD₁ to AD₂.

B) The short-run aggregate supply (SRAS) curve would shift from SRAS2 to SRAS1.

C) The SRAS curve would shift from SRAS1 to SRAS2.

D) The AD curve would shift from AD₁ to AD₂ at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The AD curve would shift from AD₂ to AD₁.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

72

Expansionary fiscal policy leads to:

A) decreases in budget deficits and the national debt during economic downturns.

B) contractionary fiscal policy the following year.

C) increases in budget deficits and the national debt during economic downturns.

D) increases in budget surpluses and decreases in the national debt during economic downturns.

E) contractionary monetary policy the following year.

A) decreases in budget deficits and the national debt during economic downturns.

B) contractionary fiscal policy the following year.

C) increases in budget deficits and the national debt during economic downturns.

D) increases in budget surpluses and decreases in the national debt during economic downturns.

E) contractionary monetary policy the following year.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

73

During economic expansions,outlays:

A) increase and tax revenue falls.

B) increase and tax revenue increases.

C) decrease and tax revenue increases.

D) decrease and tax revenue falls.

E) and tax revenue stay the same.

A) increase and tax revenue falls.

B) increase and tax revenue increases.

C) decrease and tax revenue increases.

D) decrease and tax revenue falls.

E) and tax revenue stay the same.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

74

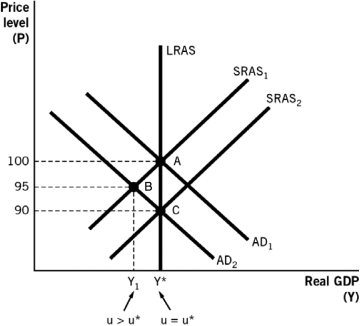

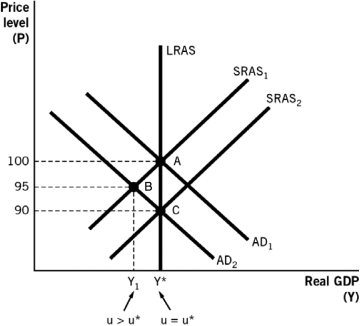

Refer to the following figure to answer the questions that follow.

Which of the following would be the theoretical outcome of contractionary fiscal policy in the following aggregate demand-aggregate supply model,where LRAS is long-run aggregate supply and SRAS is short-run aggregate supply?

A) The aggregate demand (AD) curve would shift from AD₁ to AD₂.

B) The short-run aggregate supply (SRAS) curve would shift from SRAS2 to SRAS1.

C) The SRAS curve would shift from SRAS1 to SRAS2.

D) The AD curve would shift from AD₁ to AD₂ at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The AD curve would shift from AD₂ to AD₁.

Which of the following would be the theoretical outcome of contractionary fiscal policy in the following aggregate demand-aggregate supply model,where LRAS is long-run aggregate supply and SRAS is short-run aggregate supply?

A) The aggregate demand (AD) curve would shift from AD₁ to AD₂.

B) The short-run aggregate supply (SRAS) curve would shift from SRAS2 to SRAS1.

C) The SRAS curve would shift from SRAS1 to SRAS2.

D) The AD curve would shift from AD₁ to AD₂ at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The AD curve would shift from AD₂ to AD₁.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

75

The first of two significant fiscal policy initiatives enacted by the government during the Great Recession,signed in February 2008 by President George W.Bush,was the ________ Act of 2008.

A) Economic Stimulus

B) American Recovery and Reinvestment

C) American Stimulus

D) Economic Recovery and Reinvestment

E) Economic Tax Rebate

A) Economic Stimulus

B) American Recovery and Reinvestment

C) American Stimulus

D) Economic Recovery and Reinvestment

E) Economic Tax Rebate

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

76

When aggregate demand is low enough to drive unemployment above the natural rate:

A) there is downward pressure on the price level and the government may want to conduct contractionary fiscal policy.

B) the economy is entering into an expansion and the government may want to conduct contractionary fiscal policy.

C) there is upward pressure on the price level and the government may want to conduct contractionary fiscal policy.

D) there is upward pressure on the price level and the government may want to conduct expansionary fiscal policy.

E) there is downward pressure on the price level and the government may want to conduct expansionary fiscal policy.

A) there is downward pressure on the price level and the government may want to conduct contractionary fiscal policy.

B) the economy is entering into an expansion and the government may want to conduct contractionary fiscal policy.

C) there is upward pressure on the price level and the government may want to conduct contractionary fiscal policy.

D) there is upward pressure on the price level and the government may want to conduct expansionary fiscal policy.

E) there is downward pressure on the price level and the government may want to conduct expansionary fiscal policy.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

77

As part of the Economic Stimulus Act of 2008,the typical family of four received:

A) an extension on unemployment benefits.

B) an increase in pay.

C) food stamps to buy basic necessities.

D) free job training.

E) a rebate check for $1,800.

A) an extension on unemployment benefits.

B) an increase in pay.

C) food stamps to buy basic necessities.

D) free job training.

E) a rebate check for $1,800.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

78

Assume that the government is currently balancing the national budget so that outlays equal tax revenue.Then the economy slips into recession,and the government decides to increase government spending by $50 billion.The government must pay for this by borrowing; it must sell $50 billion worth of bonds.As a result,the federal budget will:

A) be in deficit by no more than $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by $50 billion.

E) be in deficit by at least $50 billion.

A) be in deficit by no more than $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by $50 billion.

E) be in deficit by at least $50 billion.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

79

Contractionary fiscal policy occurs when the:

A) government decreases spending or increases taxes to slow economic expansion.

B) government decreases spending or decreases taxes to slow economic expansion.

C) government increases spending or increases taxes to slow economic expansion.

D) government increases spending or decreases taxes to stimulate the economy toward expansion.

E) Federal Reserve decreases money supply to stimulate the economy toward expansion.

A) government decreases spending or increases taxes to slow economic expansion.

B) government decreases spending or decreases taxes to slow economic expansion.

C) government increases spending or increases taxes to slow economic expansion.

D) government increases spending or decreases taxes to stimulate the economy toward expansion.

E) Federal Reserve decreases money supply to stimulate the economy toward expansion.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck

80

Assume that the government is currently balancing the national budget so that outlays equal tax revenue.Then the economy starts into an expansion,and the government decides to decrease government spending by $50 billion.As a result,the federal budget will:

A) be in deficit by $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by no more than $50 billion.

E) be in deficit by at least $50 billion.

A) be in deficit by $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by no more than $50 billion.

E) be in deficit by at least $50 billion.

Unlock Deck

Unlock for access to all 166 flashcards in this deck.

Unlock Deck

k this deck