Deck 9: Futures and Options on Foreign Exchange

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 9: Futures and Options on Foreign Exchange

1

Which of the following statements is true?

A) The buyer of a forward contract holds a short position.

B) The buyer of a futures contract holds a short position.

C) The buyer of a forward contract holds a wining position.

D) The buyer of a futures contract holds a long position.

A) The buyer of a forward contract holds a short position.

B) The buyer of a futures contract holds a short position.

C) The buyer of a forward contract holds a wining position.

D) The buyer of a futures contract holds a long position.

D

2

In reference to the derivatives market,a "hedger":

A) attempts to profit from a change in the futures price.

B) wants to avoid price variation by locking in a purchase price of the underlying asset through a long position in the futures contract or a sales price through a short position.

C) plays a zero-sum game.

D) speculates the price movement.

A) attempts to profit from a change in the futures price.

B) wants to avoid price variation by locking in a purchase price of the underlying asset through a long position in the futures contract or a sales price through a short position.

C) plays a zero-sum game.

D) speculates the price movement.

B

3

An "option" is:

A) a contract giving the seller (writer) the right, but not the obligation, to buy or sell a given quantity of an asset at an specified price at some time in the future.

B) a contract giving the owner (buyer) the right, but not the obligation, to buy or sell a given quantity of an asset at a specified price at some time in the future.

C) not a derivative, nor a contingent claim, security.

D) unlike a futures or forward contract.

A) a contract giving the seller (writer) the right, but not the obligation, to buy or sell a given quantity of an asset at an specified price at some time in the future.

B) a contract giving the owner (buyer) the right, but not the obligation, to buy or sell a given quantity of an asset at a specified price at some time in the future.

C) not a derivative, nor a contingent claim, security.

D) unlike a futures or forward contract.

B

4

In the absence of transactions costs,for the same maturity and currency:

A) the futures price is always higher than the forward rate.

B) the forward rate is always higher than the futures price.

C) the futures price and the forward rate are the same.

D) the futures price and the forward rate are not related.

A) the futures price is always higher than the forward rate.

B) the forward rate is always higher than the futures price.

C) the futures price and the forward rate are the same.

D) the futures price and the forward rate are not related.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

You have one short position in foreign exchange futures contracts on £s.The contract size is £100,000.During the day the futures exchange rate (measured in $/£)increased by $0.01/£ while the spot exchange rate decreased by 0.01.As a result,you:

A) have won $1,000.

B) have lost $1,000.

C) have neither won nor lost any money.

D) are unable to answer based on the information provided.

A) have won $1,000.

B) have lost $1,000.

C) have neither won nor lost any money.

D) are unable to answer based on the information provided.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

The following Eurodollar futures contract is quoted in the Wall Street Journal:

-Next day,the implied 3-month LIBOR yield drops by 0.10%.What is the new settlement price?

A) 93.49

B) 93.59

C) 93.69

D) cannot be determined

-Next day,the implied 3-month LIBOR yield drops by 0.10%.What is the new settlement price?

A) 93.49

B) 93.59

C) 93.69

D) cannot be determined

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

Eurodollar interest rate futures contracts have all of the following characteristics except:

A) the futures contract is written on a hypothetical $1,000,000 180-day deposit of Eurodollars.

B) no actual delivery of Eurodollars takes place.

C) the contracts are made out many years into the future.

D) the contracts are widely used.

A) the futures contract is written on a hypothetical $1,000,000 180-day deposit of Eurodollars.

B) no actual delivery of Eurodollars takes place.

C) the contracts are made out many years into the future.

D) the contracts are widely used.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

The "open interest" shown in currency futures quotations is:

A) the total number of people indicating interest in buying the contracts in the near future.

B) the total number of people indicating interest in selling the contracts in the near future.

C) the total number of people indicating interest in buying or selling the contracts in the near future.

D) the total number of long or short contracts outstanding for the particular delivery month.

A) the total number of people indicating interest in buying the contracts in the near future.

B) the total number of people indicating interest in selling the contracts in the near future.

C) the total number of people indicating interest in buying or selling the contracts in the near future.

D) the total number of long or short contracts outstanding for the particular delivery month.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose the Canadian Wheat Pool wants to hedge a US dollar payable using futures contracts that trade on the Chicago Mercantile exchange.

A) The Wheat Pool should buy Canadian dollar futures.

B) The Wheat Pool should sell Canadian dollar futures.

C) The Wheat Pool cannot hedge this position.

D) The Wheat Pool should not use the Chicago Mercantile exchange.

A) The Wheat Pool should buy Canadian dollar futures.

B) The Wheat Pool should sell Canadian dollar futures.

C) The Wheat Pool cannot hedge this position.

D) The Wheat Pool should not use the Chicago Mercantile exchange.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

What is the lowest possible 1-year forward $/£ exchange rate FROM THE LIST BELOW?

A) $1.93/£

B) $1.96/£

C) $2.01/£

D) $2.05/£

A) $1.93/£

B) $1.96/£

C) $2.01/£

D) $2.05/£

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

When the current spot exchange rate exceeds the exercise price which of the following combinations of statements is true?

(i)A call option is in the money.

(ii)A call option is out of the money.

(iii)A put option is in the money.

(iv)A put option is out of the money.

A) (i) and (ii)

B) (i) and (iii)

C) (i) and (iv)

D) (ii) and (iv)

(i)A call option is in the money.

(ii)A call option is out of the money.

(iii)A put option is in the money.

(iv)A put option is out of the money.

A) (i) and (ii)

B) (i) and (iii)

C) (i) and (iv)

D) (ii) and (iv)

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

If you have a long position in one futures contract,the changes in the margin account from daily marking-to-market,will result in the balance of the margin account after the third day to be:

A) $1,425.

B) $1,675.

C) $2,000.

D) $3,425.

A) $1,425.

B) $1,675.

C) $2,000.

D) $3,425.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

What is the highest possible 1-year forward $/£ exchange rate FROM THE LIST BELOW?

A) $1.93/£

B) $1.97/£

C) $2.03/£

D) $2.05/£

A) $1.93/£

B) $1.97/£

C) $2.03/£

D) $2.05/£

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

In reference to the derivatives market,a "speculator":

A) attempts to profit from a change in the futures price.

B) wants to avoid price variation by locking in a purchase price of the underlying asset through a long position in the futures contract or a sales price through a short position.

C) plays a zero-sum game.

D) passes off the risk of price variation to other player, who is better able, or at least more willing, to bear this risk.

A) attempts to profit from a change in the futures price.

B) wants to avoid price variation by locking in a purchase price of the underlying asset through a long position in the futures contract or a sales price through a short position.

C) plays a zero-sum game.

D) passes off the risk of price variation to other player, who is better able, or at least more willing, to bear this risk.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

Comparing "forward" and "futures" exchange contracts,we can say that:

A) they are both "marked-to-market" daily.

B) their major difference is in the way the underlying asset is priced for spot purchase or sale.

C) a futures contract is negotiated by open outcry between floor brokers or traders and is traded on unorganized exchanges, while forward contract is tailor-made by a domestic bank for its clients and is traded OTC.

D) futures contract is negotiated by open outcry between floor brokers or traders and is traded on organized exchanges, while forward contract is tailor-made by an international bank for its clients and is traded OTC.

A) they are both "marked-to-market" daily.

B) their major difference is in the way the underlying asset is priced for spot purchase or sale.

C) a futures contract is negotiated by open outcry between floor brokers or traders and is traded on unorganized exchanges, while forward contract is tailor-made by a domestic bank for its clients and is traded OTC.

D) futures contract is negotiated by open outcry between floor brokers or traders and is traded on organized exchanges, while forward contract is tailor-made by an international bank for its clients and is traded OTC.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

If you have a short position in one futures contract,the changes in the margin account from daily marking-to-market will result in the balance of the margin account after the third day to be:

A) $1,425.

B) $2,000.

C) $2,325.

D) $3,425.

A) $1,425.

B) $2,000.

C) $2,325.

D) $3,425.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

An investor believes that the price of a stock,say IBM's shares,will increase in the next 60 days.If the investor is correct,which combination of the following investment strategies will show a profit in all the choices?

(i)- buy the stock and hold it for 60 days

(ii)- buy a put option

(iii)- sell (write)a call option

(iv)- buy a call option

(v)- sell (write)a put option

A) (i), (ii), and (iii)

B) (i), (ii), and (iv)

C) (i), (iv), and (v)

D) (ii) and (iii)

(i)- buy the stock and hold it for 60 days

(ii)- buy a put option

(iii)- sell (write)a call option

(iv)- buy a call option

(v)- sell (write)a put option

A) (i), (ii), and (iii)

B) (i), (ii), and (iv)

C) (i), (iv), and (v)

D) (ii) and (iii)

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following best describes the difference between American and European options?

A) They are traded on different exchanges.

B) They are for different currencies.

C) They use different exchange rate quotations.

D) None of these.

A) They are traded on different exchanges.

B) They are for different currencies.

C) They use different exchange rate quotations.

D) None of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

The following Eurodollar futures contract is quoted in the Wall Street Journal:

-Determine the implied 3-month LIBOR yield for March 2010.

A) 6.38%

B) 6.41%

C) 9.36%

D) need more information

-Determine the implied 3-month LIBOR yield for March 2010.

A) 6.38%

B) 6.41%

C) 9.36%

D) need more information

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

When the LIBOR yield drops,the:

A) value of a eurodollar futures contract drops.

B) value of a eurodollar futures contract remains unchanged.

C) value of a eurodollar futures contract increases.

D) value of a eurodollar futures contract might drop or increase depending on the circumstances.

A) value of a eurodollar futures contract drops.

B) value of a eurodollar futures contract remains unchanged.

C) value of a eurodollar futures contract increases.

D) value of a eurodollar futures contract might drop or increase depending on the circumstances.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

The value of a European call will increase with all of the following except:

A) the spot exchange rate.

B) the exercise price.

C) time to maturity.

D) the foreign interest rate.

A) the spot exchange rate.

B) the exercise price.

C) time to maturity.

D) the foreign interest rate.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

How the value of a European put option for £1 will change if the current exchange rate will instantly increase from $1.4/£ to $1.5/£?

A) Increase by $0.1.

B) Increase by an amount that cannot be determined based on the available information.

C) Decrease by $0.1.

D) Decrease by an amount that cannot be determined based on the available information.

A) Increase by $0.1.

B) Increase by an amount that cannot be determined based on the available information.

C) Decrease by $0.1.

D) Decrease by an amount that cannot be determined based on the available information.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

Today's settlement price on a Chicago Mercantile Exchange (CME)Euro futures contract is $1.2010/EUR.Your margin account currently has a balance of $2,500.The next two days' settlement prices are $1.2210/EUR and $1.2010/EUR.(The contractual size of one CME EURO contract is EUR 125,000).Calculate your margin account balance at the end of the first and second day if you have a long position on Euro futures.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

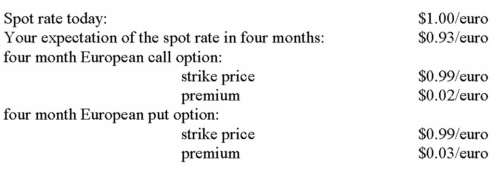

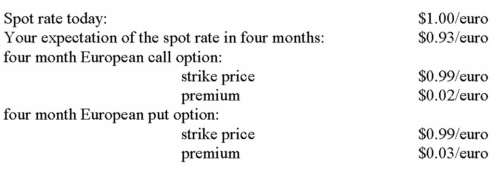

Given the following information:

If your expectations prove correct at maturity:

If your expectations prove correct at maturity:

a)What would be your profit per euro from speculating in the options market? Show the strategy that would give the highest payoff given your expectation about the future exchange rate.

b)Graphically illustrate the loss and profit positions for the speculation in the options market.Label your graph clearly.

If your expectations prove correct at maturity:

If your expectations prove correct at maturity:a)What would be your profit per euro from speculating in the options market? Show the strategy that would give the highest payoff given your expectation about the future exchange rate.

b)Graphically illustrate the loss and profit positions for the speculation in the options market.Label your graph clearly.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

Today's settlement price on a Chicago Mercantile Exchange (CME)Euro futures contract is $1.2010/EUR.Your margin account currently has a balance of $2,500.The next two days' settlement prices are $1.2210/EUR and $1.2010/EUR.(The contractual size of one CME EURO contract is EUR 125,000).Calculate your margin account balance at the end of the first and second day if you have a short position on Euro futures.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

Assume that the spot Euro is $1.2000 and the six-months forward rate is $1.2100.Determine the minimum price for which a six-month American put should sell for.The strike price is $1.1900 and the annualized six-month Eurodollar rate is 4%.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

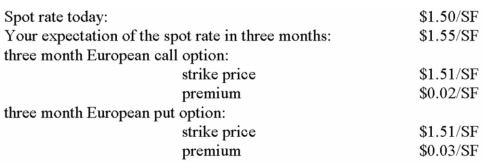

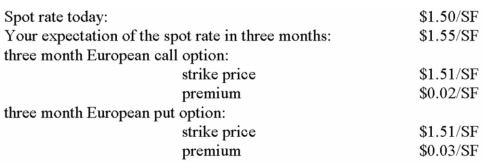

Given the following information:

If your expectations prove correct at maturity:

If your expectations prove correct at maturity:

a)What would be your profit per Swiss franc from speculating in the options market? Show the strategy that would give the highest payoff given your expectation about the future exchange rate.

b)Graphically illustrate the loss and profit positions for the speculation in the options market.Label your graph clearly.

If your expectations prove correct at maturity:

If your expectations prove correct at maturity:a)What would be your profit per Swiss franc from speculating in the options market? Show the strategy that would give the highest payoff given your expectation about the future exchange rate.

b)Graphically illustrate the loss and profit positions for the speculation in the options market.Label your graph clearly.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

You paid $0.1 for a one-year European call option for £1 with the strike price of $1.7/£.At which exchange rates on the maturity date will you exercise your option?

A) Less than $1.7/£

B) Less than $1.8/£

C) More than $1.7/£

D) More than $1.8/£

A) Less than $1.7/£

B) Less than $1.8/£

C) More than $1.7/£

D) More than $1.8/£

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck