Deck 15: Raising Capital

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/72

Play

Full screen (f)

Deck 15: Raising Capital

1

Which one of the following terms could be defined as a new issue of common stock offered to the general public by a firm that is currently publicly held?

A)Initial public offering

B)Private placement

C)Rights offer

D)Venture capital

E)Seasoned equity offering

A)Initial public offering

B)Private placement

C)Rights offer

D)Venture capital

E)Seasoned equity offering

Seasoned equity offering

2

Jersey T's is preparing to sell new shares of stock to the general public.As part of this process,the firm just filed the required paperwork with the SEC that contains the material information related to this issue of stock.What is the name associated with this paperwork?

A)Prospectus

B)Red herring

C)Security agreement

D)Comment letter

E)Registration statement

A)Prospectus

B)Red herring

C)Security agreement

D)Comment letter

E)Registration statement

Registration statement

3

What is the advertisement,commonly found in financial newspapers,that announces a public offering of securities and provides the name of the underwriters called?

A)Prospectus

B)Red herring

C)Tombstone

D)Green Shoe

E)Underwriter's ad

A)Prospectus

B)Red herring

C)Tombstone

D)Green Shoe

E)Underwriter's ad

Tombstone

4

What is the legal document called that is provided to potential investors and describes a new security offering?

A)Security agreement

B)Prospectus

C)Public statement

D)Registration statement

E)Formal filing

A)Security agreement

B)Prospectus

C)Public statement

D)Registration statement

E)Formal filing

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

5

Which one of the following is an underwriting of securities where the offer price is determined by investor bids?

A)Private placement

B)Best efforts underwriting

C)Initial public offering

D)Green Shoe option

E)Dutch auction

A)Private placement

B)Best efforts underwriting

C)Initial public offering

D)Green Shoe option

E)Dutch auction

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

6

A.B.Securities assists issuers by pricing and selling new securities to the general public.Which one of the following terms best fits the role that A.B.Securities is playing?

A)Underwriter

B)Investment advisor

C)Specialist

D)Securities dealer

E)Venture capitalist

A)Underwriter

B)Investment advisor

C)Specialist

D)Securities dealer

E)Venture capitalist

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

7

Which one of the following terms is defined as an underwriting for which the underwriters assume full responsibility for any unsold shares?

A)Initial public offering

B)Best efforts underwriting

C)Firm commitment underwriting

D)Rights offer

E)Private placement

A)Initial public offering

B)Best efforts underwriting

C)Firm commitment underwriting

D)Rights offer

E)Private placement

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

8

Sly's just arranged a three-year direct business loan.Which one of the following terms matches this loan arrangement?

A)Term loan

B)Private placement

C)Rights offer

D)Seasoned offer

E)Shelf offer

A)Term loan

B)Private placement

C)Rights offer

D)Seasoned offer

E)Shelf offer

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

9

Lisa is interested in purchasing 1,000 shares of TJH,Inc.when the shares are issued.Her broker just gave Lisa a preliminary prospectus on these shares for her to review as she waits for the shares to be cleared for sale.What is the name of this prospectus?

A)Green Shoe

B)Rights offer

C)Red herring

D)Spread

E)Tombstone

A)Green Shoe

B)Rights offer

C)Red herring

D)Spread

E)Tombstone

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

10

Which one of the following best describes an initial public offering?

A)Shares held by a firm's founder

B)Any newly issued shares offered to the general public

C)Shares issued to the public on a cash basis

D)The first sale of equity shares to the general public

E)Any shares initially offered to a firm's existing shareholders

A)Shares held by a firm's founder

B)Any newly issued shares offered to the general public

C)Shares issued to the public on a cash basis

D)The first sale of equity shares to the general public

E)Any shares initially offered to a firm's existing shareholders

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

11

Richardson Marina has 18,000 shares of stock outstanding that were sold to the general public last year.The firm has just decided to issue an additional 6,000 shares of common stock and has also decided to make the shares available to the firm's current shareholders before making any offer of these shares to the general public.Which one of the following terms best applies to this offer?

A)General cash offer

B)Rights offer

C)In-house offering

D)Private placement

E)Initial public offering

A)General cash offer

B)Rights offer

C)In-house offering

D)Private placement

E)Initial public offering

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

12

Gee Whiz Underwriters retains the difference between its buying price and its offering price on new securities.What is this amount called?

A)Markup

B)Commission

C)Rights price

D)Spread

E)Offer

A)Markup

B)Commission

C)Rights price

D)Spread

E)Offer

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

13

Which one of the following describes a Green Shoe provision?

A)Determination of underwriters' fees

B)Guarantee of sale for all offered shares

C)Price auction

D)Overallotment option

E)Description of issue excluding the offer price

A)Determination of underwriters' fees

B)Guarantee of sale for all offered shares

C)Price auction

D)Overallotment option

E)Description of issue excluding the offer price

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

14

Which one of the following specifies the length of time that must pass after an initial public offering (IPO)before insiders are permitted to sell their shares?

A)Lockup period

B)Quiet period

C)Comment period

D)Green Shoe period

E)Rights offer period

A)Lockup period

B)Quiet period

C)Comment period

D)Green Shoe period

E)Rights offer period

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

15

Which one of the following best describes a private placement?

A)Interim financing for a new, high-risk entity

B)Long-term loan by a limited number of investors

C)Two-year direct business loan

D)Three-year loan to a firm by its original founder

E)New equity issue offered to current shareholders

A)Interim financing for a new, high-risk entity

B)Long-term loan by a limited number of investors

C)Two-year direct business loan

D)Three-year loan to a firm by its original founder

E)New equity issue offered to current shareholders

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

16

Lewis Materials recently offered 15,000 shares of stock but received payment for only 12,500 shares since that was all the shares the underwriters could sell.What type of underwriting was this?

A)Syndicated

B)Firm commitment

C)Private placement

D)Best efforts

E)Dutch auction

A)Syndicated

B)Firm commitment

C)Private placement

D)Best efforts

E)Dutch auction

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

17

Venture capital is most apt to be the source of funding for which one of the following?

A)Bankruptcy reorganization

B)Global expansion for an established firm

C)New, high-risk venture

D)Seasonal production

E)Daily operations for an established, profitable firm

A)Bankruptcy reorganization

B)Global expansion for an established firm

C)New, high-risk venture

D)Seasonal production

E)Daily operations for an established, profitable firm

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

18

What is the group of underwriters called who share both the risks and the marketing responsibilities for a securities offering?

A)Syndicate

B)Underwriting cartel

C)Firm commitment group

D)Dutch auction group

E)Venture capitalists

A)Syndicate

B)Underwriting cartel

C)Firm commitment group

D)Dutch auction group

E)Venture capitalists

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

19

The Road House Diner is offering 10,000 shares of stock to the general public on a cash basis.Which one of the following terms best applies to this offer?

A)Rights offer

B)General cash offer

C)Green Shoe

D)Red herring

E)Prospectus

A)Rights offer

B)General cash offer

C)Green Shoe

D)Red herring

E)Prospectus

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

20

Which one of the following is the name given to a registration of securities under SEC 415 which permits a firm to issue the securities over a two-year period?

A)Seasoned registration

B)Negotiated registration

C)Shelf registration

D)Extended registration

E)Delayed registration

A)Seasoned registration

B)Negotiated registration

C)Shelf registration

D)Extended registration

E)Delayed registration

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following have been offered as justification for IPO underpricing?

I.Young firms tend to be very risky.

II.The best IPOs are oversubscribed.

III.Underwriters like to avoid lawsuits.

IV.It benefits the existing shareholders.

A)I and III only

B)II and IV only

C)I, II, and III only

D)II, III, and IV only

E)I, II, III, and IV

I.Young firms tend to be very risky.

II.The best IPOs are oversubscribed.

III.Underwriters like to avoid lawsuits.

IV.It benefits the existing shareholders.

A)I and III only

B)II and IV only

C)I, II, and III only

D)II, III, and IV only

E)I, II, III, and IV

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

22

Currently,you own 5.4 percent of the outstanding stock of Keiffer Industries.The firm has decided to issue additional shares of stock and has given you the first option to purchase 5.4 percent of those additional shares.Which one of the following will you be participating in if you opt to purchase the shares you have been offered?

A)Rights offer

B)Red herring offer

C)Private placement

D)IPO

E)General cash offer

A)Rights offer

B)Red herring offer

C)Private placement

D)IPO

E)General cash offer

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following are true statements?

I.Venture capitalists tend to be long-term investors in a firm.

II.Venture capital is relatively easy to obtain for most new firms.

III.Venture capitalists generally have an exit strategy.

IV.Venture capitalists tend to specialize in one type of financing for a select type of firm.

A)I and II only

B)III and IV only

C)I and III only

D)I and IV only

E)II and IV only

I.Venture capitalists tend to be long-term investors in a firm.

II.Venture capital is relatively easy to obtain for most new firms.

III.Venture capitalists generally have an exit strategy.

IV.Venture capitalists tend to specialize in one type of financing for a select type of firm.

A)I and II only

B)III and IV only

C)I and III only

D)I and IV only

E)II and IV only

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

24

Assume the SEC approved the registration statement for a new securities issue this morning.Which one of the following statements must be true about this issue?

A)The red herrings can now be distributed as the distribution was awaiting the SEC approval.

B)The waiting period started when the approval was received this morning.

C)The SEC believes the issue will be a profitable investment for all purchases made at the offer price.

D)The issuer is following all the required rules and regulations in regard to this issue.

E)The final prospectuses were all delivered or the SEC would not have approved the issue.

A)The red herrings can now be distributed as the distribution was awaiting the SEC approval.

B)The waiting period started when the approval was received this morning.

C)The SEC believes the issue will be a profitable investment for all purchases made at the offer price.

D)The issuer is following all the required rules and regulations in regard to this issue.

E)The final prospectuses were all delivered or the SEC would not have approved the issue.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

25

When issuing securities,which of the following can occur prior to receiving the approval by the SEC of a registration statement?

I.Oral offer to buy shares

II.Written offer to buy shares

III.Final determination of the offer price

IV.Distribution of a preliminary prospectus

A)I only

B)III only

C)III and IV only

D)I and IV only

E)None of the listed activities can occur until after the SEC approval is received.

I.Oral offer to buy shares

II.Written offer to buy shares

III.Final determination of the offer price

IV.Distribution of a preliminary prospectus

A)I only

B)III only

C)III and IV only

D)I and IV only

E)None of the listed activities can occur until after the SEC approval is received.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

26

Which one of the following statements is correct?

A)Oral offers can be made for new securities during the waiting period.

B)A Green Shoe letter must be provided to all investors who purchase shares of a new equity offering.

C)Corporate directors have the authority to authorize additional shares of stock for a new issue.

D)The underwriters must approve any increase in the authorized number of shares for a firm.

E)When issuing new securities, the first step is the distribution of the prospectus.

A)Oral offers can be made for new securities during the waiting period.

B)A Green Shoe letter must be provided to all investors who purchase shares of a new equity offering.

C)Corporate directors have the authority to authorize additional shares of stock for a new issue.

D)The underwriters must approve any increase in the authorized number of shares for a firm.

E)When issuing new securities, the first step is the distribution of the prospectus.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following are important factors to consider when seeking a venture capitalist?

I.Exit strategy

II.Management style

III.Personal contacts

IV.Financial strength

A)I and III only

B)II and IV only

C)III and IV only

D)II, III, and IV only

E)I, II, III, and IV

I.Exit strategy

II.Management style

III.Personal contacts

IV.Financial strength

A)I and III only

B)II and IV only

C)III and IV only

D)II, III, and IV only

E)I, II, III, and IV

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

28

Who determines the offer price in a Dutch auction?

A)Lead underwriter

B)Chief financial officer of the issuing firm

C)SEC

D)Bidders

E)Board of directors of the issuing firm

A)Lead underwriter

B)Chief financial officer of the issuing firm

C)SEC

D)Bidders

E)Board of directors of the issuing firm

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

29

Which one of the following is probably the most effective means of increasing investors' interest in an IPO?

A)Extending the lockup period

B)Issuing the IPO through a rights offering

C)Underpricing the IPO

D)Eliminating the quiet period

E)Eliminating the Green Shoe option

A)Extending the lockup period

B)Issuing the IPO through a rights offering

C)Underpricing the IPO

D)Eliminating the quiet period

E)Eliminating the Green Shoe option

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

30

Which one of the following is an intended result of a lockup agreement?

A)Temporarily supporting the market price of IPO shares

B)Maximizing the return to a firm's original owners from an initial spike in the market price of IPO shares

C)Increasing the volume of trading for shares of a recent IPO

D)Limiting the price volatility of recent IPO shares caused by day trading

E)Guaranteeing a minimum number of sold shares for an IPO

A)Temporarily supporting the market price of IPO shares

B)Maximizing the return to a firm's original owners from an initial spike in the market price of IPO shares

C)Increasing the volume of trading for shares of a recent IPO

D)Limiting the price volatility of recent IPO shares caused by day trading

E)Guaranteeing a minimum number of sold shares for an IPO

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following duties belong to the underwriters of a firm commitment securities offer?

I.Duty to offer the Green Shoe provision to all investors who buy at the offer price

II.Duty to set the offer price

III.Duty to distribute the offered shares

IV.Duty to purchase any unsold shares

A)I and III only

B)II and IV only

C)II, III, and IV only

D)I, II, and III only

E)I, II, III, and IV

I.Duty to offer the Green Shoe provision to all investors who buy at the offer price

II.Duty to set the offer price

III.Duty to distribute the offered shares

IV.Duty to purchase any unsold shares

A)I and III only

B)II and IV only

C)II, III, and IV only

D)I, II, and III only

E)I, II, III, and IV

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

32

Which one of the following projects is most apt to be financed with venture capital?

A)Additional warehouse space for a profitable trucking firm

B)New product for an international plastics manufacturing company

C)Prototype for a newly patented hand tool by an individual inventor

D)Seasonal merchandise for a major retailer

E)Domestic outlet for a large global exporter

A)Additional warehouse space for a profitable trucking firm

B)New product for an international plastics manufacturing company

C)Prototype for a newly patented hand tool by an individual inventor

D)Seasonal merchandise for a major retailer

E)Domestic outlet for a large global exporter

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

33

Lunar Excursions wants to do an IPO but is very uncertain that underwriters will set the most optimal offer price for the securities.Which one of the following might the firm consider to address this uncertainty?

A)Extended quiet period

B)Extended lockup period

C)Best efforts underwriting

D)Dutch auction underwriting

E)Standby underwriting

A)Extended quiet period

B)Extended lockup period

C)Best efforts underwriting

D)Dutch auction underwriting

E)Standby underwriting

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

34

Which one of the following statements concerning underwriting is correct?

A)Underwriters exercise the Green Shoe option whenever the market price of an IPO declines initially.

B)Underwriters guarantee the number of shares to be sold in a best efforts underwriting.

C)Competitive underwriting is generally more expensive than negotiated underwriting.

D)The majority of equity underwritings in the U.S. are competitive underwritings.

E)Underwriters may receive warrants as part of their compensation.

A)Underwriters exercise the Green Shoe option whenever the market price of an IPO declines initially.

B)Underwriters guarantee the number of shares to be sold in a best efforts underwriting.

C)Competitive underwriting is generally more expensive than negotiated underwriting.

D)The majority of equity underwritings in the U.S. are competitive underwritings.

E)Underwriters may receive warrants as part of their compensation.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

35

You own 100 of the 15,000 outstanding shares of Delta Movers stock.The firm just announced that it will be issuing an additional 5,000 shares to the general public in a cash offer at $22 per share.What type of event are you participating in if you opt to purchase 100 of these additional shares?

A)Dutch auction

B)Seasoned equity offering

C)Private placement

D)IPO

E)Rights offer

A)Dutch auction

B)Seasoned equity offering

C)Private placement

D)IPO

E)Rights offer

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

36

What is the primary purpose of a lockup agreement?

A)Ensures the lead underwriter maintains an economic interest in the IPO it is managing

B)Ensures the issuer of new securities receives a minimally agreed upon amount from the issue

C)Ensures no research reports are issued during the waiting period

D)Ensures company insiders maintain an economic interest in the issuer of an IPO for a minimum period of time

E)Ensures an IPO is not underpriced by more than 5 percent

A)Ensures the lead underwriter maintains an economic interest in the IPO it is managing

B)Ensures the issuer of new securities receives a minimally agreed upon amount from the issue

C)Ensures no research reports are issued during the waiting period

D)Ensures company insiders maintain an economic interest in the issuer of an IPO for a minimum period of time

E)Ensures an IPO is not underpriced by more than 5 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

37

Which one of the following is an aftermarket function performed by the underwriters of a securities issue?

A)Distributing the registration statements

B)Distributing the red herrings

C)Filing a letter of comment with the SEC

D)Exercising the Green Shoe option

E)Setting the market price

A)Distributing the registration statements

B)Distributing the red herrings

C)Filing a letter of comment with the SEC

D)Exercising the Green Shoe option

E)Setting the market price

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

38

Which one of the following statements related to IPO underpricing is correct?

A)The IPOs of larger-sized firms tend to be more underpriced than the IPOs of smaller-sized firms.

B)IPO underpricing is limited to the U.S. markets.

C)The percentage of underpricing remains stable over time in the U.S.

D)The only period in the U.S. when underpricing produced first day returns of 50 percent or more was during the tech bubble of 1999-2000.

E)Some of the greatest IPO underpricing has occurred in China.

A)The IPOs of larger-sized firms tend to be more underpriced than the IPOs of smaller-sized firms.

B)IPO underpricing is limited to the U.S. markets.

C)The percentage of underpricing remains stable over time in the U.S.

D)The only period in the U.S. when underpricing produced first day returns of 50 percent or more was during the tech bubble of 1999-2000.

E)Some of the greatest IPO underpricing has occurred in China.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

39

The quiet period is designed to do which one of the following?

A)Prevent the original investors in a firm from selling their shares and destabilizing a security's price during the first six months of public trading

B)Ensure that all potential investors have fair access to identical information

C)Ensure that all bidders are heard in a Dutch auction

D)Stabilize the aftermarket

E)Quiet the market so the SEC can fairly evaluate a new securities offer

A)Prevent the original investors in a firm from selling their shares and destabilizing a security's price during the first six months of public trading

B)Ensure that all potential investors have fair access to identical information

C)Ensure that all bidders are heard in a Dutch auction

D)Stabilize the aftermarket

E)Quiet the market so the SEC can fairly evaluate a new securities offer

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

40

Phil and Terry started a new business three years ago.Two years ago,they incorporated the business and issued themselves each 20,000 shares of stock.Last year,they took the company public in an IPO and issued an additional 100,000 shares of stock at that time.The offer price was $14 a share,the spread was 8 percent,and the lockup period was six months.The stock closed at $17 a share at the end of the first day of trading.During the first six months of trading,the stock had a price range of $13 to $23 per share.During the second six months of trading,the stock sold between $15 and $21 per share.Both Tracie and Amy purchased 100 shares at the offer price.Given this,which one of the following statements is correct? Ignore trading costs and taxes.

A)Tracie could have earned a maximum profit of 100($23 - 17) on her investment.

B)Phil could have sold 5,000 shares at $23 per share.

C)The underwriters earned a spread equal to 8 percent of $17.

D)The maximum price at which Terry could have sold shares is $21.

E)Amy paid 108 percent of $14 per share to purchase her 100 shares.

A)Tracie could have earned a maximum profit of 100($23 - 17) on her investment.

B)Phil could have sold 5,000 shares at $23 per share.

C)The underwriters earned a spread equal to 8 percent of $17.

D)The maximum price at which Terry could have sold shares is $21.

E)Amy paid 108 percent of $14 per share to purchase her 100 shares.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

41

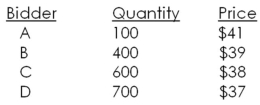

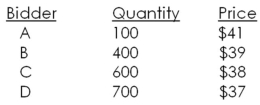

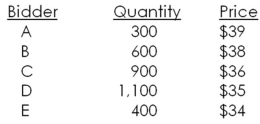

The Jelly Jar would like to sell 1,000 shares of stock using the Dutch auction method.The bids received are as follows:  Bidder D will receive _____ shares and pay a price per share of _____.

Bidder D will receive _____ shares and pay a price per share of _____.

A)0; $0

B)700; $37.00

C)272; $37.00

D)272; $38.75

E)700; $38.75

Bidder D will receive _____ shares and pay a price per share of _____.

Bidder D will receive _____ shares and pay a price per share of _____.A)0; $0

B)700; $37.00

C)272; $37.00

D)272; $38.75

E)700; $38.75

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

42

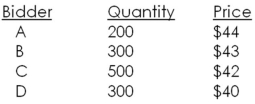

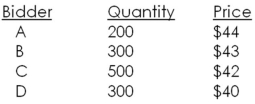

Southern Air would like to sell 750 shares of stock using the Dutch auction method.The bids received are as follows:  Bidder B will receive _____ shares and pay a price per share of ____.

Bidder B will receive _____ shares and pay a price per share of ____.

A)0; $0

B)69; $42.25

C)69; $42.00

D)225; $42.00

E)300; $40.00

Bidder B will receive _____ shares and pay a price per share of ____.

Bidder B will receive _____ shares and pay a price per share of ____.A)0; $0

B)69; $42.25

C)69; $42.00

D)225; $42.00

E)300; $40.00

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

43

Mountaintop Market is offering 60,000 shares of stock to the public in a general cash offer.The offer price is $30 a share and the underwriter's spread is 9 percent.The administrative costs are estimated at $310,000.How much will Hilltop Market receive from this stock offering assuming the issue is completely sold?

A)$1,370,800

B)$1,328,000

C)$1,490,000

D)$1,638,000

E)$1,800,000

A)$1,370,800

B)$1,328,000

C)$1,490,000

D)$1,638,000

E)$1,800,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

44

Quali Tech wants to raise $21 million to purchase equipment by issuing new securities.Management estimates the issue will cost the firm $320,000 for accounting,legal,and other costs.The underwriting spread is 7.5 percent and the issue price is $22 per share.How many shares of stock must be sold if Quali Tech is to receive sufficient funds to purchase all the desired equipment?

A)1,008,010 shares

B)1,021,121 shares

C)1,047,666 shares

D)1,147,666 shares

E)1,110,333 shares

A)1,008,010 shares

B)1,021,121 shares

C)1,047,666 shares

D)1,147,666 shares

E)1,110,333 shares

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

45

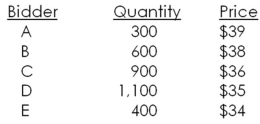

Fresh Foods would like to sell 1,600 shares of stock using a Dutch auction.The bids received are as follows:  What is the total amount the issuer will receive from this auction?

What is the total amount the issuer will receive from this auction?

Ignore costs.

A)$59,700

B)$57,600

C)$56,500

D)$54,000

E)$51,000

What is the total amount the issuer will receive from this auction?

What is the total amount the issuer will receive from this auction?Ignore costs.

A)$59,700

B)$57,600

C)$56,500

D)$54,000

E)$51,000

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

46

Chinese Importers wants to raise $58 million to expand its operations into South America.The company will sell new shares of common stock using a general cash offering.The underwriters charge a 7.8 percent spread,the administrative costs are $411,000,and the offer price is $35 per share.How many shares of stock must be sold if the firm is to raise the funds it desires?

A)1,648,315 shares

B)1,810,071 shares

C)1,911,502 shares

D)1,989,415 shares

E)2,051,515 shares

A)1,648,315 shares

B)1,810,071 shares

C)1,911,502 shares

D)1,989,415 shares

E)2,051,515 shares

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

47

Which one of the following statements concerning issue costs is correct?

A)The underwriters pay the spread.

B)Taxes are an indirect underwriting cost.

C)Seasoned equity offerings (SEOs) tend to be less costly than IPOs.

D)Straight bonds are more costly to issue than convertible bonds.

E)The total direct cost as a percentage of gross proceeds for an IPO tends to decrease as the size of the offer decreases.

A)The underwriters pay the spread.

B)Taxes are an indirect underwriting cost.

C)Seasoned equity offerings (SEOs) tend to be less costly than IPOs.

D)Straight bonds are more costly to issue than convertible bonds.

E)The total direct cost as a percentage of gross proceeds for an IPO tends to decrease as the size of the offer decreases.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

48

Which one of the following statements concerning the issuance of long-term debt is correct?

A)Rarely is debt issued privately in the U.S.

B)All U.S. debt issues, private and public, must be registered with the SEC.

C)Private placements generally have shorter maturities than term loans.

D)It is easier to renegotiate a public issue than it is a private issue of debt.

E)A direct placement of debt generally has more restrictive covenants than a public issue.

A)Rarely is debt issued privately in the U.S.

B)All U.S. debt issues, private and public, must be registered with the SEC.

C)Private placements generally have shorter maturities than term loans.

D)It is easier to renegotiate a public issue than it is a private issue of debt.

E)A direct placement of debt generally has more restrictive covenants than a public issue.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

49

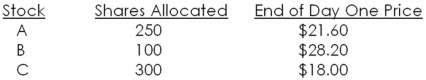

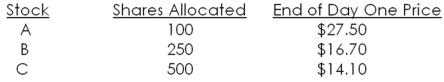

Kim placed an order with her broker to purchase 400 shares of each of three IPOs that are being released this month.Each IPO has an offer price of $23 a share.The number of shares allocated to Kim,along with the closing stock price at the end of the first day of trading for each stock,are as follows:  What is Kim's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is Kim's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

A)-$1,330

B)-$540

C)-$230

D)$1,330

E)$2,370

What is Kim's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is Kim's total profit or loss on these three stocks as of the end of the first day of trading for each stock?A)-$1,330

B)-$540

C)-$230

D)$1,330

E)$2,370

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

50

Alicia placed an order with her broker to purchase 500 shares of each of three IPOs that are being released this month.Each IPO has an offer price of $16 a share.The number of shares allocated to Alicia along with the closing stock price at the end of the first day of trading for each stock,are as follows:  What is Alicia's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is Alicia's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

A)-$425

B)-$260

C)-$150

D)$375

E)$550

What is Alicia's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is Alicia's total profit or loss on these three stocks as of the end of the first day of trading for each stock?A)-$425

B)-$260

C)-$150

D)$375

E)$550

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

51

If the market price of existing publicly traded shares declines due to the announcement of a seasoned issue of stock,the decline is referred to as which one of the following?

A)Spread

B)Direct underwriting cost

C)Underpricing

D)Direct issue cost

E)Abnormal return

A)Spread

B)Direct underwriting cost

C)Underpricing

D)Direct issue cost

E)Abnormal return

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

52

The total direct costs of a debt issue,when expressed as a percentage of gross proceeds,tends to:

A)increase as the quality of the debt increases.

B)decrease as the size of the issue decreases.

C)decrease when the bonds are convertible rather than straight.

D)decrease as the proceeds of the bond issue increase.

E)be relatively the same regardless of the type or quality of the debt issue.

A)increase as the quality of the debt increases.

B)decrease as the size of the issue decreases.

C)decrease when the bonds are convertible rather than straight.

D)decrease as the proceeds of the bond issue increase.

E)be relatively the same regardless of the type or quality of the debt issue.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

53

The Green Shoe option is most apt to be exercised when an IPO is ______ and _____.

A)underpriced; oversubscribed

B)underpriced; undersubscribed

C)correctly priced; neither over- nor undersubscribed

D)overpriced; oversubscribed

E)overpriced; undersubscribed

A)underpriced; oversubscribed

B)underpriced; undersubscribed

C)correctly priced; neither over- nor undersubscribed

D)overpriced; oversubscribed

E)overpriced; undersubscribed

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

54

Stock prices tend to _____ following the announcement of a new equity issue and tend to _____ following the announcement of a new debt issue.

A)increase; increase

B)increase; decrease

C)increase; remain relatively constant

D)decrease; increase

E)decrease; remain relatively constant

A)increase; increase

B)increase; decrease

C)increase; remain relatively constant

D)decrease; increase

E)decrease; remain relatively constant

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

55

Which one of the following statements concerning IPOs and underpricing is correct?

A)IPO underpricing primarily benefits a firm's pre-issue owners.

B)IPO underpricing is a function of the underwriting spread.

C)The more an issue is underpriced, the more it tends to be oversubscribed.

D)Underpricing tends to discourage investors from participating in the IPO market.

E)Undersubscribed shares generally tend to also be underpriced shares.

A)IPO underpricing primarily benefits a firm's pre-issue owners.

B)IPO underpricing is a function of the underwriting spread.

C)The more an issue is underpriced, the more it tends to be oversubscribed.

D)Underpricing tends to discourage investors from participating in the IPO market.

E)Undersubscribed shares generally tend to also be underpriced shares.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

56

Which one of the following statements is correct?

A)The financial market generally reacts the same to a new issue of equity as it does to a new issue of debt as long as the issuer is the same.

B)Issuing new equity shares is always viewed by the market as a positive event.

C)Informed managers tend to issue new securities when the existing securities are underpriced.

D)A decline in the price of existing stock when a new issue is released is a direct cost of selling securities.

E)A firm's existing shareholders would prefer that new securities be issued when those securities are overpriced rather than underpriced.

A)The financial market generally reacts the same to a new issue of equity as it does to a new issue of debt as long as the issuer is the same.

B)Issuing new equity shares is always viewed by the market as a positive event.

C)Informed managers tend to issue new securities when the existing securities are underpriced.

D)A decline in the price of existing stock when a new issue is released is a direct cost of selling securities.

E)A firm's existing shareholders would prefer that new securities be issued when those securities are overpriced rather than underpriced.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

57

Which one of the following statements concerning debt issues is correct?

A)Firms often pay higher interest rates on term loans than on public issues of debt.

B)The only difference between a term loan and a private placement is the size of the issue.

C)A prospectus is required for equity issues but not for debt issues.

D)The flotation costs of issuing debt tend to be more expensive than for issuing equity.

E)Direct long-term loans must be registered with the SEC.

A)Firms often pay higher interest rates on term loans than on public issues of debt.

B)The only difference between a term loan and a private placement is the size of the issue.

C)A prospectus is required for equity issues but not for debt issues.

D)The flotation costs of issuing debt tend to be more expensive than for issuing equity.

E)Direct long-term loans must be registered with the SEC.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

58

Which one of the following tends to be true for the average investor?

A)They frequently earn initially high returns on IPOs when shares are undersubscribed.

B)They generally receive their full allocation of shares even when an IPO is oversubscribed.

C)They often encounter the "winner's curse."

D)They are protected from losses by the Green Shoe provision.

E)Average investors are not allowed to purchase IPOs at the offer price.

A)They frequently earn initially high returns on IPOs when shares are undersubscribed.

B)They generally receive their full allocation of shares even when an IPO is oversubscribed.

C)They often encounter the "winner's curse."

D)They are protected from losses by the Green Shoe provision.

E)Average investors are not allowed to purchase IPOs at the offer price.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

59

Which one of the following correctly states a qualification an issuer must meet to be qualified to use Rule 415 for shelf registration?

A)The issuer must never have defaulted on its debt.

B)The issuer must have outstanding stock with a market value in excess of $250 million.

C)The issuer must never have violated the Securities Act of 1934.

D)The issuer must have an investment grade rating.

E)The issuer cannot have defaulted on its debt within the past five years.

A)The issuer must never have defaulted on its debt.

B)The issuer must have outstanding stock with a market value in excess of $250 million.

C)The issuer must never have violated the Securities Act of 1934.

D)The issuer must have an investment grade rating.

E)The issuer cannot have defaulted on its debt within the past five years.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

60

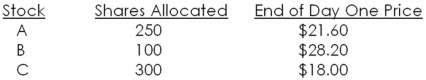

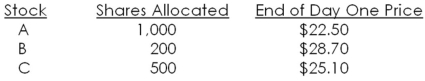

Scott placed an order with his broker to purchase 1,000 shares of each of three IPOs that are being released this month.Each IPO has an offer price of $24 a share.The number of shares allocated to Scott along with the closing stock price at the end of the first day of trading for each stock,are as follows:  What is Scott's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is Scott's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

A)-$380

B)-$240

C)-$10

D)$220

E)$450

What is Scott's total profit or loss on these three stocks as of the end of the first day of trading for each stock?

What is Scott's total profit or loss on these three stocks as of the end of the first day of trading for each stock?A)-$380

B)-$240

C)-$10

D)$220

E)$450

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

61

Franklin Oil issued 150,000 shares of stock last week.The underwriters charged a 7.5 percent spread in exchange for agreeing to a firm commitment.The legal and accounting fees amounted to $310,000 and the company incurred $65,000 in indirect costs.The offer price was $31 a share.Within the first hour of trading,the stock price increased to $34 a share.What was the flotation cost as a percentage of the funds raised?

A)20.89 percent

B)24.03 percent

C)24.47 percent

D)26.55 percent

E)29.89 percent

A)20.89 percent

B)24.03 percent

C)24.47 percent

D)26.55 percent

E)29.89 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

62

The Bread Basket needs to raise $38 million to expand its operations nationally.The company will sell new shares of common stock using a general cash offering.The underwriters charge a 7.65 percent spread,the administrative costs are $395,000,and the offer price is $26 per share.How many shares of stock must be sold for The Bread Basket to receive the total funds it desires?

A)1,599,059 shares

B)1,638,311 shares

C)1,647,222 shares

D)1,814,141 shares

E)1,833,333 shares

A)1,599,059 shares

B)1,638,311 shares

C)1,647,222 shares

D)1,814,141 shares

E)1,833,333 shares

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

63

Provide two arguments in favor of IPO underpricing and two arguments against IPO underpricing.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

64

Sherpa Movers has just gone public.Under a firm commitment agreement,the firm received $34.40 for each of the 3.5 million shares sold.The initial offering price was $37 per share,and the stock rose to $43 per share in the first few minutes of trading.Sherpa Movers paid $896,000 in legal and other direct costs and $225,000 in indirect costs.What was the flotation cost as a percentage of the funds raised?

A)22.91 percent

B)23.85 percent

C)24.49 percent

D)26.17 percent

E)28.60 percent

A)22.91 percent

B)23.85 percent

C)24.49 percent

D)26.17 percent

E)28.60 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

65

ADP,Inc.needs to raise $43 million to finance its expansion into new markets.The company will sell new shares of equity via a general cash offering to raise the needed funds.The SEC filing fee and associated administrative expenses of the offering are $389,000.If the offer price is $38 per share and the company's underwriters charge a spread of 9 percent,how many shares need to be sold?

A)1,254,743 shares

B)1,354,743 shares

C)1,406,211 shares

D)1,514,141 shares

E)1,587,923 shares

A)1,254,743 shares

B)1,354,743 shares

C)1,406,211 shares

D)1,514,141 shares

E)1,587,923 shares

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

66

High Mountain Gear issued 240,000 shares of stock last week.The underwriters charged a 7.85 percent spread in exchange for agreeing to a firm commitment.The legal and accounting fees were $385,000.The company incurred $98,000 in indirect costs related to management time and other internal expenses.The offer price was $21 a share.Within the first hour of trading,the stock was selling for $23.20 a share.What was the flotation cost as a percentage of the funds raised?

A)21.53 percent

B)25.29 percent

C)27.46 percent

D)33.80 percent

E)41.22 percent

A)21.53 percent

B)25.29 percent

C)27.46 percent

D)33.80 percent

E)41.22 percent

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

67

What are some of the key factors an individual should consider before selecting a first-stage venture capitalist?

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

68

Abbott Co.and Costello Co.have both announced IPOs at $24 per share.One of these is undervalued by $3,and the other is overvalued by $1.30,but you have no way of knowing which is which.You plan on buying 1,000 shares of each issue.If an issue is underpriced,it will be rationed,and only half your order will be filled.What profit do you actually expect?

A)$175

B)$200

C)$225

D)$350

E)$425

A)$175

B)$200

C)$225

D)$350

E)$425

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

69

Miller Tool is a successful manufacturer of both consumer and industrial hand tools and is publicly owned.The firm has several positive net present value projects that it would like to pursue and thus decided to issue additional shares of common stock.As a result of this stock issue,the firm's stock price declined.Explain why this occurred when the proceeds of the issue are being used to fund positive net present value projects.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

70

ADP,Inc.needs to raise $32 million to finance its expansion into new markets.The company will sell new shares of equity via a general cash offering to raise the needed funds.If the offer price is $45 per share and the company's underwriters charge an 8.25 percent spread,how many shares need to be sold?

A)648,729 shares

B)691,208 shares

C)723,467 shares

D)775,053 shares

E)775,323 shares

A)648,729 shares

B)691,208 shares

C)723,467 shares

D)775,053 shares

E)775,323 shares

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

71

Kate is the sole founder of the exclusive retail store,Kate's Interiors.Kate identified additional locations that she believed offered profitable opportunities for expansion so decided to take her firm public in order to finance her expansion plans.Bob is an investor who purchased shares of Kate's Interiors stock at the offer price.After one month as a public firm,Kate realized that Bob had earned $1.1 million in profit on his investment and had already cashed out and moved on.Kate,on the other hand,had made no profit and still owns her shares.Explain how this could happen.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck

72

Explain how a Dutch auction operates and why a firm might choose to sell its securities in this manner.

Unlock Deck

Unlock for access to all 72 flashcards in this deck.

Unlock Deck

k this deck