Deck 4: Planning Your Tax Strategy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/108

Play

Full screen (f)

Deck 4: Planning Your Tax Strategy

1

An office audit requires that a taxpayer visit an IRS office to clarify some aspect of his or her tax return.

True

2

A person's filing status is affected by marital status and dependents.

True

3

Money received in the form of dividends or interest is commonly called "earned income."

False

4

The main purpose of taxes is to:

A) generate revenue for funding government programs.

B) reduce the chances of inflation.

C) create jobs.

D) discourage use of certain goods and services.

E) decrease competition from foreign companies.

A) generate revenue for funding government programs.

B) reduce the chances of inflation.

C) create jobs.

D) discourage use of certain goods and services.

E) decrease competition from foreign companies.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

5

Real-estate property taxes are a major source of revenue for local governments.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

6

Tax avoidance refers to illegal actions to reduce one's taxes.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

7

A drawback of Flexible Spending Accounts (FSA) is that any account funds must be used to pay for expenses incurred before year's end or the money is lost.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

8

The ______________ property tax is based on the value of land and buildings at some point in time.

A) personal

B) real estate

C) direct

D) proportional

E) regressive

A) personal

B) real estate

C) direct

D) proportional

E) regressive

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

9

A general sales tax is also referred to as an excise tax.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

10

A tax credit is an amount subtracted directly from the amount of taxes owed.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

11

The principal purpose of taxes is to control economic conditions.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

12

Taxes are only considered as financial planning activities in April.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

13

An exclusion is earnings not included in taxable income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

14

Capital gains refer to profits from the sale of investments.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

15

A tax on the value of automobiles, boats, or furniture is referred to as a personal property tax.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

16

Tax evasion is the use of illegal actions to reduce one's taxes.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

17

Which type of tax is imposed on specific goods and services at the time of purchase?

A) Estate

B) Inheritance

C) Excise

D) General sales

E) Value-added

A) Estate

B) Inheritance

C) Excise

D) General sales

E) Value-added

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

18

An estate tax is imposed on the value of an individual's property at the time of his or her death.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

19

A state may impose a personal property tax.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

20

Exemptions are deductions for yourself, your spouse, and qualified dependents that you can deduct from adjusted gross income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

21

Interest earnings of $1,600 from a taxable investment for a person in a 28 percent tax bracket would result in after-tax earnings of:

A) $1,600.

B) $1,152.

C) $1,100.

D) $448.

E) $152.

A) $1,600.

B) $1,152.

C) $1,100.

D) $448.

E) $152.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

22

_____________ are expenses that a taxpayer is allowed to deduct from adjusted gross income.

A) Exemptions

B) Exclusions

C) Itemized deductions

D) Tax credits

E) Passive income

A) Exemptions

B) Exclusions

C) Itemized deductions

D) Tax credits

E) Passive income

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

23

A person has $4,000 in medical expenses and an adjusted gross income of $32,000. If taxpayers are allowed to deduct the amount of medical expenses that exceed 7.5 percent of adjusted gross income, what would be the amount of the deduction in this situation?

A) $300

B) $1,600

C) $2,400

D) $4,000

E) $32,000

A) $300

B) $1,600

C) $2,400

D) $4,000

E) $32,000

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

24

A $2,000 deposit to a tax-deferred retirement account for a person in a 25 percent tax bracket would result in a reduced tax bill of:

A) $2,000.

B) $1,500.

C) $1,200.

D) $500.

E) $300.

A) $2,000.

B) $1,500.

C) $1,200.

D) $500.

E) $300.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following would result in a reduction of taxable income?

A) Portfolio income

B) Tax credits

C) Exclusions

D) Passive income

E) Earned income

A) Portfolio income

B) Tax credits

C) Exclusions

D) Passive income

E) Earned income

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

26

George Washburn had earnings from his salary of $34,000, interest on savings of $800, a contribution to a traditional individual retirement account of $1,500, and dividends from mutual funds of $600. George's adjusted income (AGI) would be:

A) $33,900.

B) $34,000.

C) $34,600.

D) $34,800.

E) $35,400.

A) $33,900.

B) $34,000.

C) $34,600.

D) $34,800.

E) $35,400.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

27

Tax-deferred retirement plans are a type of:

A) exemption.

B) itemized deduction.

C) passive income.

D) tax shelter.

E) tax credit.

A) exemption.

B) itemized deduction.

C) passive income.

D) tax shelter.

E) tax credit.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

28

Which one of the following items is a set amount of income on which no taxes are paid?

A) Itemized deductions

B) Standard deduction

C) Earned tax credit

D) Withholding

E) Capital gains

A) Itemized deductions

B) Standard deduction

C) Earned tax credit

D) Withholding

E) Capital gains

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

29

Earnings from a limited partnership would be an example of ____________ income.

A) passive

B) capital gain

C) portfolio

D) earned

E) excluded

A) passive

B) capital gain

C) portfolio

D) earned

E) excluded

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

30

What type of tax is imposed on the value of an individual's property at the time of his or her death?

A) Inheritance

B) Excise

C) Gift

D) Personal property

E) Estate

A) Inheritance

B) Excise

C) Gift

D) Personal property

E) Estate

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

31

An expense that would be included in the itemized deductions of a taxpayer is:

A) personal postage expenses.

B) life insurance premiums.

C) real estate property taxes.

D) a driver's license fee.

E) annual interest paid on credit cards.

A) personal postage expenses.

B) life insurance premiums.

C) real estate property taxes.

D) a driver's license fee.

E) annual interest paid on credit cards.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

32

Taxable income is used to compute a person's:

A) exemptions.

B) income tax.

C) deductions.

D) capital gains.

E) exclusions.

A) exemptions.

B) income tax.

C) deductions.

D) capital gains.

E) exclusions.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

33

Money received by an individual for personal effort is classified as ______________ income.

A) passive

B) earned

C) portfolio

D) excluded

E) capital gains

A) passive

B) earned

C) portfolio

D) excluded

E) capital gains

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

34

Reductions from gross income for such items as individual retirement account contributions and alimony payments will result in:

A) adjusted gross income.

B) taxable income.

C) earned income.

D) passive income.

E) total exclusions.

A) adjusted gross income.

B) taxable income.

C) earned income.

D) passive income.

E) total exclusions.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following would be deducted from gross income to obtain adjusted gross income?

A) Alimony payments

B) Mortgage interest

C) Medical expenses

D) Foreign income exclusion

E) Charitable contributions

A) Alimony payments

B) Mortgage interest

C) Medical expenses

D) Foreign income exclusion

E) Charitable contributions

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

36

An exclusion affects a person's taxes by:

A) reducing the amount of taxable income.

B) increasing itemized deductions.

C) decreasing itemized deductions.

D) decreasing the number of exemptions a person can claim.

E) increasing the number of exemptions a person can claim.

A) reducing the amount of taxable income.

B) increasing itemized deductions.

C) decreasing itemized deductions.

D) decreasing the number of exemptions a person can claim.

E) increasing the number of exemptions a person can claim.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

37

When a taxpayer's income increases $1,000 and the taxes owed increases from $7,867 to $8,177, the marginal tax rate is ______ percent.

A) 15

B) 20

C) 25

D) 28

E) 31

A) 15

B) 20

C) 25

D) 28

E) 31

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

38

Which one of the following is not included in gross income?

A) Tax credit

B) Exemption

C) Exclusion

D) Earned income

E) Portfolio income

A) Tax credit

B) Exemption

C) Exclusion

D) Earned income

E) Portfolio income

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

39

Money received in the form of dividends or interest is classified as ____________ income.

A) passive

B) earned

C) excluded

D) capital gain

E) investment

A) passive

B) earned

C) excluded

D) capital gain

E) investment

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

40

A taxpayer with a taxable income of $47,856 and a total tax bill of $5,889 would have an average tax rate of ____ percent.

A) 8.6

B) 10.3

C) 12.3

D) 14.2

E) 16.7

A) 8.6

B) 10.3

C) 12.3

D) 14.2

E) 16.7

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

41

A tax credit of $50 for a person in a 28 percent tax bracket would reduce a person's taxes by:

A) $10.

B) $28.

C) $14.

D) $50.

E) $35.

A) $10.

B) $28.

C) $14.

D) $50.

E) $35.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

42

Most people pay federal income tax by:

A) paying the total amount owed on April 15.

B) filing quarterly tax payments.

C) having amounts withheld from income.

D) earning tax credits for various deductions.

E) filing the 1040 EZ form.

A) paying the total amount owed on April 15.

B) filing quarterly tax payments.

C) having amounts withheld from income.

D) earning tax credits for various deductions.

E) filing the 1040 EZ form.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

43

Kelly Vernon wants her tax return prepared by a government approved tax expert. Which of the following tax preparers should Kelly use?

A) CPA

B) Enrolled agent

C) Nationally-certified tax preparer

D) Tax attorney

E) Local tax preparer

A) CPA

B) Enrolled agent

C) Nationally-certified tax preparer

D) Tax attorney

E) Local tax preparer

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

44

Which type of audit is the least complicated for taxpayers?

A) A field audit

B) An office audit

C) A research audit

D) A correspondence audit

E) A documentation audit

A) A field audit

B) An office audit

C) A research audit

D) A correspondence audit

E) A documentation audit

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

45

A tax ____________ is an amount subtracted directly from the amount of taxes owed.

A) credit

B) exemption

C) deduction

D) exclusion

E) shelter

A) credit

B) exemption

C) deduction

D) exclusion

E) shelter

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

46

Union dues, fees for tax return preparation, and other miscellaneous expenses are:

A) not deductible.

B) fully deductible.

C) deductible for self-employed individuals only.

D) deductible for people in certain income categories.

E) deductible to the extent they exceed two percent of adjusted gross income.

A) not deductible.

B) fully deductible.

C) deductible for self-employed individuals only.

D) deductible for people in certain income categories.

E) deductible to the extent they exceed two percent of adjusted gross income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

47

Estimated quarterly tax payments must be made by people who:

A) are employed in a foreign country.

B) receive dividends.

C) work for the government.

D) do not have adequate amounts withheld from income.

E) itemize deductions.

A) are employed in a foreign country.

B) receive dividends.

C) work for the government.

D) do not have adequate amounts withheld from income.

E) itemize deductions.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following would qualify a person for an exemption when computing taxable income?

A) Mortgage interest

B) A tax shelter

C) A dependent

D) Charitable contributions

E) Passive income

A) Mortgage interest

B) A tax shelter

C) A dependent

D) Charitable contributions

E) Passive income

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

49

A taxpayer whose spouse recently died is most likely to use the ____________ filing status.

A) single

B) married filing joint return

C) married filing separate return

D) head of household

E) qualifying widow or widower

A) single

B) married filing joint return

C) married filing separate return

D) head of household

E) qualifying widow or widower

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

50

Which one of the following people is least likely to have to file a federal income tax return?

A) A U.S. citizen who is a resident of Puerto Rico

B) A U.S. citizen living and working in a foreign country

C) A person earning less than $9,000

D) A person over age 65

E) A college student

A) A U.S. citizen who is a resident of Puerto Rico

B) A U.S. citizen living and working in a foreign country

C) A person earning less than $9,000

D) A person over age 65

E) A college student

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

51

Itemized deductions are recorded on:

A) Form 1040A.

B) Schedule A.

C) Schedule B.

D) Form 2106.

E) Form 1040B.

A) Form 1040A.

B) Schedule A.

C) Schedule B.

D) Form 2106.

E) Form 1040B.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

52

A deduction from adjusted gross income for yourself, your spouse, and qualified dependents is:

A) the standard deduction.

B) a tax credit.

C) an itemized deduction.

D) an exclusion.

E) an exemption.

A) the standard deduction.

B) a tax credit.

C) an itemized deduction.

D) an exclusion.

E) an exemption.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

53

The Form 1040 is most helpful to a person who:

A) is single with no other exemptions.

B) makes less than $50,000 with no interest or dividends.

C) itemizes deductions.

D) has exempt income.

E) has a simple tax situation.

A) is single with no other exemptions.

B) makes less than $50,000 with no interest or dividends.

C) itemizes deductions.

D) has exempt income.

E) has a simple tax situation.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

54

For a dependent to qualify as an exemption, he or she must:

A) be married.

B) be under age 16.

C) be registered in school.

D) receive more than one half of his or her support from the taxpayer.

E) be a relative.

A) be married.

B) be under age 16.

C) be registered in school.

D) receive more than one half of his or her support from the taxpayer.

E) be a relative.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

55

An exemption affects a person's tax situation by:

A) increasing the standard deduction.

B) increasing the taxpayer's marginal tax rate.

C) decreasing itemized deductions.

D) reducing the taxpayer's taxable income.

E) decreasing tax credits.

A) increasing the standard deduction.

B) increasing the taxpayer's marginal tax rate.

C) decreasing itemized deductions.

D) reducing the taxpayer's taxable income.

E) decreasing tax credits.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

56

Michele Walsh is considering an additional charitable contribution of $2,000 to a tax-deductible charity, bringing her total itemized deductions to $16,000. If Michele is in a 28 percent tax bracket, how much will this $2,000 contribution reduce her taxes?

A) $0

B) $560

C) $1,600

D) $2,000

E) $4,480

A) $0

B) $560

C) $1,600

D) $2,000

E) $4,480

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

57

A person with a total tax liability of $4,350 and withholding of federal taxes of $3,975 would:

A) receive a refund of $3,975.

B) owe $4,350.

C) owe $375.

D) receive a refund of $4,350.

E) receive a refund of $375.

A) receive a refund of $3,975.

B) owe $4,350.

C) owe $375.

D) receive a refund of $4,350.

E) receive a refund of $375.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

58

Which one of these terms is defined as the use of legitimate methods to reduce one's taxes?

A) Tax evasion

B) Tax avoidance

C) Tax exemption

D) Tax deferral

E) Tax deduction

A) Tax evasion

B) Tax avoidance

C) Tax exemption

D) Tax deferral

E) Tax deduction

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

59

Which form would an individual use who has less than $100,000 in taxable income from wages, salaries, tips, unemployment compensation, interest, or dividends, and who is married and does not itemize deductions?

A) Form 1040X

B) Form 1040EZ

C) Form 1040A

D) Schedule A

E) Schedule E

A) Form 1040X

B) Form 1040EZ

C) Form 1040A

D) Schedule A

E) Schedule E

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

60

The "head of household" filing status is for people who are:

A) recently divorced.

B) the surviving spouse.

C) unmarried and have dependent children.

D) married but only one spouse has income.

E) married and each spouse makes about the same income.

A) recently divorced.

B) the surviving spouse.

C) unmarried and have dependent children.

D) married but only one spouse has income.

E) married and each spouse makes about the same income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

61

An itemized deduction of $500 with a 36 percent tax rate would reduce a person's taxes by:

A) $500.

B) $36.

C) $464.

D) $280.

E) $180.

$500 × .36 = $180

A) $500.

B) $36.

C) $464.

D) $280.

E) $180.

$500 × .36 = $180

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

62

Alex Bates goes on Jeopardy and earns $875,000 in winnings. What type of income is this?

A) Earned income

B) Investment income

C) Passive income

D) Other income

E) Deferred income

A) Earned income

B) Investment income

C) Passive income

D) Other income

E) Deferred income

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

63

Haley Thomas has adjusted gross income of $40,000. She paid $3,600 in property taxes during the year. How much of the tax can she deduct from adjusted gross income?

A) $3,600

B) $3,000

C) $1,800

D) $600

E) $0

A) $3,600

B) $3,000

C) $1,800

D) $600

E) $0

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

64

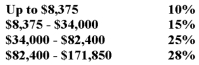

Al Barkley is single and earns $40,000 in taxable income. He uses the following tax rate schedule to calculate the taxes he owes. What is Al's average tax rate?

A) 15.45%

B) 18.27%

C) 21.35%

D) 23.87%

E) 25.00%

A) 15.45%

B) 18.27%

C) 21.35%

D) 23.87%

E) 25.00%

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

65

Capital gains refer to:

A) tax-exempt investments.

B) retirement accounts.

C) profits from the sale of an investment asset.

D) earnings from investments such as dividends or interest.

E) tax-deferred investments.

A) tax-exempt investments.

B) retirement accounts.

C) profits from the sale of an investment asset.

D) earnings from investments such as dividends or interest.

E) tax-deferred investments.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

66

A traditional IRA, Keogh plan, and 401(k) plan are examples of:

A) tax-exempt retirement plans.

B) tax-deferred retirement plans.

C) capital gains.

D) self-employment insurance programs.

E) job-related expenses that are tax deductible.

A) tax-exempt retirement plans.

B) tax-deferred retirement plans.

C) capital gains.

D) self-employment insurance programs.

E) job-related expenses that are tax deductible.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

67

Tim Bridges owns a bass fishing boat. His state imposes an annual 3.25 percent tax on the current value of this boat. What type of tax is this most likely to be?

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

68

Elizabeth Gleason just died. At the time of her death the total value of her assets was $150,000. The federal government collected $7,500 in taxes based on this value. What type of tax is this most likely to be?

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

69

The state of Oklahoma imposes a tax of $.17 per gallon on gasoline. What type of tax is this most likely to be?

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

70

Joan Sanchez is single and earns $40,000 in taxable income. She uses the following tax rate schedule to calculate the taxes she owes. What is Joan's marginal tax rate?

A) 10%

B) 15%

C) 25%

D) 28%

E) between 10% and 15%

A) 10%

B) 15%

C) 25%

D) 28%

E) between 10% and 15%

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

71

For which of the following types of credit plans is the interest tax deductible?

A) Home equity loan

B) Auto loan

C) Credit card

D) Life insurance policy cash value loan

E) Personal cash loan from a credit union

A) Home equity loan

B) Auto loan

C) Credit card

D) Life insurance policy cash value loan

E) Personal cash loan from a credit union

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

72

Which one of these investments produces tax-exempt income?

A) U.S. savings bonds

B) Corporate stock

C) Stock mutual fund

D) Municipal bond

E) Corporate bond

A) U.S. savings bonds

B) Corporate stock

C) Stock mutual fund

D) Municipal bond

E) Corporate bond

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

73

Randal Ice is 57 years old, and has adjusted gross income of $32,000. He has medical expenses for the year of $6,000. How much of these expenses can he deduct from adjusted gross income?

A) $0

B) $2,400

C) $2,800

D) $3,600

E) $4,500

A) $0

B) $2,400

C) $2,800

D) $3,600

E) $4,500

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

74

John Camey goes into a local department store and purchases a new suit. He pays $43 in taxes on this purchase. What type of tax is this most likely to be?

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

75

Mr. and Mrs. Keating want to give their son Dudley a total of $24,000. They each write him a check for $12,000 so they won't have to pay any gift tax. This is an example of:

A) fraud.

B) tax evasion.

C) tax exclusion.

D) tax avoidance.

E) tax deferred income.

A) fraud.

B) tax evasion.

C) tax exclusion.

D) tax avoidance.

E) tax deferred income.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

76

Drew Davis earns $4,500 per month from his job at Cisco Systems; $900 is withheld from this amount each month for taxes. What type of tax is this most likely to be?

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

A) General sales tax

B) Excise tax

C) Personal property tax

D) Income tax

E) Estate tax

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

77

Which one of the following is most apt to qualify as an itemized deduction?

A) Interest on a credit card or charge account

B) Unreimbursed job-related travel expenses

C) Cost of commuting to work

D) Life insurance premiums

E) Traffic violation fee

A) Interest on a credit card or charge account

B) Unreimbursed job-related travel expenses

C) Cost of commuting to work

D) Life insurance premiums

E) Traffic violation fee

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

78

Kim Ye is single and earns $40,000 in taxable income. He uses the following tax rate schedule to calculate the taxes he owes. Calculate the dollar amount of estimated taxes that Kim owes.

A) $6,000.00

B) $6,181.25

C) $10,000.00

D) $11,200.25

E) $16,181.25

A) $6,000.00

B) $6,181.25

C) $10,000.00

D) $11,200.25

E) $16,181.25

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

79

Which one of these statements correctly applies to a Roth IRA?

A) Earnings on the account are tax-free after five years.

B) Annual contributions may exceed $2,000.

C) Deposits must be in federally-insured accounts.

D) Funds are only to be used for educational expenses.

E) Only self-employed workers can contribute to a Roth IRA.

A) Earnings on the account are tax-free after five years.

B) Annual contributions may exceed $2,000.

C) Deposits must be in federally-insured accounts.

D) Funds are only to be used for educational expenses.

E) Only self-employed workers can contribute to a Roth IRA.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck

80

A short-term capital gain is profit earned on an investment that is:

A) made involving small companies.

B) not taxed as ordinary income.

C) held less than 12 months.

D) in foreign companies.

E) made in real estate.

A) made involving small companies.

B) not taxed as ordinary income.

C) held less than 12 months.

D) in foreign companies.

E) made in real estate.

Unlock Deck

Unlock for access to all 108 flashcards in this deck.

Unlock Deck

k this deck