Deck 10: Project Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/75

Play

Full screen (f)

Deck 10: Project Analysis

1

The Solar Calculator Company proposes to invest $5 million in a new calculator-making plant.Fixed costs are $2 million per year.A solar calculator costs $5 per unit to manufacture and sells for $20 per unit.If the plant lasts for three years and the cost of capital is 12%,what is the break-even level of annual sales? (Assume that revenues and costs occur at the end of each year.Assume no taxes.)Round to the nearest 1,000 units.

A)133,000 units

B)272,000 units

C)228,000 units

D)244,000 units

A)133,000 units

B)272,000 units

C)228,000 units

D)244,000 units

272,000 units

2

Generally,postaudits for projects are conducted to:

I.identify problems that need fixing;

II.check the accuracy of forecasts;

III.generate questions that should have been asked before project commencement

A)I only

B)II only

C)I and II only

D)I,II,and III

I.identify problems that need fixing;

II.check the accuracy of forecasts;

III.generate questions that should have been asked before project commencement

A)I only

B)II only

C)I and II only

D)I,II,and III

I,II,and III

3

You obtain the following data for year 1: Revenue = $43; Variable costs = $30; Depreciation = $3; Tax rate = 30%.Calculate the operating cash flow for the project for year 1.

A)$7

B)$10

C)$13

D)$16

A)$7

B)$10

C)$13

D)$16

$10

4

Most firms' capital investment proposals originate from:

A)senior management.

B)planning staff,corporate finance department.

C)the board of directors.

D)divisional management.

A)senior management.

B)planning staff,corporate finance department.

C)the board of directors.

D)divisional management.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

5

Discounted cash-flow (DCF)analysis generally:

I.assumes that firms hold assets passively when it invests in a project;

II.considers opportunities to expand a project if the project is successful;

III.considers opportunities to abandon a project if the project is a failure

A)I only

B)II only

C)II and III only

D)I,II,and III

I.assumes that firms hold assets passively when it invests in a project;

II.considers opportunities to expand a project if the project is successful;

III.considers opportunities to abandon a project if the project is a failure

A)I only

B)II only

C)II and III only

D)I,II,and III

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

6

You are given the following data for year 1: Revenues = 100,Fixed costs = 30; Total variable costs = 50; Depreciation = $10; Tax rate = 30%.Calculate the after-tax cash flow for the project for year 1.

A)$17

B)$13

C)$10

D)$7

A)$17

B)$13

C)$10

D)$7

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

7

A project has an initial investment of 100.You have come up with the following estimates of the project's cash flows: ![<strong>A project has an initial investment of 100.You have come up with the following estimates of the project's cash flows: Suppose the cash flows are perpetuities and the cost of capital is 10%.What does a sensitivity analysis of NPV (no taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)</strong> A)-50,20,+100. B)-100,-50,+80. C)-50,+50,+70. D)+5,+11,+18](https://d2lvgg3v3hfg70.cloudfront.net/TB1768/11ea6f34_5c65_f67c_af34_6326979e9a92_TB1768_00.jpg)

Suppose the cash flows are perpetuities and the cost of capital is 10%.What does a sensitivity analysis of NPV (no taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)

A)-50,20,+100.

B)-100,-50,+80.

C)-50,+50,+70.

D)+5,+11,+18

![<strong>A project has an initial investment of 100.You have come up with the following estimates of the project's cash flows: Suppose the cash flows are perpetuities and the cost of capital is 10%.What does a sensitivity analysis of NPV (no taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)</strong> A)-50,20,+100. B)-100,-50,+80. C)-50,+50,+70. D)+5,+11,+18](https://d2lvgg3v3hfg70.cloudfront.net/TB1768/11ea6f34_5c65_f67c_af34_6326979e9a92_TB1768_00.jpg)

Suppose the cash flows are perpetuities and the cost of capital is 10%.What does a sensitivity analysis of NPV (no taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)

A)-50,20,+100.

B)-100,-50,+80.

C)-50,+50,+70.

D)+5,+11,+18

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

8

Generally,postaudits are conducted for large projects:

A)shortly after the completion of the project.

B)several years after the completion of the project.

C)shortly after the project has begun to operate.

D)well before the start of the project.

A)shortly after the completion of the project.

B)several years after the completion of the project.

C)shortly after the project has begun to operate.

D)well before the start of the project.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

9

The Financial Calculator Company proposes to invest $12 million in a new calculator-making plant.Fixed costs are $3 million per year.A financial calculator costs $10 per unit to manufacture and sells for $30 per unit.If the plant lasts for four years and the cost of capital is 20%,what is the break-even level of annual sales? (Assume that revenues and costs occur at the end of each year.Assume no taxes.)Round to the nearest 1,000 units.

A)150,000 units

B)342,000 units

C)382,000 units

D)300,000 units

A)150,000 units

B)342,000 units

C)382,000 units

D)300,000 units

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

10

A project requires an initial investment in equipment of $90,000 and then requires an initial investment in working capital of $10,000 (at t = 0).You expect the project to produce sales revenue of $120,000 per year for three years.You estimate manufacturing costs at 60% of revenues.(Assume all revenues and costs occur at year-end,i.e.,t = 1,t = 2,and t = 3.)The equipment depreciates using straight-line depreciation over three years.At the end of the project,the firm can sell the equipment for $10,000.The corporate tax rate is 30% and the cost of capital is 16.5%.Calculate the NPV of the project.

A)$5,648

B)$3,840

C)-$2,735

D)$4,848

A)$5,648

B)$3,840

C)-$2,735

D)$4,848

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

11

A project requires an initial investment in equipment of $90,000 and then requires an initial investment in working capital of $10,000 (at t = 0).You expect the project to produce sales revenue of $120,000 per year for three years.You estimate manufacturing costs at 60% of revenues.(Assume all revenues and costs occur at year-end,i.e.,t = 1,t = 2,and t = 3.)The equipment depreciates using straight-line depreciation over three years.At the end of the project,the firm can sell the equipment for $10,000 and also recover the investment in net working capital.The corporate tax rate is 30% and the cost of capital is 15%.Calculate the NPV of the project:

A)$3,840.

B)$8,443.

C)$-2,735.

D)$7,342.

A)$3,840.

B)$8,443.

C)$-2,735.

D)$7,342.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements most appropriately describes scenario analysis?

A)It looks at the project by changing one variable at a time.

B)It provides the break-even level of sales for the project.

C)It looks at different but consistent combinations of variables.

D)Each of these statements describes scenario analysis correctly.

A)It looks at the project by changing one variable at a time.

B)It provides the break-even level of sales for the project.

C)It looks at different but consistent combinations of variables.

D)Each of these statements describes scenario analysis correctly.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

13

A project requires an initial investment in equipment of $90,000 and then requires an initial investment in working capital of $10,000 (at t = 0).You expect the project to produce sales revenue of $120,000 per year for three years.You estimate manufacturing costs at 60% of revenues.(Assume all revenues and costs occur at year-end,i.e.,t = 1,t = 2,and t = 3.)The equipment depreciates using straight-line depreciation over three years.At the end of the project,the firm can sell the equipment for $10,000 and also recover the investment in net working capital.The corporate tax rate is 30% and the cost of capital is 15%.What is the NPV of the project if the revenues were higher by 10% and the costs were 65% of the revenues?

A)$8,443

B)$964

C)$5,566

D)$4,840

A)$8,443

B)$964

C)$5,566

D)$4,840

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

14

A project requires an initial investment in equipment of $90,000 and then requires an initial investment in working capital of $10,000 (at t = 0).You expect the project to produce sales revenue of $120,000 per year for three years.You estimate manufacturing costs at 60% of revenues.(Assume all revenues and costs occur at year-end,i.e.,t = 1,t = 2,and t = 3.)The equipment depreciates using straight-line depreciation over three years.At the end of the project,the firm can sell the equipment for $10,000 and also recover the investment in net working capital.The corporate tax rate is 30% and the cost of capital is 15%.Cash flows from the project are:

A)CF0: -90,000; CF1: 12,600; CF2: 12,600; CF3: 29,600.

B)CF0: -100,000; CF1: 42,600; CF2: 42,600; CF3: 59,600.

C)CF0: -100,000; CF1: 42,600; CF2: 42,600; CF3: 42,600.

D)CF0: -100,000; CF1: 42,600; CF2: 42,600; CF3: 49,600.Initial Investment = 90,000 + 10,000 = 100,000; CF0 = -100,000;CF1 and CF2: (120,000 - 72,000 - 30,000)(1 - 0.3)+ 30,000 = 42,600;CF3: (120,000 - 72,000 - 30,000)(1 - 0.3)+ 30,000 + (10,000)(1 - 0.3)+ 10,000 = 59,600.

A)CF0: -90,000; CF1: 12,600; CF2: 12,600; CF3: 29,600.

B)CF0: -100,000; CF1: 42,600; CF2: 42,600; CF3: 59,600.

C)CF0: -100,000; CF1: 42,600; CF2: 42,600; CF3: 42,600.

D)CF0: -100,000; CF1: 42,600; CF2: 42,600; CF3: 49,600.Initial Investment = 90,000 + 10,000 = 100,000; CF0 = -100,000;CF1 and CF2: (120,000 - 72,000 - 30,000)(1 - 0.3)+ 30,000 = 42,600;CF3: (120,000 - 72,000 - 30,000)(1 - 0.3)+ 30,000 + (10,000)(1 - 0.3)+ 10,000 = 59,600.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

15

A project requires an initial investment of $150.Your research generates the following estimates of revenues and costs: ![<strong>A project requires an initial investment of $150.Your research generates the following estimates of revenues and costs: The cost of capital equals 10%.Assume that the cash flows occur in perpetuity.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)</strong> A)50,-100,+400 B)-50,+300,+500 C)-100,+150,+350 D)+100,+150,+350](https://d2lvgg3v3hfg70.cloudfront.net/TB1768/11ea6f34_5c66_6bae_af34_8b90d51fb147_TB1768_00.jpg)

The cost of capital equals 10%.Assume that the cash flows occur in perpetuity.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)

A)50,-100,+400

B)-50,+300,+500

C)-100,+150,+350

D)+100,+150,+350

![<strong>A project requires an initial investment of $150.Your research generates the following estimates of revenues and costs: The cost of capital equals 10%.Assume that the cash flows occur in perpetuity.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)</strong> A)50,-100,+400 B)-50,+300,+500 C)-100,+150,+350 D)+100,+150,+350](https://d2lvgg3v3hfg70.cloudfront.net/TB1768/11ea6f34_5c66_6bae_af34_8b90d51fb147_TB1768_00.jpg)

The cost of capital equals 10%.Assume that the cash flows occur in perpetuity.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)

A)50,-100,+400

B)-50,+300,+500

C)-100,+150,+350

D)+100,+150,+350

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

16

Firms often calculate a project's break-even sales using book earnings.However,break-even sales based on NPV is generally:

A)higher than the one calculated using book earnings.

B)lower than the one calculated using book earnings.

C)equal to the one calculated using book earnings.

D)not related to the one calculated using book earnings.

A)higher than the one calculated using book earnings.

B)lower than the one calculated using book earnings.

C)equal to the one calculated using book earnings.

D)not related to the one calculated using book earnings.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

17

The following are drawbacks of sensitivity analysis EXCEPT:

A)it can provide ambiguous results.

B)the underlying variables are likely interrelated.

C)it can help identify the project's most important variables.

D)all of these statements are drawbacks of sensitivity analysis.

A)it can provide ambiguous results.

B)the underlying variables are likely interrelated.

C)it can help identify the project's most important variables.

D)all of these statements are drawbacks of sensitivity analysis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

18

A project requires an initial investment in equipment of $90,000 and then requires an initial investment in working capital of $10,000 (at t = 0).You expect the project to produce sales revenue of $120,000 per year for three years.You estimate manufacturing costs at 60% of revenues.(Assume all revenues and costs occur at year-end,i.e.,t = 1,t = 2,and t = 3.)The equipment depreciates using straight-line depreciation over three years.At the end of the project,the firm can sell the equipment for $10,000 and also recover the investment in net working capital.The corporate tax rate is 30% and the cost of capital is 12%.

Calculate the NPV of the project:

A)$14,418.

B)$8,443.

C)$-2,735.

D)$12,873.

Calculate the NPV of the project:

A)$14,418.

B)$8,443.

C)$-2,735.

D)$12,873.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

19

You calculate the following estimates of project cash flows: ![<strong>You calculate the following estimates of project cash flows: The revenues and costs occur in perpetuity,as opposed to the initial investment.The cost of capital is 8%.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)</strong> A)25.00,+232.50,+440.00 B)-100.00,+500.00,+800.00 C)-90.00,-55.00,-20.00 D)-88.33,-50.00,-18.50](https://d2lvgg3v3hfg70.cloudfront.net/TB1768/11ea6f34_5c66_449d_af34_01dffccada4a_TB1768_00.jpg)

The revenues and costs occur in perpetuity,as opposed to the initial investment.The cost of capital is 8%.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)

A)25.00,+232.50,+440.00

B)-100.00,+500.00,+800.00

C)-90.00,-55.00,-20.00

D)-88.33,-50.00,-18.50

![<strong>You calculate the following estimates of project cash flows: The revenues and costs occur in perpetuity,as opposed to the initial investment.The cost of capital is 8%.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)</strong> A)25.00,+232.50,+440.00 B)-100.00,+500.00,+800.00 C)-90.00,-55.00,-20.00 D)-88.33,-50.00,-18.50](https://d2lvgg3v3hfg70.cloudfront.net/TB1768/11ea6f34_5c66_449d_af34_01dffccada4a_TB1768_00.jpg)

The revenues and costs occur in perpetuity,as opposed to the initial investment.The cost of capital is 8%.What does a sensitivity analysis of NPV (without taxes)show? (Answers appear in order: [Pessimistic,Most Likely,Optimistic].)

A)25.00,+232.50,+440.00

B)-100.00,+500.00,+800.00

C)-90.00,-55.00,-20.00

D)-88.33,-50.00,-18.50

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

20

A project has the following cash flows: C0 = -100,000; C1 = 50,000; C2 = 150,000; C3 = 100,000.If the discount rate changes from 12% to 15%,what is the CHANGE in the NPV of the project (approximately)?

A)12,750 increase

B)12,750 decrease

C)14,240 increase

D)14,240

A)12,750 increase

B)12,750 decrease

C)14,240 increase

D)14,240

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

21

The accounting break-even point occurs when:

A)the total revenue line cuts the fixed cost line.

B)the present value of inflows line cuts the present value of outflows line.

C)the total revenue line cuts the total cost line.

D)total revenue is large enough to recapture depreciation expense.

A)the total revenue line cuts the fixed cost line.

B)the present value of inflows line cuts the present value of outflows line.

C)the total revenue line cuts the total cost line.

D)total revenue is large enough to recapture depreciation expense.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

22

The Taj Mahal Tour Company proposes to invest $3 million in a new tour package project.Fixed costs are $1 million per year.The tour package costs the company $500 to produce and can be sold at $1500 per package to tourists.This tour package will last for the next five years.If the cost of capital is 20%,what is the NPV break-even number of tourists per year? (Ignore taxes.Round to the nearest 1,000.)

A)1,000

B)2,000

C)3,000

D)4,000First,find the annual cash flow that justifies a $3 million investment using the equivalent annual cost (EAC)method.The 5-year annuity factor @ 20% equals 2.9906.EAC = $3 million/2.9906 = $1.00 million.The tour must net this amount of cash flow each year.Given $1M of annual fixed costs,let X = the annual sales rate: (X)× (1500 - 500)- 1,000,000 = 1,000,000.X (1000)= 2,000,000;

A)1,000

B)2,000

C)3,000

D)4,000First,find the annual cash flow that justifies a $3 million investment using the equivalent annual cost (EAC)method.The 5-year annuity factor @ 20% equals 2.9906.EAC = $3 million/2.9906 = $1.00 million.The tour must net this amount of cash flow each year.Given $1M of annual fixed costs,let X = the annual sales rate: (X)× (1500 - 500)- 1,000,000 = 1,000,000.X (1000)= 2,000,000;

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

23

All else equal,an increase in fixed costs:

I.increases the break-even point based on NPV;

II.increases the accounting break-even point;

III.decreases the break-even point based on NPV;

IV.decreases the accounting break-even point

A)I and IV only

B)III and IV only

C)II and III only

D)I and II only

I.increases the break-even point based on NPV;

II.increases the accounting break-even point;

III.decreases the break-even point based on NPV;

IV.decreases the accounting break-even point

A)I and IV only

B)III and IV only

C)II and III only

D)I and II only

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

24

Petroleum Inc.(PI)controls offshore oil leases.It is considering the construction of a deep-sea oil rig at a cost of $500 million.The price of oil is $100/bbl.and extraction costs are $50/bbl.PI expects costs to remain constant.The rig will produce an estimated 1,200,000 bbl.per year forever.The risk-free rate is 10% per year,which is also the cost of capital.(Ignore taxes).Suppose that oil prices are uncertain and are equally likely to be $120/bbl.or $80/bbl.next year.Calculate today's NPV of the project if it were postponed by one year.

A)+$100 million

B)+$154 million

C)+$170 million

D)+$187 million

A)+$100 million

B)+$154 million

C)+$170 million

D)+$187 million

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

25

The Hammer Company proposes to invest $6 million in a new type of hammer-making equipment.The fixed costs are $0.5 million per year.The equipment will last for five years.The manufacturing cost per hammer is $1 and each hammer sells for $6.The cost of capital is 20%.Calculate the break-even sales volume per year.(Ignore taxes.Round to the nearest 1,000.)

A)500,000 units

B)600,000 units

C)450,000 units

D)550,000 unitsFirst,find the annual cash flow that justifies a $6 million investment using the equivalent annual cost (EAC)method.The 5-year annuity factor @ 20% equals 2.9906.EAC = 6/2.9906 = 2 million.The equipment must net this amount of cash flow each year.Given $0.5M of annual fixed costs,let X = the annual sales rate:X (6 - 1)- 500,000 = 2,000,000;

A)500,000 units

B)600,000 units

C)450,000 units

D)550,000 unitsFirst,find the annual cash flow that justifies a $6 million investment using the equivalent annual cost (EAC)method.The 5-year annuity factor @ 20% equals 2.9906.EAC = 6/2.9906 = 2 million.The equipment must net this amount of cash flow each year.Given $0.5M of annual fixed costs,let X = the annual sales rate:X (6 - 1)- 500,000 = 2,000,000;

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

26

The Financial Calculator Company proposes to invest $12 million in a new calculator-making plant that will depreciate on a straight-line basis.Fixed costs are $3 million per year.A financial calculator costs $10 per unit to manufacture and sells for $30 per unit.If the plant lasts for four years and the cost of capital is 20%,what is the accounting break-even level of annual sales? (Assume no taxes.)

A)300,000 units

B)150,000 units

C)381,777 units

D)750,000 units

A)300,000 units

B)150,000 units

C)381,777 units

D)750,000 units

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

27

Monte Carlo simulation involves the following steps:

I.Step 1: Modeling the project;

II.Step 2: Specifying probabilities;

III.Step 3: Simulating cash flows;

IV.Step 4: Calculating present value

A)I and II only

B)I,II,and III only

C)II,III,and IV only

D)I,II,III,and IV

I.Step 1: Modeling the project;

II.Step 2: Specifying probabilities;

III.Step 3: Simulating cash flows;

IV.Step 4: Calculating present value

A)I and II only

B)I,II,and III only

C)II,III,and IV only

D)I,II,III,and IV

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

28

After completing a project analysis,an analyst should rely on which tool to make a final recommendation on the project?

A)sensitivity analysis

B)break-even analysis

C)decision trees

D)NPV

A)sensitivity analysis

B)break-even analysis

C)decision trees

D)NPV

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

29

The NPV break-even point occurs when:

A)the present value of inflows line cuts the present value of outflows line.

B)the total revenue line cuts the fixed cost line.

C)the total revenue line cuts the total cost line.

D)the present value of inflows cuts the total cost line.

A)the present value of inflows line cuts the present value of outflows line.

B)the total revenue line cuts the fixed cost line.

C)the total revenue line cuts the total cost line.

D)the present value of inflows cuts the total cost line.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

30

Project analysis,beyond simply calculating NPV,includes the following procedures:

I.sensitivity analysis;

II.break-even analysis;

III.Monte Carlo simulation;

IV.scenario analysis

A)I only

B)I and II only

C)I,II,and III only

D)I,II,III,and IV

I.sensitivity analysis;

II.break-even analysis;

III.Monte Carlo simulation;

IV.scenario analysis

A)I only

B)I and II only

C)I,II,and III only

D)I,II,III,and IV

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

31

Hammer Company proposes to invest $6 million in a new type of hammer-making equipment.The fixed costs are $1.0 million per year.The equipment will last for five years.The manufacturing cost per hammer is $1 and each hammer sells for $6.The cost of capital is 20%.Calculate the break-even sales volume per year.(Ignore taxes.Round to the nearest 1,000.)

A)500,000 units

B)550,000 units

C)600,000 units

D)650,000 unitsFirst,find the annual cash flow that justifies a $6 million investment using the equivalent annual cost (EAC)method.The 5-year annuity factor @ 20% equals 2.9906.EAC = 6/2.9906 = 2 million.The equipment must net this amount of cash flow each year.Given $1.0M of annual fixed costs,let X = the annual sales rate:X (6 - 1)- 1,000,000 = 2,000,000;

A)500,000 units

B)550,000 units

C)600,000 units

D)650,000 unitsFirst,find the annual cash flow that justifies a $6 million investment using the equivalent annual cost (EAC)method.The 5-year annuity factor @ 20% equals 2.9906.EAC = 6/2.9906 = 2 million.The equipment must net this amount of cash flow each year.Given $1.0M of annual fixed costs,let X = the annual sales rate:X (6 - 1)- 1,000,000 = 2,000,000;

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

32

Petroleum Inc.(PI)controls offshore oil leases.It is considering the construction of a deep-sea oil rig at a cost of $500 million.The price of oil is $100/bbl.and extraction costs are $50/bbl.PI expects prices and costs to remain constant.The rig will produce an estimated 1,200,000 bbl.per year forever.The risk-free rate is 10% per year,which is also the cost of capital.(Ignore taxes).Calculate the NPV to invest today.

A)+100,000,000

B)+80,000,000

C)+60,000,000

D)+40,000,000Easiest to do computations in $M.

A)+100,000,000

B)+80,000,000

C)+60,000,000

D)+40,000,000Easiest to do computations in $M.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following does NOT represent an option to expand a project?

A)A firm leases more office space than it forecasts it will need.

B)A company engages in test marketing for a new product.

C)Your university builds an administrators' parking garage having more parking spaces than administrators.

D)A dry cleaner purchases equipment that can be readily sold to other dry cleaners.

A)A firm leases more office space than it forecasts it will need.

B)A company engages in test marketing for a new product.

C)Your university builds an administrators' parking garage having more parking spaces than administrators.

D)A dry cleaner purchases equipment that can be readily sold to other dry cleaners.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

34

Monte Carlo simulation is likely to be most useful:

A)for very complex projects.

B)for projects of moderate complexity.

C)for very simple projects.

D)regardless of the project's complexity.

A)for very complex projects.

B)for projects of moderate complexity.

C)for very simple projects.

D)regardless of the project's complexity.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

35

One can employ simulation models to:

i.understand the project better; II)better understand forecasted cash flows; III)assess the project risk

A)I only

B)II only

C)III only

D)I,II,and III

i.understand the project better; II)better understand forecasted cash flows; III)assess the project risk

A)I only

B)II only

C)III only

D)I,II,and III

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

36

Petroleum Inc.(PI)controls off-shore oil leases.It is considering the construction of a deep-sea oil rig at a cost of $500 million.The price of oil is $100/bbl.and extraction costs are $50/bbl.PI expects costs to remain constant.The rig will produce an estimated 1,200,000 bbl.per year forever.The risk-free rate is 10% per year,which is also the cost of capital.(Ignore taxes).Suppose that oil prices are uncertain and are equally likely to be $120/bbl.or $80/bbl.next year.

Suppose that PI has the option to postpone the project by one year.Calculate the value of the real option to postpone the project for one year.

A)+$30 million

B)+$50 million

C)+$54 million

D)+$70 million

Suppose that PI has the option to postpone the project by one year.Calculate the value of the real option to postpone the project for one year.

A)+$30 million

B)+$50 million

C)+$54 million

D)+$70 million

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

37

The following are real options EXCEPT:

A)stock options.

B)timing options.

C)options to expand.

D)options to abandon.

A)stock options.

B)timing options.

C)options to expand.

D)options to abandon.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following simulation outputs is likely to be most useful and easy to interpret? The output shows the distribution(s)of the project's:

A)sales.

B)internal rate of return.

C)cash flows.

D)profits.

A)sales.

B)internal rate of return.

C)cash flows.

D)profits.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

39

The Solar Calculator Company proposes to invest $5 million in a new calculator-making plant that will depreciate on a straight-line basis.Fixed costs are $2 million per year.A calculator costs $5 per unit to manufacture and sells for $20 per unit.If the plant lasts for three years and the cost of capital is 12%,what is the accounting break-even level of annual sales? (Assume no taxes.)

A)133,334 units

B)272,117 units

C)244,444 units

D)466,666 unitsFixed costs and depreciation equal $2M and $1.67M per year,respectively.Let X = the annual sales rate.Given a price of $20 and variable cost of $5,

A)133,334 units

B)272,117 units

C)244,444 units

D)466,666 unitsFixed costs and depreciation equal $2M and $1.67M per year,respectively.Let X = the annual sales rate.Given a price of $20 and variable cost of $5,

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

40

Generally,Monte Carlo models,for project analysis,use which device to generate simulations?

A)pair of dice

B)roulette wheel

C)computer

D)pack of cards

A)pair of dice

B)roulette wheel

C)computer

D)pack of cards

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

41

Firms with higher fixed costs tend to have higher degrees of operating leverage.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

42

In constructing a Monte Carlo simulation model of an investment project,one typically ignores possible interdependencies between variables.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

43

Postaudits are conducted before the start of projects.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

44

Expansion options generally show as an asset on a corporation's balance sheet.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

45

Projects with higher fixed costs have lower break-even points.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

46

You are planning to produce a new action figure called "Hillary".However,you are very uncertain about the demand for the product.If it is a hit,you will have net cash flows of $50 million per year for three years (starting next year,i.e.,at t = 1).If it fails,you will only have net cash flows of $10 million per year for two years (also starting next year).There is an equal chance that it will be a hit or failure (probability = 50%).You will not know whether it is a hit or a failure until after the first year's cash flows are in,i.e.,at t = 1.You have to spend $80 million immediately for equipment and the rights to produce the figure.If the discount rate is 10%,calculate Hillary's NPV.

A)-9.15

B)+13.99

C)+5.15

D)-14.4

A)-9.15

B)+13.99

C)+5.15

D)-14.4

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

47

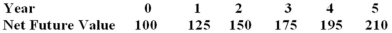

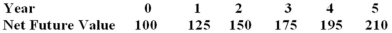

You are given the following net future values for harvesting trees from a plot of forestland.(This is a one-time harvest.)

If the cost of capital is 15%,calculate the optimal year to harvest:

A)year 1

B)year 2

C)year 3

D)year 4

If the cost of capital is 15%,calculate the optimal year to harvest:

A)year 1

B)year 2

C)year 3

D)year 4

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following does NOT represent an option to abandon a project?

A)Your friend builds a custom-made home.

B)You enroll in five classes,planning to drop one class before the semester ends.

C)A dry cleaner purchases equipment that can be readily sold to other dry cleaners.

D)You purchase a fully refundable airplane ticket.

A)Your friend builds a custom-made home.

B)You enroll in five classes,planning to drop one class before the semester ends.

C)A dry cleaner purchases equipment that can be readily sold to other dry cleaners.

D)You purchase a fully refundable airplane ticket.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

49

The break-even point in terms of NPV is usually lower than the break-even point on an accounting basis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

50

The option to wait is a type of abandonment option.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

51

The Consumer-Mart Company is going to introduce a new consumer product.If brought to market without research about consumer tastes the firm believes that there is a 60% chance that the product will be successful.If successful,the project has a NPV = $500,000.If the product is a failure (40%)and withdrawn from the market,then NPV = -$100,000.A consumer survey will cost $60,000 and delay the introduction by one year.With a survey,there is an 80% chance of consumer acceptance,in which case the NPV = $500,000.If,on the other hand the product is a failure (20%)and withdrawn from the market,then NPV = -$100,000.The discount rate is 10%.By how much does the marketing survey change the expected net present value of the project?

A)increases the NPV by $25,455

B)decreases the NPV by $5950

C)increases the NPV by $8955

D)decreases the NPV by $25,455

A)increases the NPV by $25,455

B)decreases the NPV by $5950

C)increases the NPV by $8955

D)decreases the NPV by $25,455

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

52

Monte Carlo simulation is a tool intended to consider all possible combinations of variables.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

53

Tangible assets usually have higher abandonment values than intangible ones.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

54

KMW Inc.sells finance textbooks for $150 each.The variable cost per book is $30 and the fixed cost per year is $30,000.The process of creating a textbook costs $150,000 and the average book has a life span of three years.What is the economic or NPV break-even number of books that must be sold each year given a discount rate of 12%?

A)156

B)191

C)235

D)771

A)156

B)191

C)235

D)771

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

55

The following options associated with a project increase managerial flexibility:

i.option to expand; II)option to abandon; III)production options; IV)timing options

A)I only

B)II only

C)I,II,III,and IV

D)IV only

i.option to expand; II)option to abandon; III)production options; IV)timing options

A)I only

B)II only

C)I,II,III,and IV

D)IV only

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

56

Firms that operate at break-even on an accounting basis are really losing the opportunity cost of capital on their investments.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

57

You are planning to produce a new action figure called "Hillary".However,you are very uncertain about the demand for the product.If it is a hit,you will have net cash flows of $50 million per year for three years (starting next year,i.e.,at t = 1).If it fails,you will only have net cash flows of $10 million per year for two years (also starting next year).There is an equal chance that it will be a hit or failure (probability = 50%).You will not know whether it is a hit or a failure until the first year's cash flows are in,i.e.,at t = 1.You have to spend $80 million immediately for equipment and the rights to produce the figure.If you can sell your equipment for $60 million immediately after the first year's cash flows are received,calculate Hillary's NPV with this abandonment option.(The discount rate is 10%.The equipment can only be resold at the end of the first year.)

A)-9.1

B)+9.1

C)+13.99

D)-14.4

A)-9.1

B)+9.1

C)+13.99

D)-14.4

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

58

Most firms keep track of the progress of projects by conducting postaudits shortly after the projects have begun to operate.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

59

Monte Carlo simulation should be used to get the distribution of NPV values for a project.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

60

You are planning to produce a new action figure called "Hillary".However,you are very uncertain about the demand for the product.If it is a hit,you will have net cash flows of $50 million per year for three years (starting next year,i.e.,at t = 1).If it fails,you will only have net cash flows of $10 million per year for two years (also starting next year).There is an equal chance that it will be a hit or failure (probability = 50%).You will not know whether it is a hit or a failure until the first year's cash flows are in,i.e.,at t = 1.You have to spend $80 million immediately for equipment and the rights to produce the figure.If you can sell your equipment for $60 million once the first year's cash flows are received,calculate the value of the abandonment option.(The discount rate is 10%.)

A)-9.15

B)+13.99

C)+23.14

D)01)

A)-9.15

B)+13.99

C)+23.14

D)01)

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

61

Briefly describe sensitivity analysis as used for project analysis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

62

Briefly explain timing options.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

63

Monte Carlo simulation is mostly an advanced version of scenario analysis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

64

Define the term abandonment value.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

65

Briefly discuss break-even analysis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

66

Briefly discuss the usefulness of Monte Carlo simulation in project analysis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

67

Adding a fudge factor to the cost of capital will penalize longer-term projects more due to compounding.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

68

In most cases the present value break-even quantity is higher than the accounting break-even quantity.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

69

Explain the usefulness of decision trees in project analysis.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

70

Why is sensitivity analysis less realistic than Monte Carlo simulation?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

71

Discuss the importance of conducting postaudits.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

72

Briefly discuss various real options associated with capital budgeting projects.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

73

Indicate some of the problems associated with the capital investment process.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

74

Briefly explain the term real options.

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck

75

How do managers supplement the NPV analysis of a project to gain a better understanding of a project?

Unlock Deck

Unlock for access to all 75 flashcards in this deck.

Unlock Deck

k this deck