Deck 22: Gsthst Overview

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/8

Play

Full screen (f)

Deck 22: Gsthst Overview

1

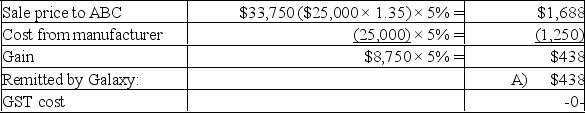

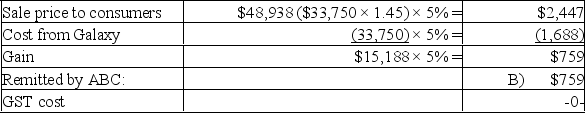

Galaxy Wholesalers purchased inventory from a local manufacturer for $25,000.Galaxy marked up the price by 35% and sold the inventory to ABC Retailers.ABC marked up the inventory by a further 45% and sold the products to its customers.(Pre-GST costs are used to calculate the marked up prices.)

Required:

Calculate how much GST was remitted by:

A)Galaxy Wholesalers

B)ABC Retailers

(Round all amounts to zero decimal places.)

Required:

Calculate how much GST was remitted by:

A)Galaxy Wholesalers

B)ABC Retailers

(Round all amounts to zero decimal places.)

Galaxy Wholesalers:

ABC Retailers:

ABC Retailers:

ABC Retailers:

ABC Retailers:

2

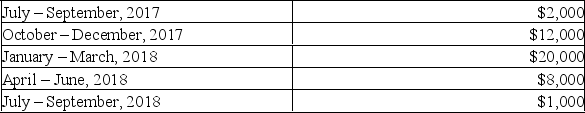

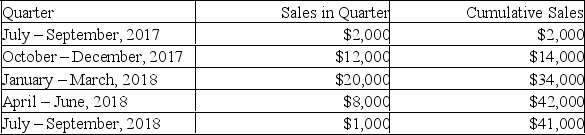

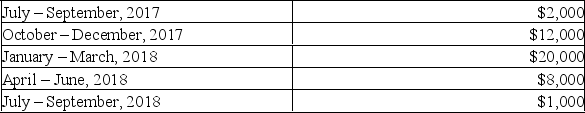

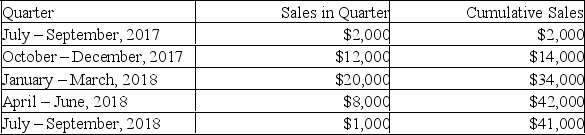

Sam began a small seasonal business in Prince Edward Island on July 1st,2017.He began operations slowly during the off-season,prior to a larger sales between October and March.Sam's sales of taxable supplies per quarter for the first fifteen months are provided for you here:

Required:

Required:

Apply the 'sales in quarter' and 'cumulative sales' tests to determine when Sam was required to become an HST registrant.Show your calculations and answer the following:

A.When did Sam lose his small supplier status?

B.What date was Sam required to start collecting HST?

C.By what date was Sam required to become an HST registrant?

Required:

Required:Apply the 'sales in quarter' and 'cumulative sales' tests to determine when Sam was required to become an HST registrant.Show your calculations and answer the following:

A.When did Sam lose his small supplier status?

B.What date was Sam required to start collecting HST?

C.By what date was Sam required to become an HST registrant?

A)Sam's sales have surpassed the $30,000 threshold in the January - March,2018 quarter under the cumulative sales test.Therefore,his small supplier status was lost on April 30th,2018.

B)Sam was required to start collecting HST on May 1st,2018.

C)Sam needed to be registered prior to May 30th,2018.

B)Sam was required to start collecting HST on May 1st,2018.

C)Sam needed to be registered prior to May 30th,2018.

3

Jordan was required to pay her own employment expenses in 20x0,which totaled $12,000,including $2,000 CCA.All of the expenses were deducted on her 20x0 tax return,and all included a 15% HST component,other than the CCA which had a deemed inclusion since HST was originally paid on the vehicle.If Jordan applied for an HST rebate in 20x1 when preparing her 20x0 tax return,what impact would the rebate have on her 20x1 tax return?

A)Increase in employment income of $1,304 and increase in UCC of $261

B)Increase in employment income of $1,304 and decrease in UCC of $261

C)Increase in employment income of $1,565

D)Decrease in employment income of $1,565

A)Increase in employment income of $1,304 and increase in UCC of $261

B)Increase in employment income of $1,304 and decrease in UCC of $261

C)Increase in employment income of $1,565

D)Decrease in employment income of $1,565

B

4

With respect to GST/HST,supplies fall under different categories with different sets of rules.Which of the following is FALSE with regard to zero-rated supplies?

A)Zero-rated supplies are not included in the determination of the mandatory reporting period.

B)GST/HST is charged at a rate of 0%.

C)Prescription drugs and medical devices are examples of zero-rated supplies.

D)Input tax credits may be claimed on expenditures made to provide the zero-rated supplies.

A)Zero-rated supplies are not included in the determination of the mandatory reporting period.

B)GST/HST is charged at a rate of 0%.

C)Prescription drugs and medical devices are examples of zero-rated supplies.

D)Input tax credits may be claimed on expenditures made to provide the zero-rated supplies.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

5

With respect to GST/HST,supplies fall under different categories with different sets of rules.Which of the following is FALSE with regard to exempt supplies?

A)Exempt supplies are not included in the determination of the mandatory reporting period.

B)GST/HST is not applicable.

C)Childcare services and music lessons are examples of exempt supplies.

D)Input tax credits may be claimed on expenditures made to provide the exempt supplies.

A)Exempt supplies are not included in the determination of the mandatory reporting period.

B)GST/HST is not applicable.

C)Childcare services and music lessons are examples of exempt supplies.

D)Input tax credits may be claimed on expenditures made to provide the exempt supplies.

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

6

Blue Co.earned $80,000 in revenue and paid $45,000 in operating expenses.If Blue Co.elects to use the quick method,how much is the net HST remittance? (Blue Co.is in a province with 13% HST and an 8.8% remittance rate.)

A)$3,080

B)$4,550

C)$6,740

D)$7,040

A)$3,080

B)$4,550

C)$6,740

D)$7,040

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

7

The Little Company (TLC),located in British Columbia,provided a company car to its key employee,Ben,in 2018.The car was purchased for $38,000 + 5% GST at the beginning of the year,and was available to Ben for all twelve months of 2018.Ben drove the car 20,000 kms in 2018,9,000 of which were for employment purposes.TLC paid $5,200 for the operating costs of the car during the year.Ben did not receive an automobile allowance from TLC and he did not reimburse his employer for any of the operating costs.

Required:

A)Calculate the following for TLC:

(i)Input tax credit (ITC)for 2018

(ii)GST owing for 2018

B)Calculate Ben's total taxable benefit for 2018.

(Round all amounts to zero decimal places.)

Required:

A)Calculate the following for TLC:

(i)Input tax credit (ITC)for 2018

(ii)GST owing for 2018

B)Calculate Ben's total taxable benefit for 2018.

(Round all amounts to zero decimal places.)

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck

8

Green Co.earned $20,000 in revenue and paid $15,000 in expenses (that do not include meals and entertainment).How much GST will Green Co.remit using the simplified ITC calculation? (Green Co.is in a province with 5% GST.)

A)$0

B)$238

C)$250

D)$652

A)$0

B)$238

C)$250

D)$652

Unlock Deck

Unlock for access to all 8 flashcards in this deck.

Unlock Deck

k this deck