Deck 5: Accounting for General Capital Assets and Capital Projects

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 5: Accounting for General Capital Assets and Capital Projects

1

Proceeds of debt issued for the construction or acquisition of capital assets are recognized by the capital projects fund as "other financing sources" and as a liability in the governmental activities journal.

True

Explanation: The long-term liability would not be recorded in the capital projects fund since it is a governmental fund type. Governmental funds account for only current assets and liabilities.

Explanation: The long-term liability would not be recorded in the capital projects fund since it is a governmental fund type. Governmental funds account for only current assets and liabilities.

2

Cash discounts available on the purchase of capital assets but not taken should be capitalized as part of the cost of the capital assets.

False

Explanation: Cash discounts, whether or not taken, are not a cost of the asset. Cash discounts taken should be treated as a reduction of cost; those not taken are noncapitalizable expenditures of the governmental fund acquiring the assets.

Explanation: Cash discounts, whether or not taken, are not a cost of the asset. Cash discounts taken should be treated as a reduction of cost; those not taken are noncapitalizable expenditures of the governmental fund acquiring the assets.

3

General capital assets acquired under capital leases should not be recorded in the governmental activities accounts.

False

Explanation: General capital assets acquired by capital lease should be capitalized in the governmental activities accounts in the same manner as general capital assets acquired with other resources.

Explanation: General capital assets acquired by capital lease should be capitalized in the governmental activities accounts in the same manner as general capital assets acquired with other resources.

4

A government must capitalize the cost of improvements such as roads and bridges,because the GASB requires the cost of such assets to be displayed in the basic financial statements.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

The cost of the periodic recarpeting of the city mayor's office should be capitalized in the governmental activities accounts.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

Depreciation of general capital assets for the period should be reported in the operating statement for governmental activities at the government-wide level.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

Capital projects funds should use the modified accrual basis of accounting for revenues and expenses.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

The disposal of a general capital asset,resulting in no revenue or expenditure to the government,is recorded only in the governmental activities accounts.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

Interest incurred on interim or long-term financing during construction of general capital assets cannot be capitalized as part of the cost of those assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

A government expended $200,000 to buy land to be used by the city electric utility as a site for an office building.This land should be capitalized in the utility fund,not in the governmental activities accounts.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

If a bond sale occurs between interest dates,accrued interest sold should be credited to Proceeds of Bonds.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

General capital assets should be distinguished from capital assets that are specifically associated with activities financed by proprietary and fiduciary funds,since capital assets acquired by proprietary and fiduciary funds are accounted for by those funds.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

In addition to required disclosures about general capital assets,a government is required to allocate the depreciation expense on all of its general capital assets to functional categories.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

Governments may choose the modified approach,whereby they are not required to record depreciation on general capital assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

If a capital projects fund starts construction of a building in one year and finishes it in a subsequent year an entry must be made in the governmental activities accounts until the building is completed,inspected,and accepted.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

At the time a bond issue is legally authorized it is usual practice to make either no entry or a memorandum entry in the capital projects fund general journal.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

Capital projects funds generally do not use the Encumbrances Control account.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

One of the required general capital asset disclosures is a report on the additions to,and deductions from,general capital assets during the course of a fiscal year.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

The recorded premium on tax-supported bonds issued should be amortized at the government-wide level in the same manner as a bond premium would be amortized by a business that issued bonds.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

GASB standards require that all governmental expenditures for long-lived assets be accounted for by a capital projects fund.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following would be considered a general capital asset?

A) A vehicle purchased from General Fund revenues.

B) A vehicle purchased and maintained by an enterprise fund.

C) A computer purchased from revenues of an internal service fund and used by the supplies department.

D) Real estate purchased with the assets of a pension trust fund.

A) A vehicle purchased from General Fund revenues.

B) A vehicle purchased and maintained by an enterprise fund.

C) A computer purchased from revenues of an internal service fund and used by the supplies department.

D) Real estate purchased with the assets of a pension trust fund.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

After all liabilities are paid and the operating statement accounts closed,it is common to transfer any remaining assets of a capital projects fund to the General Fund.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

GASB standards require that

A) General capital assets be recorded at historical cost.

B) Donated capital assets be recorded at their fair value at the time of receipt,plus ancillary charges.

C) A capital asset be recorded at estimated cost if the cost of a capital asset was not recorded when the asset was acquired and it is unknown when accounting control over the asset occurred.

D) All of the above.

A) General capital assets be recorded at historical cost.

B) Donated capital assets be recorded at their fair value at the time of receipt,plus ancillary charges.

C) A capital asset be recorded at estimated cost if the cost of a capital asset was not recorded when the asset was acquired and it is unknown when accounting control over the asset occurred.

D) All of the above.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

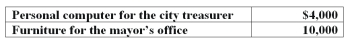

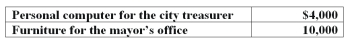

The following items were included in Prairie City's General Fund expenditures for the year ended June  How much should be classified as capital assets in Prairie City's General Fund balance sheet at June 30?

How much should be classified as capital assets in Prairie City's General Fund balance sheet at June 30?

A) $0.

B) $4,000.

C) $10,000.

D) $14,000.

How much should be classified as capital assets in Prairie City's General Fund balance sheet at June 30?

How much should be classified as capital assets in Prairie City's General Fund balance sheet at June 30?A) $0.

B) $4,000.

C) $10,000.

D) $14,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

Even though the life of a capital projects fund is the life of the project,not year-to-year,operating statement accounts should be closed at year-end to facilitate preparation of year-end financial statements.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

Equipment in general governmental service that had been acquired several years ago by a special revenue fund at a cost of $40,000 was sold for $15,000 cash.Accumulated depreciation of $30,000 existed at the time of the sale.The journal entry to be made in the governmental activities journal will include all of the following except

A) A debit to Cash for $15,000.

B) A debit to Accumulated Depreciation for $30,000.

C) A credit to Equipment for $40,000.

D) A credit to Other Financing Sources for $5,000.

A) A debit to Cash for $15,000.

B) A debit to Accumulated Depreciation for $30,000.

C) A credit to Equipment for $40,000.

D) A credit to Other Financing Sources for $5,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

Construction contracts for governmental projects often provide that a certain percentage of each billing by the contractor will be retained by the government until the project is inspected and accepted upon completion.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

The capital assets used by government departments accounted for in the governmental funds should be reported in

A) The appropriate governmental funds.

B) The property,plant,and equipment fund.

C) Departmental memorandum records.

D) The governmental activities accounts at the government-wide level.

A) The appropriate governmental funds.

B) The property,plant,and equipment fund.

C) Departmental memorandum records.

D) The governmental activities accounts at the government-wide level.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

If all asset,liability,and fund equity accounts of a capital projects fund were closed during a certain fiscal year,it is unnecessary to prepare any financial statements for that fund for that year.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

If general capital assets are donated,revenue related to the donation is recognized in the governmental fund statement of revenue,expenditures and changes in fund balance.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

Streets,curbs,and sidewalks constructed or acquired through use of capital projects fund resources should never be reported in the financial statements of a government because they are for the use of the public,not for use by the government.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

When a project has been completed,inspected,and accepted,retained percentages of contract billings may be paid.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

Water rights purchased by a city would be considered a capital asset.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

The city of Oak Park constructed a new storage facility using the city's own public works employees.Construction costs were incurred in the amount of $900,000,plus $25,000 in interest on short-term notes used to finance construction.What amount should be capitalized as a general capital asset?

A) $900,000.

B) $925,000.

C) $875,000.

D) $0.

A) $900,000.

B) $925,000.

C) $875,000.

D) $0.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

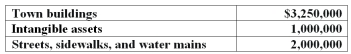

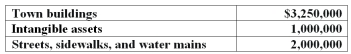

The following general capital assets were owned by the town of Otterville:  What amount should be recorded as capital assets in the town's governmental activities accounts if Otterville follows GASB standards?

What amount should be recorded as capital assets in the town's governmental activities accounts if Otterville follows GASB standards?

A) $0.

B) $3,250,000.

C) $5,250,000.

D) $6,250,000.

What amount should be recorded as capital assets in the town's governmental activities accounts if Otterville follows GASB standards?

What amount should be recorded as capital assets in the town's governmental activities accounts if Otterville follows GASB standards?A) $0.

B) $3,250,000.

C) $5,250,000.

D) $6,250,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

During the year,a wealthy local merchant donated a building to the city of Pasedena.The original cost of the building was $300,000.Accumulated depreciation at the date of the gift amounted to $250,000.The appraised fair market value of the donation at the date of the gift was $600,000,of which $40,000 was the value of the land on which the building was situated.At what amount should Rosewood record this donated property in the governmental activities accounts at the government-wide level?

A) $50,000.

B) $300,000.

C) $600,000.

D) $0.

A) $50,000.

B) $300,000.

C) $600,000.

D) $0.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

During the year,a wealthy local merchant donated a building to the city of Pasedena.The original cost of the building was $300,000.Accumulated depreciation at the date of the gift amounted to $250,000.The appraised fair market value of the donation at the date of the gift was $600,000,of which $40,000 was the value of the land on which the building was situated.At what amount should Rosewood record this donated property in the General Fund?

A) $50,000.

B) $300,000.

C) $600,000.

D) $0.

A) $50,000.

B) $300,000.

C) $600,000.

D) $0.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

Under a service concession arrangement,a government transfers the rights and obligations of an asset to another legally separate governmental or private sector entity.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is not a required disclosure about each major class of capital assets?

A) Beginning-of-year and end-of-year balances showing accumulated depreciation separate from historical cost.

B) Capital acquisitions and sales or other dispositions during the year showing the date and method of acquisition or disposition.

C) Depreciation expense for the current period with disclosure of the amounts charged to each function in the statement of activities.

D) Disclosures describing works of art or historical treasures that are not capitalized and explaining why they are not capitalized.

A) Beginning-of-year and end-of-year balances showing accumulated depreciation separate from historical cost.

B) Capital acquisitions and sales or other dispositions during the year showing the date and method of acquisition or disposition.

C) Depreciation expense for the current period with disclosure of the amounts charged to each function in the statement of activities.

D) Disclosures describing works of art or historical treasures that are not capitalized and explaining why they are not capitalized.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

The acquisition of long-lived assets under an operating lease does not require any asset recognition in the accounts of any governmental fund.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

In 2014,Canon City signed a contract in the amount of $6,000,000 for the construction of a new city hall.Expenditures were $4,000,000 in 2014 and $2,050,000 in 2015,which included a change to the original construction design in the amount of $50,000.What amount should be added to net capital assets in the governmental activities accounts in 2015?

A) $6,000,000

B) $6,050,000

C) $2,050,000

D) $2,000,000

A) $6,000,000

B) $6,050,000

C) $2,050,000

D) $2,000,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

A government enters into a capital lease for the purchase of a new fire truck.The present value of the future lease payments is $745,500 and there is a down payment at the inception of the lease of $25,000.The fire truck should be recorded in the governmental activities accounts at

A) $25,000.

B) $770,500.

C) $745,500.

D) $0.

A) $25,000.

B) $770,500.

C) $745,500.

D) $0.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

With regard to depreciation of general capital assets,which of the following statements is correct?

A) Depreciation expense should be recorded in the appropriate governmental funds,and recorded in the governmental activities accounts.

B) Depreciation expense must be recorded in the governmental fund,but no depreciation expense is recorded in the governmental activities accounts.

C) No depreciation can be recorded in any governmental fund,but depreciation expense must be recorded in the governmental activities accounts.

D) No depreciation can be recorded in any governmental fund,nor is it permissible to record depreciation expense in the governmental activities accounts.

A) Depreciation expense should be recorded in the appropriate governmental funds,and recorded in the governmental activities accounts.

B) Depreciation expense must be recorded in the governmental fund,but no depreciation expense is recorded in the governmental activities accounts.

C) No depreciation can be recorded in any governmental fund,but depreciation expense must be recorded in the governmental activities accounts.

D) No depreciation can be recorded in any governmental fund,nor is it permissible to record depreciation expense in the governmental activities accounts.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

When materials that were ordered for a capital projects fund for use on a construction project are received but the invoice has not yet been paid,what account is debited?

A) Encumbrances.

B) Appropriations.

C) Vouchers payable.

D) Construction Expenditures.

A) Encumbrances.

B) Appropriations.

C) Vouchers payable.

D) Construction Expenditures.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

How should a capital lease for a general capital asset be recorded in the governmental activities accounts at the inception of the lease?

A) Debit to a capital asset account.

B) Debit to a capital expense/expenditure account.

C) Credit to Capital Lease Obligations Payable.

D) Both A and C are correct.

A) Debit to a capital asset account.

B) Debit to a capital expense/expenditure account.

C) Credit to Capital Lease Obligations Payable.

D) Both A and C are correct.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

The sale of tax-supported bonds at par for the eventual construction of a new city jail would require recognition in which of the following funds and/or activities?

A) Capital projects and debt service funds.

B) Debt service fund,capital projects,and governmental activities.

C) Debt service fund and the governmental activities.

D) Capital projects fund and the governmental activities.

A) Capital projects and debt service funds.

B) Debt service fund,capital projects,and governmental activities.

C) Debt service fund and the governmental activities.

D) Capital projects fund and the governmental activities.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

A city recorded an asset impairment to a Public Works facility.Which of the following is correct concerning the recording of the amount of the asset impairment?

A) The General Fund would record a debit to Expenditures.

B) The General Fund would record a debit to Other Financing Uses-Loss due to Impairment.

C) The governmental activities accounts would record a debit to Loss due to Impairment.

D) The governmental activities accounts would record a debit to Expenses-Public Works.

A) The General Fund would record a debit to Expenditures.

B) The General Fund would record a debit to Other Financing Uses-Loss due to Impairment.

C) The governmental activities accounts would record a debit to Loss due to Impairment.

D) The governmental activities accounts would record a debit to Expenses-Public Works.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

A capital projects fund might be used to account for which of the following activities?

A) Maintaining roads and bridges.

B) Building a parking garage.

C) Providing water and sewer services.

D) Servicing long-term debt.

A) Maintaining roads and bridges.

B) Building a parking garage.

C) Providing water and sewer services.

D) Servicing long-term debt.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements is correct concerning interest expenditures incurred during the period of construction of capital projects?

A) Interest expenditures may not be capitalized as part of the cost of general capital assets reported in governmental activities.

B) Interest expenditures may be capitalized as part of the cost of general capital assets reported in the governmental activities accounts at the government-wide level.

C) Interest expenditures must be capitalized as part of the cost of general capital assets reported in the capital projects fund.

D) The capitalization of interest expenditures as part of the cost of general capital assets reported in the capital projects fund is optional.

A) Interest expenditures may not be capitalized as part of the cost of general capital assets reported in governmental activities.

B) Interest expenditures may be capitalized as part of the cost of general capital assets reported in the governmental activities accounts at the government-wide level.

C) Interest expenditures must be capitalized as part of the cost of general capital assets reported in the capital projects fund.

D) The capitalization of interest expenditures as part of the cost of general capital assets reported in the capital projects fund is optional.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

Interfund transfers from the General Fund to the capital projects fund to provide partial financing of a capital project would be reported by the capital projects fund as a(an)

A) Fund balance addition.

B) Revenue.

C) Other financing source.

D) Current liability.

A) Fund balance addition.

B) Revenue.

C) Other financing source.

D) Current liability.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

Equipment in general governmental service that had been acquired several years ago by a special revenue fund at a cost of $40,000 was sold for $15,000 cash.Accumulated depreciation of $30,000 existed at the time of the sale.The journal entry to be made in the special revenue fund will include

A) A credit to Other Financing Sources for $15,000.

B) A debit to Accumulated Depreciation for $30,000.

C) A credit to Equipment for $40,000.

D) All of the above.

A) A credit to Other Financing Sources for $15,000.

B) A debit to Accumulated Depreciation for $30,000.

C) A credit to Equipment for $40,000.

D) All of the above.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following activities or transactions would normally not be accounted for in a capital projects fund?

A) Construction of a new city jail.

B) Construction of airport runways financed by revenue bonds and to be repaid from the revenues of the city airport,an enterprise fund.

C) Lease of a building to be used as a city office building.

D) Construction of a new city park to be maintained primarily from General Fund revenues.

A) Construction of a new city jail.

B) Construction of airport runways financed by revenue bonds and to be repaid from the revenues of the city airport,an enterprise fund.

C) Lease of a building to be used as a city office building.

D) Construction of a new city park to be maintained primarily from General Fund revenues.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is a true statement about governments that issue tax-supported debt to finance capital projects?

A) Most states do not permit bonds to be issued at a premium.

B) Accrued interest is recorded as an other financing source of the capital projects fund.

C) Premiums on bonds issued must be amortized in the debt service fund.

D) Premiums on bonds issued are recorded as an other financing source of the debt service fund.

A) Most states do not permit bonds to be issued at a premium.

B) Accrued interest is recorded as an other financing source of the capital projects fund.

C) Premiums on bonds issued must be amortized in the debt service fund.

D) Premiums on bonds issued are recorded as an other financing source of the debt service fund.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

How should a capital lease for a general capital asset be recorded in the General Fund accounts at the inception of the lease?

A) Debit to a capital asset account.

B) Debit to a capital expense/expenditure account.

C) Credit to Capital Lease Obligations Payable.

D) Both A and C are correct.

A) Debit to a capital asset account.

B) Debit to a capital expense/expenditure account.

C) Credit to Capital Lease Obligations Payable.

D) Both A and C are correct.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is true regarding capital projects funds?

A) Encumbrances accounting is employed.

B) Encumbrances accounting is not normally employed,but Estimated Revenues and Appropriations accounts are used.

C) No budgetary accounts are ever used.

D) All budgetary accounts are employed in the same manner as for the General Fund and special revenue funds.

A) Encumbrances accounting is employed.

B) Encumbrances accounting is not normally employed,but Estimated Revenues and Appropriations accounts are used.

C) No budgetary accounts are ever used.

D) All budgetary accounts are employed in the same manner as for the General Fund and special revenue funds.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

A government enters into a capital lease for the purchase of a new fire truck.The present value of the future lease payments is $745,500 and there is a down payment at the inception of the lease of $25,000.The fire truck should be recorded in the General Fund at

A) $25,000.

B) $770,500.

C) $745,500.

D) $0.

A) $25,000.

B) $770,500.

C) $745,500.

D) $0.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following funds of a government uses the modified accrual basis of accounting?

A) Private-purpose trust fund.

B) Capital projects.

C) Internal service.

D) Enterprise.

A) Private-purpose trust fund.

B) Capital projects.

C) Internal service.

D) Enterprise.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

Premiums received on tax-supported bonds are generally transferred to what fund?

A) Internal service fund.

B) Debt service.

C) General.

D) Special revenue.

A) Internal service fund.

B) Debt service.

C) General.

D) Special revenue.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

The city of Columbus issued bonds at par for the construction of a new city office building.Receipt of the bond proceeds would result in journal entries in which funds?

A) Capital Projects Fund: Yes; Debt Service Fund: No

B) Capital Projects Fund: No; Debt Service Fund: Yes

C) Capital Projects Fund: Yes; Debt Service Fund: Yes

D) Capital Projects Fund: No; Debt Service Fund: No

A) Capital Projects Fund: Yes; Debt Service Fund: No

B) Capital Projects Fund: No; Debt Service Fund: Yes

C) Capital Projects Fund: Yes; Debt Service Fund: Yes

D) Capital Projects Fund: No; Debt Service Fund: No

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

To defray engineering and other preliminary expenses incurred prior to the issuance of a long-term bond issue,a capital projects fund borrowed the sum of $50,000 on a short-term basis from National Bank.This transaction should be recorded in

A) The capital projects fund.

B) The debt service fund.

C) The General Fund.

D) None of the above.Debt is not recorded in governmental funds.

A) The capital projects fund.

B) The debt service fund.

C) The General Fund.

D) None of the above.Debt is not recorded in governmental funds.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

In which of the following funds or activities general journals would it not be appropriate to record depreciation of capital assets?

A) Capital projects fund.

B) Internal service fund.

C) Business-type activities.

D) Governmental activities.

A) Capital projects fund.

B) Internal service fund.

C) Business-type activities.

D) Governmental activities.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

In late June,the Buildit Construction Co.submitted a $600,000 progress billing on a construction contract.On July 2,the bill was approved for payment,subject to a five percent retention,as provided by the contract.The amount that should be debited to Construction Expenditures is

A) $0.

B) $30,000.

C) $570,000.

D) $600,000.

A) $0.

B) $30,000.

C) $570,000.

D) $600,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

Equipment acquired several years ago by a capital projects fund and recorded in the governmental activities general journal was sold.The cash received was considered to be unrestricted revenue.Entries are necessary in the

A) General Fund,capital projects fund,and governmental activities.

B) General Fund,capital projects fund,and enterprise fund.

C) General Fund and governmental activities.

D) Governmental activities only.

A) General Fund,capital projects fund,and governmental activities.

B) General Fund,capital projects fund,and enterprise fund.

C) General Fund and governmental activities.

D) Governmental activities only.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is one of the requirements that must be met to elect the "modified approach" to reporting certain eligible infrastructure assets?

A) The government omits the cost of the assets from the government-wide statement of net assets.

B) The government maintains the assets at a condition level equal to or greater than 75 percent of the condition of a new asset.

C) The government manages the assets using an asset management system that meets specific criteria.

D) The government gets the permission of the Government Accounting Standards Board.

A) The government omits the cost of the assets from the government-wide statement of net assets.

B) The government maintains the assets at a condition level equal to or greater than 75 percent of the condition of a new asset.

C) The government manages the assets using an asset management system that meets specific criteria.

D) The government gets the permission of the Government Accounting Standards Board.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

When a government transfers the rights and obligations of an asset to another legally separate governmental or private sector entity,the transaction is referred to as

A) A capital lease.

B) An operating lease.

C) A service concession arrangement.

D) A sale-leaseback agreement.

A) A capital lease.

B) An operating lease.

C) A service concession arrangement.

D) A sale-leaseback agreement.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

A capital projects fund might be used to record which of the following activities?

A) Building an addition to the city hall building.

B) Maintaining roads and bridges.

C) Operating a municipal golf course.

D) Paying the principal and interest on debt incurred to build a municipal swimming pool.

A) Building an addition to the city hall building.

B) Maintaining roads and bridges.

C) Operating a municipal golf course.

D) Paying the principal and interest on debt incurred to build a municipal swimming pool.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

In late June,the Buildit Construction Co.submitted a $600,000 progress billing on a construction contract.On July 2,the bill was approved for payment,subject to a five percent retention,as provided by the contract.Construction expenditures should be debited when

A) The bill is approved for payment.

B) The bill is received.

C) The bill is paid (except for the five percent retention).

D) The final five percent of the bill is paid.

A) The bill is approved for payment.

B) The bill is received.

C) The bill is paid (except for the five percent retention).

D) The final five percent of the bill is paid.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

For which of the following assets can the "modified approach" be elected in lieu of depreciation?

A) Buildings and equipment.

B) All general capital assets.

C) All capital assets.

D) Eligible infrastructure assets.

A) Buildings and equipment.

B) All general capital assets.

C) All capital assets.

D) Eligible infrastructure assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

When a police vehicle purchased by a government is received,it should be recorded in the governmental activities general journal as a(an)

A) Expenditure.

B) Capital asset.

C) Appropriation.

D) Expense.

A) Expenditure.

B) Capital asset.

C) Appropriation.

D) Expense.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

Under a service concession arrangement,

A) The transferring government continues to report the transferred asset as a capital asset and any related contractual obligations as liabilities.

B) The operating government will record the transferring government's payment or receivable,a liability for the present value of significant contractual obligations and a corresponding deferred inflow of resources for the difference between the two.

C) Any deferred inflow is recognized as revenue at the time the arrangement takes place.

D) All of the above statements are true.

A) The transferring government continues to report the transferred asset as a capital asset and any related contractual obligations as liabilities.

B) The operating government will record the transferring government's payment or receivable,a liability for the present value of significant contractual obligations and a corresponding deferred inflow of resources for the difference between the two.

C) Any deferred inflow is recognized as revenue at the time the arrangement takes place.

D) All of the above statements are true.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

One of the common objections to computing depreciation of general capital assets has been that the assets are used for activities that are not expected to generate revenues sufficient to replace the assets; therefore,depreciation expense is not relevant to decisions about the acquisition or use of general capital assets.Evaluate this argument.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

"Capital projects funds are established by a government to account for all plant or equipment acquired by construction." Do you agree? Why or why not?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

At the government-wide level,net position related to capital assets should be reported as

A) Net investment in capital assets.

B) Restricted or unrestricted financial assets,as appropriate.

C) General capital assets,preceding general long-term liabilities.

D) Net equity in capital assets.

A) Net investment in capital assets.

B) Restricted or unrestricted financial assets,as appropriate.

C) General capital assets,preceding general long-term liabilities.

D) Net equity in capital assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

The city of Palisades purchased a squad car for the police department.If the operations of the police department are financed by general revenues,which of the following is correct concerning where the purchase of the car would be recorded?

A) General Fund: No; Governmental Activities: Yes

B) General Fund: No; Governmental Activities: No

C) General Fund: Yes; Governmental Activities: No

D) General Fund: Yes; Governmental Activities: Yes

A) General Fund: No; Governmental Activities: Yes

B) General Fund: No; Governmental Activities: No

C) General Fund: Yes; Governmental Activities: No

D) General Fund: Yes; Governmental Activities: Yes

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following is not true for capital projects funds?

A) Capital projects funds use a Construction Work in Progress account to record costs until the project is completed.

B) Encumbrance accounting is generally used.

C) Capital projects funds use the modified accrual basis of accounting.

D) Capital projects funds have a project-life focus.

A) Capital projects funds use a Construction Work in Progress account to record costs until the project is completed.

B) Encumbrance accounting is generally used.

C) Capital projects funds use the modified accrual basis of accounting.

D) Capital projects funds have a project-life focus.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

The following key terms from Chapter 5 relate to general capital assets and capital projects:

A.Bond anticipation notes

B.Infrastructure assets

C.Service Concession Arrangements

D.General capital assets

E.Capital projects funds

F.Asset impairment

G.Capital leases

H.Operating leases

I.Depreciation

For each of the following definitions,indicate the key term from the list above that best matches the definition by placing the appropriate letter in the blank space next to the definition.

_____ 1.A rental-type lease in which the risks and benefits of ownership are primarily those of the lessor

_____ 2.Short-term interest-bearing instruments issued by a government with a plan to replace with longer-term debt

_____ 3.Roads,bridges,curbs and gutters,streets,sidewalks,and drainage systems installed for the common good

_____ 4.Capital assets of a government that are not recorded in a proprietary or fiduciary fund

_____ 5.Significant,unexpected decline in the service utility of a capital asset

A.Bond anticipation notes

B.Infrastructure assets

C.Service Concession Arrangements

D.General capital assets

E.Capital projects funds

F.Asset impairment

G.Capital leases

H.Operating leases

I.Depreciation

For each of the following definitions,indicate the key term from the list above that best matches the definition by placing the appropriate letter in the blank space next to the definition.

_____ 1.A rental-type lease in which the risks and benefits of ownership are primarily those of the lessor

_____ 2.Short-term interest-bearing instruments issued by a government with a plan to replace with longer-term debt

_____ 3.Roads,bridges,curbs and gutters,streets,sidewalks,and drainage systems installed for the common good

_____ 4.Capital assets of a government that are not recorded in a proprietary or fiduciary fund

_____ 5.Significant,unexpected decline in the service utility of a capital asset

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

At the start of a capital lease the journal entry required in the capital projects fund will include which of the following?

A) A debit to Capital Lease Equipment.

B) A debit to Expenditures.

C) A credit to Obligations under Capital Leases.

D) A debit to Other Financing Uses-Capital Leases.

A) A debit to Capital Lease Equipment.

B) A debit to Expenditures.

C) A credit to Obligations under Capital Leases.

D) A debit to Other Financing Uses-Capital Leases.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

The following are the city of Beaver Creek's capital assets:  What aggregate amount should Beaver Creek record in the governmental activities journal?

What aggregate amount should Beaver Creek record in the governmental activities journal?

A) $7,000,000.

B) $8,000,000.

C) $8,700,000.

D) $9,700,000.

What aggregate amount should Beaver Creek record in the governmental activities journal?

What aggregate amount should Beaver Creek record in the governmental activities journal?A) $7,000,000.

B) $8,000,000.

C) $8,700,000.

D) $9,700,000.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

How should capital assets acquired under a capital lease be recorded in the capital projects fund?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

"Infrastructure assets (e.g.,roads,bridges,curbs and gutters,streets,etc.)need not be capitalized since they are immovable and not likely to be stolen." Do you agree or disagree? Explain your answer.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck