Deck 3: Basic Cost Management Concepts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

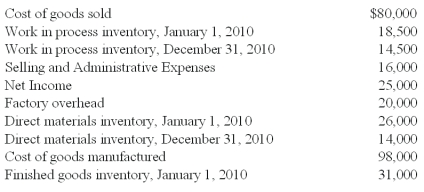

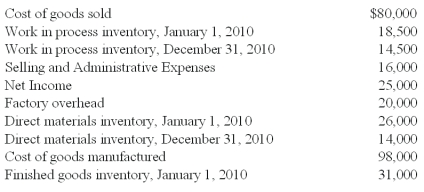

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

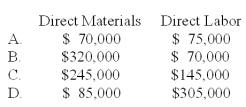

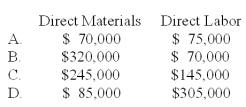

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 3: Basic Cost Management Concepts

1

Since indirect cost cannot be conveniently or economically traced directly to a cost pool or cost object,the management accountant will:

A)Assign them by means of cost allocation.

B)Assign them where needed.

C)Assign them randomly to even out these costs.

D)Not assign them at all.

A)Assign them by means of cost allocation.

B)Assign them where needed.

C)Assign them randomly to even out these costs.

D)Not assign them at all.

A

2

All indirect manufacturing costs are commonly combined into a single cost pool called:

A)Activity cost pools.

B)Value streams.

C)Resources.

D)Overhead.

E)Other manufacturing costs.

A)Activity cost pools.

B)Value streams.

C)Resources.

D)Overhead.

E)Other manufacturing costs.

D

3

The range of the cost driver in which the actual value of the cost driver is expected to fall is called the:

A)Actual cost range.

B)Driver range.

C)Activity range.

D)Expected cost range.

E)Relevant Range.

A)Actual cost range.

B)Driver range.

C)Activity range.

D)Expected cost range.

E)Relevant Range.

E

4

Variable costs within the relevant range for a firm are assumed:

A)Not to vary per unit.

B)Not to vary in total.

C)To be nonlinear.

D)To be curvilinear.

A)Not to vary per unit.

B)Not to vary in total.

C)To be nonlinear.

D)To be curvilinear.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

Structural cost drivers are to executional cost drivers as:

A)Long-term is to short-term.

B)Fixed is to variable.

C)Total is to partial.

D)Direct is to indirect.

A)Long-term is to short-term.

B)Fixed is to variable.

C)Total is to partial.

D)Direct is to indirect.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

Any product,service,or organizational unit to which costs are assigned for some management purpose is a(n):

A)Cost object.

B)Direct cost.

C)Indirect cost.

D)Cost driver.

E)Allocation base.

A)Cost object.

B)Direct cost.

C)Indirect cost.

D)Cost driver.

E)Allocation base.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

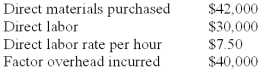

7

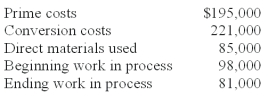

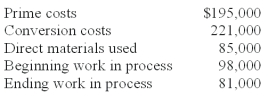

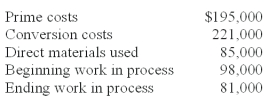

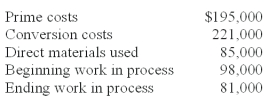

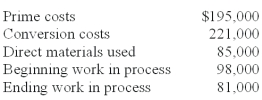

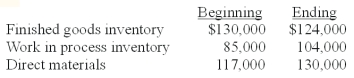

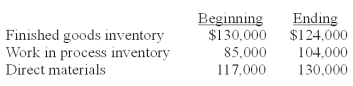

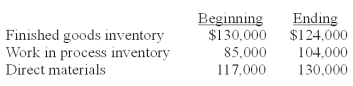

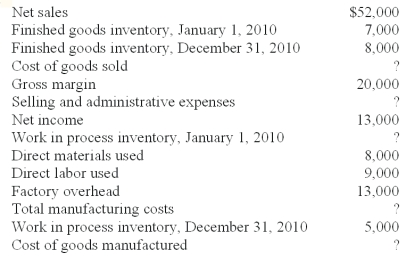

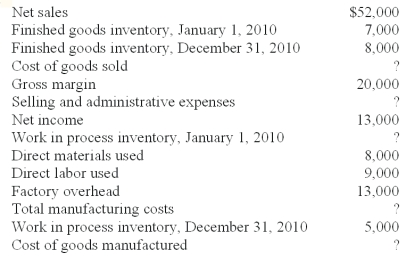

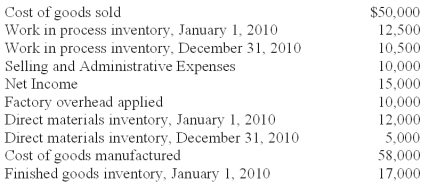

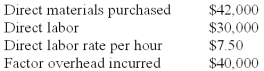

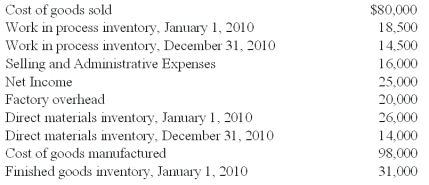

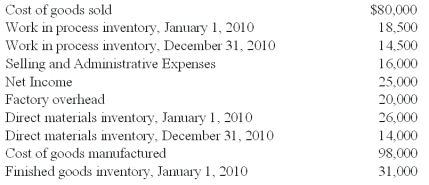

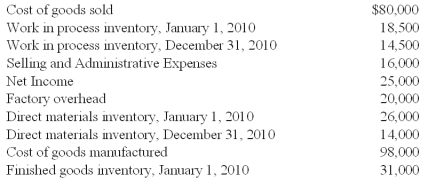

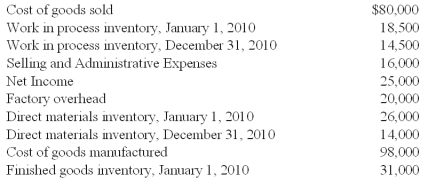

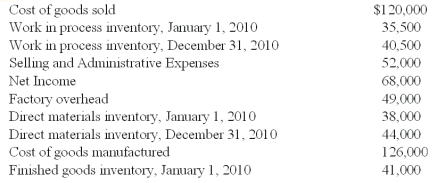

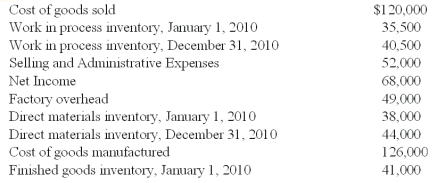

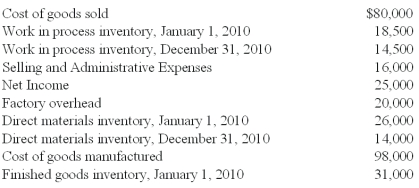

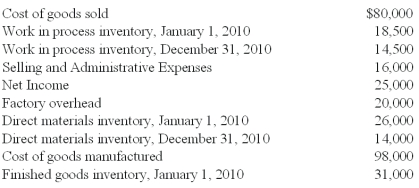

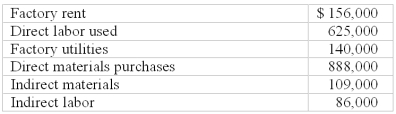

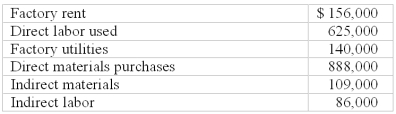

Assume the following information pertaining to Cub Company:

Factory overhead is calculated to be:

A)$110,000.

B)$136,000.

C)$111,000.

D)$84,000.

E)$112,000.

Factory overhead is calculated to be:

A)$110,000.

B)$136,000.

C)$111,000.

D)$84,000.

E)$112,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

The additional cost incurred as the cost driver increases by one unit is:

A)Average cost.

B)Controllable cost.

C)Variable cost.

D)Unit cost.

A)Average cost.

B)Controllable cost.

C)Variable cost.

D)Unit cost.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

Which one of the following would not be found in a merchandising company?

A)Beginning inventory.

B)Cost of goods sold.

C)Ending inventory.

D)Gross profit.

E)Work-in-process.

A)Beginning inventory.

B)Cost of goods sold.

C)Ending inventory.

D)Gross profit.

E)Work-in-process.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

Strategic analysis uses which of the following to help a firm improve its competitive position through an analysis of product and production complexity?

A)Differential cost drivers.

B)Discretionary cost drivers.

C)Structural cost drivers.

D)Marginal cost drivers.

A)Differential cost drivers.

B)Discretionary cost drivers.

C)Structural cost drivers.

D)Marginal cost drivers.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following tend to be non-differential in the short term since they cannot be changed,but are more likely to be differential in the long term?

A)Fixed costs.

B)Variable costs.

C)Mixed costs.

D)Semi variable costs.

A)Fixed costs.

B)Variable costs.

C)Mixed costs.

D)Semi variable costs.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

The change in total cost associated with each change in the quantity of the cost driver is:

A)Average cost.

B)Controllable cost.

C)Variable cost.

D)Unit cost.

A)Average cost.

B)Controllable cost.

C)Variable cost.

D)Unit cost.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

How will unit (average)cost of manufacturing (materials,labor and overhead)usually change if the production level rises?

A)It will remain constant.

B)It will increase in direct proportion to the production increase.

C)It will increase,but inversely with the production increase.

D)It will decrease inversely and in direct proportion to the production increases.

E)It will decrease,but not in direct proportion to the production increase.

A)It will remain constant.

B)It will increase in direct proportion to the production increase.

C)It will increase,but inversely with the production increase.

D)It will decrease inversely and in direct proportion to the production increases.

E)It will decrease,but not in direct proportion to the production increase.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

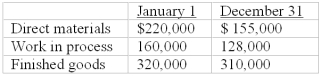

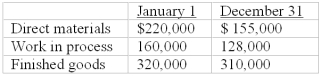

Assume the following information pertaining to Cub Company:

Total manufacturing cost is calculated to be:

A)$332,000.

B)$306,000.

C)$280,000.

D)$331,000.

E)$307,000.

Total manufacturing cost is calculated to be:

A)$332,000.

B)$306,000.

C)$280,000.

D)$331,000.

E)$307,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

Theoretically,a decision maker would probably be willing to buy cost management information if:

A)It is accurate.

B)It is consistent with management objectives.

C)It is timely.

D)Its value is equal to or greater than its cost.

A)It is accurate.

B)It is consistent with management objectives.

C)It is timely.

D)Its value is equal to or greater than its cost.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

Which one of the following is not a type of cost driver?

A)Structural cost driver.

B)Executional cost driver.

C)Volume-Based cost driver.

D)Differential cost driver.

E)Activity-Based cost driver.

A)Structural cost driver.

B)Executional cost driver.

C)Volume-Based cost driver.

D)Differential cost driver.

E)Activity-Based cost driver.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

Assume the following information pertaining to Cub Company:

Cost of goods manufactured is calculated to be:

A)$289,000.

B)$348,000.

C)$314,000.

D)$297,000.

E)$323,000.

Cost of goods manufactured is calculated to be:

A)$289,000.

B)$348,000.

C)$314,000.

D)$297,000.

E)$323,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

The cost of goods that were finished and transferred out of work-in-process during the current period is:

A)Cost of goods sold.

B)Cost of goods available for use.

C)Cost of goods manufactured.

D)Cost of goods available for sale.

E)Cost of goods purchased.

A)Cost of goods sold.

B)Cost of goods available for use.

C)Cost of goods manufactured.

D)Cost of goods available for sale.

E)Cost of goods purchased.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

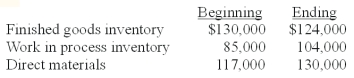

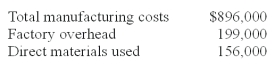

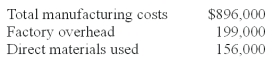

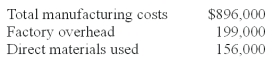

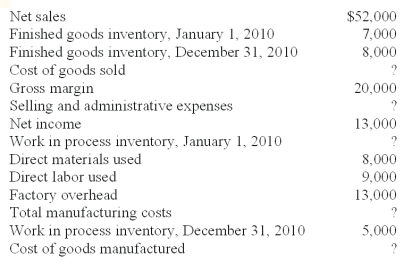

Assume the following information pertaining to Moonbeam Company:

Costs incurred during the period are as follows:

Materials purchases are calculated to be:

A)$143,000.

B)$156,000.

C)$91,000.

D)$169,000.

E)$140,000.

Costs incurred during the period are as follows:

Materials purchases are calculated to be:

A)$143,000.

B)$156,000.

C)$91,000.

D)$169,000.

E)$140,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

Assume the following information pertaining to Cub Company:

Direct labor used is calculated to be:

A)$110,000.

B)$136,000.

C)$111,000.

D)$84,000.

E)$112,000.

Direct labor used is calculated to be:

A)$110,000.

B)$136,000.

C)$111,000.

D)$84,000.

E)$112,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

Prime cost and conversion cost share what common element of total cost?

A)Direct labor.

B)Direct materials.

C)Variable overhead.

D)Fixed overhead.

A)Direct labor.

B)Direct materials.

C)Variable overhead.

D)Fixed overhead.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

If the volume of production is increased over the level planned,the cost per unit would be expected to:

A)Decrease for fixed costs and remain unchanged for variable costs.

B)Remain unchanged for fixed costs and increase for variable costs.

C)Decrease for fixed costs and increase for variable costs.

D)Increase for fixed costs and increase for variable costs.

A)Decrease for fixed costs and remain unchanged for variable costs.

B)Remain unchanged for fixed costs and increase for variable costs.

C)Decrease for fixed costs and increase for variable costs.

D)Increase for fixed costs and increase for variable costs.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

Certain workers are assigned the task of unpacking production materials received from suppliers.These workers place the material in a storage area pending subsequent use in the production process.The labor cost of such workers is normally classified as:

A)Direct labor.

B)Direct materials.

C)Indirect labor.

D)Indirect materials.

A)Direct labor.

B)Direct materials.

C)Indirect labor.

D)Indirect materials.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is normally considered to be a product cost?

A)Insurance on a factory building.

B)Selling expenses.

C)President's salary.

D)Miscellaneous office expense.

A)Insurance on a factory building.

B)Selling expenses.

C)President's salary.

D)Miscellaneous office expense.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

The term relevant range as used in cost accounting means the range over which:

A)Costs may fluctuate.

B)Cost relationships are valid.

C)Production may vary.

D)Relevant costs are incurred.

A)Costs may fluctuate.

B)Cost relationships are valid.

C)Production may vary.

D)Relevant costs are incurred.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

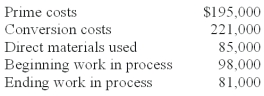

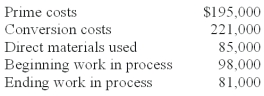

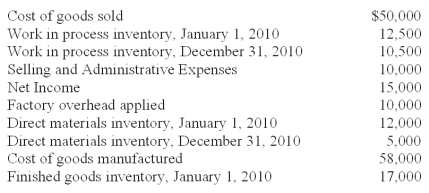

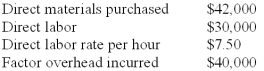

The following data pertains to Lam Co.'s manufacturing operations:

Additional information for the month of April:

Overhead is applied at $10 per direct labor hour.

For the month of April,conversion cost incurred was:

A)$30,000.

B)$40,000.

C)$70,000.

D)$72,000.

Labor hours - $30,000/$7.50 = 4,000 hours

Conversion of labor plus applied overhead = $30,000 + 4,000 x $10 = $70,000

Additional information for the month of April:

Overhead is applied at $10 per direct labor hour.

For the month of April,conversion cost incurred was:

A)$30,000.

B)$40,000.

C)$70,000.

D)$72,000.

Labor hours - $30,000/$7.50 = 4,000 hours

Conversion of labor plus applied overhead = $30,000 + 4,000 x $10 = $70,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

The Gray Company has a staff of five clerks in its general accounting department.Three clerks who work during the day perform sundry accounting tasks;the two clerks who work in the evening are responsible for (1)collecting the cost data for the various jobs in process,(2)verifying manufacturing material and labor reports,and (3)supplying production reports to the supervisors by the next morning.The salaries of these two clerks who work at night should be classified as:

A)Period costs.

B)Direct costs.

C)Product costs.

D)Indirect costs.

A)Period costs.

B)Direct costs.

C)Product costs.

D)Indirect costs.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

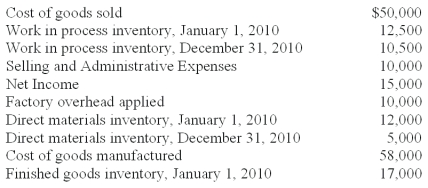

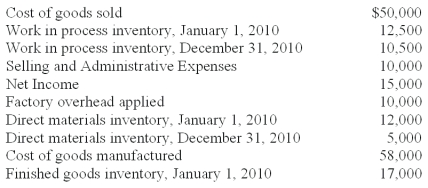

28

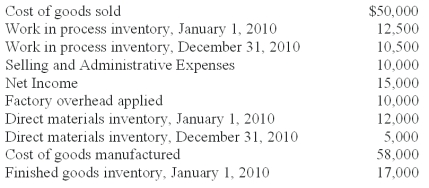

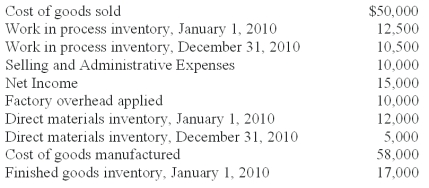

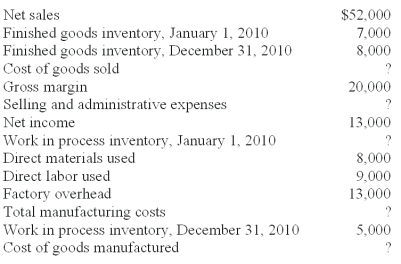

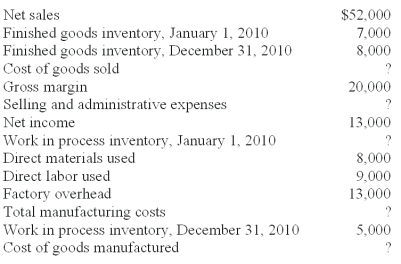

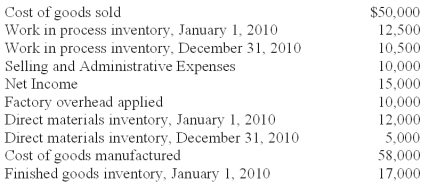

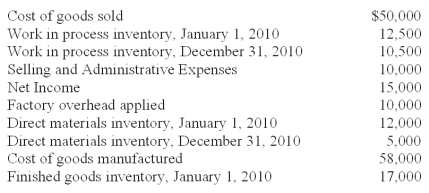

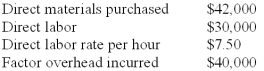

The following information was taken from the accounting records of Elliott Manufacturing Corp.Unfortunately,some of the data were destroyed by a computer malfunction.

Cost of goods manufactured is calculated to be:

A)$32,000.

B)$30,000.

C)$33,000.

D)$38,000.

E)$27,000.

Cost of goods manufactured is calculated to be:

A)$32,000.

B)$30,000.

C)$33,000.

D)$38,000.

E)$27,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

Assume the following information pertaining to Moonbeam Company:

Costs incurred during the period are as follows:

Cost of goods sold is calculated to be:

A)$890,000.

B)$896,000.

C)$883,000.

D)$877,000.

E)$870,000.

Costs incurred during the period are as follows:

Cost of goods sold is calculated to be:

A)$890,000.

B)$896,000.

C)$883,000.

D)$877,000.

E)$870,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

When cost relationships are linear,total variable costs will vary in proportion to changes in:

A)Direct labor hours.

B)Total material cost.

C)Total overhead cost.

D)Volume of production.

E)Machine hours.

A)Direct labor hours.

B)Total material cost.

C)Total overhead cost.

D)Volume of production.

E)Machine hours.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

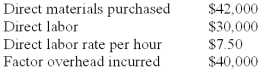

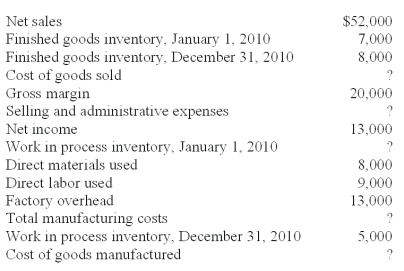

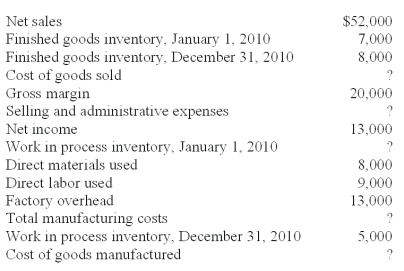

The following information was taken from the accounting records of Elliott Manufacturing Corp.Unfortunately,some of the data were destroyed by a computer malfunction.

Work in process inventory at January 1,2010 is calculated to be:

A)$5,000.

B)$9,000.

C)$6,000.

D)$8,000.

E)$7,000.

Work in process inventory at January 1,2010 is calculated to be:

A)$5,000.

B)$9,000.

C)$6,000.

D)$8,000.

E)$7,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

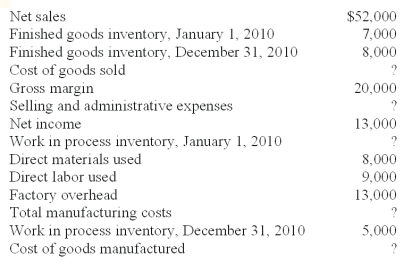

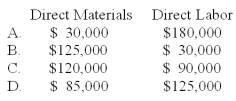

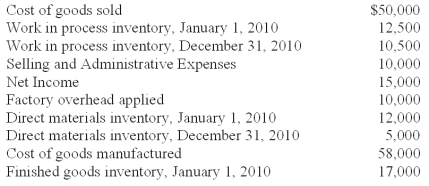

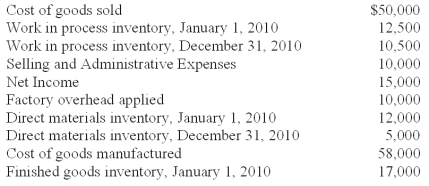

Fisher,Inc.recently lost a portion of its records in an office fire.The following information was salvaged from the accounting records.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of direct materials used?

A)$24,000.

B)$28,000.

C)$31,000.

D)$36,000.

= (use the WIP account)

= $58,000 + $10,500 - $12,500 - $10,000 - (1.5 x $10,000)= $31,000

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of direct materials used?

A)$24,000.

B)$28,000.

C)$31,000.

D)$36,000.

= (use the WIP account)

= $58,000 + $10,500 - $12,500 - $10,000 - (1.5 x $10,000)= $31,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

The following information was taken from the accounting records of Elliott Manufacturing Corp.Unfortunately,some of the data were destroyed by a computer malfunction.

Selling and administrative expenses are calculated to be:

A)$5,000.

B)$9,000.

C)$6,000.

D)$8,000.

E)$7,000.

Selling and administrative expenses are calculated to be:

A)$5,000.

B)$9,000.

C)$6,000.

D)$8,000.

E)$7,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

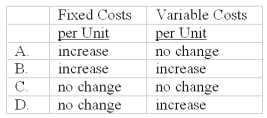

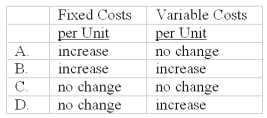

When production levels are expected to decline within a relevant range,what effects would be anticipated with respect to each of the following?

A)A

B)B

C)C

D)D

A)A

B)B

C)C

D)D

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

Fisher,Inc.recently lost a portion of its records in an office fire.The following information was salvaged from the accounting records.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount in the finished goods inventory at December 31,2010?

A)$10,500.

B)$15,000.

C)$23,000.

D)$25,000.

$25,000 = ($58,000 + $17,000)- $50,000 = $25,000

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount in the finished goods inventory at December 31,2010?

A)$10,500.

B)$15,000.

C)$23,000.

D)$25,000.

$25,000 = ($58,000 + $17,000)- $50,000 = $25,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

The following information was taken from the accounting records of Elliott Manufacturing Corp.Unfortunately,some of the data were destroyed by a computer malfunction.

Cost of goods sold is calculated to be:

A)$32,000.

B)$30,000.

C)$33,000.

D)$38,000.

E)$27,000.

Cost of goods sold is calculated to be:

A)$32,000.

B)$30,000.

C)$33,000.

D)$38,000.

E)$27,000.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

A manufacturer of machinery currently produces equipment for a single client.The client supplies all required raw material on a no-cost basis.The manufacturer contracts to complete the desired units from this raw material.The total production costs incurred by the manufacturer are correctly identified as:

A)Prime costs.

B)Conversion costs.

C)Variable production costs.

D)Factory overhead.

A)Prime costs.

B)Conversion costs.

C)Variable production costs.

D)Factory overhead.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

Fisher,Inc.recently lost a portion of its records in an office fire.The following information was salvaged from the accounting records.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of direct materials purchased?

A)$24,000.

B)$28,000.

C)$31,000.

D)$36,000.

$24,000 = $31,000 - ($12,000 - $5,000)= $24,000

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of direct materials purchased?

A)$24,000.

B)$28,000.

C)$31,000.

D)$36,000.

$24,000 = $31,000 - ($12,000 - $5,000)= $24,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

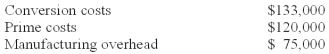

The following data pertains to Lam Co.'s manufacturing operations:

Additional information for the month of April:

Overhead is applied at $10 per direct labor hour.

For the month of April,prime cost incurred was:

A)$75,000.

B)$69,000.

C)$45,000.

D)$39,000.

= $75,000 = Material (($18,000 + 42,000-15,000)= $45,000)plus Direct labor of $30,000

Additional information for the month of April:

Overhead is applied at $10 per direct labor hour.

For the month of April,prime cost incurred was:

A)$75,000.

B)$69,000.

C)$45,000.

D)$39,000.

= $75,000 = Material (($18,000 + 42,000-15,000)= $45,000)plus Direct labor of $30,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

The following data pertains to Lam Co.'s manufacturing operations:

Additional information for the month of April:

Overhead is applied at $10 per direct labor hour.

For the month of April,cost of goods manufactured was:

A)$118,000.

B)$115,000.

C)$112,000.

D)$109,000.

$118,000 = $9,000 + ($42,000 + $18,000 - $15,000)+ $30,000 + $40,000 - $6,000

Overhead incurred = overhead applied = ($30,000/$7.50)x $10 = $40,000

Additional information for the month of April:

Overhead is applied at $10 per direct labor hour.

For the month of April,cost of goods manufactured was:

A)$118,000.

B)$115,000.

C)$112,000.

D)$109,000.

$118,000 = $9,000 + ($42,000 + $18,000 - $15,000)+ $30,000 + $40,000 - $6,000

Overhead incurred = overhead applied = ($30,000/$7.50)x $10 = $40,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

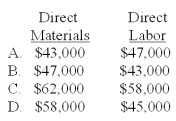

41

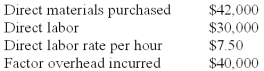

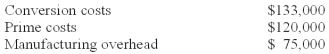

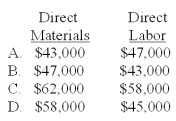

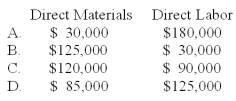

Bracken Co.incurred the following costs during 2010:

What was the amount of direct materials used and direct labor for the year?

A)A

B)B

C)C

D)D

= $62,000 + $58,000 = $120,000;or $133,000 - $75,000 = $58,000

And $120,000 - $58,000 = $62,000

What was the amount of direct materials used and direct labor for the year?

A)A

B)B

C)C

D)D

= $62,000 + $58,000 = $120,000;or $133,000 - $75,000 = $58,000

And $120,000 - $58,000 = $62,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Factory overhead costs for this period were 3 times as much as the direct material costs.Prime costs totaled $2,000.Conversion costs totaled $3,280.What are the direct labor costs for the period?

A)$1,220.

B)$1,360.

C)$1,410.

D)$1,540.

$3,280 = Direct Labor Costs + Factory Overhead Costs

Direct Labor Costs = $2,000 - Direct Materials Costs

Factory Overhead Costs = 3 x (Direct Materials Costs)

Solve for Direct Materials Costs via substitution:

$3,280 = ($2,000 - Direct Materials Costs)+ 3(Direct Materials Costs)

Direct Materials Costs = $640

Direct Labor Costs = $2,000 - $640 = $1,360

A)$1,220.

B)$1,360.

C)$1,410.

D)$1,540.

$3,280 = Direct Labor Costs + Factory Overhead Costs

Direct Labor Costs = $2,000 - Direct Materials Costs

Factory Overhead Costs = 3 x (Direct Materials Costs)

Solve for Direct Materials Costs via substitution:

$3,280 = ($2,000 - Direct Materials Costs)+ 3(Direct Materials Costs)

Direct Materials Costs = $640

Direct Labor Costs = $2,000 - $640 = $1,360

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

Stephenson Company's computer system recently crashed,erasing much of the Company's financial data.The following accounting information was discovered soon afterwards on the CFO's backup computer disk.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of total manufacturing cost?

A)$138,500.

B)$131,000.

C)$142,500.

D)$121,000.

$131,000 = $8,500 Direct Materials + $73,500 Direct Labor + $49,000 Overhead

Where $73,500 = 1.5($49,000)

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of total manufacturing cost?

A)$138,500.

B)$131,000.

C)$142,500.

D)$121,000.

$131,000 = $8,500 Direct Materials + $73,500 Direct Labor + $49,000 Overhead

Where $73,500 = 1.5($49,000)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

Factory overhead costs for a given period were 1.5 times as much as the direct material costs.Prime costs totaled $15,500.Conversion costs totaled $22,725.What are the direct labor costs for the period?

A)$1,200.

B)$1,050.

C)$1,075.

D)$1,155.

$22,725 = Direct Labor Costs + Factory Overhead Costs

Direct Labor Costs = $15,500 - Direct Materials Costs

Factory Overhead Costs = 1.5(Direct Materials Costs)

Solve for Direct Materials Costs via substitution:

$22,725 = ($15,500 - Direct Materials Costs)+ 1.5(Direct Materials Costs)

Direct Materials Costs = $14,450

Direct Labor Costs = $15,500 - $14,450 = $1,050

A)$1,200.

B)$1,050.

C)$1,075.

D)$1,155.

$22,725 = Direct Labor Costs + Factory Overhead Costs

Direct Labor Costs = $15,500 - Direct Materials Costs

Factory Overhead Costs = 1.5(Direct Materials Costs)

Solve for Direct Materials Costs via substitution:

$22,725 = ($15,500 - Direct Materials Costs)+ 1.5(Direct Materials Costs)

Direct Materials Costs = $14,450

Direct Labor Costs = $15,500 - $14,450 = $1,050

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

Tierney Construction,Inc.recently lost a portion of its financial records in an office theft.The following accounting information remained in the office files:

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of direct materials used?

A)$15,000.

B)$29,000.

C)$20,000.

D)$24,000.

$24,000 = $18,500 + X + $50,000 + $20,000 - $14,500 = $98,000;Where $50,000 = (2.5 x Overhead)= 2.5 x $20,000;X = 24,000

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of direct materials used?

A)$15,000.

B)$29,000.

C)$20,000.

D)$24,000.

$24,000 = $18,500 + X + $50,000 + $20,000 - $14,500 = $98,000;Where $50,000 = (2.5 x Overhead)= 2.5 x $20,000;X = 24,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

If finished goods inventory has increased during the period,which of the following is always true?

A)Cost of goods sold is less than cost of goods manufactured.

B)Cost of goods sold is more than cost of goods manufactured.

C)Cost of goods manufactured is more than total manufacturing costs.

D)Cost of goods manufactured is less than total manufacturing costs.

A)Cost of goods sold is less than cost of goods manufactured.

B)Cost of goods sold is more than cost of goods manufactured.

C)Cost of goods manufactured is more than total manufacturing costs.

D)Cost of goods manufactured is less than total manufacturing costs.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

Tierney Construction,Inc.recently lost a portion of its financial records in an office theft.The following accounting information remained in the office files:

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount in the finished goods inventory at December 31,2010?

A)$55,500.

B)$35,000.

C)$43,000.

D)$49,000.

$49,000 = $98,000 + $31,000 - $80,000

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount in the finished goods inventory at December 31,2010?

A)$55,500.

B)$35,000.

C)$43,000.

D)$49,000.

$49,000 = $98,000 + $31,000 - $80,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

Jeffrey's Bottling Co.incurred the following costs during 2010:

If direct materials cost was $140,000 in 2010,what was the conversion cost for year 2010?

A)$255,000

B)$240,000

C)$215,000

D)$235,000

Direct Labor Cost = $220,000 - $140,000 = $80,000

Conversion Cost = $80,000 + $175,000 = $255,000

If direct materials cost was $140,000 in 2010,what was the conversion cost for year 2010?

A)$255,000

B)$240,000

C)$215,000

D)$235,000

Direct Labor Cost = $220,000 - $140,000 = $80,000

Conversion Cost = $80,000 + $175,000 = $255,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

Furniture Co.incurred the following costs during 2010:

What was the amount of direct materials and direct labor used for the year?

A)A

B)B

C)C

D)D

= Labor + $115,000 = $240,000;Labor = $125,000.Materials + $125,000 = $210,000 = Prime Costs.Materials = $85,000

What was the amount of direct materials and direct labor used for the year?

A)A

B)B

C)C

D)D

= Labor + $115,000 = $240,000;Labor = $125,000.Materials + $125,000 = $210,000 = Prime Costs.Materials = $85,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

Factory overhead costs for a given period were 2 times as much as the direct material costs.Prime costs totaled $8,000.Conversion costs totaled $11,350.What are the direct labor costs for the period?

A)$4,650.

B)$3,560.

C)$4,200.

D)$3,860.

$11,350 = Direct Labor Costs + Factory Overhead Costs

Direct Labor Costs = $8,000 - Direct Materials Costs

Factory Overhead Costs = 2(Direct Materials Costs)

Solve for Direct Materials Costs via substitution:

$11,350 = ($8,000 - Direct Materials Costs)+ 2(Direct Materials Costs)

Direct Materials Costs = $3,350

Direct Labor Costs = $8,000 - $3,350 = $4,650

A)$4,650.

B)$3,560.

C)$4,200.

D)$3,860.

$11,350 = Direct Labor Costs + Factory Overhead Costs

Direct Labor Costs = $8,000 - Direct Materials Costs

Factory Overhead Costs = 2(Direct Materials Costs)

Solve for Direct Materials Costs via substitution:

$11,350 = ($8,000 - Direct Materials Costs)+ 2(Direct Materials Costs)

Direct Materials Costs = $3,350

Direct Labor Costs = $8,000 - $3,350 = $4,650

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

Fisher,Inc.recently lost a portion of its records in an office fire.The following information was salvaged from the accounting records.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of total manufacturing cost?

A)$50,000.

B)$52,000.

C)$56,000.

D)$58,000.

$56,000 = $31,000 + $15,000 + $10,000

Where $15,000 = 1.5($10,000)

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of total manufacturing cost?

A)$50,000.

B)$52,000.

C)$56,000.

D)$58,000.

$56,000 = $31,000 + $15,000 + $10,000

Where $15,000 = 1.5($10,000)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

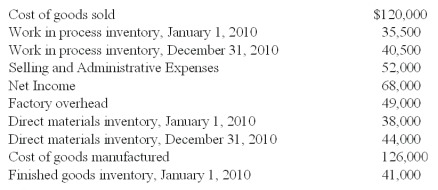

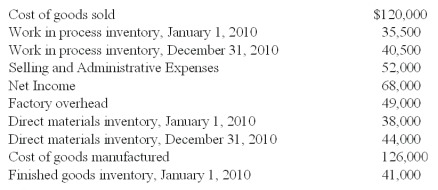

Stephenson Company's computer system recently crashed,erasing much of the Company's financial data.The following accounting information was discovered soon afterwards on the CFO's backup computer disk.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of direct materials purchased?

A)$14,500.

B)$17,000.

C)$10,000.

D)$21,000.

$14,500 = $8,500 - ($38,000 - $44,000)= $14,500

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of direct materials purchased?

A)$14,500.

B)$17,000.

C)$10,000.

D)$21,000.

$14,500 = $8,500 - ($38,000 - $44,000)= $14,500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

Fisher,Inc.recently lost a portion of its records in an office fire.The following information was salvaged from the accounting records.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of net sales?

A)$68,500.

B)$70,000.

C)$72,500.

D)$75,000.

$75,000 = $15,000 + $10,000 + $50,000

Where $15,000 = Net Income;$10,000 = Sell & Admin.Expenses;and $50,000 = COGS

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Fisher,Inc.has asked you to recalculate the following accounts and to report to him by the end of the day.

What is the amount of net sales?

A)$68,500.

B)$70,000.

C)$72,500.

D)$75,000.

$75,000 = $15,000 + $10,000 + $50,000

Where $15,000 = Net Income;$10,000 = Sell & Admin.Expenses;and $50,000 = COGS

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

Woodcarving Co.incurred the following costs during 2010:

What was the amount of direct materials and direct labor used for the year?

A)A

B)B

C)C

D)D

= Labor + $315,000 = $460,000;Labor = $145,000.Materials + $145,000 = $390,000 = Prime Costs.Materials = $245,000

What was the amount of direct materials and direct labor used for the year?

A)A

B)B

C)C

D)D

= Labor + $315,000 = $460,000;Labor = $145,000.Materials + $145,000 = $390,000 = Prime Costs.Materials = $245,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

Tierney Construction,Inc.recently lost a portion of its financial records in an office theft.The following accounting information remained in the office files:

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of total manufacturing cost?

A)$83,000.

B)$94,000.

C)$108,000.

D)$75,000.

= $94,000 = $24,000 Direct Materials Used + $50,000 Direct Labor + $20,000

Overhead = $94,000 Total Manufacturing Cost

Where Direct Labor = 2.5($20,000)= $50,000

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of total manufacturing cost?

A)$83,000.

B)$94,000.

C)$108,000.

D)$75,000.

= $94,000 = $24,000 Direct Materials Used + $50,000 Direct Labor + $20,000

Overhead = $94,000 Total Manufacturing Cost

Where Direct Labor = 2.5($20,000)= $50,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

Stephenson Company's computer system recently crashed,erasing much of the Company's financial data.The following accounting information was discovered soon afterwards on the CFO's backup computer disk.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of direct materials used?

A)$8,500.

B)$7,000.

C)$12,500.

D)$2,000.

$8,500 = $35,500 + $73,500 + X + $49,000 - $126,000 = $40,500;

Where $73,500 = (1.5 x Overhead);X = $8,500

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.What should be the amount of direct materials used?

A)$8,500.

B)$7,000.

C)$12,500.

D)$2,000.

$8,500 = $35,500 + $73,500 + X + $49,000 - $126,000 = $40,500;

Where $73,500 = (1.5 x Overhead);X = $8,500

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

Tierney Construction,Inc.recently lost a portion of its financial records in an office theft.The following accounting information remained in the office files:

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of direct materials purchased?

A)$28,000.

B)$19,000.

C)$15,000.

D)$12,000.

$12,000 = $24,000 - ($26,000 - $14,000)= $12,000

Direct labor cost incurred during the period amounted to 2.5 times the factory overhead.The CFO of Tierney Construction,Inc.has asked you to recalculate the following accounts and to report to him by the end of tomorrow.

What should be the amount of direct materials purchased?

A)$28,000.

B)$19,000.

C)$15,000.

D)$12,000.

$12,000 = $24,000 - ($26,000 - $14,000)= $12,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

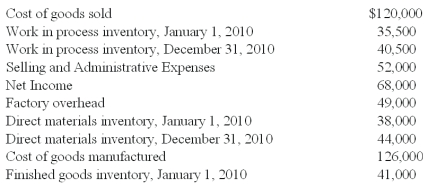

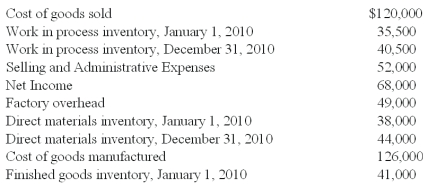

Stephenson Company's computer system recently crashed,erasing much of the Company's financial data.The following accounting information was discovered soon afterwards on the CFO's backup computer disk.

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.

What should be the amount in the finished goods inventory at December 31,2010?

A)$42,000.

B)$47,000.

C)$40,000.

D)$51,000.

$47,000 = $126,000 + $41,000 - $120,000

Direct labor cost incurred during the period amounted to 1.5 times the factory overhead.The CFO of Stephenson Company has asked you to recalculate the following accounts and report to him by week's end.

What should be the amount in the finished goods inventory at December 31,2010?

A)$42,000.

B)$47,000.

C)$40,000.

D)$51,000.

$47,000 = $126,000 + $41,000 - $120,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

Manufacturing firms use which of the following three inventory accounts?

A)Materials,Work-in-process,Transferred-out.

B)Materials,Work-in-process,Finished goods.

C)Materials,Finished goods,Transferred out.

D)Work-in-process,Finished goods,Transferred-out.

A)Materials,Work-in-process,Transferred-out.

B)Materials,Work-in-process,Finished goods.

C)Materials,Finished goods,Transferred out.

D)Work-in-process,Finished goods,Transferred-out.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

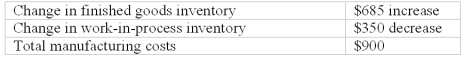

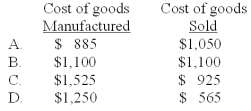

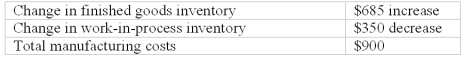

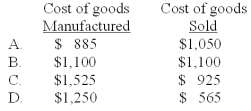

Consider the following for Franklin Street Manufacturing:

What are the cost of goods manufactured and cost of goods sold?

A)A

B)B

C)C

D)D

COGM = $900 + $350 = $1,250

COGS = $1,250 - $685 = $565

What are the cost of goods manufactured and cost of goods sold?

A)A

B)B

C)C

D)D

COGM = $900 + $350 = $1,250

COGS = $1,250 - $685 = $565

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

Lester-Sung,Inc.is a large general construction firm in the commercial building industry.The following is a list of costs incurred by this company:

1)The cost of a laborer for 8 hours at $6.00 an hour.

2)The cost of insurance for the carpenters.

3)The cost of 1,000 board feet of 2x4 lumber.

4)The CEO's salary.

Required: Classify each cost above using the following categories:

(a)Selling and administrative cost

(b)Direct material

(c)Direct labor

(d)Overhead cost

1)The cost of a laborer for 8 hours at $6.00 an hour.

2)The cost of insurance for the carpenters.

3)The cost of 1,000 board feet of 2x4 lumber.

4)The CEO's salary.

Required: Classify each cost above using the following categories:

(a)Selling and administrative cost

(b)Direct material

(c)Direct labor

(d)Overhead cost

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

Direct materials and direct labor costs total $70,000 and factory overhead costs total $100 per machine hour.If 300 machine hours were used for Job #222,what is the total manufacturing cost for Job #222?

A)$30,000

B)$60,000

C)$70,000

D)$90,000

E)$100,000

A)$30,000

B)$60,000

C)$70,000

D)$90,000

E)$100,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

Williams Company is an East Coast producer of electronic furnace air filters.A significant jump in new housing starts in the region has triggered a 25 percent increase in orders for the filter units,especially the quality model that Williams sells for $270.Six weeks after increasing production to supply the increased orders,the assistant controller notices some unusual unit cost data in the monthly report she is preparing.Prior and current month unit values are given below:

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following should be considered with structural cost drivers?

A)Scale.

B)Experience.

C)Complexity.

D)Technology.

E)Scale,Experience,Complexity,and Technology.

A)Scale.

B)Experience.

C)Complexity.

D)Technology.

E)Scale,Experience,Complexity,and Technology.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

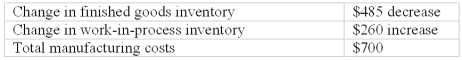

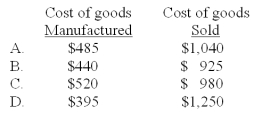

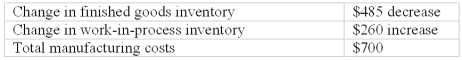

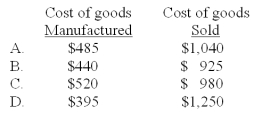

Consider the following for Neil Wood Manufacturing:

What are the cost of goods manufactured and cost of goods sold?

A)A

B)B

C)C

D)D

COGM = $700 - $260 = $440

COGS = $440 + $485 = $925

What are the cost of goods manufactured and cost of goods sold?

A)A

B)B

C)C

D)D

COGM = $700 - $260 = $440

COGS = $440 + $485 = $925

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

A manager of a small manufacturing firm is interested in knowing what the company's product costs are.Which of the following would be considered a product cost for the manager's company?

A)Direct materials.

B)Product design cost.

C)Office expenses.

D)Selling expenses.

E)Advertising expense.

A)Direct materials.

B)Product design cost.

C)Office expenses.

D)Selling expenses.

E)Advertising expense.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

The income statement for a merchandising company includes:

A)Direct Labor.

B)Factory Overhead.

C)Total Manufacturing Cost.

D)Cost of Goods Sold.

A)Direct Labor.

B)Factory Overhead.

C)Total Manufacturing Cost.

D)Cost of Goods Sold.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

In order to assure that accounting information is accurate and to avoid potentially costly mistakes in the decision making process,firms should:

A)Design and monitor an effective system of internal accounting controls.

B)Have the internal auditors and controller each check the accounting data before it is released to management.

C)Purchase an accounting system that is designed specifically for the industry in which the firm conducts business.

D)Develop and implement a code of ethics.

A)Design and monitor an effective system of internal accounting controls.

B)Have the internal auditors and controller each check the accounting data before it is released to management.

C)Purchase an accounting system that is designed specifically for the industry in which the firm conducts business.

D)Develop and implement a code of ethics.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following best describes a fixed cost?

A)It may change in total when such change is unrelated to changes in production volume.

B)It may change in total when such change is related to changes in production volume.

C)It is constant per unit of change in production volume.

D)It may change in total when such change depends on production volume within the relevant range.

A)It may change in total when such change is unrelated to changes in production volume.

B)It may change in total when such change is related to changes in production volume.

C)It is constant per unit of change in production volume.

D)It may change in total when such change depends on production volume within the relevant range.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

Which characteristic is the most critical about information in the decision-making process?

A)Relevance.

B)Timeliness.

C)Accuracy.

D)Cost.

A)Relevance.

B)Timeliness.

C)Accuracy.

D)Cost.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

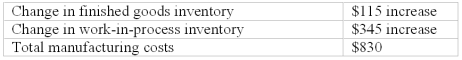

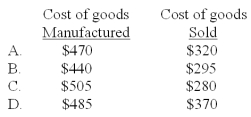

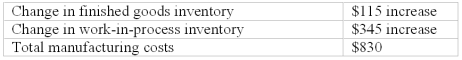

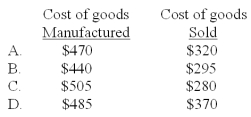

Consider the following for Premiere Tire Manufacturing:

What are the cost of goods manufactured and cost of goods sold?

A)A

B)B

C)C

D)D

COGM = $830 - $345 = $485

COGS = $485 - $115 = $370

What are the cost of goods manufactured and cost of goods sold?

A)A

B)B

C)C

D)D

COGM = $830 - $345 = $485

COGS = $485 - $115 = $370

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

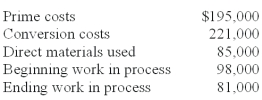

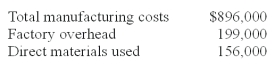

Fashionaire Company produces children's clothing.During 2010,the company incurred the following costs:

Inventories for the year were:

Required: Prepare a statement of cost of goods manufactured and cost of goods sold.

Inventories for the year were:

Required: Prepare a statement of cost of goods manufactured and cost of goods sold.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

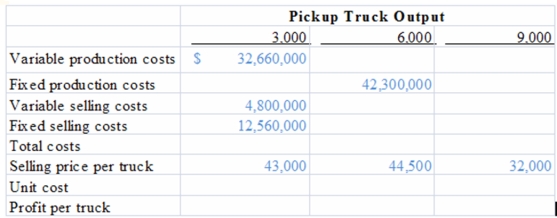

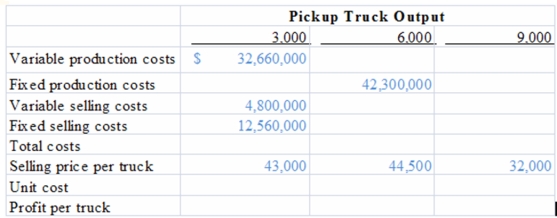

Tough Trucks is an up-scale,higher-priced,specialty pickup truck maker based in Irvine,California.The management accountant for Premium Pickups compiled information for various levels of pickup truck output:

Required: Rounding all calculations to the nearest dollar,fill in the blanks with the correct figures.

Required: Rounding all calculations to the nearest dollar,fill in the blanks with the correct figures.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

The following costs are incurred by the Oakland Company,a manufacturer of furniture.

1)wood and fabric used in furniture

2)depreciation on machinery

3)property taxes on the factory

4)labor costs to manufacture the furniture

5)electricity cost to operate the machinery

6)factory rent

7)production supervisor's salary

8)sandpaper and other supplies

9)fire insurance on factory

10)commissions paid to salespersons

Required: Classify each cost as either variable or fixed.

1)wood and fabric used in furniture

2)depreciation on machinery

3)property taxes on the factory

4)labor costs to manufacture the furniture

5)electricity cost to operate the machinery

6)factory rent

7)production supervisor's salary

8)sandpaper and other supplies

9)fire insurance on factory

10)commissions paid to salespersons

Required: Classify each cost as either variable or fixed.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

A manager of a large retail firm is interested in knowing what the company's product costs are.Which of the following would be considered a product cost for the manager's company?

A)Direct materials.

B)Direct labor.

C)Factory overhead.

D)Transportation costs paid by the retailer to transport the purchased product to its distribution location.

A)Direct materials.

B)Direct labor.

C)Factory overhead.

D)Transportation costs paid by the retailer to transport the purchased product to its distribution location.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

The main objective(s)of internal accounting controls is/are:

A)To increase customer satisfaction.

B)To increase revenue.

C)To prevent or detect errors and fraudulent acts.

D)To facilitate new product lines.

E)To increase employee morale.

A)To increase customer satisfaction.

B)To increase revenue.

C)To prevent or detect errors and fraudulent acts.

D)To facilitate new product lines.

E)To increase employee morale.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

Direct materials and direct labor costs total $40,000 and factory overhead costs total $100 per machine hour.If 200 machine hours were used for Job #202,what is the total manufacturing cost for Job #202?

A)$95,000

B)$75,000

C)$65,000

D)$60,000

E)$55,000

A)$95,000

B)$75,000

C)$65,000

D)$60,000

E)$55,000

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

A portion of the costs incurred by business organizations is designated as direct labor cost.As used in practice,the term direct labor cost has a wide variety of meanings.Unless the meaning intended in a given context is clear,misunderstanding and confusion are likely to ensue.If a user does not understand the elements included in direct labor cost,erroneous interpretations of the numbers might occur and could result in poor management decisions.Measurement of direct labor costs has two aspects: (1)the quantity of labor effort that is to be included,that is,the types of hours or other units of time that are to be counted;and (2)the unit price by which each of these quantities is multiplied to arrive at a monetary cost.

Required:

1)Distinguish between direct labor and indirect labor.

2)Presented below are labor cost elements that a company has been classified as direct labor,factory overhead,or either direct labor or factory overhead depending upon the situation.

Direct labor -- Included in the company's direct labor are cost production efficiency bonuses and certain benefits for direct labor workers such as FICA (employer's portion),group life insurance,vacation pay,and workers' compensation insurance.

Factory overhead -- The company's calculation of manufacturing overhead includes the cost of the following: wage continuation plans,the company sponsored cafeteria,the personnel department,and recreational facilities.

Direct labor or factory overhead -- The costs that the company includes in this category are maintenance expense,overtime premiums,and shift premiums.

Explain the reasoning used by the company in classifying the cost elements in each of the three categories.

Required:

1)Distinguish between direct labor and indirect labor.

2)Presented below are labor cost elements that a company has been classified as direct labor,factory overhead,or either direct labor or factory overhead depending upon the situation.

Direct labor -- Included in the company's direct labor are cost production efficiency bonuses and certain benefits for direct labor workers such as FICA (employer's portion),group life insurance,vacation pay,and workers' compensation insurance.

Factory overhead -- The company's calculation of manufacturing overhead includes the cost of the following: wage continuation plans,the company sponsored cafeteria,the personnel department,and recreational facilities.

Direct labor or factory overhead -- The costs that the company includes in this category are maintenance expense,overtime premiums,and shift premiums.

Explain the reasoning used by the company in classifying the cost elements in each of the three categories.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

The income statement for a manufacturing company includes:

A)Indirect Labor,Factory Overhead,and Total Manufacturing Cost.

B)Total Manufacturing Cost and Cost of Goods Sold.

C)Indirect Materials,Factory Overhead,and Cost of Goods Manufactured.

D)Indirect Labor,Indirect Materials and Cost of Goods Sold.

A)Indirect Labor,Factory Overhead,and Total Manufacturing Cost.

B)Total Manufacturing Cost and Cost of Goods Sold.

C)Indirect Materials,Factory Overhead,and Cost of Goods Manufactured.

D)Indirect Labor,Indirect Materials and Cost of Goods Sold.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

Choco Chocolata is a cookie company in Juarez,Mexico that produces and sells American-style chocolate chip cookies with extremely high quality and service.The owner would like to identify the various costs incurred during each year in order to plan and control the costs in the business.Chocolata's costs are the following (in thousands of pesos):

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck