Deck 15: How Corporations Issue Securities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/70

Play

Full screen (f)

Deck 15: How Corporations Issue Securities

1

Wealthy individuals who provide equity investment for new firms are called:

i.white knights; II)red herrings; III)angel investors

A)I only

B)I and II only

C)III only

D)II only

i.white knights; II)red herrings; III)angel investors

A)I only

B)I and II only

C)III only

D)II only

III only

2

A business plan generally contains:

I.a description of the proposed products;

II.a description of the potential market;

III.a description of the underlying technology;

IV.a description of resources needed

A)I only

B)I and II only

C)II and III only

D)I,II,III,and IV

I.a description of the proposed products;

II.a description of the potential market;

III.a description of the underlying technology;

IV.a description of resources needed

A)I only

B)I and II only

C)II and III only

D)I,II,III,and IV

I,II,III,and IV

3

Generally,underwriters provide the following services to the issuing firm:

i.provide advice; II)buy some or all of the new issue; III)resell the issue to the public

A)I only

B)I and II only

C)I and III only

D)I,II,and III

i.provide advice; II)buy some or all of the new issue; III)resell the issue to the public

A)I only

B)I and II only

C)I and III only

D)I,II,and III

I,II,and III

4

Generally,venture capital funds are organized as:

i.proprietorships; II)corporations; III)limited private partnerships

A)I only

B)II only

C)III only

D)I and II only

i.proprietorships; II)corporations; III)limited private partnerships

A)I only

B)II only

C)III only

D)I and II only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

5

According to evidence from surveys of CFOs,the top-most motive for firms to go public is to:

A)broaden the base of ownership.

B)enhance the reputation of the firm.

C)establish a market price/value for our firm.

D)create public shares for

A)broaden the base of ownership.

B)enhance the reputation of the firm.

C)establish a market price/value for our firm.

D)create public shares for

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

6

Arrange the following in chronological order for a typical start-up firm:

i.VC financing; II)mezzanine financing; III)stage 1,2,3,4,etc.,financing; IV)IPO

A)I,II,III,and IV

B)I,III,II,and IV

C)IV,I,II,and III

D)III,I,II,and IV

i.VC financing; II)mezzanine financing; III)stage 1,2,3,4,etc.,financing; IV)IPO

A)I,II,III,and IV

B)I,III,II,and IV

C)IV,I,II,and III

D)III,I,II,and IV

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

7

Underwriters will handle an issue of new securities on a:

I.best efforts basis;

II.firm commitment basis;

III.all or none basis

A)I only

B)II only

C)III only

D)I or II or III

I.best efforts basis;

II.firm commitment basis;

III.all or none basis

A)I only

B)II only

C)III only

D)I or II or III

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

8

The managing underwriter is also called the:

A)syndicate.

B)book runner.

C)specialist.

D)lead angel.

A)syndicate.

B)book runner.

C)specialist.

D)lead angel.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

9

Venture capital investment was highest in the year:

A)1999.

B)2000.

C)2003.

D)2005.

A)1999.

B)2000.

C)2003.

D)2005.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

10

The market for venture capital refers to the:

I.private financial marketplace for providing equity investment for small,start-up firms;

II.bond market;

III.market for providing equity to well-established firms

A)I only

B)II only

C)II and III only

D)III only

I.private financial marketplace for providing equity investment for small,start-up firms;

II.bond market;

III.market for providing equity to well-established firms

A)I only

B)II only

C)II and III only

D)III only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

11

State laws that regulate sales of securities within the state are called:

A)red herrings.

B)registration laws.

C)Rule 415 regulations.

D)blue-sky laws.

A)red herrings.

B)registration laws.

C)Rule 415 regulations.

D)blue-sky laws.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

12

According to the National Venture Capital Association,"venture capital funds earn an average annual rate of return (after expenses)of about":

A)32%.

B)24%.

C)19%.

D)12%.

A)32%.

B)24%.

C)19%.

D)12%.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

13

Venture capitalists provide start-up companies:

A)all the money they will need up front.

B)enough money at each stage so that they can reach the next stage or major checkpoint.

C)assistance in managing the initial public offering (IPO).

D)funding intended to buy-out the company's founders.

A)all the money they will need up front.

B)enough money at each stage so that they can reach the next stage or major checkpoint.

C)assistance in managing the initial public offering (IPO).

D)funding intended to buy-out the company's founders.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is generally true of venture capital (VC)firms?

A)VCs are always silent partners in the start-up company that they finance.

B)VCs always have a majority of directors in the start-up company.

C)VCs generally provide management advice and contacts in addition to capital.

D)VCs are combinations of publicly-traded companies.

A)VCs are always silent partners in the start-up company that they finance.

B)VCs always have a majority of directors in the start-up company.

C)VCs generally provide management advice and contacts in addition to capital.

D)VCs are combinations of publicly-traded companies.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

15

Equity investment in start-up private companies is called:

A)venture capital.

B)mezzanine financing.

C)initial public offering (IPO).

D)seasoned equity offering (SEO).

A)venture capital.

B)mezzanine financing.

C)initial public offering (IPO).

D)seasoned equity offering (SEO).

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

16

Underwriters are typically compensated for their services in helping a firm issue new securities in the form of a:

A)commission.

B)set fee.

C)spread.

D)finder's fee.

A)commission.

B)set fee.

C)spread.

D)finder's fee.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

17

Firms looking to raise funds will file registration statements with the:

A)Federal Reserve Board (FED).

B)Office of the Comptroller of the Currency (OCC).

C)Securities and Exchange Commission (SEC).

D)Public Company Accounting Oversight Board (PCAOB).

A)Federal Reserve Board (FED).

B)Office of the Comptroller of the Currency (OCC).

C)Securities and Exchange Commission (SEC).

D)Public Company Accounting Oversight Board (PCAOB).

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

18

The stock exchange that specializes in trading the shares of young and rapidly growing companies is:

A)Nasdaq.

B)NYSE.

C)London Stock Exchange.

D)Tokyo Stock Exchange.

A)Nasdaq.

B)NYSE.

C)London Stock Exchange.

D)Tokyo Stock Exchange.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

19

Large technology firms like Intel,Johnson and Johnson,and Sun Microsystems that provide equity capital to new innovative companies are called:

A)angel investors.

B)corporate venturers.

C)white knights.

D)mezzanine financiers.

A)angel investors.

B)corporate venturers.

C)white knights.

D)mezzanine financiers.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

20

The main reason for the recent migration of a large number of firms from public-to-private ownership is:

A)blue-sky laws.

B)Sarbanes-Oxley Act.

C)international accounting standards (IAS).

D)advent of shelf registration.

A)blue-sky laws.

B)Sarbanes-Oxley Act.

C)international accounting standards (IAS).

D)advent of shelf registration.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

21

Image Storage Corporation has 1,000,000 shares outstanding.It wishes to issue 500,000 new shares using a (North American)rights issue.If the current stock price is $50 and the subscription price is $47/share,what is the value of a right?

A)$0.40/right

B)$5.00/right

C)$2.50/right

D)$1.00/right

A)$0.40/right

B)$5.00/right

C)$2.50/right

D)$1.00/right

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

22

Generally,initial public offerings (IPOs)are:

A)overpriced.

B)correctly priced.

C)underpriced.

D)there is no general trend.

A)overpriced.

B)correctly priced.

C)underpriced.

D)there is no general trend.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

23

A rights issue is also called a(an):

A)private placement.

B)shelf registration.

C)initial public offering (IPO).

D)privileged subscription.

A)private placement.

B)shelf registration.

C)initial public offering (IPO).

D)privileged subscription.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

24

A general cash offer involves the following processes:

I.register the issue with the SEC;

II.sell the securities through an underwriter or a syndicate of underwriters;

III.have underwriter build up a book of likely demand for the securities;

IV.price of the issue is fixed;

V.sell the securities to the public

A)I,II,and III only

B)I,II,and IV only

C)I,II,III,IV,and V

D)II,III,IV,and V only

I.register the issue with the SEC;

II.sell the securities through an underwriter or a syndicate of underwriters;

III.have underwriter build up a book of likely demand for the securities;

IV.price of the issue is fixed;

V.sell the securities to the public

A)I,II,and III only

B)I,II,and IV only

C)I,II,III,IV,and V

D)II,III,IV,and V only

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

25

A new public equity issue from a company with public equity previously outstanding is called a(an):

A)initial public offering (IPO).

B)American depository receipt (ADR).

C)seasoned equity offering (SEO).

D)private placement.

A)initial public offering (IPO).

B)American depository receipt (ADR).

C)seasoned equity offering (SEO).

D)private placement.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

26

Shelf registration is more often used for the:

A)issue of common stock.

B)issue of convertible securities.

C)issue of corporate bonds.

D)issue of warrants.

A)issue of common stock.

B)issue of convertible securities.

C)issue of corporate bonds.

D)issue of warrants.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements best describes shelf registration?

A)The issuance of securities to qualified institutional investors.

B)The enforcement of blue-sky laws.

C)The provision that allows large companies to file a single registration statement covering financing plans up to three years into the future.

D)Registration of the sale of securities in the primary market.

A)The issuance of securities to qualified institutional investors.

B)The enforcement of blue-sky laws.

C)The provision that allows large companies to file a single registration statement covering financing plans up to three years into the future.

D)Registration of the sale of securities in the primary market.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

28

In a uniform-price auction:

A)all winning bidders pay the price that they bid.

B)all winning bidders pay a price that is the highest bid.

C)all winning bidders pay a price that is the lowest winning bid.

D)all winning bidders receive their full allocation.

A)all winning bidders pay the price that they bid.

B)all winning bidders pay a price that is the highest bid.

C)all winning bidders pay a price that is the lowest winning bid.

D)all winning bidders receive their full allocation.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

29

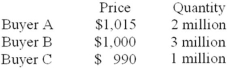

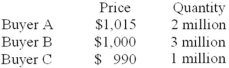

Suppose a government wishes to auction 5 million bonds,and three would-be buyers submit the following bids:

In a uniform-price auction:

A)Buyer A pays $1,015 and Buyer B pays $1,000.

B)Buyer A pays $1,000 and Buyer B pays $1,000.

C)Buyer A pays $990 and Buyer B pays $990.

D)Buyer A pays $1,000 and Buyer C Pays $990.

In a uniform-price auction:

A)Buyer A pays $1,015 and Buyer B pays $1,000.

B)Buyer A pays $1,000 and Buyer B pays $1,000.

C)Buyer A pays $990 and Buyer B pays $990.

D)Buyer A pays $1,000 and Buyer C Pays $990.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

30

Most financial economists attribute the drop in the price of equity subsequent to the announcement of a new issue to:

A)an increase in the supply of shares.

B)information effect.

C)both a and b.

D)neither a nor b.

A)an increase in the supply of shares.

B)information effect.

C)both a and b.

D)neither a nor b.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

31

Generally,which of the following issues have the lowest total direct costs of issuing as a percentage of gross proceeds?

A)initial public offerings (IPOs)

B)seasoned equity offerings (SEOs)

C)convertible bonds

D)straight bonds

A)initial public offerings (IPOs)

B)seasoned equity offerings (SEOs)

C)convertible bonds

D)straight bonds

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

32

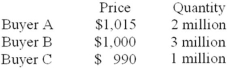

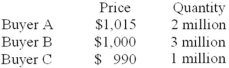

Suppose that a government wishes to auction 5 million bonds (quantity),and three potential buyers submit the following bids:

In a discriminatory auction:

A)Buyer A pays $1,015 and Buyer B pays $1,000.

B)Buyer A pays $1,000 and Buyer B pays $1,000.

C)Buyer A pays $990 and Buyer B pays $990.

D)Buyer A pays $1,000 and Buyer C Pays $990.

In a discriminatory auction:

A)Buyer A pays $1,015 and Buyer B pays $1,000.

B)Buyer A pays $1,000 and Buyer B pays $1,000.

C)Buyer A pays $990 and Buyer B pays $990.

D)Buyer A pays $1,000 and Buyer C Pays $990.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

33

New Image Corporation has 1,000,000 shares outstanding.It wishes to issue 500,000 new shares using rights issue.How many (North American)rights are needed to buy one new share?

A)1 right/share

B)2 rights/share

C)3 rights/share

D)4 rights/share

A)1 right/share

B)2 rights/share

C)3 rights/share

D)4 rights/share

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

34

The underwriter's spread is the highest for:

A)IPOs.

B)seasoned equity offerings.

C)convertible bonds.

D)straight bonds.

A)IPOs.

B)seasoned equity offerings.

C)convertible bonds.

D)straight bonds.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

35

The winner's curse is reduced in a(an):

A)discriminatory auction.

B)uniform-price auction.

C)English auction.

D)winner-take-all auction.

A)discriminatory auction.

B)uniform-price auction.

C)English auction.

D)winner-take-all auction.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

36

The average initial returns from investing in IPOs is the highest in:

A)Denmark.

B)China.

C)Italy.

D)Mexico.

A)Denmark.

B)China.

C)Italy.

D)Mexico.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

37

The following are advantages of shelf registration except:

I.securities can be issued in dribs and drabs without incurring excessive transaction costs;

II.securities can be issued on short notice;

III.security issues can be timed to take advantage of market conditions

A)I only

B)II only

C)III only

D)I,II,and III

I.securities can be issued in dribs and drabs without incurring excessive transaction costs;

II.securities can be issued on short notice;

III.security issues can be timed to take advantage of market conditions

A)I only

B)II only

C)III only

D)I,II,and III

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

38

An equity issue sold to the firm's existing stockholders is called a:

A)rights offer.

B)general cash offer.

C)private placement.

D)discriminatory-price auction.

A)rights offer.

B)general cash offer.

C)private placement.

D)discriminatory-price auction.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

39

The possibility that the winner (highest bidder)in an auction process may have bid a price that is very high (far above the value)is called:

A)winner's curse.

B)seniority.

C)English auction.

D)uniform-price auction.

A)winner's curse.

B)seniority.

C)English auction.

D)uniform-price auction.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

40

The very first public equity sold by a company is referred to as:

A)a rights issue.

B)American depositing receipts (ADRs).

C)an initial public offering (IPO).

D)a seasoned equity offering (SEO).

A)a rights issue.

B)American depositing receipts (ADRs).

C)an initial public offering (IPO).

D)a seasoned equity offering (SEO).

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is a possible exception to the efficient-market theory?

A)Underwriters charge investors more for IPO shares than they pay the issuing firms.

B)IPO spreads are lower on larger issues.

C)The issuance of equity is interpreted as an unfavorable signal by investors.

D)The long-run returns of IPOs tend to underperform the market.

A)Underwriters charge investors more for IPO shares than they pay the issuing firms.

B)IPO spreads are lower on larger issues.

C)The issuance of equity is interpreted as an unfavorable signal by investors.

D)The long-run returns of IPOs tend to underperform the market.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

42

What term might be used to describe an underwriter who influences an analyst in the same firm to modify a report so as to create a favorable impression of a securities issue?

A)SOX compliance

B)spinning

C)conflict of interest

D)Chinese wall

A)SOX compliance

B)spinning

C)conflict of interest

D)Chinese wall

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

43

Mezzanine financing must come in the third stage.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

44

What costs in an IPO generally exceed all other costs?

A)commissions

B)issues fees

C)spreads

D)underpricing

A)commissions

B)issues fees

C)spreads

D)underpricing

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

45

Rule 144A allows large financial institutions to trade unregistered securities among themselves.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

46

For industrial stocks in the U.S.,the announcement of an SEO usually leads to a decline in stock price,with the decline averaging 3-4%.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

47

The first public issue by a firm is known as a seasoned equity offering.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

48

If a shareholder or an investor wants to acquire a new share of stock under a rights issue,he/she must:

A)buy call options on the stock.

B)acquire the appropriate number of rights per share and subscription price per share and submit them to the subscription agent.

C)acquire the correct number of rights per share and submit them to the subscription agent.

D)register his order with the NYSE.

A)buy call options on the stock.

B)acquire the appropriate number of rights per share and subscription price per share and submit them to the subscription agent.

C)acquire the correct number of rights per share and submit them to the subscription agent.

D)register his order with the NYSE.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

49

Shelf registration allows the firm to file a registration statement with the SEC to cover a series of subsequent issues.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

50

Most public issues must be registered with the SEC,and the company may not sell securities until the SEC has approved its registration statement.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

51

Generally,IPOs are overpriced and are subject to the winner's curse.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

52

When a company sells an entire issue of securities to a small group of institutional investors like life insurance companies,pension funds,etc.,it is called a(an):

A)rights offering.

B)general art offering.

C)private placement.

D)unseasoned issue.

A)rights offering.

B)general art offering.

C)private placement.

D)unseasoned issue.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

53

The New Word Corporation has 1,000,000 shares outstanding at $30/share.If the firm wishes to raise $13.5 million at a subscription price (North American rights offering)of $27/share,calculate the value of a right.

A)$1/right

B)$2/right

C)$3/right

D)$4/right

A)$1/right

B)$2/right

C)$3/right

D)$4/right

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

54

The most prevalent motive for firms to undertake an IPO is to create public shares for use in future acquisitions.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

55

The SEC provision under which qualified institutional investors can trade privately placed securities among themselves is called:

A)Rule 144A.

B)Rule 415.

C)the Sarbanes-Oxley Act.

D)none of the options.

A)Rule 144A.

B)Rule 415.

C)the Sarbanes-Oxley Act.

D)none of the options.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

56

Underpricing is a technique used by underwriters to enhance the success of an issue.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

57

The underwriting spread for debt is generally less than that for equity.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

58

Spinning refers to the practice whereby an underwriter sells shares in a hot new issue to a CEO-for the CEO's personal benefit-for the purpose of the underwriter gaining future business from the CEO's firm.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

59

SEC registration is not required when a company makes a:

A)private placement of securities.

B)public offering of securities issue having a value less than $5 million and a maturity less than nine months.

C)public offering of securities having a value greater than $5 million.

D)both A and B.

A)private placement of securities.

B)public offering of securities issue having a value less than $5 million and a maturity less than nine months.

C)public offering of securities having a value greater than $5 million.

D)both A and B.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

60

Underpricing is not a serious problem for most initial public offerings (IPOs).

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

61

Briefly explain the role of underwriters in the issuance of securities.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

62

Explain the need for a firewall between underwriters and analysts.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

63

Briefly explain the basic procedure for a new issue.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

64

Briefly discuss SEC rule 144A.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

65

Briefly explain the term initial public offering (IPO).

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

66

Explain the term winner's curse.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

67

Discuss the advantages of shelf registration.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

68

Briefly explain the term venture capital.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

69

Briefly explain the term private placement.

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck

70

What are some of the costs to a firm associated with issuing new securities?

Unlock Deck

Unlock for access to all 70 flashcards in this deck.

Unlock Deck

k this deck