Deck 11: Investment Analysis and Taxation of Income Properties

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/26

Play

Full screen (f)

Deck 11: Investment Analysis and Taxation of Income Properties

1

Which of the following is FALSE,concerning DCR:

A) It indicates whether NOI is sufficient to cover mortgage payments

B) It is not of concern to lenders when loan to value ratios are low

C) It is an indication of risk for the lender

D) It is derived from NOI / Mortgage Payment

A) It indicates whether NOI is sufficient to cover mortgage payments

B) It is not of concern to lenders when loan to value ratios are low

C) It is an indication of risk for the lender

D) It is derived from NOI / Mortgage Payment

It is not of concern to lenders when loan to value ratios are low

2

A property is sold for $5,100,000 with selling costs of 3% of the sales price.The mortgage balance at the time of sale is $3,600,000.The property was purchased 5 years ago for $4,820,000.Annual depreciation allowances of $153,016 have been taken.If the tax rate is 28%,what is the after-tax cash flow from sale of the property?

A) $1,184,062

B) $969,840

C) $1,347,000

D) $1,097,218

A) $1,184,062

B) $969,840

C) $1,347,000

D) $1,097,218

$1,097,218

3

A property produces a first year NOI of $100,000 which is expected to grow by 2% per year.If the property is expected to be sold in year 10,what is the expected sale price based on a terminal capitalization rate of 9.5% applied to the eleventh year NOI?

A) $1,308,815

B) $1,283,152

C) $1,263,158

D) $1,257,992

A) $1,308,815

B) $1,283,152

C) $1,263,158

D) $1,257,992

$1,283,152

4

Which of the following definitions of income includes income from real estate classified as a capital assets?

A) Passive income

B) Active income

C) Portfolio income

D) Passive activity income

A) Passive income

B) Active income

C) Portfolio income

D) Passive activity income

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

5

A gross lease is riskier for the lessor than a net lease.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

6

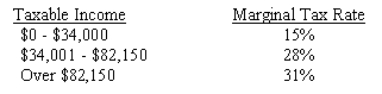

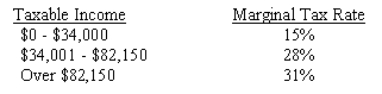

An investor who has $75,000 in taxable income purchases a building that produces another $15,000 in taxable income.According to the table below,what is the marginal tax rate?

A) 29.50%

B) 29.57%

C) 28.00%

D) 31.00%

A) 29.50%

B) 29.57%

C) 28.00%

D) 31.00%

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

7

The debt coverage ratio is used by lenders to indicate the riskiness of a loan.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

8

A small office building is purchased of $1,200,000 with a balloon mortgage that is due at the end of year 10.Payments are based on a 25 year amortization period.If one point was charged,what annual amount can be deducted for tax purposes?

A) $1,200

B) $480

C) $0

D) $800

A) $1,200

B) $480

C) $0

D) $800

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

9

A property that produces a first year NOI of $80,000 is purchased for $750,000.The NOI is expected to increase by 15% in the sixth year when some of the leases turnover.The resale price in year 10 is expected to be $830,000.What is the net present value of the property based on the 10-year holding period and a discount rate of 9.5%?

A) $87,433

B) $87,221

C) $95,294

D) $116,490

A) $87,433

B) $87,221

C) $95,294

D) $116,490

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is FALSE regarding expense stops?

A) Expense Stops protect owners against increases in expenses

B) Expense stops are usually based on expenses during the first term of the lease

C) Expense Stops can pass through expense savings to tenants

D) Expense Stops provide some protection against inflation

A) Expense Stops protect owners against increases in expenses

B) Expense stops are usually based on expenses during the first term of the lease

C) Expense Stops can pass through expense savings to tenants

D) Expense Stops provide some protection against inflation

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

11

A property that produces a level of NOI of $200,000 per year is expected to be sold in year 5 for $2,000,000.If the property was purchased for $2,000,000,what percent of the IRR can be attributed to the operating income only?

A) 10.0%

B) 90.0%

C) 37.9%

D) 63.1%

A) 10.0%

B) 90.0%

C) 37.9%

D) 63.1%

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

12

Net Sale Proceeds less Adjusted Basis of the property determines which of the following:

A) After-Tax Net Present Value of the property

B) Depreciation allowance for the property

C) Before-Tax Net Present Value of the property

D) Capital gains or losses

A) After-Tax Net Present Value of the property

B) Depreciation allowance for the property

C) Before-Tax Net Present Value of the property

D) Capital gains or losses

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

13

The use of a CPI index in lease contracts shifts risk to the tenant.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

14

The minimum lenders typically require for a DCR is:

A) 0.8

B) 1.0

C) 1.2

D) 1.5

A) 0.8

B) 1.0

C) 1.2

D) 1.5

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

15

A property that produces an annual NOI of $100,000 was purchased for $1,200,000.Debt service for the year was $95,000 of which $93,400 was interest and the remainder was principal.Annual depreciation is $38,095.What is the taxable income?

A) $5,000

B) $6,600

C) -$31,495

D) -$33,095

A) $5,000

B) $6,600

C) -$31,495

D) -$33,095

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

16

Expense stops protect the lessee from unexpected changes in market rents.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

17

A property produces an after tax internal rate of return of 12.24%.If the investor has a marginal tax rate of 31%,what is the before-tax equivalent yield?

A) 8.45%

B) 11.39%

C) 16.03%

D) 17.74%

A) 8.45%

B) 11.39%

C) 16.03%

D) 17.74%

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is NOT true for an expense stop:

A) All operating expenses are covered by the stop

B) The passthrough is based on the tenants' percentage of total leasable area

C) Expenses to be included must be agreed upon and included in the lease

D) The stop is often based on the actual amount of operating expenses at the time the lease is signed

A) All operating expenses are covered by the stop

B) The passthrough is based on the tenants' percentage of total leasable area

C) Expenses to be included must be agreed upon and included in the lease

D) The stop is often based on the actual amount of operating expenses at the time the lease is signed

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

19

The adjusted basis can defined as:

A) original cost + capital improvements - accumulated depreciation.

B) sales price - mortgage balance - sales costs.

C) sales price - accumulated depreciation.

D) original cost - mortgage balance - sales costs.

A) original cost + capital improvements - accumulated depreciation.

B) sales price - mortgage balance - sales costs.

C) sales price - accumulated depreciation.

D) original cost - mortgage balance - sales costs.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

20

A property is purchase for $15 million.Financing is obtained at a 75% loan-to-value ration with total annual payments of $1,179,000.The property produces an NOI of $1,400,000.What is the equity dividend rate (ratio of first year cash flow to equity)?

A) 5.89%

B) 9.33%

C) 7.86%

D) 8.64%

A) 5.89%

B) 9.33%

C) 7.86%

D) 8.64%

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

21

When the sale of a passive activity produces a capital loss and unused passive losses from previous years remain,the unused losses can be used to offset any other source of income.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

22

Residential property is depreciated over 27.5 years where as non-residential property is depreciated over 31.5 years.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

23

Property held as a personal residence cannot be depreciated.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

24

When calculating the adjusted IRR the cash flows are always discounted to a present value at a safe rate.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

25

If an individual actively participates in the management of a rental property,he may deduct the full amount of the passive activity losses from active income,regardless of his adjusted gross income.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck

26

The deductibility of depreciation to calculate taxable income will usually cause the effective tax rate to be lower than the actual tax rate.

Unlock Deck

Unlock for access to all 26 flashcards in this deck.

Unlock Deck

k this deck