Deck 12: The Design of the Tax System

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/397

Play

Full screen (f)

Deck 12: The Design of the Tax System

1

A budget surplus occurs when government receipts exceed government spending.

True

2

As of 2005,the largest source of receipts for state and local governments was individual income taxes.

False

3

The U.S.federal government collects about one-half of the taxes in our economy.

False

4

A budget deficit occurs when government receipts fall short of government spending.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

5

Individual income taxes generate rougly 25% of the tax revenue for the federal government.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

6

Sales taxes generate nearly 50% of the tax revenue for state and local governments.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

7

Some states do not have a state income tax.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

8

The administrative burden of any tax system is part of the inefficiency it creates.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

9

The U.S.tax burden is high compared to many European countries,but is low compared to many other nations in the world.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

10

The average American pays a higher percent of his income in taxes today than he would have in the late 18th century.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

11

In the United States,all families pay the same proportion of their income in taxes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

12

As of 2005,the largest source of receipts for state and local governments was corporate income taxes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

13

By law,all states must have a state income tax.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

14

Income taxes and property taxes generate the highest tax revenue for state and local governments.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

15

One reason for the projected increase,over the next several decades,in government spending as a percentage of GDP is the projected increase in the size of the elderly population.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

16

Poor countries such as India and Pakistan usually have low tax burdens.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

17

A budget surplus occurs when government receipts fall short of government spending.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

18

A budget deficit occurs when government receipts exceed government spending.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

19

Individual income taxes and social insurance taxes generate the highest tax revenue for the federal government.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

20

Social Security is an income support program,designed primarily to maintain the living standards of the poor.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

21

In practice,the U.S.income tax system is filled with special provisions that alter a family's tax based on its specific circumstances.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

22

If a tax generates a reduction in surplus that is exactly offset by the tax revenue collected by the government,the tax does not have a deadweight loss.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

23

The equity of a tax system concerns whether the tax burden is distributed equally among the population.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

24

The administrative burden of complying with tax laws is a cost to the government but not to taxpayers.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

25

Deadweight losses arise because a tax causes some individuals to change their behavior.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

26

Resources devoted to complying with the tax laws are a type of deadweight loss.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

27

Lump-sum taxes are equitable but not efficient.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

28

The marginal tax rate serves as a measure of the extent to which the tax system discourages people from working.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

29

Many people consider lump-sum taxes to be unfair to low-income taxpayers.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

30

One characteristic of an efficient tax system is that it minimizes the costs associated with revenue collection.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

31

A lump-sum tax minimizes deadweight loss.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

32

If Christopher earns $80,000 in taxable income and pays $20,000 in taxes,his average tax rate is 20 percent.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

33

An efficient tax system is one that imposes small deadweight losses and small administrative burdens.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

34

If James earns $80,000 in taxable income and pays $20,000 in taxes,his average tax rate is 25 percent.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

35

Deadweight losses and administrative burdens are key factors considered when determining the efficiency of the tax system.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

36

An advantage of a consumption tax is that it does not distort the incentive to save.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

37

If Mary earns $80,000 in taxable income and pays $40,000 in taxes,her marginal tax rate must be 50 percent.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

38

Tax evasion is legal,but tax avoidance is illegal.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

39

Tax evasion is illegal,but tax avoidance is legal.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

40

When the total surplus lost as a result of a tax is less than the amount of tax revenue collected by the government there is a deadweight loss.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

41

Antipoverty programs funded by taxes on the wealthy are sometimes advocated on the basis of the benefits principle.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

42

If all taxpayers pay the same percentage of income in taxes,the tax system is progressive.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

43

To fully understand the progressivity of government policies,one should only look at the proportion of total income that individuals pay in taxes each year.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

44

In a regressive tax system,it is impossible for individuals with higher incomes to pay more in taxes than individuals with lower incomes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

45

Horizontal equity refers to a tax system in which individuals with similar incomes pay similar taxes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

46

Horizontal equity refers to a tax system in which individuals with higher incomes pay more in taxes than individuals with lower incomes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

47

According to the benefits principle,it is fair for people to pay taxes based on the benefits they receive from the government.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

48

If the rich pay more in taxes than the poor,the tax system must be progressive.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

49

List the three most important expenditure programs of the federal government.How do they differ from the three most important expenditure programs of state and local governments? Explain why it makes more sense for the federal government to purchase "national defense" rather than state governments.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

50

According to the benefits principle,it is fair for people to pay taxes based on their ability to shoulder the tax burden.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

51

A recent increase in federal gasoline taxes was estimated to cause a $150 million reduction in the total surplus (consumer plus producer surplus)in the gasoline market.If tax revenues increased by $100 million,what is the deadweight loss associated with the tax? As a result of the tax,10,000 people sold their cars and started riding their bicycles to work.How much of the burden of the deadweight loss is incurred by the bicycle riders?

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

52

Horizontal and vertical equity are the two primary measures of efficiency of a tax system.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

53

Most economists believe that a corporate income tax affects the stockholders of a corporation but not its employees or customers.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

54

A tax system exhibits vertical equity when taxpayers with similar abilities to pay contribute the same amount.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

55

Vertical equity refers to a tax system in which individuals with higher incomes pay more in taxes than individuals with lower incomes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

56

Vertical equity is not consistent with a regressive tax structure.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

57

According to the ability-to-pay principle,it is fair for people to pay taxes based on their ability to handle the financial burden.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

58

Vertical equity refers to a tax system in which individuals with similar incomes pay similar taxes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

59

According to the ability-to-pay principle,it is fair for people to pay taxes based on the amount of government services that they receive.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

60

If all taxpayers pay the same percentage of income in taxes,the tax system is proportional.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

61

From the time of Benjamin Franklin to the present,the percentage of the average American's income that goes to pay taxes

A) has decreased from about 20 percent to about 10 percent.

B) has remained constant at about 10 percent.

C) has risen from less than 2 percent to about 44.4 percent.

D) has risen from less than 5 percent to about 33.3 percent.

A) has decreased from about 20 percent to about 10 percent.

B) has remained constant at about 10 percent.

C) has risen from less than 2 percent to about 44.4 percent.

D) has risen from less than 5 percent to about 33.3 percent.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

62

According to long-run projections,under current law,

A) federal government spending as a percentage of GDP will rise gradually but substantially in the next several decades.

B) federal taxes as a percentage of GDP will rise gradually but substantially in the next several decades.

C) the federal government's budget deficit will gradually be eliminated in the next several decades.

D) All of the above are correct.

A) federal government spending as a percentage of GDP will rise gradually but substantially in the next several decades.

B) federal taxes as a percentage of GDP will rise gradually but substantially in the next several decades.

C) the federal government's budget deficit will gradually be eliminated in the next several decades.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

63

In 2007,which category represented the largest category of spending for the U.S.federal government?

A) Medicare

B) Social Security

C) National defense

D) Net interest

A) Medicare

B) Social Security

C) National defense

D) Net interest

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

64

Today the typical American pays approximately what percent of income in taxes,including all federal,state,and local taxes?

A) 5 percent

B) 18 percent

C) 33 percent

D) 50 percent

A) 5 percent

B) 18 percent

C) 33 percent

D) 50 percent

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

65

The two types of taxes that are most important to state and local governments as sources of revenue are

A) individual income taxes and corporate income taxes.

B) sales taxes and individual income taxes.

C) sales taxes and property taxes.

D) social insurance taxes and property taxes.

A) individual income taxes and corporate income taxes.

B) sales taxes and individual income taxes.

C) sales taxes and property taxes.

D) social insurance taxes and property taxes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

66

In 2007,approximately how much of federal government spending went to Social Security?

A) 10%

B) 20%

C) 30%

D) 40%

A) 10%

B) 20%

C) 30%

D) 40%

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

67

Of the following countries,which country's government collects the largest amount of tax revenue as a percentage of that country's total income?

A) France

B) United States

C) Canada

D) Sweden

A) France

B) United States

C) Canada

D) Sweden

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

68

The revenue that the federal government collects from payroll taxes is earmarked to pay for

A) National defense and income security (welfare)programs

B) National defense and Medicare

C) Social Security and public schools

D) Social Security and Medicare

A) National defense and income security (welfare)programs

B) National defense and Medicare

C) Social Security and public schools

D) Social Security and Medicare

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

69

In 2007,approximately what percentage of federal government receipts came from individual income taxes?

A) 15%

B) 30%

C) 45%

D) 60%

A) 15%

B) 30%

C) 45%

D) 60%

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is not an important reason for the projected increase in government spending as a percentage of GDP over the next several decades?

A) The increase in life expectancy resulting from advances in healthcare

B) A reduction in the average number of children per family.

C) The increase in the number of jobs lost each year to foreign countries as a result of outsourcing

D) The increase in the cost of healthcare

A) The increase in life expectancy resulting from advances in healthcare

B) A reduction in the average number of children per family.

C) The increase in the number of jobs lost each year to foreign countries as a result of outsourcing

D) The increase in the cost of healthcare

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

71

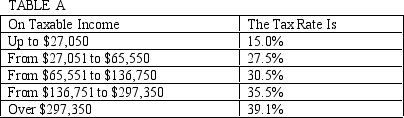

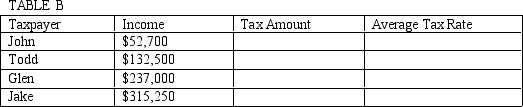

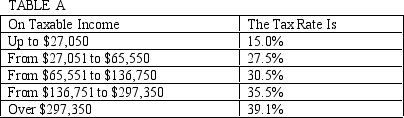

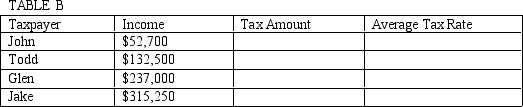

Use Table A to complete Table B.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

72

The U.S.federal government collects about

A) one-third of the taxes in our economy.

B) one-half of the taxes in our economy.

C) two-thirds of the taxes in our economy.

D) three-fourths of the taxes in our economy.

A) one-third of the taxes in our economy.

B) one-half of the taxes in our economy.

C) two-thirds of the taxes in our economy.

D) three-fourths of the taxes in our economy.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

73

In 2007,which category represented the largest source of receipts for the U.S.federal government?

A) Medicare

B) Social Security

C) Corporate income taxes

D) Individual income taxes

A) Medicare

B) Social Security

C) Corporate income taxes

D) Individual income taxes

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

74

Who observed that "in this world nothing is certain but death and taxes"?

A) Mark Twain

B) P.T.Barnum

C) Ben Franklin

D) Richard Nixon

A) Mark Twain

B) P.T.Barnum

C) Ben Franklin

D) Richard Nixon

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

75

The two taxes that together provide the U.S.federal government with approximately 80 percent of its revenue are

A) individual income taxes and property taxes.

B) individual income taxes and corporate income taxes.

C) individual income taxes and payroll taxes.

D) sales taxes and payroll taxes.

A) individual income taxes and property taxes.

B) individual income taxes and corporate income taxes.

C) individual income taxes and payroll taxes.

D) sales taxes and payroll taxes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

76

Taxes on specific goods such as gasoline and alcoholic beverages are called

A) excise taxes.

B) payroll taxes.

C) sales taxes.

D) social insurance taxes.

A) excise taxes.

B) payroll taxes.

C) sales taxes.

D) social insurance taxes.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

77

The concept of a "welfare program" is most closely associated with which particular federal government program?

A) Spending on medical research

B) Temporary Assistance for Needy Families (TANF)

C) Medicare

D) Social Security

A) Spending on medical research

B) Temporary Assistance for Needy Families (TANF)

C) Medicare

D) Social Security

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

78

In 1789,the average American paid approximately what percent of income in taxes?

A) 5%

B) 15%

C) 33%

D) 50%

A) 5%

B) 15%

C) 33%

D) 50%

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

79

The federal taxes owed by a taxpayer depend

A) only upon the marginal tax rate on the taxpayer's first $25,000 of income.

B) only upon the marginal tax rate on the taxpayer's last $10,000 of income.

C) upon all the marginal tax rates up to the taxpayer's overall level of income.

D) upon all the marginal tax rates,including those for income levels that exceed the taxpayer's overall level of income.

A) only upon the marginal tax rate on the taxpayer's first $25,000 of income.

B) only upon the marginal tax rate on the taxpayer's last $10,000 of income.

C) upon all the marginal tax rates up to the taxpayer's overall level of income.

D) upon all the marginal tax rates,including those for income levels that exceed the taxpayer's overall level of income.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck

80

Which of the following statements is correct?

A) Equity is more important than efficiency as a goal of the tax system.

B) Efficiency is more important than equity as a goal of the tax system.

C) Both equity and efficiency are important goals of the tax system.

D) Neither equity nor efficiency is an important goal of the tax system.

A) Equity is more important than efficiency as a goal of the tax system.

B) Efficiency is more important than equity as a goal of the tax system.

C) Both equity and efficiency are important goals of the tax system.

D) Neither equity nor efficiency is an important goal of the tax system.

Unlock Deck

Unlock for access to all 397 flashcards in this deck.

Unlock Deck

k this deck