Deck 17: International Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/28

Play

Full screen (f)

Deck 17: International Capital Budgeting

1

What is concessionary loan?

A) A loan from the parent company to its rival companies' subsidiary.

B) A loan from a subsidiary to its parent company.

C) A low interest loan to a company for a capital expenditure made in the foreign land.

D) None of these.

A) A loan from the parent company to its rival companies' subsidiary.

B) A loan from a subsidiary to its parent company.

C) A low interest loan to a company for a capital expenditure made in the foreign land.

D) None of these.

C

2

Sensitivity analysis in the calculation of the adjusted present value (APV)allows the financial manager to:

A) analyze all of the risks (business, economic, exchange rate uncertainty, political, etc.) inherent in the investment.

B) more fully understand the implications of planned capital expenditures.

C) consider in advance actions that can be taken should an investment not develop as anticipated.

D) All of these.

A) analyze all of the risks (business, economic, exchange rate uncertainty, political, etc.) inherent in the investment.

B) more fully understand the implications of planned capital expenditures.

C) consider in advance actions that can be taken should an investment not develop as anticipated.

D) All of these.

D

3

The financial manager's responsibilities involve:

A) increasing the per share price of the company's stock at any cost and by any means, ways and fashion that is possible.

B) shareholder profit maximization.

C) which capital projects to select.

D) increasing the dividend yield of the company's shares by any means.

A) increasing the per share price of the company's stock at any cost and by any means, ways and fashion that is possible.

B) shareholder profit maximization.

C) which capital projects to select.

D) increasing the dividend yield of the company's shares by any means.

B

4

The "incremental" cash flows of a capital project are calculated by using:

A) (i), (ii), and (iii).

B) (ii), (iv), and (vi).

C) (i), (iii), (v), and (vii).

D) (iv), (v), (vi), and (vii).

A) (i), (ii), and (iii).

B) (ii), (iv), and (vi).

C) (i), (iii), (v), and (vii).

D) (iv), (v), (vi), and (vii).

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

5

Company Y,a Canadian manufacturer of boats,is currently exporting $100,000 worth of boats to the United States.The firm is considering opening a production facility in the United States because without a presence in the United States,the entire US market would be lost to a competitor.The new facility would produce boats for about $800,000 and the firm anticipates total sales in the United States to be $900,000.When analyzing this project,Company Y should:

A) ignore the exports of $100,000 since they are not an incremental cash flow from the project.

B) ignore the exports of $100,000 since they are not part of the project.

C) include $100,000 as lost export sales in the capital budget.

D) None of these.

A) ignore the exports of $100,000 since they are not an incremental cash flow from the project.

B) ignore the exports of $100,000 since they are not part of the project.

C) include $100,000 as lost export sales in the capital budget.

D) None of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

6

Given the following information for a levered and unlevered firm,calculate the difference in the cash flow available to investors. Assume the corporate tax rate is 40%. (Hint: Calculate the tax savings arising from the tax deductibility of interest payments).

A) 8

B) 18

C) 78

D) 90

A) 8

B) 18

C) 78

D) 90

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

7

Capital budgeting analysis is very important,because it:

A) involves, usually expensive investments in capital assets.

B) has to do with the productive capacity of a firm.

C) will determine how competitive and profitable a firm will be.

D) All of these.

A) involves, usually expensive investments in capital assets.

B) has to do with the productive capacity of a firm.

C) will determine how competitive and profitable a firm will be.

D) All of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

8

The current spot rate between the Canadian dollar and the Euro is C$1.6000/euro.The Canadian and European inflation rates are expected to be 2% and 4% per year for the next 10 years respectively.Using purchasing power parity to predict the exchange rate in 10 years,the predicted exchange rate is:

A) C$1.3176/euro.

B) C$1.5692/euro.

C) C$1.6000/euro.

D) C$1.6923/euro.

A) C$1.3176/euro.

B) C$1.5692/euro.

C) C$1.6000/euro.

D) C$1.6923/euro.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

9

A real option is:

A) a commodity option.

B) an option that has 90% probability or higher to be in the money at the time of maturity.

C) an ability to close the production line.

D) None of these.

A) a commodity option.

B) an option that has 90% probability or higher to be in the money at the time of maturity.

C) an ability to close the production line.

D) None of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

10

Company X,a Canadian manufacturer of chairs,is currently exporting $100,000 worth of chairs to the United States.The firm is considering opening a production facility in the United States that would produce enough chairs for the entire US market and is predicting total sales in the United States to be $500,000.When analyzing this project,Company X should:

A) ignore the exports of $100,000 since they are not an incremental cash flow from the project.

B) ignore the exports of $100,000 since they are not part of the project.

C) include $100,000 as lost export sales in the capital budget.

D) None of these.

A) ignore the exports of $100,000 since they are not an incremental cash flow from the project.

B) ignore the exports of $100,000 since they are not part of the project.

C) include $100,000 as lost export sales in the capital budget.

D) None of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

11

The "net present value" of a capital project is calculated by using:

A) (i), (ii), and (iii).

B) (ii), (iv), and (vi).

C) (i), (iii), (v), and (vii).

D) (iv), (v), (vi), and (vii).

A) (i), (ii), and (iii).

B) (ii), (iv), and (vi).

C) (i), (iii), (v), and (vii).

D) (iv), (v), (vi), and (vii).

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

12

The adjusted present value (APV)model that is suitable for an MNC is the basic net present value (NPV)model expanded to:

A) distinguish between the market value of a levered firm and the market value of an unlevered firm.

B) discern the blocking of certain cash flows by the host country from being legally remitted to the parent.

C) consider foreign currency fluctuations or extra taxes imposed by the host country on foreign exchange remittances.

D) All of these.

A) distinguish between the market value of a levered firm and the market value of an unlevered firm.

B) discern the blocking of certain cash flows by the host country from being legally remitted to the parent.

C) consider foreign currency fluctuations or extra taxes imposed by the host country on foreign exchange remittances.

D) All of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

13

The option to quit a foreign project early is called:

A) timing option.

B) abandonment option.

C) growth option.

D) exercise option.

A) timing option.

B) abandonment option.

C) growth option.

D) exercise option.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not an example of a real option?

A) Timing option

B) Abandonment option

C) Growth option

D) Exercise option

A) Timing option

B) Abandonment option

C) Growth option

D) Exercise option

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following statements is false about "borrowing capacity"?

A) It is an especially important point in international capital budgeting analysis because of the frequency of large concessionary loans.

B) It creates tax shields for APV analysis regardless of how the project is actually financed.

C) It is synonymous to the "project debt".

D) It is based on the firm's optimal capital structure.

A) It is an especially important point in international capital budgeting analysis because of the frequency of large concessionary loans.

B) It creates tax shields for APV analysis regardless of how the project is actually financed.

C) It is synonymous to the "project debt".

D) It is based on the firm's optimal capital structure.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

16

In the context of the capital budgeting analysis of an MNC that has strong foreign competitors,"lost sales" refers to:

A) the cannibalization of new projects by existing projects.

B) the entire sales revenue of a new foreign manufacturing facility representing the incremental sales revenue of an old project.

C) the end of existing projects when the company takes over new projects.

D) None of these.

A) the cannibalization of new projects by existing projects.

B) the entire sales revenue of a new foreign manufacturing facility representing the incremental sales revenue of an old project.

C) the end of existing projects when the company takes over new projects.

D) None of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

17

The ABC Company,a U.S.based MNC,plans to establish a subsidiary in Ecuador to manufacture and sell water pumps.ABC has total assets of $80 million,of which $60 million is equity financed.The remainder is financed with debt.ABC considers its current capital structure optimal.The construction cost of the facility in Ecuador is estimated to be ECS 8,500 million,of which ECS 6,500 million is to be financed at a below-market rate of interest arranged by the Ecuador's government.The proposed project will increase the borrowing capacity by:

A) ECS 1,215 million

B) ECS 2,215 million

C) ECS 3,215 million

D) ECS 4,215 million

A) ECS 1,215 million

B) ECS 2,215 million

C) ECS 3,215 million

D) ECS 4,215 million

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

18

When using the adjusted present value (APV)to evaluate a capital budgeting problem,the appropriate discount rate for foreign loans is:

A) the cost of equity for a leveraged firm.

B) the cost of equity for an unleveraged firm.

C) the firm's domestic cost of debt.

D) the firm's foreign cost of debt.

A) the cost of equity for a leveraged firm.

B) the cost of equity for an unleveraged firm.

C) the firm's domestic cost of debt.

D) the firm's foreign cost of debt.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

19

If a given project is less risky than the firm's overall risk level,the following adjustment must be made to the APV formula:

A) Cost of capital should be increased.

B) Cost of capital should be decreased.

C) OCF should be increased.

D) OCF should be decreased.

A) Cost of capital should be increased.

B) Cost of capital should be decreased.

C) OCF should be increased.

D) OCF should be decreased.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

20

When making a capital budgeting decision the ultimate decision depends on:

A) the APV from the parent's perspective.

B) the APV from the subsidiary's perspective.

C) the APV from the competitor's perspective.

D) None of these.

A) the APV from the parent's perspective.

B) the APV from the subsidiary's perspective.

C) the APV from the competitor's perspective.

D) None of these.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

21

The APV is calculated using the following formula:

A) (I) + (II) + (III) + (IV) - (V)

B) (I) + (II) + (III) + (IV) + (V)

C) - (I) + (II) + (III) + (IV) + (V)

D) (I) - (II) + (III) + (IV) - (V)

A) (I) + (II) + (III) + (IV) - (V)

B) (I) + (II) + (III) + (IV) + (V)

C) - (I) + (II) + (III) + (IV) + (V)

D) (I) - (II) + (III) + (IV) - (V)

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

22

The discount rates to use for the APV calculations are:

A) Cost of levered equity for (I) and cost of debt for (II), (III), (IV) and (V)

B) Cost of levered equity for (I) and cost of unlevered equity for (II), (III), (IV) and (V)

C) Cost of unlevered equity for (I) and cost of levered equity for (II), (III), (IV) and (V)

D) Cost of unlevered equity for (I) and cost of debt for (II), (III), (IV) and (V)

A) Cost of levered equity for (I) and cost of debt for (II), (III), (IV) and (V)

B) Cost of levered equity for (I) and cost of unlevered equity for (II), (III), (IV) and (V)

C) Cost of unlevered equity for (I) and cost of levered equity for (II), (III), (IV) and (V)

D) Cost of unlevered equity for (I) and cost of debt for (II), (III), (IV) and (V)

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

23

The discount rates to use for the APV calculations are:

A) Cost of domestic debt for (II),(III),(IV) and (V).

B) Cost of domestic debt for (II) and (IV).

C) Cost of foreign debt for (II),(III),(IV) and (V).

D) Cost of foreign debt for (II) and (IV).

A) Cost of domestic debt for (II),(III),(IV) and (V).

B) Cost of domestic debt for (II) and (IV).

C) Cost of foreign debt for (II),(III),(IV) and (V).

D) Cost of foreign debt for (II) and (IV).

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

24

Is it possible that a project has a positive APV from the subsidiary's perspective and a negative APV from the parent's perspective?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

25

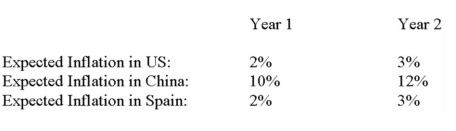

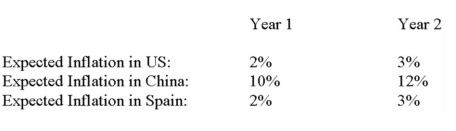

Desert Inc.is a Spanish producer of barrels and is considering the establishment of a subsidiary in China.The projected time horizon for the project is 2 years.Management wants to set up the production facilities,get them running and then sell the facilities after 2 years.The current exchange rate is renminbi 11/euro.The renminbi is pegged to the US dollar at an exchange rate of renminbi 8.28/$ and the peg is expected to stay unchanged over the next two years.The expected inflation rates for the next two years are given below:

Forecast the exchanges rates between the renminbi and the euro for the next two years.Justify your forecast.

Forecast the exchanges rates between the renminbi and the euro for the next two years.Justify your forecast.

Forecast the exchanges rates between the renminbi and the euro for the next two years.Justify your forecast.

Forecast the exchanges rates between the renminbi and the euro for the next two years.Justify your forecast.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

26

Which cash flows are relevant for the international capital budgeting analysis?

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

27

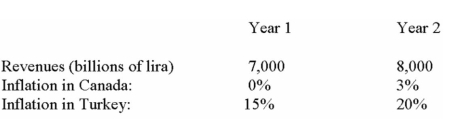

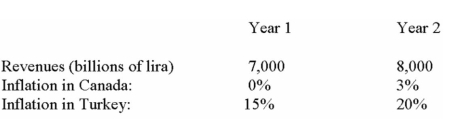

White Rock Inc.located in British Columbia makes moccasins marketed mostly to tourists.The firm would like to take advantage of lower labour costs in Turkey and is considering the establishment of a foreign operation in Turkey.The current exchange rate is Lira 1,000,000/C$.Management predicts the following for the next two years for the Turkish subsidiary:  All cash flows are in current liras.Determine the Canadian dollar revenues for the next two years.

All cash flows are in current liras.Determine the Canadian dollar revenues for the next two years.

All cash flows are in current liras.Determine the Canadian dollar revenues for the next two years.

All cash flows are in current liras.Determine the Canadian dollar revenues for the next two years.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck

28

ABC Inc.,located in Halifax,produces towels and is considering the establishment of a foreign operation in Indonesia ABC wants to know its weighted average cost of capital and the cost of capital of an equivalent all-equity financed firm.The interest rate on Indonesian government securities is 18% and on Canadian government securities it is 5%.The Indonesian income tax rate is 40% and the Canadian income rate is 35%.ABC Inc.debt-to-equity ratio is 1:3 and its cost of equity financing is 12%.

Unlock Deck

Unlock for access to all 28 flashcards in this deck.

Unlock Deck

k this deck