Deck 12: Investments: Debt and Equity Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/89

Play

Full screen (f)

Deck 12: Investments: Debt and Equity Securities

1

The equity method of accounting for an investment in the common stock of another company should be used when the investment

A) Is composed of common stock and it is the investor's intent to vote on corporate matters

B) Ensures a source of supply such as raw materials

C) Enables the investor to exercise significant influence over the investee

D) Gives the investor voting control over the investee

A) Is composed of common stock and it is the investor's intent to vote on corporate matters

B) Ensures a source of supply such as raw materials

C) Enables the investor to exercise significant influence over the investee

D) Gives the investor voting control over the investee

C

2

The equity method is used to account for an investment of more than 20% of another company's

A) Bonds

B) Preferred stock

C) Common stock

D) Convertible bonds

A) Bonds

B) Preferred stock

C) Common stock

D) Convertible bonds

C

3

Accounting for investments under the equity method generally applies when the level of ownership in another company is at what percentage?

A) Less than 20 percent

B) 20 percent to 30 percent

C) 20 percent to 50 percent

D) More than 50 percent

A) Less than 20 percent

B) 20 percent to 30 percent

C) 20 percent to 50 percent

D) More than 50 percent

C

4

Which type of securities are purchased with the intent of selling them in the near future?

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

5

What are the two general types of securities purchased by companies?

A) Debt and bonds

B) Debt and equity

C) Stock and equity

D) Common and preferred

A) Debt and bonds

B) Debt and equity

C) Stock and equity

D) Common and preferred

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

6

If a trading security is sold, the investment account is

A) Debited for the market value of the security

B) Credited for the cost of the security

C) Credited for the market value of the security

D) Debited for the cost of the security

A) Debited for the market value of the security

B) Credited for the cost of the security

C) Credited for the market value of the security

D) Debited for the cost of the security

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

7

A financial instrument that carries with it the promise to pay interest payments and repay the principal amount is a(n)

A) Debt security

B) Equity security

C) Both debt and equity security

D) Neither debt nor equity security

A) Debt security

B) Equity security

C) Both debt and equity security

D) Neither debt nor equity security

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is NOT a typical reason that a company would prefer a debt security over an equity security?

A) Certainty of income

B) Low risk level

C) Certainty of repayment at maturity

D) Voting rights

A) Certainty of income

B) Low risk level

C) Certainty of repayment at maturity

D) Voting rights

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

9

Which category of security does NOT include debt securities?

A) Available-for-sale

B) Trading

C) Equity method

D) Held-to-maturity

A) Available-for-sale

B) Trading

C) Equity method

D) Held-to-maturity

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

10

A financial instrument that represents actual ownership in a corporation is a(n)

A) Debt security

B) Equity security

C) Both debt and equity security

D) Neither debt nor equity security

A) Debt security

B) Equity security

C) Both debt and equity security

D) Neither debt nor equity security

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

11

Consolidated financial statements are typically prepared when one company has

A) Accounted for its investment in another company by the equity method

B) Significant influence over the operating and financial policies of another company

C) The controlling financial interest in another company

D) A substantial equity interest in the net assets of another company

A) Accounted for its investment in another company by the equity method

B) Significant influence over the operating and financial policies of another company

C) The controlling financial interest in another company

D) A substantial equity interest in the net assets of another company

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following is NOT one of the acceptable classifications for investments?

A) Trading securities

B) Available-for-sale securities

C) Equity method securities

D) Control securities

A) Trading securities

B) Available-for-sale securities

C) Equity method securities

D) Control securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

13

Harvey Corporation purchased 1,200 of the 3,000 outstanding shares of Michael Company common stock for $50 per share. Given this information, Harvey Corporation should account for the investment in Michael Company stock using the

A) Cost method

B) Equity method

C) Effective-amortization method

D) Straight-line amortization method

A) Cost method

B) Equity method

C) Effective-amortization method

D) Straight-line amortization method

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

14

The most common type of debt security is

A) Common stock

B) Preferred stock

C) Bonds

D) None of these are debt securities

A) Common stock

B) Preferred stock

C) Bonds

D) None of these are debt securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

15

If a trading security is bought, the investment account is

A) Debited for the cost of the security NOT including any extra expenditures required in making the purchase

B) Credited for the cost of the security NOT including any extra expenditures required in making the purchase

C) Credited for the cost of the security including any extra expenditures required in making the purchase

D) Debited for the cost of the security including any extra expenditures required in making the purchase

A) Debited for the cost of the security NOT including any extra expenditures required in making the purchase

B) Credited for the cost of the security NOT including any extra expenditures required in making the purchase

C) Credited for the cost of the security including any extra expenditures required in making the purchase

D) Debited for the cost of the security including any extra expenditures required in making the purchase

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

16

Unless there is compelling evidence to the contrary, significant influence is presumed when a company owns

A) 20 to 50 percent of the outstanding voting stock of another company

B) 50 percent or more of the outstanding voting stock of another company

C) 0 to 20 percent of the outstanding voting stock of another company

D) 10 to 40 percent of the outstanding voting stock of another company

A) 20 to 50 percent of the outstanding voting stock of another company

B) 50 percent or more of the outstanding voting stock of another company

C) 0 to 20 percent of the outstanding voting stock of another company

D) 10 to 40 percent of the outstanding voting stock of another company

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

17

Which type of securities is purchased with the intent of holding the security until it matures?

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is NOT typically a reason why one company would invest in another company?

A) To diversify product offerings

B) To ensure a supply of raw materials

C) To recruit key personnel

D) To acquire a new product

A) To diversify product offerings

B) To ensure a supply of raw materials

C) To recruit key personnel

D) To acquire a new product

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is NOT typically a reason why one company would invest in another company?

A) To earn higher returns than those offered by banks

B) To make a safer investment than those offered by banks

C) To influence the board of directors

D) To make use of seasonal increases in cash flows

A) To earn higher returns than those offered by banks

B) To make a safer investment than those offered by banks

C) To influence the board of directors

D) To make use of seasonal increases in cash flows

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

20

Which category includes only debt securities?

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

21

On January 5, 2012, Gannon Corporation purchased 100 shares of Hedney Company stock at $12 per share and paid a $50 brokerage commission. Gannon classified the shares as available-for-sale securities. On May 31, 2012, the entry to record the receipt of the 60-cent-per-share dividend would include a credit to

A) Dividend Revenue for $100

B) Long-Term Investments for $60

C) Dividend Revenue for $60

D) Long-Term Investments for $100

A) Dividend Revenue for $100

B) Long-Term Investments for $60

C) Dividend Revenue for $60

D) Long-Term Investments for $100

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

22

On January 1, 2011, Ailey Company purchased a $30,000, 8% bond, at face value. Interest is paid annually each January 1. The entry related to this investment on December 31, 2011, would include a

A) Debit to Interest Receivable for $2,400

B) Credit to Interest Expense for $2,400

C) Debit to Interest Revenue for $2,400

D) Credit to Cash for $2,400

A) Debit to Interest Receivable for $2,400

B) Credit to Interest Expense for $2,400

C) Debit to Interest Revenue for $2,400

D) Credit to Cash for $2,400

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

23

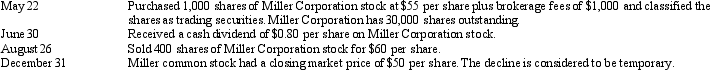

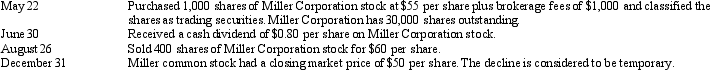

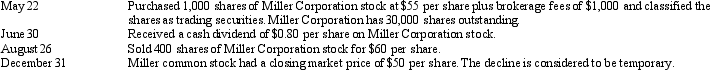

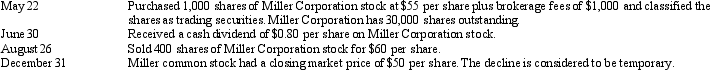

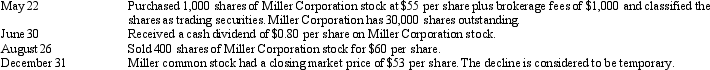

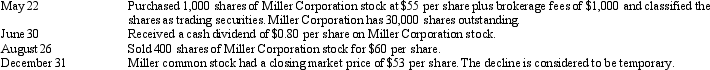

Exhibit 12-1 Augsburg Corporation recorded the following transactions for its long-term investments during 2012:

Refer to Exhibit 12-1. Given the information above, on May 22, Augsburg should

Refer to Exhibit 12-1. Given the information above, on May 22, Augsburg should

A) Credit Investment in Trading Securities for $55,000

B) Debit Investment in Trading Securities for $56,000

C) Credit Cash for $56,000

D) Debit Cash for $55,000

Refer to Exhibit 12-1. Given the information above, on May 22, Augsburg should

Refer to Exhibit 12-1. Given the information above, on May 22, Augsburg shouldA) Credit Investment in Trading Securities for $55,000

B) Debit Investment in Trading Securities for $56,000

C) Credit Cash for $56,000

D) Debit Cash for $55,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

24

On May 1, one hundred shares of stock were originally purchased for $124 per share and are being held as trading securities. The price decreased to $116 per share on August 1 and then increased to $132 on December 31. At what amount should the investment be valued in the December 31 balance sheet?

A) $11,600

B) $12,400

C) $13,200

D) Some other amount

A) $11,600

B) $12,400

C) $13,200

D) Some other amount

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

25

On January 2, 2012, Forsyth Co. acquired 4,000 shares of Hiram Company common stock for $44,000 and classified these shares as available-for-sale securities. During 2012, Forsyth received $12,000 of cash dividends. The fair value of Hiram's stock on December 31, 2012, was $14 per share. Forsyth should report the following amount in 2012 related to Hiram Co.

A) Revenue of $12,000

B) Revenue of $24,000

C) A $56,000 decrease in the investment account

D) A $56,000 increase in the investment account

A) Revenue of $12,000

B) Revenue of $24,000

C) A $56,000 decrease in the investment account

D) A $56,000 increase in the investment account

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

26

On January 2, 2012, Murray Corporation bought 15 percent of Castro Corporation's capital stock for $60,000 and classified it as available-for-sale securities. Castro's net income for the year ended December 31, 2012, was $100,000. During 2012, Castro declared a dividend of $140,000. On December 31, 2012, the fair value of the Castro stock owned by Murray had increased to $90,000. How much should Murray show on its 2012 income statement as income from this investment?

A) $3,150

B) $15,000

C) $21,000

D) $51,000

A) $3,150

B) $15,000

C) $21,000

D) $51,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

27

Changes in fair value of securities are reported in the income statement for which type of securities?

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

28

Unrealized losses on trading securities are

A) Classified as contra-owners' equity accounts

B) Recorded only when the stock is sold

C) Classified as a contra-investment asset account

D) Included in a section on the income statement

A) Classified as contra-owners' equity accounts

B) Recorded only when the stock is sold

C) Classified as a contra-investment asset account

D) Included in a section on the income statement

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

29

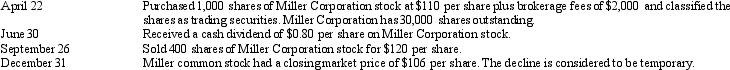

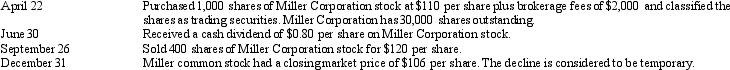

Exhibit 12-1 Augsburg Corporation recorded the following transactions for its long-term investments during 2012:

Refer to Exhibit 12-1. Given the information above, on August 26, Augsburg should

Refer to Exhibit 12-1. Given the information above, on August 26, Augsburg should

A) Credit Investment in Trading Securities for $22,000

B) Credit Realized Gain on Sale of Securities for $1,600

C) Credit Realized Gain on Sale of Securities for $1,200

D) Debit Dividend Revenue for $23,600

Refer to Exhibit 12-1. Given the information above, on August 26, Augsburg should

Refer to Exhibit 12-1. Given the information above, on August 26, Augsburg shouldA) Credit Investment in Trading Securities for $22,000

B) Credit Realized Gain on Sale of Securities for $1,600

C) Credit Realized Gain on Sale of Securities for $1,200

D) Debit Dividend Revenue for $23,600

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

30

During 2012, Walker Corporation acquired 500 shares of Wychek stock at $30 per share. Walker Corporation accounted for the stock as available-for-sale securities. All declines in market value are considered to be temporary. The market price per share of Wychek's stock as of December 31, 2012 and 2013, is $22.50 and $37.50, respectively. Given this information, the correct adjusting entry by walker at December 31, 2013, would include a credit to

A) Market Adjustment - Available-for-Sale Securities of $3,750

B) Unrealized Increase in Value of Available-for-Sale Securities - Equity of $7,500

C) Market Adjustment - Available-for-Sale Securities of $7,500

D) Unrealized Increase in Value of Available-for-Sale Securities - Equity of $3,750

A) Market Adjustment - Available-for-Sale Securities of $3,750

B) Unrealized Increase in Value of Available-for-Sale Securities - Equity of $7,500

C) Market Adjustment - Available-for-Sale Securities of $7,500

D) Unrealized Increase in Value of Available-for-Sale Securities - Equity of $3,750

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

31

Augsburg Corporation recorded the following transactions for its short-term investments during 2012:  Given this information, the adjusting entry that Augsburg needs to make on December 31 is

Given this information, the adjusting entry that Augsburg needs to make on December 31 is

A) Market Adjustment - Trading Securities 1,800

Unrealized Loss on Trading

Securities - Income 1,800

B) Unrealized Loss on Trading Securities - Income 1,800

Market Adjustment - Trading

Securities 1,800

C) Market Adjustment - Trading Securities 3,000

Unrealized Loss on Trading

Securities - Income 3,000

D) Unrealized Loss on Trading Securities - Income 3,000

Market Adjustment - Trading

Securities 3,000

Given this information, the adjusting entry that Augsburg needs to make on December 31 is

Given this information, the adjusting entry that Augsburg needs to make on December 31 isA) Market Adjustment - Trading Securities 1,800

Unrealized Loss on Trading

Securities - Income 1,800

B) Unrealized Loss on Trading Securities - Income 1,800

Market Adjustment - Trading

Securities 1,800

C) Market Adjustment - Trading Securities 3,000

Unrealized Loss on Trading

Securities - Income 3,000

D) Unrealized Loss on Trading Securities - Income 3,000

Market Adjustment - Trading

Securities 3,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

32

A net unrealized increase in the value of available-for-sale securities (considered as a whole) should be reflected in the current financial statements as

A) An extraordinary item on the income statement which increases retained earnings

B) A current revenue resulting from holding securities

C) Only a disclosure in the footnotes to the financial statements

D) A valuation allowance which is included in the equity section of the balance sheet

A) An extraordinary item on the income statement which increases retained earnings

B) A current revenue resulting from holding securities

C) Only a disclosure in the footnotes to the financial statements

D) A valuation allowance which is included in the equity section of the balance sheet

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is NOT one of the issues associated with accounting for securities?

A) Accounting for the purchase

B) Accounting for the dividend revenue earned

C) Accounting for the changes in value

D) All of these are an issue associated with accounting for securities

A) Accounting for the purchase

B) Accounting for the dividend revenue earned

C) Accounting for the changes in value

D) All of these are an issue associated with accounting for securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

34

Unrealized holding gains or losses which are recognized in income are from securities classified as

A) Trading

B) Available-for-sale

C) Held-to-maturity

D) Income producing

A) Trading

B) Available-for-sale

C) Held-to-maturity

D) Income producing

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

35

If 2,500 shares of stock are purchased for $90 per share and are sold one year later for $82 per share, what is the net gain or loss on sale? (Assume that there are no transaction costs.)

A) $20,000 gain

B) $20,000 loss

C) $2,500 gain

D) $2,500 loss

A) $20,000 gain

B) $20,000 loss

C) $2,500 gain

D) $2,500 loss

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

36

During 2012, Walker Corp. acquired 500 shares of Wychek stock at $30 per share. Walker accounted for the stock as trading securities. The market price per share of Wychek's stock as of December 31, 2012 and 2013, is $22.50 and $37.50, respectively. How much unrealized gain or loss on long-term investments should Walker report on its December 31, 2012, income statement?

A) $3,750 unrealized loss

B) $11,250 unrealized loss

C) $1,875 unrealized gain

D) No unrealized gain or loss

A) $3,750 unrealized loss

B) $11,250 unrealized loss

C) $1,875 unrealized gain

D) No unrealized gain or loss

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

37

Changes in fair value of securities are reported in the stockholders' equity section of the balance sheet for which type of securities?

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

A) Marketable equity securities

B) Available-for-sale securities

C) Trading securities

D) Held-to-maturity securities

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

38

A realized gain or loss indicates that

A) An arm's-length transaction has occurred

B) The securities have actually been sold

C) Both an arm's-length transaction has occurred and the securities have actually been sold

D) Neither an arm's-length transaction has occurred nor the securities have actually been sold

A) An arm's-length transaction has occurred

B) The securities have actually been sold

C) Both an arm's-length transaction has occurred and the securities have actually been sold

D) Neither an arm's-length transaction has occurred nor the securities have actually been sold

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

39

A net unrealized decrease in the value of available-for-sale securities (considered as a whole) should be reflected in the current financial statements as

A) An extraordinary item on the income statement which reduces retained earnings

B) A current liability resulting from holding securities

C) Only a disclosure in the footnotes to the financial statements

D) A valuation allowance which is included in the equity section of the balance sheet

A) An extraordinary item on the income statement which reduces retained earnings

B) A current liability resulting from holding securities

C) Only a disclosure in the footnotes to the financial statements

D) A valuation allowance which is included in the equity section of the balance sheet

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

40

In July 2011, Leaf Company acquired 5,000 shares of the common stock of Ryan Corporation and classified the shares as trading securities. The following January, Ryan announced net income of $100,000 for 2011 and declared a cash dividend of $0.50 per share on its 100,000 shares of outstanding common stock. The Leaf Company dividend revenue from Ryan Corporation in January 2012 would be

A) $0

B) $2,500

C) $5,000

D) $10,000

A) $0

B) $2,500

C) $5,000

D) $10,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

41

The amortization of a bond discount

A) Increases the amount of interest revenue earned on an investment in bonds

B) Decreases the amount of interest revenue earned on an investment in bonds

C) Decreases the balance of the Investment account

D) Does not affect the balance in the Investment account

A) Increases the amount of interest revenue earned on an investment in bonds

B) Decreases the amount of interest revenue earned on an investment in bonds

C) Decreases the balance of the Investment account

D) Does not affect the balance in the Investment account

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

42

The entry to amortize an investment in bonds purchased at a discount includes a debit to

A) Investment in Bonds

B) Interest Expense

C) Bond Interest Revenue

D) Bond Discount

A) Investment in Bonds

B) Interest Expense

C) Bond Interest Revenue

D) Bond Discount

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

43

On January 1, 2012, Roswell purchased ten $1,000, 12 percent, 10-year bonds issued by E. T. Corporation at 101. The bonds pay interest on June 30 and December 31. When the bonds showed an unamortized balance of $10,070, Roswell sold them for $10,050. How much gain or loss should Roswell record on the sale?

A) $100 gain

B) $50 gain

C) $30 loss

D) $20 loss

A) $100 gain

B) $50 gain

C) $30 loss

D) $20 loss

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

44

Farve purchased ten $1,000, 10 percent bonds issued by Marino Corporation for 104 on July 1, 2012. The bonds will mature on July 1, 2022, and pay interest on June 30 and December 31. Farve uses the straight-line method to amortize premiums and discounts. How much interest revenue should Farve recognize from its investment for the year ending December 31, 2012?

A) $480

B) $485

C) $500

D) $520

A) $480

B) $485

C) $500

D) $520

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

45

On April 1, 2012, Fiedler purchased $10,000 of Hun Corporation Bonds at 96 plus accrued interest. The bonds pay interest of 10 percent semiannually on March 1 and September 1. To record this acquisition, Fiedler should debit Investments in Held-to-Maturity Securities - Hun's Bonds for

A) $9,600

B) $9,700

C) $10,000

D) $10,100

A) $9,600

B) $9,700

C) $10,000

D) $10,100

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

46

Janis Corporation purchased $60,000 of Keller Corporation's 10 percent bonds at 96 plus accrued interest on March 1, 2012. The bonds mature on January 1, 2022, and interest is payable on June 30 and December 31. How much did Simpson pay in total on March 1, 2012?

A) $60,000

B) $58,600

C) $57,600

D) $56,600

A) $60,000

B) $58,600

C) $57,600

D) $56,600

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

47

Cleveland purchased $100,000 of Rob Company's 10-year, 9 percent bonds for $83,050 on July 1, 2012. Cleveland purchased the bonds to yield 12 percent interest. If Cleveland uses the effective-interest method to amortize discounts, how much interest revenue should Cleveland recognize for 2012 as a result of the investment?

A) $7,474

B) $6,000

C) $5,767

D) $4,983

A) $7,474

B) $6,000

C) $5,767

D) $4,983

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

48

The total amount of interest earned when bonds are purchased at a premium is the amount of the cash interest payments

A) Plus the discount

B) Minus the discount

C) Plus the premium

D) Minus the premium

A) Plus the discount

B) Minus the discount

C) Plus the premium

D) Minus the premium

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

49

Mel Company purchased $60,000 of Gibson Company's 20-year, 8 percent bonds at 98 on November 1, 2012. The bonds pay interest each January 1 and July 1, and they mature on July 1, 2029. Given this information, the entry to record the purchase of Gibson Company bonds would include a

A) Debit to Interest Receivable of $800

B) Debit to Held-to-Maturity Securities of $60,000

C) Credit to Cash of $60,400

D) Credit to Interest Revenue of $1,600

A) Debit to Interest Receivable of $800

B) Debit to Held-to-Maturity Securities of $60,000

C) Credit to Cash of $60,400

D) Credit to Interest Revenue of $1,600

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

50

On January 1, 2012, Ya-Ling Co. paid $500,000 for 20,000 shares of Chen Co.'s common stock and classified these shares as trading securities. The fair value of Chen Co.'s stock at December 31, 2012, is $27 per share. What is the net asset amount (which includes both investments and any related market adjustments) attributable to the investment in Chen that will be included on Ya-Ling's balance sheet at December 31, 2012?

A) $0

B) $40,000

C) $500,000

D) $540,000

A) $0

B) $40,000

C) $500,000

D) $540,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

51

When bonds that are held as a long-term investment are sold before their maturity dates, the difference between the sales price and the balance in the Investment account is

A) Debited or credited to Capital Stock

B) Recorded as a gain or loss on the sale

C) Recorded directly to Retained Earnings

D) Recorded as interest revenue or expense

A) Debited or credited to Capital Stock

B) Recorded as a gain or loss on the sale

C) Recorded directly to Retained Earnings

D) Recorded as interest revenue or expense

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

52

Lilburn Inc. purchased $56,000 of Metter Corporation's 12 percent, 10-year bonds on January 1, 2011, for $59,360 plus accrued interest. Interest on the bonds is payable on April 1 and October 1. On January 1, 2012, Lilburn sold the bonds for 103 plus accrued interest. As a result of the sale, Lilburn should debit Cash for

A) $58,900

B) $56,000

C) $59,360

D) $57,680

A) $58,900

B) $56,000

C) $59,360

D) $57,680

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

53

On April 1, 2012, Bering Inc. purchased $20,000 of Warner Corporation's 10-year, 8 percent bonds at par plus accrued interest. Interest is payable on June 30 and December 31. How much interest revenue should Bering report on its December 31, 2012, income statement as a result of this investment?

A) $1,248

B) $1,200

C) $824

D) $800

A) $1,248

B) $1,200

C) $824

D) $800

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

54

The journal entry to record the amortization of a premium resulting from an investment in bonds would cause

A) An increase in Investment in Bonds

B) An increase in Bond Interest Revenue

C) A decrease in Bond Interest Revenue

D) No change in Investment in Bonds

A) An increase in Investment in Bonds

B) An increase in Bond Interest Revenue

C) A decrease in Bond Interest Revenue

D) No change in Investment in Bonds

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

55

Rouen Corporation recorded the following transactions for its short-term investments during 2012:  Given this information, the adjusting entry that Rouen needs to make on December 31 is

Given this information, the adjusting entry that Rouen needs to make on December 31 is

A) Market Adjustment - Trading Securities 3,600

Unrealized Loss on Trading

Securities - Income 3,600

B) Unrealized Loss on Trading Securities - Income 3,600

Market Adjustment - Trading

Securities 3,600

C) Market Adjustment - Trading Securities 6,000

Unrealized Loss on Trading

Securities - Income 6,000

D) Unrealized Loss on Trading Securities - Income 6,000

Market Adjustment - Trading

Securities 6,000

Given this information, the adjusting entry that Rouen needs to make on December 31 is

Given this information, the adjusting entry that Rouen needs to make on December 31 isA) Market Adjustment - Trading Securities 3,600

Unrealized Loss on Trading

Securities - Income 3,600

B) Unrealized Loss on Trading Securities - Income 3,600

Market Adjustment - Trading

Securities 3,600

C) Market Adjustment - Trading Securities 6,000

Unrealized Loss on Trading

Securities - Income 6,000

D) Unrealized Loss on Trading Securities - Income 6,000

Market Adjustment - Trading

Securities 6,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

56

On January 1, 2012, Young Inc. purchased $50,000 of Montana Corporation 14 percent bonds for $53,000. Interest is payable semiannually. If Young desires a 12 percent rate of return, how much premium should be amortized on June 30, 2012, using the effective-interest method?

A) $3,180

B) $1,855

C) $320

D) $210

A) $3,180

B) $1,855

C) $320

D) $210

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

57

When investors purchase bonds between interest dates, they

A) Earn "extra" interest

B) Do not earn any interest until after the first interest date has passed

C) Must purchase the accrued interest from the seller

D) Receive interest based on the market price at the beginning of the period

A) Earn "extra" interest

B) Do not earn any interest until after the first interest date has passed

C) Must purchase the accrued interest from the seller

D) Receive interest based on the market price at the beginning of the period

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

58

If a 12 percent, $16,000 face value bond sells for $14,000, the effective interest rate will be

A) Less than 12 percent

B) Greater than 12 percent

C) Equal to 12 percent

D) Unknown; more information is needed

A) Less than 12 percent

B) Greater than 12 percent

C) Equal to 12 percent

D) Unknown; more information is needed

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

59

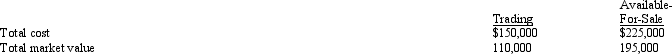

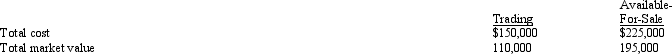

Nguyen Inc. began business on January 1, 2012, and at December 31, 2012, Nguyen had the following investment portfolios of equity securities:  Unrealized losses at December 31, 2012, should be recorded with corresponding charges against Income and Stockholders' Equity of

Unrealized losses at December 31, 2012, should be recorded with corresponding charges against Income and Stockholders' Equity of

A) $70,000 and $0, respectively

B) $40,000 and $30,000, respectively

C) $30,000 and 40,000, respectively

D) $0 and $70,000, respectively

Unrealized losses at December 31, 2012, should be recorded with corresponding charges against Income and Stockholders' Equity of

Unrealized losses at December 31, 2012, should be recorded with corresponding charges against Income and Stockholders' Equity ofA) $70,000 and $0, respectively

B) $40,000 and $30,000, respectively

C) $30,000 and 40,000, respectively

D) $0 and $70,000, respectively

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

60

Mel Company purchased $60,000 of Gibson Company's 20-year, 8 percent bonds at 98 on July 1, 2012. The bonds pay interest each January 1 and July 1, and they mature on July 1, 2029. Given this information, the entry to record the purchase of Gibson Company bonds would include a

A) Debit to Held-to-Maturity Securities of $58,800

B) Debit to Held-to-Maturity Securities of $60,000

C) Credit to Cash of $60,000

D) Credit to Interest Revenue of $5,000

A) Debit to Held-to-Maturity Securities of $58,800

B) Debit to Held-to-Maturity Securities of $60,000

C) Credit to Cash of $60,000

D) Credit to Interest Revenue of $5,000

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

61

Bart Corporation purchased 1,200 of the 3,000 outstanding shares of Starr Company common stock for $50 per share. Given this information, when Bart Corporation receives a cash dividend from Starr Company, which of the following accounts should be credited?

A) Revenue from Investments

B) Dividend Revenue

C) Investment in Equity Method Securities

D) None of these will be credited

A) Revenue from Investments

B) Dividend Revenue

C) Investment in Equity Method Securities

D) None of these will be credited

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

62

Mel Company purchased $60,000 of Gibson Company's 20-year, 8 percent bonds at 98 on July 1, 2012. The bonds pay interest each January 1 and July 1, and they mature on July 1, 2029. Given this information, the entry needed on December 31, 2012 (year-end), to account for the interest on Gibson Company's bonds would include a debit to

A) Cash of $4,800

B) Cash of $2,400

C) Interest Receivable of $4,800

D) Interest Receivable of $2,400

A) Cash of $4,800

B) Cash of $2,400

C) Interest Receivable of $4,800

D) Interest Receivable of $2,400

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

63

On January 1, 2012, Newton Corporation purchased $200,000 of 10-year, 10 percent bonds for $227,184 to yield 8 percent annually. The bonds pay interest on January 1, and July 1 of each year. If Tomas uses the effective interest method of amortization, how much interest revenue will the company record for the first six months? (rounded)

A) $10,912

B) $10,000

C) $9,087

D) $8,912

A) $10,912

B) $10,000

C) $9,087

D) $8,912

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

64

Answer the following questions with respect to classifications of security:

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

65

Cleveland purchased $200,000 of Clair Company's 10-year, 9 percent bonds for $166,100 on July 1, 2012. Cleveland purchased the bonds to yield 12 percent interest. If Cleveland uses the effective-interest method to amortize discounts, how much interest revenue should Cleveland recognize for 2012 as a result of the investment?

A) $14,948

B) $12,000

C) $11,534

D) $9,966

A) $14,948

B) $12,000

C) $11,534

D) $9,966

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

66

When an investor uses the equity method to account for investments in common stock, cash dividends received by the investor from the investee should be recorded as

A) An increase in the investment account

B) A deduction from the investment account

C) Dividend revenue

D) A deduction from the investor's share of the investee's profits

A) An increase in the investment account

B) A deduction from the investment account

C) Dividend revenue

D) A deduction from the investor's share of the investee's profits

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

67

Johnson Company owns 90% of the outstanding stock of Smith Company. The equity of the remaining 10% of Smith Company stock is called the

A) Parent

B) Minority interest

C) Majority interest

D) Subsidiary

A) Parent

B) Minority interest

C) Majority interest

D) Subsidiary

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

68

On February 19, 2012, Jose Inc. acquired 18,000 shares of Luis Corporation stock at $45 per share. Jose has 50,000 shares outstanding. On December 31, 2012, Luis common stock had a closing market price of $26 per share. Assuming that the decline in market price is considered to be temporary, at December 31, Luis would

A) Make an adjusting entry, including a debit to Unrealized Loss on Equity Method Securities of $342,000

B) Make an adjusting entry, including a credit to Market Adjustment on Equity Method Securities of $468,000

C) Make an adjusting entry, including a credit to Investment in Luis Stock of $342,000

D) Do nothing; an adjusting entry is not required

A) Make an adjusting entry, including a debit to Unrealized Loss on Equity Method Securities of $342,000

B) Make an adjusting entry, including a credit to Market Adjustment on Equity Method Securities of $468,000

C) Make an adjusting entry, including a credit to Investment in Luis Stock of $342,000

D) Do nothing; an adjusting entry is not required

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

69

Stanger Company owns 85% of the outstanding stock of Willden Company. At the end of the year, Willden Company reported revenues of $2,500 and expenses of $1,800. How much will Stanger Company report on its own financial statements as income from Willden Company?

A) $700

B) $825

C) $595

D) $0

A) $700

B) $825

C) $595

D) $0

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

70

When the equity method is used to account for long-term investments in stock, the receipt of dividends is recorded as a credit to

A) The Investment account

B) Dividend revenue

C) Cash

D) Interest revenue

A) The Investment account

B) Dividend revenue

C) Cash

D) Interest revenue

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

71

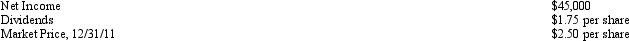

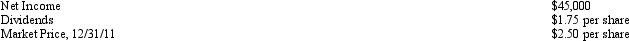

On January 2, 2011, U.S. Buyers, Inc. purchased 5,000 shares of the 20,000 shares outstanding of Latino Corporation stock for $15,000. The following information was reported by Latino during 2011:  U.S. Buyers, Inc. sold all of its Latino Corporation stock on March 1, 2012, for $3.10 per share. The total amount U.S. Buyers, Inc. should report on the sale is

U.S. Buyers, Inc. sold all of its Latino Corporation stock on March 1, 2012, for $3.10 per share. The total amount U.S. Buyers, Inc. should report on the sale is

A) $3,500 gain

B) $3,000 loss

C) $2,000 loss

D) $1,950 loss

U.S. Buyers, Inc. sold all of its Latino Corporation stock on March 1, 2012, for $3.10 per share. The total amount U.S. Buyers, Inc. should report on the sale is

U.S. Buyers, Inc. sold all of its Latino Corporation stock on March 1, 2012, for $3.10 per share. The total amount U.S. Buyers, Inc. should report on the sale isA) $3,500 gain

B) $3,000 loss

C) $2,000 loss

D) $1,950 loss

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

72

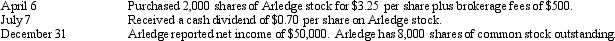

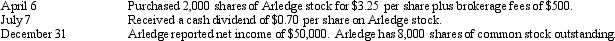

In 2012, Rune had the following activities in long-term investments:  What should be the balance in the Investment in Equity Method Securities-Arledge Stock account as of December 31, 2012?

What should be the balance in the Investment in Equity Method Securities-Arledge Stock account as of December 31, 2012?

A) $17,600

B) $18,100

C) $19,500

D) $20,900

What should be the balance in the Investment in Equity Method Securities-Arledge Stock account as of December 31, 2012?

What should be the balance in the Investment in Equity Method Securities-Arledge Stock account as of December 31, 2012?A) $17,600

B) $18,100

C) $19,500

D) $20,900

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

73

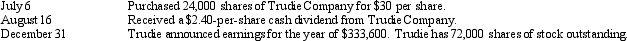

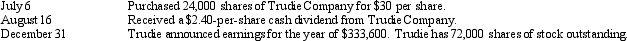

Sasser Inc. had the following activities related to long-term investments during 2012:  Given this information, how much revenue should Sasser report in 2012 for its investment in Trudie stock?

Given this information, how much revenue should Sasser report in 2012 for its investment in Trudie stock?

A) $28,800

B) $111,200

C) $140,000

D) $168,800

Given this information, how much revenue should Sasser report in 2012 for its investment in Trudie stock?

Given this information, how much revenue should Sasser report in 2012 for its investment in Trudie stock?A) $28,800

B) $111,200

C) $140,000

D) $168,800

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

74

When an investor uses the equity method to account for investments in common stock, the investment account will be increased when the investor recognizes

A) A proportionate share of the net income of the investee

B) A cash dividend received from the investee

C) Periodic amortization of the goodwill related to the purchase

D) Depreciation related to the excess of market value over book value of the investee's depreciable assets at the date of purchase by the investor

A) A proportionate share of the net income of the investee

B) A cash dividend received from the investee

C) Periodic amortization of the goodwill related to the purchase

D) Depreciation related to the excess of market value over book value of the investee's depreciable assets at the date of purchase by the investor

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

75

Financial statements in which financial data for two or more companies are combined as a single entity are called

A) Conventional statements

B) Consolidated statements

C) Audited statements

D) Constitutional statements

A) Conventional statements

B) Consolidated statements

C) Audited statements

D) Constitutional statements

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

76

Stanger Company owns 85% of the outstanding stock of Willden Company. At the end of the year, Willden Company reported revenues of $2,500 and expenses of $1,800. How much minority interest will be reported on Stanger Company's financial statements?

A) $700

B) $105

C) $595

D) $0

A) $700

B) $105

C) $595

D) $0

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

77

In general, consolidated financial statements should be prepared

A) When a corporation owns more than 20% of the common stock of another company

B) When a corporation owns more than 50% of the common stock of another company

C) Only when a corporation owns 100% of the common stock of another company

D) Whenever the market value of the stock investment is significantly lower than its cost

A) When a corporation owns more than 20% of the common stock of another company

B) When a corporation owns more than 50% of the common stock of another company

C) Only when a corporation owns 100% of the common stock of another company

D) Whenever the market value of the stock investment is significantly lower than its cost

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

78

On January 1, 2011, the Nevada Company purchased $800,000 of Utah Company's 10 percent, 20-year bonds at 104 and classified the investment as held-to-maturity securities. The bonds pay interest on January 1 and July 1 of each year. Nevada uses straight-line amortization for all premiums and discounts. The entry for the receipt of the semiannual interest on July 1, 2011, is

A) Cash 40,000 Investment in Held to

Maturity Securities 800

Bond Interest Revenue 40,800

B) Cash 40,000 Investment in Held-to

Maturity Securities 800

Bond Interest Revenue 39,200

C) Cash 40,000 Bond Interest Revenue 40,000

D) Cash 40,800 Bond Interest Revenue 40,800

A) Cash 40,000 Investment in Held to

Maturity Securities 800

Bond Interest Revenue 40,800

B) Cash 40,000 Investment in Held-to

Maturity Securities 800

Bond Interest Revenue 39,200

C) Cash 40,000 Bond Interest Revenue 40,000

D) Cash 40,800 Bond Interest Revenue 40,800

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

79

On January 2, 2011, Oakwood, Inc., purchased $800,000 of 10 percent, 10-year bonds for $872,000. The bonds pay interest on January 1 and July 1 of each year. Oakwood uses straight-line amortization for all premiums or discounts. On July 1, 2014, Oakwood sold the bonds for $832,000. How much gain or loss should Oakwood record on the sale?

A) $6,800 gain

B) $6,800 loss

C) $14,800 gain

D) $14,800 loss

A) $6,800 gain

B) $6,800 loss

C) $14,800 gain

D) $14,800 loss

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck

80

Simpson Corporation purchased $30,000 of Tekservice Corporation's 12 percent bonds for $27,345 plus accrued interest on March 1, 2012. The bonds mature on January 1, 2022, and interest is payable on June 30 and December 31. How much discount or premium should be amortized on June 30, 2012, under the straight-line method?

A) $135.00

B) $132.75

C) $90.00

D) $88.50

A) $135.00

B) $132.75

C) $90.00

D) $88.50

Unlock Deck

Unlock for access to all 89 flashcards in this deck.

Unlock Deck

k this deck