Deck 12: Capital Budgeting Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/96

Play

Full screen (f)

Deck 12: Capital Budgeting Decisions

1

The use of return on investment as a sole performance measure may lead managers to make decisions that are not in the best interests of the company as a whole.

True

2

For purposes of determining the costs to be included in each segment's performance evaluations,in general common fixed costs should be allocated to each segment and traceable fixed costs should not be assigned to segments.

False

3

Return on investment can provide information at to the benefits that managers can obtain by reducing their investments in current and fixed assets.

True

4

Support departments within an organization such as information technology,cannot be evaluated as profit centres as they have no external sales revenues.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

5

The return on investment can ordinarily be improved by either increasing sales,reducing expenses,or reducing operating assets,assuming each of the other factors remain unchanged.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

6

A key feature of the balanced scorecard performance measurement system is that the different dimensions are linked together.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

7

Some managers believe that residual income is superior to return on investment as a means of measuring performance,since it encourages the manager to make investment decisions that are more consistent with the interests of the company as a whole.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

8

Residual income is income plus an imputed interest charge for the investment.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

9

The balance scorecard approach usually includes all of the following categories of measures except:

A) direct material measures.

B) internal business process measures.

C) financial measures.

D) learning and growth measures.

A) direct material measures.

B) internal business process measures.

C) financial measures.

D) learning and growth measures.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

10

Transfer prices that one segment of an organization charges other segments of the same organization are always the costs of the goods or services provided.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

11

An investment centre has the highest level of responsibility from a performance management perspective.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

12

Centralized organizations normally include multiple business segments.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

13

Cost centre managers are often evaluated by comparing actual costs under their control against budgeted or standard costs using variance analysis.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

14

Since the sales figure is neutral in the return on investment (ROI)formula ROI = Margin × Turnover,a change in total sales will not affect ROI.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

15

In performing return on investment calculations,it is safe to assume that total assets from the balance sheet may be used in all calculations.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

16

Multidimensional performance systems such as the balanced scorecard are appropriate for not-for-profit organizations but not for commercial businesses.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

17

Profit centre managers are authorized to make decisions about pricing,production,operations and capital acquisitions.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

18

In looking at ROI,turnover measures management's ability to control operating expenses in relation to sales.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

19

Residual income is the net operating income that an investment centre earns above the minimum required return on the investment in operating assets.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

20

ROI and residual income can be used as performance measures.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

21

Delmar Corporation is considering the use of residual income as a measure of the performance of its divisions.What major disadvantage of this method should the company consider before deciding to institute it?

A) This method does not make allowance for difference in the size of compared divisions.

B) Opportunities may be undertaken which will decrease the overall return on investment.

C) The minimum required rate of return may eliminate desirable opportunities from consideration.

D) Residual income does not measure how effectively the division manager controls costs.

A) This method does not make allowance for difference in the size of compared divisions.

B) Opportunities may be undertaken which will decrease the overall return on investment.

C) The minimum required rate of return may eliminate desirable opportunities from consideration.

D) Residual income does not measure how effectively the division manager controls costs.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following are benefits of decentralization? I Giving a manager of a division greater decision making control over his/her division provides vital training for a manager who is on the rise in the company.

II Managers at corporate headquarters have greater control in seeing that the goals of the company are realized.

III Added decision-making authority and responsibility often leads to increased job satisfaction and often persuades a manager to put forth his/her best efforts.

A) Only I and II.

B) Only II and III.

C) Only I and III.

D) Only I.

II Managers at corporate headquarters have greater control in seeing that the goals of the company are realized.

III Added decision-making authority and responsibility often leads to increased job satisfaction and often persuades a manager to put forth his/her best efforts.

A) Only I and II.

B) Only II and III.

C) Only I and III.

D) Only I.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

23

The performance of the manager of Division A is measured by residual income.Which of the following would increase the manager's performance measure?

A) Increase in average operating assets.

B) Decrease in average operating assets.

C) Increase in minimum required return.

D) Decrease in net operating income.

A) Increase in average operating assets.

B) Decrease in average operating assets.

C) Increase in minimum required return.

D) Decrease in net operating income.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

24

Assuming that sales and net operating income remain the same,a company's return on investment will:

A) increase if average operating assets increase.

B) decrease if average operating assets decrease.

C) decrease if turnover decreases.

D) decrease if turnover increases.

A) increase if average operating assets increase.

B) decrease if average operating assets decrease.

C) decrease if turnover decreases.

D) decrease if turnover increases.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

25

Turnover is computed by dividing average operating assets into:

A) invested capital.

B) total assets.

C) net operating income.

D) sales.

A) invested capital.

B) total assets.

C) net operating income.

D) sales.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

26

Consider the following three statements: I a profit centre has control over both costs and revenues.

II an investment centre has control over invested funds,but not over costs and revenues.

III a cost centre has no control over sales.

Which statement(s)is/are correct?

A) Only I.

B) Only II.

C) Only I and III.

D) Only I and II.

II an investment centre has control over invested funds,but not over costs and revenues.

III a cost centre has no control over sales.

Which statement(s)is/are correct?

A) Only I.

B) Only II.

C) Only I and III.

D) Only I and II.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

27

All other things being equal,a company's return on investment (ROI)would generally increase when:

A) average operating assets increase.

B) sales decrease.

C) operating expenses decrease.

D) operating expenses increase.

A) average operating assets increase.

B) sales decrease.

C) operating expenses decrease.

D) operating expenses increase.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is not an operating asset?

A) Cash.

B) Inventory.

C) Plant equipment.

D) Common stock.

A) Cash.

B) Inventory.

C) Plant equipment.

D) Common stock.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

29

Net operating income is defined as:

A) sales minus variable expenses.

B) sales minus variable expenses and traceable fixed expenses.

C) contribution margin minus traceable and common fixed expenses.

D) net income plus interest and taxes.

A) sales minus variable expenses.

B) sales minus variable expenses and traceable fixed expenses.

C) contribution margin minus traceable and common fixed expenses.

D) net income plus interest and taxes.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements provide(s)an argument in favor of including only a plant's net book value rather than gross book value as part of operating assets in the ROI computation? I Net book value is consistent with how plant and equipment items are reported on a balance sheet.

II Net book value is consistent with the computation of net operating income,which includes depreciation as an operating expense.

III Net book value allows ROI to decrease over time as assets get older.

A) Only I.

B) Only III.

C) Only I and II.

D) Only I and III.

II Net book value is consistent with the computation of net operating income,which includes depreciation as an operating expense.

III Net book value allows ROI to decrease over time as assets get older.

A) Only I.

B) Only III.

C) Only I and II.

D) Only I and III.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose a manager's performance is to be measured by residual income.Which of the following will not result in an increase in the residual income figure for this manager,assuming other factors remain constant?

A) An increase in sales.

B) An increase in the minimum required rate of return.

C) A decrease in expenses.

D) A decrease in operating assets.

A) An increase in sales.

B) An increase in the minimum required rate of return.

C) A decrease in expenses.

D) A decrease in operating assets.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

32

During Cummings most profitable year its net income was $25,000.What is the ROI if the investment was $50,000?

A) 28%.

B) 50%.

C) 51%.

D) 63%.

A) 28%.

B) 50%.

C) 51%.

D) 63%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

33

Division B had a ROI last year of 15%.The division's minimum required rate of return is 10%.If the division's average operating assets last year were $450,000,then the division's residual income for last year was?

A) $22,500.

B) $37,500.

C) $45,000.

D) $67,500.

A) $22,500.

B) $37,500.

C) $45,000.

D) $67,500.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

34

A segment of a business responsible for both revenues and expenses would be called:

A) a cost centre.

B) an investment centre.

C) a profit centre.

D) a motivation centre.

A) a cost centre.

B) an investment centre.

C) a profit centre.

D) a motivation centre.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

35

In 2003 the real estate market experienced an all-time high revenue with a net income of $45 billion with investment of $10 billion.What is the ROI for the real estate industry?

A) 4.5.

B) 5.44.

C) 6.22.

D) 14.2.

A) 4.5.

B) 5.44.

C) 6.22.

D) 14.2.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

36

A company's return on investment is the:

A) margin divided by turnover.

B) margin multiplied by turnover.

C) turnover divided by average operating assets.

D) turnover multiplied by average operating assets.

A) margin divided by turnover.

B) margin multiplied by turnover.

C) turnover divided by average operating assets.

D) turnover multiplied by average operating assets.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

37

Keeping all other factors constant,which of the following would not cause an increase in the ROI?

A) Increase in liabilities.

B) Increase in sales.

C) Reduction in expenses.

D) Reduction in operating assets.

A) Increase in liabilities.

B) Increase in sales.

C) Reduction in expenses.

D) Reduction in operating assets.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not an operating asset?

A) cash.

B) inventory.

C) plant equipment.

D) investment in another company.

A) cash.

B) inventory.

C) plant equipment.

D) investment in another company.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

39

Assuming that sales and average operating assets remain the same,a company's return on investment will:

A) increase if net operating income increases.

B) decrease if net operating income decreases.

C) increase if margin decreases.

D) decrease if margin increases.

A) increase if net operating income increases.

B) decrease if net operating income decreases.

C) increase if margin decreases.

D) decrease if margin increases.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

40

In computing the margin in a ROI analysis,which of the following is used in the denominator?

A) Sales.

B) Net operating income.

C) Average operating assets.

D) Residual income.

A) Sales.

B) Net operating income.

C) Average operating assets.

D) Residual income.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

41

Emiley Inc. ,newly incorporated on January 2,earned $100,000 in net operating income in its first year of operations which ended December 31.Operating assets,which increased evenly throughout the year,totalled $200,000 at year end.ROI for the year was?

A) 0%.

B) 50%.

C) 100%.

D) 200%.

A) 0%.

B) 50%.

C) 100%.

D) 200%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

42

How many units must the South Division sell each year to have an ROI of 16%?

A) 52,000.

B) 65,000.

C) 240,000.

D) 130,000.

A) 52,000.

B) 65,000.

C) 240,000.

D) 130,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

43

Sales and average operating assets for Company P and Company Q are given below:  What is the margin that each company will have to earn in order to generate a return on investment of 20%?

What is the margin that each company will have to earn in order to generate a return on investment of 20%?

A) 2.5% and 5%.

B) 8% and 4%.

C) 12% and 16%.

D) 50% and 100%.

What is the margin that each company will have to earn in order to generate a return on investment of 20%?

What is the margin that each company will have to earn in order to generate a return on investment of 20%?A) 2.5% and 5%.

B) 8% and 4%.

C) 12% and 16%.

D) 50% and 100%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

44

Division A's residual income is?

A) $20,000.

B) $30,000.

C) $35,000.

D) $45,000.

A) $20,000.

B) $30,000.

C) $35,000.

D) $45,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

45

If the South Division wants a residual income of $50,000 and the minimum required rate of return is 10%,the annual turnover will have to be?

A) 0.32.

B) 0.80.

C) 1.25.

D) 1.50.

A) 0.32.

B) 0.80.

C) 1.25.

D) 1.50.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

46

Last year,a company had stockholder's equity of $160,000,net operating income of $16,000 and sales of $100,000.The turnover was 0.5.The return on investment (ROI)was?

A) 7%.

B) 8%.

C) 9%.

D) 10%.

A) 7%.

B) 8%.

C) 9%.

D) 10%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

47

If the Axle Division sells 16,000 units per year,the return on investment should be?

A) 12%.

B) 15%.

C) 16%.

D) 18%.

A) 12%.

B) 15%.

C) 16%.

D) 18%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

48

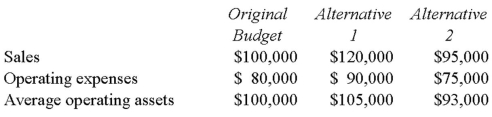

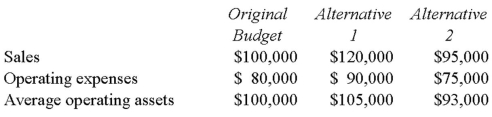

Stephanie Co.'s managers are considering alternative strategies to improve ROI from its current budgeted 20% for the coming year.Alternative 1 has more money spent on advertising to increase sales while alternative 2 has the budget for meals and entertainment expenses eliminated with a drop off in sales as a result.Adjustments to operating assets are anticipated in each of the two alternatives as well.The numbers as in the original budget and in the two alternatives are set out below:  What is the relative ranking based upon ROI of the above three choices (highest to lowest)?

What is the relative ranking based upon ROI of the above three choices (highest to lowest)?

A) Original Budget,Alternative 1,Alternative 2.

B) Alternative 1,Alternative 2,Original Budget.

C) Alternative 2,Original Budget,Alternative 1.

D) Original Budget,Alternative 2,Alternative 1.

What is the relative ranking based upon ROI of the above three choices (highest to lowest)?

What is the relative ranking based upon ROI of the above three choices (highest to lowest)?A) Original Budget,Alternative 1,Alternative 2.

B) Alternative 1,Alternative 2,Original Budget.

C) Alternative 2,Original Budget,Alternative 1.

D) Original Budget,Alternative 2,Alternative 1.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

49

Division A's sales are?

A) $125,000.

B) $200,000.

C) $400,000.

D) $625,000.

A) $125,000.

B) $200,000.

C) $400,000.

D) $625,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

50

Reed Company's sales last year totalled $150,000 and its return on investment (ROI)was 12%.If the company's turnover was 3,then its net operating income for the year must have been?

A) $2,000.

B) $6,000.

C) $18,000.

D) $12,000.

A) $2,000.

B) $6,000.

C) $18,000.

D) $12,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

51

Howe Company increased its ROI from 20% to 25%.Net operating income and sales remained at their previous levels of $40,000 and $1,000,000 respectively.The increase in ROI was attributed to a reduction in average operating assets brought about by the sale of obsolete inventory at cost (the proceeds from the sale were used to reduce bank loans).By how much was inventory reduced?

A) $8,000.

B) $10,000.

C) $40,000.

D) it is impossible to determine from the data given.

A) $8,000.

B) $10,000.

C) $40,000.

D) it is impossible to determine from the data given.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

52

Largo Company recorded for the past year,sales of $750,000 and had average operating assets of $375,000.What is the margin that Largo Company needed to earn in order to achieve an ROI of 15%?

A) 2.00%.

B) 7.50%.

C) 9.99%.

D) 15.00%.

A) 2.00%.

B) 7.50%.

C) 9.99%.

D) 15.00%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

53

The Northern Division of the Smith Company had average operating assets totalling $150,000 last year.If the minimum required rate of return is 12% and if last year's net operating income at Northern was $20,000,then the residual income for Northern last year was?

A) $2,000.

B) $5,000.

C) $18,000.

D) $20,000.

A) $2,000.

B) $5,000.

C) $18,000.

D) $20,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

54

Company A's return on investment (ROI)is?

A) 4%.

B) 15%.

C) 20%.

D) 36%.

A) 4%.

B) 15%.

C) 20%.

D) 36%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

55

A company had the following results last year: sales,$700,000;return on investment,28%;and margin,8%.The average operating assets last year were?

A) $200,000.

B) $540,000.

C) $2,450,000.

D) $2,500,000.

A) $200,000.

B) $540,000.

C) $2,450,000.

D) $2,500,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

56

If the Axle Division sells 15,000 units per year,the residual income should be?

A) $10,000.

B) $30,000.

C) $50,000.

D) $100,000.

A) $10,000.

B) $30,000.

C) $50,000.

D) $100,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

57

Cable Company had the following results for the year just ended:  Cable Company's average operating assets during the year were?

Cable Company's average operating assets during the year were?

A) $10,000.

B) $12,500.

C) $50,000.

D) $200,000.

Cable Company's average operating assets during the year were?

Cable Company's average operating assets during the year were?A) $10,000.

B) $12,500.

C) $50,000.

D) $200,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

58

Company A's residual income is?

A) $9,000.

B) $21,000.

C) $24,000.

D) $45,000.

A) $9,000.

B) $21,000.

C) $24,000.

D) $45,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

59

Suppose the manager of the Axle Division desires an annual residual income of $45,000.In order to achieve this,Axle should sell how many units per year?

A) 14,500.

B) 16,750.

C) 18,250.

D) 19,500.

A) 14,500.

B) 16,750.

C) 18,250.

D) 19,500.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

60

Suppose the manager of the Axle Division desires a return on investment of 22%.In order to achieve this goal,the Axle Division must sell how many units per year?

A) 14,500.

B) 16,750.

C) 18,250.

D) 19,500.

A) 14,500.

B) 16,750.

C) 18,250.

D) 19,500.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

61

For the past year,the margin was?

A) 12.50%.

B) 13.00%.

C) 14.75%.

D) 15.00%.

A) 12.50%.

B) 13.00%.

C) 14.75%.

D) 15.00%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

62

The margin for the past year was?

A) 8.0%.

B) 11.2%.

C) 14.4%.

D) 19.2%.

A) 8.0%.

B) 11.2%.

C) 14.4%.

D) 19.2%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

63

The return on investment for the past year was?

A) 8%.

B) 20%.

C) 28%.

D) 36%.

A) 8%.

B) 20%.

C) 28%.

D) 36%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

64

The average operating assets in Year 2 were?

A) $720,000.

B) $750,000.

C) $800,000.

D) $900,000.

A) $720,000.

B) $750,000.

C) $800,000.

D) $900,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

65

The net operating income in Year 1 was?

A) $90,000.

B) $135,000.

C) $140,000.

D) $150,000.

A) $90,000.

B) $135,000.

C) $140,000.

D) $150,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

66

For the past year,the return on investment was?

A) 15.75%.

B) 20.50%.

C) 25.00%

D) 31.25%.

A) 15.75%.

B) 20.50%.

C) 25.00%

D) 31.25%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

67

Division B's average operating assets are?

A) $81,200.

B) $130,000.

C) $1,333,333.

D) $2,080,000.

A) $81,200.

B) $130,000.

C) $1,333,333.

D) $2,080,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

68

For the past year,the minimum required rate of return was?

A) 11%.

B) 12%.

C) 13%.

D) 14%.

A) 11%.

B) 12%.

C) 13%.

D) 14%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

69

The turnover for the past year was?

A) 1.40.

B) 2.50.

C) 2.98.

D) 6.94.

A) 1.40.

B) 2.50.

C) 2.98.

D) 6.94.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

70

How much is the residual income?

A) $40,000.

B) $80,000.

C) $100,000.

D) $420,000.

A) $40,000.

B) $80,000.

C) $100,000.

D) $420,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

71

How much is the return on the investment?

A) 12.5%.

B) 20%.

C) 25%.

D) 40%.

A) 12.5%.

B) 20%.

C) 25%.

D) 40%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

72

Sales in Year 1 amounted to?

A) $400,000.

B) $750,000.

C) $900,000.

D) $1,200,000.

A) $400,000.

B) $750,000.

C) $900,000.

D) $1,200,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

73

The net operating income for Year 1 was?

A) $240,000.

B) $256,000.

C) $384,000.

D) $768,000.

A) $240,000.

B) $256,000.

C) $384,000.

D) $768,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

74

How much is the residual income?

A) $10,000.

B) $40,000.

C) $50,000.

D) $80,000.

A) $10,000.

B) $40,000.

C) $50,000.

D) $80,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

75

The minimum required rate of return for the past year was?

A) 8%.

B) 12%.

C) 36%.

D) 40%.

A) 8%.

B) 12%.

C) 36%.

D) 40%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

76

The residual income for the Northern Division last year was?

A) $48,000.

B) $90,000.

C) $125,000.

D) $135,000.

A) $48,000.

B) $90,000.

C) $125,000.

D) $135,000.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

77

How much is the return on investment?

A) 15%.

B) 16%.

C) 20%.

D) 40%.

A) 15%.

B) 16%.

C) 20%.

D) 40%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

78

The return on investment last year for the Northern Division was?

A) 18.00%.

B) 28.13%.

C) 40.00%.

D) 62.50%.

A) 18.00%.

B) 28.13%.

C) 40.00%.

D) 62.50%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

79

The margin in Year 2 was?

A) 12.00%.

B) 18.75%.

C) 22.50%.

D) 27.00%.

A) 12.00%.

B) 18.75%.

C) 22.50%.

D) 27.00%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

80

For the past year,the turnover was?

A) 2.

B) 4.

C) 10.

D) 25.

A) 2.

B) 4.

C) 10.

D) 25.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck