Deck 16: Intercorporate Equity Investments

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/132

Play

Full screen (f)

Deck 16: Intercorporate Equity Investments

1

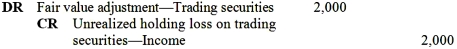

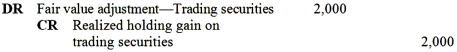

The upward or downward adjustment to reflect fair value of trading securities is a direct debit or credit to a market adjustment account.

True

2

When the ownership percentage of voting stock exceeds 20 percent,GAAP requires that the investor use the equity method to account for the investment.

False

3

For an investor each share of common stock and each share of preferred stock owned usually entitles the owner to one vote.

False

4

The investment account is adjusted for the investor's share of the reported income of the investee when the investor uses the equity method to account for the stock investment.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

5

Debt or equity securities held in a firm's trading portfolio that suffer other-than-temporary declines in market value are recorded at fair value with the unrealized losses recognized in other comprehensive income,net of applicable taxes.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

6

The acquired goodwill is $30,000 when the investor pays $100,000 to acquire 40% of a company's outstanding voting shares at a time when the fair value of the company's net assets was $175,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

7

An unrealized loss on trading securities results in a deferred tax asset because the loss reduces pre-tax income but has no effect on taxable income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

8

The realized gain on an investment classified as trading securities is calculated by comparing the selling price to the original cost.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

9

An investment of 30% of a company's voting shares must be accounted for using the equity method.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

10

Equity securities designated by the investor to be held for a short period of time are classified as available-for-sale securities.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

11

Stock shares classified as trading securities are typically purchased by the investor to generate profits on trading gains.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

12

Minority passive investments of less than 20% of the voting stock shares are classified as either trading securities or available-for-sale securities.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

13

The investment account is decreased by the dividends received by the investor when the investor uses the equity method to account for the stock investment.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

14

Unrealized gains and losses on available-for-sale securities are reported as a component of other comprehensive income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

15

An unrealized loss for an equity securities investment classified as trading securities does not reduce net income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

16

GAAP presumes that ownership of less than 20% of another company's voting shares constitutes a passive investment.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

17

When the ownership percentage of voting stock exceeds 20 percent,GAAP presumes that the investor is able to exert significant influence over the investee company.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

18

The unrealized gain from an investment classified as available-for-sale reduces net income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

19

When trading securities are sold,the amount of the realized gain or loss is the selling price of the securities relative to the most recent fair value reflected in the financial statements.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

20

An investment of 50% or more of a company's voting shares will require the investor to prepare consolidated financial statements.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

21

Consolidated financial statements must always be prepared when a corporation acquires more than 50% of the voting stock of another corporation.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

22

Once a company decides to use the fair value option to account for an equity method investment,the decision is irrevocable.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

23

When using the acquisition method to account for a business combination,the subsidiary's assets and liabilities are reported on the consolidated balance sheet at their fair values regardless of the level of ownership attributable to the minority shareholders.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

24

Intra-entity receivables and payables for an 80%-owned subsidiary are eliminated to the extent of ownership (i.e.,80% of balance is eliminated).

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

25

When consolidating foreign subsidiaries,the foreign subsidiary's financial numbers must be translated into the parents' currency unit.Under GAAP,if the foreign subsidiary is merely an extension of the parent,the current rate method is used.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

26

When using purchase accounting to account for a business combination,the subsidiary's assets and liabilities are reported on the consolidated balance sheet at their fair values at the date of purchase regardless of whether there is a noncontrolling interest.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

27

Foreign currency nonmonetary assets and liabilities for non-free-standing subsidiaries are translated using the current exchange rate at the balance sheet date.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

28

Under the fair value method of accounting for equity investments,unrealized gains and losses as well as dividends received from the investee are reported in the investor's income statement.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

29

The fixed assets reported on a consolidated balance sheet include assets of both the parent company and the subsidiary company.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

30

When two companies form a joint venture and each company owns exactly 50% of the joint venture,both parents will account for the joint venture using the equity method.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

31

A variable interest entity must be consolidated into the financial statements of the sponsoring entity if the sponsoring entity has either a controlling or a noncontrolling financial interest.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

32

Under the temporal method,foreign translation gains and losses are reported on the income statement.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

33

The amount of goodwill recognized on a consolidated balance sheet will always be the same when accounting for a business combination under either the acquisition method or the purchase method.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

34

Monetary assets that arise from foreign currency transactions are shown in the financial statements at their dollar equivalent using the exchange rate in effect at the financial statement date.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

35

If a parent owns less than 100% of a subsidiary's stock,the noncontrolling shareholders represent the minority interest.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

36

Consolidation procedures for 100%-owned subsidiaries require simply adding together the asset,liability,and stockholders' equity accounts of the two companies.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

37

Any foreign translation gains or losses using the current rate method should be reported as other comprehensive income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

38

GAAP requires comparative financial statements to be retroactively adjusted to include data for the acquired company for periods prior to the acquisition.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

39

Consolidation adjustments that are made to prepare consolidated financial statements of the parent and subsidiary are required to avoid double counting.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

40

At any point in time a company can elect to use the fair value option to account for equity method investments.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

41

Under IFRS,nonmarketable equity securities whose fair value can be determined are included in the trading portfolio.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

42

If a company elects to use the fair value method for available-for-sale debt investments,the interest income pattern in the income statement is identical to the interest income pattern under the held-to-maturity classification.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

43

The fair value adjustment for available-for-sale securities results in

A)a realized gain or loss to be reported within income from continuing operations.

B)an unrealized gain or loss to be reported within income from continuing operations.

C)a reduction of retained earnings.

D)an unrealized gain or loss to be reported as a component of other comprehensive income.

A)a realized gain or loss to be reported within income from continuing operations.

B)an unrealized gain or loss to be reported within income from continuing operations.

C)a reduction of retained earnings.

D)an unrealized gain or loss to be reported as a component of other comprehensive income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

44

Under the Exposure Draft issued by the FASB (based on joint deliberations with IASB),debt instruments held for collection of contractual cash flows will be reported at amortized cost.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

45

Minority passive equity securities designated by the investor to be held for the long-term are

A)trading securities.

B)available-for-sale securities.

C)fair value securities.

D)adjusted historical cost securities.

A)trading securities.

B)available-for-sale securities.

C)fair value securities.

D)adjusted historical cost securities.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

46

Under the Exposure Draft issued by the FASB (based on joint deliberations with IASB),most changes in fair value of financial assets would be recorded in net income.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

47

Under IFRS,firms can elect to measure the noncontrolling interest at the book value of the identifiable net assets at the acquisition date,which excludes goodwill from the measurement of the noncontrolling interest.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

48

A minority active ownership is represented by

A)less than 20% ownership.

B)20% or more but less than 50% ownership.

C)more than 50% ownership.

D)more than 60% and less than 70% ownership.

A)less than 20% ownership.

B)20% or more but less than 50% ownership.

C)more than 50% ownership.

D)more than 60% and less than 70% ownership.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

49

Minority active equity investments are accounted for by the

A)fair value method.

B)purchase method.

C)equity method.

D)cost.

A)fair value method.

B)purchase method.

C)equity method.

D)cost.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

50

Investments in held-to-maturity debt investments must be accounted for using amortized cost.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

51

Equity or debt securities designated by the investor intended to be held for a short period of time are usually classified as

A)available-for-sale securities.

B)trading securities.

C)fair value securities.

D)adjusted historical cost securities.

A)available-for-sale securities.

B)trading securities.

C)fair value securities.

D)adjusted historical cost securities.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

52

Bond investments made to generate trading gains are classified as

A)available-for-sale securities.

B)trading securities.

C)held to maturity securities.

D)minority securities.

A)available-for-sale securities.

B)trading securities.

C)held to maturity securities.

D)minority securities.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

53

Minority ownership occurs when a corporate investor owns less than which of the following percentages of the stock of another company?

A)20%

B)30%

C)40%

D)50%

A)20%

B)30%

C)40%

D)50%

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

54

While both IFRS and GAAP require companies to consolidate entities they control,IFRS defines control more narrowly than GAAP.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

55

Under both IFRS and GAAP special purpose entities are consolidated when the firm is the "primary beneficiary."

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

56

IFRS reports all impairment losses for AFS-debt securities in income regardless of reason.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

57

In a pooling of interests,both companies are assumed to combine their resources with neither having a controlling interest over the other.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

58

The consolidated financial statements under a pooling of interests combine the market values of the two entities.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

59

The unrealized holding gain or loss on trading securities is recorded on

A)the income statement in the period after the security price change.

B)the income statement in the period of the security price change.

C)the balance sheet as a deferred charge in the period of the security price change.

D)the balance sheet as a separate component of stockholders' equity.

A)the income statement in the period after the security price change.

B)the income statement in the period of the security price change.

C)the balance sheet as a deferred charge in the period of the security price change.

D)the balance sheet as a separate component of stockholders' equity.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

60

IFRS does not permit use of the fair value option for equity-method investments.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following properly describes a difference between the accounting for a trading security relative to the accounting for an available-for-sale security for a particular investment?

A)Total stockholders' equity at any point in time differs between the two alternatives.

B)Total assets at any point in time differs between the two alternatives.

C)Net income for a particular period may differ between the two alternatives.

D)Net income over the life of the investment will differ.

A)Total stockholders' equity at any point in time differs between the two alternatives.

B)Total assets at any point in time differs between the two alternatives.

C)Net income for a particular period may differ between the two alternatives.

D)Net income over the life of the investment will differ.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

62

Almond Industries owns an investment that experienced a decline during 2015 that has been judged to be "other than temporary." The investment is held in Almond's trading portfolio.It was purchased in March 2014 at a cost of $460,000.At the end of 2014,the fair value of the investment was $520,000.At the end of 2015,the fair value of the investment is $410,000.What amount of loss will Almond Industries report on its income statement for the year ending December 31,2015 related to this investment?

A)an unrealized loss of $110,000.

B)an unrealized loss of $50,000.

C)an unrealized loss of $60,000.

D)a realized loss of $50,000.

A)an unrealized loss of $110,000.

B)an unrealized loss of $50,000.

C)an unrealized loss of $60,000.

D)a realized loss of $50,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

63

The Shasta Corporation began operations in 2014.Shasta's investment portfolio reported the following on December 31,2014:

Which of the following is correct with respect to the accounting for Shasta's investment portfolio?

A)Net income was decreased $55,000 during 2014.

B)Total stockholders' equity was decreased $55,000 as of December 31,2014.

C)Net income was increased $15,000 during 2014.

D)Total stockholders' equity was decreased $15,000 as of December 31,2014.

Which of the following is correct with respect to the accounting for Shasta's investment portfolio?

A)Net income was decreased $55,000 during 2014.

B)Total stockholders' equity was decreased $55,000 as of December 31,2014.

C)Net income was increased $15,000 during 2014.

D)Total stockholders' equity was decreased $15,000 as of December 31,2014.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

64

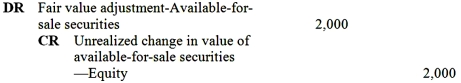

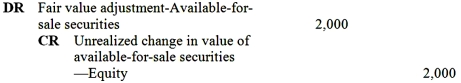

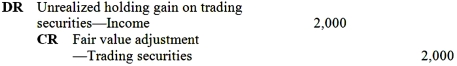

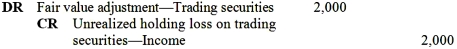

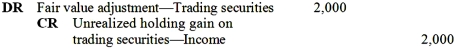

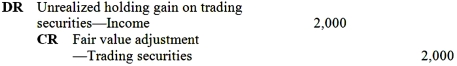

If the securities purchased are classified as available-for-sale securities,Perry should record the year-end adjustment as

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

65

Palmon Industries owns an investment that experienced a decline during 2015 that has been judged to be "other than temporary." The investment is held in Palmon's available-for-sale debt portfolio,and Palmon expects to sell the security before recovery of its amortized cost basis less current-period credit loss.It was purchased in March 2014 at a cost of $460,000.At the end of 2014,the fair value of the investment was $520,000 and its amortized cost basis was $454,000.At the end of 2015,the fair value of the investment is $410,000 and its amortized cost is $448,000.What amount of loss will Palmon Industries report on its income statement for the year ending December 31,2015 related to this investment?

A)an unrealized loss of $110,000.

B)an unrealized loss of $38,000.

C)an unrealized loss of $44,000.

D)an unrealized loss of $50,000.

A)an unrealized loss of $110,000.

B)an unrealized loss of $38,000.

C)an unrealized loss of $44,000.

D)an unrealized loss of $50,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

66

The 2016 year-end adjustment resulted in

A)a $12,000 reduction of stockholders' equity.

B)a $2,000 reduction of stockholders' equity.

C)a $2,000 increase in stockholders' equity.

D)a realized gain of $2,000.

A)a $12,000 reduction of stockholders' equity.

B)a $2,000 reduction of stockholders' equity.

C)a $2,000 increase in stockholders' equity.

D)a realized gain of $2,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

67

A minority active investment is accounted for by the

A)cost method.

B)equity method.

C)lower of cost or market method.

D)speculative investment methoD.

A)cost method.

B)equity method.

C)lower of cost or market method.

D)speculative investment methoD.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

68

A company purchased shares of stock of another company for $75,000 during 2014;the shares were classified as available-for-sale.The shares' market value was $79,000 at the end of 2014 and $81,000 at the end of 2015.Which of the following statements correctly describes the investor's accounting for the investment?

A)A realized gain of $4,000 was recorded during 2014.

B)An unrealized gain of $6,000 was recorded during 2015.

C)An unrealized gain of $2,000 was recorded during 2015.

D)A realized gain of $2,000 was recorded during 2015.

A)A realized gain of $4,000 was recorded during 2014.

B)An unrealized gain of $6,000 was recorded during 2015.

C)An unrealized gain of $2,000 was recorded during 2015.

D)A realized gain of $2,000 was recorded during 2015.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

69

Ralmond Industries owns an investment that experienced a decline during 2015 that has been judged to be "other than temporary." The investment is held in Ralmond's available-for-sale debt portfolio,and Ralmond does not expect to sell the security and it is unlikely that Ralmond will be required to sell the security before recovery of its amortized cost basis less any current-period credit loss.It was purchased in March 2014 at a cost of $460,000.At the end of 2014,the fair value of the investment was $520,000 and its amortized cost basis was $454,000.At the end of 2015,the fair value of the investment is $410,000 and its amortized cost is $448,000.At the end of 2015,the present value of expected cash flows associated with the security discounted at the effective interest rate implicit when it was originally acquired is $432,000.What amount of loss will Ralmond Industries report on its income statement for the year ending December 31,2015 related to this investment?

A)an unrealized loss of $16,000.

B)an unrealized loss of $38,000.

C)an unrealized loss of $44,000.

D)an unrealized loss of $22,000.

A)an unrealized loss of $16,000.

B)an unrealized loss of $38,000.

C)an unrealized loss of $44,000.

D)an unrealized loss of $22,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

70

The Kerry Company began operations during 2014 and purchased shares of Molson Corporation stock during the year.The market value of the Molson stock had increased as of the end of 2014.Kerry should have classified this investment as a trading security but mistakenly classified it as an available-for-sale security.Which of the following properly describes the impact of this error?

A)The 2014 net income was not misstated.

B)Total assets as of December 31,2014 were understated.

C)Total stockholders' equity as of December 31,2014 was understated.

D)Total stockholders' equity as of December 31,2014 was not misstateD.

A)The 2014 net income was not misstated.

B)Total assets as of December 31,2014 were understated.

C)Total stockholders' equity as of December 31,2014 was understated.

D)Total stockholders' equity as of December 31,2014 was not misstateD.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

71

When an investor owns less than 20 percent of the investee company,the investor may still be able to exert influence over the investee company if the other stock is

A)closely held by a few investors.

B)widely distributed across a few investors.

C)widely distributed across a large number of individual investors.

D)controlled a small group of investors.

A)closely held by a few investors.

B)widely distributed across a few investors.

C)widely distributed across a large number of individual investors.

D)controlled a small group of investors.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

72

How much income was reported on the 2015 income statement?

A)$240

B)$14,240

C)$14,000

D)$0

A)$240

B)$14,240

C)$14,000

D)$0

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

73

Perry Investments bought 2,000 shares of Able, Inc. common stock on January 1, 2015, for $20,000 and 2,000 shares of Baker, Inc. common stock on July 1, 2015 for $24,000. Baker paid $2,400 of previously declared dividends to Perry on December 31, 2015. At the end of 2015, the market value of the Able stock was $18,000 and the market value of the Baker stock was $28,000. The stocks were purchased for short-term speculation. Perry owns 10% of each company.

-Perry should record the receipt of the Baker dividend as

A) DR Cash 240

CR Dividend income 240

B) DR Dividends receivable 2,400

CR Dividend income 2,400

C) DR Cash 2,400

CR Investment in Baker 2,400

D) DR Cash 2,400

CR Dividends receivable 2,400

-Perry should record the receipt of the Baker dividend as

A) DR Cash 240

CR Dividend income 240

B) DR Dividends receivable 2,400

CR Dividend income 2,400

C) DR Cash 2,400

CR Investment in Baker 2,400

D) DR Cash 2,400

CR Dividends receivable 2,400

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

74

When an investor is capable of influencing the investee company's dividend policy,the investor is able to augment its own reported income when using

A)minority passive accounting treatment.

B)minority active accounting treatment.

C)majority active accounting treatment.

D)the equity methoD.

A)minority passive accounting treatment.

B)minority active accounting treatment.

C)majority active accounting treatment.

D)the equity methoD.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

75

Perry Investments bought 2,000 shares of Able, Inc. common stock on January 1, 2015, for $20,000 and 2,000 shares of Baker, Inc. common stock on July 1, 2015 for $24,000. Baker paid $2,400 of previously declared dividends to Perry on December 31, 2015. At the end of 2015, the market value of the Able stock was $18,000 and the market value of the Baker stock was $28,000. The stocks were purchased for short-term speculation. Perry owns 10% of each company.

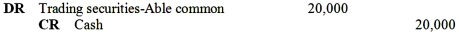

-The entry to record the purchase of Able,Inc.common stock would be

A)

B) DR Available-for-sale securities-Able common

CR Cash 20,000

C) DR Held to maturity securities-Able common 20,000

CR Cash 20,000

D) DR Cash 20,000

CR Available-for-sale securities

-Able common 20,000

-The entry to record the purchase of Able,Inc.common stock would be

A)

B) DR Available-for-sale securities-Able common

CR Cash 20,000

C) DR Held to maturity securities-Able common 20,000

CR Cash 20,000

D) DR Cash 20,000

CR Available-for-sale securities

-Able common 20,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

76

Assume that the Roy Company stock was sold during 2017 for $31,000.The proper accounting recognition at the date of sale was

A)an unrealized loss of $1,000.

B)a realized gain of $7,000.

C)a realized gain of $6,000.

D)a realized loss of $1,000.

A)an unrealized loss of $1,000.

B)a realized gain of $7,000.

C)a realized gain of $6,000.

D)a realized loss of $1,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

77

What is the balance in the investment account as of December 31,2015?

A)$70,000

B)$98,000

C)$56,000

D)$84,000

A)$70,000

B)$98,000

C)$56,000

D)$84,000

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

78

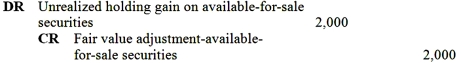

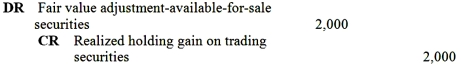

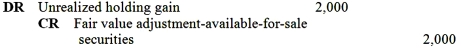

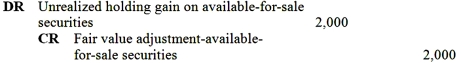

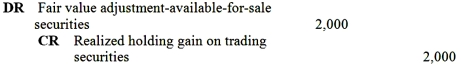

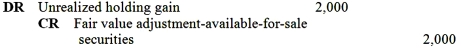

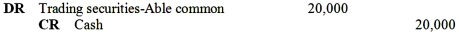

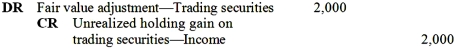

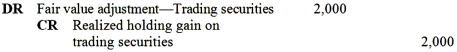

Perry should record the year-end adjustment as

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

79

When the ownership percentage of stock exceeds 20 percent but is less than 50 percent,GAAP presumes that the investor

A)has no influence to exert over the investee company.

B)is only investing for a short term trading position.

C)is able to exert influence over the investee company.

D)is trying to take over the investee company.

A)has no influence to exert over the investee company.

B)is only investing for a short term trading position.

C)is able to exert influence over the investee company.

D)is trying to take over the investee company.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck

80

Ramsey's share of Vapor's income for 2015 is

A)$14,000.

B)$28,000.

C)$42,000.

D)$40,000.

A)$14,000.

B)$28,000.

C)$42,000.

D)$40,000.

Unlock Deck

Unlock for access to all 132 flashcards in this deck.

Unlock Deck

k this deck